(13 AUGUST 2020)DAILY MARKET BRIEF 2:The EURUSD is back above $1.18

Elsewhere, the European July inflation figures are expected to print negative numbers in July despite business reopening and normalisation. The Australian unemployment rate rose to 7.5% in July, the highest since November 1998, as the number of unemployed skyrocketed from 15.7K to above a million as the pandemic took a toll on the economic activity. The employment change has been better-than-expected however, as 114.7K new jobs were added in July, versus 30K expected by analysts. The AUDUSD remained bid above the 0.71 mark.

While the global economic data is badly infected by the coronavirus pandemic, showing the worst numbers on record for growth and employment, the market reaction depends on the perspective investors look at it. As long as the data matches the expectations, it is assumed that the market prices already take the figures into account, no matter how bad they are. This is why we see the share prices climbing relentlessly. With of course the precious push from government and central bank stimuli.

Trading in Asia was mixed and the activity on European futures hint at a flat-to-negative open on Thursday.

The US dollar halted its three-day rise as the US yields advanced to 0.66%.

Gold rebounded to $1940 per oz following a sharp fall to $1862 on Wednesday. The rising US inflation should overweigh the advance in US yields and provide support to gold on a firmer basis, after a part of the speculative long positions were cleared at this week’s downside correction.

WTI crude tests the 200-day moving average ($42.90 pb) to the upside. The surprise 4.5-million-barrel decline in US oil inventories last week is supportive, but insufficient to whet the bulls’ appetite above this level.

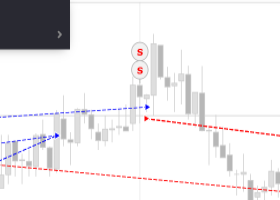

The EURUSD is back above $1.18, and the pound remains bid above the $1.30 mark on broadly softer US dollar. There is a decent potential for a deeper downside correction on both pairs, but the short-term direction remains highly contingent on the US dollar appetite. Price advances could be interesting top selling opportunities for traders betting on a further dollar correction in the coming days.

By Ipek Ozkardeskaya