Interview with Alexander Topchylo (ATC 2010)

Automated-Trading | 9 September, 2010

Interview on Automated Trading Championship 2010 from 09.09.2010.

Alexander Topchylo (Better) is the winner of the Automated Trading Championship 2007. Alexander is an expert in neural networks - his Expert Advisor based on a neural network was on top of best EAs of year 2007. In this interview Alexander tells us about his life after the Championships, his own business and new algorithms for trading systems.

- Hello Alexander. What were the two years of your life after the Automated Trading Championship 2008?

- This time I have been doing the same that I had been doing before it – trading. However, I had traded for my own benefit. And after I won the Championship I started to work with investors. Now I manage investor accounts. Winning the Championship was a powerful advertisement for my business.

- Tell us more about your business. Do you currently develop Expert Advisors?

- No, I don’t develop Expert Advisors to order – this is the job of programmers. And I don’t sell my Expert Advisors. I only trade in Forex. Most of investor accounts are managed through PAMM with various brokerage companies – and most of them work with the MetaTrader 4 trading platform. This is very convenient both for traders and investors. Also there are individually managed accounts.

- What is the ratio of your capital and that of investors on your PAMM accounts?

- There is no need to have my own capital on a PAMM account. This

innovation appeared not so long ago for the PAMM services, where traders

can trade anonymously. For investors this is a kind of a "black box":

they invest in the equity curve pictured on the site of a PAMM service,

often knowing nothing about the trader. I do not advocate this approach.

I prefer complete openness in relations with investors.

- And what are your relations with investors? What do you mean by "complete openness"?

- I attract investors through advertising on the web and through my website. Complete openness means that any potential investor can view and analyze the detailed statement - my entire history of trading for three years, with all its wins and losses. The history is made up of more than three thousand transactions. Links to account monitoring are posted on my site and are available without any registration. The monitoring is regularly updated.

- Can you remember any curious case connected with your investors?

- Well, one of investors had the following demand: "I will entrust my money to you only if you guarantee profit of 100% a month".

- Alexander, you have come to Forex from trading binary options on an exchange. Haven't you tried to return to it?

- Never. I'm feeling well in Forex so far. I'm thinking about the American stock market, and preparing for it meanwhile.

-Why exactly this market?

- Well, I don't want to get stuck on a single Forex. The new market means new opportunities for trading, business diversification. I hope soon I can trade stocks and futures through MetaTrader 5.

- Was it hard for you to move to MQL5? What did you like most about the new language and the new platform?

- It was easy for me to move to the new language. When moving Expert Advisors from MetaTrader 4 to MetaTrader 5, the main job was to rewrite trade operations, while the algorithms of decision making remained the same. From all the new features of MetaTrader 5, the most handy was object oriented programming to me - development of large projects is much easier now.

- You've long been working on the Forex market. Have you noticed anything interesting recently? What conclusions have you made?

- Economists who insist that Forex is an efficient market, and thus you can earn there only by chance, are not quite right. Yes, Forex is very close to the efficient market, but from time to time inefficiencies (some laws) appear there, which allow for profit. Some inefficiency may occur for short time, others may exist for months, so our task is to discover and use them.

Of course, a single trading system that would always make profit cannot exist. Like all phenomena in our life, trading systems sooner or later fade away, ceasing to make a profit. So that perhaps in some time they start working again.

The more traders are involved in forex trading, the more liquid and

efficient the market is becoming - and it's becoming harder to profit

here. Therefore, the advantage is given to those who use advanced

technical and analytical tools when developing trading systems. As a

consequence, in the future more and more trading systems will be

developed based on the latest algorithms of computational mathematics.

And manual trading will gradually be replaced by automatic. So followers

of automated trading are moving in the right direction.

- This will be a multicurrency Expert Advisor. My new development. I haven't used this EA on my real account yet, but I'm going to do that soon, possibly even together with the Championship. I believe that multi- and single-currency EAs have equal chances to win. The limit of 15 lots is not so great to reduce the chances of single-currency Expert Advisors.

- Which currency pairs will your system trade?

- As of now, the candidates are EUR/USD, USD/CHF, GBP/USD, USD/CAD, EUR/JPY. Perhaps, not all of them will be used in the final version.

- In the Championship in 2007 you won, using an Expert Advisor based on a neural network. Do you use a neural EA this year?

- No, this is not a neural network. I use simpler algorithms, statistical analysis. Frankly speaking, I needed much time to decide which Expert Advisor to run on the Championship. And finally I decided to use an absolutely new development. I still run a neural network on real accounts, but I'm not really satisfied with its behavior in recent months. Markets are constantly changing, and the current phase of the market is not the most suitable for the old system.

- Which system of money management is used in your Expert Advisor?

- I use the same money management system as on ATC 2007. A part of the starting capital will be initially allocated to each subsystem (currency pair), and then each system will operate independently. Lot size will be calculated in proportion to the current size of the capital, which corresponding to this subsystem. As a result, subsystems with low productivity will gradually reduce the size of their lots, and successful subsystems - increase.

- In 2007, you said that the "committee of neural networks - is one of

the possible direction to improve your Expert Advisor in the future".

Have you worked in this area?

- No, I took a little different direction - I worked learning classifier systems (LCS). I think these algorithms are promising for analyzing financial markets and developing trading systems based on them. As for now, developments in these direction are far from being completed.

Unlike the committee of neural networks, in LCS each Expert Advisor

(classifier) has a simple form. But due to the simplicity of

calculations, tens or hundreds of them can be used in a system. The

classifier system is learning and evolving using genetic algorithms.

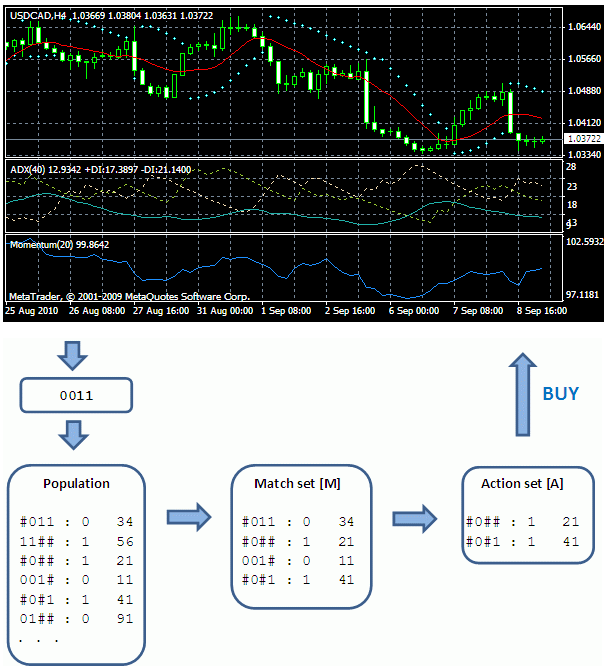

Each classifier has the following form: Condition1 Condition2 ... ConditionN : Action : Reinforcement.

Conditions are simple logical expressions, familiar to a technical analyst, for example:

Condition1: SAR(0.02,0.2) < CLOSE

Condition2: MA(10) < CLOSE

Condition3: MOMENTUM(20) < 100

Condition4: ADX(40) < 15

The conditional part of the classifier is coded by a string of characters '0' (false), '1' (true) and '#' (don't care). The action is also coded with 1 (bull market) and 0 (bear market). The classifier reinforcement is calculate based on the accuracy of prediction, it varies throughout operation. LCS contains a mechanism of generation of new classifiers based on a genetic algorithm. The system is trained according to the following scheme.

- The required indicators are calculated and a string of Conditions corresponding to them is constructed. In our example - 0011.

- The

conditional part of classifier from the current population is compared

with this string, and matching classifiers are selected into a match set

[M].

- Them from the match set [M] an action set [A] is

formed.

The larger the cumulative reinforcement of classifiers with the same

action is, the more chances such a classifier has to be selected into an

action set.

- A signal corresponding to the Action of classifiers in [A] is sent for execution to a trading system, while the action set [A] is remembered to further correct the reinforcement value of this classifiers depending on how accurate the prediction was.

The LCS algorithm is adaptable to change of input data flow, which is good for analyzing financial series. you can read the following articles about LCS:

- On the Automated Trading Championship 2008 your Expert Advisor was not

so successful as a year before. Have you made any conclusions from

that?

- Perhaps not. Like for ATC 2008, now I use an absolutely new system that I haven't run on real accounts yet. And if noting a problem in an EA when running it on a real account you can fix it, during the Championship you can do nothing. However, I wouldn't call such a result in the Championship a defeat. By participating in this contest we risk nothing, and get an invaluable experience, which is extremely useful in our work.

- Thanks for the interesting interview, Alexander. Good luck in the Championship!