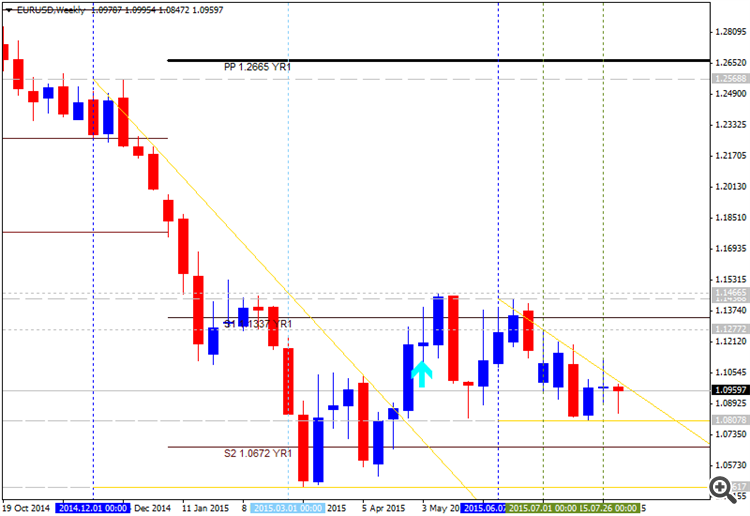

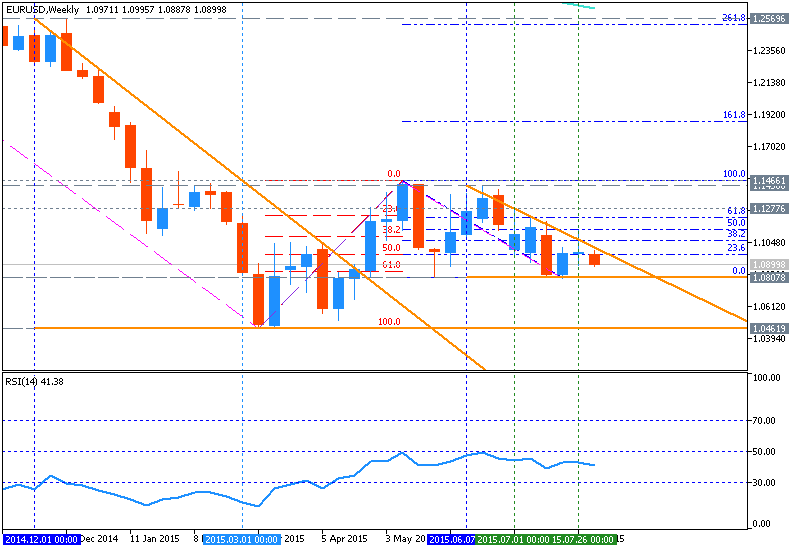

EURUSD Weekly Outlook - the 1.0800 area remains a critical pivot zone

W1 price is located below 200 period SMA (200-SMA) and below 100 period SMA (100-SMA) for the primary bullish with ranging between Fibo resistance level at 1.1466 and Fibo support level at 1.0807:

- descending triangle pattern with 1.0807 support is going to be broken by the price from above to above for the bearish trend to be continuing;

- the next bearish target is 1.0461 which can be reached by price in the case of 1.0807 support broken;

- “the 1.0800 area remains a critical pivot zone as a close below there would confirm a resumption of the broader downtrend and set into motion a more important decline. However, the contraction in range over the past few months does make us wonder if the market is setting up a bear trap”;

- “the potential inverse head and shoulders pattern on the daily (price action since July) doesn’t help things either, but only a move through 1.1130 would start to turn things more clearly positive for the euro”;

- RSI indicator is estimating the uptrend to be continuing.

If the price will break Fibo

support level at 1.0807 so the bearish trend will be continuing up to 1.0461 as the next level in our case.

If the price will break Fibo resistance level at 1.1466 from below to above so the local uptrend as the secondary market rally will be started within the primary bearish market condition.

If not so the price will be ranging between between the levels.

Trend: