Creating a Multi-Currency Multi-System Expert Advisor

Maxim Khrolenko | 5 December, 2013

Introduction

I believe there are quite a few traders who trade more than one trading symbol and use multiple strategies. This approach does not only allow you to potentially increase your profit but to also minimize the risk of substantial drawdown upon efficient money management. When creating an Expert Advisor, the first natural step in checking the efficiency of the program strategy is optimization in order to determine the best input parameters.

With parameter values identified, Expert Advisors would technically be ready for trading. However that would leave one important question unanswered. What would testing results be like if a trader could put all his strategies together in a single Expert Advisor? The realization that drawdown on several symbols or strategies might at some point overlap and result in a ghastly total drawdown or even a margin call may sometimes come as a nasty surprise.

This article introduces a concept of creating a multi-currency multi-system Expert Advisor that will allow us to find an answer to this important question.

1. Structure of the Expert Advisor

In general terms, the structure of the Expert Advisor is as follows:

Fig. 1. Structure of the multi-currency multi-system Expert Advisor

As you can see, the program is based on a for loop. Each strategy is arranged in a loop where each iteration is responsible for trading each symbol separately. Here, you can arrange in loops unlimited number of strategies. Important is for your computer to have sufficient resources to "process" such a program.

You should keep in mind that there may only be one position for each traded symbol in MetaTrader 5. Such position represents the sum of lots of previously executed Buys and Sells. Therefore, the result of multi-strategy testing for one symbol will not be identical to the sum of separate testing results of the same strategies for the same symbol.

For a closer consideration of the structure of the Expert Advisor we will take 2 strategies each of which trades two symbols:

Strategy A:

- Buy: Ask price reaches the lower band of the Bollinger Bands indicator calculated based on Low price.

Closing: Bid price reaches the lower band of the Bollinger Bands indicator calculated based on High price. - Sell: Bid price reaches the upper band of the Bollinger Bands indicator calculated based on High price.

Closing: Ask price reaches the upper band of the Bollinger Bands indicator calculated based on Low price. - Restriction: only one deal can be executed on any given bar.

Strategy В:

- Buy: the previous bar is bearish (close < open) and Ask price reaches the previous bar's high.

Closing: by Stop Loss or Take Profit. - Sell: the previous bar is bullish (close > open) and Bid price reaches the previous bar's low.

Closing: by Stop Loss or Take Profit. - Restriction: only one deal can be executed on any given bar.

To be independent from the new ticks for a symbol on which the Expert Advisor will be tested or which it will trade, it is advisable to use the OnTimer() function for trading in multi-currency mode.

For this purpose, when initializing the Expert Advisor we specify the frequency of generating an event for program calculation call using the EventSetTimer() function, and upon deinitialization we use the EventKillTimer() function to tell the terminal to stop generation of events:

// Include standard libraries // Create external parameters // Create arrays, variables, indicator handles, etc. //--- Initialization of the Expert Advisor int OnInit() { //--- Set event generation frequency EventSetTimer(1); // 1 second // ... return(0); } void OnTimer() { // ... } //--- Deinitialization of the Expert Advisor void OnDeinit(const int reason) { //--- Stop event generation EventKillTimer(); // ... }

Instead of EventSetTimer(), you can also use EventSetMillisecondTimer(), where frequency is set accurate to millisecond but you should not misuse it by too frequent program calculation calls.

For access to account, position and symbol settings, as well as trading functions, we will use CAccountInfo, CPositionInfo, CSymbolInfo and CTrade classes, respectively. Let's include them in the Expert Advisor:

//--- Include standard libraries #include <Trade\AccountInfo.mqh> #include <Trade\PositionInfo.mqh> #include <Trade\SymbolInfo.mqh> #include <Trade\Trade.mqh>

Since the Expert Advisor is based on for loops, we will need to create arrays for its external parameters. Let's first create constants equal to the number of symbols for each strategy:

//--- Number of traded symbols for each strategy #define Strategy_A 2 #define Strategy_B 2

We then create external parameters. Using constants, we determine sizes of arrays to which they will be copied. Further, we create indicator handles and other global variables.

An example for one symbol of strategy А is provided below:

//------------------- External parameters of strategy A input string Data_for_Strategy_A="Strategy A -----------------------"; //--- Symbol 0 input string Symbol_A0 = "EURUSD"; // Symbol input bool IsTrade_A0 = true; // Permission for trading //--- Bollinger Bands (BB) parameters input ENUM_TIMEFRAMES Period_A0 = PERIOD_H1; // ВВ period input uint BBPeriod_A0 = 20; // Period for calculation of the moving average of BB input int BBShift_A0 = 0; // Horizontal shift of ВВ input double BBDeviation_A0 = 2.0; // Number of standard deviations of BB //... //--- General parameters of strategy A input double DealOfFreeMargin_A = 1.0; // Percent of free margin for a deal input uint MagicNumber_A = 555; // Magic number input uint Slippage_A = 100; // Permissible slippage for a deal //... //------------- Set variables of strategy A ----- //--- Arrays for external parameters string Symbol_A[Strategy_A]; bool IsTrade_A[Strategy_A]; ENUM_TIMEFRAMES Period_A[Strategy_A]; int BBPeriod_A[Strategy_A]; int BBShift_A[Strategy_A]; double BBDeviation_A[Strategy_A]; //--- Arrays for global variables double MinLot_A[Strategy_A],MaxLot_A[Strategy_A]; double Point_A[Strategy_A],ContractSize_A[Strategy_A]; uint DealNumber_A[Strategy_A]; datetime Locked_bar_time_A[Strategy_A],time_arr_A[]; //--- Indicator handles int BB_handle_high_A[Strategy_A]; int BB_handle_low_A[Strategy_A]; //--- Arrays for indicator values double BB_upper_band_high[],BB_lower_band_high[]; double BB_upper_band_low[],BB_lower_band_low[]; //--- Class CTrade Trade_A; //... //--- Set global variables for all strategies long Leverage; //--- Classes CAccountInfo AccountInfo; CPositionInfo PositionInfo; CSymbolInfo SymbolInfo;

To have the possibility to disable trading for a certain symbol, we have created a Boolean variable IsTrade_A0 that will be placed at the very beginning of for loops.

2. Initialization of the Expert Advisor

First, let's get the values required for all strategies, e.g. leverage. Since leverage is applied to the trading account and has nothing to do with a strategy or a symbol, there is no need to copy its value to the arrays:

//--- Get the leverage for the account

Leverage=AccountInfo.Leverage();

We then copy external variables to arrays.

//--- Copy external variables to arrays Symbol_A[0] =Symbol_A0; IsTrade_A[0] =IsTrade_A0; Period_A[0] =Period_A0; BBPeriod_A[0] =(int)BBPeriod_A0; BBShift_A[0] =BBShift_A0; BBDeviation_A[0]=BBDeviation_A0;

If any external parameter is defined by the type that will require conversion to another one, this can be done in a more convenient way when copying to arrays.

In this case, we can see that BBPeriod_A0 was created as uint to prevent the user from setting a negative value. Here, we convert it to int and copy it to the array which was also created as int. Otherwise, the compiler will give a warning if you try to insert uint type parameter in the indicator handle.

Let's further see whether the traded symbol is available in the Market Watch and whether it has been used more than once within one strategy:

//--- Check for the symbol in the Market Watch for(int i=0; i<Strategy_A; i++) { if(IsTrade_A[i]==false) continue; if(IsSymbolInMarketWatch(Symbol_A[i])==false) { Print(Symbol_A[i]," could not be found on the server!"); ExpertRemove(); } } //--- Check whether the symbol is used more than once if(Strategy_A>1) { for(int i=0; i<Strategy_A-1; i++) { if(IsTrade_A[i]==false) continue; for(int j=i+1; j<Strategy_A; j++) { if(IsTrade_A[j]==false) continue; if(Symbol_A[i]==Symbol_A[j]) { Print(Symbol_A[i]," is used more than once!"); ExpertRemove(); } } } } //--- The IsSymbolInMarketWatch() function bool IsSymbolInMarketWatch(string f_Symbol) { for(int s=0; s<SymbolsTotal(false); s++) { if(f_Symbol==SymbolName(s,false)) return(true); } return(false); }

If the symbols were selected correctly, check for errors in input parameters for each of them, create indicator handles, get the data required for the lot calculation and, if necessary, do other things as defined by the given strategy.

We will implement the above mentioned actions inside a for loop.

//--- General actions for(int i=0; i<Strategy_A; i++) { if(IsTrade_A[i]==false) continue; //--- Check for errors in input parameters //... //--- Set indicator handles BB_handle_high_A[i]=iBands(Symbol_A[i],Period_A[i],BBPeriod_A[i],BBShift_A[i],BBDeviation_A[i], PRICE_HIGH); if(BB_handle_high_A[i]<0) { Print("Failed to create a handle for Bollinger Bands based on High prices for ",Symbol_A[i]," . Handle=",INVALID_HANDLE, "\n Error=",GetLastError()); ExpertRemove(); } //... //--- Calculate data for the Lot //--- set the name of the symbol for which the information will be obtained SymbolInfo.Name(Symbol_A[i]); //--- minimum and maximum volume size in trading operations MinLot_A[i]=SymbolInfo.LotsMin(); MaxLot_A[i]=SymbolInfo.LotsMax(); //--- point value Point_A[i]=SymbolInfo.Point(); //--- contract size ContractSize_A[i]=SymbolInfo.ContractSize(); //--- Set some additional parameters }

Then, we set the parameters for trading operations of strategy A using the Trade_A object of the CTrade class.

//--- Set parameters for trading operations //--- set the magic number Trade_A.SetExpertMagicNumber(MagicNumber_A); //--- set the permissible slippage in points upon deal execution Trade_A.SetDeviationInPoints(Slippage_A); //--- order filling mode, use the mode that is allowed by the server Trade_A.SetTypeFilling(ORDER_FILLING_RETURN); //--- logging mode, it is advisable not to call this method as the class will set the optimal mode by itself Trade_A.LogLevel(1); //--- the function to be used for trading: true - OrderSendAsync(), false - OrderSend(). Trade_A.SetAsyncMode(true);

The same procedure is repeated for each strategy, i.e.

- Copy external variables to arrays;

- Check whether symbols are selected correctly;

- Check errors, set indicator handles, calculate data for the lot and for everything that is required for a given strategy;

- Set parameters for trading operations.

Finally, it would be good to check if one and the same symbol is used in several strategies (an example for two strategies is provided below):

//--- Check whether one and the same symbol is used in several strategies for(int i=0; i<Strategy_A; i++) { if(IsTrade_A[i]==false) continue; for(int j=0; j<Strategy_B; j++) { if(IsTrade_B[j]==false) continue; if(Symbol_A[i]==Symbol_B[j]) { Print(Symbol_A[i]," is used in several strategies!"); ExpertRemove(); } } }

3. Trading "For" Loops

The framework of for loops inside the OnTimer() function is as follows:

void OnTimer() { //--- Check if the terminal is connected to the trade server if(TerminalInfoInteger(TERMINAL_CONNECTED)==false) return; //--- Section A: Main loop of the FOR operator for strategy A ----------- for(int A=0; A<Strategy_A; A++) { //--- A.1: Check whether the symbol is allowed to be traded if(IsTrade_A[A]==false) continue; // terminate the current FOR iteration } //--- Section В: Main loop of the FOR operator for strategy В ----------- for(int B=0; B<Strategy_B; B++) { //--- B.1: Check whether the symbol is allowed to be traded if(IsTrade_B[B]==false) continue; // terminate the current FOR iteration } }

If a single-symbol Expert Advisor based on a single strategy has a condition whereby all subsequent calculations need to be ceased, we use the return operator. In our case, we just need to terminate the current iteration and proceed to the next symbol iteration. For this purpose, it is best to use the continue operator.

If you want to enhance your multi-strategy Expert Advisor by adding a strategy with a for loop that contains a condition for termination of all subsequent calculations, you can use the following pattern:

//--- Section N: Main loop of the FOR operator for strategy N ----------- for(int N=0; N<Strategy_N; N++) { //... bool IsInterrupt=false; for(int i=0; i<Number; i++) { if(...) // terminate all calculations { IsInterrupt=true; break; } } if(IsInterrupt=true) continue; // terminate the current FOR iteration //... }

After creating the framework of the for loops, we simply insert in it codes from other EAs and then replace some variables with array elements.

For example, we change the predefined variable _Symbol to Symbol_A[i] or _Point to Point_A[i]. Values of these variables are typical of the given symbol and were therefore copied to arrays upon initialization.

For instance, let's find the indicator value:

//--- A.3: Lower band of BB calculated based on High prices if(CopyBuffer(BB_handle_high_A[A],LOWER_BAND,BBShift_A[A],1,BB_lower_band_high)<=0) continue; // terminate the current FOR iteration ArraySetAsSeries(BB_lower_band_high,true);

To implement closing of a buy position, we will write the following code:

//--- A.7.1: Calculate the current Ask and Bid prices SymbolInfo.Name(Symbol_A[A]); SymbolInfo.RefreshRates(); double Ask_price=SymbolInfo.Ask(); double Bid_price=SymbolInfo.Bid(); if(PositionSelect(Symbol_A[A])) { //--- A.7.2: Closing a BUY position if(PositionInfo.PositionType()==POSITION_TYPE_BUY) { if(Bid_price>=BB_lower_band_high[0] || DealNumber_A[A]==0) { if(!Trade_A.PositionClose(Symbol_A[A])) { Print("Failed to close the Buy ",Symbol_A[A]," position. Code=",Trade_A.ResultRetcode(), " (",Trade_A.ResultRetcodeDescription(),")"); continue; // terminate the current FOR iteration } else { Print("The Buy ",Symbol_A[A]," position closed successfully. Code=",Trade_A.ResultRetcode(), " (",Trade_A.ResultRetcodeDescription(),")"); continue; // terminate the current FOR iteration } } } //... }

Opening a Buy position:

//--- A.9.1: for a Buy if(Ask_price<=BB_lower_band_low[0]) { //... //--- A.9.1.3: Execute a deal if(!Trade_A.Buy(OrderLot,Symbol_A[A])) { Print("The Buy ",Symbol_A[A]," has been unsuccessful. Code=",Trade_A.ResultRetcode(), " (",Trade_A.ResultRetcodeDescription(),")"); continue; // terminate the current FOR iteration } else { Print("The Buy ",Symbol_A[A]," has been successful. Code=",Trade_A.ResultRetcode(), " (",Trade_A.ResultRetcodeDescription(),")"); continue; // terminate the current FOR iteration } }

Remember to terminate timer event generation and delete the indicator handles at deinitialization.

4. Test Results

When the Expert Advisor is ready, we test each strategy and each symbol separately and compare the test results with the ones obtained in the test mode when trading all strategies and symbols simultaneously.

It is assumed that the user has already identified the optimal values of input parameters.

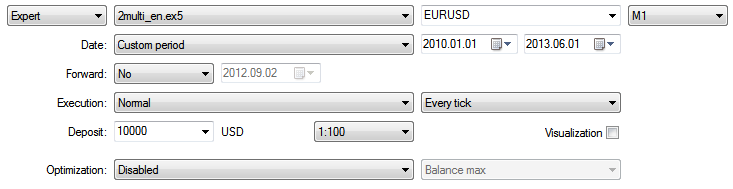

Below are the settings of the Strategy Tester:

Fig. 2. Strategy Tester settings

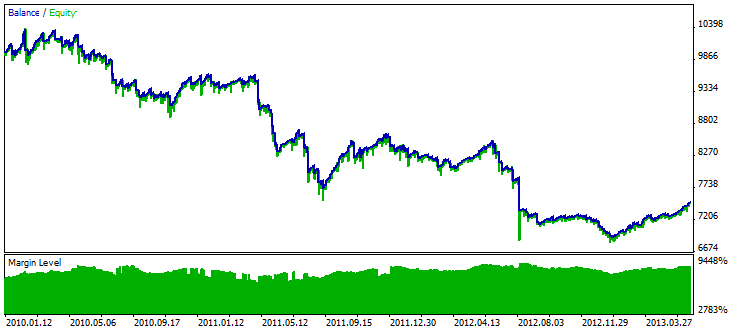

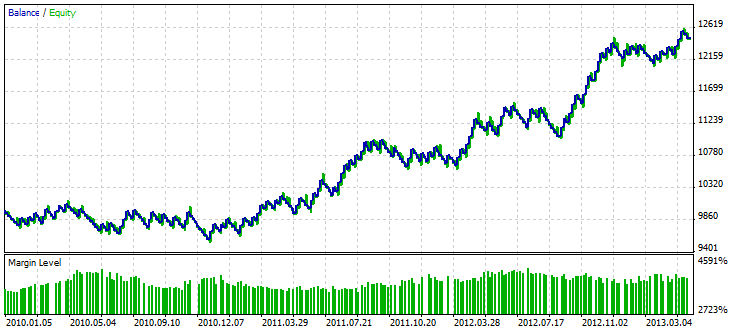

Results for strategy A, EURUSD:

Fig. 3. Test results for strategy A, EURUSD

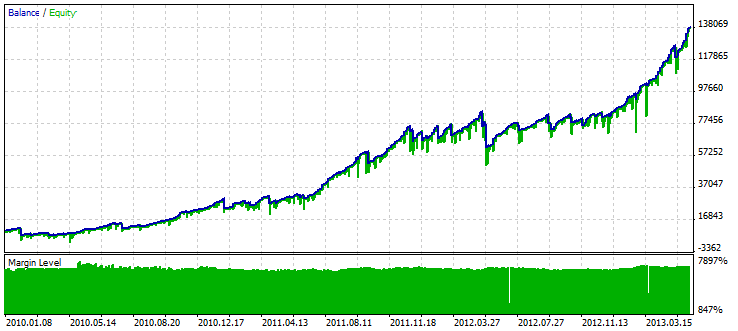

Results for strategy A, GBPUSD:

Fig. 4. Test results for strategy A, GBPUSD

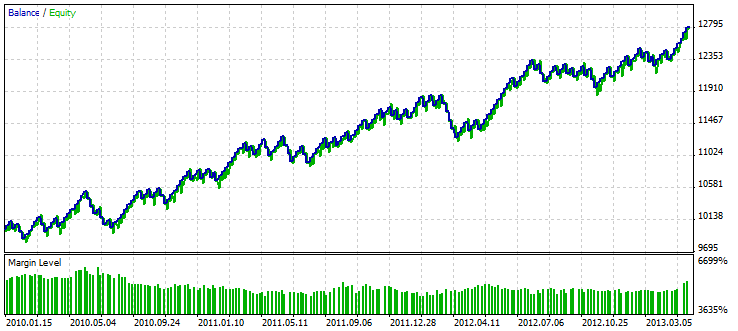

Results for strategy B, AUDUSD:

Fig. 5. Test results for strategy В, AUDUSD

Results for strategy B, EURJPY:

Fig. 6. Test results for strategy В, EURJPY

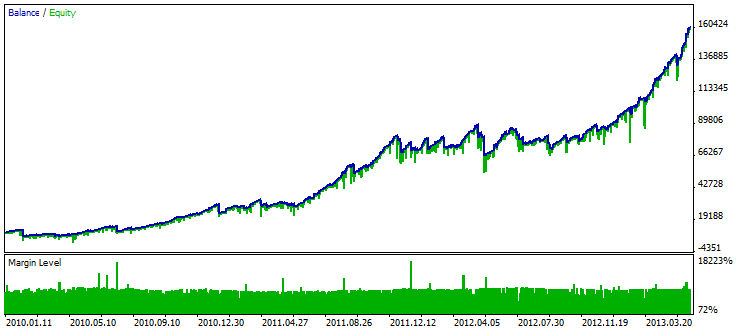

Test results for all strategies and symbols:

Fig. 7. Test results for all strategies and symbols

Conclusion

As a result, we have a convenient and simple structure of the multi-currency multi-system Expert Advisor in which you can place virtually any of your strategies.

Such an Expert Advisor allows you to better assess the efficiency of trading using all your strategies. It may also prove useful in case only one Expert Advisor is allowed to work on a given account. The source code of the Expert Advisor is attached to the article to facilitate studying the above information.