(03 April 2020)DAILY MARKET BRIEF 2:UK’s services PMI could be revised lower.

In the currency markets, the US dollar defines the overall direction for all. And the greenback remains strong as the risk-off behaviour

reigns.

Due today, the US nonfarm payrolls are expected to unveil 100’000 job losses in March. But looking at the devastating jobless

claims figures, it is possible we see significantly worse figures. As we mentioned in our earlier reports, the US dollar should not fall from

grace with bad US data, in contrary, as investors have no safer place to flee. Hence, we may see a reversed relationship between data and the

USD appetite. A better data would be more efficient in softening the US dollar before the weekly closing bell.

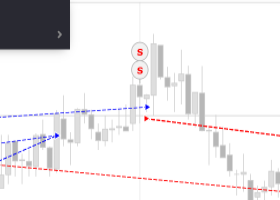

The EURUSD heads toward the

1.08 on the back of a strengthening US dollar. The final PMI figures should hide no surprise for euro traders this morning, other than

confirming the sharpest fall on record. The NFP read could however shake the EURUSD later in the session. Any disappointment could increase

the safe haven outflows toward the USD and pull the pair below the 1.08 mark. A better-than-expected data, on the other hand, could encourage

a recovery toward the 1.10 resistance.

Across the Channel, Cable treads water a touch below the 1.24 mark. The services PMI figure in the UK

could be revised lower to 34.7 from 35.7 printed earlier, given that the announcement of the British lockdown came just after the release of

the latest PMI figure. Provided that up to 80% of the British economy is made up by services, inevitable weakness in services data could weigh

on the pound.

By Ipek Ozkardeskaya