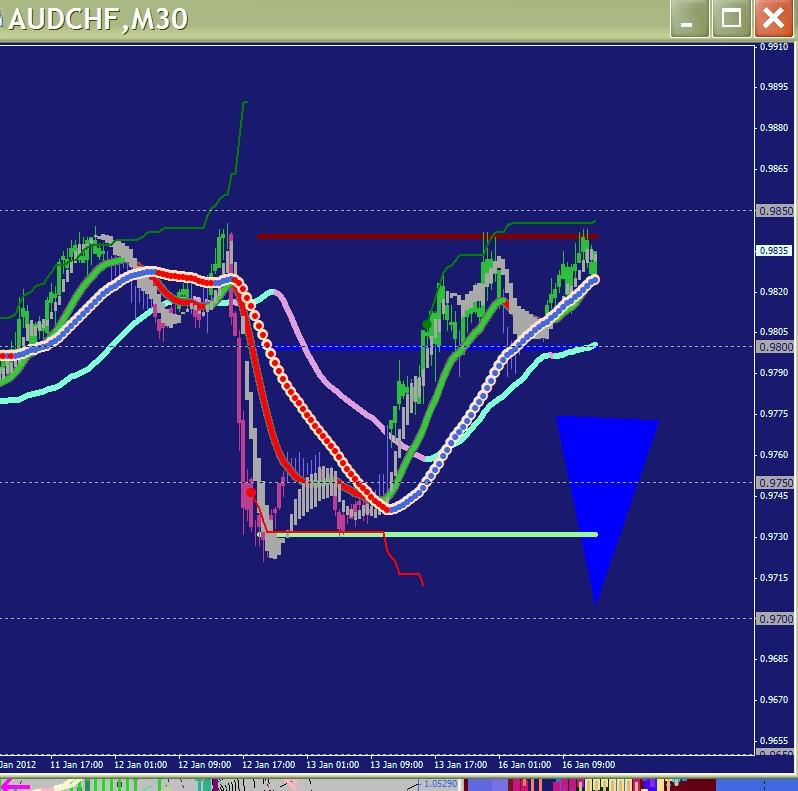

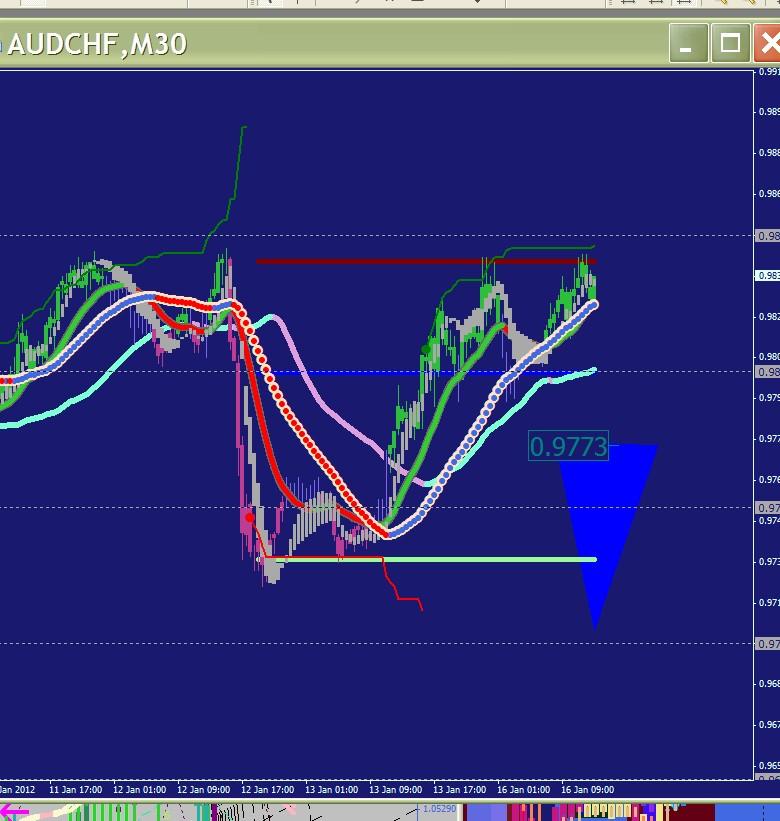

I just return to the balance before it fall 50 micro USD (i.e. last week, I was losing, now it rebound to the initial level- or last week losing trans, I got break-even today)

therefore a successful swing-thinking (can't stop that bit in my mind) is to

take 1/2 way -- between the green line (now it is close to red, so opposite is green-- and vice versa) and the blue horizontal line -- then I set a swing pending order

i.e.

sell at 9337

but of course, if the trend continue to go up, this indicator would repaint

i.e. the 3 line move MORE up-side , then I am not sure that I should set sell 9337 to 9340 or even higher

this strategy should have a few advantage

- I tend to try to hold something, after all transaction has been closed i.e. this way I won't enter too early

- quite sure it would be a swing down (certainty) when it touch 9337 again and likely to be a SELL

- easier to handle initial profit, rather than a loss or peaking at the end of one trend

-- just sit back and watch when will the pending order get hit, rather than holding more and more and try to hedge 1 transaction at a loss

-----

the above explanation, does not tell us what are the 3 pillars for success as there is no way to beat the 3 items that mentioned --- just tell us urban myth is wrong, that's all

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Lately I have been getting asked many similar questions regarding trading success. I don’t really like to repeat myself if there is no need, so I decided to write a short article to explain is a solid base for success in trading Forex and Futures.

In order to achieve trading success, there are 3 main areas of focus. They are all of equal importance and must not be separated from each other. I will cover these in more detail below. These areas are:

1. Trading strategy or method

2. Discipline

3. Psychology

Contrary to what is being taught about psychology importance in trading up to 90%, the other 2 concepts are as equally important. If a trader has got only 2 out of 3, then the results are either consequent losses or a break even. Let me explain why.

If a trader uses a method that doesn’t really work, or works with only temporary success, no matter how hard he tries the results will remain the same. It’s said that you have to stay with a method for a certain period of time to make it yours. I strongly recommend not to switch methods or trading strategy more often then once in 6 months if you want to be a successful trader. However, this option also has its disadvantages. If you stick with the wrong trading strategy, you could spend years with no results. What I mean by “the wrong strategy” is the one that is too subjective and almost no one can trade it successfully. Let’s put it in to plain English, ‘the wrong strategy’ is the one that fails 60-90% of the time.

While considering a trading strategy to learn, you need to understand that all successful traders are very mechanical in their trading approach. They do the same thing every day. It can get boring sometimes. Therefore, when you choose a strategy to learn, you need to answer this question: “Is there any chance you can become mechanical with this particular strategy?” This means the fewer variables to consider while making a decision, the easier it is to understand and apply.

I want to add few more words about picking the wrong trading method. There are too many mentors selling strategies that they never trade. They are called ‘scam artists’. They sound very professional when they talk about trading and their systems, but that’s because they are good salesmen. In reality, there would be no difference between them selling you their strategy for day trading, or a pack of fantastic knives.

I need to mention a pitfall for those who have just discovered the world of trading. Most forex beginners fall into the trap of listening to advisors or financial experts and make their decision accordingly. But here is the sad truth. The Brightest analysts cannot trade their own analysis. There is a huge difference in being a good analyst and being a profitable trader. Why is that??? It’s because profitable/professional traders posses a set of skills that are crucial for being profitable in forex. Among these would be a successful trader mindset, a proven method, absolute discipline and hours of screen time. Analysts don’t have that. They are paid for talking. If they knew how to trade their own analysis they would trade it and make more money then they are making now.

So when choosing a trading strategy or a forex coach, you need to be concerned about real evidence of his knowledge and skills. The best option would be to see him in action. Rarely would you see any scam artist trade live with his automated software nor trading his method in front of a live audience. Professional traders have nothing to hide; they have winners and losers.

Other important questions to ask yourself when choosing a trading method would be is it applicable to different market conditions, does it work in real time or only hindsight and are the stop losses offered by the method realistic? If someone tells you that your stop should be 100 pips in day trading then that should alert you that something’s not right.

Trading discipline is as equally important as trading psychology. When you have a flaw in discipline you are guaranteed to fail. But what do I mean by that?

Trading discipline covers these questions:

- Can you take trades every time your method tells you to do so?

- Do you skip trades because deep inside you have a fear of losing another trade?

- If you have your daily profit target, are you able to turn off your screen and walk away when you’ve reached it? If you don’t have a daily profit target how do you know when to leave the screen?

- Do you have any revenge trading habits?

- And last but not least, are you able to trade with full accordance with your trading method or is your current method a combination of gut feel and some knowledge from classes you attended?

Now when you have answered all these questions, you know what you need to work on to get better in your trading discipline. Write the answers down, highlight them and then stick them on your monitor. This will be a reminder for you every time you fail in following your rules. You can only grade yourself 100% on discipline if you have automated trading habits to the extent when you don’t think about it anymore and you are ok to consciously skip trades that don’t meet your entry criteria. It takes time to get absolutely disciplined, but takes much less time compared to getting your trading psychology right.

Talking of trading psychology I don’t want to repeat what you know from other sources. However, I need to mention that proper psychological attitude can’t be formed if the other two aspects I talked about haven’t been mastered. You can’t develop a winning mind set if you fail in having a successful trading strategy or being somewhat disciplined.

Successful trading psychology consists of a successful mind set, the ability to resist stress, the ability to withstand tough periods in your trading and taking full responsibility for your trading results. Building a successful trader takes time, for some it takes years. Some never get to that point.

One of the main reasons why traders fail in becoming successful is an improper expectation of the industry as a whole and the inability to withstand financial and domestic pressure in the long run. This influences the process of forming a winner’s attitude and leads to the desire of wanting results here and now.

There is no magic in trading and no trading systems that are 90% accurate. Miracles don’t happen here. The path to success is long and hard, but when you get there it is totally different compared to where you are now in trading. You will enjoy it and even get bored with making money.

You can take a short cut by finding a good mentor, but you can also do it on your own. The only difference is the time that you will spend on your journey to success.

After reading this article you should be able to see and evaluate your current trading against the 3 pillars of profitable trading that I have mentioned. It should be easy for you to identify what part you need to work on. If you score only 2 out of 3 it still won’t work. You need to score 3 out 3 to get different results from what you are getting now. Remember, the Forex market is the only place where everyone has an equal chance for success disregarding your background, education, social status and your past achievements.

This article was written by professional forex trader and trading coach known as pipbanker. You can find more information at www.pipbanker.com