The pound strengthened significantly at the end of last week, and the GBP / USD jumped 170 points in two days to 1.3112.

The growth of the pound contributed mainly by two news regarding Brexit. EU's main Brexit negotiator, Michelle Barnier, said the EU and Britain had reached the final stage of negotiations.

On Friday, Bloomberg reported that the European Union intends to offer the UK a very favorable free trade agreement. Brussels intends to propose an agreement that goes much further than any previous agreements. The EU proposal will provide for 30% -40% of what May requires from a large-scale transaction, which should cover aspects ranging from trade to security, the report says.

The pound was the only currency hardened against the dollar last week.

Other major dollar competitors have fallen against it. The data on the US labor market, received on Friday from the US Department of Commerce, strengthened investors' opinion that the Fed will continue to tighten monetary policy.

In September, unemployment in the United States fell to 3.7%, which increases inflation expectations, especially with regard to wage growth.

At a press conference in September, Fed Chairman Powell confirmed plans for another interest rate increase in 2018 and 3 rate increases in 2019. The Fed is currently the single largest global central bank tightening monetary policy, and this will be the main fundamental driver for the growth of the dollar.

The DXY dollar index, which tracks the US currency against a basket of 6 other major currencies, has been rising since the opening of today's trading day. DXY futures traded at the beginning of the European session near the level of 95.65, 43 points higher than the opening price of the trading day.

However, the Brexit theme remains central to the definition of further pound dynamics. In the case of a hard Brexit, the probability of which is still there, the Bank of England can go on reducing the rate to compensate for the damage. The long-term outlook for the British pound is still uncertain. In the short term, the resumption of the decline in GBP / USD is expected.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and Resistance Levels

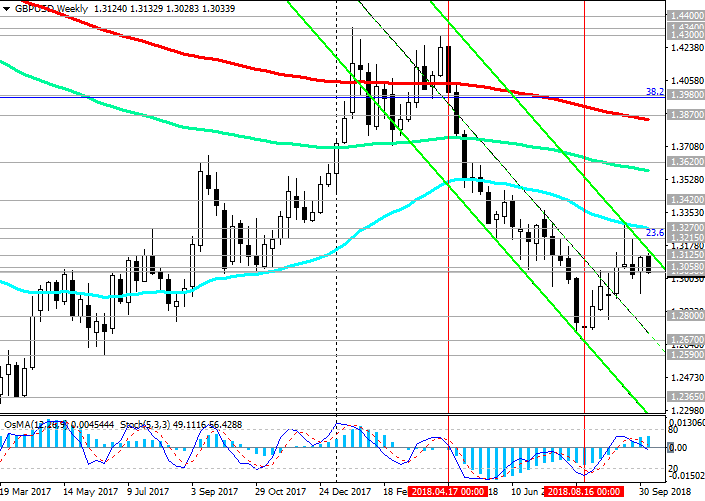

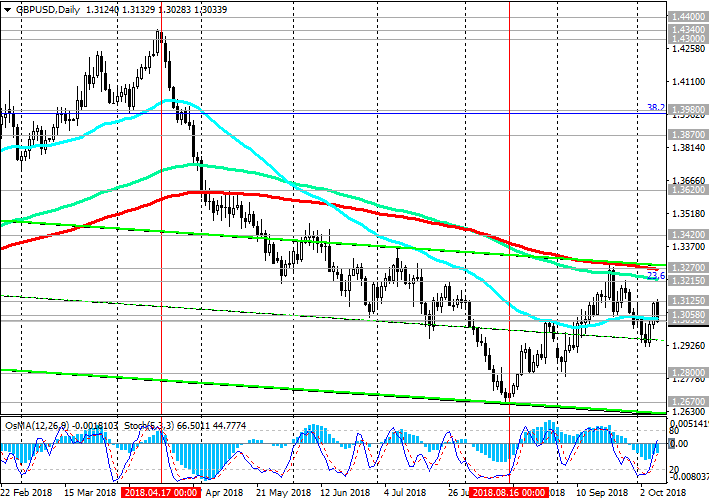

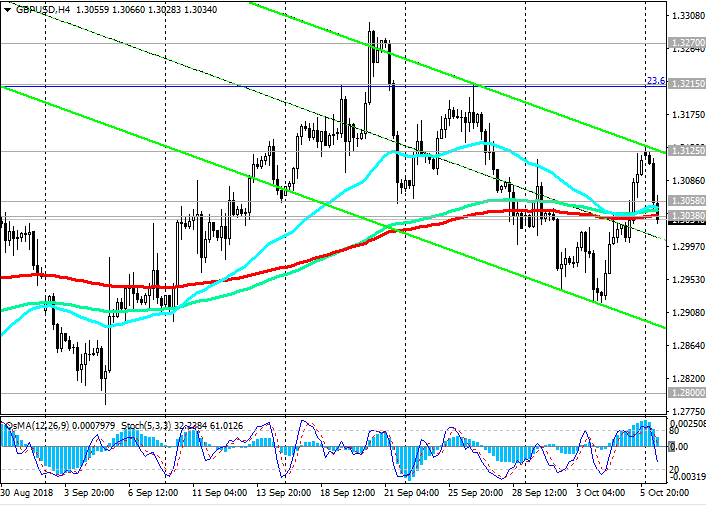

On Monday, GBP / USD attempts to break through the support level of 1.3038 (ЕМА50 on the daily chart, ЕМА200 on the 4-hour chart). In case of its breakdown, the upward GBP / USD correction will end. In this case, short positions are again preferred. A long-term bearish trend persists, and the GBP / USD pair may decline to August and annual lows near the support level of 1.2670, and the lower border of the downward channel on the weekly chart, which passing through the 1.2000 mark.

The alternative scenario assumes a resumption of the upward correction and growth to resistance levels of 1.3215 (Fibonacci level 23.6% of the correction to the decline of GBP / USD in a wave that began in July 2014 near the level of 1.7200), 1.3270 (ЕМА200 on the daily chart).

The signal for the development of this scenario will be the breakdown of the short-term resistance level of 1.3058 (ЕМА200 on the 15-minute chart).

Farther growth targets are resistance levels of 1.3870 (ЕМА200 on the weekly chart), 1.3980 (Fibonacci level 38.2%).

Support levels: 1.3038, 1.3000, 1.2900, 1.2800, 1.2670, 1.2590, 1.2365, 1.2110, 1.2000

Resistance Levels: 1.3058, 1.3125, 1.3215, 1.3270, 1.3300, 1.3420, 1.3620

Trading Scenarios

Sell Stop 1.2990. Stop Loss 1.3070. Take-Profit 1.2900, 1.2800, 1.2670, 1.2590, 1.2365, 1.2110, 1.2000

Buy Stop 1.3070. Stop Loss 1.2990. Take-Profit 1.3125, 1.3215, 1.3270, 1.3300, 1.3420, 1.3620

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com