InfinityFlow

- Experts

- Krzysztof Sitko

- Version: 9.6

- Activations: 8

InfinityFlow

Adaptive Market Intelligence System

InfinityFlow is an advanced trading system built on MetaTrader 5 technology, designed to automatically execute trading strategies on the forex market. The system combines five different analytical algorithms with an intelligent risk management framework.

🎯 Key Features

5 Trading Strategies:

- Momentum Flow – Directional trend tracking system that identifies sustained price movements and follows market momentum

- Mean Regression – Statistical reversion engine that trades price pullbacks to mathematical averages

- Breakout Surge – Range analysis protocol that detects breakouts from established support and resistance levels

- Volatility Pulse – Adaptive spread monitor that adjusts trading parameters based on market volatility conditions

- Micro Scalp – Ultra-high frequency processor optimized for rapid scalping operations

Risk Management:

- Maximum order execution control (25 orders per minute)

- Dynamic margin requirement verification

- Configurable stop-loss and take-profit levels

- Real-time market spread monitoring with adaptive thresholds

Trading Schedule:

- Customizable trading hours for daily sessions

- Independent control for each day of the week

- Automatic system activation and deactivation

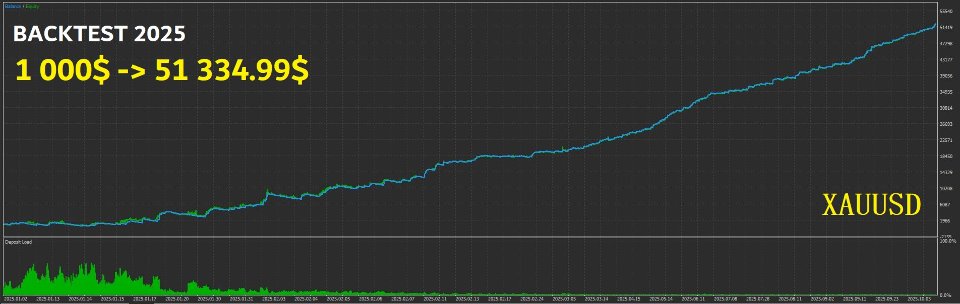

📊 Performance (2025 Backtest - XAUUSD)

- Return on Investment: 5,033% ($1,000 → $51,334.99)

- Profit Factor: 2.12

- Recovery Factor: 20.84

- Maximum Drawdown: 17.13%

- Total Trades: 438,503

- Win Rate: ~1.19% (short trades), ~1.78% (long trades)

- Average Win: $15.01

- Average Loss: $0.11

- Risk/Reward Ratio: ~1:136

⚙️ Configuration Parameters

The system offers extensive customization through the following key parameters:

Core Settings: System identifier, activation status, and master control switch for the entire trading platform.

Strategy Selection: Choose from five distinct trading strategies tailored to different market conditions and trading styles, with the ability to switch strategies in real-time.

Session Timing: Define trading hours (default 00:30 - 23:30) with individual activation toggles for each day of the week to align with your preferred trading schedule.

Position Management: Control trade volume (default 0.01 lots), risk percentage (1.0%), profit targets (1,500 points), and maximum loss limits (8 points).

Execution Parameters: Set maximum orders per minute (25), maximum spread threshold (25 points), price lookback period (6 candles), and minimum price movement sensitivity (3 points).

🔧 Technical Requirements

- Platform: MetaTrader 5

- Account Type: ECN recommended for low spreads

- Minimum Deposit: $500-$1,000

- Compatible Instruments: All currency pairs (EURUSD, GBPUSD, XAUUSD, etc.)

- Connection: 24/5 internet connection for uninterrupted operation

📈 How It Works

The system continuously monitors price action using a rolling buffer analysis. When market conditions align with the selected strategy parameters, the EA generates trading signals and executes positions automatically. Each trade includes calculated take-profit and stop-loss levels based on your risk settings. The system respects margin requirements and enforces strict position limits to maintain capital preservation.

⚠️ Important Disclaimers

This system is designed for advanced traders and institutional investors. Past performance does not guarantee future results. Thorough backtesting and paper trading are strongly recommended before deploying on a live account. Market conditions vary, and parameters require periodic adjustment. Use only risk capital you can afford to lose. This is a sophisticated trading tool that requires understanding of forex markets and proper risk management discipline.