(27 September 2019) DAILY MARKET BRIEF 2:Oil prices deflate as Saudi output close to normal

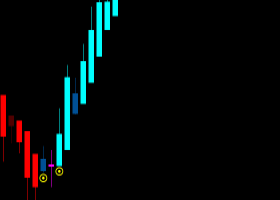

Things have turned for oil, which is set for the second weekly loss of the month. The impressive price appreciation that brought oil

prices up by over 14% in three days following the presumed Iran attacks on Saudi Aramco oil facilities that caused a production drop by over

50% or 5.7 million bpd is now softening as the kingdom production capacity is outpacing its initial repair schedule while additional

defense infrastructures should safeguard the region. Additionally, Trump’s impeachment affair and the recent release of China’s

industrial profits in contraction territory also contribute to current gloomy price action, although upcoming US – China trade talks

officially starting on 10 October 2019 could provide some support despite a muted global economic outlook.

Developments in the Persian Gulf and Strait of Hormuz Middle East region have increased production costs amid heightened security and insurance

premiums as the demand for oil prices is expected to drop for 2019/2020. According to OPEC and the International Energy Agency, oil demand

should oscillate along 1.1 - 1.02 mbpd for 2019 and 1.3 - 1.08 mpbd for 2020 while additional decline is conceivable if the global economy

continues to worsen. Whereas production activities in OPEC’s largest producer Saudi Arabia have resumed promptly, with a production pace

of 8 million bpd or 70% of its maximum capacity, US EIA Crude oil inventory data for the week ended to 20 September are pointing to a rise of 2.4

million barrels, the second consecutive rise, thus supporting an overall negative trend on oil prices. In this setting, crude oil is

expected to remain in the current range, given investor sentiment regarding current political turmoil and additional sanctions that may

be imposed on Iran.

By Vincent Mivelaz