Young Ho Seo / Profile

- Information

|

10+ years

experience

|

62

products

|

1170

demo versions

|

|

4

jobs

|

0

signals

|

0

subscribers

|

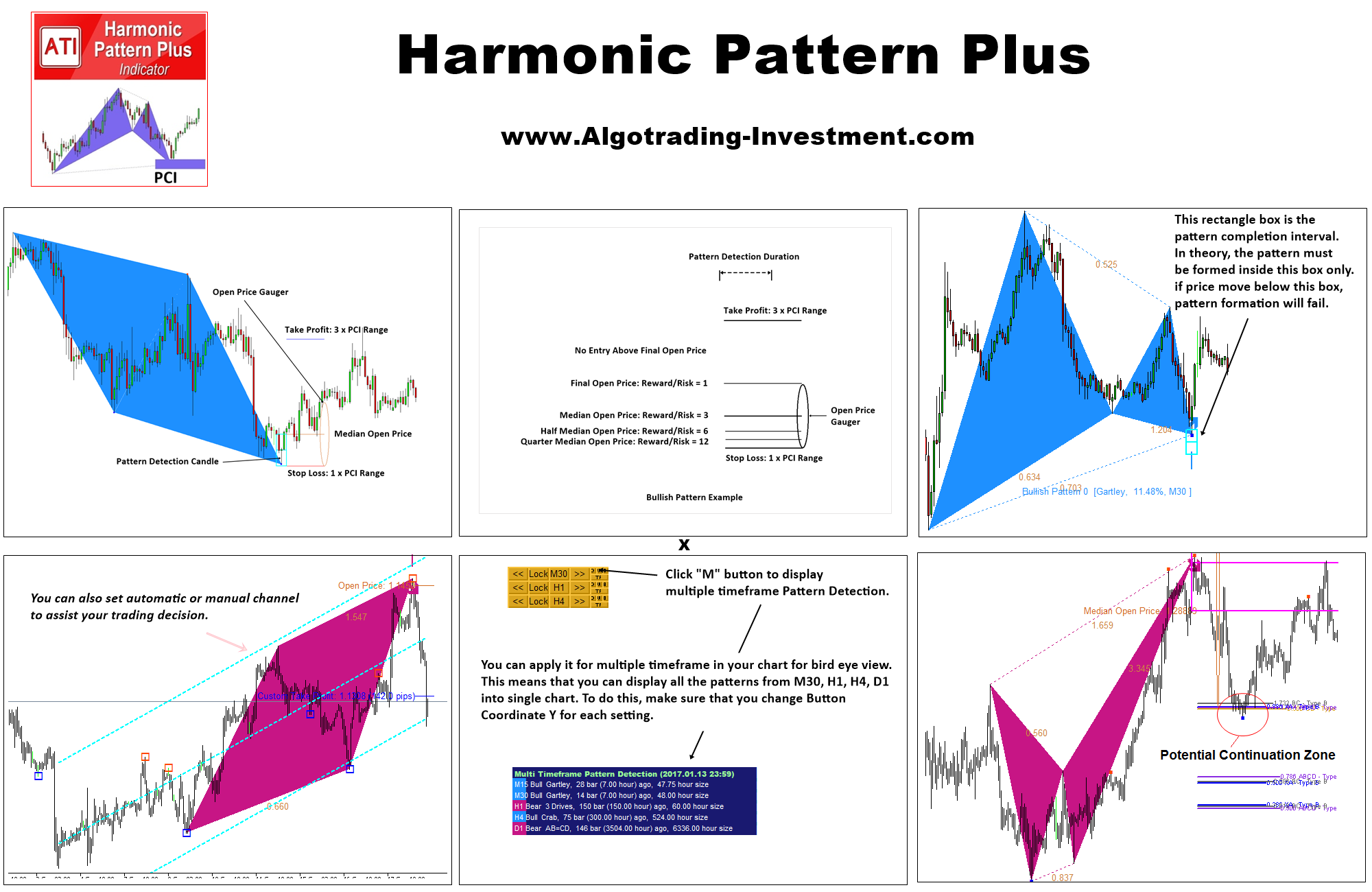

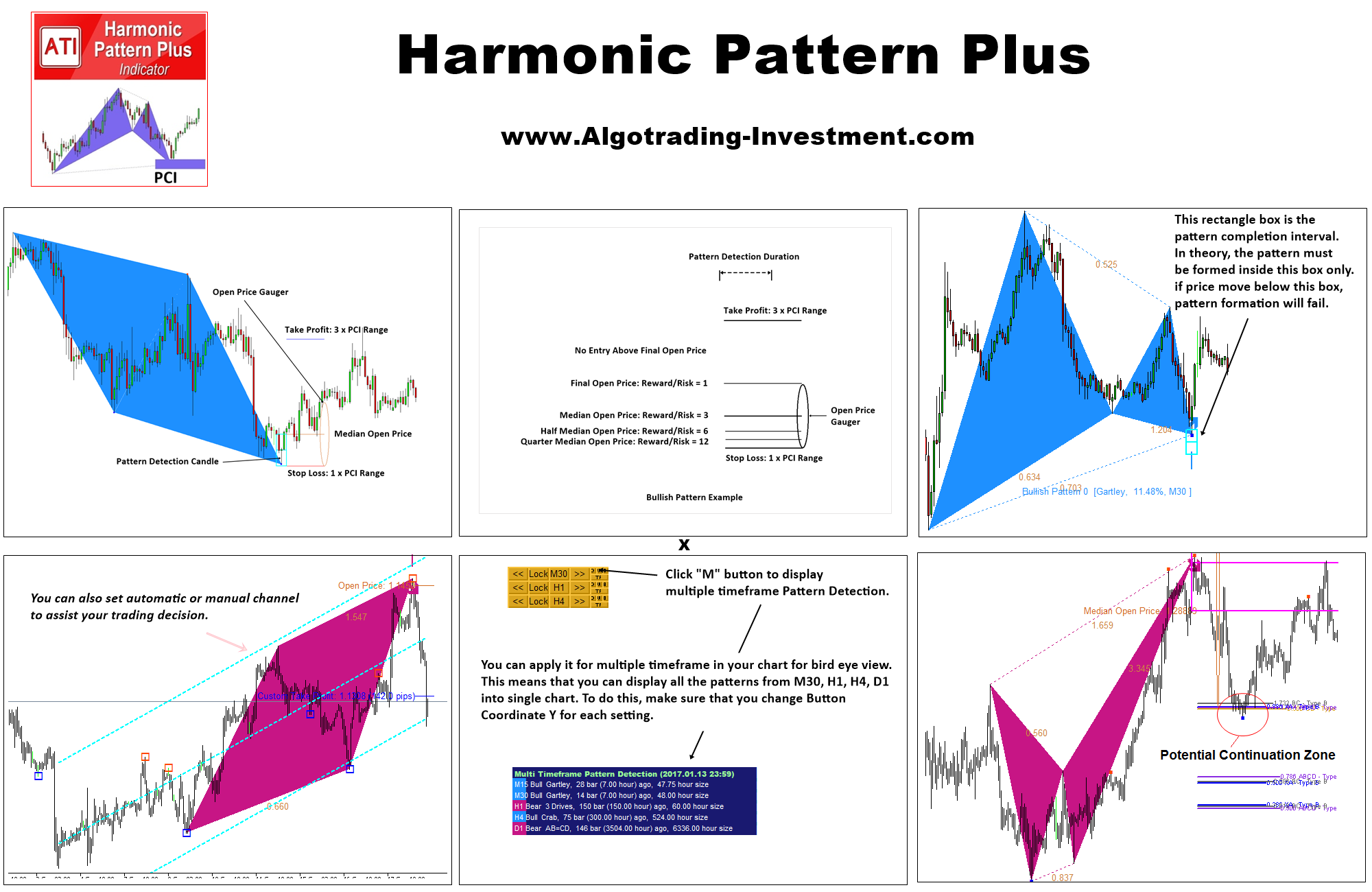

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

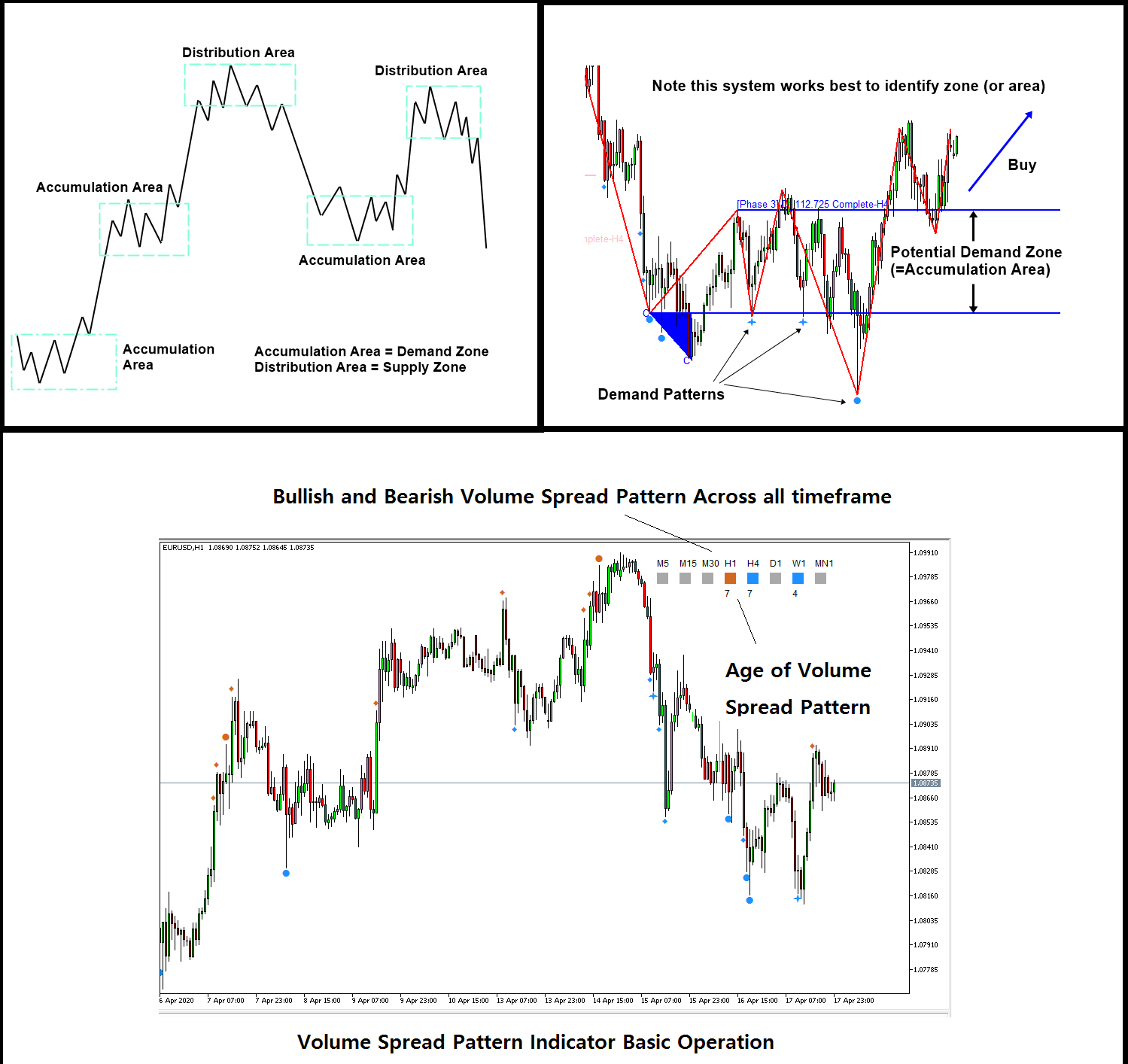

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

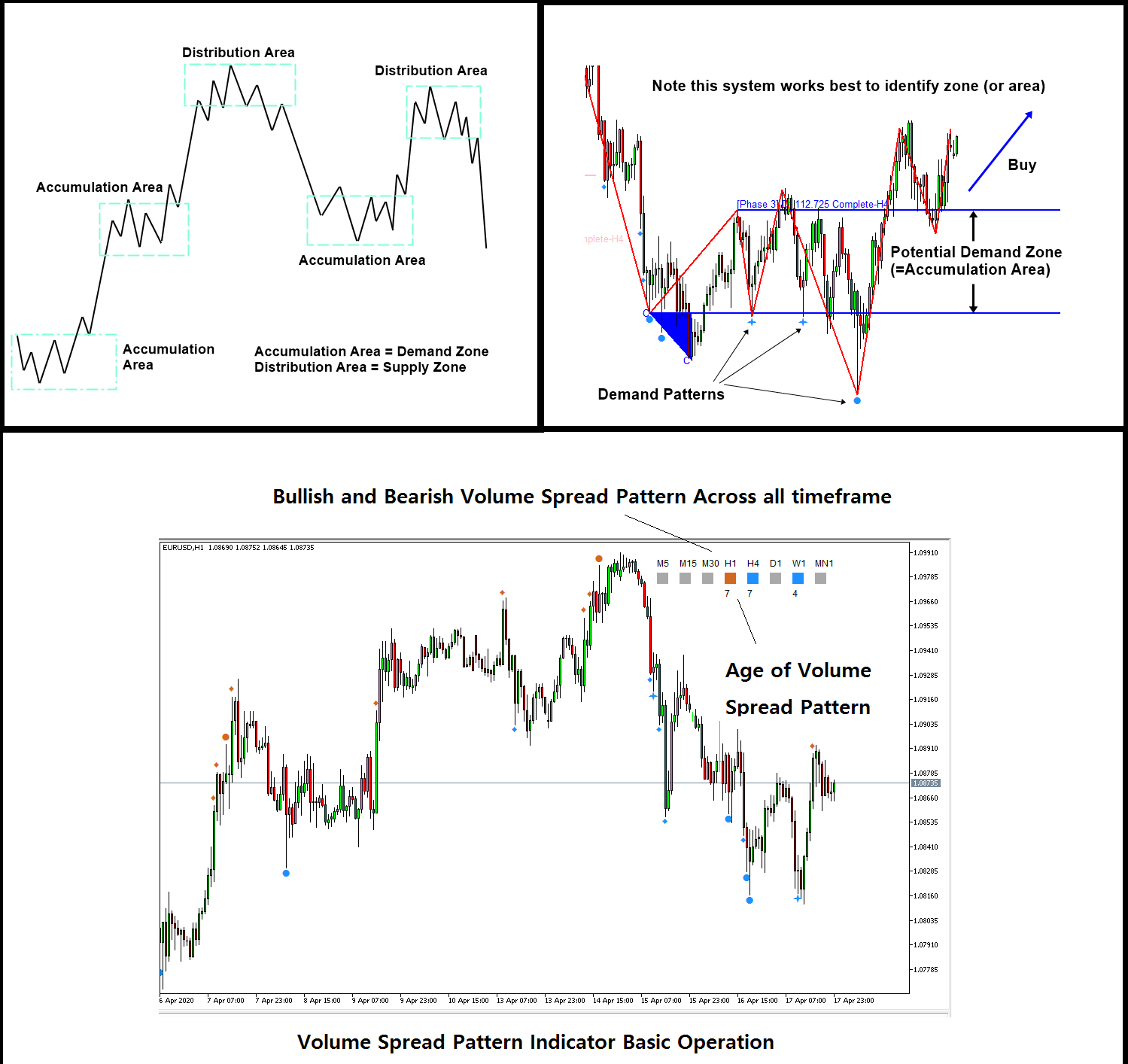

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

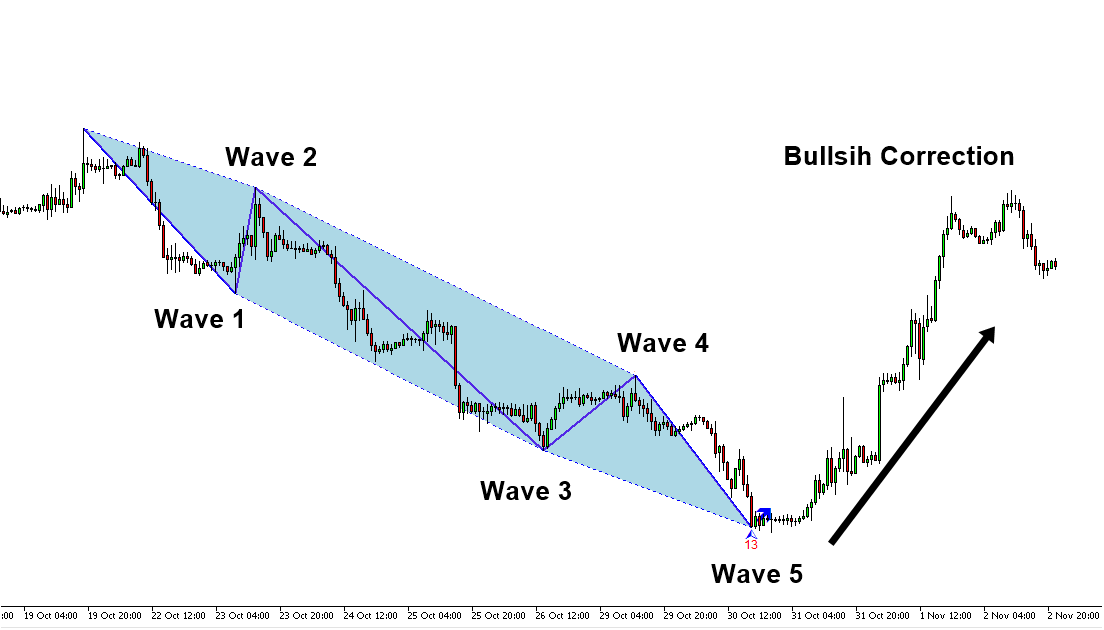

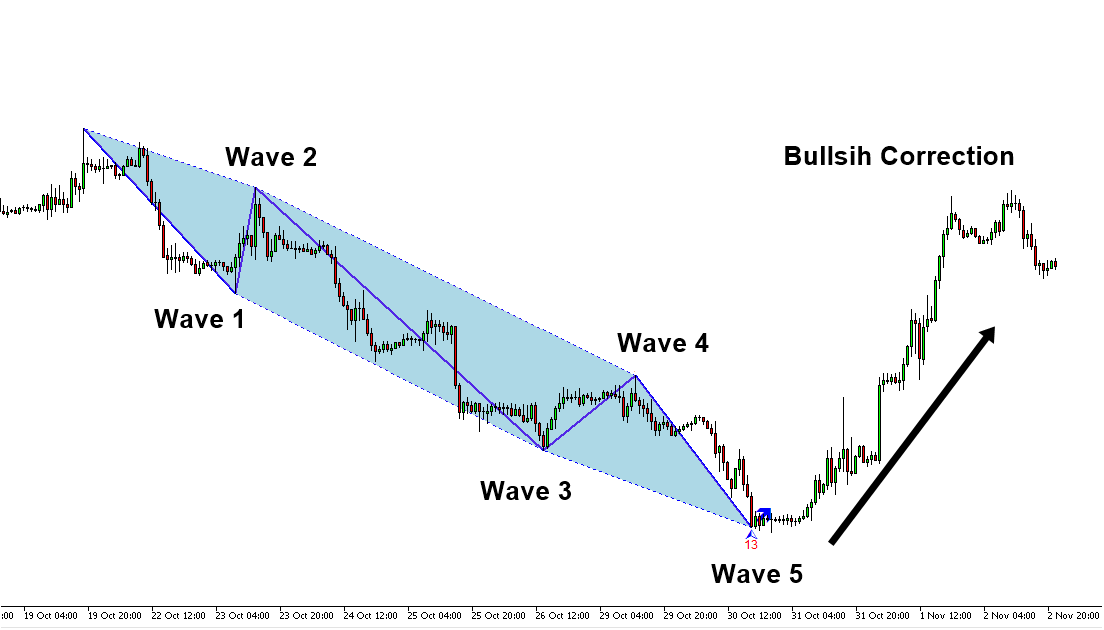

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

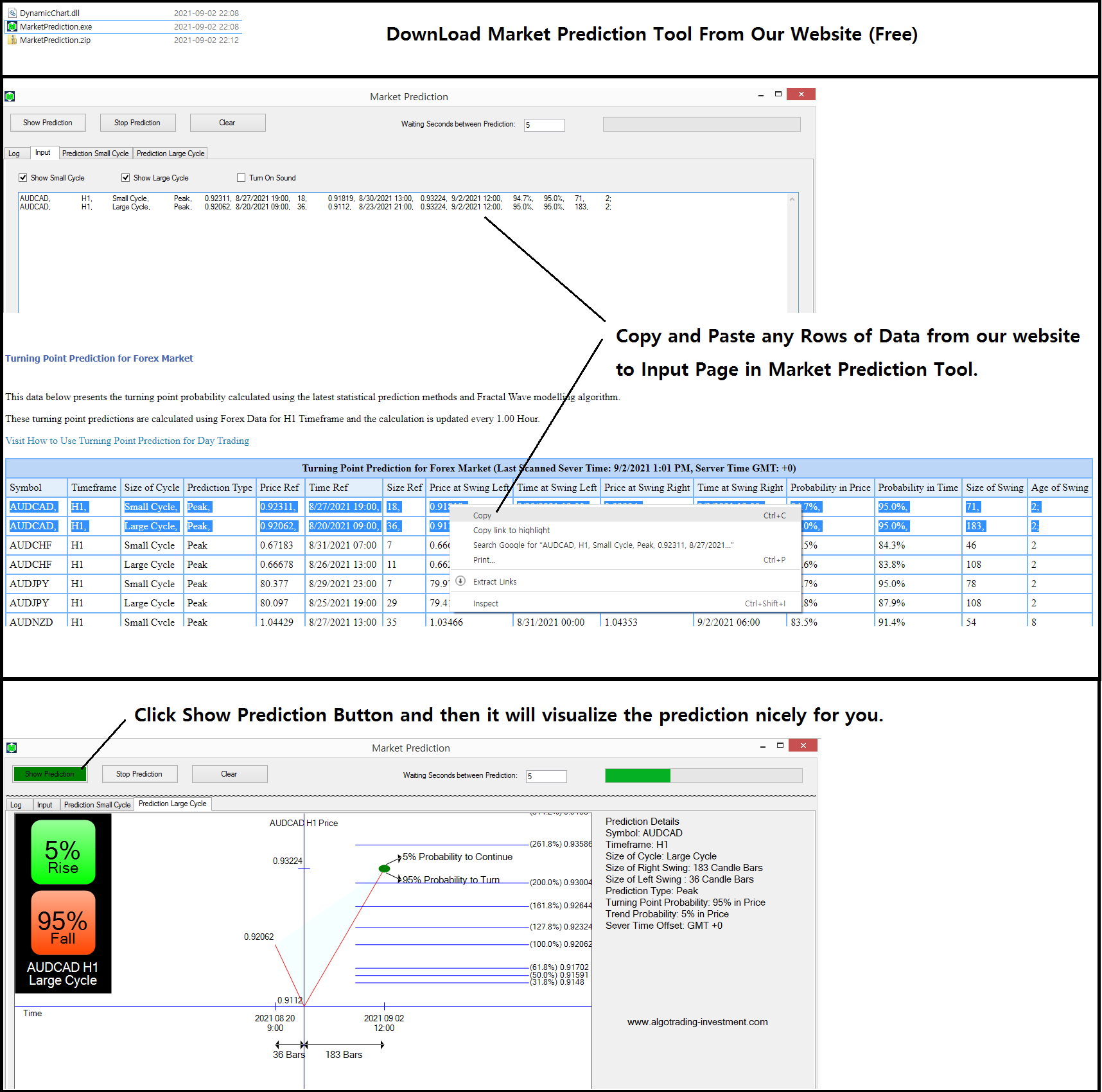

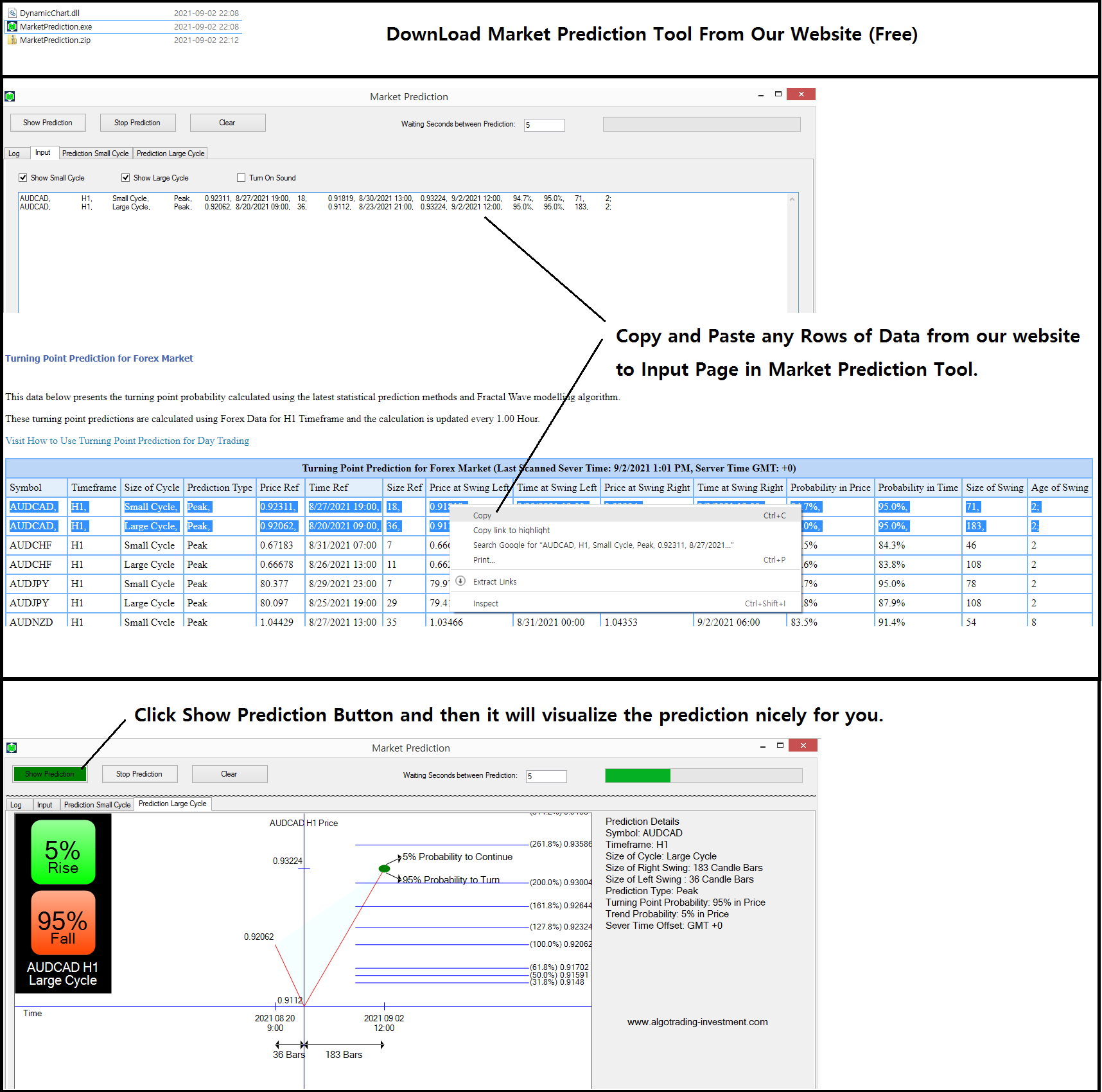

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

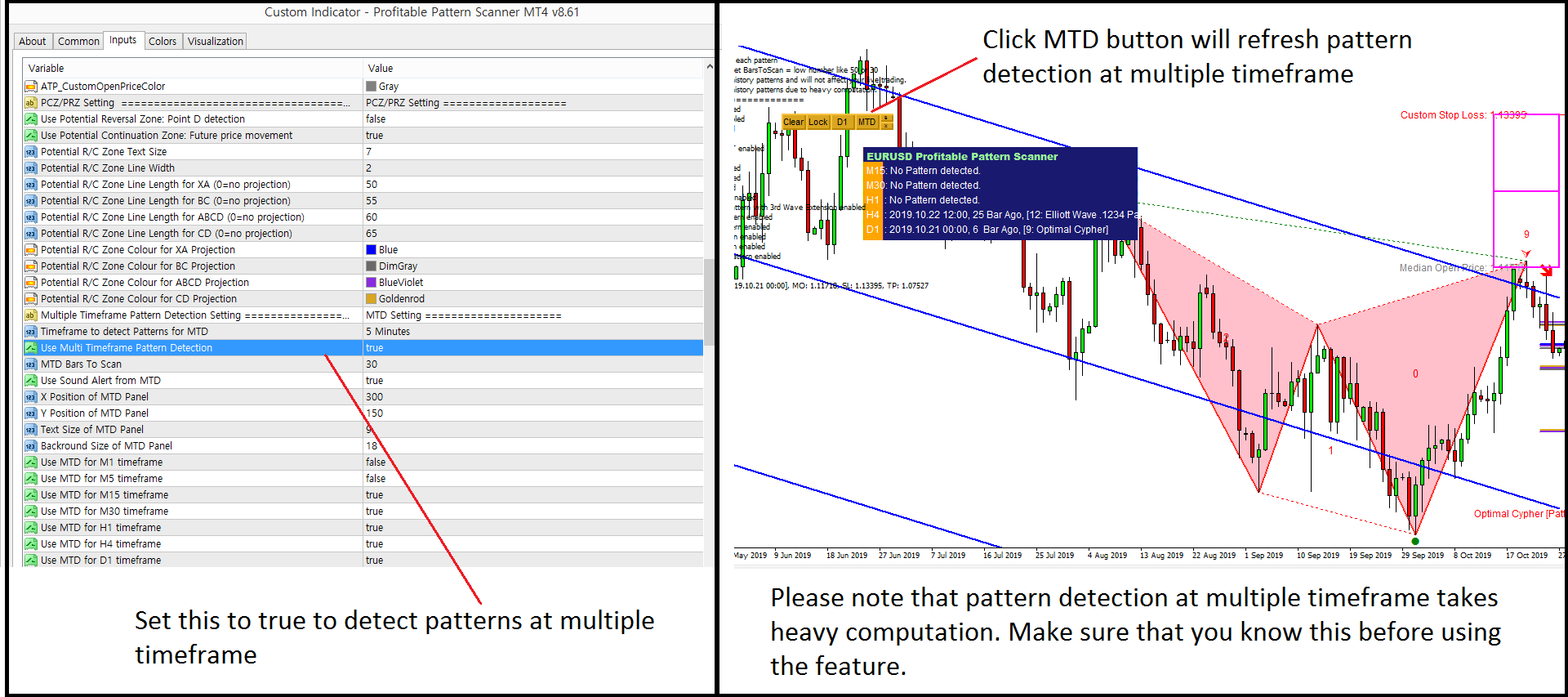

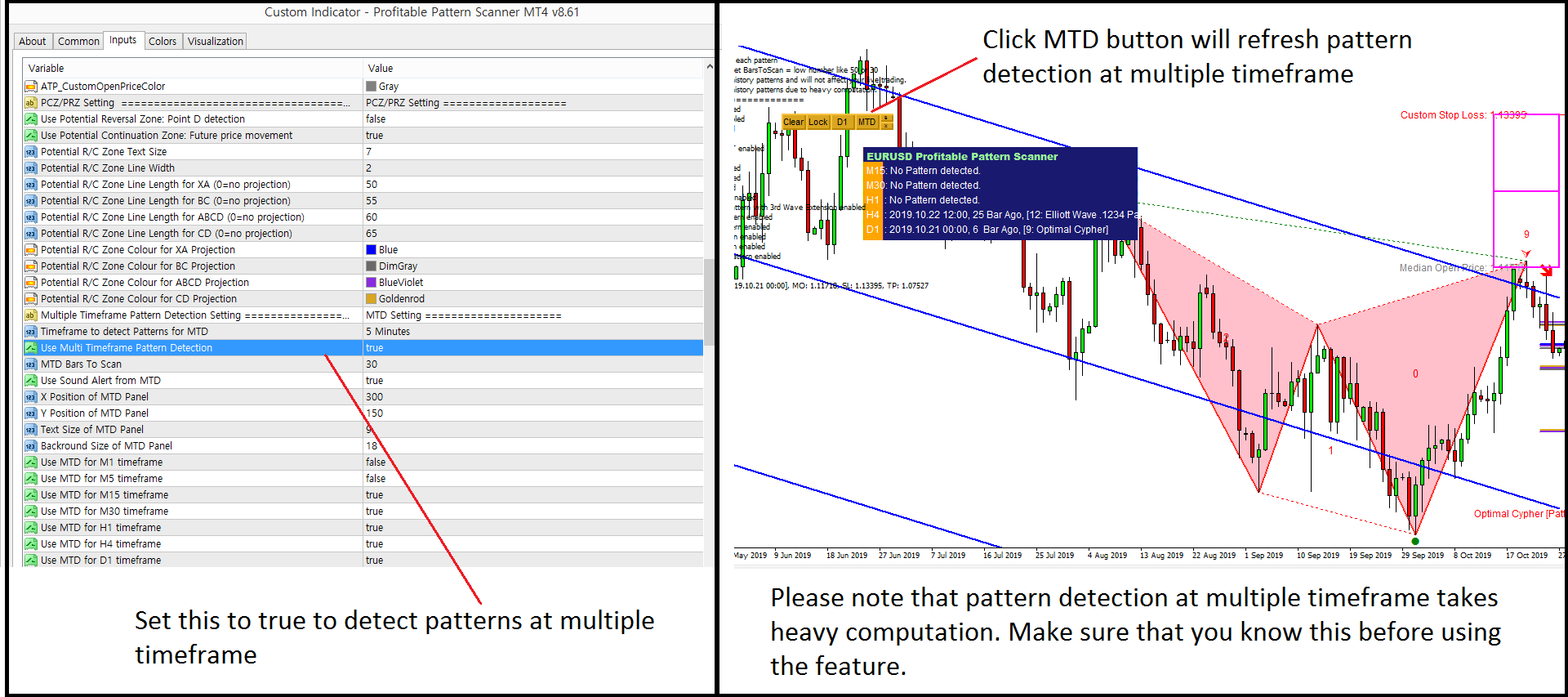

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

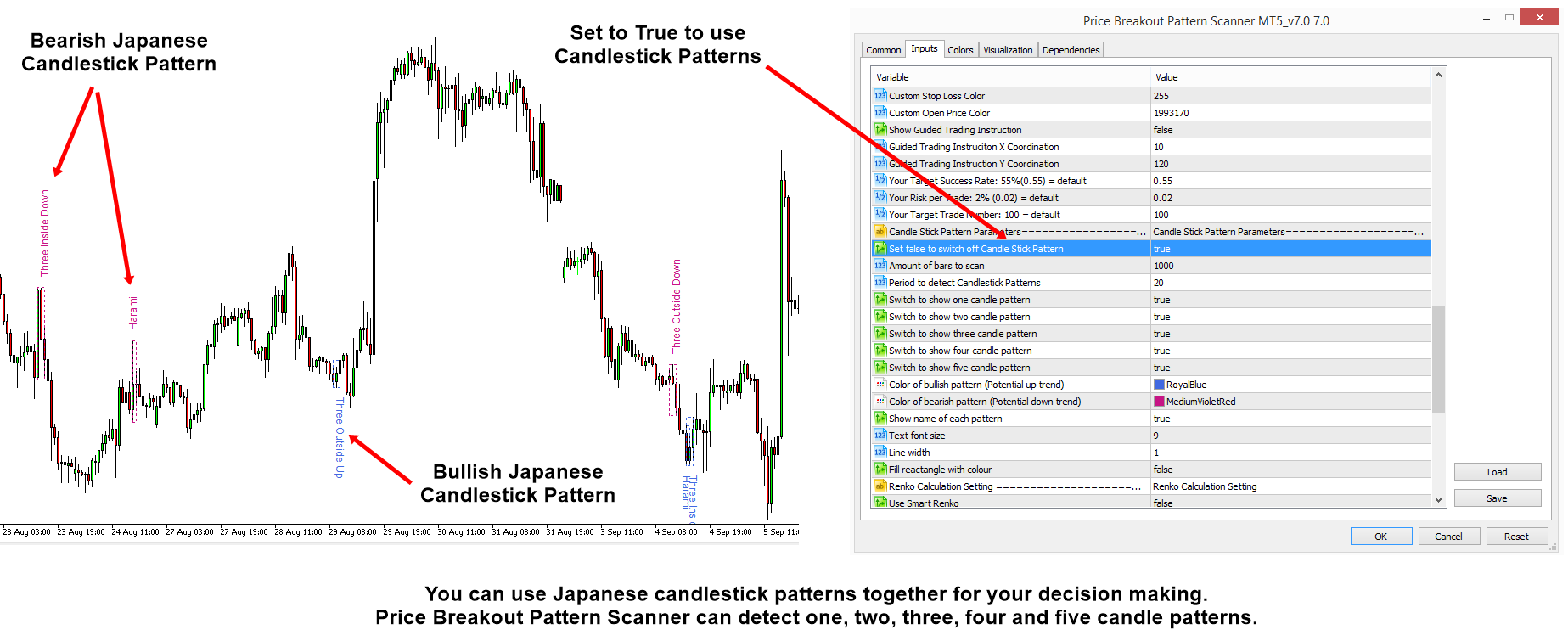

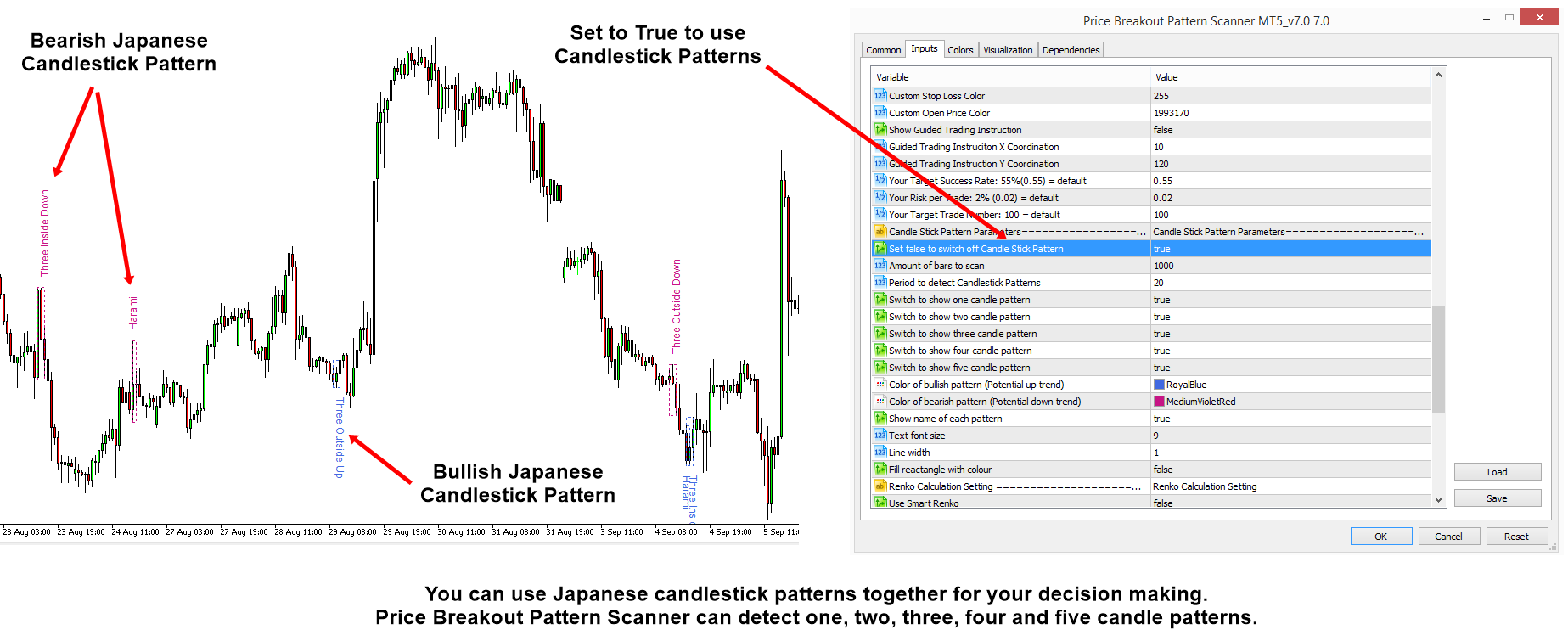

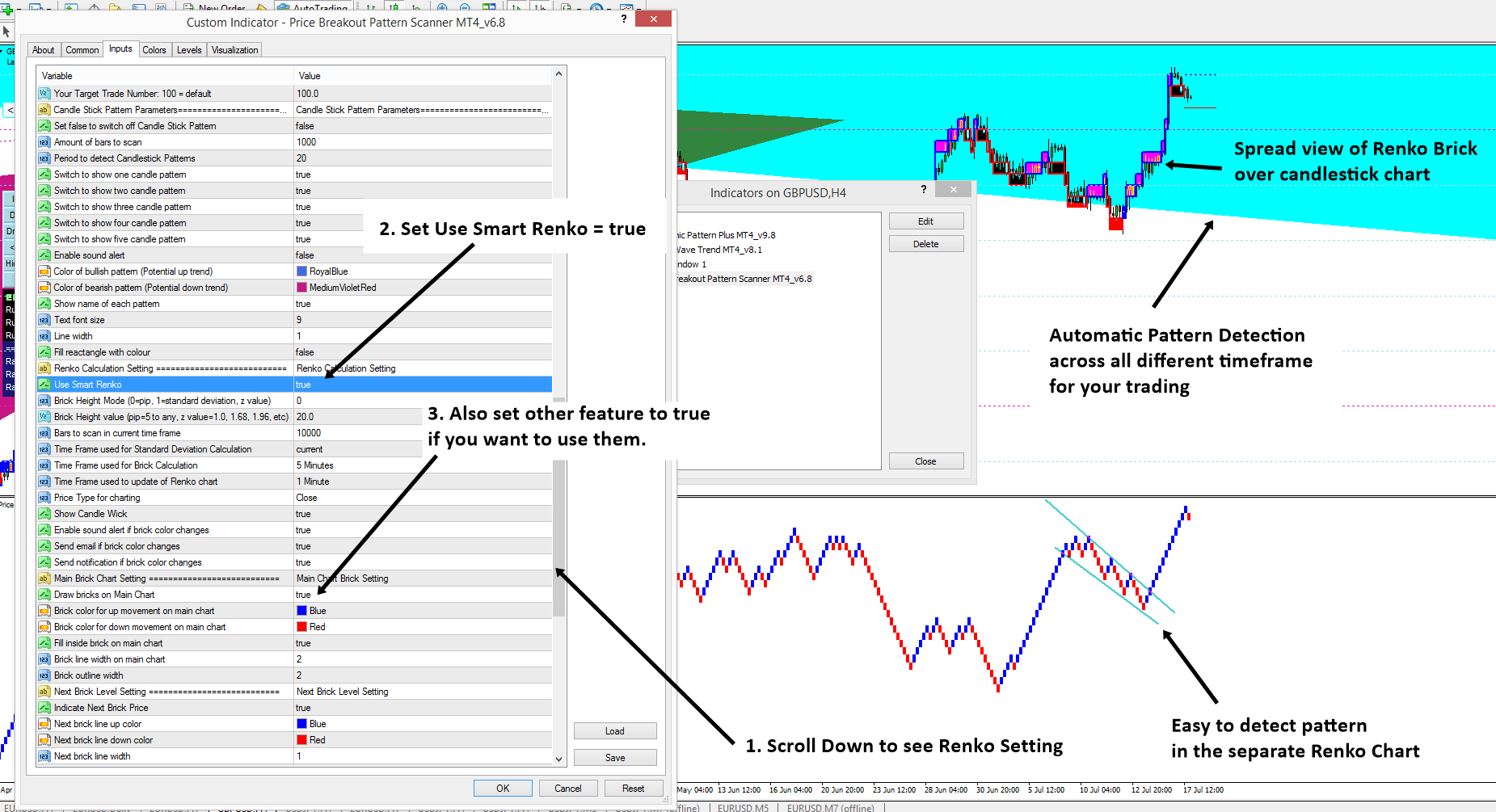

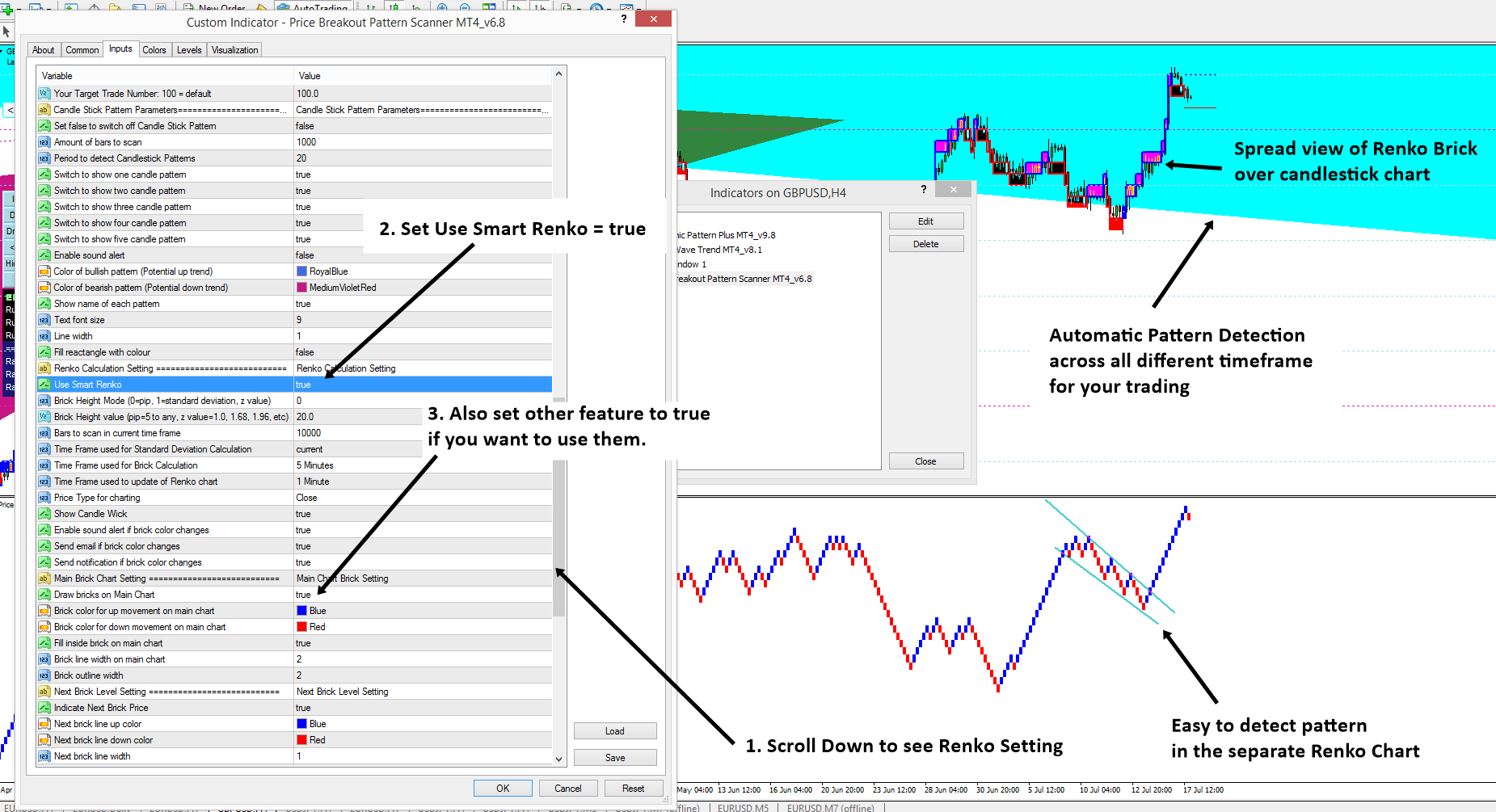

Using Japanese candlestick patterns with Price Breakout Pattern Scanner

Price Breakout Pattern Scanner combines several trading systems in one product. Properly used, they can yield excellent trading results. One of the trading system built inside Price Breakout Pattern Scanner is Japanese candlestick patterns. Price Breakout Pattern Scanner can detect 52 different Japanese candlestick patterns. They are categorized under five categories including one, two, three, four and five candlestick patterns.

To use Japanese candlestick patterns, you have enable the candlestick pattern from Price Breakout Pattern Scanner. See the attached screenshot for the purpose. Then you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two and three candlestick patterns if you wish.

In addition, you can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Price Breakout Pattern Scanner combines several trading systems in one product. Properly used, they can yield excellent trading results. One of the trading system built inside Price Breakout Pattern Scanner is Japanese candlestick patterns. Price Breakout Pattern Scanner can detect 52 different Japanese candlestick patterns. They are categorized under five categories including one, two, three, four and five candlestick patterns.

To use Japanese candlestick patterns, you have enable the candlestick pattern from Price Breakout Pattern Scanner. See the attached screenshot for the purpose. Then you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two and three candlestick patterns if you wish.

In addition, you can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Young Ho Seo

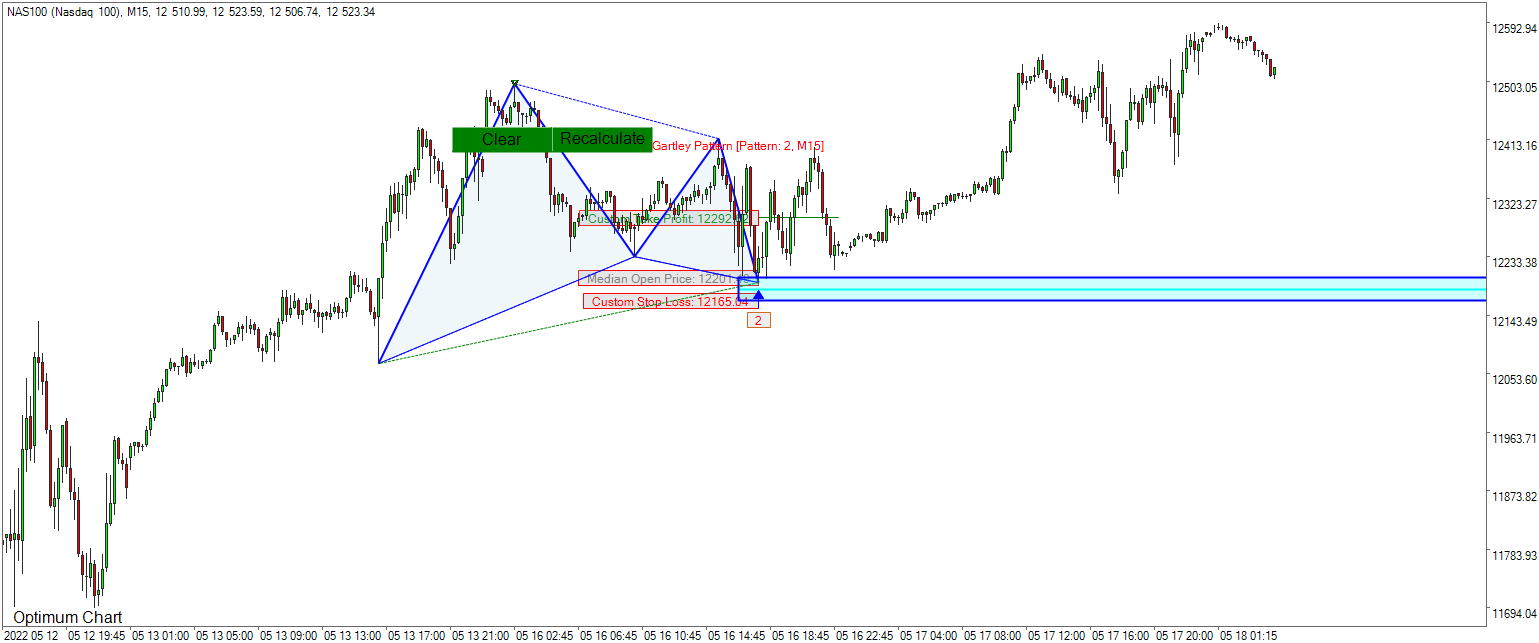

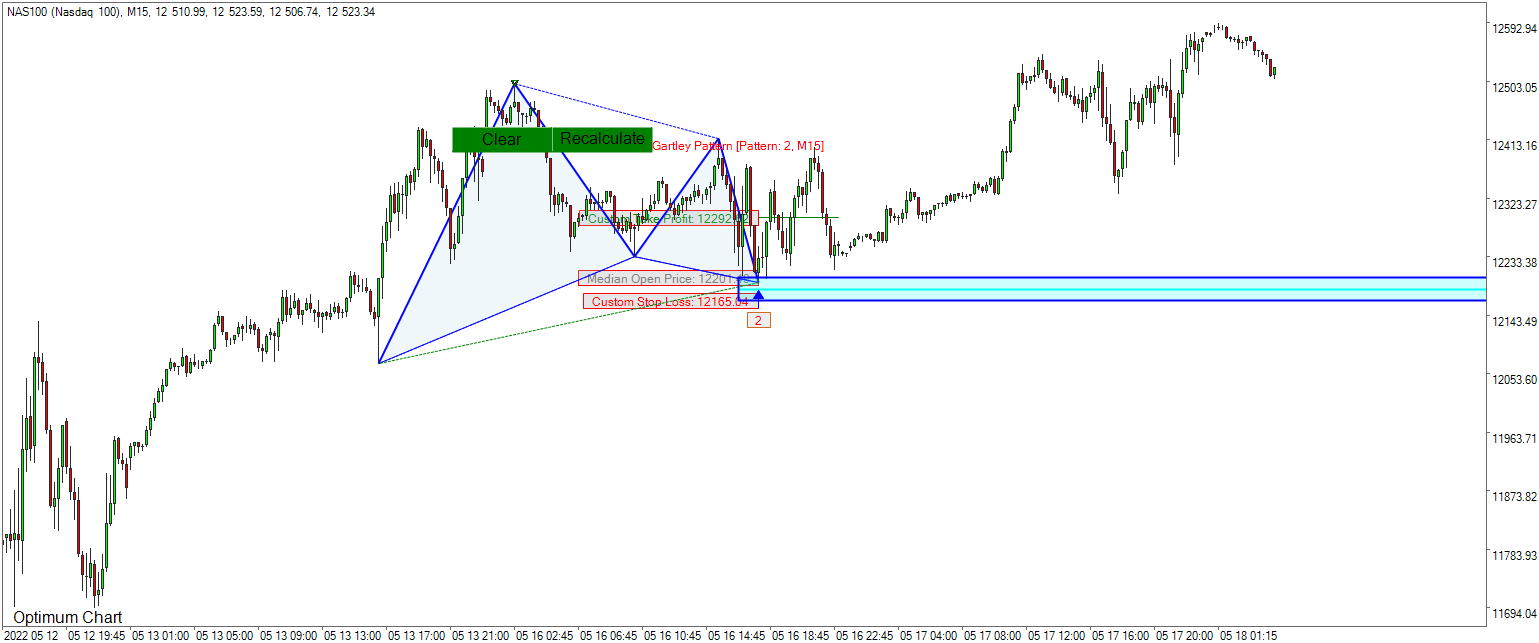

Gartley Pattern Study

This study involves to exam 96 Gartley Patterns, historically formed in Forex and stock market index Chart. First screenshot is taken with Garltey Pattern only. Second screenshot is taken with Gartley pattern + Supply Demand Zone + Bollinger Bands. So there are 192 screenshots (96 x 2) in this study. This study uses non repainting and non lagging Harmonic Pattern detection algorithm. Hence, this study will show both failed and successful pattern to provide you the unbiased results. Typically, a repainting indicator will show the successful pattern making it hard to check the real performance of your strategy in historical study in your chart. If you want to become a profitable trader, you should study the strategy in the scientific manner. It basically involves checking the repeatability or reproducibility. We provide this study to enhance the forex and stock trading for the trading community. We also want to add some scientific value for the Harmonic Pattern, X3 Chart Pattern and Elliott Wave Pattern too. The Gartley Pattern in this study has the following Structure:

N: 3, C0: 0.618 to T0: 3

R0: 1.272, R1: 0.382 -0.886, R2: 0.618

Points to watch out in this study:

Price movement around the Pattern Completion Zone (= Trading Zone) in the Gartley Pattern

Supply Demand Zone interaction with Gartley Pattern

Risk management around the Trading Zone. Look for the trading entry, where at least, Reward > Risk x 2

Possibility for breakout trading around the trading zone (=use them as support and resistance)

Look for continuation pattern vs reversal pattern

You can find some Reference for this study below:

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Here is the YouTube Link for Gartly Pattern Study: https://youtu.be/J3vjlHatUTI

This study was performed using the Robo Advisor built inside Optimum Chart.

https://algotrading-investment.com/2019/07/23/optimum-chart/

You can also check the similar results using the X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5 platform (Non repainting and non lagging algorithm).

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Harmonic Pattern Plus is the repainting Harmonic Pattern Scanner with tons of powerful features at affordable cost.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

Harmonic Pattern Scenario Planner is the advanced repainting Harmonic Pattern Scanner with tons of powerful features at affordable cost.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

This study involves to exam 96 Gartley Patterns, historically formed in Forex and stock market index Chart. First screenshot is taken with Garltey Pattern only. Second screenshot is taken with Gartley pattern + Supply Demand Zone + Bollinger Bands. So there are 192 screenshots (96 x 2) in this study. This study uses non repainting and non lagging Harmonic Pattern detection algorithm. Hence, this study will show both failed and successful pattern to provide you the unbiased results. Typically, a repainting indicator will show the successful pattern making it hard to check the real performance of your strategy in historical study in your chart. If you want to become a profitable trader, you should study the strategy in the scientific manner. It basically involves checking the repeatability or reproducibility. We provide this study to enhance the forex and stock trading for the trading community. We also want to add some scientific value for the Harmonic Pattern, X3 Chart Pattern and Elliott Wave Pattern too. The Gartley Pattern in this study has the following Structure:

N: 3, C0: 0.618 to T0: 3

R0: 1.272, R1: 0.382 -0.886, R2: 0.618

Points to watch out in this study:

Price movement around the Pattern Completion Zone (= Trading Zone) in the Gartley Pattern

Supply Demand Zone interaction with Gartley Pattern

Risk management around the Trading Zone. Look for the trading entry, where at least, Reward > Risk x 2

Possibility for breakout trading around the trading zone (=use them as support and resistance)

Look for continuation pattern vs reversal pattern

You can find some Reference for this study below:

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Here is the YouTube Link for Gartly Pattern Study: https://youtu.be/J3vjlHatUTI

This study was performed using the Robo Advisor built inside Optimum Chart.

https://algotrading-investment.com/2019/07/23/optimum-chart/

You can also check the similar results using the X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5 platform (Non repainting and non lagging algorithm).

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Harmonic Pattern Plus is the repainting Harmonic Pattern Scanner with tons of powerful features at affordable cost.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

Harmonic Pattern Scenario Planner is the advanced repainting Harmonic Pattern Scanner with tons of powerful features at affordable cost.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Young Ho Seo

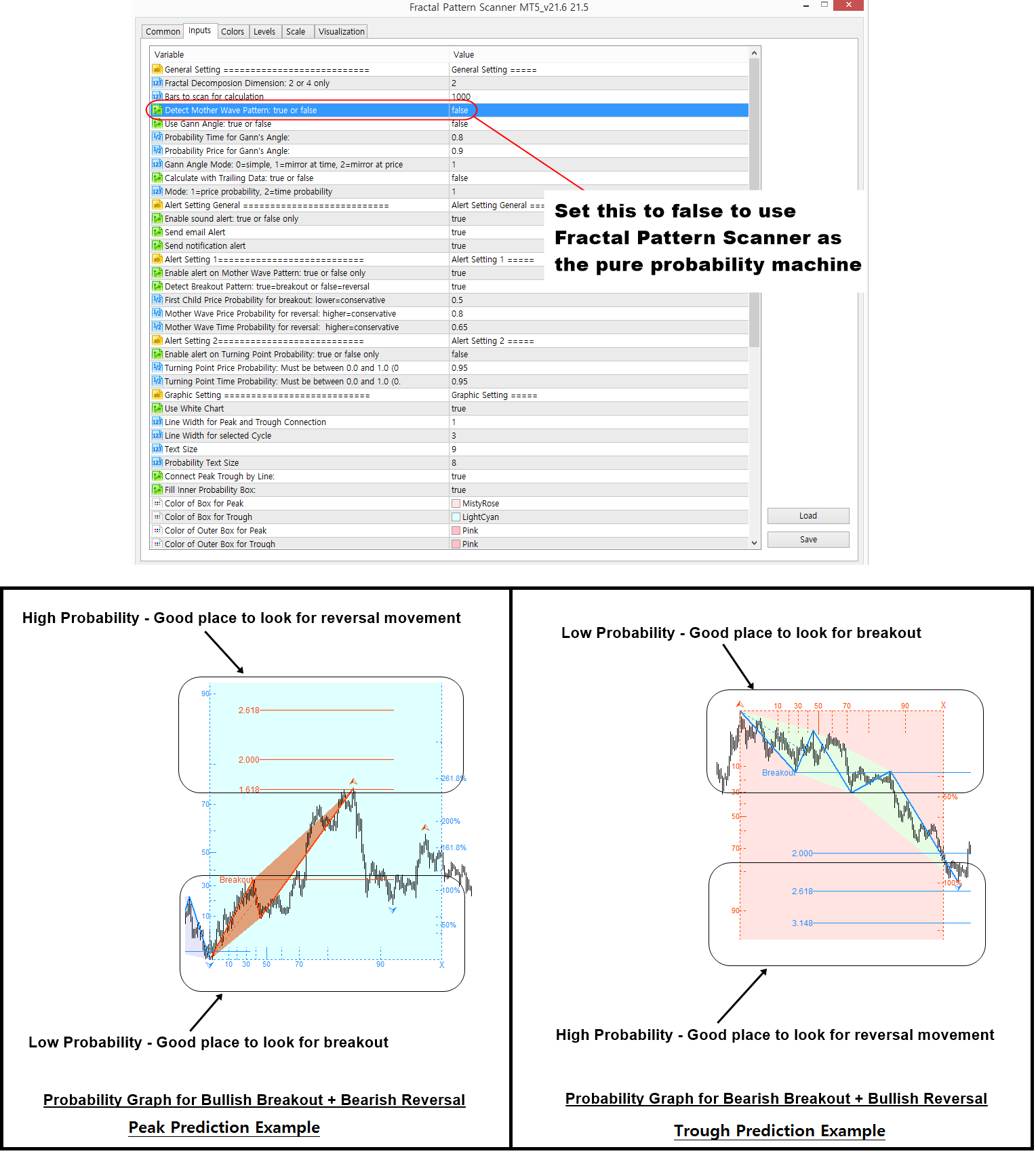

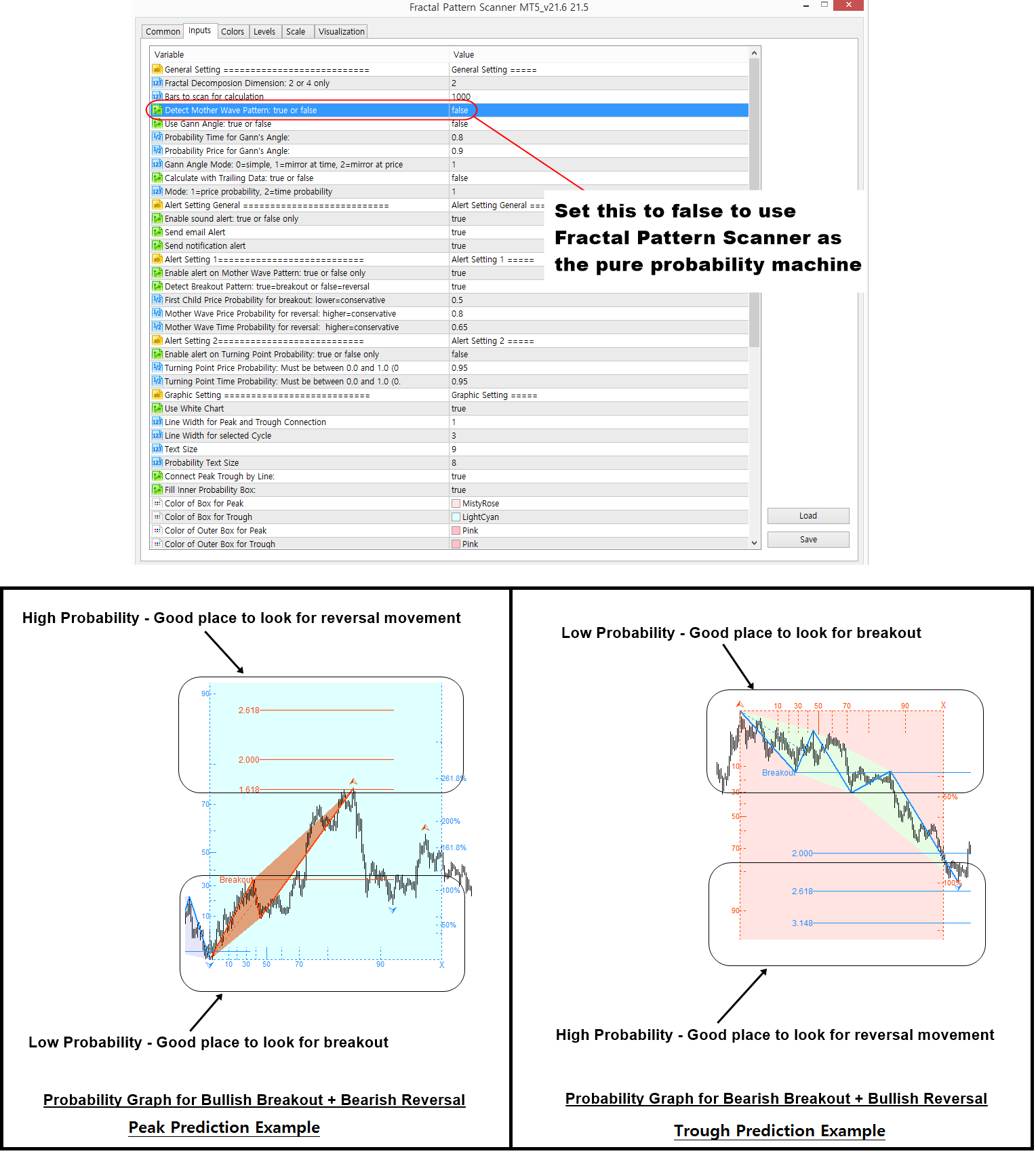

Fractal Pattern Scanner – Trading Operation

In this short article, we will explain the trading operation with turning point probability for Fractal Pattern Scanner in MetaTrader and in Optimum Chart. Fractal Pattern Scanner is the powerful tool to predict the Forex and Stock market. It is the highly predictive tool that quantifies the price action at every wave in your chart. Fractal Pattern Scanner provides three main features. The three features include:

1. Turning Point Probability Measurement (Essential feature that you can use everyday)

2. Breakout and Reversal Trading Signal Detection with Mother Wave detection

3. Automatic Gann Angles (Bonus feature and optional use only)

The turning point probability measurement is the essential to your daily trading. The turning point probability basically quantifies the price action in your chart. Quantifying the price action will provide you the another level of trading experience. Capability to access the turning point probability in one button click is really handy feature for every day trader on the earth. In addition, Fractal Pattern Scanner provides the probability scanning capability across all timeframe. You can also switch on and off the multiple timeframe pattern detection. When you set Detect Mother Wave = false, you can run the Fractal Pattern Scanner as the pure probability machine.

The turning point probability is a powerful tool that you can use it as both reversal trading or breakout trading within your technical analysis. You can watch this YouTube video titled as “Breakout Trading vs Reversal Trading (Turn Support & Resistance to Killer Strategy)” in this link below to get some hands on practice with breakout and reversal trading opportunity with Support and Resistance Technical Analysis.

YouTube Video Link: https://youtu.be/UbORmOacKIQ

Mother wave pattern detection can be considered as the statistical representation of the Elliott Wave Theory. For example, Mother wave pattern detect the pattern inside pattern structure, where small patterns are jagged inside big pattern, like the Elliott Wave pattern. We can use this pattern inside pattern to trade both reversal and breakout trading. Fractal Pattern Scanner does the excellent job in detecting these signals automatically. When you set Detect Mother Wave = true, then Fractal Pattern Scanner will detect trading signal using Mother wave pattern detection. Even in that, you can also perform both breakout and reversal trading automatically.

If you want to use Breakout Trading Mode, then set Detect Breakout Opportunity = true.

If you want to use Reversal Trading Mode, then set Detect Breakout Opportunity = false.

You can also watch the YouTube Video titled as “Breakout Trading Signal Explained” to understand the breakout trading with mother wave detection.

YouTube video link: https://youtu.be/4XGuMIMaV6w

====================================================================================

Mother Wave Pattern Explained further

The idea behind the Breakout trading with Mother wave is to detect mother wave relatively young and fresh. Those young and fresh mother wave will be typically found in the low turning point probability area. Then what does “First Child Price Probability” input do ? It is the criteria for how small first child wave could be when the mother wave pattern is detected. If this is even hard to understand, then you can think it is the size of mother wave.

If you set the First Child Price Probability = 30%, then Fractal Pattern Scanner will detect first child wave with its size less than 30% amplitude. Likewise, if you set the First Child Price Probability = 50%, then Fractal Pattern Scanner will detect first child wave with its size less than 50%. For your information, the detected mother wave patterns does not provide any sort of geometric regularity detection in the case of breakout trading. We have taught you several geometric regularity detection like support, resistance and triangle and wedge patterns. You will need similar sort of operation here.

In the reversal trading mode with Mother Wave, the size of first child wave is no longer required to be controlled. However, we can control the size of Mother wave. The idea behind the reversal trading mode is to detect mature mother wave pattern that are likely to make reversal movement. Hence, it is better to find these mother wave patterns in high probability area in the probability graph.

For this reason, we have set the mother wave price probability = 80%. You can set even higher number if you wish. When you are using reversal trading mode, we provide automatic Fibonacci expansion to help you to decide the final turning point. This is sort of geometric regularity you can use. But you can use any other geometric regularity we have taught you in our articles and books too like Harmonic Pattern or Elliott Wave patterns, etc if you are good with them.

Here is some important tips. From our experience, some Forex symbols are better with breakout trading mode. Some Forex symbols are better with reversal trading mode. To find out the best trading approach, just set Bars to Scan = 6000 or higher. Just find how each trading mode is profitable in the chart.

You can also use strategy tester for this purpose too. When you are using the strategy tester, then set Calculating with Trailing Data = true. This will tell the Fractal Pattern Scanner to calculate the probability with trailing data (i.e. technical analysis approach) rather than the statistical approach. When you are using technical analysis approach, the probability will be calculated like other technical indicators like Moving average indicator or RSI indicator using trailing data. In statistical approach, the entire data will be used to calculate probability.

Statistical approach and technical analysis approach does not matter for the latest pattern to trade. It is only matter for historical patterns for your information. I personally prefer to calculate the probability using Statistical approach because it provides the identical probability across all price series.

I guess it is too much mathematical talk. I will cut it out. If you do not want to think, then just remember these two cases.

A. If you want to see the historical patterns in your chart, then set “Calculating with Trailing Data” = false.

B. When you are using the strategy tester, then set “Calculating with Trailing Data” = true.

Landing Page to Fractal Pattern Scanner

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Landing Page to Optimum Chart

https://algotrading-investment.com/2019/07/23/optimum-chart/

In this short article, we will explain the trading operation with turning point probability for Fractal Pattern Scanner in MetaTrader and in Optimum Chart. Fractal Pattern Scanner is the powerful tool to predict the Forex and Stock market. It is the highly predictive tool that quantifies the price action at every wave in your chart. Fractal Pattern Scanner provides three main features. The three features include:

1. Turning Point Probability Measurement (Essential feature that you can use everyday)

2. Breakout and Reversal Trading Signal Detection with Mother Wave detection

3. Automatic Gann Angles (Bonus feature and optional use only)

The turning point probability measurement is the essential to your daily trading. The turning point probability basically quantifies the price action in your chart. Quantifying the price action will provide you the another level of trading experience. Capability to access the turning point probability in one button click is really handy feature for every day trader on the earth. In addition, Fractal Pattern Scanner provides the probability scanning capability across all timeframe. You can also switch on and off the multiple timeframe pattern detection. When you set Detect Mother Wave = false, you can run the Fractal Pattern Scanner as the pure probability machine.

The turning point probability is a powerful tool that you can use it as both reversal trading or breakout trading within your technical analysis. You can watch this YouTube video titled as “Breakout Trading vs Reversal Trading (Turn Support & Resistance to Killer Strategy)” in this link below to get some hands on practice with breakout and reversal trading opportunity with Support and Resistance Technical Analysis.

YouTube Video Link: https://youtu.be/UbORmOacKIQ

Mother wave pattern detection can be considered as the statistical representation of the Elliott Wave Theory. For example, Mother wave pattern detect the pattern inside pattern structure, where small patterns are jagged inside big pattern, like the Elliott Wave pattern. We can use this pattern inside pattern to trade both reversal and breakout trading. Fractal Pattern Scanner does the excellent job in detecting these signals automatically. When you set Detect Mother Wave = true, then Fractal Pattern Scanner will detect trading signal using Mother wave pattern detection. Even in that, you can also perform both breakout and reversal trading automatically.

If you want to use Breakout Trading Mode, then set Detect Breakout Opportunity = true.

If you want to use Reversal Trading Mode, then set Detect Breakout Opportunity = false.

You can also watch the YouTube Video titled as “Breakout Trading Signal Explained” to understand the breakout trading with mother wave detection.

YouTube video link: https://youtu.be/4XGuMIMaV6w

====================================================================================

Mother Wave Pattern Explained further

The idea behind the Breakout trading with Mother wave is to detect mother wave relatively young and fresh. Those young and fresh mother wave will be typically found in the low turning point probability area. Then what does “First Child Price Probability” input do ? It is the criteria for how small first child wave could be when the mother wave pattern is detected. If this is even hard to understand, then you can think it is the size of mother wave.

If you set the First Child Price Probability = 30%, then Fractal Pattern Scanner will detect first child wave with its size less than 30% amplitude. Likewise, if you set the First Child Price Probability = 50%, then Fractal Pattern Scanner will detect first child wave with its size less than 50%. For your information, the detected mother wave patterns does not provide any sort of geometric regularity detection in the case of breakout trading. We have taught you several geometric regularity detection like support, resistance and triangle and wedge patterns. You will need similar sort of operation here.

In the reversal trading mode with Mother Wave, the size of first child wave is no longer required to be controlled. However, we can control the size of Mother wave. The idea behind the reversal trading mode is to detect mature mother wave pattern that are likely to make reversal movement. Hence, it is better to find these mother wave patterns in high probability area in the probability graph.

For this reason, we have set the mother wave price probability = 80%. You can set even higher number if you wish. When you are using reversal trading mode, we provide automatic Fibonacci expansion to help you to decide the final turning point. This is sort of geometric regularity you can use. But you can use any other geometric regularity we have taught you in our articles and books too like Harmonic Pattern or Elliott Wave patterns, etc if you are good with them.

Here is some important tips. From our experience, some Forex symbols are better with breakout trading mode. Some Forex symbols are better with reversal trading mode. To find out the best trading approach, just set Bars to Scan = 6000 or higher. Just find how each trading mode is profitable in the chart.

You can also use strategy tester for this purpose too. When you are using the strategy tester, then set Calculating with Trailing Data = true. This will tell the Fractal Pattern Scanner to calculate the probability with trailing data (i.e. technical analysis approach) rather than the statistical approach. When you are using technical analysis approach, the probability will be calculated like other technical indicators like Moving average indicator or RSI indicator using trailing data. In statistical approach, the entire data will be used to calculate probability.

Statistical approach and technical analysis approach does not matter for the latest pattern to trade. It is only matter for historical patterns for your information. I personally prefer to calculate the probability using Statistical approach because it provides the identical probability across all price series.

I guess it is too much mathematical talk. I will cut it out. If you do not want to think, then just remember these two cases.

A. If you want to see the historical patterns in your chart, then set “Calculating with Trailing Data” = false.

B. When you are using the strategy tester, then set “Calculating with Trailing Data” = true.

Landing Page to Fractal Pattern Scanner

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Landing Page to Optimum Chart

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

Harmonic Pattern Indicator with Japanese Candlestick Pattern

Apparently Japanese Candlestick patterns are popular and helpful tools to trader to predict the market direction. It is possible to use Japanese Candlestick patterns in your Harmonic Pattern Trading. These Japanese candlestick patterns include “Hammer”, “Doji Star”, “Harami”, “Inverted Hammer”, “Break away” and so on.

Here is some short article on how to use Japanese candlestick pattern with Harmonic Pattern Plus. This article meant to be quick guideline on enabling Japanese Candlestick pattern together with Harmonic Pattern. In addition, you can use the Japanese Candlestick Patterns from X3 Chart Pattern Scanner too.

https://algotrading-investment.com/2019/04/19/using-japanese-candlestick-patterns-with-harmonic-pattern-plus/

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Apparently Japanese Candlestick patterns are popular and helpful tools to trader to predict the market direction. It is possible to use Japanese Candlestick patterns in your Harmonic Pattern Trading. These Japanese candlestick patterns include “Hammer”, “Doji Star”, “Harami”, “Inverted Hammer”, “Break away” and so on.

Here is some short article on how to use Japanese candlestick pattern with Harmonic Pattern Plus. This article meant to be quick guideline on enabling Japanese Candlestick pattern together with Harmonic Pattern. In addition, you can use the Japanese Candlestick Patterns from X3 Chart Pattern Scanner too.

https://algotrading-investment.com/2019/04/19/using-japanese-candlestick-patterns-with-harmonic-pattern-plus/

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

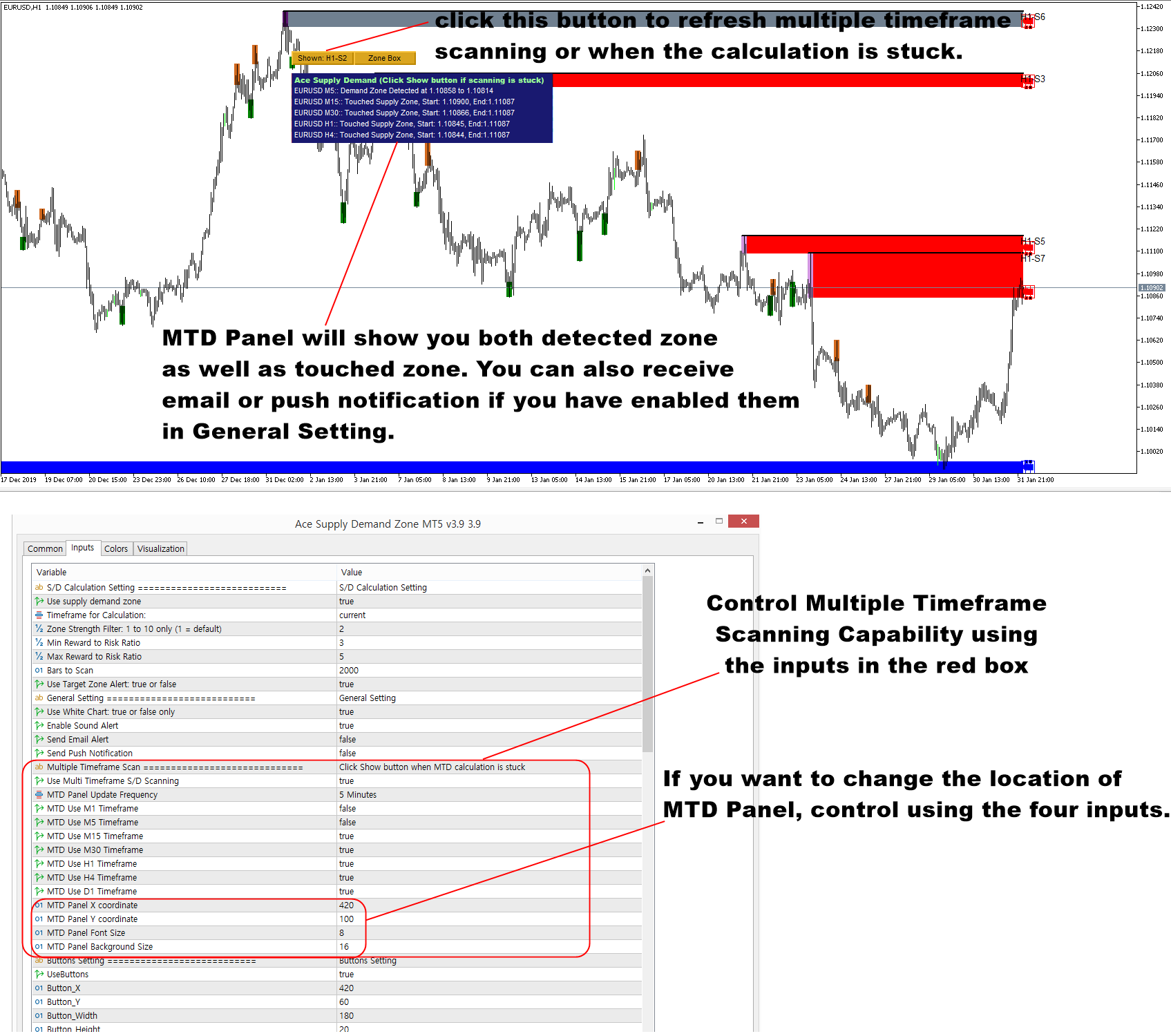

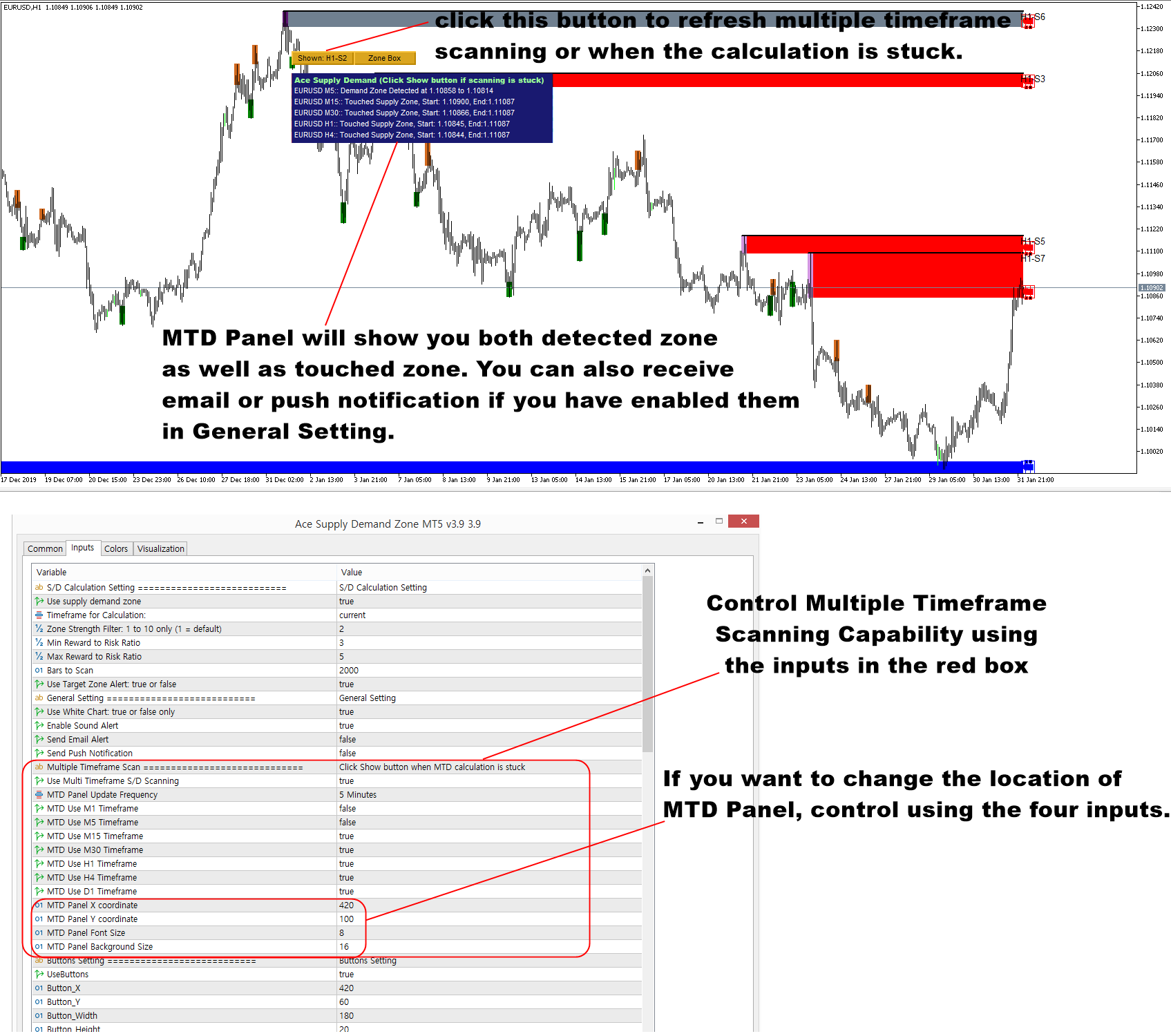

Scan Supply Demand Zone Across All Timeframe

In Ace Supply Demand Zone indicator, you can scan the supply and demand zone across all timeframe for your Forex trading. This is a powerful feature included in Ace Supply Demand Zone indicator. Controlling the Multiple Timeframe scanning is similar to our other MetaTrader products like Harmonic Pattern Plus or X3 Chart Pattern Scanner. You can control them from the inputs under the Multiple Timeframe Scanning. With the inputs, you can enable or disable multiple timeframe scanning. You can also choose to switch on or off specific timeframe from your dashboard. In addition, you can also control how frequently the indicator should scan. The default value for update frequency is M5 timeframe. However, you can use M1 for update frequency if you need to scan them more frequently.

If you enabled email or push notification in the inputs under General Setting, then you can also receive the alert for the detected supply and demand zone as well as the touched supply and demand zone. The thing you need to understand about multiple timeframe scanning is that it requires multiple computation too per each timeframe. The computation can be heavier up to 7 times or more when you enabled M1 to D1 timeframes. Hence, due to data loading issues, the calculation might be stuck sometimes. In that case, just click Show button to refresh all the calculation. Of course, it is possible to switch off the multiple timeframe scanning if you only want to trade one timeframe.

Ace Supply Demand Zone in MetaTrader 4 and MetaTrader 5

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Landing page for Ace Supply Demand Zone.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

In Ace Supply Demand Zone indicator, you can scan the supply and demand zone across all timeframe for your Forex trading. This is a powerful feature included in Ace Supply Demand Zone indicator. Controlling the Multiple Timeframe scanning is similar to our other MetaTrader products like Harmonic Pattern Plus or X3 Chart Pattern Scanner. You can control them from the inputs under the Multiple Timeframe Scanning. With the inputs, you can enable or disable multiple timeframe scanning. You can also choose to switch on or off specific timeframe from your dashboard. In addition, you can also control how frequently the indicator should scan. The default value for update frequency is M5 timeframe. However, you can use M1 for update frequency if you need to scan them more frequently.

If you enabled email or push notification in the inputs under General Setting, then you can also receive the alert for the detected supply and demand zone as well as the touched supply and demand zone. The thing you need to understand about multiple timeframe scanning is that it requires multiple computation too per each timeframe. The computation can be heavier up to 7 times or more when you enabled M1 to D1 timeframes. Hence, due to data loading issues, the calculation might be stuck sometimes. In that case, just click Show button to refresh all the calculation. Of course, it is possible to switch off the multiple timeframe scanning if you only want to trade one timeframe.

Ace Supply Demand Zone in MetaTrader 4 and MetaTrader 5

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Landing page for Ace Supply Demand Zone.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

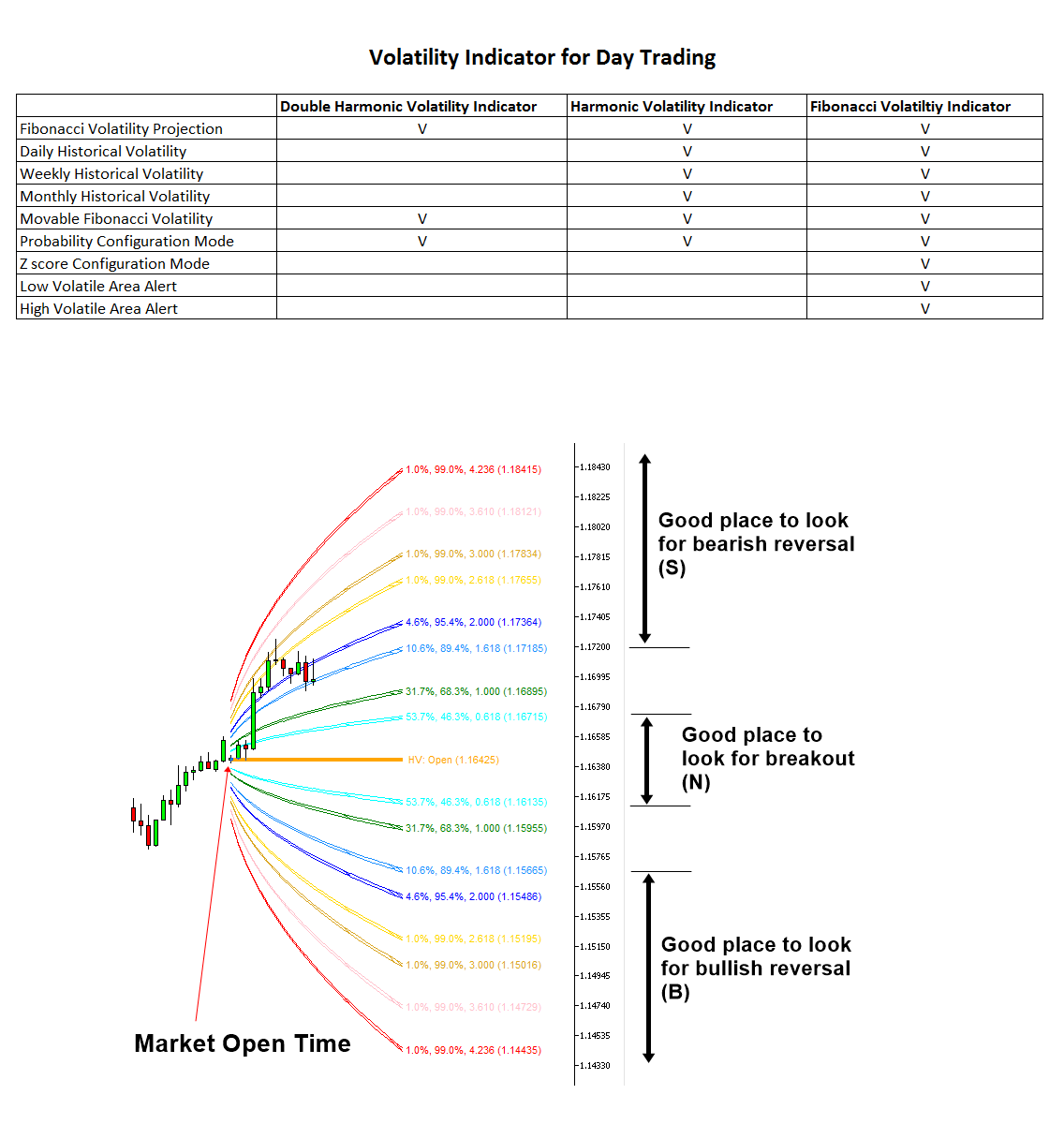

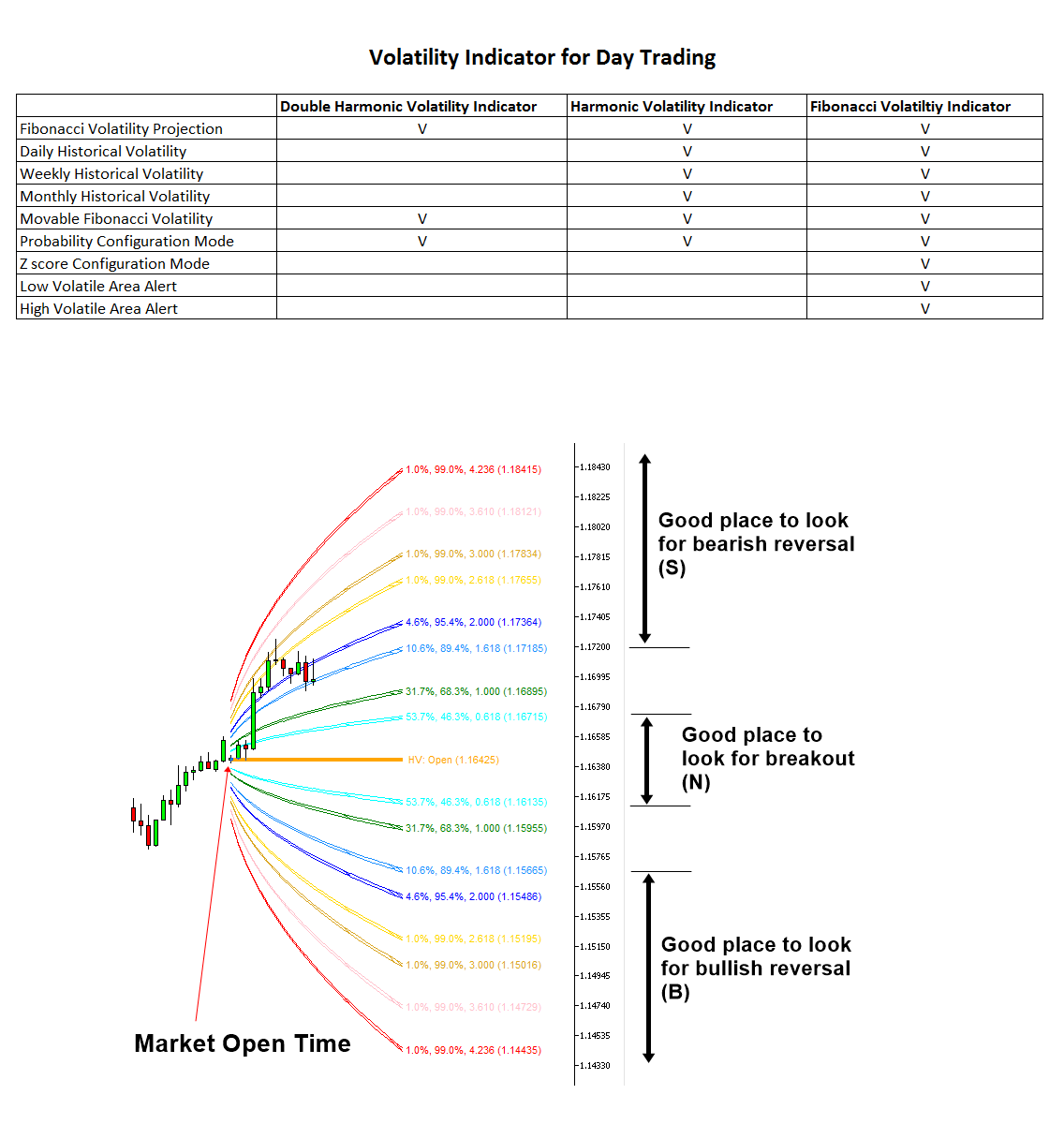

Volatility Indicator for Day Trading

Volatility indicator can help you to detect any statistical advantage for your day trading. Especially, if you are trading with Price Action and Price Patterns, then we recommend using the Volatility indicator together with your strategy. Without the volatility indicator, you can make small and big mistakes often. We provide the advanced volatility indicators for MetaTrader 4 and MetaTrader 5 platform.

Fibonacci Volatility Indicator

Fibonacci Volatility indicator can provide the market volatility in visual form in your chart for your trading. You can use Daily, Weekly, Monthly and Yearly Volatility for your trading. The most important application of this Volatility indicator is to detect the potential breakout area, potential bullish reversal area and potential bearish reversal area. When you want to visualize the Volatility for your trading, this is the best tool available in the market. Additionally, you can also use the Movable Volatility indicator and you can set the alert at low and high volatile area in your chart.

https://www.mql5.com/en/market/product/52671

https://www.mql5.com/en/market/product/52670

https://algotrading-investment.com/portfolio-item/fibonacci-volatility-indicator/

Harmonic Volatility Indicator

Harmonic Volatility indicator also provides the market volatility in visual form in your chart for your trading. This tool can be used to visualize the Daily, Weekly, Monthly and Yearly Volatility. The difference between Harmonic Volatility indicator and Fibonacci Volatility indicator is that you can only use Probability Configuration mode in the Harmonic Volatility indicator whereas in the Fibonacci Volatility indicator you can access both Probability Configuration and Z Score configuration. This is cheaper than Fibonacci Volatility indicator. Hence, this is the light version of the Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/29008

https://www.mql5.com/en/market/product/29004

https://algotrading-investment.com/portfolio-item/harmonic-volatility-indicator/

Double Harmonic Volatility Indicator

This is the cheapest Volatility indicator. This indicator is specialized in the Movable Volatility indicator mostly. Hence, if you only need the Movable Volatility indicator and you want to have more cost effective tool, then use this. However, if you want to have more choice in the Volatility visualization, then use either Harmonic Volatility indicator or Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/23779

https://www.mql5.com/en/market/product/23769

https://algotrading-investment.com/portfolio-item/double-harmonic-volatility-indicator/

GARCH improved Nelder Mead – Free indicator

This is free Volatility indicator that implements the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) methods with Nelder Mead algorithm. This is bit of experimental indicator to realize the GARCH (1,1) model. Hence, we provide this indicator for free. It would be interesting to see how this Volatility indicator works for your trading.

https://www.mql5.com/en/market/product/6918

https://www.mql5.com/en/market/product/6910

https://algotrading-investment.com/portfolio-item/garch-improved-nelder-mead/

In addition, you can watch this YouTube video titled as “Volatility Indicator for Day Trading” to feel what the Volatility indicator looks like in MetaTrader 4 and MetaTrader 5 platform.

YouTube Video “Volatility Indicator for Day Trading” : https://youtu.be/erWhucDT_6M

Volatility indicator can help you to detect any statistical advantage for your day trading. Especially, if you are trading with Price Action and Price Patterns, then we recommend using the Volatility indicator together with your strategy. Without the volatility indicator, you can make small and big mistakes often. We provide the advanced volatility indicators for MetaTrader 4 and MetaTrader 5 platform.

Fibonacci Volatility Indicator

Fibonacci Volatility indicator can provide the market volatility in visual form in your chart for your trading. You can use Daily, Weekly, Monthly and Yearly Volatility for your trading. The most important application of this Volatility indicator is to detect the potential breakout area, potential bullish reversal area and potential bearish reversal area. When you want to visualize the Volatility for your trading, this is the best tool available in the market. Additionally, you can also use the Movable Volatility indicator and you can set the alert at low and high volatile area in your chart.

https://www.mql5.com/en/market/product/52671

https://www.mql5.com/en/market/product/52670

https://algotrading-investment.com/portfolio-item/fibonacci-volatility-indicator/

Harmonic Volatility Indicator

Harmonic Volatility indicator also provides the market volatility in visual form in your chart for your trading. This tool can be used to visualize the Daily, Weekly, Monthly and Yearly Volatility. The difference between Harmonic Volatility indicator and Fibonacci Volatility indicator is that you can only use Probability Configuration mode in the Harmonic Volatility indicator whereas in the Fibonacci Volatility indicator you can access both Probability Configuration and Z Score configuration. This is cheaper than Fibonacci Volatility indicator. Hence, this is the light version of the Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/29008

https://www.mql5.com/en/market/product/29004

https://algotrading-investment.com/portfolio-item/harmonic-volatility-indicator/

Double Harmonic Volatility Indicator

This is the cheapest Volatility indicator. This indicator is specialized in the Movable Volatility indicator mostly. Hence, if you only need the Movable Volatility indicator and you want to have more cost effective tool, then use this. However, if you want to have more choice in the Volatility visualization, then use either Harmonic Volatility indicator or Fibonacci Volatility indicator.

https://www.mql5.com/en/market/product/23779

https://www.mql5.com/en/market/product/23769

https://algotrading-investment.com/portfolio-item/double-harmonic-volatility-indicator/

GARCH improved Nelder Mead – Free indicator

This is free Volatility indicator that implements the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) methods with Nelder Mead algorithm. This is bit of experimental indicator to realize the GARCH (1,1) model. Hence, we provide this indicator for free. It would be interesting to see how this Volatility indicator works for your trading.

https://www.mql5.com/en/market/product/6918

https://www.mql5.com/en/market/product/6910

https://algotrading-investment.com/portfolio-item/garch-improved-nelder-mead/

In addition, you can watch this YouTube video titled as “Volatility Indicator for Day Trading” to feel what the Volatility indicator looks like in MetaTrader 4 and MetaTrader 5 platform.

YouTube Video “Volatility Indicator for Day Trading” : https://youtu.be/erWhucDT_6M

Young Ho Seo

Harmonic Pattern Indicator Explained (Must Read for Harmonic Pattern Trader)

There are several variations of Harmonic pattern indicators in history of Price Action and Pattern Trading community. Not all the harmonic pattern indicators are the same. In the past the main variations of Harmonic pattern indicators can be categorized as following three different types.

Type 1: Non lagging (fast signal) but repainting – option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint.

Type 2: Lagging (slow signal) but non repainting – no option to enter at turning point. Indicator does not show the failed pattern but last pattern does not repaint.

Type 3: Detecting pattern at point C but repainting – option to enter at turning point. Indicator detect pattern too early and you have to wait until the point D. Pattern may not achieve point D. Indicator does not show the failed pattern and last pattern can repaint.

Type 1. Non lagging (fast signal) but repainting

First type is non lagging but repainting harmonic indicators. This sort of Harmonic pattern indicator is the typical harmonic pattern indicators used by many traders. The advantage is that you do get the signal early as possible. You have an opportunity to trade from the turning point all the ways down to the continued trend. The disadvantage is that you are not able to test your strategy in chart because this type of harmonic pattern indicator does not show the entry of the failed patterns in chart but only successful one. In fact, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are under this category. They would provide the fastest signal but you will not able to test your strategy in your chart because they do not show the failed entry in chart.

Type 2. Lagging (slow signal) but non repainting

The second type is that lagging but non repainting. Some people use pretty words like minimal lag Harmonic pattern indicator or etc. But really lagging is just lagging. You can not make it really pretty though. As the literal meaning of lagging indicates, this type of harmonic pattern indicators provide you the lagging signal comparing to the first type. It will only provide you the signal after some times passed the turning point. Hence, you do not have an option to consider your entry from turning point. Depending on the pattern size, sometimes, the lagging can be only several bars but it can range up to several dozens of bars like 30 or 60 bars. Sometimes, your entry might be at the first reversal after the turning point. Hence you have be careful with this sort of entry. The advantage is that you will not experience repaint with the latest pattern though. I am not sure if non repainting property can offset the disadvantage of lagging signals because professional harmonic pattern traders are looking for the turning point entry.

Type 3. Detecting pattern at point C but repainting

The third type is that detecting pattern at C point completion not at D point completion. This type of Harmonic pattern indicator do exists. This type of Harmonic Pattern indicators detect patterns way too early at the point C. For this reason, you have to wait quite some time to trade at point D. If you are trade on higher time frame like H1 or H4 or D1, you might have to wait at least half days to several days. You might run out of your patience quickly with this type of Harmonic Pattern indicator by just waiting and waiting. Since, it is detecting pattern at point D, you are not able to see any failed entry in your chart either. So it does repaint. What is worse is that the pattern can be disappeared while you have been waiting some time. You are just wasting your time in this case.

Some people asked me if they can trade from point C to D. The answer is no because we only recommend to trade patterns after we have done intensive research. We did not do research on trading from point C to D.

By summarizing above three types of harmonic pattern indicator, we can draw some interesting conclusion. Non lagging means repainting and lagging means non repainting. There seems to be some balance between fast signal and repainting issues. It might be the universal or physical law.

4. Main problem of Harmonic Pattern Trading for starter

At the moment, the main problem of Harmonic pattern trading is that indicator or scanner does not show the failed patterns in chart. In fact, no harmonic pattern indicator or scanner shows anyway. Hence this is not the problem for you only but for entire harmonic pattern trader ( also including Elliott Wave pattern trader too). Because Harmonic pattern indicators (Type 1, 2 and 3) show only successful patterns in chart, some people take them as true success rate. This look like success rate of 90% or something.

But, this is not the true success rate. There are many failed patterns and they are just not shown in chart. Then why harmonic pattern indicator or scanner do not show the failed patterns in chart? Is it because we want to hide the failed patterns in the intention to show some false information to trader? Answer is no and never. We are all honest people. Simply it was considered as being impossible to create such a pattern detection algorithm showing failed patterns in chart. So the reason was simply because of the technological barrier.

Hence, experienced Harmonic pattern trader live with this fact every day including myself and others because no such a tool showing failed historical pattern in chart anywhere. We just use our experience to fill the missing information about the failed patterns.

For starters, however this makes difficult to visually understand and test strategy with patterns from chart. They have to rely on external source to learn strategy. This is hard for starters and even for experienced harmonic pattern trader. Sometimes, starters believe that harmonic pattern indicator provide the success rate that was counted from successful patterns only in chart like 90% or something as they do not know that harmonic pattern indicator (Type 1, 2 and 3) does not show failed patterns in chart.. This should be not the right motivation to get involved with harmonic pattern trading. The right motivation to trade with harmonic pattern is that you have an option to trade from turning point.

Now the question, can we have non lagging and non repainting harmonic pattern indicator showing failed historical patterns in chart? The answer is yes. We have broken the critical technological barrier. Now you can have non repainting and non lagging harmonic pattern indicator giving you the true success rate in your chart.

This would be great guidance and trading resource on its own. Because you can easily learn how to use pattern together with other technical and fundamental tools, this would relieve strategy concern for all harmonic pattern trader. You have to remember that non repainting and non lagging harmonic pattern indicator is superior than above three pattern indicators (Type 1, 2 and 3). However, because non repainting and non lagging harmonic pattern indicator shows failed patterns in chart, you might get the opposite perception. Please don’t. Repainting or lagging harmonic pattern indicator (Type 1, 2 and 3) will have equally bad or even more number of failed patterns comparing to non repainting and non lagging one.

For your advantage, it is always better to work with the indicator giving you the realistic success rate for your trading. Then you will quickly learn how to improve your trading. In long run, non repainting and non lagging harmonic pattern indicator is definitely good one to stick with. You can add extra filter or other secondary confirmation. These efforts are real because you can measure the realistic outcome with non repainting and non lagging indicator. Remember that you can readily find out the true winning system with non repainting and non lagging harmonic pattern indicator whereas it is very hard for repainting or lagging indicators (Type 1, 2 and 3).

5. Can we have non lagging but non repainting Harmonic pattern Indicator?

Now the question, can we have non lagging and non repainting harmonic pattern indicator? The answer is yes. This is the next generation of Harmonic pattern indicator which was born from intensive scientific research. We shipped the technology to our Profitable Pattern Scanner. We have provided it for the first time in history.

This type of non repainting and non lagging indicator will provide you the fastest signal entry like first type of harmonic pattern indicator. At the same time, it will show you the failed entry in your chart. Hence you can build and tune your strategy in your chart with other technical indicators at ease or even in backtesting mode. Since you can trade as you see from chart, the confidence of your trading will increase dramatically. This is the true hybrid of all above three types of harmonic pattern indicators. With little bit of knowledge on Pattern Completion Interval, you could take the entry at your favored risk to rewards ratio. We also provide Potential Continuation Zone to perfect your harmonic pattern trading. In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below is the direct link to X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5 platform.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

There are several variations of Harmonic pattern indicators in history of Price Action and Pattern Trading community. Not all the harmonic pattern indicators are the same. In the past the main variations of Harmonic pattern indicators can be categorized as following three different types.

Type 1: Non lagging (fast signal) but repainting – option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint.

Type 2: Lagging (slow signal) but non repainting – no option to enter at turning point. Indicator does not show the failed pattern but last pattern does not repaint.

Type 3: Detecting pattern at point C but repainting – option to enter at turning point. Indicator detect pattern too early and you have to wait until the point D. Pattern may not achieve point D. Indicator does not show the failed pattern and last pattern can repaint.

Type 1. Non lagging (fast signal) but repainting

First type is non lagging but repainting harmonic indicators. This sort of Harmonic pattern indicator is the typical harmonic pattern indicators used by many traders. The advantage is that you do get the signal early as possible. You have an opportunity to trade from the turning point all the ways down to the continued trend. The disadvantage is that you are not able to test your strategy in chart because this type of harmonic pattern indicator does not show the entry of the failed patterns in chart but only successful one. In fact, Harmonic Pattern Plus and Harmonic Pattern Scenario Planner are under this category. They would provide the fastest signal but you will not able to test your strategy in your chart because they do not show the failed entry in chart.

Type 2. Lagging (slow signal) but non repainting

The second type is that lagging but non repainting. Some people use pretty words like minimal lag Harmonic pattern indicator or etc. But really lagging is just lagging. You can not make it really pretty though. As the literal meaning of lagging indicates, this type of harmonic pattern indicators provide you the lagging signal comparing to the first type. It will only provide you the signal after some times passed the turning point. Hence, you do not have an option to consider your entry from turning point. Depending on the pattern size, sometimes, the lagging can be only several bars but it can range up to several dozens of bars like 30 or 60 bars. Sometimes, your entry might be at the first reversal after the turning point. Hence you have be careful with this sort of entry. The advantage is that you will not experience repaint with the latest pattern though. I am not sure if non repainting property can offset the disadvantage of lagging signals because professional harmonic pattern traders are looking for the turning point entry.

Type 3. Detecting pattern at point C but repainting

The third type is that detecting pattern at C point completion not at D point completion. This type of Harmonic pattern indicator do exists. This type of Harmonic Pattern indicators detect patterns way too early at the point C. For this reason, you have to wait quite some time to trade at point D. If you are trade on higher time frame like H1 or H4 or D1, you might have to wait at least half days to several days. You might run out of your patience quickly with this type of Harmonic Pattern indicator by just waiting and waiting. Since, it is detecting pattern at point D, you are not able to see any failed entry in your chart either. So it does repaint. What is worse is that the pattern can be disappeared while you have been waiting some time. You are just wasting your time in this case.

Some people asked me if they can trade from point C to D. The answer is no because we only recommend to trade patterns after we have done intensive research. We did not do research on trading from point C to D.

By summarizing above three types of harmonic pattern indicator, we can draw some interesting conclusion. Non lagging means repainting and lagging means non repainting. There seems to be some balance between fast signal and repainting issues. It might be the universal or physical law.

4. Main problem of Harmonic Pattern Trading for starter

At the moment, the main problem of Harmonic pattern trading is that indicator or scanner does not show the failed patterns in chart. In fact, no harmonic pattern indicator or scanner shows anyway. Hence this is not the problem for you only but for entire harmonic pattern trader ( also including Elliott Wave pattern trader too). Because Harmonic pattern indicators (Type 1, 2 and 3) show only successful patterns in chart, some people take them as true success rate. This look like success rate of 90% or something.

But, this is not the true success rate. There are many failed patterns and they are just not shown in chart. Then why harmonic pattern indicator or scanner do not show the failed patterns in chart? Is it because we want to hide the failed patterns in the intention to show some false information to trader? Answer is no and never. We are all honest people. Simply it was considered as being impossible to create such a pattern detection algorithm showing failed patterns in chart. So the reason was simply because of the technological barrier.

Hence, experienced Harmonic pattern trader live with this fact every day including myself and others because no such a tool showing failed historical pattern in chart anywhere. We just use our experience to fill the missing information about the failed patterns.

For starters, however this makes difficult to visually understand and test strategy with patterns from chart. They have to rely on external source to learn strategy. This is hard for starters and even for experienced harmonic pattern trader. Sometimes, starters believe that harmonic pattern indicator provide the success rate that was counted from successful patterns only in chart like 90% or something as they do not know that harmonic pattern indicator (Type 1, 2 and 3) does not show failed patterns in chart.. This should be not the right motivation to get involved with harmonic pattern trading. The right motivation to trade with harmonic pattern is that you have an option to trade from turning point.

Now the question, can we have non lagging and non repainting harmonic pattern indicator showing failed historical patterns in chart? The answer is yes. We have broken the critical technological barrier. Now you can have non repainting and non lagging harmonic pattern indicator giving you the true success rate in your chart.

This would be great guidance and trading resource on its own. Because you can easily learn how to use pattern together with other technical and fundamental tools, this would relieve strategy concern for all harmonic pattern trader. You have to remember that non repainting and non lagging harmonic pattern indicator is superior than above three pattern indicators (Type 1, 2 and 3). However, because non repainting and non lagging harmonic pattern indicator shows failed patterns in chart, you might get the opposite perception. Please don’t. Repainting or lagging harmonic pattern indicator (Type 1, 2 and 3) will have equally bad or even more number of failed patterns comparing to non repainting and non lagging one.

For your advantage, it is always better to work with the indicator giving you the realistic success rate for your trading. Then you will quickly learn how to improve your trading. In long run, non repainting and non lagging harmonic pattern indicator is definitely good one to stick with. You can add extra filter or other secondary confirmation. These efforts are real because you can measure the realistic outcome with non repainting and non lagging indicator. Remember that you can readily find out the true winning system with non repainting and non lagging harmonic pattern indicator whereas it is very hard for repainting or lagging indicators (Type 1, 2 and 3).

5. Can we have non lagging but non repainting Harmonic pattern Indicator?

Now the question, can we have non lagging and non repainting harmonic pattern indicator? The answer is yes. This is the next generation of Harmonic pattern indicator which was born from intensive scientific research. We shipped the technology to our Profitable Pattern Scanner. We have provided it for the first time in history.

This type of non repainting and non lagging indicator will provide you the fastest signal entry like first type of harmonic pattern indicator. At the same time, it will show you the failed entry in your chart. Hence you can build and tune your strategy in your chart with other technical indicators at ease or even in backtesting mode. Since you can trade as you see from chart, the confidence of your trading will increase dramatically. This is the true hybrid of all above three types of harmonic pattern indicators. With little bit of knowledge on Pattern Completion Interval, you could take the entry at your favored risk to rewards ratio. We also provide Potential Continuation Zone to perfect your harmonic pattern trading. In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below is the direct link to X3 Chart Pattern Scanner in MetaTrader 4 and MetaTrader 5 platform.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Advanced Supply Demand Zone Indicator

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading.

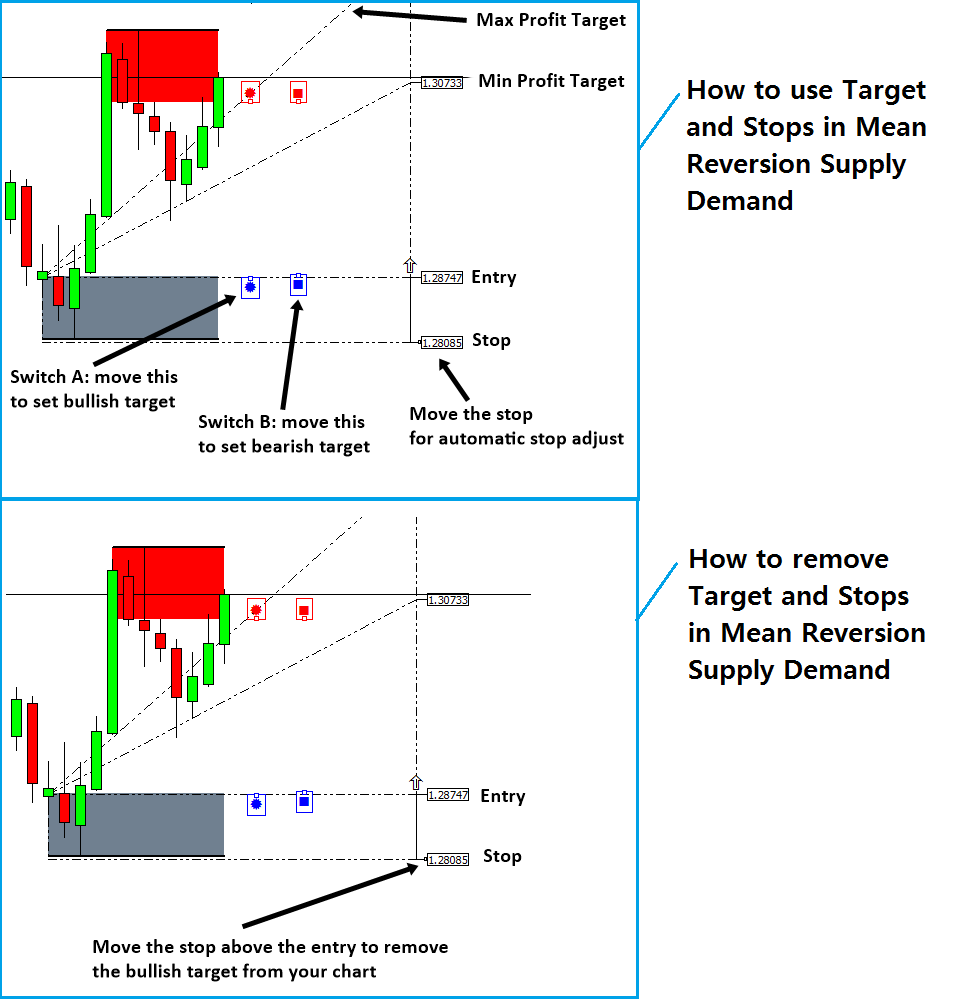

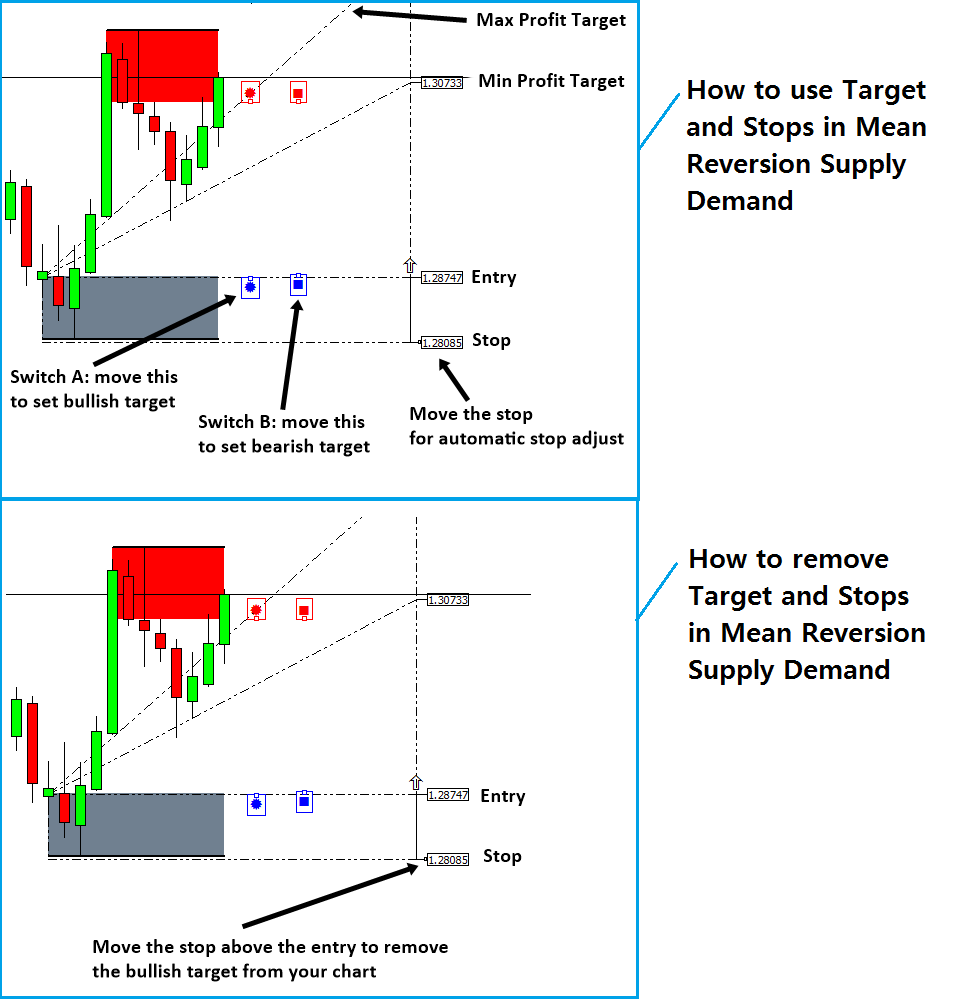

Mean Reversion Supply Demand

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target.

Below are the links to the Mean Reversion Supply Demand indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity.

Below are the links to the Ace Supply Demand Zone indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

For your information, both mean reversion supply demand and Ace supply demand zone indicator uses completely different algorithm in detecting supply and demand zone.

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading.

Mean Reversion Supply Demand

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target.

Below are the links to the Mean Reversion Supply Demand indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity.

Below are the links to the Ace Supply Demand Zone indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

For your information, both mean reversion supply demand and Ace supply demand zone indicator uses completely different algorithm in detecting supply and demand zone.

Young Ho Seo

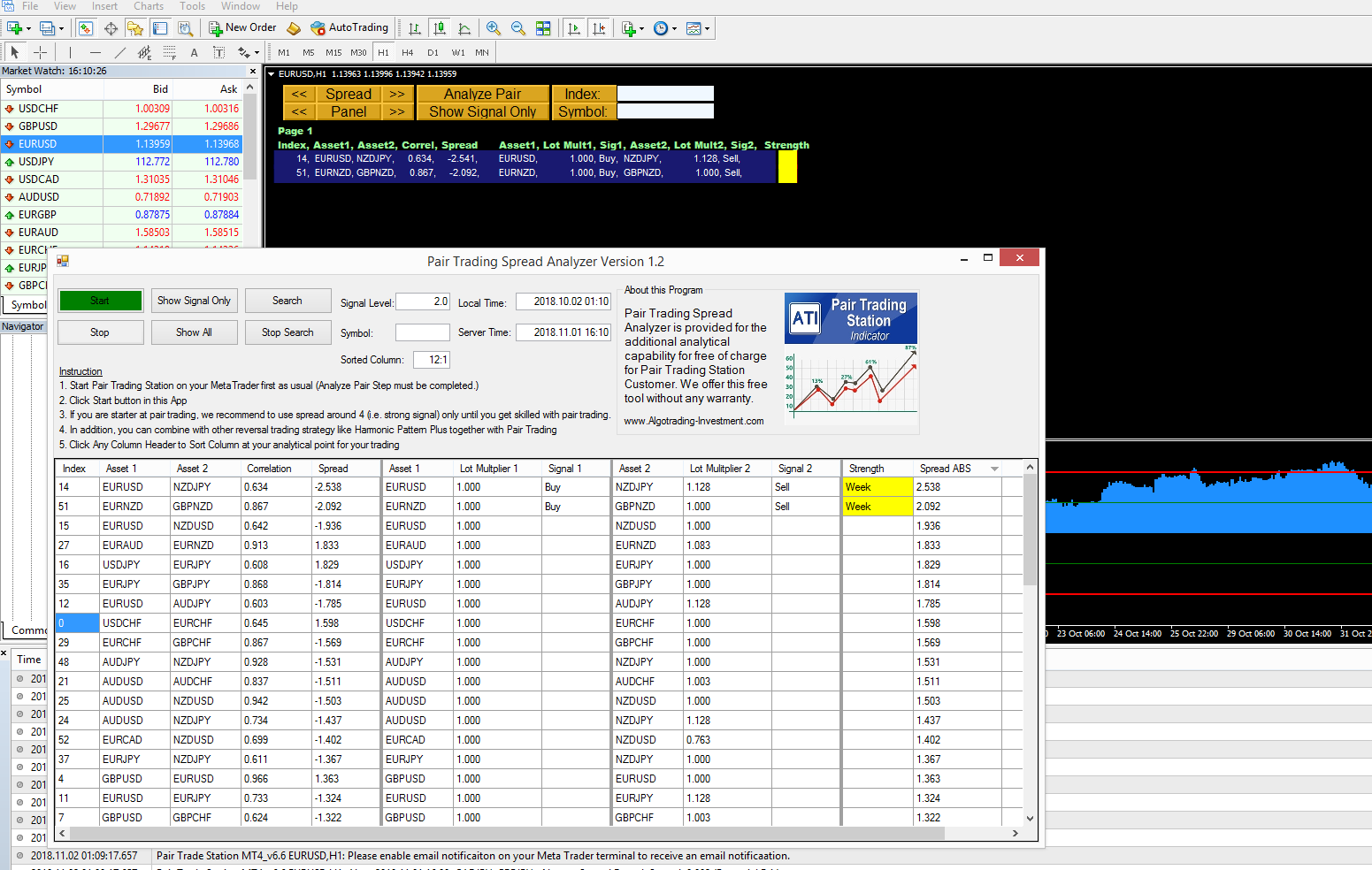

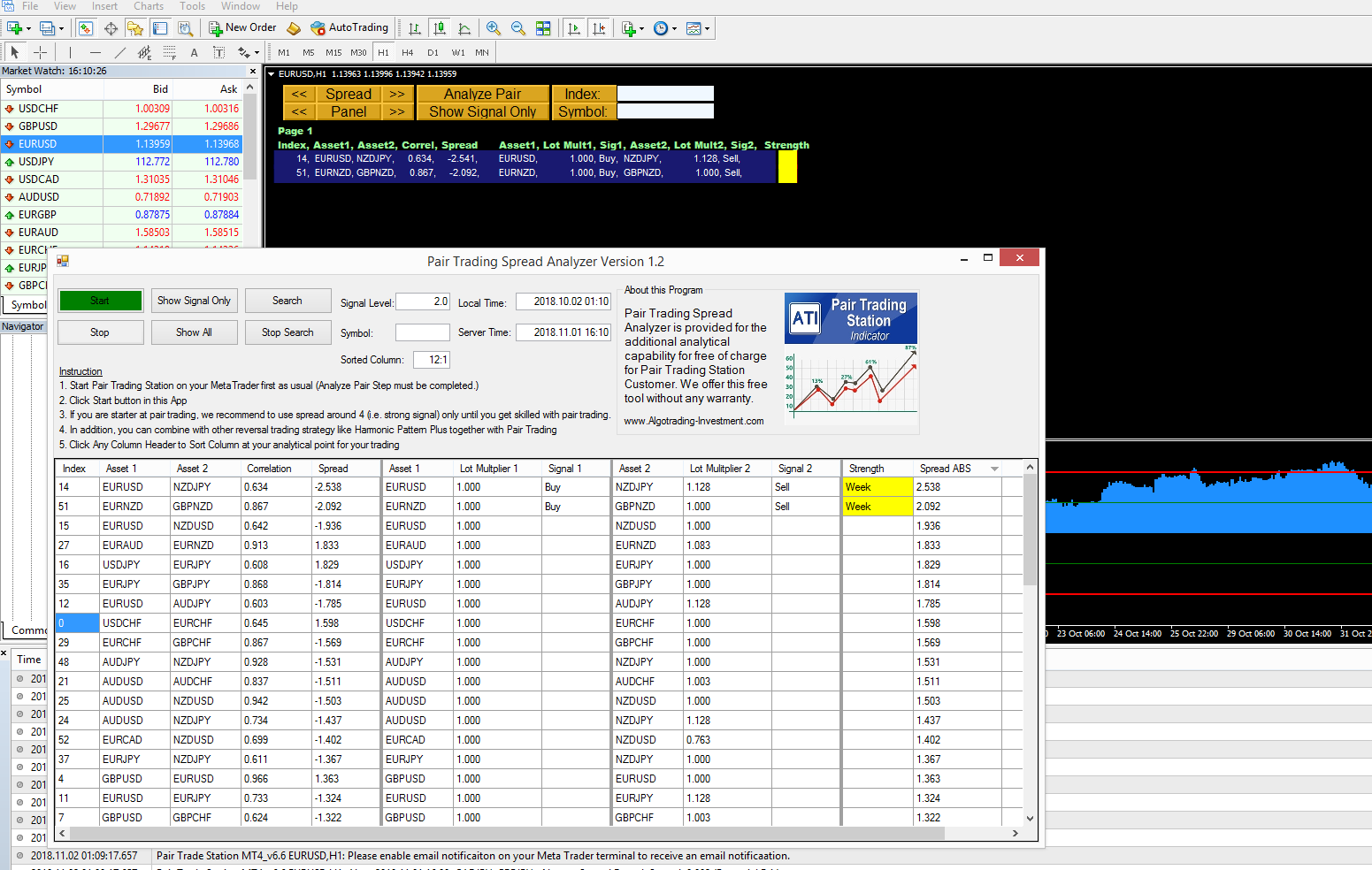

Pair Trading Spread Analyser

In version 6.5, Pair Trading station can work together with Pair Trading Spread Analyser. Pair Trading Spread Analyser is free and supportive tool for our Pair Trading Station Customer. Therefore, Pair Trading Spread Analyser will work when you have the Pair Trading Station installed in your computer. Below is the download link for the free Pair Trading Spread Analyser.

https://algotrading-investment.com/FreeDownload/PairTradingSpreadAnalyzer.zip

How to use Pair Trading Spread Analyzer is simple as ABC.

1. Firstly, run our Pair Trading station in your MetaTrader (any between MT4 and MT5) as usual.

2. After you have attached Pair Trading Station, in your chart, click on Analyzer Pair button to start Pair Trading Station.

3. Now Start Pair Trading Spread Analyzer and click on Start button.

4. That is it. You will start to see spread for each currency pairs in Spread Analyzer.

Please note that Pair Trading Station is standalone trading system. Therefore, you can make the trading decision with Pair Trading Station alone too. If you feel enough with Pair Trading Station alone, then you do not need to use the Pair Trading Spread Analyzer. Pair Trading Spread Analyzer is only extra for your convenience.

From my experience, using Pair Trading Spread Analyzer, you can use the powerful sorting and searching features to identify the weak and strong currency pairs to trade. This might be not too significant. However, when you have a lot of rows in your Pair Trading Station, then you will really appreciate this sorting and search features, which helps to quickly identify important trading signals.

Important note about Pair Trading Spread Analyzer

For the Pair Trading Spread Analyzer to run, you must run Pair Trading Station in your MetaTrader first. For starter with pair trading, we recommend to use the spread around 4 for your trading (i.e. strong signal) until you get skilled with pair trading. Later you might use the insignficant spread for your trading too when you know what you are doing.

Two good references to read to trade with Pair Trading Station.

https://www.investopedia.com/university/guide-pairs-trading/

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

Pair Trading Station is very unique trading system based on Statistical Arbritage trading principle. Below is the direct link to Pair Trading Station:

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

In version 6.5, Pair Trading station can work together with Pair Trading Spread Analyser. Pair Trading Spread Analyser is free and supportive tool for our Pair Trading Station Customer. Therefore, Pair Trading Spread Analyser will work when you have the Pair Trading Station installed in your computer. Below is the download link for the free Pair Trading Spread Analyser.

https://algotrading-investment.com/FreeDownload/PairTradingSpreadAnalyzer.zip

How to use Pair Trading Spread Analyzer is simple as ABC.

1. Firstly, run our Pair Trading station in your MetaTrader (any between MT4 and MT5) as usual.

2. After you have attached Pair Trading Station, in your chart, click on Analyzer Pair button to start Pair Trading Station.

3. Now Start Pair Trading Spread Analyzer and click on Start button.

4. That is it. You will start to see spread for each currency pairs in Spread Analyzer.

Please note that Pair Trading Station is standalone trading system. Therefore, you can make the trading decision with Pair Trading Station alone too. If you feel enough with Pair Trading Station alone, then you do not need to use the Pair Trading Spread Analyzer. Pair Trading Spread Analyzer is only extra for your convenience.

From my experience, using Pair Trading Spread Analyzer, you can use the powerful sorting and searching features to identify the weak and strong currency pairs to trade. This might be not too significant. However, when you have a lot of rows in your Pair Trading Station, then you will really appreciate this sorting and search features, which helps to quickly identify important trading signals.

Important note about Pair Trading Spread Analyzer

For the Pair Trading Spread Analyzer to run, you must run Pair Trading Station in your MetaTrader first. For starter with pair trading, we recommend to use the spread around 4 for your trading (i.e. strong signal) until you get skilled with pair trading. Later you might use the insignficant spread for your trading too when you know what you are doing.

Two good references to read to trade with Pair Trading Station.

https://www.investopedia.com/university/guide-pairs-trading/

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

Pair Trading Station is very unique trading system based on Statistical Arbritage trading principle. Below is the direct link to Pair Trading Station:

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

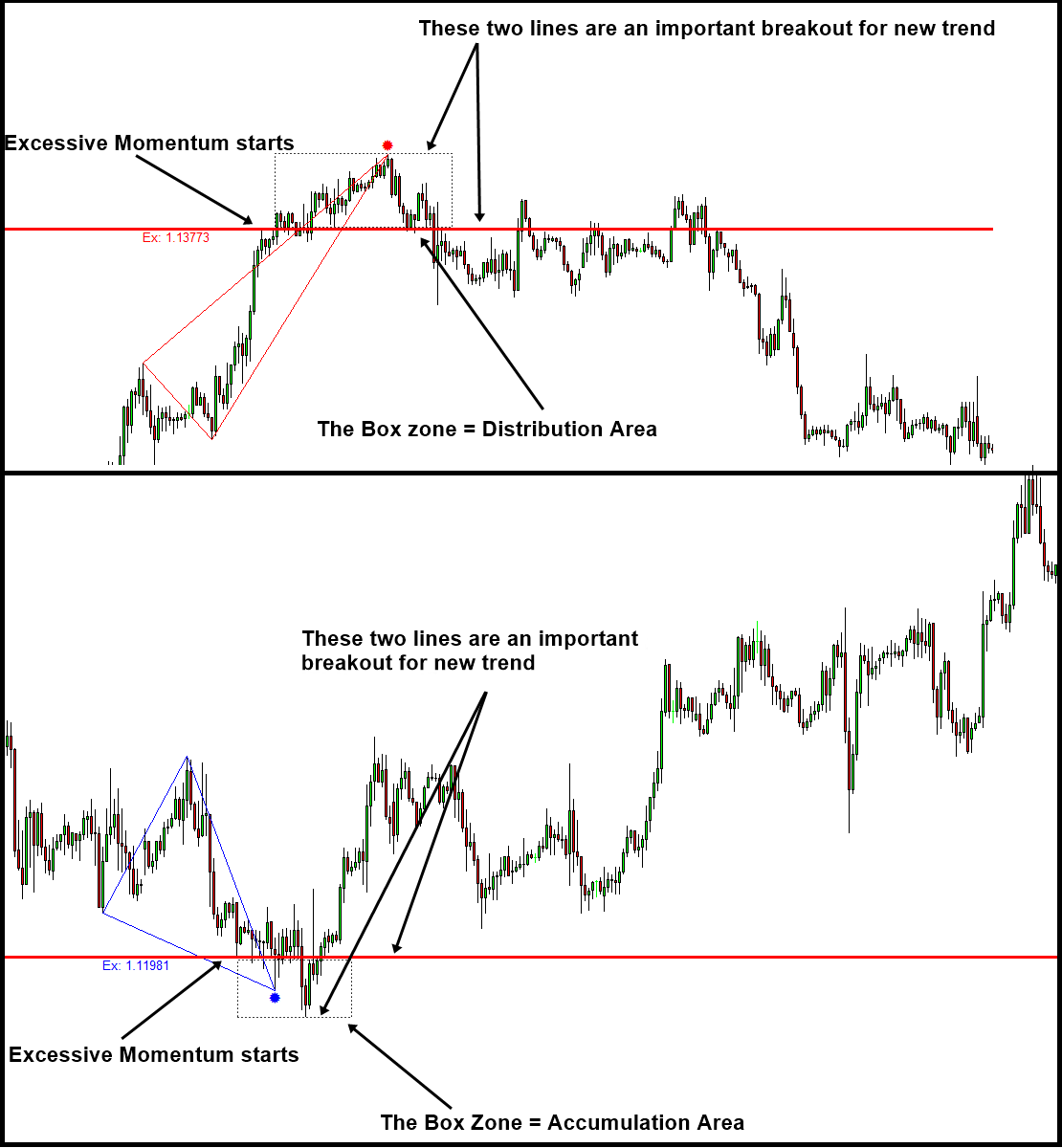

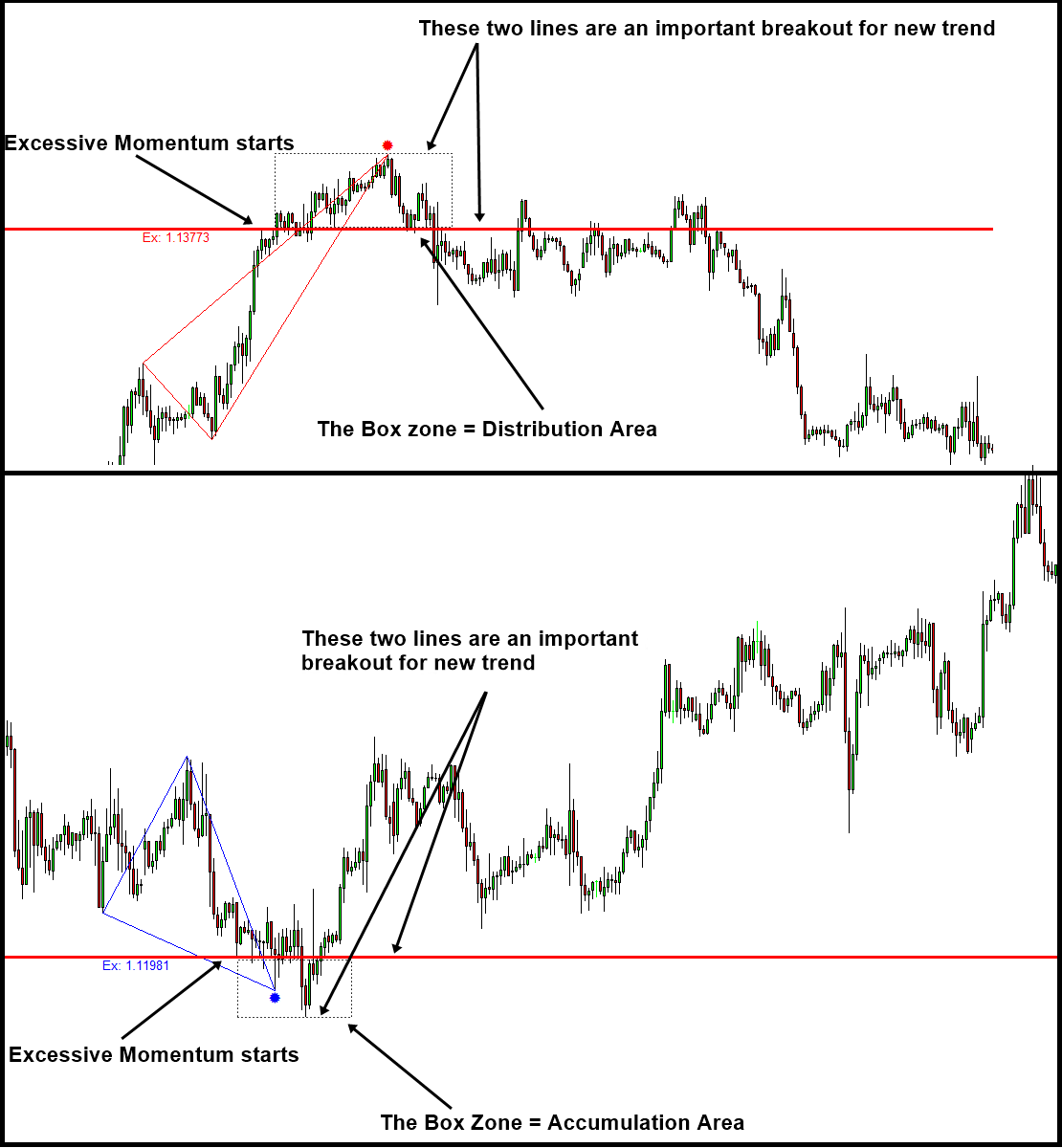

Young Ho Seo

Winning Trading Logic – Detecting Supply and Demand Unbalance