Forum on trading, automated trading systems and testing trading strategies

Something Interesting to Read January 2017

Sergey Golubev, 2016.12.24 14:04

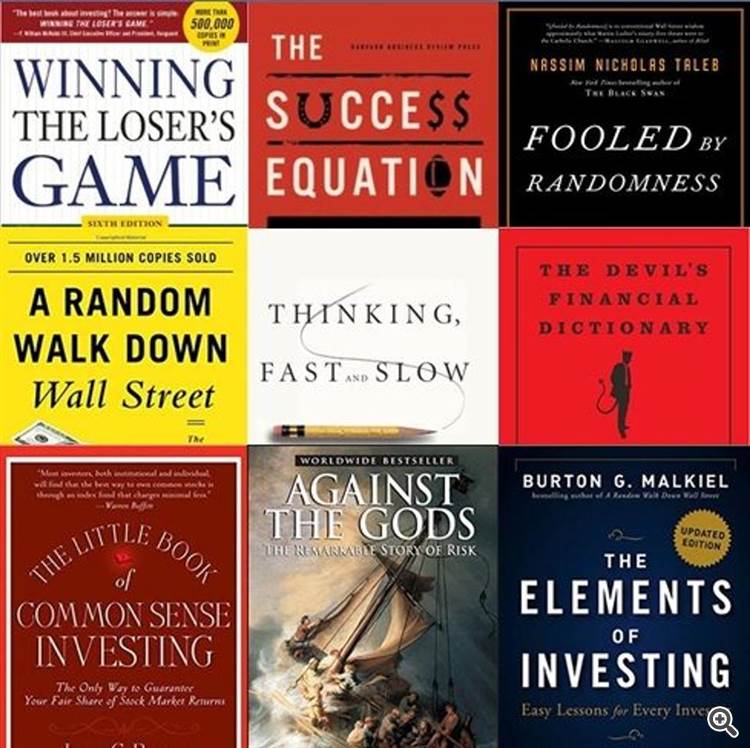

10 Important Books To Make You A Better Investor In 2017 (adapted from the article)

Short Reads For Beginners

The Elements of Investing: Easy Lessons for Every Investor

by Burton Malkiel and Charles Ellis

"These authors each penned one of “The Classics” below, but they join forces to provide one of my favorite short reads on investing and saving. Perfect for readers of all ages and experience levels."

The Little Book of Common Sense Investing

by John Bogle

"Jack Bogle, the father of the index fund, helped revolutionize investing. Bogle has written many books, but this relatively short one contains a lifetime of wisdom."

----------------

The Classics

A Random Walk Down Wall Street

by Burton Malkiel

"A must own for serious investors, Burton Malkiel explains the difficulty of predicting stock prices, but also focuses on aspects of investing at different stages of life."

Winning the Loser’s Game: Timeless Strategies for Successful Investing

by Charles Ellis

"This book is a classic and should be required reading for investors of all levels. With markets seemingly getting more unpredictable by the day, this book helps you avoid common traps and raise your probability for success."

Thinking, Fast and Slow

by Daniel Kahneman

"Daniel Kahneman won the 2002 Nobel Prize in Economic Sciences for his work in behavioral finance. There are countless lessons applicable to investing, but this will also transform the way you think about choices we make in business and our personal lives."

The Success Equation: Untangling Skill And Luck in Business, Sports, and Investing

by Michael Mauboussin

"This book is a slam dunk for a sports fan, but extremely useful to all investors. We quickly attribute our successes to skill, but luck plays a far greater role than most people realize. Mauboussin provides framework for identifying skill versus luck and makes concrete suggestions for using this knowledge to your advantage."

Against the Gods: The Remarkable Story of Risk

by Peter Bernstein

"Peter Bernstein explores the history of money through the lens of financial risk, beginning in ancient times and into the modern world of portfolio theory. Bernstein does an excellent job explaining the underlying mathematics in simple terms, making this book very informative and relevant to practitioners."

Fooled By Randomness

by Nassim Taleb

"Serious investors will find this Nassim Taleb's stories to be highly insightful. Using a combination of his own experiences as well as stories of others successes and failures, Taleb to help us better understand the role of chance in the world around us."

----------------

Investment Books That Will Make You Laugh

The Devil’s Financial Dictionary

by Jason Zweig

"Funny and easy read. Jason Zweig, known by most for his columns in The Wall Street Journal, is one of the best writers around. This book is relevant for anyone that has been exposed to the investment industry as an employee or customer."

Where Are the Customers’ Yachts?

By Fred Schwed

"The title is based on the story of a man admiring the yachts of New York bankers and brokers, but then wonders: where are the customers’ yachts? This book was written in the 1940’s, but still portrays many truths about the business of Wall Street."

The Alchemy of Finance by George Soros Full Audiobook

Forex Trading and Leverage

For a very small GBP100

deposit traders can effectively trade GBP13,000 positions; as such a

cent movement in a currency with such leverage could make moves that

much bigger. The more leverage you employ to a product, the more the

normal volatility of a market is going to be exaggerated.

Forex News - How to Trade News Announcements

One of the reasons so many forex traders

come to the Forex market is because of the potential to make fast money.

With huge amounts of leverage, and extremely volatile price movements,

many traders look to focus on trading forex news since this can produce

some of the fastest movements that the forex market might see.

Unfortunately,

a lot of these types of traders will fail. Forex news can be

notoriously difficult to trade as price movements can be so wild and

volatile. Not only can these movements be unpredictable, but forex

traders will often employ sloppy risk management and end up turning a

short-term trade into a long-term problem.

There has to be a better way to do this.

Some

traders choose to just avoid trading forex news, or those trading

longer-term strategies often try to 'trade around them.' But there are a few different ways to try to "use the

forex news".

For one, since these price movements can be so wild

and volatile, it may offer longer-term forex traders the opportunity to

get a better entry price than they would have initially anticipated.

Let's

say that the EURUSD is trading at 1.3000, and a trader wants to go long

with a 100 pip stop and a 300 pip profit target; but NFP is 30 minutes

away and our traders doesn't want to take the risk of losing 100 pips so

shortly after placing a trade designed to be open for a few days. So

our trader waits...

Once NFP comes out, the trader sees price

hurry down to 1.2950 before finding support shortly after the data was

announced. Our trader can then buy, keeping their stop at 1.2900, and

now can look for a 350 pip profit target. Their original risk-reward

was going to be 1-to-3. Now, it can be 1-to-7, and they were able to

get long the EURUSD at a much better price.

The other way to use the forex news is to trade the volatility that can come from news announcements. This involves placing an entry order to go long above resistance, and an entry order to go short below support. This way, if the volatility from the news release creates a price movement that could go on for days, forex traders could potentially enter at the early portion of the move as prices initially move on to make new highs or lows.

VIDEO LESSON - AN INTRODUCTION TO ECNS

This video provides an introduction to electronic communications networks (ECNs), systems that allow buyers and sellers of stocks to trade directly without an intermediary.

==============

Most forex traders participate in the forex market with forex brokers. There are mainly two types of forex brokers: market makers and electronic communications networks (ECNs). In this article we want to introduce the latter type of brokers, the ecn forex broker.

What is an ECN forex broker?

ECN forex broker is a financial expert that provides the clients with direct access to other forex participants in the currency market by using electronic communications networks (ECNs). Unlike market makers, which always trade against their clients to make profit, an ECN forex broker only creates opportunities of trading between forex traders.

How does an ECN forex broker work?

The ECN forex brokers provide a medium by passing on the prices for different market participants such as banks, market makers and other traders in the market. Then the best bid/ask quotes will be displayed on the trading platforms based on these prices. ECN forex brokers also serve as counterparties to forex transactions, but it is a settlement that they operate on instead of pricing basis. While fixed spreads are offered by some market makers, spreads of currency pairs can be very different, determined by the trading activities of the currency pair. In active trading periods, sometimes you cannot get ECN spread at all, especially in those very liquid currency pairs such as the majors (EUR/USD, GBP/USD, USD/JPY, USD/CHF) and some currency crosses.

Pros and cons of the ECN forex broker

The ECN forex broker has both advantages and disadvantages. The pros and cons of the ECN forex broker are as follows.

The pros of the ECN forex broker can be presented in following aspects.

Traders can usually get better bid/ask prices for they are derived from multiple sources.

At certain time traders may trade on prices with no spread or with only very little spread.

Genuine ECN forex broker will pass on the orders to a bank or other trading participants on the opposite side of the transaction instead of trading against the traders.

It is very likely that the prices on the ECN forex broker are more volatile.

Traders can take on the role of market traders to other traders on the ECNs since they can offer a price between bid and ask.

The cons of the ECN forex broker can be presented in following aspects.

Many ECN forex brokers do not provide integrated charting or new feeds.

Some trading platforms are not so easy for traders to use or operate.

Since there are variable spreads between the bid and the ask prices, it may be difficult to calculate stop-loss and breakeven points in pips in advance.

Forex traders are obligated to pay commissions for each transaction.

It is obvious that there are both pros and cons of an ECN forex broker. Traders have to take many factors into consideration when choosing a forex broker.

Trading Signals showcase in MetaTrader 4/5

How to choose a trading signals and subscribe to it in MetaTrader Platforms? Its easy! Watch the video and you will know everything about trading signals.

Detailed statistics of a trading signal in MetaTrader 4/5

In MetaTrader Platforms the most valuable perameters of trading signals are placed in a separate block. From this video you will find out where to find them and what to pay attention to.

Trade statistics, growth, equity & balance graphs of the Trading Signals of MetaTrader 4/5

Trade statistics is a detailed information on a signal, that will help you to make a wise decision. Growth, equity & balance graphs allow you to visually estimate a successful provider directly in MetaTrader Platforms.

Risks, distribution, news and reviews of trading signals in MetaTrader 4/5

MetaTrader Reports will show you how risky your provider trades and what other subscriber think of that?

Visualize a trading signal on a chart in MetaTrader 4/5

The effectiveness of the entry points and the unrealized profit can be easily assessed with the visualized chart of provider's deals in MetaTrader Platforms.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.