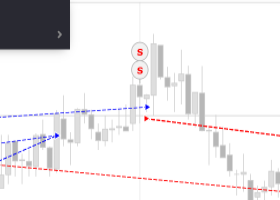

Еliot wave pattern

The Elliott Wave Theory is basically five-wave impulses and their more or less complex corrections. These simple ones usually consist of three waves (abc), while more complex corrective structures can form a wedge, channel, triangle or complex zigzag and many others, less readable. From an investor's point of view, it is most beneficial when such an impulse and its clear retracement structure can be identified, and if the retracement stops at some important support, we get a very reliable entry setup.

Eliot wave pattern, you need to try to determine individual highs and lows yourself, thus drawing new waves. Remember the guiding principle of five impulse waves and a three-wave corrective structure. You should, at the end, answer the following questions:

1. Is there an impulse or correction on the chart?

2. What is the name of this education? (Hint: in the case of an impulse, we recognize a wave structure or a rising wedge; in the case of corrections, we recognize a zigzag, flat correction or triangles)

3. Will you be able to recognize which higher order wave we are dealing with?

However, TFE does not always come to the rescue, at least not immediately. And you must be aware of this. There are times when the wave motion is completely unreadable. Some of the larger and more complex structures are being built, growing over time, and we really don't know what we're dealing with. until they are complete, or at least more complete.

One of such formations, in my opinion, the worst in terms of market fluctuations, are the periods commonly known as "oyster mushrooms". More professionally speaking, this is base formation or another period of accumulation or distribution.

The Elliott Wave Theory was then refined by A.J. Frost, Robert Prechter, and Robert Miner, who created many rules for putting the theory into practice. Below are some of the more important rules:

1. Wave 2 cannot break the low of wave 1 in an uptrend and cannot break the top of wave 1 in a downtrend.

2. Wave 3 cannot be the shortest in time and length compared to waves 1 and 5.

3. Wave 4 cannot break the top of wave 1 in an uptrend or the bottom of wave 4 in a downtrend.

4. Wave 4 cannot be longer than wave 2.

According to the theory, the second wave is usually 60 percent of the first wave. Let's take a look at an example. If the DAX rises 100 pips in the first wave, the second wave should bring a 60 pips fall. If it was a downtrend and the first wave was 200 pips, the upward correction should be about 120 pips.