Roberto Jacobs / Profile

- Information

|

8+ years

experience

|

3

products

|

74

demo versions

|

|

28

jobs

|

0

signals

|

0

subscribers

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

ASX200 Faces Resistance at 200 Day MA, Break Above Atrgets 5225/5275 Major resistance - 5158 (200 day MA) ASX200 has made a high of 5158 yesterday and slightly declined from that level. It is currently trading at 5148. The index should close above 5158 (200 day MA) for further trend reversal...

Share on social networks · 1

80

Roberto Jacobs

Bears Fleeing Fast as Emerging-Market Assets Roar Back to Life (Bloomberg) -- The best rally in emerging-market stocks and bonds in seven years is sending bears back into hibernation...

Share on social networks · 1

95

Roberto Jacobs

When Traders will Get to the 'Down and Dirty' Earnings from big tech, industrials and financial firms should all drive trading in the week ahead, but what traders are waiting for first is the fallout from Doha on oil prices...

Share on social networks · 1

147

Roberto Jacobs

Asia Stocks at Mercy of Post-Doha Oil Moves Futures pointed to weaker Asian markets on Monday, with oil in focus after an summit in Doha of top producers ended without an agreement...

Share on social networks · 1

57

Roberto Jacobs

Leveraged Funds Continue to Reduce Long USD Exposure - ANZ ANZ provides its take on the futures positioning data for the week ending 12 April 2016, noting that leveraged funds continue to reduce their net long USD exposure...

Share on social networks · 1

62

Roberto Jacobs

FxWirePro: Nikkei 225 Faces Strong Resistance at 16600, Good to Sell on Rallies Major resistance - 17000 The index has opened gap down today morning after making a high of 16926 yesterday .It is currently trading around 16336...

Share on social networks · 1

54

Roberto Jacobs

AUD/JPY Dumped 1 Big Figure Amid Oil Driven-Risk-Off The offered tone around the AUD/JPY cross weakened a bit in the mid-Asian session, allowing a tepid-bounce to 83 handle, only to find fresh at the last and now consolidates around 82.80 region...

Share on social networks · 1

43

Roberto Jacobs

USD/CAD on a Tear Post Doha, Bulls Aim to Re-Take 1.30 USD/CAD is on a tear this morning in Asia, last exchanging hands at 1.2985 day highs, after Oil talks in Doha failed to reach an agreement to freeze production levels. USD/CAD threatens to re-take 1...

Share on social networks · 1

35

Roberto Jacobs

USD/JPY: Sent Crashing to Test 2016 Lows USD/JPY is down to the test the 108 handle in this livelier than usual start to the week. USD/JPY opened early Asia with a large bearish gap of over 0.70% marking lows of 108.12 before further supply took the pair down to lows of 107...

Share on social networks · 1

76

Roberto Jacobs

NZD/USD: Back to Close Gap after CPI NZD/USD has been a volatile display at the start of Asia this week...

Share on social networks · 1

61

Roberto Jacobs

Asian Stocks Dive on Failed Doha Deal, Nikkei Down -3% The stocks on the Asian bourses kicked-off the week on a bearish note, as failed Doha meeting to reach an oil output freeze deal combined weighed heavily on the market’s sentiment and curbed the appetite for riskier assets, including equities...

Share on social networks · 1

54

Roberto Jacobs

The Trend Trader for Forex The Trend Trader helps to identify the current trend status of your favorite ETF markets. It not only helps us to stay on the right side of market direction, but also helps us avoid those without a trend...

Share on social networks · 1

112

Roberto Jacobs

Oil Collapses After No Doha Deal Crude Oil contract WTI has opened under extreme pressure, last at $37.65 from last Friday's close above $40 after the long-awaited Doha Oil meeting failed to agree on any production freeze in order to further stabilize prices...

Share on social networks · 1

85

Roberto Jacobs

AUD/USD: Stablising After Heavy Supply AUD/USD is making a bullish case for itself on the wider picture, but has suffered a strong bout of supply on the bearish opening gap for this Asian start to the full business week. AUD/USD went from last week's close of 0.7719 to make a low of 0...

Share on social networks · 1

127

Roberto Jacobs

Sergey Golubev

Comment to topic Forecast for Q2'16 - levels for DAX Index

Forecast for Tomorrow - levels for DAX Index DAX Index : ranging within key narrow level for the bullish trend to be continuing or to the secondary correction to be started . Intra-day H4 price was on

Roberto Jacobs

Sergey Golubev

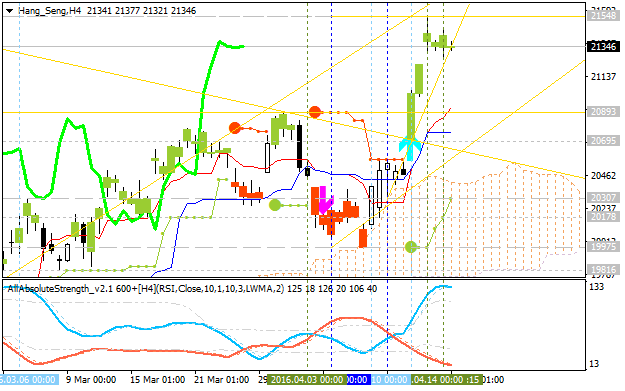

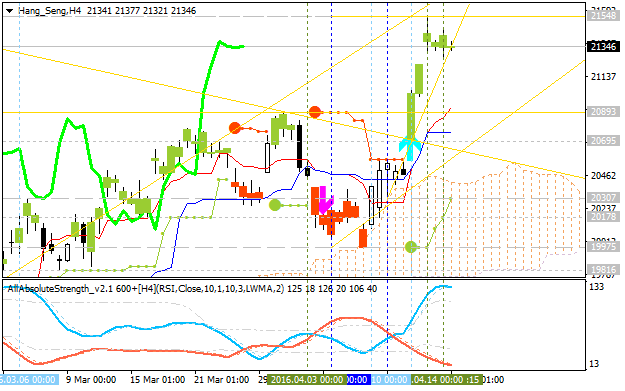

Comment to topic Forecast for Q2'16 - levels for Hang Seng Index (HSI)

Forecast for Tomorrow - levels for Hang Seng Index Hang Seng Index (HSI) : bullish breakout . The price (H4 timeframe) is on bullish breakout which was started in the beginning of the last week: price

Roberto Jacobs

Sergey Golubev

Comment to topic Forecast for Q2'16 - levels for Brent Crude Oil

Crude Oil Medium-Term Technical Analysis: ranging near 200 SMA waiting for fundamental news for direction The price is located near 200-day SMA (200 SMA) and below 100-day SMA (100 SMA) on the border

Roberto Jacobs

Sergey Golubev

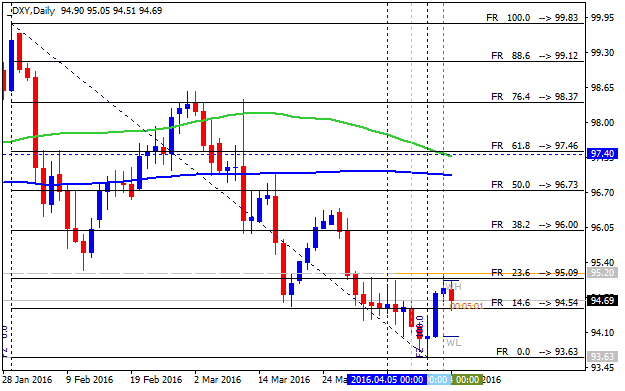

Comment to topic Press review

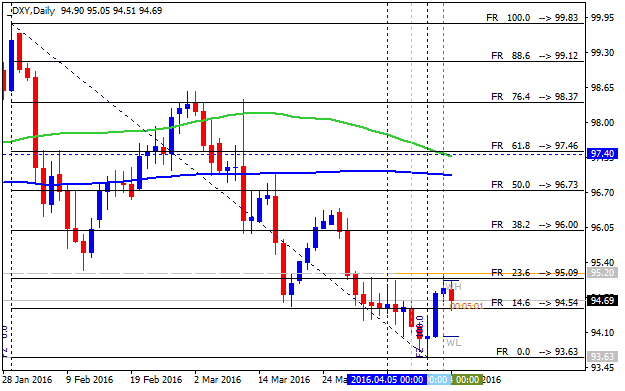

Fundamental Weekly Forecasts for Dollar Index, GBPUSD, USDJPY, USD/CNH and GOLD (based on the article ) Dollar Index - " The final theme to consider is risk trends. We’ve not seen the Dollar truly

Roberto Jacobs

Sergey Golubev

Comment to topic Forecast for Q2'16 - levels for USD/JPY

USDJPY Technical Analysis 2016, 17.04 - 24.04: bearish ranging within key narrow s/r levels Daily price is on bearish market condition located below Ichimoku cloud and below Senkou Span line which is

: