Unfortunately, "Martingale" is unavailable

You can check out other products of Xianba Xia:

MACD Trend strategy is MACD and strategy of trading skills combine a stable profit based strategy, which is based on the MACD MACD (or admission at the same time, Sicha) according to the market trend to control the position, the risk control in the lowest level, the strategy is applicable to the strong liquidity of currency, precious metals and other major currencies recommended to the following is the basic framework, strategy (with only part of the transaction logic), specific to the program d

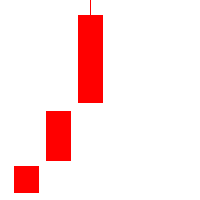

Outline A strategy based on K-line shape requires only three K-lines. Grasping opportunities quickly when the market is emotional can not only get into the market as soon as possible, but also make great profits. Understand the market through three K-lines. Parameter Lots: The basic position at the time of placing an order is 0.1 by default. SlipPage: Consider the impact of sliding points in trading,Default 3 base points.

Breakout Trend Forex expert advisor trades in the direction of a breakout from a previous eight-hours' range. It uses the Low of the previous eight-hours as the stop-loss for its buy orders, and it uses High of the previous eight-hours as the stop-loss level for its sell orders. If the new hours starts within the previous eight-hours' trading range, the EA uses two pending stop orders to implement its strategy. They will expire at the end of the hours if not triggered. If the hours starts o

The US Dollar Index, also known as DXY, is used by traders seeking a measure of the value of USD against a basket of currencies used by US trade partners. The index will rise if the Dollar strengthens against these currencies and will fall if the Dollar weakens against these currencies. Plan your technical analysis of the US Dollar Index by tracking its price in the chart and keep up with the latest market movements with news, advice pieces, and the dollar index forecast. The U.S. dollar index (