(21 MARCH 2018)DAILY MARKET BRIEF 1:SECO revised its forecast to the upside

According to the Federal Government’s Expert Group published, Switzerland is also expected to take advantage of the broad-based economic recovery. The SECO revised its growth forecast to the upside as it anticipates that the dynamic recovery will continue. The economy is expected to growth 2.4% in 2018 compared to December estimate of 2.3%. Similarly, 2019 gross national product growth should reach 2%, compared to 1.9% previously estimated. The moderate slowdown expected for 2019 is mostly due to a slackening in construction investments (1.1% growth in 2018 and 0.3% in 2019). Personal consumption forecast has not been revised and is expected to expand at an annual pace of 1.4% in 2018 and 1.5% in 2019.

In the job market, the picture is still bright as the unemployment rate should continue to decrease, easing from 2.9% in 2018 to 2.8% the following year. Unfortunately, it should not translate into firmer real wage growth. Finally, the expert group revised their inflation forecast to the upside for 2018, from 0.3% to 0.6%, while the following year forecast was left unchanged at 0.7%.

The SECO is quite optimistic regarding the short-term economic outlook, as it anticipates that the risk are broadly balanced. Further depreciation of the Swiss franc, together with a lasting global economic recovery should stimulate further the Swiss economy. However, an escalation of the trade war, which was initiated by the US, could dampen the recovery. The expert group also mentioned the monetary policy normalisation process in the US and Europe has a risk to the global recovery.

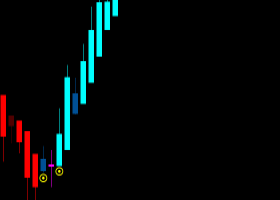

The publication of this optimistic report didn’t affect the FX market. EUR/CHF has been trading with a positive momentum since the beginning of the month, rising as much as 2.60% to 1.1749. On Tuesday, the single currency eased to 1.1730. We maintain our bullish bias on the pair as we expect the recovery in the Eurozone will keep attracting investors’ money. We expect EUR/CHF to keep grinding higher. The key 1.20 level is within reach.

By Arnaud Masset