Trade Operations in MQL5 - It's Easy

MetaQuotes | 21 August, 2012

Almost all traders come to market to make money but some traders also enjoy the process itself. However, it is not only manual trading that can provide you with an exciting experience. Automated trading systems development can also be quite absorbing. Creating a trading robot can be as interesting as reading a good mystery novel.

When developing a trading algorithm, we have to deal with plenty of technical issues including the most important ones:

- What to trade?

- When to trade?

- How to trade?

We need to answer the first question to choose the most suitable symbol. Our choice can be affected by many factors including the ability to automate our trading system for the market. The second question involves elaboration of the trading rules clearly indicating deals' direction, as well as entry and exit points. The third question seems to be relatively simple: how to buy and sell using some definite programming language?

In this article we will consider how to implement trade operations in algorithmic trading using MQL5 language.

MQL5 Features for Algo Trading

MQL5 is a trading strategies' programming language having plenty of trade functions for working with orders, positions and trade requests. Thus, making algo trading robots in MQL5 is the least labor-consuming task for a developer.

MQL5 features allow you to make a trade request and send it to a server using OrderSend() or OrderSendAsync() functions, receive its processing result, view the trading history, examine contract specification for a symbol, handle a trade event, as well as receive other necessary data.

Besides, MQL5 can be used for writing custom technical indicators and applying already implemented ones, drawing any marks and objects on a chart, developing custom user interface, etc. Implementation examples can be seen in multiple articles.

Trade Operations: Easy As ABC!

There are several basic types of trade operations that can be necessary for your trading robot:

- buying/selling at the current price,

- placing a pending order for buying/selling according to a certain condition,

- modifying/deleting a pending order,

- closing/adding to/reducing/reversing a position.

All these operations are performed using OrderSend() function. There is also an asynchronous version called OrderSendAsync(). All variety of trade operations is described by MqlTradeRequest structure containing a trade request description. Therefore, only correct filling of MqlTradeRequest structure and handling request execution results can be challenging when dealing with trade operations.

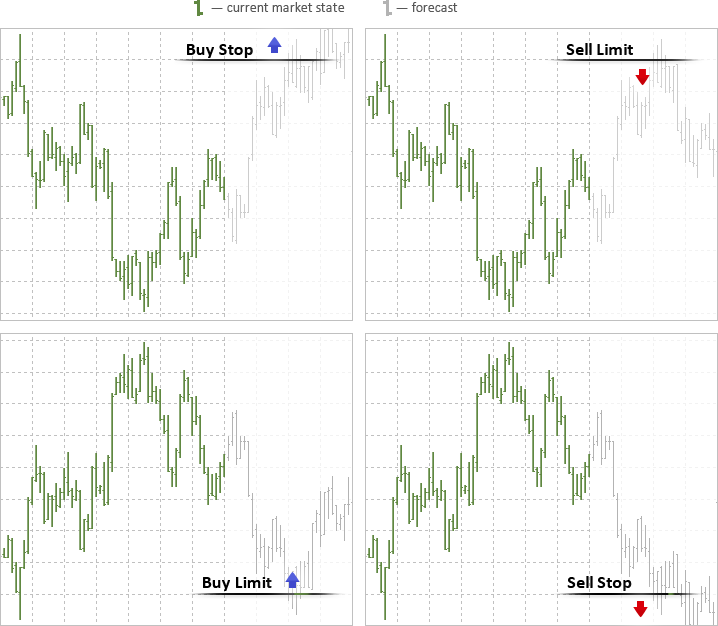

According to your trading system, you can buy or sell at market price (BUY or SELL), as well as place a pending buy/sell order at some distance from the current market price:

- BUY STOP, SELL STOP - buying or selling in case of a specified level breakout (worse than the current price);

- BUY LIMIT, SELL LIMIT - buying or selling in case a specified level is reached (better than the current price);

- BUY STOP LIMIT, SELL STOP LIMIT - setting BUY LIMIT or SELL LIMIT in case a specified price is reached.

These standard order types correspond to ENUM_ORDER_TYPE enumeration.

You may need to modify or delete a pending order. This can also be done using OrderSend()/OrderSendAsync() functions. Modifying an open position is also quite an easy process, as it is performed using the same trade operations.

If you think trade operations to be complex and intricate, it is about time that you change your mind. We will show not only how to code buys and sells in MQL5 quickly and easily but also how to work with a trade account and symbols' properties. Trade classes will help us in this undertaking.

Check Your Trading Account with CAccountInfo

The first thing you need to know when launching your trading robot is what trading account will be used for its operation. Since we are writing a training code, we will implement a check for the case when Expert Advisor has been launched on a real account.

CAccountInfo class is used for working with an account. We will add AccountInfo.mqh file inclusion and declare the variable of the class - account:

#include <Trade\AccountInfo.mqh> //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- object for working with the account CAccountInfo account; //--- receiving the account number, the Expert Advisor is launched at long login=account.Login(); Print("Login=",login); //--- clarifying account type ENUM_ACCOUNT_TRADE_MODE account_type=account.TradeMode(); //--- if the account is real, the Expert Advisor is stopped immediately! if(account_type==ACCOUNT_TRADE_MODE_REAL) { MessageBox("Trading on a real account is forbidden, disabling","The Expert Advisor has been launched on a real account!"); return(-1); } //--- displaying the account type Print("Account type: ",EnumToString(account_type)); //--- clarifying if we can trade on this account if(account.TradeAllowed()) Print("Trading on this account is allowed"); else Print("Trading on this account is forbidden: you may have entered using the Investor password"); //--- clarifying if we can use an Expert Advisor on this account if(account.TradeExpert()) Print("Automated trading on this account is allowed"); else Print("Automated trading using Expert Advisors and scripts on this account is forbidden"); //--- clarifying if the permissible number of orders has been set int orders_limit=account.LimitOrders(); if(orders_limit!=0)Print("Maximum permissible amount of active pending orders: ",orders_limit); //--- displaying company and server names Print(account.Company(),": server ",account.Server()); //--- displaying balance and current profit on the account in the end Print("Balance=",account.Balance()," Profit=",account.Profit()," Equity=",account.Equity()); Print(__FUNCTION__," completed"); //--- return(0); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { //--- } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- }

As we can see from the above code, plenty of useful data can be received using account variable in OnInit() function. You can add this code to your Expert Advisor to examine the logs easily when analyzing its operation.

Results of an Expert Advisor launched on the Automated Trading Championship 2012 account are shown below.

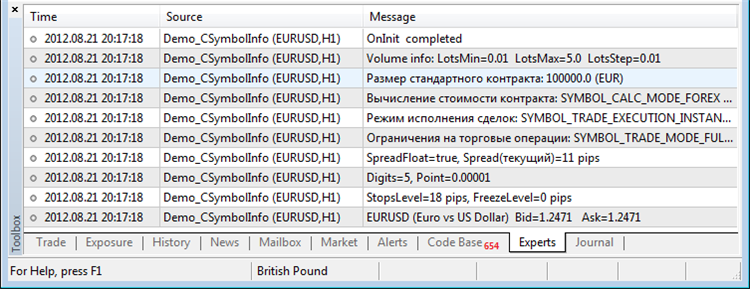

Receiving Symbol Settings with CSymbolInfo

We now have the data on the account but we also need to know the properties of the symbol we are going to trade before performing the necessary operations. CSymbolInfo class with great number of methods is designed for these purposes. We will show only a small part of the methods in the below example.

#include<Trade\SymbolInfo.mqh> //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- object for receiving symbol settings CSymbolInfo symbol_info; //--- set the name for the appropriate symbol symbol_info.Name(_Symbol); //--- receive current rates and display symbol_info.RefreshRates(); Print(symbol_info.Name()," (",symbol_info.Description(),")", " Bid=",symbol_info.Bid()," Ask=",symbol_info.Ask()); //--- receive minimum freeze levels for trade operations Print("StopsLevel=",symbol_info.StopsLevel()," pips, FreezeLevel=", symbol_info.FreezeLevel()," pips"); //--- receive the number of decimal places and point size Print("Digits=",symbol_info.Digits(), ", Point=",DoubleToString(symbol_info.Point(),symbol_info.Digits())); //--- spread info Print("SpreadFloat=",symbol_info.SpreadFloat(),", Spread(current)=", symbol_info.Spread()," pips"); //--- request order execution type for limitations Print("Limitations for trade operations: ",EnumToString(symbol_info.TradeMode()), " (",symbol_info.TradeModeDescription(),")"); //--- clarifying trades execution mode Print("Trades execution mode: ",EnumToString(symbol_info.TradeExecution()), " (",symbol_info.TradeExecutionDescription(),")"); //--- clarifying contracts price calculation method Print("Contract price calculation: ",EnumToString(symbol_info.TradeCalcMode()), " (",symbol_info.TradeCalcModeDescription(),")"); //--- sizes of contracts Print("Standard contract size: ",symbol_info.ContractSize(), " (",symbol_info.CurrencyBase(),")"); //--- minimum and maximum volumes in trade operations Print("Volume info: LotsMin=",symbol_info.LotsMin()," LotsMax=",symbol_info.LotsMax(), " LotsStep=",symbol_info.LotsStep()); //--- Print(__FUNCTION__," completed"); //--- return(0); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { //--- } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- }

EURUSD properties at the Automated Trading Championship are shown below. Now we are ready to perform trade operations.

CTrade - Convenient Class for Trade Operations

Trading in MQL5 is performed only by two functions - OrderSend() and OrderSendAsync(). In fact, these are two implementations of one function. OrderSend() sends a trade request and waits for its execution result, while asynchronous OrderSendAsync() just sends a request allowing the application to continue its operation without waiting for a trading server's response. Thus, it is really easy to trade in MQL5, as you use only one function for all trade operations.

So, what is the challenge? Both functions receive MqlTradeRequest structure containing more than a dozen of fields as the first parameter. Not all fields should be necessarily filled. The set of necessary ones depends on a trade operation type. Incorrect value or blank field that is necessary to be filled will result in an error and the request will not be sent to a server. 5 of these fields require correct values from predefined enumerations.

Such a large number of fields is necessary for describing lots of order properties in one trade request. The orders may change depending on execution policy, expiration time and some other parameters. But you do not have to learn all these subtleties. Just use ready-made CTrade class. That is how the class can be used in your trading robot:

#include<Trade\Trade.mqh> //--- object for performing trade operations CTrade trade; //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- set MagicNumber for your orders identification int MagicNumber=123456; trade.SetExpertMagicNumber(MagicNumber); //--- set available slippage in points when buying/selling int deviation=10; trade.SetDeviationInPoints(deviation); //--- order filling mode, the mode allowed by the server should be used trade.SetTypeFilling(ORDER_FILLING_RETURN); //--- logging mode: it would be better not to declare this method at all, the class will set the best mode on its own trade.LogLevel(1); //--- what function is to be used for trading: true - OrderSendAsync(), false - OrderSend() trade.SetAsyncMode(true); //--- return(0); }

Now let's see how CTrade helps in trade operations.

Buying/selling at the current price

Trading strategies often provide the possibility to buy or sell at the current price right now. In this case, CTrade asks only to specify a necessary trade operation volume. All other parameters (open price and symbol name, Stop Loss and Take Profit levels, order comments) are optional.

//--- 1. example of buying at the current symbol if(!trade.Buy(0.1)) { //--- failure message Print("Buy() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("Buy() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

By default, CTrade will use the symbol name of the chart it has been launched on if the symbol name is not specified. It is convenient for simple strategies. For multicurrency strategies you should always explicitly specify the symbol, for which the trade operation will be performed.

//--- 2. example of buying at the specified symbol if(!trade.Buy(0.1,"GBPUSD")) { //--- failure message Print("Buy() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("Buy() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

All order parameters may be specified: Stop Loss/Take Profit levels, open price and comments.

//--- 3. example of buying at the specified symbol with specified SL and TP double volume=0.1; // specify a trade operation volume string symbol="GBPUSD"; //specify the symbol, for which the operation is performed int digits=(int)SymbolInfoInteger(symbol,SYMBOL_DIGITS); // number of decimal places double point=SymbolInfoDouble(symbol,SYMBOL_POINT); // point double bid=SymbolInfoDouble(symbol,SYMBOL_BID); // current price for closing LONG double SL=bid-1000*point; // unnormalized SL value SL=NormalizeDouble(SL,digits); // normalizing Stop Loss double TP=bid+1000*point; // unnormalized TP value TP=NormalizeDouble(TP,digits); // normalizing Take Profit //--- receive the current open price for LONG positions double open_price=SymbolInfoDouble(symbol,SYMBOL_ASK); string comment=StringFormat("Buy %s %G lots at %s, SL=%s TP=%s", symbol,volume, DoubleToString(open_price,digits), DoubleToString(SL,digits), DoubleToString(TP,digits)); if(!trade.Buy(volume,symbol,open_price,SL,TP,comment)) { //--- failure message Print("Buy() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("Buy() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

As we have already said, Magic Number and permissible slippage were set when initializing Ctrade copy. Therefore, they are not required. However, they can also be set before each trade operation if necessary.

Placing a limit order

The appropriate BuyLimit() or SellLimit() class method is used for sending a limit order. The shortened version (when only an open price and a volume are specified) will be appropriate in most cases. Open price for Buy Limit should be lower than the current price, while it should be higher for Sell Limit. These orders are used to enter the market at the best price and are usually most suitable for the strategies expecting the price bounce from the support line. The symbol, at which an Expert Advisor has been launched, is used in that case:

//--- 1. example of placing a Buy Limit pending order string symbol="GBPUSD"; // specify the symbol, at which the order is placed int digits=(int)SymbolInfoInteger(symbol,SYMBOL_DIGITS); // number of decimal places double point=SymbolInfoDouble(symbol,SYMBOL_POINT); // point double ask=SymbolInfoDouble(symbol,SYMBOL_ASK); // current buy price double price=1000*point; // unnormalized open price price=NormalizeDouble(price,digits); // normalizing open price //--- everything is ready, sending a Buy Limit pending order to the server if(!trade.BuyLimit(0.1,price)) { //--- failure message Print("BuyLimit() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("BuyLimit() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

More detailed version with specifying all parameters can also be used: SL/TP levels, expiration time, symbol name and comments to the order.

//--- 2. example of placing a Buy Limit pending order with all parameters double volume=0.1; string symbol="GBPUSD"; // specify the symbol, at which the order is placed int digits=(int)SymbolInfoInteger(symbol,SYMBOL_DIGITS); // number of decimal places double point=SymbolInfoDouble(symbol,SYMBOL_POINT); // point double ask=SymbolInfoDouble(symbol,SYMBOL_ASK); // current buy price double price=1000*point; // unnormalized open price price=NormalizeDouble(price,digits); // normalizing open price int SL_pips=300; // Stop Loss in points int TP_pips=500; // Take Profit in points double SL=price-SL_pips*point; // unnormalized SL value SL=NormalizeDouble(SL,digits); // normalizing Stop Loss double TP=price+TP_pips*point; // unnormalized TP value TP=NormalizeDouble(TP,digits); // normalizing Take Profit datetime expiration=TimeTradeServer()+PeriodSeconds(PERIOD_D1); string comment=StringFormat("Buy Limit %s %G lots at %s, SL=%s TP=%s", symbol,volume, DoubleToString(price,digits), DoubleToString(SL,digits), DoubleToString(TP,digits)); //--- everything is ready, sending a Buy Limit pending order to the server if(!trade.BuyLimit(volume,price,symbol,SL,TP,ORDER_TIME_GTC,expiration,comment)) { //--- failure message Print("BuyLimit() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("BuyLimit() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

Your task in the second version is to indicate SL and TP levels correctly. It should be noted that Take Profit level must be higher than open price when buying, while Stop Loss level must be lower than open price. The reverse situation is for Sell Limit orders. You can easily know about your error when testing an Expert Advisor on historical data. In such cases CTrade class automatically displays messages (unless you have called LogLevel function).

Placing a stop order

Similar BuyStop() and SellStop() methods are used to send a stop order. Open price for Buy Stop should be higher than the current price, while it should be lower for Sell Stop. Stop orders are used in strategies that enter the market during a resistance level breakout, as well as for cutting losses. Simple version:

//--- 1. example of placing a Buy Stop pending order string symbol="USDJPY"; // specify the symbol, at which the order is placed int digits=(int)SymbolInfoInteger(symbol,SYMBOL_DIGITS); // number of decimal places double point=SymbolInfoDouble(symbol,SYMBOL_POINT); // point double ask=SymbolInfoDouble(symbol,SYMBOL_ASK); // current buy price double price=1000*point; // unnormalized open price price=NormalizeDouble(price,digits); // normalizing open price //--- everything is ready, sending a Buy Stop pending order to the server if(!trade.BuyStop(0.1,price)) { //--- failure message Print("BuyStop() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("BuyStop() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

More detailed version when the maximum amount of parameters for Buy Stop pending order should be specified:

//--- 2. example of placing a Buy Stop pending order with all parameters double volume=0.1; string symbol="USDJPY"; // specify the symbol, at which the order is placed int digits=(int)SymbolInfoInteger(symbol,SYMBOL_DIGITS); // number of decimal places double point=SymbolInfoDouble(symbol,SYMBOL_POINT); // point double ask=SymbolInfoDouble(symbol,SYMBOL_ASK); // current buy price double price=1000*point; // unnormalized open price price=NormalizeDouble(price,digits); // normalizing open price int SL_pips=300; // Stop Loss in points int TP_pips=500; // Take Profit in points double SL=price-SL_pips*point; // unnormalized SL value SL=NormalizeDouble(SL,digits); // normalizing Stop Loss double TP=price+TP_pips*point; // unnormalized TP value TP=NormalizeDouble(TP,digits); // normalizing Take Profit datetime expiration=TimeTradeServer()+PeriodSeconds(PERIOD_D1); string comment=StringFormat("Buy Stop %s %G lots at %s, SL=%s TP=%s", symbol,volume, DoubleToString(price,digits), DoubleToString(SL,digits), DoubleToString(TP,digits)); //--- everything is ready, sending a Buy Stop pending order to the server if(!trade.BuyStop(volume,price,symbol,SL,TP,ORDER_TIME_GTC,expiration,comment)) { //--- failure message Print("BuyStop() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("BuyStop() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

The appropriate CTrade class method is used to send Sell Stop order. Specifying the prices correctly is of critical importance here.

Working with positions

You can use position opening methods instead of Buy() and Sell() ones but you will have to specify more details in this case:

//--- number of decimal places int digits=(int)SymbolInfoInteger(_Symbol,SYMBOL_DIGITS); //--- point value double point=SymbolInfoDouble(_Symbol,SYMBOL_POINT); //--- receiving a buy price double price=SymbolInfoDouble(_Symbol,SYMBOL_ASK); //--- calculate and normalize SL and TP levels double SL=NormalizeDouble(price-1000*point,digits); double TP=NormalizeDouble(price+1000*point,digits); //--- filling comments string comment="Buy "+_Symbol+" 0.1 at "+DoubleToString(price,digits); //--- everything is ready, trying to open a buy position if(!trade.PositionOpen(_Symbol,ORDER_TYPE_BUY,0.1,price,SL,TP,comment)) { //--- failure message Print("PositionOpen() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("PositionOpen() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

You need to specify only a symbol name, the rest will be done by CTrade class.

//--- closing a position at the current symbol if(!trade.PositionClose(_Symbol)) { //--- failure message Print("PositionClose() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("PositionClose() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

Only Stop Loss and Take Profit levels are available for modifying an open position. This is done using PositionModify() method

//--- number of decimal places int digits=(int)SymbolInfoInteger(_Symbol,SYMBOL_DIGITS); //--- point value double point=SymbolInfoDouble(_Symbol,SYMBOL_POINT); //--- receiving the current Bid price double price=SymbolInfoDouble(_Symbol,SYMBOL_BID); //--- calculate and normalize SL and TP levels double SL=NormalizeDouble(price-1000*point,digits); double TP=NormalizeDouble(price+1000*point,digits); //--- everything is ready, trying to modify the buy position if(!trade.PositionModify(_Symbol,SL,TP)) { //--- failure message Print("Метод PositionModify() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("PositionModify() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

Modifying and deleting an order

OrderModify() method has been implemented in CTrade class to change pending order's parameters. All required parameters should be submitted to this method.

//--- this is a sample order ticket, it should be received ulong ticket=1234556; //--- this is a sample symbol, it should be received string symbol="EURUSD"; //--- number of decimal places int digits=(int)SymbolInfoInteger(symbol,SYMBOL_DIGITS); //--- point value double point=SymbolInfoDouble(symbol,SYMBOL_POINT); //--- receiving a buy price double price=SymbolInfoDouble(symbol,SYMBOL_ASK); //--- calculate and normalize SL and TP levels //--- they should be calculated based on the order type double SL=NormalizeDouble(price-1000*point,digits); double TP=NormalizeDouble(price+1000*point,digits); //--- setting one day as a lifetime datetime expiration=TimeTradeServer()+PeriodSeconds(PERIOD_D1); //--- everything is ready, trying to modify the order if(!trade.OrderModify(ticket,price,SL,TP,ORDER_TIME_GTC,expiration)) { //--- failure message Print("OrderModify() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("OrderModify() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

You should receive the ticket of the order that should be changed. Correct Stop Loss and Take Profit levels should be specified depending on its type. Besides, the new open price shpuld also be correct relative to the current price.

You should know a ticket of an order to delete it:

//--- this is a sample order ticket, it should be received ulong ticket=1234556; //--- everyrging is ready, trying to modify a buy position if(!trade.OrderDelete(ticket)) { //--- failure message Print("OrderDelete() method failed. Return code=",trade.ResultRetcode(), ". Code description: ",trade.ResultRetcodeDescription()); } else { Print("OrderDelete() method executed successfully. Return code=",trade.ResultRetcode(), " (",trade.ResultRetcodeDescription(),")"); }

The class also contains the multipurpose OrderOpen() method, which can set pending orders of any type. Unlike specialized BuyLimit, BuyStop, SellLimit and SellStop methods, it requires to specify more essential parameters. Perhaps, you will find it more convenient.

What Else Should Be Solved?

So, we have answered two out of three questions. You have chosen the symbol for your strategy and we have shown you how to code buy and sell operations, as well as pending orders in a trading robot easily. But Trade Classes section has some more useful tools for MQL5 developers:

- COrderInfo - for working with orders;

- CHistoryOrderInfo - for working with executed orders in trading history;

- CPositionInfo - for working with positions;

- CDealInfo - for working with deals;

- CTerminalInfo - to receive data on the terminal (this one is very interesting).

With these classes, you can focus your attention on the trading side of your strategy minimizing all technical issues. Besides, CTrade class can be used to examine trade requests. After some practice you will be able to use it to create your custom classes with necessary logics of handling trade requests execution results.

The last question is how to receive trading signals and how to code that in MQL5. Most newcomers in algo trading start from studying simple standard trading systems, for example, the ones based on moving averages' crossing. To do this, you should first learn to work with technical indicators creating and using them in your trading robot.

We recommend that you read the articles from Indicators and Examples->Indicators sections beginning from the earliest ones. That will allow you to move from the most simple to the most complex matters. If you want to quickly receive an idea about how to use indicators, see MQL5 for Newbies: Guide to Using Technical Indicators in Expert Advisors.

Make Complicated Things Simple

In any undertaking the first difficulties gradually turn into the most simple issues you have to deal with. The methods of trading robots' development offered here are meant mainly for newcomers though many experienced developers may also find something new and useful.

MQL5 language provides not only limitless opportunities for algo trading but also allows everyone to implement them in the most simple and fast way. Use trade classes from the Standard Library to save time for more important things, for example, for searching the answer to the eternal question of all traders - what is a trend and how can it be found in real time.

Soon you will see that developing a trading robot in MQL5 is much easier than learning a foreign language or following a trend!