All Blogs

I use my supply demand zones to decide where i place my stoploss on a trade, also i like whwn engulfing candles are leaving the zone. This indicator can alert you when the zone is new ,broken,tested, retested, when a candle leaves the zone ( engulfing too)! https://www.mql5...

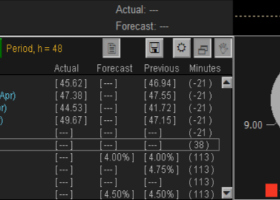

News impact : https://www.mql5.com/en/market/product/78957 News impact L: https://www.mql5.com/en/market/product/107761 News The news source can be either a terminal News Calendar or a website Investing...

Gold 1 minute setup on the Easytrade indicator( + supply demand zones) Multitimeframe and multicurrency alerts. Go to the alerted chart by pressing its button! https://www.mql5.com/en/users/gabedk/seller...

EUR/USD: A Pause After the Rally ● Last week, 60% of analysts adopted a neutral stance in their previous forecast and were proven absolutely correct. EUR/USD had a calm week, even boring at times, moving along the 1.0650 mark within the narrow corridor of 1.0600-1.0690...

Dear traders and investors, Introducing Vikopo Grid Trading MT5 , Developed by a team of experienced traders with trading experience of over 15 years. MT5 Version : https://www.mql5.com/en/market/product/116208 products List : https://www.mql5...

This is my chart on 2024.04.19 on Gold M1,. I used the DMtrendscanner indicator and my trade assistant set to ATR stoploss multiplier X2 , takeprofit on tp 1,2,3 or on opposite signal. IN THE FUTURE I WILL PULL MY STOPLOSS TO BREAKEVEN ON TP1 , PULL IT TO TP1 IF TP 2 HIT ETC. https://www.mql5...

Hi MQL Community, thanks for checking this. Here's an update on how the EAs have been performing respectively. I believe we've FOUND STABILITY . RangeMAX Signal: https://www.mql5.com/en/signals/2217499 MT4: https://www.mql5.com/en/market/product/108426 MT5: https://www.mql5...

mt5 version : Currencies Hunter Mt5 buy it now on sale mt4 version : Currencies Hunter mt4 on sale don't forget to join our VIP channel...

In the absence of economic reports or other news that could affect the market, investors finally paid attention to the dollar's overbought condition. So, there was nothing to prevent the local correction, which, by the way, is still far from over...

Dear traders and investors, Introducing Vikopo RSI MT5 , Developed by a team of experienced traders with trading experience of over 15 years. MT5 Version : https://www.mql5.com/en/market/product/116161 products List : https://www.mql5...

Hello everyone, I'm Esmaeil and here I will explain the inputs and how to run the EA properly to get the most out of it so stay with me :) Link to MT4 Version: https://www.mql5.com/en/market/product/116116 Link to MT5 Version: https://www.mql5...

✔️ Identify ranges and the next probable direction ✔️ Get the earliest signals and the strength of Trends ✔️ Get clear exits signals before reversal ✔️ Spot the Fibo levels the price will test MT5 version | MT4 version Get our full method with BladeSCALPER and PowerZONES 📌 What is it about...

✔️ Local Trade Copier EA MT4©: https://www.mql5.com/ja/market/product/68950 ✔️ Local Trade Copier EA MT5©: https://www.mql5...

Dear traders and investors, Introducing Vikopo ZigZag MT5 , Developed by a team of experienced traders with trading experience of over 15 years. MT5 Version : https://www.mql5.com/en/market/product/116123 products List : https://www.mql5...

1. Introduction This is the continuation on Sapphire Strat Maker and Sapphire Strat Maker Alt (Free) expert advisor (enjoy the price discount while it is still active!) - an EA which allows you to create your own strategy without coding...

Breakouts with strong momentum are challenging to catch. The purpose of the Super Breakouts Monitor is to identify such market conditions...

Bollinger bands are a volatility indicator, used by traders to identify areas of support and resistance and areas in which an asset might be experiencing increased or decreased volatility. Bollinger bands are calculated from three lines drawn onto a price chart...

This is user manual for Expert Advisor Price Action DayTrader...

Minions Labs's Super Breakouts Monitor DEMO version When you download the "FREE DEMO" from the indicator page you can only test the indicator in a BACKTEST environment and over a couple of Symbols, not on REAL or DEMO accounts and over the Symbol you want to trade...

===========INPUTS FOR TRAILING=========== Select Trailing Method: Trailing_None: Do not use the Trailing strategy. Trailing_FixedPips: When the profit of position increases with price changes, SL and TP will adjust according to the current price to maintain a set fixed value...

1234567891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071727374757677787980818283848586878889909192939495969798991001011021031041051061071081091101111121131141151161171181191201211221231241251261271281291301311321331341351361371381391401411421431441451461471481491501511521531541551561571581591601611621631641651661671681691701711721731741751761771781791801811821831841851861871881891901911921931941951961971981992002012022032042052062072082092102112122132142152162172182192202212222232242252262272282292302312322332342352362372382392402412422432442452462472482492502512522532542552562572582592602612622632642652662672682692702712722732742752762772782792802812822832842852862872882892902912922932942952962972982993003013023033043053063073083093103113123133143153163173183193203213223233243253263273283293303313323333343353363373383393403413423433443453463473483493503513523533543553563573583593603613623633643653663673683693703713723733743753763773783793803813823833843853863873883893903913923933943953963973983994004014024034044054064074084094104114124134144154164174184194204214224234244254264274284294304314324334344354364374384394404414424434444454464474484494504514524534544554564574584594604614624634644654664674684694704714724734744754764774784794804814824834844854864874884894904914924934944954964974984995005015025035045055065075085095105115125135145155165175185195205215225235245255265275285295305315325335345355365375385395405415425435445455465475485495505515525535545555565575585595605615625635645655665675685695705715725735745755765775785795805815825835845855865875885895905915925935945955965975985996006016026036046056066076086096106116126136146156166176186196206216226236246256266276286296306316326336346356366376386396406416426436446456466476486496506516526536546556566576586596606616626636646656666676686696706716726736746756766776786796806816826836846856866876886896906916926936946956966976986997007017027037047057067077087097107117127137147157167177187197207217227237247257267277287297307317327337347357367377387397407417427437447457467477487497507517527537547557567577587597607617627637647657667677687697707717727737747757767777787797807817827837847857867877887897907917927937947957967977987998008018028038048058068078088098108118128138148158168178188198208218228238248258268278288298308318328338348358368378388398408418428438448458468478488498508518528538548558568578588598608618628638648658668678688698708718728738748758768778788798808818828838848858868878888898908918928938948958968978988999009019029039049059069079089099109119129139149159169179189199209219229239249259269279289299309319329339349359369379389399409419429439449459469479489499509519529539549559569579589599609619629639649659669679689699709719729739749759769779789799809819829839849859869879889899909919929939949959969979989991000100110021003100410051006100710081009101010111012101310141015101610171018101910201021102210231024102510261027102810291030103110321033103410351036103710381039104010411042104310441045104610471048104910501051105210531054105510561057105810591060106110621063106410651066106710681069107010711072107310741075107610771078107910801081108210831084108510861087108810891090109110921093109410951096109710981099110011011102110311041105110611071108110911101111111211131114111511161117111811191120112111221123112411251126112711281129113011311132113311341135113611371138113911401141114211431144114511461147114811491150115111521153115411551156115711581159116011611162116311641165116611671168116911701171117211731174117511761177117811791180118111821183118411851186118711881189119011911192119311941195119611971198119912001201120212031204120512061207120812091210121112121213121412151216121712181219122012211222122312241225122612271228122912301231123212331234123512361237123812391240124112421243124412451246124712481249125012511252125312541255125612571258125912601261126212631264126512661267126812691270127112721273127412751276127712781279128012811282128312841285128612871288128912901291129212931294129512961297129812991300130113021303130413051306130713081309131013111312131313141315131613171318131913201321132213231324132513261327132813291330133113321333133413351336133713381339134013411342134313441345134613471348134913501351135213531354135513561357135813591360136113621363136413651366136713681369137013711372137313741375137613771378137913801381138213831384138513861387138813891390139113921393139413951396139713981399140014011402140314041405140614071408140914101411141214131414141514161417141814191420142114221423142414251426142714281429143014311432143314341435143614371438143914401441144214431444144514461447144814491450145114521453145414551456145714581459146014611462146314641465146614671468146914701471147214731474147514761477147814791480148114821483148414851486148714881489149014911492149314941495149614971498149915001501150215031504150515061507150815091510151115121513151415151516151715181519152015211522152315241525152615271528152915301531153215331534153515361537153815391540154115421543154415451546154715481549155015511552155315541555155615571558155915601561156215631564156515661567156815691570157115721573157415751576157715781579158015811582158315841585158615871588158915901591159215931594159515961597159815991600160116021603160416051606160716081609161016111612161316141615161616171618161916201621162216231624162516261627162816291630163116321633163416351636163716381639164016411642164316441645164616471648164916501651165216531654165516561657165816591660166116621663166416651666166716681669167016711672167316741675167616771678167916801681168216831684168516861687168816891690169116921693169416951696169716981699170017011702170317041705170617071708170917101711171217131714171517161717171817191720172117221723172417251726172717281729173017311732173317341735173617371738173917401741174217431744174517461747174817491750175117521753175417551756175717581759176017611762176317641765176617671768176917701771177217731774177517761777177817791780178117821783178417851786178717881789179017911792179317941795179617971798179918001801180218031804180518061807180818091810181118121813181418151816181718181819182018211822182318241825182618271828182918301831183218331834183518361837183818391840184118421843184418451846184718481849185018511852185318541855185618571858185918601861186218631864186518661867186818691870187118721873187418751876187718781879188018811882188318841885188618871888188918901891189218931894189518961897189818991900190119021903190419051906190719081909191019111912191319141915191619171918191919201921192219231924192519261927192819291930193119321933193419351936193719381939194019411942194319441945194619471948194919501951195219531954195519561957195819591960196119621963196419651966196719681969197019711972197319741975197619771978197919801981198219831984198519861987198819891990199119921993199419951996199719981999200020012002200320042005200620072008200920102011201220132014201520162017201820192020202120222023202420252026202720282029203020312032203320342035203620372038203920402041204220432044204520462047204820492050205120522053205420552056205720582059206020612062206320642065206620672068206920702071207220732074207520762077207820792080208120822083208420852086208720882089209020912092209320942095209620972098209921002101210221032104210521062107210821092110211121122113211421152116211721182119212021212122212321242125212621272128212921302131213221332134213521362137213821392140214121422143214421452146214721482149215021512152215321542155215621572158215921602161216221632164216521662167216821692170217121722173