EUR/USD: dollar declines before the publication of FOMC protocols

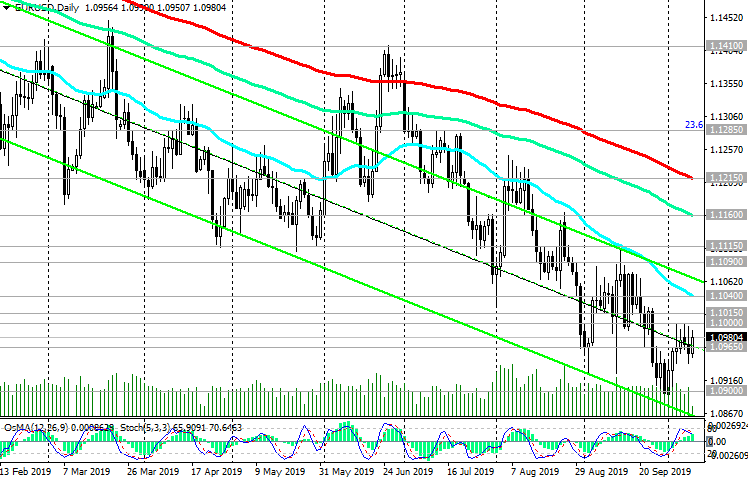

The growth of the Eurozone economy has been weakening since the beginning of 2018, which forces the ECB to actively support the European economy, lowering the interest rate and expanding quantitative easing.

In early September, the ECB lowered its key interest rate, which was already in negative territory, and resumed the bond purchase program. The ECB leaders promised to keep these measures in force, "until we see that the inflation prospects are stably in line" with reaching the target level.

Economists believe that despite the comprehensive measures taken in September, the ECB still has room for maneuver and for further stimulating the European economy, which shows clear signs of a slowdown.

In general, the long-term negative dynamics of EUR / USD remains, which speaks in favor of sales of this currency pair.

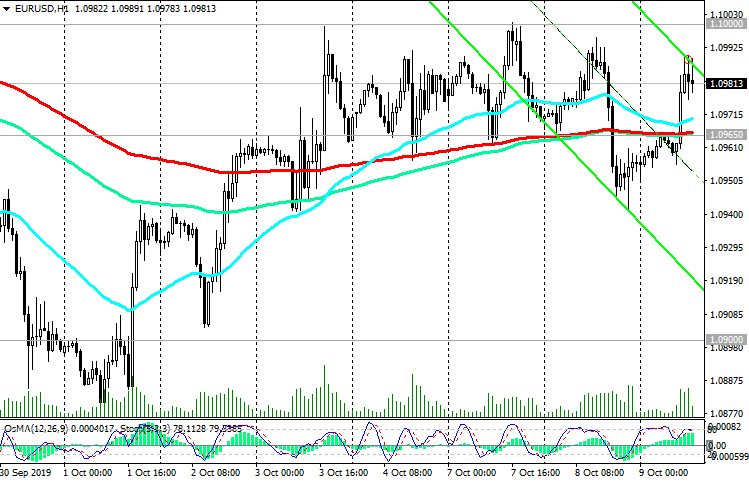

The breakdown of the short-term support level of 1.0965 will signal a resumption of sales with the immediate goal at the local support level of 1.0900. Breakdown of this support level

will provoke a deeper decline and will direct EUR / USD towards 1.0850, 1.0800.

In an alternative scenario and in case of breakdown of the short-term resistance level of 1.1015 (ЕМА200 on the 4-hour chart), EUR / USD will go towards the resistance levels of 1.1040 (ЕМА50 on the daily chart), 1.1090, 1.1115 (September highs, May - April lows). Growth above this resistance level is unlikely.

Meanwhile, traders are preparing to the publishing at 18:00 (GMT) the minutes from the September meeting of the Fed and they are selling the dollar.

Unexpected information contained in the protocols can increase volatility in the financial markets. The soft rhetoric of the statements contained in the minutes will have a negative effect on the dollar. And, on the contrary, the “hawkish” position of the Fed leadership will support the dollar.

Investors will also follow the Fed Chairman Jerome Powell's speech in Kansas City, which will begin at 15:00 (GMT).

Despite the fact that market participants expect the Fed to lower the rate at its meeting on October 29-30 by 0.25% with a probability of almost 80%, the dollar will remain attractive in the context of international trade wars and a slowdown in the global economy. Against the general background, the US economy looks more stable, which determines the attractiveness of American assets and the demand for the dollar.

Support Levels: 1.0965, 1.0900, 1.0850

Resistance Levels: 1.1000, 1.1015, 1.1040, 1.1090, 1.1115

Trading Recommendations

Sell Stop 1.0950. Stop-Loss 1.1020. Take-Profit 1.0900, 1.0850, 1.0800

Buy Stop 1.1020. Stop-Loss 1.0950. Take-Profit 1.1040, 1.1090, 1.1115