Cross-Platform Expert Advisor: Stops

Enrico Lambino | 8 September, 2017

Table of Contents

- Introduction

- COrder

- CStop

- CStops

- COrderStop

- COrderStops

- Chart Representation of Stops

- Order Stop Checking

- Examples

- Conclusion

- Programs Used in the Article

- Class Files Featured in the Article

Introduction

As discussed in a previous article, for a cross-platform expert advsior, we have created an order manager (COrderManager) which takes care of most of the differences between MQL4 and MQL5 as far as the entry and exit of trades are concerned. In both versions, the expert advisor saves the trades information in memory by creating instances of COrder. The containers of dynamic pointers to instances of this class object are also available as class members of COrderManager (for both current and historical trades).

It is possible to have the order manager directly handle the stop levels of each trade. However, doing this would have certain limitations:

- COrderManager would most likely have to be extended to customize how it handles the stop levels for each trade.

- The existing methods of COrderManager

only deal with the entry of main trades.

It is possible for COrderManager to be extended so that it can handle the stop levels for each trade on its own. However, this is not only limited to the placing of the actual levels, but also for other tasks related to the monitoring of these stops as well, such as modification and checking if the market has already hit a certain level. These functions would make COrderManager much more complex that it currently is, not mentioning the split-implementations.

The order manager only deals with the entry of main trades, while some stop levels would require the EA to perform other trading operations, such as the placing of pending orders, and closing of actual positions. While it is possible for the order manager to handle it on its own, it would be best to have it focus on the entry of main trades, and let another class object handle the stop levels.

In this article, we will discuss the implementation where the COrderManager would exclusively handle the entry and exit of main trades (as it currently is), and then have the implementation of stop levels handled separately by another class object (CStop).

COrder

As we have learned from a previous

article (see Cross-Platform Expert Advisor: Orders), an instance of

COrder is created after a successful trade operation (entry). For

both MetaTrader 4 and MetaTrader 5, the information regarding

stoploss and takeprofit can be saved from the broker's end. However,

in the event where the stops are hidden from the broker or multiple

stop levels are involved, the information regarding most of these

stops should be saved locally. Thus, in the latter case, after a

successful entry of a position, the COrder instance should be created

first, followed by the object instances representing its stoploss and

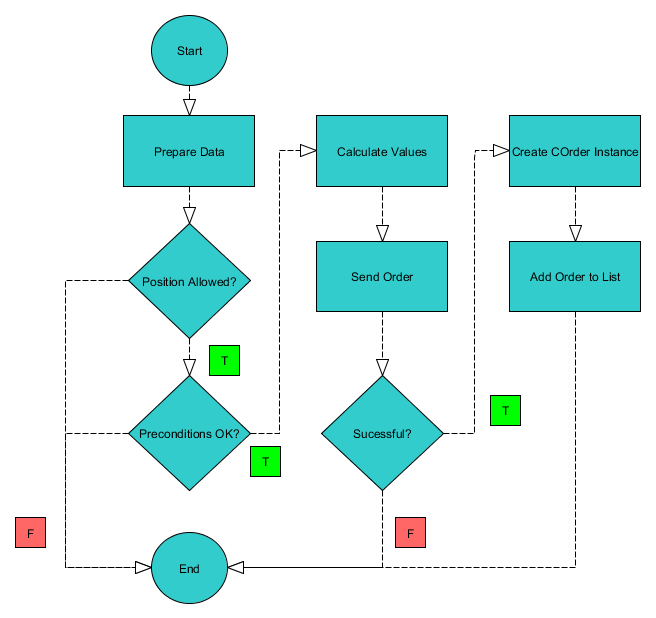

takeprofit levels. In an earlier article, we have demonstrated how the COrder instances are added to the order manager upon creation, as shown also in the following figure:

The stop levels are added in the same way. To do this, we just need to insert the method after the new COrder instance is created, and before it is added to the list of ongoing trades (COrders). Thus, we just need to slightly modify the illustration above, as shown in the following illustration:

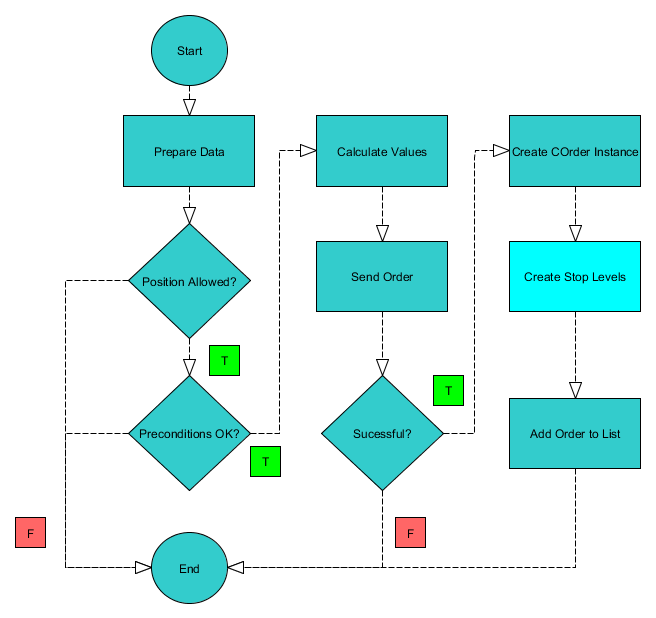

The general operation of the creation of stop levels is shown in the following figure:

As shown in the previous two flowcharts above, as soon as a trade has been successfully entered, a new COrder instance will be created representing it. After that, instances of COrderStop will be created for each of the stoploss and takeprofit levels defined. If there were no CStop instance declared on the expert advisor's initialization, this particular process would be skipped. On the other hand, if instances of COrderStop were created, the pointers to these instances will then be stored under the COrder instance created earlier. We can find this operation within the Init method of COrder:

bool COrderBase::Init(COrders *orders,CStops *stops) { if(CheckPointer(orders)) SetContainer(GetPointer(orders)); if(CheckPointer(stops)) CreateStops(GetPointer(stops)); m_order_stops.SetContainer(GetPointer(this)); return true; }

For the creation of the stop levels for the instance of COrder, we can see that it calls its CreateStops method, which is shown below:

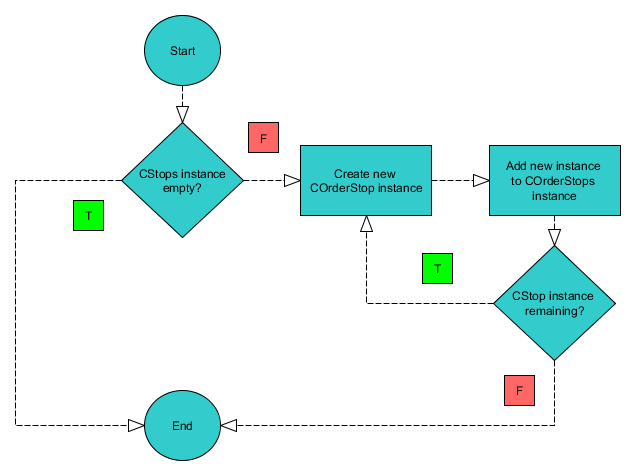

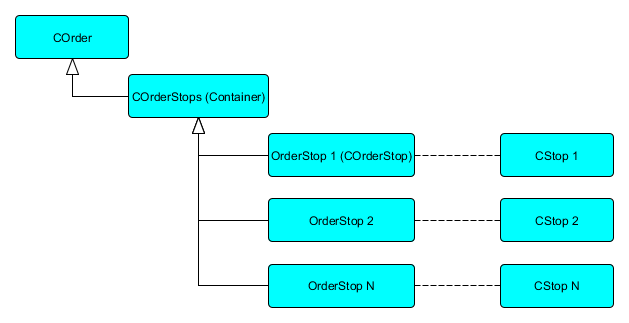

void COrderBase::CreateStops(CStops *stops) { if(!CheckPointer(stops)) return; if(stops.Total()>0) { for(int i=0;i<stops.Total();i++) { CStop *stop=stops.At(i); if(CheckPointer(stop)==POINTER_INVALID) continue; m_order_stops.NewOrderStop(GetPointer(this),stop); } } }The method iterates over all the available instances of CStop, which represents each pair of stoploss and takeprofit levels. Each of these CStop instances are passed to an instance of COrderStops, which is simply a container for all stop levels for a given order. We can then construct the hirerarchy of the class objects as follows:

For each instance of COrder, there is one member of type COrderStops. This COrderStops instance is a container (an extension of CArrayObj), which contains the pointers to instances of COrderStop. Each COrderStop instance represents a stop level (CStop) for that particular trade only (COrder instance).

CStop

As discussed earlier, we would like to have a certain level of freedom of customizing how the stop levels of each trade is handled, without having to modify the source code of the order manager. This is largely accomplished by the class CStop. Among the responsibilities of this class are the following:

- define the stoploss and takeprofit levels

- perform the calculations needed to calculate the stop levels

- implement stoploss and takeprofit levels for the main trade

- check if the stop level has been triggered

- reconcile the differences between MQL4 and MQL5 in implementing the stoploss and takeprofit levels

- define how the stops should be handled over time (e.g. breakeven, trailing, etc.)

Pointers #1-#5 will be discussed in this article, while #6 will be discussed in a separate article.

Types

Three types of stops will be discussed in this article:

- Broker-Based Stop – stops that are sent to the broker along with the trade request

- Pending Order Stop – stops using pending orders that would either act as a partial or full hedge against the main position (MetaTrader 4, MetaTrader 5 hedging mode), or subtract from the main position (MetaTrader 5 netting mode).

- Virtual Stop (Stealth Stop) – stops that are hidden from the broker and are managed locally by the expert advisor.

In MetaTrader 4, the broker-based stop are the stoploss and takeprofit that traders are most familiar with. These are the prices or stop levels that are sent to the broker along with the main trade. The MetaTrader 5 version for hedging mode uses the same mechanic as the MetaTrader 4 version. On the other hand, for netting mode, a pending order stop will be used for this type of CStop, since the stoploss and takeprofit is different (applied on the entire position for the symbol or instrument).

A pending order stop uses pending orders to somehow mimic a broker-based stop. As soon as the pending orders were executed, the EA would perform a trade operation (OrderCloseBy) to close main position using the volume of the pending order just triggered. This is true for the MetaTrader 4 and MetaTrader 5, hedging mode, versions. For the MetaTrader 5, netting mode version, the exit of some or all volume from the main position is done automatically, since there can only be one position maintained at any given time per symbol.

Main Stop

The main stop is the stop level that would trigger the exit of an entire position. Normally, this is the broker-based stop. When either the broker-based stoploss or takeprofit is triggered, the entire position leaves the market, whether the EA intends to do further work on it or not. However, if there are multiple stop levels and there are no broker-based stops, letting the EA decide which is the main stop is probably a bad idea. In this case, the coder has to select which CStop instance is the main stop for the trade. This is useful especially for some functions and features that depend on the main stop of the position, such as money management. Since the stoploss of the main stop level leads to the exit of the entire position, it represents the maximum risk for entering that trade. And knowing the main stop instance, the EA would be able to calculate the lotsize accordingly.

It is worth noting that when a stop is assigned as a main stop, its volume would always be equal to the initial volume of the main trade. This would work well with broker-based and virtual stops, but not on stops that are based on pending orders. There are two associated problems which lead to this approach.

The first reason is that in MetaTrader 4, the pending order entry price can be modified while the pending order is not yet triggered. In MetaTrader 5, this is not possible since a clear footprint of trade operations has to be maintained. A new pending order has to be issued, and if successful, the old one should be deleted, and from then, the expert advisor should use the new pending order as the new stop level.

The second problem is the possibility of the old pending order to be triggered while the replacement pending order is being sent to the broker. Since the EA does not have control on the triggering of pending orders (the broker has), this can lead to problems such as orphan trades or a stop level closing more volume from the main trade than it is supposed to.

In order to avoid these problems, the simpler approach would be to allocate the volume of pending orders at trade creation, rather than adjusting the volume of the pending orders dynamically throughout the lifetime of the main trade. However, this requires that there should be no other pending order stop if the main stop is of pending order type.

Volume

For the main stop level, there is no need to assign the lotsize to deduct from the main position, for as soon as it is triggered, the entire position should be closed. However, for the other types of stop levels, the volume would have to be considered, as they are usually to be intended for partial closing of the main position only. The allocation is divided into four different types:

- Fixed – fixed lotsizing

- Percent Remaining – percentage of the remaining lotsize of the main trade

- Percent Total – percentage of the total lotsize (initial volume) of the main trade

- Remaining – the remaining volume of the main trade.

Fixed lotsizing is the most simple form of volume allocation. However, this would not work optimally if the expert advisor is using some form of dynamic lotsize calculation for each position i.e. money management. This is ideal only for use when the lotsize is fixed althroughout the operation of the expert advisor.

Percent Remaining and Remaining are best used when the main stop is virtual. Remaining would prevent the EA from creating orphan trades from unclosed volume, or from executing a close operation for a volume greater than the remaining volume of the main trade. Percent Remaining, on the other hand, is used when the expert advisor should close the trade not based on the initial volume, but rather on what volume is currently left in the main trade.

The percent total can be used with broker-based, virtual, and pending-order-based stops. The calculations using this method are based on the initial main trade volume.

One-Cancels-the-Other (OCO)

CStop is always represented by a pair of values, with each value representing either the stoploss or the takeprofit. However, a one-sided level is possible (having takeprofit and missing stoploss, or vice versa) by assigning zero to either value. By default, one stop level, when triggered, closes the other. The only exception to this is when the the CStop instance is a main stop.

Base Class

The base class for CStop (CStopBase) is shown in the following code:

class CStopBase : public CObject { protected: //--- stop order parameters bool m_active; bool m_main; string m_name; bool m_oco; double m_stoploss; string m_stoploss_name; ENUM_STOP_TYPE m_stop_type; double m_takeprofit; string m_takeprofit_name; int m_delay; //--- stop order trade parameters ENUM_VOLUME_TYPE m_volume_type; double m_volume; int m_magic; int m_deviation; string m_comment; //--- stop order objects parameters bool m_entry_visible; bool m_stoploss_visible; bool m_takeprofit_visible; color m_entry_color; color m_stoploss_color; color m_takeprofit_color; ENUM_LINE_STYLE m_entry_style; ENUM_LINE_STYLE m_stoploss_style; ENUM_LINE_STYLE m_takeprofit_style; //--- objects CSymbolManager *m_symbol_man; CSymbolInfo *m_symbol; CAccountInfo *m_account; CTradeManager m_trade_man; CExpertTradeX *m_trade; CTrails *m_trails; CEventAggregator *m_event_man; CStops *m_stops; public: CStopBase(void); ~CStopBase(void); virtual int Type(void) const {return CLASS_TYPE_STOP;} //--- initialization virtual bool Init(CSymbolManager*,CAccountInfo*,CEventAggregator*); virtual bool InitAccount(CAccountInfo*); virtual bool InitEvent(CEventAggregator*); virtual bool InitSymbol(CSymbolManager*); virtual bool InitTrade(void); virtual CStops *GetContainer(void); virtual void SetContainer(CStops*); virtual bool Validate(void) const; //--- getters and setters bool Active(void); void Active(const bool); bool Broker(void) const; void Comment(const string); string Comment(void) const; void Delay(int delay); int Delay(void) const; void SetDeviation(const int); int SetDeviation(void) const; void EntryColor(const color clr); void EntryStyle(const ENUM_LINE_STYLE); void EntryVisible(const bool); bool EntryVisible(void) const; void Magic(const int); int Magic(void) const; void Main(const bool); bool Main(void) const; void Name(const string); string Name(void) const; void OCO(const bool oco); bool OCO(void) const; bool Pending(void) const; void StopLoss(const double); double StopLoss(void) const; void StopLossColor(const color); bool StopLossCustom(void); void StopLossName(const string); string StopLossName(void) const; void StopLossVisible(const bool); bool StopLossVisible(void) const; void StopLossStyle(const ENUM_LINE_STYLE); void StopType(const ENUM_STOP_TYPE); ENUM_STOP_TYPE StopType(void) const; string SymbolName(void); void TakeProfit(const double); double TakeProfit(void) const; void TakeProfitColor(const color); bool TakeProfitCustom(void); void TakeProfitName(const string); string TakeProfitName(void) const; void TakeProfitStyle(const ENUM_LINE_STYLE); void TakeProfitVisible(const bool); bool TakeProfitVisible(void) const; bool Virtual(void) const; void Volume(double); double Volume(void) const; void VolumeType(const ENUM_VOLUME_TYPE); ENUM_VOLUME_TYPE VolumeType(void) const; //--- stop order checking virtual bool CheckStopLoss(COrder*,COrderStop*); virtual bool CheckTakeProfit(COrder*,COrderStop*); virtual bool CheckStopOrder(ENUM_STOP_MODE,COrder*,COrderStop*)=0; virtual bool DeleteStopOrder(const ulong)=0; virtual bool DeleteMarketStop(const ulong)=0; virtual bool OrderModify(const ulong,const double); //--- stop order object creation virtual CStopLine *CreateEntryObject(const long,const string,const int,const double); virtual CStopLine *CreateStopLossObject(const long,const string,const int,const double); virtual CStopLine *CreateTakeProfitObject(const long,const string,const int,const double); //--- stop order price calculation virtual bool Refresh(const string); virtual double StopLossCalculate(const string,const ENUM_ORDER_TYPE,const double); virtual double StopLossCustom(const string,const ENUM_ORDER_TYPE,const double); virtual double StopLossPrice(COrder*,COrderStop*); virtual double StopLossTicks(const ENUM_ORDER_TYPE,const double); virtual double TakeProfitCalculate(const string,const ENUM_ORDER_TYPE,const double); virtual double TakeProfitCustom(const string,const ENUM_ORDER_TYPE,const double); virtual double TakeProfitPrice(COrder*,COrderStop*); virtual double TakeProfitTicks(const ENUM_ORDER_TYPE,const double); //--- trailing virtual bool Add(CTrails*); virtual double CheckTrailing(const string,const ENUM_ORDER_TYPE,const double,const double,const ENUM_TRAIL_TARGET); protected: //--- object creation virtual CStopLine *CreateObject(const long,const string,const int,const double); //--- stop order price calculation virtual double LotSizeCalculate(COrder*,COrderStop*); //--- stop order entry virtual bool GetClosePrice(const string,const ENUM_ORDER_TYPE,double&); //--- stop order exit virtual bool CloseStop(COrder*,COrderStop*,const double)=0; //--- deinitialization virtual void Deinit(void); virtual void DeinitSymbol(void); virtual void DeinitTrade(void); virtual void DeinitTrails(void); };

For stoploss and takeprofit levels based on number of pips or points, at least four class methods need to be remembered:

- The type of stop (broker-based, pending order, or virtual), using the method StopType

- The type of volume calculation used, using the method VolumeType

- The stoploss level in points (whenever needed), using the the method StopLoss

- The takeprofit level in points (whenever needed), using the method TakeProfit

All of these are mere setters on class members, so there is no need to elaborate on these methods. Most of the rest of the methods are needed only by the class in its internal calculations. Among the most important of these protected methods are the StopLossCalculate and TakeProfitCalculate methods, whose code are shown below:

double CStopBase::StopLossCalculate(const string symbol,const ENUM_ORDER_TYPE type,const double price) { if(!Refresh(symbol)) return 0; if(type==ORDER_TYPE_BUY || type==ORDER_TYPE_BUY_STOP || type==ORDER_TYPE_BUY_LIMIT) return price-m_stoploss*m_symbol.Point(); else if(type==ORDER_TYPE_SELL || type==ORDER_TYPE_SELL_STOP || type==ORDER_TYPE_SELL_LIMIT) return price+m_stoploss*m_symbol.Point(); return 0; } double CStopBase::TakeProfitCalculate(const string symbol,const ENUM_ORDER_TYPE type,const double price) { if(!Refresh(symbol)) return 0; if(type==ORDER_TYPE_BUY || type==ORDER_TYPE_BUY_STOP || type==ORDER_TYPE_BUY_LIMIT) return price+m_takeprofit*m_symbol.Point(); else if(type==ORDER_TYPE_SELL || type==ORDER_TYPE_SELL_STOP || type==ORDER_TYPE_SELL_LIMIT) return price-m_takeprofit*m_symbol.Point(); return 0; }

Both methods take three arguments, all of which are related to the main trade. The methods start by first refreshing the symbol through the Refresh method, which simply updates the symbol manager with the correct symbol to use. Once the symbol has been refreshed, it would then return the value of stoploss or takeprofit based on the point value supplied to the class instance during initialization.

CStops

Class CStops will serve as container

for instances of CStop. An instance of this class will have to be

dynamically added to the order manager as one of its members.The following code shows CStopsBase, which is the base class for CStops:

class CStopsBase : public CArrayObj { protected: bool m_active; CEventAggregator *m_event_man; CObject *m_container; public: CStopsBase(void); ~CStopsBase(void); virtual int Type(void) const {return CLASS_TYPE_STOPS;} //--- initialization virtual bool Init(CSymbolManager*,CAccountInfo*,CEventAggregator*); virtual CObject *GetContainer(void); virtual void SetContainer(CObject*); virtual bool Validate(void) const; //--- setters and getters virtual bool Active(void) const; virtual void Active(const bool); virtual CStop *Main(void); //--- recovery virtual bool CreateElement(const int); };

This is class is very similar to the other containers described so far in this article-series.

COrderStop

COrderStop represents the implementation of CStop for a particular trade. For a given position, a CStop can create a maximum of one COrderStop. However, an arbitrary number of COrderStop instances can share the same instance of CStop. Thus, if an expert advisor has 3 different instances of CStop, we would typically expect each COrder instance to have the same number of instances of COrderStop. If the expert advisor has made 1000 trades, the number of COrderStop instances created would be 1000 * 3 = 3000, whereas the number of CStop instances created would still be 3.

The definition of COrderStopBase, from which COrderStop is based, is shown in the code below:

class COrderStopBase : public CObject { protected: bool m_active; //--- stop parameters double m_volume; CArrayDouble m_stoploss; CArrayDouble m_takeprofit; ulong m_stoploss_ticket; ulong m_takeprofit_ticket; bool m_stoploss_closed; bool m_takeprofit_closed; bool m_closed; ENUM_STOP_TYPE m_stop_type; string m_stop_name; //--- main order object COrder *m_order; //--- stop objects CStop *m_stop; CStopLine *m_objentry; CStopLine *m_objsl; CStopLine *m_objtp; COrderStops *m_order_stops; public: COrderStopBase(void); ~COrderStopBase(void); virtual int Type(void) const {return CLASS_TYPE_ORDERSTOP;} //--- initialization virtual void Init(COrder*,CStop*,COrderStops*); virtual COrderStops *GetContainer(void); virtual void SetContainer(COrderStops*); virtual void Show(bool); //--- getters and setters bool Active(void) const; void Active(bool active); string EntryName(void) const; ulong MainMagic(void) const; ulong MainTicket(void) const; double MainTicketPrice(void) const; ENUM_ORDER_TYPE MainTicketType(void) const; COrder *Order(void); void Order(COrder*); CStop *Stop(void); void Stop(CStop*); bool StopLoss(const double); double StopLoss(void) const; double StopLoss(const int); void StopLossClosed(const bool); bool StopLossClosed(void); double StopLossLast(void) const; string StopLossName(void) const; void StopLossTicket(const ulong); ulong StopLossTicket(void) const; void StopName(const string); string StopName(void) const; bool TakeProfit(const double); double TakeProfit(void) const; double TakeProfit(const int); void TakeProfitClosed(const bool); bool TakeProfitClosed(void); double TakeProfitLast(void) const; string TakeProfitName(void) const; void TakeProfitTicket(const ulong); ulong TakeProfitTicket(void) const; void Volume(const double); double Volume(void) const; //--- checking virtual void Check(double&)=0; virtual bool Close(void); virtual bool CheckTrailing(void); virtual bool DeleteChartObject(const string); virtual bool DeleteEntry(void); virtual bool DeleteStopLines(void); virtual bool DeleteStopLoss(void); virtual bool DeleteTakeProfit(void); virtual bool IsClosed(void); virtual bool Update(void) {return true;} virtual void UpdateVolume(double) {} //--- deinitialization virtual void Deinit(void); //--- recovery virtual bool Save(const int); virtual bool Load(const int); virtual void Recreate(void); protected: virtual bool IsStopLossValid(const double) const; virtual bool IsTakeProfitValid(const double) const; virtual bool Modify(const double,const double); virtual bool ModifyStops(const double,const double); virtual bool ModifyStopLoss(const double) {return true;} virtual bool ModifyTakeProfit(const double){return true;} virtual bool UpdateOrderStop(const double,const double){return true;} virtual bool MoveStopLoss(const double); virtual bool MoveTakeProfit(const double); };

COrderStop is contained by COrderStops (to be discussed in the next section), which is in turn contained by COrder. In the actual development of an EA, there is no further need to declare an instance of COrderStop. This is automatically created by COrder based on a particular instance of CStop.

COrderStops

class COrderStopsBase : public CArrayObj { protected: bool m_active; CArrayInt m_types; COrder *m_order; public: COrderStopsBase(void); ~COrderStopsBase(void); virtual int Type(void) const {return CLASS_TYPE_ORDERSTOPS;} void Active(bool); bool Active(void) const; //--- initialization virtual CObject *GetContainer(void); virtual void SetContainer(COrder*); virtual bool NewOrderStop(COrder*,CStop*)=0; //--- checking virtual void Check(double &volume); virtual bool CheckNewTicket(COrderStop*); virtual bool Close(void); virtual void UpdateVolume(const double) {} //--- hiding and showing of stop lines virtual void Show(const bool); //--- recovery virtual bool CreateElement(const int); virtual bool Save(const int); virtual bool Load(const int); };

Just like CStop this looks like just a typical container. However, it contains some methods which mirror the methods of the objects whose pointers it is intended to store (COrderStop).

Chart Representation of Stops

CStopLine is a class member of CStop, whose primary responsibility is the graphical representation of stop levels on the chart. It has three core functions in an expert advisor:

- Show the stop levels at the initialization of a COrder instance

- Update the stop levels in the event where one or both of the stop levels were changed

- Remove the stop lines as soon as the main trade has left the market

All of these functions are implemented through the CStop class.

The definition of CStopLineBase, from which CStopLine is based, is shown below:

class CStopLineBase : public CChartObjectHLine { protected: bool m_active; CStop *m_stop; public: CStopLineBase(void); ~CStopLineBase(void); virtual int Type(void) const {return CLASS_TYPE_STOPLINE;} virtual void SetContainer(CStop*); virtual CStop *GetContainer(void); bool Active(void) const; void Active(const bool); virtual bool ChartObjectExists(void) const; virtual double GetPrice(const int); virtual bool Move(const double); virtual bool SetStyle(const ENUM_LINE_STYLE); virtual bool SetColor(const color); };

In older versions of MetaTrader 4, stoploss and takeprofit levels are not modifiable by dragging. These levels had to be modified either through the order window or through the use of expert advsiors and scripts. However, showing graphical representations of these levels may still be useful, especially when dealing with virtual stops.

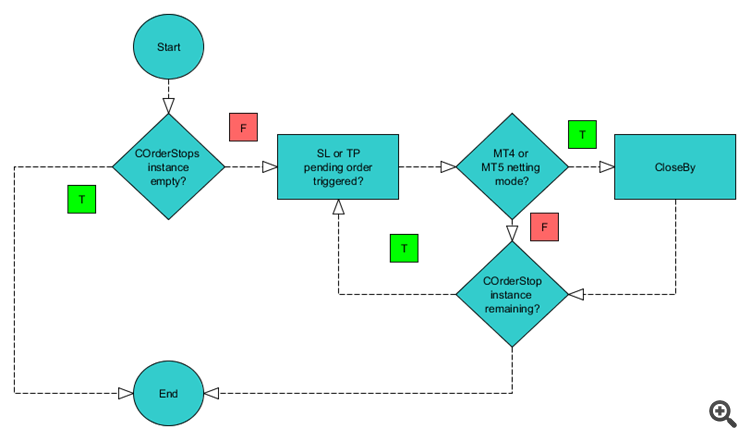

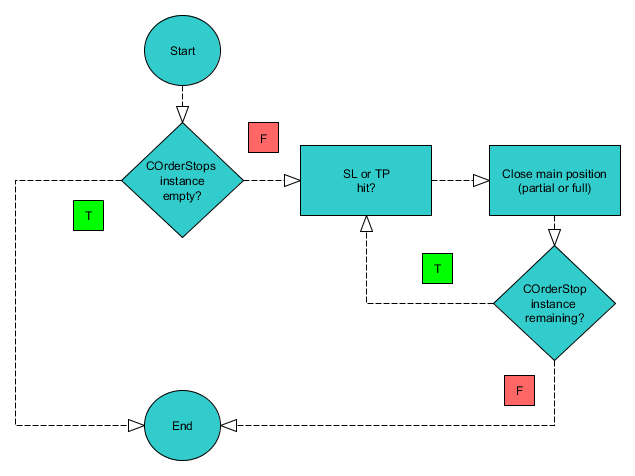

Order Stop Checking

After the stop levels were successfully created for a given position, the next step would be to check if the market has hit a given stop level. For broker-based stops, the process is not necessary, since the closing operation is done on the server side. However, for virtual stops and stops based on pending orders, in most cases, it would be up to the expert advisor itself to perform the closing operation.

For virtual stops, the expert advisor is entirely responsible for monitoring the movement of the market and for checking whether or not the market has hit a given stop level. The following figure shows the general operation. As soon as the market hits a stop level, the expert advisor performs the appropriate closing operation.

For stops based on pending orders, the process is slightly more complex. A stop level being triggered would lead to a pending order being triggered i.e. becoming a position. This is done automatically on the broker side. Thus, it would be the responsibility of the expert advisor to detect if the given pending order is still pending or has already entered the market. If the pending order has already been triggered, then the expert advisor would be responsible for closing the main position with the volume of the pending order that just triggered - a trade close by operation.

In all cases, as soon as a given order stop level is triggered, the stop level is marked as closed. This is to prevent a given stop level from being executed more than once.

Examples

Example #1: An EA using Heiken Ashi and Moving Average, with a Single Stop Level (Main Stop)

In most expert advisor, one stoploss and one takeprofit is often enough. We will now extend the example in the previous article (see Cross-Platform Expert Advisor: Time Filters) to add a stoploss and takeprofit to the source code. To do this, first, we create a new instance of the container (CStops). Then create an instance of CStop, and then add its pointer to the container. The pointer to the container will then be eventually added to the order manager. The code is shown below:

int OnInit() { //--- other code CStops *stops=new CStops(); CStop *main=new CStop("main"); main.StopType(stop_type_main); main.VolumeType(VOLUME_TYPE_PERCENT_TOTAL); main.Main(true); main.StopLoss(stop_loss); main.TakeProfit(take_profit); stops.Add(GetPointer(main)); order_manager.AddStops(GetPointer(stops)); //--- other code }

Testing the broker-based stop on MetaTrader 4 shows the results on the following table. This is what traders would usually expect for trades executed by an expert advisor on the platform.

| # | Time | Type | Order | Size | Price | S / L | T / P | Profit | Balance |

| 1 | 2017.01.03 10:00 | sell | 1 | 0.30 | 1.04597 | 1.05097 | 1.04097 | ||

| 2 | 2017.01.03 11:34 | t/p | 1 | 0.30 | 1.04097 | 1.05097 | 1.04097 | 150.00 | 3150.00 |

| 3 | 2017.01.05 11:00 | sell | 2 | 0.30 | 1.05149 | 1.05649 | 1.04649 | ||

| 4 | 2017.01.05 17:28 | s/l | 2 | 0.30 | 1.05649 | 1.05649 | 1.04649 | -150.00 | 3000.00 |

For stops based on pending orders, the stops are placed in advance just like in standard sl/tp, but in the form of pending orders. As soon as the pending order is triggered, the expert advisor will then perform a closeby operation, closing the main trade by the volume of the triggered pending order. However, unlike standard sl/tp, the expert advisor performs this on the client-side. This will not be executed unless the trading platform is live and the EA is running on a chart.

| # | Time | Type | Order | Size | Price | S / L | T / P | Profit | Balance |

| 1 | 2017.01.03 10:00 | sell | 1 | 0.30 | 1.04597 | 0.00000 | 0.00000 | ||

| 2 | 2017.01.03 10:00 | buy stop | 2 | 0.30 | 1.05097 | 0.00000 | 0.00000 | ||

| 3 | 2017.01.03 10:00 | buy limit | 3 | 0.30 | 1.04097 | 0.00000 | 0.00000 | ||

| 4 | 2017.01.03 11:34 | buy | 3 | 0.30 | 1.04097 | 0.00000 | 0.00000 | ||

| 5 | 2017.01.03 11:34 | close by | 1 | 0.30 | 1.04097 | 0.00000 | 0.00000 | 150.00 | 3150.00 |

| 6 | 2017.01.03 11:34 | close by | 3 | 0.00 | 1.04097 | 0.00000 | 0.00000 | 0.00 | 3150.00 |

| 7 | 2017.01.03 11:34 | delete | 2 | 0.30 | 1.05097 | 0.00000 | 0.00000 | ||

| 8 | 2017.01.05 11:00 | sell | 4 | 0.30 | 1.05149 | 0.00000 | 0.00000 | ||

| 9 | 2017.01.05 11:00 | buy stop | 5 | 0.30 | 1.05649 | 0.00000 | 0.00000 | ||

| 10 | 2017.01.05 11:00 | buy limit | 6 | 0.30 | 1.04649 | 0.00000 | 0.00000 | ||

| 11 | 2017.01.05 17:28 | buy | 5 | 0.30 | 1.05649 | 0.00000 | 0.00000 | ||

| 12 | 2017.01.05 17:28 | close by | 4 | 0.30 | 1.05649 | 0.00000 | 0.00000 | -150.00 | 3000.00 |

| 13 | 2017.01.05 17:28 | close by | 5 | 0.00 | 1.05649 | 0.00000 | 0.00000 | 0.00 | 3000.00 |

| 14 | 2017.01.05 17:28 | delete | 6 | 0.30 | 1.04649 | 0.00000 | 0.00000 | ||

Virtual stops do not send anything about the stops on the main trade. The broker is only informed as soon as the EA executes a closing order. The following table shows the behavior of the EA using virtual stops. Here, as soon as the target price for a stop level is triggered, the EA sends a trade request to the server in order to close the main trade.

| # | Time | Type | Order | Size | Price | S / L | T / P | Profit | Balance |

| 1 | 2017.01.03 10:00 | sell | 1 | 0.30 | 1.04597 | 0.00000 | 0.00000 | ||

| 2 | 2017.01.03 11:34 | close | 1 | 0.30 | 1.04097 | 0.00000 | 0.00000 | 150.00 | 3150.00 |

| 3 | 2017.01.05 11:00 | sell | 2 | 0.30 | 1.05149 | 0.00000 | 0.00000 | ||

| 4 | 2017.01.05 17:28 | close | 2 | 0.30 | 1.05649 | 0.00000 | 0.00000 | -150.00 | 3000.00 |

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 1.05097 | 1.04097 | 2017.01.03 10:00:00 | filled | |||

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | tp 1.04097 | ||||

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 1.05649 | 1.04649 | 2017.01.05 11:00:00 | filled | |||

| 2017.01.05 17:28:37 | 5 | EURUSD | buy | 0.30 / 0.30 | 1.05649 | 2017.01.05 17:28:37 | filled | sl 1.05649 | ||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | out | 0.30 | 1.04097 | 3 | 0.00 | 0.00 | 150.00 | 3 150.00 | tp 1.04097 |

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | in | 0.30 | 1.05149 | 4 | 0.00 | 0.00 | 0.00 | 3 150.00 | |

| 2017.01.05 17:28:37 | 5 | EURUSD | buy | out | 0.30 | 1.05649 | 5 | 0.00 | 0.00 | -150.00 | 3 000.00 | sl 1.05649 |

| 0.00 | 0.00 | 0.00 | 3 000.00 | |||||||||

In hedging mode, pending orders work in basically the same way as MetaTrader 4, so the EA will also perform a closeby operation when a pending order has triggered.

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 2017.01.03 10:00:00 | filled | |||||

| 2017.01.03 10:00:00 | 3 | EURUSD | buy stop | 0.30 / 0.00 | 1.05097 | 2017.01.03 11:34:38 | canceled | |||||

| 2017.01.03 10:00:00 | 4 | EURUSD | buy limit | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | |||||

| 2017.01.03 11:34:38 | 5 | EURUSD | close by | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | close #2 by #4 | ||||

| 2017.01.05 11:00:00 | 6 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 2017.01.05 11:00:00 | filled | |||||

| 2017.01.05 11:00:00 | 7 | EURUSD | buy stop | 0.30 / 0.30 | 1.05649 | 2017.01.05 17:28:37 | filled | |||||

| 2017.01.05 11:00:00 | 8 | EURUSD | buy limit | 0.30 / 0.00 | 1.04649 | 2017.01.05 17:28:37 | canceled | |||||

| 2017.01.05 17:28:37 | 9 | EURUSD | close by | 0.30 / 0.30 | 1.05649 | 2017.01.05 17:28:37 | filled | close #6 by #7 | ||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | in | 0.30 | 1.04097 | 4 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 4 | EURUSD | buy | out by | 0.30 | 1.04097 | 5 | 0.00 | 0.00 | 150.00 | 3 150.00 | close #2 by #4 |

| 2017.01.03 11:34:38 | 5 | EURUSD | sell | out by | 0.30 | 1.04597 | 5 | 0.00 | 0.00 | 0.00 | 3 150.00 | close #2 by #4 |

| 2017.01.05 11:00:00 | 6 | EURUSD | sell | in | 0.30 | 1.05149 | 6 | 0.00 | 0.00 | 0.00 | 3 150.00 | |

| 2017.01.05 17:28:37 | 7 | EURUSD | buy | in | 0.30 | 1.05649 | 7 | 0.00 | 0.00 | 0.00 | 3 150.00 | |

| 2017.01.05 17:28:37 | 9 | EURUSD | sell | out by | 0.30 | 1.05149 | 9 | 0.00 | 0.00 | 0.00 | 3 150.00 | close #6 by #7 |

| 2017.01.05 17:28:37 | 8 | EURUSD | buy | out by | 0.30 | 1.05649 | 9 | 0.00 | 0.00 | -150.00 | 3 000.00 | close #6 by #7 |

| 0.00 | 0.00 | 0.00 | 3 000.00 | |||||||||

Using virtual stops, we do not typically see a "close" tag the way we see in MetaTrader 4. Rather, the closing operation uses the type opposite of the main trade, but we can see on the deals history whether or not it is buying/selling in or out.

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 2017.01.03 10:00:00 | filled | |||||

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | |||||

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 2017.01.05 11:00:00 | filled | |||||

| 2017.01.05 17:28:37 | 5 | EURUSD | buy | 0.30 / 0.30 | 1.05649 | 2017.01.05 17:28:37 | filled | |||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | out | 0.30 | 1.04097 | 3 | 0.00 | 0.00 | 150.00 | 3 150.00 | |

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | in | 0.30 | 1.05149 | 4 | 0.00 | 0.00 | 0.00 | 3 150.00 | |

| 2017.01.05 17:28:37 | 5 | EURUSD | buy | out | 0.30 | 1.05649 | 5 | 0.00 | 0.00 | -150.00 | 3 000.00 | |

| 0.00 | 0.00 | 0.00 | 3 000.00 | |||||||||

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 2017.01.03 10:00:00 | filled | |||||

| 2017.01.03 10:00:00 | 3 | EURUSD | buy stop | 0.30 / 0.00 | 1.05097 | 2017.01.03 11:34:38 | canceled | |||||

| 2017.01.03 10:00:00 | 4 | EURUSD | buy limit | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | |||||

| 2017.01.05 11:00:00 | 5 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 2017.01.05 11:00:00 | filled | |||||

| 2017.01.05 11:00:00 | 6 | EURUSD | buy stop | 0.30 / 0.30 | 1.05649 | 2017.01.05 17:28:37 | filled | |||||

| 2017.01.05 11:00:00 | 7 | EURUSD | buy limit | 0.30 / 0.00 | 1.04649 | 2017.01.05 17:28:37 | canceled | |||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | out | 0.30 | 1.04097 | 4 | 0.00 | 0.00 | 150.00 | 3 150.00 | |

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | in | 0.30 | 1.05149 | 5 | 0.00 | 0.00 | 0.00 | 3 150.00 | |

| 2017.01.05 17:28:37 | 5 | EURUSD | buy | out | 0.30 | 1.05649 | 6 | 0.00 | 0.00 | -150.00 | 3 000.00 | |

| 0.00 | 0.00 | 0.00 | 3 000.00 | |||||||||

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 2017.01.03 10:00:00 | filled | |||||

| 2017.01.03 10:00:00 | 3 | EURUSD | buy stop | 0.30 / 0.00 | 1.05097 | 2017.01.03 11:34:38 | canceled | |||||

| 2017.01.03 10:00:00 | 4 | EURUSD | buy limit | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | |||||

| 2017.01.05 11:00:00 | 5 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 2017.01.05 11:00:00 | filled | |||||

| 2017.01.05 11:00:00 | 6 | EURUSD | buy stop | 0.30 / 0.30 | 1.05649 | 2017.01.05 17:28:37 | filled | |||||

| 2017.01.05 11:00:00 | 7 | EURUSD | buy limit | 0.30 / 0.00 | 1.04649 | 2017.01.05 17:28:37 | canceled | |||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | out | 0.30 | 1.04097 | 4 | 0.00 | 0.00 | 150.00 | 3 150.00 | |

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | in | 0.30 | 1.05149 | 5 | 0.00 | 0.00 | 0.00 | 3 150.00 | |

| 2017.01.05 17:28:37 | 5 | EURUSD | buy | out | 0.30 | 1.05649 | 6 | 0.00 | 0.00 | -150.00 | 3 000.00 | |

| 0.00 | 0.00 | 0.00 | 3 000.00 | |||||||||

The following table shows the use of virtual stops in MetaTrader 5, netting mode. The virtual stop levels in netting mode may look the same as in hedging mode, but the internal workings are different.

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 2017.01.03 10:00:00 | filled | |||||

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | |||||

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 2017.01.05 11:00:00 | filled | |||||

| 2017.01.05 17:28:37 | 5 | EURUSD | buy | 0.30 / 0.30 | 1.05649 | 2017.01.05 17:28:37 | filled | |||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | out | 0.30 | 1.04097 | 3 | 0.00 | 0.00 | 150.00 | 3 150.00 | |

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | in | 0.30 | 1.05149 | 4 | 0.00 | 0.00 | 0.00 | 3 150.00 | |

| 2017.01.05 17:28:37 | 5 | EURUSD | buy | out | 0.30 | 1.05649 | 5 | 0.00 | 0.00 | -150.00 | 3 000.00 | |

| 0.00 | 0.00 | 0.00 | 3 000.00 | |||||||||

Example #2: An EA using Heiken Ashi and Moving Average, with Three Stop Levels

More complex expert advisors often require more than one stoploss and takeprofit. We use the same method as the previous example in adding additional stop levels, namely the stop levels named "stop1" and "stop2":

int OnInit() { //--- other code CStops *stops=new CStops(); CStop *main=new CStop("main"); main.StopType(stop_type_main); main.VolumeType(VOLUME_TYPE_PERCENT_TOTAL); main.Main(true); main.StopLoss(stop_loss); main.TakeProfit(take_profit); stops.Add(GetPointer(main)); CStop *stop1=new CStop("stop1"); stop1.StopType(stop_type1); stop1.VolumeType(VOLUME_TYPE_PERCENT_TOTAL); stop1.Volume(0.35); stop1.StopLoss(stop_loss1); stop1.TakeProfit(take_profit1); stops.Add(GetPointer(stop1)); CStop *stop2=new CStop("stop2"); stop2.StopType(stop_type2); stop2.VolumeType(VOLUME_TYPE_PERCENT_TOTAL); stop2.Volume(0.35); stop2.StopLoss(stop_loss2); stop2.TakeProfit(take_profit2); stops.Add(GetPointer(stop2)); order_manager.AddStops(GetPointer(stops)); //--- other code }

The following table shows the results of a test on MetaTrader 4:

| # | Time | Type | Order | Size | Price | S / L | T / P | Profit | Balance |

| 1 | 2017.01.03 10:00 | sell | 1 | 0.30 | 1.04597 | 1.05097 | 1.04097 | ||

| 2 | 2017.01.03 10:00 | buy stop | 2 | 0.11 | 1.04847 | 0.00000 | 0.00000 | ||

| 3 | 2017.01.03 10:00 | buy limit | 3 | 0.11 | 1.04347 | 0.00000 | 0.00000 | ||

| 4 | 2017.01.03 10:21 | buy | 3 | 0.11 | 1.04347 | 0.00000 | 0.00000 | ||

| 5 | 2017.01.03 10:21 | close by | 1 | 0.11 | 1.04347 | 1.05097 | 1.04097 | 27.50 | 3027.50 |

| 6 | 2017.01.03 10:21 | sell | 4 | 0.19 | 1.04597 | 1.05097 | 1.04097 | ||

| 7 | 2017.01.03 10:21 | close by | 3 | 0.00 | 1.04347 | 0.00000 | 0.00000 | 0.00 | 3027.50 |

| 8 | 2017.01.03 10:21 | delete | 2 | 0.11 | 1.04847 | 0.00000 | 0.00000 | ||

| 9 | 2017.01.03 10:34 | close | 4 | 0.11 | 1.04247 | 1.05097 | 1.04097 | 38.50 | 3066.00 |

| 10 | 2017.01.03 10:34 | sell | 5 | 0.08 | 1.04597 | 1.05097 | 1.04097 | ||

| 11 | 2017.01.03 11:34 | t/p | 5 | 0.08 | 1.04097 | 1.05097 | 1.04097 | 40.00 | 3106.00 |

| 12 | 2017.01.05 11:00 | sell | 6 | 0.30 | 1.05149 | 1.05649 | 1.04649 | ||

| 13 | 2017.01.05 11:00 | buy stop | 7 | 0.11 | 1.05399 | 0.00000 | 0.00000 | ||

| 14 | 2017.01.05 11:00 | buy limit | 8 | 0.11 | 1.04899 | 0.00000 | 0.00000 | ||

| 15 | 2017.01.05 12:58 | buy | 8 | 0.11 | 1.04899 | 0.00000 | 0.00000 | ||

| 16 | 2017.01.05 12:58 | close by | 6 | 0.11 | 1.04899 | 1.05649 | 1.04649 | 27.50 | 3133.50 |

| 17 | 2017.01.05 12:58 | sell | 9 | 0.19 | 1.05149 | 1.05649 | 1.04649 | ||

| 18 | 2017.01.05 12:58 | close by | 8 | 0.00 | 1.04899 | 0.00000 | 0.00000 | 0.00 | 3133.50 |

| 19 | 2017.01.05 12:58 | delete | 7 | 0.11 | 1.05399 | 0.00000 | 0.00000 | ||

| 20 | 2017.01.05 16:00 | close | 9 | 0.19 | 1.05314 | 1.05649 | 1.04649 | -31.35 | 3102.15 |

| 21 | 2017.01.05 16:00 | buy | 10 | 0.30 | 1.05314 | 1.04814 | 1.05814 | ||

| 22 | 2017.01.05 16:00 | sell stop | 11 | 0.11 | 1.05064 | 0.00000 | 0.00000 | ||

| 23 | 2017.01.05 16:00 | sell limit | 12 | 0.11 | 1.05564 | 0.00000 | 0.00000 | ||

| 24 | 2017.01.05 17:09 | sell | 12 | 0.11 | 1.05564 | 0.00000 | 0.00000 | ||

| 25 | 2017.01.05 17:09 | close by | 10 | 0.11 | 1.05564 | 1.04814 | 1.05814 | 27.50 | 3129.65 |

| 26 | 2017.01.05 17:09 | buy | 13 | 0.19 | 1.05314 | 1.04814 | 1.05814 | ||

| 27 | 2017.01.05 17:09 | close by | 12 | 0.00 | 1.05564 | 0.00000 | 0.00000 | 0.00 | 3129.65 |

| 28 | 2017.01.05 17:09 | delete | 11 | 0.11 | 1.05064 | 0.00000 | 0.00000 | ||

| 29 | 2017.01.05 17:28 | close | 13 | 0.11 | 1.05664 | 1.04814 | 1.05814 | 38.50 | 3168.15 |

| 30 | 2017.01.05 17:28 | buy | 14 | 0.08 | 1.05314 | 1.04814 | 1.05814 | ||

| 31 | 2017.01.05 17:40 | t/p | 14 | 0.08 | 1.05814 | 1.04814 | 1.05814 | 40.00 | 3208.15 |

As shown on the table above, all the three stop levels were triggered for the first trade. For the virtual stop level, the EA performed a partial close on the main trade as expected. For the stop level using pending orders, as soon as the pending order was executed, the EA performed a close by operation and deducted its volume from the main trade. Finally, for the main stop level, which is a broker-based stop, the main trade has left the market with its remaining volume of 0.08 lot.

The following table shows the results

of a test on MetaTrader 5, hedging mode:

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 1.05097 | 1.04097 | 2017.01.03 10:00:00 | filled | |||

| 2017.01.03 10:00:00 | 3 | EURUSD | buy stop | 0.11 / 0.00 | 1.04847 | 2017.01.03 10:21:32 | canceled | |||||

| 2017.01.03 10:00:00 | 4 | EURUSD | buy limit | 0.11 / 0.11 | 1.04347 | 2017.01.03 10:21:32 | filled | |||||

| 2017.01.03 10:21:32 | 5 | EURUSD | close by | 0.11 / 0.11 | 1.04347 | 2017.01.03 10:21:32 | filled | close #2 by #4 | ||||

| 2017.01.03 10:33:40 | 6 | EURUSD | buy | 0.11 / 0.11 | 1.04247 | 2017.01.03 10:33:40 | filled | |||||

| 2017.01.03 11:34:38 | 7 | EURUSD | buy | 0.08 / 0.08 | 1.04097 | 2017.01.03 11:34:38 | filled | tp 1.04097 | ||||

| 2017.01.05 11:00:00 | 8 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 1.05649 | 1.04649 | 2017.01.05 11:00:00 | filled | |||

| 2017.01.05 11:00:00 | 9 | EURUSD | buy stop | 0.11 / 0.00 | 1.05399 | 2017.01.05 12:58:27 | canceled | |||||

| 2017.01.05 11:00:00 | 10 | EURUSD | buy limit | 0.11 / 0.11 | 1.04899 | 2017.01.05 12:58:27 | filled | |||||

| 2017.01.05 12:58:27 | 11 | EURUSD | close by | 0.11 / 0.11 | 1.04896 | 2017.01.05 12:58:27 | filled | close #8 by #10 | ||||

| 2017.01.05 16:00:00 | 12 | EURUSD | buy | 0.19 / 0.19 | 1.05307 | 2017.01.05 16:00:00 | filled | |||||

| 2017.01.05 16:00:00 | 13 | EURUSD | buy | 0.30 / 0.30 | 1.05307 | 1.04807 | 1.05807 | 2017.01.05 16:00:00 | filled | |||

| 2017.01.05 16:00:00 | 14 | EURUSD | sell stop | 0.11 / 0.00 | 1.05057 | 2017.01.05 17:09:40 | canceled | |||||

| 2017.01.05 16:00:00 | 15 | EURUSD | sell limit | 0.11 / 0.11 | 1.05557 | 2017.01.05 17:09:40 | filled | |||||

| 2017.01.05 17:09:40 | 16 | EURUSD | close by | 0.11 / 0.11 | 1.05557 | 2017.01.05 17:09:40 | filled | close #13 by #15 | ||||

| 2017.01.05 17:28:47 | 17 | EURUSD | sell | 0.11 / 0.11 | 1.05660 | 2017.01.05 17:28:47 | filled | |||||

| 2017.01.05 17:29:15 | 18 | EURUSD | sell | 0.08 / 0.08 | 1.05807 | 2017.01.05 17:29:15 | filled | tp 1.05807 | ||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 10:21:32 | 3 | EURUSD | buy | in | 0.11 | 1.04347 | 4 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 10:21:32 | 4 | EURUSD | buy | out by | 0.11 | 1.04347 | 5 | 0.00 | 0.00 | 27.50 | 3 027.50 | close #2 by #4 |

| 2017.01.03 10:21:32 | 5 | EURUSD | sell | out by | 0.11 | 1.04597 | 5 | 0.00 | 0.00 | 0.00 | 3 027.50 | close #2 by #4 |

| 2017.01.03 10:33:40 | 6 | EURUSD | buy | out | 0.11 | 1.04247 | 6 | 0.00 | 0.00 | 38.50 | 3 066.00 | |

| 2017.01.03 11:34:38 | 7 | EURUSD | buy | out | 0.08 | 1.04097 | 7 | 0.00 | 0.00 | 40.00 | 3 106.00 | tp 1.04097 |

| 2017.01.05 11:00:00 | 8 | EURUSD | sell | in | 0.30 | 1.05149 | 8 | 0.00 | 0.00 | 0.00 | 3 106.00 | |

| 2017.01.05 12:58:27 | 9 | EURUSD | buy | in | 0.11 | 1.04896 | 10 | 0.00 | 0.00 | 0.00 | 3 106.00 | |

| 2017.01.05 12:58:27 | 10 | EURUSD | buy | out by | 0.11 | 1.04896 | 11 | 0.00 | 0.00 | 27.83 | 3 133.83 | close #8 by #10 |

| 2017.01.05 12:58:27 | 11 | EURUSD | sell | out by | 0.11 | 1.05149 | 11 | 0.00 | 0.00 | 0.00 | 3 133.83 | close #8 by #10 |

| 2017.01.05 16:00:00 | 12 | EURUSD | buy | out | 0.19 | 1.05307 | 12 | 0.00 | 0.00 | -30.02 | 3 103.81 | |

| 2017.01.05 16:00:00 | 13 | EURUSD | buy | in | 0.30 | 1.05307 | 13 | 0.00 | 0.00 | 0.00 | 3 103.81 | |

| 2017.01.05 17:09:40 | 14 | EURUSD | sell | in | 0.11 | 1.05557 | 15 | 0.00 | 0.00 | 0.00 | 3 103.81 | |

| 2017.01.05 17:09:40 | 16 | EURUSD | buy | out by | 0.11 | 1.05307 | 16 | 0.00 | 0.00 | 0.00 | 3 103.81 | close #13 by #15 |

| 2017.01.05 17:09:40 | 15 | EURUSD | sell | out by | 0.11 | 1.05557 | 16 | 0.00 | 0.00 | 27.50 | 3 131.31 | close #13 by #15 |

| 2017.01.05 17:28:47 | 17 | EURUSD | sell | out | 0.11 | 1.05660 | 17 | 0.00 | 0.00 | 38.83 | 3 170.14 | |

| 2017.01.05 17:29:15 | 18 | EURUSD | sell | out | 0.08 | 1.05807 | 18 | 0.00 | 0.00 | 40.00 | 3 210.14 | tp 1.05807 |

| 0.00 | 0.00 | 210.14 | 3 210.14 | |||||||||

As shown on the table above, the EA works in somewhat a similar way in MetaTrader 5, hedging mode. The mechanics were the same as in MetaTrader 4 for the three types of stop levels.

The following table shows the results of a test on MetaTrader 5, netting mode:

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 2017.01.03 10:00:00 | filled | |||||

| 2017.01.03 10:00:00 | 3 | EURUSD | buy stop | 0.30 / 0.00 | 1.05097 | 2017.01.03 11:34:38 | canceled | |||||

| 2017.01.03 10:00:00 | 4 | EURUSD | buy limit | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | |||||

| 2017.01.03 10:00:00 | 5 | EURUSD | buy stop | 0.11 / 0.00 | 1.04847 | 2017.01.03 10:21:32 | canceled | |||||

| 2017.01.03 10:00:00 | 6 | EURUSD | buy limit | 0.11 / 0.11 | 1.04347 | 2017.01.03 10:21:32 | filled | |||||

| 2017.01.03 10:33:40 | 7 | EURUSD | buy | 0.11 / 0.11 | 1.04247 | 2017.01.03 10:33:40 | filled | |||||

| 2017.01.05 11:00:00 | 8 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 2017.01.05 11:00:00 | filled | |||||

| 2017.01.05 11:00:00 | 9 | EURUSD | buy stop | 0.30 / 0.00 | 1.05649 | 2017.01.05 16:00:00 | canceled | |||||

| 2017.01.05 11:00:00 | 10 | EURUSD | buy limit | 0.30 / 0.00 | 1.04649 | 2017.01.05 16:00:00 | canceled | |||||

| 2017.01.05 11:00:00 | 11 | EURUSD | buy stop | 0.11 / 0.00 | 1.05399 | 2017.01.05 12:58:27 | canceled | |||||

| 2017.01.05 11:00:00 | 12 | EURUSD | buy limit | 0.11 / 0.11 | 1.04899 | 2017.01.05 12:58:27 | filled | |||||

| 2017.01.05 16:00:00 | 13 | EURUSD | buy | 0.19 / 0.19 | 1.05307 | 2017.01.05 16:00:00 | filled | |||||

| 2017.01.05 16:00:00 | 14 | EURUSD | buy | 0.30 / 0.30 | 1.05307 | 2017.01.05 16:00:00 | filled | |||||

| 2017.01.05 16:00:00 | 15 | EURUSD | sell stop | 0.30 / 0.00 | 1.04807 | 2017.01.05 17:29:15 | canceled | |||||

| 2017.01.05 16:00:00 | 16 | EURUSD | sell limit | 0.30 / 0.30 | 1.05807 | 2017.01.05 17:29:15 | filled | |||||

| 2017.01.05 16:00:00 | 17 | EURUSD | sell stop | 0.11 / 0.00 | 1.05057 | 2017.01.05 17:09:40 | canceled | |||||

| 2017.01.05 16:00:00 | 18 | EURUSD | sell limit | 0.11 / 0.11 | 1.05557 | 2017.01.05 17:09:40 | filled | |||||

| 2017.01.05 17:28:47 | 19 | EURUSD | sell | 0.11 / 0.11 | 1.05660 | 2017.01.05 17:28:47 | filled | |||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 5 | EURUSD | buy | in/out | 0.30 | 1.04097 | 4 | 0.00 | 0.00 | 40.00 | 3 040.00 | |

| 2017.01.03 10:21:32 | 3 | EURUSD | buy | out | 0.11 | 1.04347 | 6 | 0.00 | 0.00 | 27.50 | 3 067.50 | |

| 2017.01.03 10:33:40 | 4 | EURUSD | buy | out | 0.11 | 1.04247 | 7 | 0.00 | 0.00 | 38.50 | 3 106.00 | |

| 2017.01.05 11:00:00 | 6 | EURUSD | sell | in/out | 0.30 | 1.05149 | 8 | 0.00 | -0.61 | 231.44 | 3 336.83 | |

| 2017.01.05 12:58:27 | 7 | EURUSD | buy | in/out | 0.11 | 1.04896 | 12 | 0.00 | 0.00 | 20.24 | 3 357.07 | |

| 2017.01.05 16:00:00 | 8 | EURUSD | buy | in | 0.19 | 1.05307 | 13 | 0.00 | 0.00 | 0.00 | 3 357.07 | |

| 2017.01.05 16:00:00 | 9 | EURUSD | buy | in | 0.30 | 1.05307 | 14 | 0.00 | 0.00 | 0.00 | 3 357.07 | |

| 2017.01.05 17:29:15 | 12 | EURUSD | sell | out | 0.30 | 1.05807 | 16 | 0.00 | 0.00 | 157.11 | 3 514.18 | |

| 2017.01.05 17:09:40 | 10 | EURUSD | sell | out | 0.11 | 1.05557 | 18 | 0.00 | 0.00 | 30.11 | 3 544.29 | |

| 2017.01.05 17:28:47 | 11 | EURUSD | sell | out | 0.11 | 1.05660 | 19 | 0.00 | 0.00 | 41.44 | 3 585.73 | |

| 0.00 | -0.61 | 586.34 | 3 585.73 | |||||||||

Here, we encountered a problem. The final stop level closed at 0.30 lot rather than 0.08 lot as observed in the two previous tests.

As discussed earlier, the standard stoploss and takeprofit in MetaTrader 5, netting mode, is different to those of the previous two. Thus, the EA would convert the broker-based stop into a pending-order-based stop instead. However, with this setting, the EA already has two stop levels based on pending orders, and one of them is a main stop. As also discussed earlier, this would lead to orphan trades. The final or main stop level would always have a volume equal to the initial volume of the main trade. And since there were other stop levels involved, it can lead to the main stop level to close the main position for more than its remaining volume.

In order to fix this, one way is to set

the main stop to be virtual instead, rather than being broker-based

or pending-order based. With this new setting, the EA now has 2 stops that are virtual, and one stop that is based on pending orders. The result of a test using this new setting is shown

below.

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 2017.01.03 10:00:00 | filled | |||||

| 2017.01.03 10:00:00 | 3 | EURUSD | buy stop | 0.11 / 0.00 | 1.04847 | 2017.01.03 10:21:32 | canceled | |||||

| 2017.01.03 10:00:00 | 4 | EURUSD | buy limit | 0.11 / 0.11 | 1.04347 | 2017.01.03 10:21:32 | filled | |||||

| 2017.01.03 10:33:40 | 5 | EURUSD | buy | 0.11 / 0.11 | 1.04247 | 2017.01.03 10:33:40 | filled | |||||

| 2017.01.03 11:34:38 | 6 | EURUSD | buy | 0.08 / 0.08 | 1.04097 | 2017.01.03 11:34:38 | filled | |||||

| 2017.01.05 11:00:00 | 7 | EURUSD | sell | 0.30 / 0.30 | 1.05149 | 2017.01.05 11:00:00 | filled | |||||

| 2017.01.05 11:00:00 | 8 | EURUSD | buy stop | 0.11 / 0.00 | 1.05399 | 2017.01.05 12:58:27 | canceled | |||||

| 2017.01.05 11:00:00 | 9 | EURUSD | buy limit | 0.11 / 0.11 | 1.04899 | 2017.01.05 12:58:27 | filled | |||||

| 2017.01.05 16:00:00 | 10 | EURUSD | buy | 0.19 / 0.19 | 1.05307 | 2017.01.05 16:00:00 | filled | |||||

| 2017.01.05 16:00:00 | 11 | EURUSD | buy | 0.30 / 0.30 | 1.05307 | 2017.01.05 16:00:00 | filled | |||||

| 2017.01.05 16:00:00 | 12 | EURUSD | sell stop | 0.11 / 0.00 | 1.05057 | 2017.01.05 17:09:40 | canceled | |||||

| 2017.01.05 16:00:00 | 13 | EURUSD | sell limit | 0.11 / 0.11 | 1.05557 | 2017.01.05 17:09:40 | filled | |||||

| 2017.01.05 17:28:47 | 14 | EURUSD | sell | 0.11 / 0.11 | 1.05660 | 2017.01.05 17:28:47 | filled | |||||

| 2017.01.05 17:29:15 | 15 | EURUSD | sell | 0.08 / 0.08 | 1.05807 | 2017.01.05 17:29:15 | filled | |||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 10:21:32 | 3 | EURUSD | buy | out | 0.11 | 1.04347 | 4 | 0.00 | 0.00 | 27.50 | 3 027.50 | |

| 2017.01.03 10:33:40 | 4 | EURUSD | buy | out | 0.11 | 1.04247 | 5 | 0.00 | 0.00 | 38.50 | 3 066.00 | |

| 2017.01.03 11:34:38 | 5 | EURUSD | buy | out | 0.08 | 1.04097 | 6 | 0.00 | 0.00 | 40.00 | 3 106.00 | |

| 2017.01.05 11:00:00 | 6 | EURUSD | sell | in | 0.30 | 1.05149 | 7 | 0.00 | 0.00 | 0.00 | 3 106.00 | |

| 2017.01.05 12:58:27 | 7 | EURUSD | buy | out | 0.11 | 1.04896 | 9 | 0.00 | 0.00 | 27.83 | 3 133.83 | |

| 2017.01.05 16:00:00 | 8 | EURUSD | buy | out | 0.19 | 1.05307 | 10 | 0.00 | 0.00 | -30.02 | 3 103.81 | |

| 2017.01.05 16:00:00 | 9 | EURUSD | buy | in | 0.30 | 1.05307 | 11 | 0.00 | 0.00 | 0.00 | 3 103.81 | |

| 2017.01.05 17:09:40 | 10 | EURUSD | sell | out | 0.11 | 1.05557 | 13 | 0.00 | 0.00 | 27.50 | 3 131.31 | |

| 2017.01.05 17:28:47 | 11 | EURUSD | sell | out | 0.11 | 1.05660 | 14 | 0.00 | 0.00 | 38.83 | 3 170.14 | |

| 2017.01.05 17:29:15 | 12 | EURUSD | sell | out | 0.08 | 1.05807 | 15 | 0.00 | 0.00 | 40.00 | 3 210.14 | |

| 0.00 | 0.00 | 210.14 | 3 210.14 | |||||||||

The total volume taken by the stop levels are now equal to the initial volume of the main trade.

Example #3: Stops with Money Management

In an earlier article (see Cross-Platform Expert Advisor: Money Management), it was discussed that some money management methods depend on a certain stop level (takeprofit is possible, but the stoploss is normally used). Money management methods such as fixed fractional, fixed risk, and fixed risk per point/pip would often require a finite stoploss level. Not setting this level suggests a very large or even infinite risk, and thus, the volume calculated would be very large as well. In order to show an expert advisor capable of using the class objects mentioned in this article with money management, we will modify the first example so that the previously commented lines of code would be included in the compilation.

First, we remove the comment tags on the lines of code for the money management methods, as shown in the code below, within the OnInit functon:

int OnInit() { //--- other code order_manager=new COrderManager(); money_manager= new CMoneys(); CMoney *money_fixed=new CMoneyFixedLot(0.05); CMoney *money_ff=new CMoneyFixedFractional(5); CMoney *money_ratio=new CMoneyFixedRatio(0,0.1,1000); CMoney *money_riskperpoint=new CMoneyFixedRiskPerPoint(0.1); CMoney *money_risk=new CMoneyFixedRisk(100); money_manager.Add(money_fixed); money_manager.Add(money_ff); money_manager.Add(money_ratio); money_manager.Add(money_riskperpoint); money_manager.Add(money_risk); order_manager.AddMoneys(money_manager); //--- other code }

Then, at the top of the source code, we declare a custom enumeration so that we could create an external parameter that would allow us to select the money management method to use, in the order they were presented in the source code:

enum ENUM_MM_TYPE { MM_FIXED=0, MM_FIXED_FRACTIONAL, MM_FIXED_RATIO, MM_FIXED_RISK_PER_POINT, MM_FIXED_RISK };

We then declare a new input parameter for this enumeration:

input ENUM_MM_TYPE mm_type=MM_FIXED_FRACTIONAL;

Finally, we have to link this parameter to the actual selection of the money management method within the OnTick function:

void OnTick() { //--- manage_trades(); if(symbol_info.RefreshRates()) { signals.Check(); if(signals.CheckOpenLong()) { close_last(); if(time_filters.Evaluate(TimeCurrent())) { Print("Entering buy trade.."); money_manager.Selected((int)mm_type); //use mm_type, cast to 'int' type order_manager.TradeOpen(Symbol(),ORDER_TYPE_BUY,symbol_info.Ask()); } } else if(signals.CheckOpenShort()) { close_last(); if(time_filters.Evaluate(TimeCurrent())) { Print("Entering sell trade.."); money_manager.Selected((int)mm_type); //use mm_type, cast to 'int' type order_manager.TradeOpen(Symbol(),ORDER_TYPE_SELL,symbol_info.Bid()); } } } }

Since the money management methods deal only with pure calculation, there is no issue regarding compatibility between MQL4 and MQL5. The previous two examples have already shown how the stop levels work on the two platforms. The following tables show the results of tests on MetaTrader 5, hedging mode.

The following table shows a test result using fixed fractional money management. The coded setting is to risk 5% of the account. With a starting balance of $3000, we expect the value to be around $150 if it hits stoploss for the first trade. Since the stoploss and takeprofit have the same value (500 points), then we expect the trade to earn $150 as well if it hit takeprofit.

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.30 / 0.30 | 1.04597 | 1.05097 | 1.04097 | 2017.01.03 10:00:00 | filled | |||

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | 0.30 / 0.30 | 1.04097 | 2017.01.03 11:34:38 | filled | tp 1.04097 | ||||

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | 0.32 / 0.32 | 1.05149 | 1.05649 | 1.04649 | 2017.01.05 11:00:00 | filled | |||

| 2017.01.05 16:00:00 | 5 | EURUSD | buy | 0.32 / 0.32 | 1.05307 | 2017.01.05 16:00:00 | filled | |||||

| 2017.01.05 16:00:00 | 6 | EURUSD | buy | 0.31 / 0.31 | 1.05307 | 1.04807 | 1.05807 | 2017.01.05 16:00:00 | filled | |||

| 2017.01.05 17:29:15 | 7 | EURUSD | sell | 0.31 / 0.31 | 1.05807 | 2017.01.05 17:29:15 | filled | tp 1.05807 | ||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.30 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | out | 0.30 | 1.04097 | 3 | 0.00 | 0.00 | 150.00 | 3 150.00 | tp 1.04097 |

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | in | 0.32 | 1.05149 | 4 | 0.00 | 0.00 | 0.00 | 3 150.00 | |

| 2017.01.05 16:00:00 | 5 | EURUSD | buy | out | 0.32 | 1.05307 | 5 | 0.00 | 0.00 | -50.56 | 3 099.44 | |

| 2017.01.05 16:00:00 | 6 | EURUSD | buy | in | 0.31 | 1.05307 | 6 | 0.00 | 0.00 | 0.00 | 3 099.44 | |

| 2017.01.05 17:29:15 | 7 | EURUSD | sell | out | 0.31 | 1.05807 | 7 | 0.00 | 0.00 | 155.00 | 3 254.44 | tp 1.05807 |

| 0.00 | 0.00 | 254.44 | 3 254.44 | |||||||||

Note that the calculated volume value would also depend on the lot precision of the broker, determined by the minimum lot and minimum lot step parameters. We cannot expect the expert advisor to always make the precise calculations. With these constraints, the expert advisor may find it necessary to round off the value at some point. The same is true for the other methods of money management.

For fixed risk per point money management, the coded setting is to risk $0.1 per point of stoploss. With the setting of 500 points for both stoploss and takeprofit, we expect the profit/loss to be worth $50 either way.

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.10 / 0.10 | 1.04597 | 1.05097 | 1.04097 | 2017.01.03 10:00:00 | filled | |||

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | 0.10 / 0.10 | 1.04097 | 2017.01.03 11:34:38 | filled | tp 1.04097 | ||||

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | 0.10 / 0.10 | 1.05149 | 1.05649 | 1.04649 | 2017.01.05 11:00:00 | filled | |||

| 2017.01.05 16:00:00 | 5 | EURUSD | buy | 0.10 / 0.10 | 1.05307 | 2017.01.05 16:00:00 | filled | |||||

| 2017.01.05 16:00:00 | 6 | EURUSD | buy | 0.10 / 0.10 | 1.05307 | 1.04807 | 1.05807 | 2017.01.05 16:00:00 | filled | |||

| 2017.01.05 17:29:15 | 7 | EURUSD | sell | 0.10 / 0.10 | 1.05807 | 2017.01.05 17:29:15 | filled | tp 1.05807 | ||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.10 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | out | 0.10 | 1.04097 | 3 | 0.00 | 0.00 | 50.00 | 3 050.00 | tp 1.04097 |

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | in | 0.10 | 1.05149 | 4 | 0.00 | 0.00 | 0.00 | 3 050.00 | |

| 2017.01.05 16:00:00 | 5 | EURUSD | buy | out | 0.10 | 1.05307 | 5 | 0.00 | 0.00 | -15.80 | 3 034.20 | |

| 2017.01.05 16:00:00 | 6 | EURUSD | buy | in | 0.10 | 1.05307 | 6 | 0.00 | 0.00 | 0.00 | 3 034.20 | |

| 2017.01.05 17:29:15 | 7 | EURUSD | sell | out | 0.10 | 1.05807 | 7 | 0.00 | 0.00 | 50.00 | 3 084.20 | tp 1.05807 |

| 0.00 | 0.00 | 84.20 | 3 084.20 | |||||||||

For fixed risk money management, the coded setting is to risk $100. The EA, in turn, would have to calculate a volume that would fit to this set risk. The result is shown below.

Orders |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Open Time | Order | Symbol | Type | Volume | Price | S / L | T / P | Time | State | Comment | ||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | 0.20 / 0.20 | 1.04597 | 1.05097 | 1.04097 | 2017.01.03 10:00:00 | filled | |||

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | 0.20 / 0.20 | 1.04097 | 2017.01.03 11:34:38 | filled | tp 1.04097 | ||||

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | 0.20 / 0.20 | 1.05149 | 1.05649 | 1.04649 | 2017.01.05 11:00:00 | filled | |||

| 2017.01.05 16:00:00 | 5 | EURUSD | buy | 0.20 / 0.20 | 1.05307 | 2017.01.05 16:00:00 | filled | |||||

| 2017.01.05 16:00:00 | 6 | EURUSD | buy | 0.20 / 0.20 | 1.05307 | 1.04807 | 1.05807 | 2017.01.05 16:00:00 | filled | |||

| 2017.01.05 17:29:15 | 7 | EURUSD | sell | 0.20 / 0.20 | 1.05807 | 2017.01.05 17:29:15 | filled | tp 1.05807 | ||||

Deals |

||||||||||||

| Time | Deal | Symbol | Type | Direction | Volume | Price | Order | Commission | Swap | Profit | Balance | Comment |

| 2017.01.01 00:00:00 | 1 | balance | 0.00 | 0.00 | 3 000.00 | 3 000.00 | ||||||

| 2017.01.03 10:00:00 | 2 | EURUSD | sell | in | 0.20 | 1.04597 | 2 | 0.00 | 0.00 | 0.00 | 3 000.00 | |

| 2017.01.03 11:34:38 | 3 | EURUSD | buy | out | 0.20 | 1.04097 | 3 | 0.00 | 0.00 | 100.00 | 3 100.00 | tp 1.04097 |

| 2017.01.05 11:00:00 | 4 | EURUSD | sell | in | 0.20 | 1.05149 | 4 | 0.00 | 0.00 | 0.00 | 3 100.00 | |

| 2017.01.05 16:00:00 | 5 | EURUSD | buy | out | 0.20 | 1.05307 | 5 | 0.00 | 0.00 | -31.60 | 3 068.40 | |

| 2017.01.05 16:00:00 | 6 | EURUSD | buy | in | 0.20 | 1.05307 | 6 | 0.00 | 0.00 | 0.00 | 3 068.40 | |

| 2017.01.05 17:29:15 | 7 | EURUSD | sell | out | 0.20 | 1.05807 | 7 | 0.00 | 0.00 | 100.00 | 3 168.40 | tp 1.05807 |

| 0.00 | 0.00 | 168.40 | 3 168.40 | |||||||||

Conclusion

In this article, we have discussed the addition of stop levels in a cross-platform expert advisor. The two trading platforms, although having many parallel features, vary significantly in the way stop levels are implemented. This article has a provided a method where these differences can be reconciled in order for an expert advisor to be compatible with both platforms.

Programs Used In The Article

| # |

Name |

Type |

Description |

|---|---|---|---|

| 1. |

stops_ha_ma1.mqh |

Header File |

The main header file used for the expert advisor in the first example |

| 2. |

stops_ha_ma1.mq4 | Expert Advisor |

The main source file used for the MQL4 expert advisor in the first example |

| 3. |

stops_ha_ma1.mq5 | Expert Advisor | The main source file used for the MQL5 expert advisor in the first example |

| 4. | stops_ha_ma2.mqh | Header File | The main header file used for the expert advisor in the second example |

| 5. | stops_ha_ma2.mq4 | Expert Advisor |

The main source file used for the MQL4 expert advisor in the second example |

| 6. | stops_ha_ma2.mq5 | Expert Advisor |

The main source file used for the MQL5 expert advisor in the second example |

| 7. | stops_ha_ma3.mqh | Header File | The main header file used for the expert advisor in the third example |

| 8. | stops_ha_ma3.mq4 | Expert Advisor |

The main source file used for the MQL4 expert advisor in the third example |

| 9. | stops_ha_ma3.mq5 | Expert Advisor |

The main source file used for the MQL5 expert advisor in the third example |

Class Files Featured In The Article

| # |

Name |

Type |

Description |

|---|---|---|---|

| 1. |

MQLx\Base\Stop\StopBase.mqh |

Header File |

CStop (base class) |

| 2. |

MQLx\MQL4\Stop\Stop.mqh | Header File | CStop (MQL4 version) |

| 3. |

MQLx\MQL5\Stop\Stop.mqh | Header File | CStop (MQL5 version) |

| 4. | MQLx\Base\Stop\StopsBase.mqh | Header File | CStops (CStop container, base class) |

| 5. | MQLx\MQL4\Stop\Stops.mqh | Header File | CStops (MQL4 version) |

| 6. | MQLx\MQL5\Stop\Stops.mqh | Header File | CStops (MQL5 version) |

| 7. | MQLx\Base\Stop\StopLineBase.mqh | Header File | CStopLine (graphical representation, base class) |

| 8. | MQLx\MQL4\Stop\StopLine.mqh | Header File | CStopLine (MQL4 version) |

| 9. | MQLx\MQL5\Stop\StopLine.mqh | Header File | CStopLine (MQL5 version) |

| 10. | MQLx\Base\Order\OrderStopBase.mqh | Header File | COrderStop (base class) |

| 11. | MQLx\MQL4\Order\OrderStop.mqh | Header File | COrderStop (MQL4 version) |

| 12. | MQLx\MQL5\Order\OrderStop.mqh | Header File | COrderStop (MQL5 version) |

| 13. |

MQLx\Base\Order\OrderStopVirtualBase.mqh | Header File |

COrderStopVirtual (virtual stop level, base class) |

| 14. | MQLx\Base\Order\OrderStopVirtual.mqh | Header File |

COrderStopVirtual (MQL4 version) |

| 15. |

MQLx\Base\Order\OrderStopVirtual.mqh | Header File |

COrderStopVirtual (MQL5 version) |

| 16. | MQLx\Base\Order\OrderStopPendingBase.mqh | Header File |

COrderStopPending (pending order stop level, base class) |

| 17. | MQLx\Base\Order\OrderStopPending.mqh | Header File |

COrderStopPending (MQL4 version) |

| 18. |

MQLx\Base\Order\OrderStopPending.mqh | Header File |

COrderStopPending (MQL5 version) |

| 19. |

MQLx\Base\Order\OrderStopBroker.mqh | Header File |

COrderStopBroker (broker-based stop level, base class) |

| 20. | MQLx\Base\Order\OrderStopBroker.mqh | Header File |

COrderStopBroker (MQL4 version) |

| 21. | MQLx\Base\Order\OrderStopBroker.mqh | Header File |

COrderStopBroker (MQL5 version) |

| 22. | MQLx\Base\Order\OrderStopsBase.mqh | Header File |

COrderStops (COrderStop container, base class) |

| 23. | MQLx\Base\Order\OrderStops.mqh | Header File |

COrderStops (MQL4 version) |

| 24. | MQLx\Base\Order\OrderStops.mqh | Header File |

COrderStops (MQL5 version) |