Smart Prop Ai

- Experts

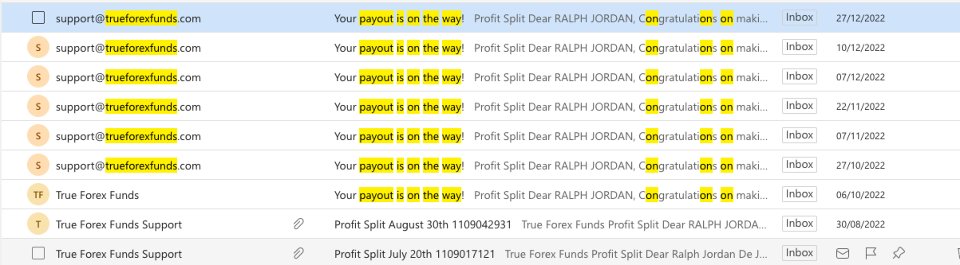

- Ralph Jordan Lipata De Jesus

- Version: 1.0

- Activations: 10

There’s NO Grid, NO Martingale, and NO HFT. Every trade includes a stop loss, making it perfectly suited for both Prop Firm accounts and personal live accounts.

Every action is guided by adaptive intelligence, calculated precision, and real-time market awareness.

Built with a six-figure architecture and powered by the most advanced AI models, this EA operates on a private multi–AI agent network — the same technology stack used by top Quant Firms, now made available to you as a retail trader. AI tokens cost thousands per month, yet you won’t pay a cent — I shoulder the full cost, enabling the AI network to execute smart, high-quality trades in real time.

Every decision inside the system is managed by a specialized AI Agent, each trained for a single mission.

They act, adapt, and respond instantly to live market conditions, forming a self-learning ecosystem that evolves with every tick:

- Technical Analysis Agent — Conducts full top-down market analysis — from Monthly, Weekly, and Daily trends down to the 4-Hour, 1-Hour, 15-Minute, and 5-Minute structures — mapping precise price behavior, detecting liquidity sweeps, reversals, and breakout points with exceptional accuracy.

- Fundamental Analysis Agent — Reads macroeconomic trends, central bank policies, and institutional order flow to align the system with the true drivers of price movement.

- News Analyzer Agent — Monitors global headlines in real time, knowing exactly what to do before high-impact news releases and how to react after the volatility hits.

- Risk Manager Agent — Safeguards every position through adaptive lot sizing, dynamic drawdown control, and intelligent stop placement.

- Position Manager Agent — Optimizes open trades by trailing profits, managing exits, and adapting instantly to changing market structures.

- Sentiment Agent — Tracks market psychology, liquidity pools, and smart-money behavior to stay aligned with institutional sentiment.

- Portfolio Manager Agent — Oversees the entire system, ensuring balanced exposure across Forex, Gold, Crypto, and Indices for maximum stability and controlled diversification.

Only A+ or A-grade trades are executed — nothing random, nothing reckless.

Every trade is fully explained by the AI — you can read the complete reasoning behind each entry directly on your MT5 terminal and through push notifications.

No guessing, full transparency, and a chance to learn from every decision.

🧠 EVOLVING INTELLIGENCE, RISING VALUE (THE PRICE OF THE EA WILL GO UP!)

The ecosystem keeps learning and expanding.

New AI Agents are continuously being added, each unlocking new layers of precision and market awareness.

With every update, the system becomes more powerful — and the price of access continues to rise.

Early adopters secure lifetime access before the next evolution.

⚙️ EXAMPLE OF A SWING TRADE EXECUTION

🟨 XAUUSD Swing Trade

Gold (XAUUSD) has been in a powerful uptrend for weeks, rallying more than 25% from its recent lows. After printing a new all-time high at 4179, price is now consolidating around 4131 — a potential setup for bullish continuation.

- Market Research Agent identifies a strong macro uptrend across metals, with Gold outperforming other commodities amid rising global uncertainty.

- Fundamental Analysis Agent notes that central banks continue to accumulate gold reserves, while geopolitical tensions and inflation concerns sustain safe-haven demand. The Federal Reserve’s policy uncertainty adds fuel to the bullish bias.

- News Analyzer Agent confirms no immediate high-impact events likely to disrupt the trend, while monitoring upcoming Fed speakers for any tone shift.

- Technical Analysis Agent performs a full top-down analysis — from Monthly and Weekly charts showing a clear bullish structure, to 4H and 1H timeframes confirming a classic continuation pattern forming above key support. All timeframes align bullish.

- Sentiment Agent detects that the majority of retail traders are short, reinforcing the bullish institutional bias.

- Setup Scoring Engine combines all confluence factors and rates the opportunity as A+ quality.

- Risk Manager Agent calculates lot size and stop distance to maintain a controlled drawdown and a balanced 1:1.1 to 1:2.7 risk-reward range.

- Position Manager Agent executes the long trade near 4131, preparing dynamic management for two profit targets: 4220 (TP1) and 4350 (TP2).

- Portfolio Manager Agent ensures portfolio diversification, maintaining balanced exposure against correlated assets like Silver and USD pairs.

“A+ Swing Trade: XAUUSD BUY @ 4131— powerful uptrend +25% from lows. Recent ATH 4179, now consolidating at 4131 — classic continuation pattern. All timeframes aligned bullish. Safe-haven demand strong amid geopolitical tensions. Central banks buying. Inflation concerns and Fed uncertainty driving flows. SL:4050 | Target 4220 (1:1.1 R:R) and 4350 (1:2.7 R:R) . Watch Fed speakers.”

But it doesn’t stop there — the Agents continue to monitor your open positions and decide whether to keep holding, trail the stop, or take profit early to avoid reversals and secure your gains.

The Asian session closes, and momentum on USDJPY continues to build near the psychological 151.00–151.30 zone. Volatility is stable, and no major news events are scheduled.

- Market Research Agent detects consistent USD strength across correlated pairs and identifies USDJPY as a potential continuation candidate in line with the prevailing macro trend.

- Fundamental Analysis Agent confirms the macro bias — the Bank of Japan remains ultra-dovish while the Federal Reserve maintains its higher-for-longer policy stance. The widening rate differential keeps JPY under pressure, supporting bullish continuation.

- News Analyzer Agent verifies low news risk for the next 24 hours, reducing the probability of unexpected intervention or volatility spikes.

- Technical Analysis Agent performs a complete top-down review — spotting a Daily uptrend consolidating above the 150.00 level, a 4H bullish flag breakout, and 1H momentum confirming the breakout above the key resistance at 151.30.

- Sentiment Agent tracks retail traders still positioned short, adding confidence to the long-side bias.

- Setup Scoring Engine compiles all inputs and assigns an A+ rating, signaling a high-probability swing setup.

- Risk Manager Agent calculates position size and dynamic stop loss for a 1:3 risk-reward ratio, adjusting to current volatility levels.

- Position Manager Agent executes the trade at market breakout confirmation and prepares trailing logic for multi-target exits at 152.70 (TP1) and 153.70 (TP2).

- Portfolio Manager Agent confirms balanced exposure across correlated pairs to prevent USD overconcentration.

“A+ Swing Trade: USDJPY Long @ 151.425 — breakout above 151.300 confirmed. Daily uptrend intact, 4H bullish flag breakout validated, and 1H momentum accelerating. Fundamental outlook supports continued USD strength as BoJ remains ultra-dovish and Fed maintains higher-for-longer stance. Low news risk, R:R 1:3. TP1: 152.700 | TP2: 153.700 | SL: 151.000.”

No guessing. You can read exactly why the trade happened, understand the logic, and even learn from the AI’s decision process.

But it doesn’t stop there — the Agents continue to monitor your open positions and decide whether to keep holding, trail the stop, or take profit early to avoid reversals and secure your gains.

- Multi-Agent Intelligence: Eight specialized AI Agents collaborate in real time — each with a unique role, ensuring every trade is data-driven, structured, and purposeful.

- All-Market Coverage: Trades across 35 instruments — including Forex majors, Gold, Crypto, and global Indices — adapting seamlessly to volatility and market conditions.

- Versatile Strategy Modes: Executes scalping, day trades, and swing trades automatically based on market structure and AI confidence scoring.

- A+ Trade Filtering System: Only A+ and A-grade setups are executed — eliminating noise, emotion, and random entries.

- Transparent Decision Engine: Every trade includes an explanation of why it happened — no guessing, full clarity, continuous learning.

- Prop Firm Ready: Built with strict risk control, stop loss protection, and dynamic drawdown management — designed for passing and maintaining Prop Firm challenges.

- Continuous Evolution: The ecosystem keeps learning and upgrading, with new AI Agents added over time — and lifetime access secured for early users.

- Premium Infrastructure: Developed under a six-figure architecture using cutting-edge AI models and private data pipelines to deliver institutional-grade execution.

| Feature | Smart Prop AI (This System) | Other AI Systems | Traditional EA |

|---|---|---|---|

| Core Logic | Multi-Agent AI ecosystem with specialized roles | Single-model prediction, mostly fake AI integration | Static indicators and fixed rules, often using dangerous Martingale or Grid methods |

| Adaptability | Learns and adapts to live market conditions in real time | Limited adaptability or can’t adapt due to fake AI integration | Fails in changing markets |

| Transparency | Every trade includes AI explanation and analysis — allowing you to learn from every setup | Partial insight or no reason at all — you learn nothing | No trade reasoning shown — clueless, you learn nothing |

| Trading Style | Executes scalping, day trades, and swing trades intelligently | Relies on curve-fitted strategies that fail in real markets | One strategy fits all, struggles with multiple strategies |

| Risk Management | Dynamic drawdown control and smart lot sizing — handled by a dedicated AI Agent that manages risk for you | Model-based or unclear | Basic stop loss, no proper risk logic |

| Prop-Firm Compatibility | Built by a Funded Trader, for Prop Firm Traders — every trade is dynamically randomized to make each user's trade execution unique, undetectable, and protected from system tracking | Most Developers know nothing about Prop Firms, resulting in detectable patterns | Often violates risk limits |

| Continuous Updates | Constantly evolving — new AI Agents added regularly | Occasional tweaks | Rarely updated |

| Market Coverage | Trades 35 pairs across Forex, Gold, Crypto & Indices | Few symbols supported or single | Usually limited to Forex |

| Cost vs Value | Early bird price — built on a six-figure AI architecture with continuous updates and new Agents being added | Expensive but shallow | Expensive yet unstable, can blow your account |

🤝 WHY TRUST THIS SYSTEM

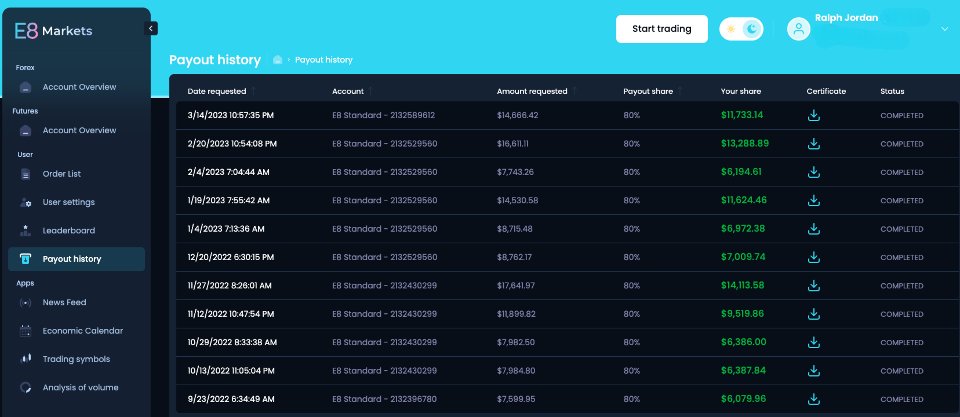

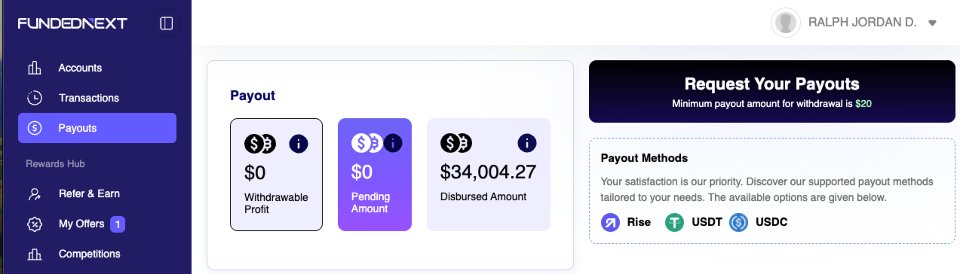

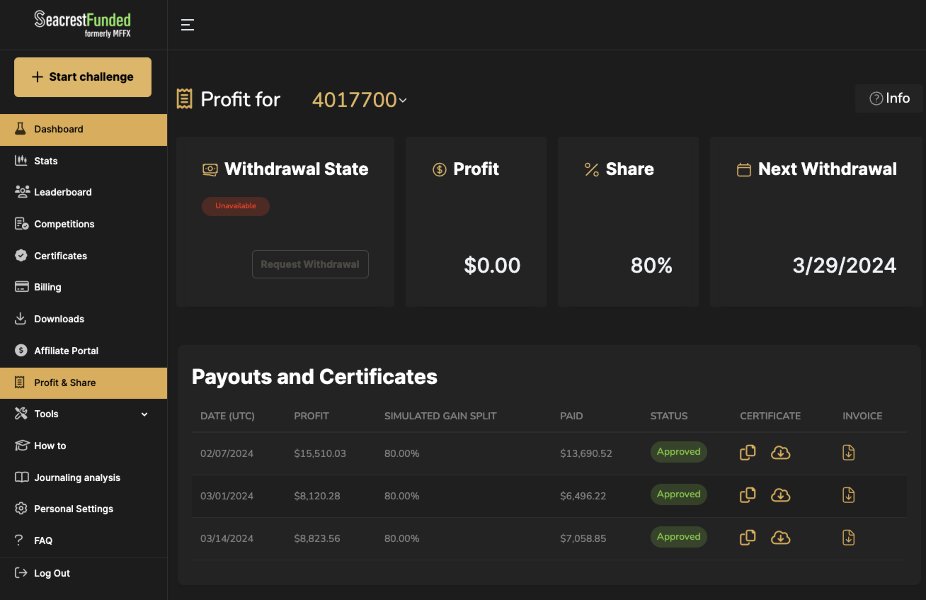

- Created by a Proven Trader: Designed and refined by a 7-figure funded trader with verified payouts across multiple Prop Firms. Every rule and filter inside this EA was built from real market experience — not theory.

- Six-Figure Development Investment: Developed through extensive testing, optimization, and AI integration — a six-figure project engineered to deliver consistency, precision, and long-term reliability.

🚀 FINAL NOTE

Early Bird Price Available — the price will increase as new AI Agents are added.

Built on a six-figure AI architecture, this system continues to evolve, expand, and grow stronger with every update.

Join now and secure lifetime access before the next Agents is released.

This Expert Advisor (EA) is very good. Profitable operations, the report explaining each operation is indeed well-founded, I'm really enjoying it. It should only have the trailing stop enabled and the option to specify the "suffix" or "prefix" of the assets. Otherwise, congratulations to the creator!!