All Blogs

In the absence of economic reports or other news that could affect the market, investors finally paid attention to the dollar's overbought condition. So, there was nothing to prevent the local correction, which, by the way, is still far from over...

Dear traders and investors, Introducing Vikopo RSI MT5 , Developed by a team of experienced traders with trading experience of over 15 years. MT5 Version : https://www.mql5.com/en/market/product/116161 products List : https://www.mql5...

Is it best to have it all done for you or is merit more satisfying? My systems require participation. Is participation with a system better than passively having others control your risk parameters? Seller - Thomas Bradley Butler - tradertb - Trader's profile (mql5.com...

Hello everyone, I'm Esmaeil and here I will explain the inputs and how to run the EA properly to get the most out of it so stay with me :) Link to MT4 Version: https://www.mql5.com/en/market/product/116116 Link to MT5 Version: https://www.mql5...

✔️ Identify ranges and the next probable direction ✔️ Get the earliest signals and the strength of Trends ✔️ Get clear exits signals before reversal ✔️ Spot the Fibo levels the price will test MT5 version | MT4 version Get our full method with BladeSCALPER and PowerZONES 📌 What is it about...

✔️ Local Trade Copier EA MT4©: https://www.mql5.com/ja/market/product/68950 ✔️ Local Trade Copier EA MT5©: https://www.mql5...

Dear traders and investors, Introducing Vikopo ZigZag MT5 , Developed by a team of experienced traders with trading experience of over 15 years. MT5 Version : https://www.mql5.com/en/market/product/116123 products List : https://www.mql5...

1. Introduction This is the continuation on Sapphire Strat Maker and Sapphire Strat Maker Alt (Free) expert advisor (enjoy the price discount while it is still active!) - an EA which allows you to create your own strategy without coding...

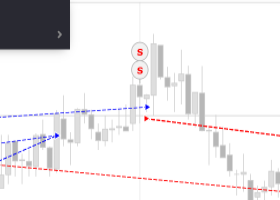

Breakouts with strong momentum are challenging to catch. The purpose of the Super Breakouts Monitor is to identify such market conditions...

Bollinger bands are a volatility indicator, used by traders to identify areas of support and resistance and areas in which an asset might be experiencing increased or decreased volatility. Bollinger bands are calculated from three lines drawn onto a price chart...

This is user manual for Expert Advisor Price Action DayTrader...

Minions Labs's Super Breakouts Monitor DEMO version When you download the "FREE DEMO" from the indicator page you can only test the indicator in a BACKTEST environment and over a couple of Symbols, not on REAL or DEMO accounts and over the Symbol you want to trade...

===========INPUTS FOR TRAILING=========== Select Trailing Method: Trailing_None: Do not use the Trailing strategy. Trailing_FixedPips: When the profit of position increases with price changes, SL and TP will adjust according to the current price to maintain a set fixed value...

Description of work The 'MA7 Clover' indicator is based on candle shapes. Shows the 'Pin Bar' candle pattern. Features of work The indicator works on the instrument and timeframe on which it is installed. The data is analyzed on closed candles, so the arrows are not redrawn...

News Trapper EA made for trading news with minimum risk how its work when i choose interest rate only then the ea trade all interest rate for all pairs and non farm payroll news those news have big movement but if i choose all news then ea trade high impact news but i recommended choose interest...

Olaf Scholz arrived in China in order to convince Xi Jinping to reduce support for Russia. During his three-day visit to China, the German Chancellor met with Xi Jinping...

Yesterday during the American session, gold reached a low of 2,325, the level that coincided with the 200 EMA and from that area, it gained a strong bullish momentum, jumping by more than $50 in less than 24 hours...

Introduction EA INTERCEPTOR is an expert advisor that uses a reversion strategy by entering a trade when the market is exhausted. The robot opens a signal only if there is a confirmation that the regression is actually occuring...

<< Back to the General Section with a description of the settings The multiple trading mode is a continuation of the development of the idea of tracking the trader’s funds and makes it possible not only to automatically restart the standard mode the required number of times, but also to tra...

1234567891011121314151617181920212223242526272829303132333435363738394041424344454647484950515253545556575859606162636465666768697071727374757677787980818283848586878889909192939495969798991001011021031041051061071081091101111121131141151161171181191201211221231241251261271281291301311321331341351361371381391401411421431441451461471481491501511521531541551561571581591601611621631641651661671681691701711721731741751761771781791801811821831841851861871881891901911921931941951961971981992002012022032042052062072082092102112122132142152162172182192202212222232242252262272282292302312322332342352362372382392402412422432442452462472482492502512522532542552562572582592602612622632642652662672682692702712722732742752762772782792802812822832842852862872882892902912922932942952962972982993003013023033043053063073083093103113123133143153163173183193203213223233243253263273283293303313323333343353363373383393403413423433443453463473483493503513523533543553563573583593603613623633643653663673683693703713723733743753763773783793803813823833843853863873883893903913923933943953963973983994004014024034044054064074084094104114124134144154164174184194204214224234244254264274284294304314324334344354364374384394404414424434444454464474484494504514524534544554564574584594604614624634644654664674684694704714724734744754764774784794804814824834844854864874884894904914924934944954964974984995005015025035045055065075085095105115125135145155165175185195205215225235245255265275285295305315325335345355365375385395405415425435445455465475485495505515525535545555565575585595605615625635645655665675685695705715725735745755765775785795805815825835845855865875885895905915925935945955965975985996006016026036046056066076086096106116126136146156166176186196206216226236246256266276286296306316326336346356366376386396406416426436446456466476486496506516526536546556566576586596606616626636646656666676686696706716726736746756766776786796806816826836846856866876886896906916926936946956966976986997007017027037047057067077087097107117127137147157167177187197207217227237247257267277287297307317327337347357367377387397407417427437447457467477487497507517527537547557567577587597607617627637647657667677687697707717727737747757767777787797807817827837847857867877887897907917927937947957967977987998008018028038048058068078088098108118128138148158168178188198208218228238248258268278288298308318328338348358368378388398408418428438448458468478488498508518528538548558568578588598608618628638648658668678688698708718728738748758768778788798808818828838848858868878888898908918928938948958968978988999009019029039049059069079089099109119129139149159169179189199209219229239249259269279289299309319329339349359369379389399409419429439449459469479489499509519529539549559569579589599609619629639649659669679689699709719729739749759769779789799809819829839849859869879889899909919929939949959969979989991000100110021003100410051006100710081009101010111012101310141015101610171018101910201021102210231024102510261027102810291030103110321033103410351036103710381039104010411042104310441045104610471048104910501051105210531054105510561057105810591060106110621063106410651066106710681069107010711072107310741075107610771078107910801081108210831084108510861087108810891090109110921093109410951096109710981099110011011102110311041105110611071108110911101111111211131114111511161117111811191120112111221123112411251126112711281129113011311132113311341135113611371138113911401141114211431144114511461147114811491150115111521153115411551156115711581159116011611162116311641165116611671168116911701171117211731174117511761177117811791180118111821183118411851186118711881189119011911192119311941195119611971198119912001201120212031204120512061207120812091210121112121213121412151216121712181219122012211222122312241225122612271228122912301231123212331234123512361237123812391240124112421243124412451246124712481249125012511252125312541255125612571258125912601261126212631264126512661267126812691270127112721273127412751276127712781279128012811282128312841285128612871288128912901291129212931294129512961297129812991300130113021303130413051306130713081309131013111312131313141315131613171318131913201321132213231324132513261327132813291330133113321333133413351336133713381339134013411342134313441345134613471348134913501351135213531354135513561357135813591360136113621363136413651366136713681369137013711372137313741375137613771378137913801381138213831384138513861387138813891390139113921393139413951396139713981399140014011402140314041405140614071408140914101411141214131414141514161417141814191420142114221423142414251426142714281429143014311432143314341435143614371438143914401441144214431444144514461447144814491450145114521453145414551456145714581459146014611462146314641465146614671468146914701471147214731474147514761477147814791480148114821483148414851486148714881489149014911492149314941495149614971498149915001501150215031504150515061507150815091510151115121513151415151516151715181519152015211522152315241525152615271528152915301531153215331534153515361537153815391540154115421543154415451546154715481549155015511552155315541555155615571558155915601561156215631564156515661567156815691570157115721573157415751576157715781579158015811582158315841585158615871588158915901591159215931594159515961597159815991600160116021603160416051606160716081609161016111612161316141615161616171618161916201621162216231624162516261627162816291630163116321633163416351636163716381639164016411642164316441645164616471648164916501651165216531654165516561657165816591660166116621663166416651666166716681669167016711672167316741675167616771678167916801681168216831684168516861687168816891690169116921693169416951696169716981699170017011702170317041705170617071708170917101711171217131714171517161717171817191720172117221723172417251726172717281729173017311732173317341735173617371738173917401741174217431744174517461747174817491750175117521753175417551756175717581759176017611762176317641765176617671768176917701771177217731774177517761777177817791780178117821783178417851786178717881789179017911792179317941795179617971798179918001801180218031804180518061807180818091810181118121813181418151816181718181819182018211822182318241825182618271828182918301831183218331834183518361837183818391840184118421843184418451846184718481849185018511852185318541855185618571858185918601861186218631864186518661867186818691870187118721873187418751876187718781879188018811882188318841885188618871888188918901891189218931894189518961897189818991900190119021903190419051906190719081909191019111912191319141915191619171918191919201921192219231924192519261927192819291930193119321933193419351936193719381939194019411942194319441945194619471948194919501951195219531954195519561957195819591960196119621963196419651966196719681969197019711972197319741975197619771978197919801981198219831984198519861987198819891990199119921993199419951996199719981999200020012002200320042005200620072008200920102011201220132014201520162017201820192020202120222023202420252026202720282029203020312032203320342035203620372038203920402041204220432044204520462047204820492050205120522053205420552056205720582059206020612062206320642065206620672068206920702071207220732074207520762077207820792080208120822083208420852086208720882089209020912092209320942095209620972098209921002101210221032104210521062107210821092110211121122113211421152116211721182119212021212122212321242125212621272128212921302131213221332134213521362137213821392140214121422143214421452146214721482149215021512152215321542155215621572158215921602161216221632164216521662167216821692170217121722173