Weekly Trading Forecast: Trump Inauguration Takes Center Stage

Financial markets face the return of high-profile event risk in the week ahead but US policy uncertainty may keep all eyes on the nearing Trump inauguration.

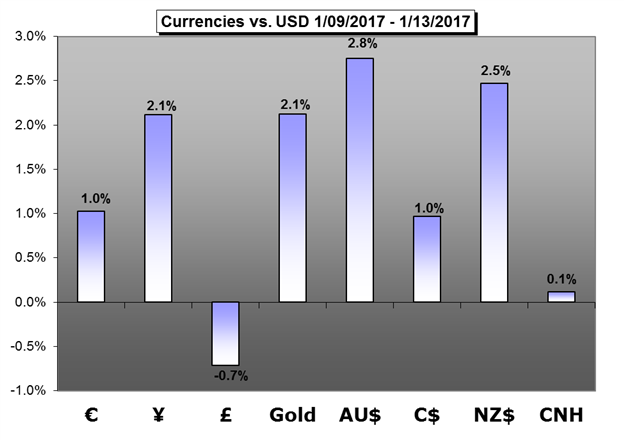

US Dollar May Fall Further as Trump Inauguration Nears

The US Dollar may continue to weaken as disillusioned traders continue to scale back exposure to the so-called “Trump trade” ahead of the nearing Presidential inauguration.

Rising U.S. CPI, Hawkish Fed Rhetoric to Tame USD/JPY Pullback

The failed run at the December high (118.66) keeps the near-term outlook for USD/JPY tilted to the downside, but the key developments coming out of the U.S. economy may prop up the exchange rate next.

GBP Clings to Support Ahead of Inflation, May’s Brexit Speech

Ever since the Brexit referendum in June, markets have volleyed the various prospects that might come from the actual execution of the split from the European Union.

Canadian Dollar Looks to Poloz for Further Strength

The Canadian Dollar has been a resilient currency at the start of the year. Much of the strength is due in part to Oil’s consistency above a long-term focal point on the chart.

Australian Dollar Figthback Can Continue

Is the Australian Dollar in a sweet spot? Well, that might be premature optimism but it’s certainly in a better place than it was back in November.

Gold Weakness to be Viewed as Opportunity- US CPI on Tap

Gold prices are higher for a third consecutive week with the precious metal up 1.8% to trade at 1194 ahead of the New York close on Friday.

Yuan Eyes on China 4Q GDP, Davos Forum

This week, the offshore Yuan remained stronger than the onshore Yuan and the PBOC’s guidance. On Friday, the USD/CNY closed at 6.8984, slightly weaker than the Yuan fix set on Friday of 6.8909.