MQL5: Analysis and Processing of Commodity Futures Trading Commission (CFTC) Reports in MetaTrader 5

Introduction

MetaTrader 5 trading terminal, developed by MetaQuotes Software Corp., as one of the trader's tools contains the MQL5 programming language, that supports object-oriented programming. On one hand, MQL5 is not compatible with its previous version - MQL4, on the other - it has a lot of new possibilities of fully-featured object-oriented language. So, traders, who already have skills in MQL4, have to comprehend this (in fact) new language, and I consider them as target audience of this article.

In this article, I will show a solution of the following problem: it's necessary to develop the trader tool, that allows to get and analyze different data of Commodity Futures Trading Commission (CFTC) Reports. This topic already has been considered in the article Meta COT Project - New Horizons for CFTC Report Analysis in MetaTrader 4, so I will assume that the reader is familiar with concepts, and we will consider the details that aren't described there.

The idea is following: to develop a single indicator, that allows to get data from files, provided by Commission, without intermediate processing and conversion. Further, it can be used for the different purposes: to plot data as an indicator; as data source in other indicators; in scripts for automated analysis; in the Expert Advisors when developing trading strategies.

1.Types of COT reports

There are three types of reports: Current Legacy Report (COT), Supplemental Commodity Index (CIT), Current Disaggregated Report (DCOT), the difference between them is presented in Table 1.

| Description | Current Legacy Reports | Supplemental Commodity Index | Current Disaggregated Reports |

|---|---|---|---|

| Short name | COT | CIT | DCOT |

| Refrence title | Current Legacy Reports | Supplemental Commodity Index | Current Disaggregated Reports |

| Reference to the recent data file | |||

| Groups of traders, presented in the report | Noncommercial Commercial Non-reportable | Noncommercial Commercial Non-reportable Index Traders | Producer/Merchant/Processor/User Swap Dealers Managed Money Other Reportables Non-reportable |

Table 1. Types of Commitments of Traders reports

Information about traders, who should report their positions on the futures markets, principles of classification and periodicity of reports can be found in the "Trade Stocks and Commodities With the Insiders: Secrets of the COT Report" book and in the Meta COT Project - New Horizons for CFTC Report Analysis in MetaTrader 4 article.

I will consider two reports, that aren't described in these sources.

The CIT acronym stands for Commitments of Index Traders. This report is being published since 2007. The current CIT report web-page is available at https://cftc.gov/dea/options/deaviewcit.htm. The index traders are in a separate group from the hedgers and speculators.

The description of the Supplemental Report can be found at https://www.cftc.gov/MarketReports/CommitmentsofTraders/AbouttheCOTReports/index.htm. All these index traders often open long positions on the markets and roll-over them from contract to contract.

Since 2009 Commission publishes the Disaggregated Commitments of Traders Report, its description can be found in the explanatory notes.

The Disaggregated COT report increases transparency from the legacy COT reports by separating traders into the following four categories of traders: Producer/Merchant/Processor/User; Swap Dealers; Managed Money; and Other Reportables.

- Producer/Merchant/Processor/User. A “producer/merchant/processor/user” is an entity that predominantly engages in the production, processing, packing or handling of a physical commodity and uses the futures markets to manage or hedge risks associated with those activities.

- Swap Dealer. A “swap dealer” is an entity that deals primarily in swaps for a commodity and uses the futures markets to manage or hedge the risk associated with those swaps transactions. The swap dealer's counterparties may be speculative traders, like hedge funds, or traditional commercial clients that are managing risk arising from their dealings in the physical commodity.

- Money Manager. A “money manager,” for the purpose of this report, is a registered commodity trading advisor (CTA); a registered commodity pool operator (CPO); or an unregistered fund identified by CFTC. These traders are engaged in managing and conducting organized futures trading on behalf of clients.

- Other Reportables. Every other reportable trader that is not placed into one of the other three categories is placed into the “other reportables” category.

The full list of reported instruments is presented in the Appendix 2. There are also columns that reflect the presence of particular instrument in the CIT and DCOT reports.

2. Writing a COT indicator, that uses external data from CSV files

The indicator will work as follows. The type of report (one of the listed in Table 1), the type of data and the group of traders are defined in the input parameters of the indicator.

The type of data may be following:

- net longs

- net longs rate in open interest

- Williams Index, calculated for net longs

- open interest

The list of possible data types isn't complete, it can be easily extended further to include most essential data, that I use. For the current symbol, the specified data is requested from data files (downloading and unpacking them is described below). We will use the CCFTCReport class for data access and downloading them from these files.

The indicator has the following structure:

2.1. Constants

To define constants the enum data type is used. The report types, supported by indicator, are following:enum cot_type_report // type of report { COT, DCOT, CIT };

Groups of traders:

enum cot_type_traders // types of traders { noncommercial, // Non-commercial commercial, // Commercial nonreportable, // Non-reportable index, // Index traders producer, // Producers swapdealers, // Swap dealers managedmoney, // Managed money otherreportables // Other reportable traders };

Data types, that can be used in indicator:

enum cot_type_data // type of COT data { netlongs, // net longs netlongsrate, // net longs rate in the open interest willams_index, // Williams index openinterest // Open interest };

2.2. Classes

To store different objects within a single variable it's possible to use structures and classes. However, it's not possible to assign two variables of structure type, if they contain dynamic arrays or values of a string type. That's why we have used class instead of structure to store COT record, and method for data assignment.

class cot_record // class for data record of COT report { public: datetime COT_DATE; //date double COT_OPENINTEREST; //open interest double COT_LONGNONCOM; //longs of non-commercial traders double COT_SHORTNONCOM; //shorts of non-commercial traders double COT_LONGCOM; //longs of commercial traders double COT_SHORTCOM; //shorts of commercial traders double COT_LONGNONREPORTABLE; //longs of the other non-reportable traders double COT_SHORTNONREPORTABLE; //shorts of the other non-reportable traders double COT_LONGINDEX; //longs of index traders double COT_SHORTINDEX; //shorts of index traders double COT_LONGPRODUCER; //longs of Producer/Merchant/Processor/User double COT_SHORTPRODUCER; //shorts of Producer/Merchant/Processor/User double COT_LONGSWAPDEALERS; //longs of Swap Dealers double COT_SHORTSWAPDEALERS; //shorts of Swap Dealers double COT_LONGMANAGEDMONEY; //longs of Managed Money traders double COT_SHORTMANAGEDMONEY; //shorts of the Managed Money traders double COT_LONGOTHERREPORTABLES; //Other Reportables double COT_SHORTOTHERREPORTABLES; string COT_ID; //instrument identifier string COT_NAME; //instrument (symbol) name void copyvar(const cot_record &from) // copying contents (values of variables) from one class to another { COT_ID = from.COT_ID; COT_NAME = from.COT_NAME; COT_DATE = from.COT_DATE; COT_OPENINTEREST = from.COT_OPENINTEREST; COT_LONGNONCOM = from.COT_LONGNONCOM; COT_SHORTNONCOM = from.COT_SHORTNONCOM; COT_LONGCOM = from.COT_LONGCOM; COT_SHORTCOM = from.COT_SHORTCOM; COT_LONGNONREPORTABLE = from.COT_LONGNONREPORTABLE; COT_SHORTNONREPORTABLE = from.COT_SHORTNONREPORTABLE; COT_LONGINDEX = from.COT_LONGINDEX; COT_SHORTINDEX = from.COT_SHORTINDEX; COT_LONGPRODUCER = from.COT_LONGPRODUCER; COT_SHORTPRODUCER = from.COT_SHORTPRODUCER; COT_LONGSWAPDEALERS = from.COT_LONGSWAPDEALERS; COT_SHORTSWAPDEALERS = from.COT_SHORTSWAPDEALERS; COT_LONGMANAGEDMONEY = from.COT_LONGMANAGEDMONEY; COT_SHORTMANAGEDMONEY = from.COT_SHORTMANAGEDMONEY; COT_LONGOTHERREPORTABLES = from.COT_LONGOTHERREPORTABLES; COT_SHORTOTHERREPORTABLES = from.COT_SHORTOTHERREPORTABLES; }; };

From now I will assume that reader is familiar with CSV format of COT reports, that is considered in the Meta COT Project - New Horizons for CFTC Report Analysis in MetaTrader 4 article. The class instance of this type will be used to store a single line of the COT report. An array of these class instances will allow to use them for storage and convenient access to fields of the COT records. The CCFTCReport class has been developed for data storage and access:

class CCFTCReport // COT report { private: cot_type_report type; //type of current report cot_record data[]; //cot report data int sizedata; //number of records in the current report string idsymbol; //symbol identifier in cot ("CFTC Contract Market Code" field) string terminalsymbol; //symbol name in the client terminal public: void ~CCFTCReport(){ sizedata=0; }; bool Init( cot_type_report passedtype, string sym="" ); //initialization of class instance bool LoadFile( string filename ); //load data from file string Name(); //returns short report name bool Type(cot_type_report passedtype); //sets type of report cot_type_report Type(){return(type);}; //returns report type bool TestGroup( cot_type_traders type_trader ); //check for the presence of specified group of traders bool DefineIdSymbol(); //definition of id in the cot report bool GetString( int handle, cot_record& arr ); //gets line (record) from csv file string GetFieldCommaDelimited(string &str); //gets field from csv string double At(datetime time,cot_type_traders type_trader,cot_type_data typedata=netlongs); //gets data from the report };

Instance of CCFTCReport class contains the whole report for a single symbol, the type of report may be COT, CIT or DCOT. The enumerations and classes are listed in the "cot.mqh" included file.

2.3. Input parameters

The input parameters are defined by input variables. These parameters allow to specify group of traders, data type and necessary COT report type:

input cot_type_traders type_trader = noncommercial; //type of traders input cot_type_data type_data = netlongs; //type of the indicator input cot_type_report type_report = COT; //type of report

2.4. OnInit function

An indicator has the OnInit function, that is used for the following purposes: to download data from the report file, to check input parameters, to assign indicator's buffers.

The buffer, initialized with the INDICATOR_DATA property, contains data that are plotted on chart. The buffer, initialized with the INDICATOR_CALCULATIONS property, contains intermediate calculations.

SetIndexBuffer( 0, BufferData, INDICATOR_DATA ); IndicatorSetString(INDICATOR_SHORTNAME,indname); SetIndexBuffer( 1, BufferCalculations, INDICATOR_CALCULATIONS );

2.5. OnCalculate function

This function is used for selection of necessary data, calculation of requested data and their plotting.

Let's consider its work in details. The second form of call is used:

int OnCalculate(const int rates_total, const int prev_calculated, const datetime &Time[], const double &Open[], const double &High[], const double &Low[], const double &Close[], const long &TickVolume[], const long &Volume[], const int &Spread[]){

Let's determine bars for calculation and plotting.

int pos=rates_total-prev_calculated-1; if( pos >= rates_total-1 )pos--;

Let's specify that elements must be indexed like timeseries.

ArraySetAsSeries(Time, true); ArraySetAsSeries(BufferData, true); ArraySetAsSeries(BufferCalculations, true);

After some experiments, I have found that it's better to use timeseries indexation for all arrays, that are related to indicator's buffers. The same is convenient for arrays, that are passed to the OnCalculate function as parameters, the last (recent) element has an index, equal to 0.

The calculation loop is looks as follows:

for(int i=pos;i>=0;i--) { cot_type_data passed = type_data; if(type_data==netlongs || type_data==netlongsrate || type_data==willams_index) { // For the types of the data (net longs, net longs rate, Williams Index) it returns net longs // Further calculations are based on these data. passed = netlongs; } double res = Report.At(Time[i], type_trader, type_data ); //get report data BufferCalculations[i] = res; BufferData[i] = CalcData( type_data, i, Time ); }

The BufferCalculations array is used to store primary data, selected from the COT report.

The BufferData array contains data ready for plotting on chart. It may be the values from report (net longs, open interest) as well as calculated values (longs rate, Williams Index). I would like to outline the following point, for which I haven't found an elegant solution. Arrays, passed to the OnCalculate function, may be required at subsequent levels, and we can access them only if they are passed in these calls, so I think that it clutters the code.

The CalcData function call:

BufferData[i] = CalcData( type_data, i, Time );

The CalcData function calls the CalcIndex function:

double CalcData( cot_type_data type_data, int i, const datetime& Time[] ) { // net longs rate in the open interest if( type_data == netlongsrate ) return( BufferCalculations[ i ] / Report.At( Time[i], type_trader, openinterest )); // Williams Index if( type_data == willams_index )return( CalcIndex( i, Time, BufferCalculations ) ); return(BufferCalculations[i]); }

I needed access to the Time array inside the CalcIndex function, so I was forced to pass it according the calls hierarchy. Just imagine how the code will look, if we need to use all 8 arrays.

3. Downloading Data Files

All files links are presented in Table 1. There is a separate file for the each year, the year number is present in file name. For example, the https://www.cftc.gov/sites/default/files/files/dea/history/deacot2010.zip file contains report for 2010 year, the https://www.cftc.gov/sites/default/files/files/dea/history/deacot2009.zip file - for 2009, etc.

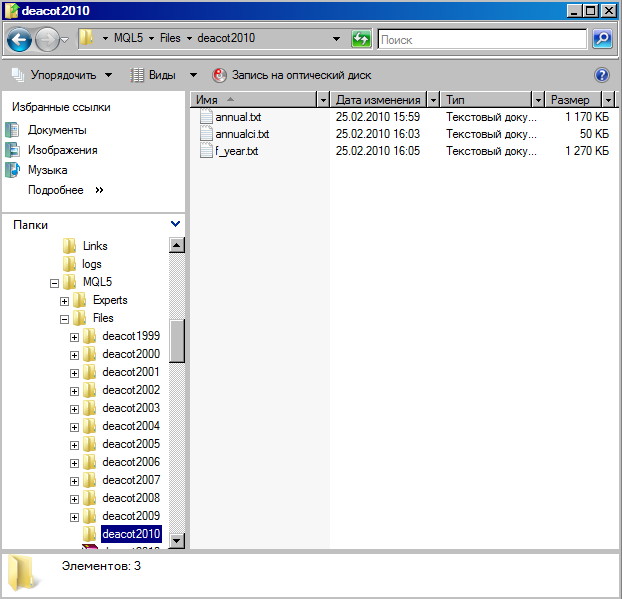

It's necessary to download all these files and unpack them into \MQL5\files\ folder of Client Terminal install directory. For each year it's necessary to create its own separate folder with a name deacotXXXX, where XXXX corresponds to a year. As a result, we will get the following folder structure.

Fig.1. Folders structure for the reports.

The process of the data preparation can be simplified. All the following operations (checking for the updates on CFTC web-site, downloading and unpacking to the appropriate folders) are performed by "Cotdownloader" script. The script kernel (data downloading) is based on WININET_TEST script. I have used the CProgressBar class, published in the The Price Histogram (Market Profile) and its implementation in MQL5 article. External applications are executed using Windows API, which is described in the Automated Optimization of a Trading Robot in Real Trading article.

Using a script is simple: just attach it to any chart. When working, it reports information about data downloading as a progress bar on the chart and as text messages on the Experts tab.

Fig.2. Data downloading process.

4. Example of Use

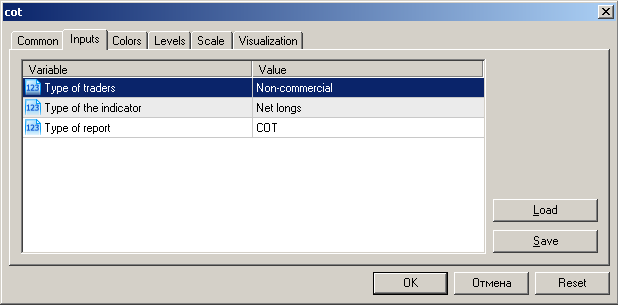

To run an indicator, it's necessary to attach it to the chart of chosen symbol and specify the input parameters.

Fig. 3 Input parameters of cot indicator

Note that now you can specify user-friendly representation instead of variable names and values of enumerated data types. It's done as follows: to replace the variable name, you should specify a comment when you declare an input variable:

input cot_type_traders type_trader = noncommercial; //Type of traders input cot_type_data type_data = netlongs; //Type of the indicator input cot_type_report type_report = COT; //Type of report

The same is for values - it's necessary to specify the description in comments when declaring the enumerated values:

enum cot_type_data // types of data { netlongs, // Net longs netlongsrate, // Net longs rate in open interest willams_index, // Williams Index openinterest // Open Interest };

If the input parameters have been specified correctly and the files have been downloaded and unpacked, then indicator will appear in a separate window:

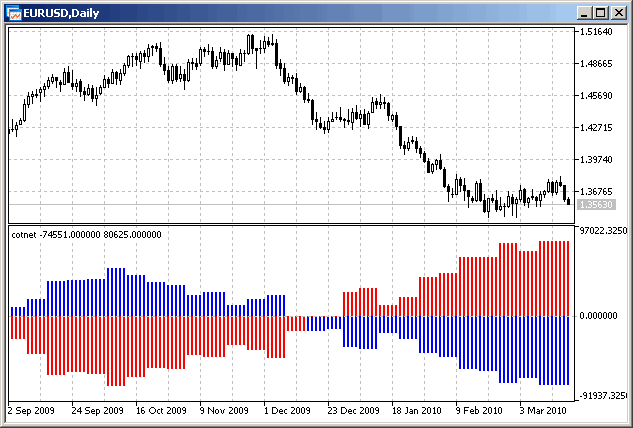

Fig. 4 COT indicator

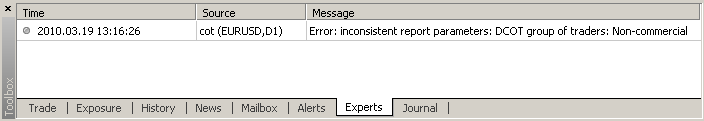

In the case of errors, they will be printed in "Experts" tab of the "Toolbox" window.

Fig. 5 Error message

5. Release Notes

The indicator isn't positioned as a fully-featured finished product. It's an example that shows how we can get results, that can be used further, by writing of a simple code. For example, we haven't developed the module, allowing to customize the type of the COT report data with Client Terminal settings, provided by a certain broker. This feature is implemented inside the DefineIdSymbol function. Here are the first few lines of:

bool CCFTCReport::DefineIdSymbol() { idsymbol=""; if(terminalsymbol=="USDLFX" || terminalsymbol=="DX_CONT" || StringFind(terminalsymbol,"DX")==0)idsymbol="098662"; //U.S. DOLLAR INDEX - CE FUTURES U.S. if( terminalsymbol == "FC_CONT" || StringFind( terminalsymbol, "FC")== 0)idsymbol = "061641"; //FEEDER CATTLE if( terminalsymbol == "LC_CONT" || StringFind( terminalsymbol, "LC")== 0)idsymbol = "057642"; //LIVE CATTLE if( terminalsymbol == "QM_CONT" || StringFind( terminalsymbol, "QM")== 0)idsymbol = "067651"; //CRUDE OIL, LIGHT SWEET - NEW YORK MERCANTILE EXCHANGE

If you need to assign a symbol from report to a symbol of client terminal, you should do it manually by modifying this code. I've used settings from BrocoTrader4 terminal. For examples in this article, I've used demo-accounts, opened on Metaquotes-Demo and Alpari-Demo servers. There are only 2 instruments available for DCOT reports: XAUUSD (gold), XAGUSD (silver).

Currently CIT reports are not supported, because there is no financial instruments on these servers. When they will appear, it's easy to include their support just by uncommenting and modifying some lines in code.

6. How to Use the COT Indicator via iCustom

I don't use indicator in a form, presented at Fig.3. The MQL5 language has the possibility to reuse of the custom indicators using the iCustom function.

6.1. Creating new indicator

There are many ways of COT reports visual analyses. One of them is a histogram, that shows positions of different traders groups with different colors.

Let's consider the following task: to create a COTnet indicator, that plots positions of different traders groups (commercial and non-commercial from COT reports), as a histogram. User must have a possibility to choose the type of data: net longs, net longs rate, Williams Index.

The process can be simplified by MQL5 Wizard, considered in the MQL5: Create Your Own Indicator article. As a result, the code of indicator (drawing styles have been created by MQL5 Wizard) looks as follows:

#property indicator_separate_window #property indicator_buffers 2 #property indicator_plots 2 //---- plot Noncommercial #property indicator_label1 "Noncommercial" #property indicator_type1 DRAW_HISTOGRAM #property indicator_color1 Blue #property indicator_style1 STYLE_SOLID #property indicator_width1 5 //---- plot Commercial #property indicator_label2 "Commercial" #property indicator_type2 DRAW_HISTOGRAM #property indicator_color2 Red #property indicator_style2 STYLE_SOLID #property indicator_width2 5 //--- indicator buffersInput variables, global variables and preprocessor directive to include the library with classes look as follows:

#include <cot.mqh> input cot_type_data type_data = netlongs; // Indicator's type double NoncommercialBuffer[]; double CommercialBuffer[]; //+------------------------------------------------------------------+ //| Custom indicator initialization function | //+------------------------------------------------------------------+ int handlecomm, handlenoncomm;

The code of the OnInit function is following:

int OnInit() { SetIndexBuffer(0,NoncommercialBuffer,INDICATOR_DATA); SetIndexBuffer(1,CommercialBuffer,INDICATOR_DATA); cot_type_traders td = commercial; cot_type_report tr = COT; handlecomm = iCustom(NULL, 0, "cot", td, type_data, tr ); td = noncommercial; handlenoncomm = iCustom(NULL, 0, "cot", td, type_data, tr ); return(0); }Let's consider how to use custom indicators (on example of non-commercial traders). After the first call of the iCustom function, the following parameters (necessary for our report) are passed to the function:

- NULL – current symbol in the client terminal

- 0 – current timeframe

- "cot" – file name (note, that it is specified without extension) of our custom indicator

- td = commercial (group of traders that we need)

- type_data = type of the indicator, it specified in the input parameters

- tr = COT – type of report

As a result, we have a handle, that will be used further to get the data of the indicator.

if(BarsCalculated(handlecomm)<rates_total || BarsCalculated(handlenoncomm)<rates_total) return(0); int to_copy = clctocopy(rates_total, prev_calculated ); if( !copycotbuf(handlecomm, CommercialBuffer, to_copy ) ) { Print("Error in data of commercial traders"); return( 0 ); } if( !copycotbuf(handlenoncomm, NoncommercialBuffer, to_copy ) ) { Print("Error in data of non-commercial traders"); return( 0 ); } return(rates_total);

We spent some time, wrote a short code and got the result:

Fig. 6 The cotnet indicator

6.2. iCustom can also be used in scripts

Let's consider the following task: creating the cotsignals script to calculate statistical estimations.

- The sign of non-commercial traders' net longs are the same as the candle color: if it's positive, the weekly trend is bullish, if it's negative, the trend is bearish.

- The candle color (white/black) is related directly with increasing/decreasing of non-commercial traders' net longs.

- The candle color is black or white depending on the Williams Index value, calculated on the non-commercial traders' net longs. If it is overbought (more than 75%), then the color is black, if it is oversold (less than 25%) - the candle color is white.

We will use data from COT report. Using these examples you can develop your own methods of COT data interpretation and get advantage of it. In your case we will check for 150 weekly bars of history, that corresponds to a period of 3 years. Before writing a script, we have to define the necessary data types and classes:

Enumeration for possible types of statistics is:

enum cot_type_statistics //types of statistics, used for calculation { speculantsign, //Sign of non-commercial traders' net longs speculantchange, //Volume changes of non-commercial traders' longs willamszones //Overbought/oversold zones of Williams Index };

To get the statistics for the specified symbol, let's create special class:

class CCOTStatistic { private: int bars ; // number of weekly bars in symbol history string symbol; // symbol name in Client Terminal double netlongsspeculantsdata[]; // data for speculators' net longs double willamsindexspeculantsdata[]; // data for speculators' Williams index net longs cot_type_statistics liststatistic[]; // list of statistics public: //initialization and initial setup void Init( string symbol_passed, cot_type_statistics& listpassed[] ); //Get the forecast for the direction int GetCotSignalDirection( int ibar, cot_type_statistics type_stat ); bool Get( double& probably[] ); // returns statistics };

The requested statistics are returned by the Get method, let's describe how it works. First, the necessary arrays are filled with data using custom indicator. We need non-commercial (speculators) traders' net longs values and Williams Index values:

if (!LoadDataFromCOTIndicator(symbol, PERIOD_W1, noncommercial, netlongs, COT, netlongsspeculantsdata, bars)) return(false); // we have got the data - speculators' net longs if (!LoadDataFromCOTIndicator(symbol, PERIOD_W1, noncommercial, willams_index, COT, willamsindexspeculantsdata, bars)) return(false); // we have got the data - speculators' Williams Index

The code for statistics calculation (we have only one parameter to be calculated - it is a forecast probability for the color of weekly candle) looks as follows:

for(int istat = 0; istat < ArraySize(liststatistic); istat++) { int cntsignals = 0; int cntsucsess = 0; for(int i=bars-1; i>=0; i--) { double colorcandle=iClose(symbol,PERIOD_W1,i)-iOpen(symbol,PERIOD_W1,i); if(symbol=="USDCHF" || symbol=="USDCAD" || symbol=="USDJPY") colorcandle=-colorcandle; double cotdirection=GetCotSignalDirection(i,liststatistic[istat]); if(cotdirection==0)continue; //no signal cntsignals++; if(cotdirection*colorcandle>0) cntsucsess++; //color and direction are same } if(cntsignals!=0) probably[istat]=1.*cntsucsess/cntsignals; Print("Calculation complete for ",symbol,GetStringTypeStatistic(liststatistic[istat]), " the correct forecast probability=",DoubleToString(probably[istat],2)); Print("Total signals:",cntsignals,"success:",cntsucsess); }The LoadDataFromCOTIndicator function is complicated, because it's necessary to perform numerous of checks to get data from indicator, so let's consider it in detail:

bool LoadDataFromCOTIndicator( string symbol, //symbol name ENUM_TIMEFRAMES timeframe, //timeframe cot_type_traders type_trader, //group of traders type cot_type_data type_data , //indicator type cot_type_report type_report, //report type double& loadto[], //output data array int nbars ) //number of requested bars { int cothandle; nbars+=10 ; //for reserve cothandle = iCustom( symbol , timeframe, "cot", type_trader, type_data, type_report );

In the last line we get the handle of custom indicator, that can be used to get data from buffers.

We have to check that the indicator has been created successfully:

if( cothandle == INVALID_HANDLE ){ Print("Error in indicator creation for symbol ", symbol ); return(false); }

Checking for history data, that we need:

int n = BarsSinh( symbol, timeframe ); if( n < nbars ) {

If there is not enough history data, let's load it:

Print("Loading history for ", symbol ); //, " start at ", loadtm CheckLoadHistory( symbol ,timeframe, loadtm ); n = BarsSinh( symbol, timeframe ); if( n < nbars ) { Print("Not enough history for the "+symbol, " total ", n, "bars"); return(false); } }

The BarsSinh (returns the number of bars, available on the specified symbol and timeframe) and CheckLoadHistory (downloading of the history) function are based on the script code from the MQL5 Reference.

Before using data from the indicator's buffer, we have to check, that data has been prepared, because just the presence of a handle doesn't guarantee that calculation has been finished.

The next call performs this check and waits when calculations are finished:

if( !WaitForCalculcateIndicator( cothandle ) ){ Print("Timeout for the COT indicator calculation"); return(false); }

The data are ready, we have to copy them:

int res = CopyBuffer(cothandle, 0, 0, nbars, loadto );

Next we're checking, that data has been copied successfully:

if( res != nbars ){ Print("Error in obtaining the data, ", MyErrorDescription(_LastError) ); return(false); }

And finally:

return(true);

We've got the data and return them into array, passed by function parameter.

The resulted statistics will be printed into CSV file, the CCOTOutFile class is developed for this purpose:

class CCOTOutFile { private: string filename; int handle; public: bool Init( string passedname ); void PutString( string symbol, double& probably[] ); void PutHeader( cot_type_statistics& arrheaders[] ) ; void ~CCOTOutFile(){ FileClose(handle); } };

It creates the file with output data, writes strings in .csv format, forms the header and closes file while destruction of class instance.

The code of the script will be short, because all necessary libraries have been written.

The Input parameters and included libraries:

input int NBars =150; //History depth W1 #include <common.mqh> #include <cot.mqh>

The list of symbols for analysis:

string listsymbols[] = {"EURUSD", "GBPUSD", "USDCHF", "USDCAD", "USDJPY", "AUDUSD", "XAUUSD"};

The object initialization:

void OnStart() { CCOTOutFile outfile; //file with results if( !outfile.Init("cotw1signals.csv") )return;

The list of statistics for calculation:

cot_type_statistics list_statistic[]= // statistic types list

{ speculantsign, speculantchange, willamszones };

Writing CSV file header:

outfile.PutHeader( list_statistic ); //writing CSV file header

In the main loop we get statistics for each symbol and signal, and write results to file:

for( int i = 0; i < ArraySize(listsymbols); i++ ) //for all symbols in the list { Print( "Analysis for "+listsymbols[i] ); CCOTStatistic stat; stat.Init( listsymbols[i ], list_statistic ); double probably[]; //probability of a signal if( !stat.Get( probably ) ) { Print( "Error in statistics calculation for the symbol ", listsymbols[i] ); return; } outfile.PutString( listsymbols[i], probably ); //write string to .csv file } Print("Calculation complete."); }

The script has been tested on Alpari-Demo server. If you will run it on MetaQuotes-Demo server, it will print the message "Error in statistics calculation for the XAUUSD symbol", because this symbol is not available now.

As a result of script execution we will get the file, that looks as follows:

To make it more clear, let's open it Excel, calculate the average values and create a histogram of probabilities:

Fig. 8 Forecast probability

- 0.54 – non-commercial traders sign;

- 0.50 – volume changes in net longs of non-commercial traders;

- 0.48 – overbought/oversold zones of Williams Index.

As we see, we have got the best forecast results for the non-commercial traders' net longs. The worst result is for the zones of Williams Index. The value 0.48 means that the probability for white candle is equal to 0.52, even if Williams Index is overbought, and black color for the case, if it is oversold. So, its use in the form, presented by Williams, isn't rational. Maybe, the results can be improved using larger timeframes: month, or maybe larger. We have used all the symbols that are available on the demo servers and in the COT reports.

Conclusion

MQL5 is a tool, that allows you to program the whole cycle of tasks, necessary to develop a trading system:- The indicators with complicated algorithms, that are used to access external data sources;

- Its reuse in other indicators, scripts and Expert Advisors;

- The implementation of own algorithms of statistical and quantitative analysis.

- Object-oriented programming greatly reduces time spent for debugging.

- Debugger.

- It's easy to migrate from MQL4 to MQL5.

- Implementation of object-oriented model is successful, it's easy to use it.

- Documentation is well organized.

- Integration with Windows API extends the platform, for example it allows to work with Internet pages.

Cons:

The main trouble for me was the access to historical data:- Lack of necessary primitive functions to access timeseries (as Time[], Open[], Close[] and others in MQL4)

- When accessing data, it's necessary to perform a numerous checks of their accessibility, it's necessary to understand their details.

There is a debugger, but it hasn't many useful features: there no indicators debugging, also it's impossible to perform checks of complicated objects, like arrays and classes. The list of the pros and cons isn't comprehensive, I have listed only what I've came across while preparing this article.

Appendix 1. List of files

All files are located in Client Terminal folder. Unpack the files from sources.zip to Client Terminal folder.

| № | File name | Description |

|---|---|---|

| 1 | MQL5\Files\unzip.exe | Windows application for unpacking of .zip archives |

| 2 | MQL5\Include\Cdownloader.mqh | Class, that downloads CFTC archives from the Internet |

| 3 | MQL5\Include\ClassProgressBar.mqh | Class CProgressBar, that is used to show the downloading process in the chart window |

| 4 | MQL5\Include\common.mqh | Common functions and constants, that used in all indicators and scripts |

| 5 | MQL5\Include\cot.mqh | Class CCFTCReport, that selects the data from cot reports |

| 6 | MQL5\Include\ErrorDescription.mqh | Error Description library |

| 7 | MQL5\Indicators\cot.mq5 | The base indicator cot |

| 8 | MQL5\Indicators\cotnet.mq5 | The indicator cotnet, a simple example of use of cot.mq5 as custom user indicator |

| 9 | MQL5\Scripts\cotdownloader.mq5 | Script cotdownloader, it downloads the archive files from the Internet |

| 10 | MQL5\Scripts\cotsignals.mq5 | Script cotsignals, example of statistical analysis of COT reports |

Table 2. List of files

Appendix 2. List of symbols, available in COT reports

| № | Symbol name | ID on exchange | ID in Client Terminal | Present in CIT | Present in DCOT |

|---|---|---|---|---|---|

| 1 | WHEAT - CHICAGO BOARD OF TRADE | 001602 | ZW | x | x |

| 2 | WHEAT - KANSAS CITY BOARD OF TRADE | 001612 | x | x | |

| 3 | WHEAT - MINNEAPOLIS GRAIN EXCHANGE | 001626 | x | ||

| 4 | CORN - CHICAGO BOARD OF TRADE | 002602 | ZC | x | x |

| 5 | OATS - CHICAGO BOARD OF TRADE | 004603 | ZO | x | |

| 6 | SOYBEANS - CHICAGO BOARD OF TRADE | 005602 | ZS | x | x |

| 7 | MINI SOYBEANS - CHICAGO BOARD OF TRADE | 005603 | x | ||

| 8 | SULFUR FINANCIAL INSTRUMENT - CHICAGO CLIMATE FUTURES EXCHANGE | 006261 | x | ||

| 9 | CARBON FINANCIAL INSTRUMENT - CHICAGO CLIMATE FUTURES EXCHANGE | 006268 | x | ||

| 10 | RGGI CO2 ALLOWANCE 2009 - CHICAGO CLIMATE FUTURES EXCHANGE | 00626U | x | ||

| 11 | SOYBEAN OIL - CHICAGO BOARD OF TRADE | 007601 | ZL | x | x |

| 12 | U.S. TREASURY BONDS - CHICAGO BOARD OF TRADE | 020601 | ZB | ||

| 13 | LONG-TERM U.S. TREASURY BONDS - CHICAGO BOARD OF TRADE | 020604 | |||

| 14 | GULF # 6 FUEL 3.0% SULFUR SWAP - NEW YORK MERCANTILE EXCHANGE | 02165A | x | ||

| 15 | NY RES FUEL 1.0% SULFUR SWAP - NEW YORK MERCANTILE EXCHANGE | 02165B | x | ||

| 16 | EUR 1% FUEL OIL NWE CAL SWAP - NEW YORK MERCANTILE EXCHANGE | 02165C | x | ||

| 17 | EUR 3.5% FUEL OIL RTD CAL SWAP - NEW YORK MERCANTILE EXCHANGE | 02165E | x | ||

| 18 | SING FUEL OIL 180 CAL SWAP - NEW YORK MERCANTILE EXCHANGE | 02165G | x | ||

| 19 | EAST WEST FUEL OIL SPR SWAP - NEW YORK MERCANTILE EXCHANGE | 02165I | x | ||

| 20 | NY 1% V GULF 3% FUEL OIL SPR - NEW YORK MERCANTILE EXCHANGE | 02165T | x | ||

| 21 | NO. 2 HEATING OIL | 022651 | x | ||

| 22 | SING GASOIL SWAP - NEW YORK MERCANTILE EXCHANGE | 02265J | x | ||

| 23 | SING GASOIL/RDAM GASOIL SWAP - NEW YORK MERCANTILE EXCHANGE | 02265T | x | ||

| 24 | NYMEX HEATING OIL/RDAM GASOIL - NEW YORK MERCANTILE EXCHANGE | 02265U | x | ||

| 25 | GASOIL (ICE) SWAP - NEW YORK MERCANTILE EXCHANGE | 02265V | x | ||

| 26 | UP DOWN GC ULSD VS HO SPR SWAP - NEW YORK MERCANTILE EXCHANGE | 022A13 | x | ||

| 27 | SING GASOIL BALMO SWAP - NEW YORK MERCANTILE EXCHANGE | 022A22 | x | ||

| 28 | NATURAL GAS ICE HENRY HUB - ICE OTC | 023391 | x | ||

| 29 | NATURAL GAS - NEW YORK MERCANTILE EXCHANGE | 023651 | QG | x | |

| 30 | MICHCON BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 02365A | x | ||

| 31 | M-3 BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 02365C | x | ||

| 32 | TCO BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 02365D | |||

| 33 | NGPL TEXOK BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 02365G | x | ||

| 34 | NGPL MIDCON BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 02365K | x | ||

| 35 | WAHA BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 02365O | x | ||

| 36 | HOUSTON SHIP CH INDEX SWAP - NEW YORK MERCANTILE EXCHANGE | 023A10 | x | ||

| 37 | CBT ETHANOL - CHICAGO BOARD OF TRADE | 025601 | x | ||

| 38 | CHICAGO ETHANOL SWAP - NEW YORK MERCANTILE EXCHANGE | 025651 | x | ||

| 39 | SOYBEAN MEAL - CHICAGO BOARD OF TRADE | 026603 | ZM | x | |

| 40 | JAPAN C&F NAPTHA SWAP - NEW YORK MERCANTILE EXCHANGE | 03265C | x | ||

| 41 | COTTON NO. 2 - ICE FUTURES U.S. | 033661 | CT | x | x |

| 42 | HENRY HUB BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 035652 | x | ||

| 43 | HOUSTON SHIP CH BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 035653 | x | ||

| 44 | NW PIPE ROCKIES BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 035654 | x | ||

| 45 | PANHANDLE BASIS SWAP - NEW YORK MERCANTILE EXCHANGE | 035655 | x | ||

| 46 | HENRY HUB SWAP - NEW YORK MERCANTILE EXCHANGE | 03565B | |||

| 47 | HENRY HUB PENULTIMATE GAS SWAP - NEW YORK MERCANTILE EXCHANGE | 03565C | x | ||

| 48 | ROUGH RICE - CHICAGO BOARD OF TRADE | 039601 | ZR | x | |

| 49 | FRZN CONCENTRATED ORANGE JUICE - ICE FUTURES U.S. | 040701 | JO | x | |

| 50 | 2-YEAR U.S. TREASURY NOTES - CHICAGO BOARD OF TRADE | 042601 | |||

| 51 | 10-YEAR U.S. TREASURY NOTES - CHICAGO BOARD OF TRADE | 043602 | ZN | ||

| 52 | 5-YEAR U.S. TREASURY NOTES - CHICAGO BOARD OF TRADE | 044601 | |||

| 53 | 30-DAY FEDERAL FUNDS - CHICAGO BOARD OF TRADE | 045601 | ZQ | ||

| 54 | MILK Class III - CHICAGO MERCANTILE EXCHANGE | 052641 | x | ||

| 55 | LEAN HOGS - CHICAGO MERCANTILE EXCHANGE | 054642 | HE | x | x |

| 56 | LIVE CATTLE - CHICAGO MERCANTILE EXCHANGE | 057642 | LC | x | x |

| 57 | RANDOM LENGTH LUMBER - CHICAGO MERCANTILE EXCHANGE | 058643 | LB | x | |

| 58 | FEEDER CATTLE - CHICAGO MERCANTILE EXCHANGE | 061641 | FC | x | x |

| 59 | PJM ELECTRICITY MONTHLY - NEW YORK MERCANTILE EXCHANGE | 064657 | x | ||

| 60 | ISO NEW ENGLAND LMP SWAP - NEW YORK MERCANTILE EXCHANGE | 06465H | x | ||

| 61 | PJM CAL MONTH OFF PK LMP SWAP - NEW YORK MERCANTILE EXCHANGE | 06465M | x | ||

| 62 | ISO NEW ENG OFF PK LMP SWAP - NEW YORK MERCANTILE EXCHANGE | 06465S | x | ||

| 63 | CINERGY CAL MONTH LMP SWAP - NEW YORK MERCANTILE EXCHANGE | 064A01 | x | ||

| 64 | CINERGY OFF PEAK LMP SWAP - NEW YORK MERCANTILE EXCHANGE | 064A02 | |||

| 65 | PJM N ILL PEAK DAY AHEAD - NEW YORK MERCANTILE EXCHANGE | 064A34 | x | ||

| 66 | PJM JCPL PEAK DAY AHEAD - NEW YORK MERCANTILE EXCHANGE | 064A48 | x | ||

| 67 | PJM PEPCO PEAK DAY AHEAD - NEW YORK MERCANTILE EXCHANGE | 064A50 | x | ||

| 68 | PJM PSEG PEAK DAY AHEAD - NEW YORK MERCANTILE EXCHANGE | 064A54 | x | ||

| 69 | PJM WESTERN PEAK DAY AHEAD - NEW YORK MERCANTILE EXCHANGE | 064A56 | |||

| 70 | PJM WESTERN PEAK REAL TIME - NEW YORK MERCANTILE EXCHANGE | 064A58 | x | ||

| 71 | PJM WESTERN OFF PEAK REAL TIME - NEW YORK MERCANTILE EXCHANGE | 064A59 | x | ||

| 72 | ISO NEW ENG INT HUB PEAK SWAP - NEW YORK MERCANTILE EXCHANGE | 064A60 | x | ||

| 73 | MW IND TRANS PEAK SWAP - NEW YORK MERCANTILE EXCHANGE | 064A62 | x | ||

| 74 | NYISO ZONE 5 MW PEAK SWAP - NEW YORK MERCANTILE EXCHANGE | 064A66 | |||

| 75 | ISO NEW ENG HUB OFF PEAK SWAP - NEW YORK MERCANTILE EXCHANGE | 064A78 | |||

| 76 | MT BELVIEU PROPANE 5 DEC SWAP - NEW YORK MERCANTILE EXCHANGE | 06665O | |||

| 77 | MT BELVIEU ETHANE 5 DEC SWAP - NEW YORK MERCANTILE EXCHANGE | 06665P | x | ||

| 78 | MT BELV NORM BUTANE 5 DEC SWAP - NEW YORK MERCANTILE EXCHANGE | 06665Q | x | ||

| 79 | MT BELV NAT GASOLINE 5 DEC SWP - NEW YORK MERCANTILE EXCHANGE | 06665R | x | ||

| 80 | CRUDE OIL LIGHT SWEET - ICE FUTURES EUROPE LIGHT SWEET - ICE FUTURES EUROPE | 067411 | x | ||

| 81 | CRUDE OIL, LIGHT SWEET - NEW YORK MERCANTILE EXCHANGE | 067651 | QM | x | |

| 82 | WTI CRUDE OIL CALENDAR SWAP - NEW YORK MERCANTILE EXCHANGE | 06765A | x | ||

| 83 | DUBAI CRUDE OIL CALENDAR SWAP - NEW YORK MERCANTILE EXCHANGE | 06765G | x | ||

| 84 | WTI CRUDE OIL FINANCIAL - NEW YORK MERCANTILE EXCHANGE | 06765I | x | ||

| 85 | BRENT FINANCIAL - NEW YORK MERCANTILE EXCHANGE | 06765J | x | ||

| 86 | BRENT (ICE) CALENDAR SWAP - NEW YORK MERCANTILE EXCHANGE | 06765N | x | ||

| 87 | BRENT-DUBAI SWAP - NEW YORK MERCANTILE EXCHANGE | 06765O | x | ||

| 88 | COCOA - ICE FUTURES U.S. | 073732 | CC | x | x |

| 89 | PALLADIUM - NEW YORK MERCANTILE EXCHANGE | 075651 | PA | x | |

| 90 | PLATINUM - NEW YORK MERCANTILE EXCHANGE | 076651 | PL | x | |

| 91 | SUGAR NO. 11 - ICE FUTURES U.S. | 080732 | SB | x | x |

| 92 | COFFEE C - ICE FUTURES U.S. | 083731 | KC | x | x |

| 93 | SILVER - COMMODITY EXCHANGE INC. | 084691 | SI,XAGUSD,ZI | x | |

| 94 | COPPER-GRADE #1 - COMMODITY EXCHANGE INC. | 085692 | HG | x | |

| 95 | GOLD - COMMODITY EXCHANGE INC. | 088691 | GC,GOLD,XAUUSD | x | |

| 96 | RUSSIAN RUBLE - CHICAGO MERCANTILE EXCHANGE | 089741 | USDRUB,USDRUR | ||

| 97 | CANADIAN DOLLAR - CHICAGO MERCANTILE EXCHANGE | 090741 | 6C,USDCAD | ||

| 98 | SWISS FRANC - CHICAGO MERCANTILE EXCHANGE | 092741 | 6S,USDCHF | ||

| 99 | MEXICAN PESO - CHICAGO MERCANTILE EXCHANGE | 095741 | |||

| 100 | BRITISH POUND STERLING - CHICAGO MERCANTILE EXCHANGE | 096742 | 6B,GBPUSD | ||

| 101 | JAPANESE YEN - CHICAGO MERCANTILE EXCHANGE | 097741 | 6J,USDJPY | ||

| 102 | U.S. DOLLAR INDEX - ICE FUTURES U.S. | 098662 | DX | ||

| 103 | EURO FX - CHICAGO MERCANTILE EXCHANGE | 099741 | 6E,EURUSD | ||

| 104 | GASOLINE BLENDSTOCK (RBOB) - NEW YORK MERCANTILE EXCHANGE | 111659 | XRB | x | |

| 105 | RBOB CALENDAR SWAP - NEW YORK MERCANTILE EXCHANGE | 11165K | x | ||

| 106 | NEW ZEALAND DOLLAR - CHICAGO MERCANTILE EXCHANGE | 112741 | 6N,NZDUSD | ||

| 107 | VIX FUTURES - CBOE FUTURES EXCHANGE | 011700 | |||

| 108 | DOW JONES INDUSTRIAL AVERAGE - CHICAGO BOARD OF TRADE | 124601 | |||

| 109 | 3-MONTH EURODOLLARS - CHICAGO MERCANTILE EXCHANGE | 132741 | |||

| 110 | S&P 500 STOCK INDEX - CHICAGO MERCANTILE EXCHANGE | 138741 | |||

| 111 | E-MINI S&P 500 STOCK INDEX - CHICAGO MERCANTILE EXCHANGE | 13874A | ES,SPX | ||

| 112 | NASDAQ-100 STOCK INDEX - CHICAGO MERCANTILE EXCHANGE | 209741 | NQ | ||

| 113 | NASDAQ-100 STOCK INDEX (MINI) - CHICAGO MERCANTILE EXCHANGE | 209742 | |||

| 114 | DOW JONES UBS EXCESS RETURN - CHICAGO BOARD OF TRADE | 221602 | |||

| 115 | AUSTRALIAN DOLLAR - CHICAGO MERCANTILE EXCHANGE | 232741 | 6A,AUDUSD | ||

| 116 | RUSSELL 2000 MINI INDEX FUTURE - ICE FUTURES U.S. | 23977A | |||

| 117 | NIKKEI STOCK AVERAGE - CHICAGO MERCANTILE EXCHANGE | 240741 | |||

| 118 | NIKKEI STOCK AVERAGE YEN DENOM - CHICAGO MERCANTILE EXCHANGE | 240743 | |||

| 119 | E-MINI MSCI EAFE - CHICAGO MERCANTILE EXCHANGE | 244741 | |||

| 120 | E-MINI MSCI EMERGING MARKETS - CHICAGO MERCANTILE EXCHANGE | 244742 | |||

| 121 | INTEREST RATE SWAPS 10YR - CHICAGO BOARD OF TRADE | 246602 | |||

| 122 | INTEREST RATE SWAPS 5YR - CHICAGO BOARD OF TRADE | 247602 | |||

| 123 | S&P GSCI COMMODITY INDEX - CHICAGO MERCANTILE EXCHANGE | 256741 | |||

| 124 | SING JET KERO SWAP - NEW YORK MERCANTILE EXCHANGE | 26265D | |||

| 125 | E-MINI S&P 400 STOCK INDEX - CHICAGO MERCANTILE EXCHANGE | 33874A | |||

| 126 | GULF JET NY HEAT OIL SPR SWAP - NEW YORK MERCANTILE EXCHANGE | 86465A | x | ||

| 127 | SING JET KERO GASOIL SPR SWAP - NEW YORK MERCANTILE EXCHANGE | 86465C | x | ||

| 128 | JET CIF NWE/GASOIL FUT - NEW YORK MERCANTILE EXCHANGE | 86465D | x | ||

| 129 | GULF # 6 FUEL OIL CRACK SWAP - NEW YORK MERCANTILE EXCHANGE | 86565A | x | ||

| 130 | 3.5% FUEL OIL RDAM CRACK SPR - NEW YORK MERCANTILE EXCHANGE | 86565C | x | ||

| 131 | NAPTHA CRACK SPR SWAP - NEW YORK MERCANTILE EXCHANGE | 86665A | x | ||

| 132 | GASOIL CRACK SPR SWAP - NEW YORK MERCANTILE EXCHANGE | 86765C | x |

Table 3. List of symbols, available in COT reports

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/34

Using the Object Pointers in MQL5

Using the Object Pointers in MQL5

Introduction to MQL5: How to write simple Expert Advisor and Custom Indicator

Introduction to MQL5: How to write simple Expert Advisor and Custom Indicator

Creating Tick Indicators in MQL5

Creating Tick Indicators in MQL5

Drawing Indicator's Emissions in MQL5

Drawing Indicator's Emissions in MQL5

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

seems there is an error in common.mqh

'SERIES_SYNCRONIZED' - undeclared identifier common.mqh 338 42

seems there is an error in common.mqh

'SERIES_SYNCRONIZED' - undeclared identifier common.mqh 338 42

Track The Largest Traders With The Commitment of Traders (CoT) Report (adapted from dailyfx article)

What Is the Commitment of Traders Report?

How would you like to know what the smartest guys and girls in the room are doing? Thanks to a requirement by the Commodity Futures Trading Commission, the largest futures traders in the world are required to report their positions which can easily be tracked due to the margin they must pay to hold their large positions which the CFTC has been publishing since 1962 and since 2000, ever Friday at 3:30ET pm. This information can be of extreme help due to the people who come into the Futures market like hedge funds to make a return above their respective index or some of the largest companies in the world with real-time data of the health of the economy that come to the futures market to hedge their exposure to price fluctuations of raw materials that they use to make their product or preform their service.

Who Are the Players In The Report?

How to Read the CoT for Directional Bias?

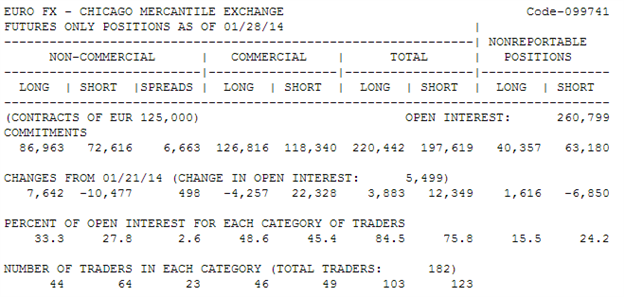

Upon the first reading of the CoT, you may be confused how future positions in USD, JPY, GBP or EUR could be helpful for trading EURUD, USDJPY, or EURGBP. There is a lot to learn about the Commitment of Traders report but what’s often helpful is to find when there is a very strong divergence between large speculators and large commercials.

Look to See What Hedge Funds Are Buying Selling :

Non-Commercials / Hedge Funds Sold USDJPY Longs & Charts Confirm This :

The first place to start with is a clean understanding of Net Positioning which is shown clearly on the reports and the week over week differential of major market bias (circled above). It may be helpful to know that what you’re looking for isn’t as much the specific number but a clear sign in % of open interest or bias so that you see Non-Commercials / Funds flipping against the primary trend. Furthermore, when you see a key flip in sentiment of non-commercials / funds who are in it for the money and not to be hedged like commercials, and there is a confirmation on the charts that a trend is exhausting, you are likely trading in the direction of the big kids.

I have returned to forex trading after an absence of 18 months.

I was using the Mql4 version of the COT report indicator. When I tried to compile the existing mql4 COT version in mql5, it obviously did not work. Rather than begin coding repair on my own, I tried to see if there was an updated / corrections of the original mql4 that would work in mql5, so began reading the mql5 COT material.

As read about the mql5 version of the COT report indicator, it appears to be quite different...? (different programmer / authors with a different approach? OR is it the same programmer that deals with changes in mql5?)

does the mql5 COT version allow for concatenation and aggregation like was available in the mql4 version? At first read through, I could not tell (I have much to learn about mql5 coding). Does the mql5 version use *.ini files?

It seems that the CFTC reports been structurally changed, to allow more detailed assessment of the data.

Regards,

spgandau

Hello,

is this report still working?

i coppied the files to the folder, activate the DLL but i cannot downloady any date, getting errors

the main question, are there any DLL needed?

i copied the include into the folter include directly

the scripts into Script/Cot Report

and the indicator Indicators/Cot Report

is there any fault in the folder or does i have to include more files?

even i checked out the website, it looks that the download format and the name of the downloads ahve changed, is this maybe the problem? maybe some work with this indicator and have any idea

amando