Fundamentals of Statistics

QSer29 | 18 September, 2012

Introduction

What is statistics? Here is the definition found on Wikipedia: "Statistics is the study of the collection, organization, analysis, interpretation, and presentation of data." (Statistics). This definition suggests three main components of statistics: data collection, measurement and analysis. Data analysis appears to be especially useful for a trader as information received is provided by the broker or via a trading terminal and is already measured.

Modern traders (mostly) use technical analysis to decide whether to buy or sell. They deal with statistics in virtually everything they do when using a certain indicator or trying to predict the level of prices for the upcoming period. Indeed, a price fluctuation chart itself represents certain statistics of a share or currency in time. It is therefore very important to understand the basic principles of statistics underlying the majority of mechanisms that facilitate the decision making process for a trader.

Probability Theory and Statistics

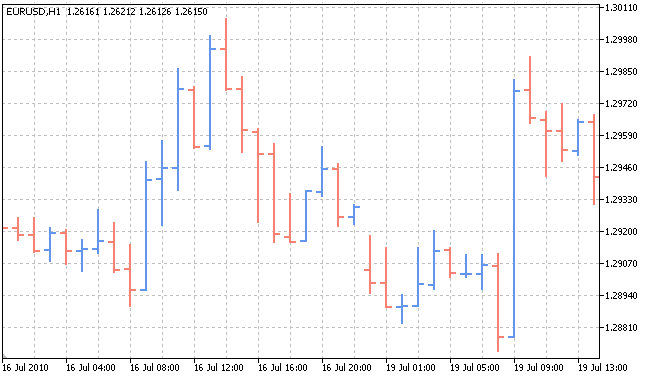

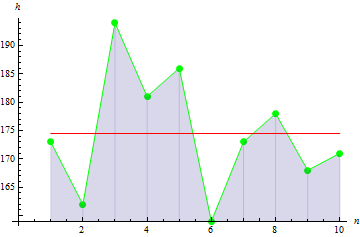

Any statistics is the result of change in the states of the object that generates it. Let us consider a EURUSD price chart on hourly time frames:

In this case, the object is the correlation between two currencies, while the statistics is their prices at every point of time. How does the correlation between two currencies affect their prices? Why do we have this price chart and not a different one at the given time interval? Why are the prices currently going down and not up? The answer to these questions is the word 'probability'. Every object, depending on probability, can take one or another value.

Let us do a simple experiment: take a coin and flip it a certain number of times, every time recording the toss outcome. Suppose we have a fair coin. Then the table for it can be as follows:

| Outcome | Probability |

|---|---|

| Heads | 0.5 |

| Tails | 0.5 |

The table suggests that the coin is equally likely to come up heads or tails. Any other outcome is not possible here (landing on the coin's edge has been excluded a priori) as the sum of probabilities of all possible events shall be equal to one.

Flip the coin 10 times. Now let us look at the toss outcomes:

| Outcome | Number |

|---|---|

| Heads | 8 |

| Tails | 2 |

Why do we have these results if the coin is equally likely to land on either of the sides? The probability of the coin to land on either of the sides is indeed equal, which however does not mean that after a few tosses the coin shall land on one side as many times as on the other side. The probability only shows that in this particular attempt (toss) the coin will land either heads up or tails up and both events stand equal chances.

Let us now flip the coin 100 times. We get the new table of outcomes:

| Outcome | Number |

|---|---|

| Heads | 53 |

| Tails | 47 |

As can be seen, the numbers of outcomes are again not equal. However, 53 to 47 is the result that proves the initial probability assumptions. The coin landed on heads in nearly as many flips as it did on tails.

Now let us do the same in the reverse order. Suppose we have a coin but the probability of landing on its sides is unknown. We need to determine if it is a fair coin, i.e. the coin that is equally likely to come up heads or tails.

Let us take the data from the first experiment. Divide the number of outcomes per side by the total number of outcomes. We get the following probabilities:

| Outcome | Probability |

|---|---|

| Heads | 0.8 |

| Tails | 0.2 |

We can see that it is very difficult to conclude from the first experiment that the coin is fair. Let us do the same for the second experiment:

| Outcome | Number |

|---|---|

| Heads | 0.53 |

| Tails | 0.47 |

Having these results at hand, we can say with a high degree of accuracy that this is a fair coin.

This simple example allows us to draw an important conclusion: the bigger the number of experiments, the more accurately the object properties are reflected by statistics generated by the object.

Thus, statistics and probability are inextricably intertwined. Statistics represents experimental results with an object and is directly dependent on probability of the object states. Conversely, the probability of the object's states can be estimated using statistics. Here is where the main challenge for a trader lies: having data on trades over a certain period of time (statistics), to predict the price behavior for the following period of time (probability) and based on this information to make a buy or sell decision.

Therefore, getting back to the points made in Introduction, it is also important to know and understand the relationship between statistics and probability, as well as to have knowledge of risk assessment and risk situations. The latter two are however out of the scope of this article.

Basic Statistical Parameters

Let us now review the basic statistical parameters. Suppose we have data on height in cm regarding 10 people in a group:

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Height | 173 | 162 | 194 | 181 | 186 | 159 | 173 | 178 | 168 | 171 |

The data set forth in the table is called sample, while the data quantity is the sample size. We will take a look at some parameters of the given sample. All parameters will be sample parameters as they result from the sample data, rather than random variable data.

1. Sample mean

Sample mean is the average value in the sample. In our case, it is the average height of people in the group.

To calculate the mean, we should:

- Add up all sample values.

- Divide the resulting value by the sample size.

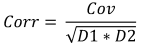

Formula:

![]()

Where:

- M is the sample mean,

- a[i] is the sample element,

- n is the sample size.

Following the calculations, we get the mean value of 174.5 cm

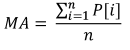

2. Sample variance

Sample variance describes how far sample values lie from the sample mean. The larger the value, the more widely the data is spread out.

To calculate the variance, we should:

- Calculate the sample mean.

- Subtract the mean from each sample element and square the difference.

- Add up the resulting values obtained above.

- Divide the sum by the sample size minus 1.

Formula:

![]()

Where:

- D is the sample variance,

- M is the sample mean,

- a[i] is the sample element,

- n is the sample size.

The sample variance in our case is 113.611.

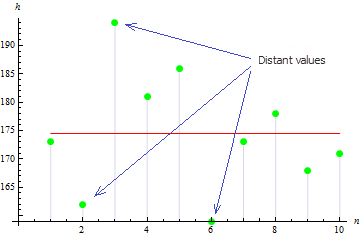

The figure suggests that 3 values are widely spread out of the mean which leads to the large variance value.

3. Sample skewness

Sample skewness is used for describing the degree of asymmetry of the sample values around its mean. The closer the skewness value is to zero, the more symmetrical the sample values are.

To calculate the skewness, we should:

- Calculate the sample mean.

- Calculate the sample variance.

- Add up cubed differences of each sample element and the mean.

- Divide the answer by the variance value raised to the power of 2/3.

- Multiply the answer by the coefficient equal to the sample size divided by the product of the sample size minus 1 and sample size minus 2.

Formula:

![]()

Where:

- A is the sample skewness,

- D is the sample variance,

- M is the sample mean,

- a[i] is the sample element,

- n is the sample size.

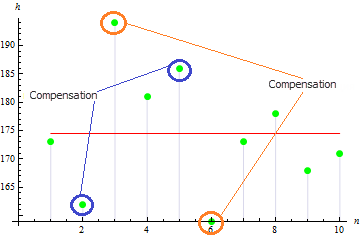

We get a quite small value of skewness for this sample: 0.372981. This is due to the fact that divergent values compensate each other.

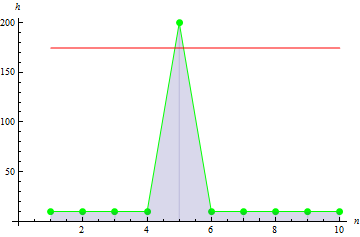

The value will be larger for asymmetrical sample. E.g. the value for the data as below will be 1.384651.

4. Sample kurtosis

Sample kurtosis describes the peakedness of the sample.

To calculate kurtosis, we should:

- Calculate the sample mean.

- Calculate the sample variance.

- Add up the fourth-power differences of each sample element and the mean.

- Divide the answer by the squared variance.

- Multiply the resulting value by the coefficient equal to the product of the sample size and the sample size plus 1, divided by the product of the sample size minus 1, sample size minus 2 and sample size minus 3.

- Subtract from the resulting value the product of 3 and the squared difference of the sample size and 1, divided by the product of the sample size minus 1 and sample size minus 2.

Formula:

![]()

Where:

- E is the sample kurtosis,

- D is the sample variance,

- M is the sample mean,

- a[i] is the sample element,

- n is the sample size.

For the given height data, we get the value of -0.1442285.

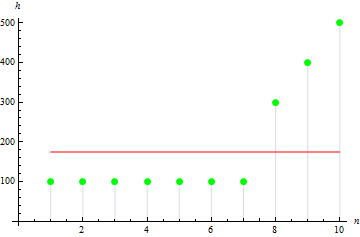

For a sharper peak data, we get a larger value: 10.

5. Sample covariance

Sample covariance is a measure indicating the degree of linear dependence between two data samples. Covariance between linearly independent data will be 0.

To illustrate this parameter, we will add weight data for each of the 10 persons:

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Weight | 65 | 70 | 83 | 60 | 105 | 58 | 69 | 90 | 78 | 65 |

To calculate covariance of two samples, we should:

- Calculate the mean of the first sample.

- Calculate the mean of the second sample.

- Add up all products of two differences: the first difference - an element of the first sample minus the mean of the first sample; the second difference - an element of the second sample (corresponding to the element of the first sample) minus the mean of the second sample.

- Divide the answer by the sample size minus 1.

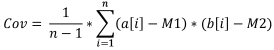

Formula:

Where:

- Cov is the sample covariance,

- a[i] is the element of the first sample,

- b[i] is the element of the second sample,

- M1 is the sample mean of the first sample,

- M2 is the sample mean of the second sample,

- n is the sample size.

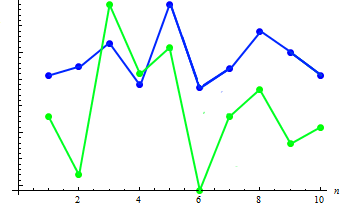

Let us calculate the covariance value of the two samples: 91.2778. The existing dependence can be shown in the combined chart:

As can be seen, the increase in height (as a rule) corresponds to the decrease in weight and vice versa.

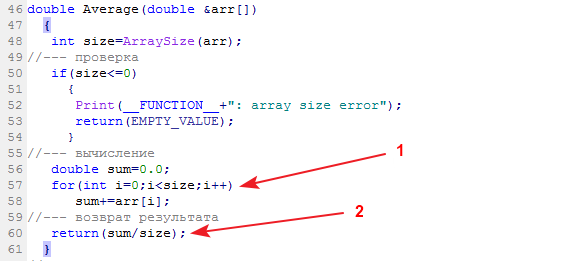

6. Sample correlation

Sample correlation is also used to describe the degree of linear dependence between two data samples but its value always lies within the range of -1 to 1.

To calculate correlation of two samples, we should:

- Calculate the variance of the first sample.

- Calculate the variance of the second sample.

- Calculate covariance of these samples.

- Divide the covariance by the square root of the product of the variances.

Formula:

Where:

- Corr is the sample correlation,

- Cov is the sample covariance,

- D1 is the sample variance of the first sample,

- D2 is the sample variance of the second sample,

For the given height and weight data, correlation will be equal to 0.579098.

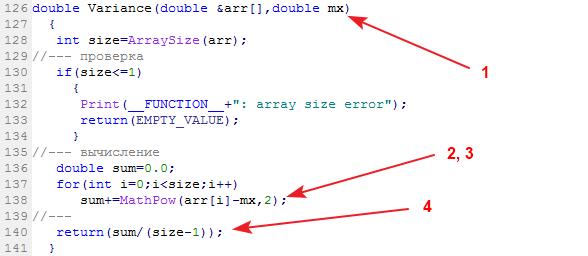

How to Use Statistics in Trading

The simplest example illustrating the use of statistical parameters in trading is the MovingAverage indicator. Its calculation requires data over a certain period of time and gives the arithmetic mean value of the price:

Where:

- MA is the indicator value,

- P[i] is the price,

- n is the MA measurement period

We can see that the indicator is a complete analog of the sample mean. Despite its simplicity, this indicator is used when calculating EMA, the exponential moving average which, in turn, is a basic element required for the MACD indicator - a classical tool for determining the trend strength and direction.

Statistics in MQL5

We will look at the MQL5 implementation of the basic statistical parameters described above. The statistical methods reviewed above (and a lot more) are implemented in the statistical functions library statistics.mqh. Let us review their codes.

1. Sample mean

The library function calculating the sample mean is called Average:

Input data: data sample. Output data: mean.

2. Sample variance

The library function calculating the sample variance is called Variance:

Input data: data sample and its mean. Output data: variance.

3. Sample skewness

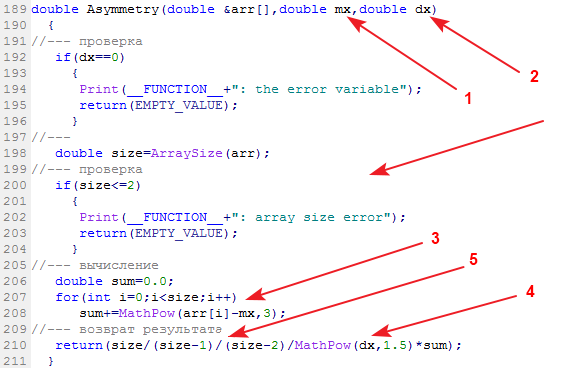

The library function calculating the sample skewness is called Asymmetry:

Input data: data sample, its mean and variance. Output data: skewness.

4. Sample kurtosis

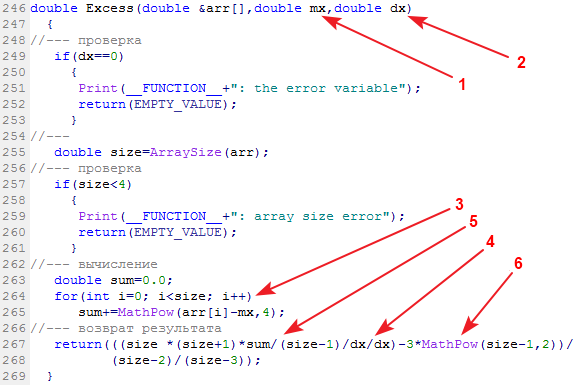

The library function calculating the sample kurtosis is called Excess (Excess2):

Input data: data sample, its mean and variance. Output data: kurtosis.

5. Sample covariance

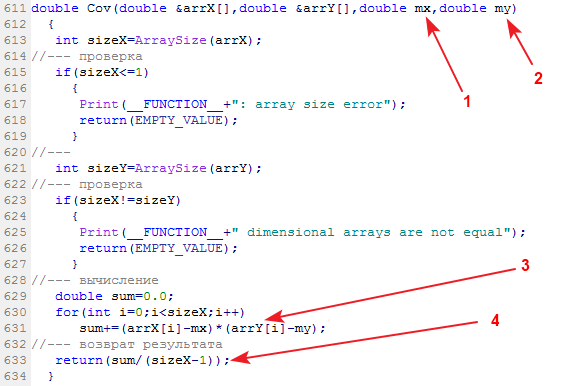

The library function calculating the sample covariance is called Cov:

Input data: two data samples and their respective means. Output data: covariance.

6. Sample correlation

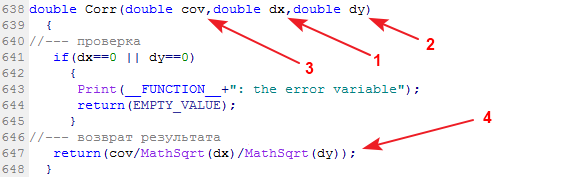

The library function calculating the sample correlation is called Corr:

Input data: covariance of two samples, variance of the first sample and variance of the second sample. Output data: correlation.

Let us now input height and weight sample data and process it using the library.#include <Statistics.mqh> //+------------------------------------------------------------------+ //| Script program start function | //+------------------------------------------------------------------+ void OnStart() { //--- specify two data samples. double arrX[10]={173,162,194,181,186,159,173,178,168,171}; double arrY[10]={65,70,83,60,105,58,69,90,78,65}; //--- calculate the mean double mx=Average(arrX); double my=Average(arrY); //--- to calculate the variance, use the mean value double dx=Variance(arrX,mx); double dy=Variance(arrY,my); //--- skewness and kurtosis values double as=Asymmetry(arrX,mx,dx); double exc=Excess(arrX,mx,dx); //--- covariance and correlation values double cov=Cov(arrX,arrY,mx,my); double corr=Corr(cov,dx,dy); //--- print results in the log file PrintFormat("mx=%.6e",mx); PrintFormat("dx=%.6e",dx); PrintFormat("as=%.6e",as); PrintFormat("exc=%.6e",exc); PrintFormat("cov=%.6e",cov); PrintFormat("corr=%.6e",corr); }

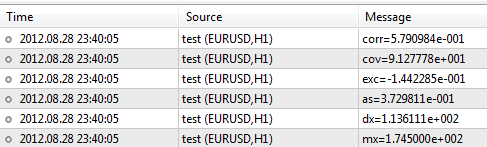

After executing the script, the terminal will produce the results as follows:

The library contains a lot more functions the descriptions of which can be found in CodeBase - https://www.mql5.com/en/code/866.

Conclusion

Some conclusions have already been drawn at the end of the "Probability Theory and Statistics" section. In addition to the above, it would be worth mentioning that statistics, like any other branch of science, shall be studied starting with its ABCs. Even its basic elements can facilitate the understanding of a great deal of complex things, mechanisms and patterns which at the end of the day can be extremely necessary in trader's work.