Creating Multi-Expert Advisors on the basis of Trading Models

Vasiliy Sokolov | 18 January, 2011

Introduction

The technical capabilities of the MetaTrader 5 terminal, and its strategy tester, determine the work and testing of multi-currency trading systems. The complexity of developing such systems for MetaTrader 4 conditioned, first of all, by the inability of simultaneous tick by tick testing of several trading tools. In addition, the limited language resources of the MQL4 language did not allow for the organization of complex data structures and for the efficient management of the data.

With the release of MQL5 the situation has changed. Henceforth, MQL5 supports the object-oriented approach, is based on a developed mechanism of auxiliary functions, and even has a set of Standard Library base classes to facilitate the daily tasks of users - ranging from the organization of data to the work interfaces for standard system functions.

And although the technical specifications of the strategy tester and the terminal allow for the use of multi-currency EAs, they do not have built-in methods for the parallelization of the work of a single EA simultaneously on several instruments or time-frames. As before, for the work of an EA in the simplest case, you need to run it in the window of the symbol, which determines the name of the trading instrument and its time-frame. As a result, the work methodology, accepted from the time of MetaTrader 4, does not allow to take full advantage of the strategy tester and the MetaTrader 5 terminal.

The situation is complicated by the fact that only one cumulative position for each instument, equal to the total amount of deals on that instrument, is allowed, Certainly, the transition to a net position is correct and timely. Net position comes closest to the perfect representation of the trader's interest on a particular market.

However, such an organization of the deals does not make the trading process simple and easily visualized. Previously, it was sufficient enough for an EA to select its open order (for example, the order could be identified using the magic number), and implement the required action. Now, even the absence of a net position on an instrument does not mean that a particular instance of an EA on it at the moment is not on the market!

Third-party developers offer various ways to solving the problem with the net position - ranging from writing a special managers of virtual orders (see the article A Virtual Order Manager to track orders within the position-centric MT5 environment) to integrating the inputs in an aggregated position, using the magic number (see The Optimal Method for Calculation of Total Position Volume by Specified Magic Number or The Use of ORDER_MAGIC for Trading with Different Expert Advisors on a Single Instrument).

However, in addition to problems with the aggregated position, there is a problem of the so-called multi-currency, when the same EA is required to trade on multiple instruments. The solution of this problem can be found in the article Creating an Expert Advisor which Trades on Different Instruments.

All of the proposed methods work and have their own advantages. However, their fatal flaw is that each of these methods is trying to approach the issue from its own perspective, offering solutions that are, for example, well suited for simultaneous trading by several EAs on a single instrument, but are not suitable for multi-currency solutions.

This article aims to solve all of the problems with a single solution. Using this solution can solve the problem of multi-currency and even multi-system testing of the interaction between different EAs on a single instrument. This seems difficult, or even impossible to achieve, but in reality it's all much easier.

Just imagine your a single EA trades simultaneously on several dozens of trading strategies, on all of the available instruments, and on all of the possible time frames! In addition, the EA is easily tested in the tester, and for all of the strategies, included in its composition, has one or several working systems of money management.

So, here are the main tasks that we will need to solve:

- The EA needs to trade on the basis of several trading systems at the same time. In addition, it must equally easily trade on a single, as well as on multiple trading systems;

- All of the trading system, implemented in the EA, must not conflict with each other. Each trading system must handle only it own contribution to the total net position, and only its own orders;

- Each system should be equally easy to trade with on a single time-frame of the instrument, as well as on all time-frames at once.

- Each systems should be equally easy to trade with on a single trading instrument, as well as on all of the available instruments at once.

If we examine carefully the list of the tasks that we need to handle, we will arrive at a three-dimensional array. The first dimension of the array - the number of trading systems, the second dimension - the number of time-frames, on which the specific TS needs to operate, and the third - the number of trading instruments for the TS. A simple calculation shows that even such a simple EA as the MACD Sample, when working simultaneously on 8 major currency pairs, will have 152 independent solutions: 1 EA * 8 pairs * 19 time-frames (weekly and monthly time-frames are not included).

If the trading system will be much larger, and the trading portfolio of EAs considerably more extensive, then the number of solutions could easily be over 500, and in some cases, over 1000! It is clear that it is impossible to manually configure and then upload each combination separately. Therefore it is necessary to build a system in such a way, that it would automatically adjusts each combination, load it into the memory of the EA, and the EA would then trade, based on the rules of a specific instance of this combination.

Terms and concepts

Here and further the notion "trading strategy" will be replaced by a more specific term trading model or simply model. A trading model is a special class, built according to specific rules, which fully describes the trading strategy: indicators, used in trade, the trade conditions of entry and exit, the methods of money management, etc. Each trading model is abstract and does not define specific parameters for its operation.

A simple example is the trading tactic, based on the crossover of two moving averages. If the fast moving average crosses the slow one upward, it opens a deal to buy, if on the contrary, downwards, it opens a deal to sell. This formulation is sufficient for writing a trading model that trades on its grounds.

However, once such a model will be described, it is necessary to determine the methods of the moving averages, with theiraveraging period, the period of the data window, and the instrument, on which this model will be trading. In general, this abstract model will contain parameters that will need to be filled once you need to create a specific model instance. It is obvious that under this approach an abstract model can be a parent of multiple instances of the models, which differ in their parameters.

Complete rejection of the accounting of the net position

Many developers are trying to keep track of the aggregated position. However, we can see from the above, that neither the size of the aggregated position, nor its dynamics, are relevant to a particular instance of the model. The model can be short, while the aggregated position may not exist at all (neutral aggregated position). On the contrary, the aggregated position may be short, while the model will have a long position.

In fact, let's consider these cases in more detail. Assume that one instrument trades with three different trading tactics, each of which has its own independent system of money management. Also assume that the first of the three systems decided to sell three contracts without cover, or simply put, to make a short position, with a volume of three contracts. After the completion of the deals, the net position will consist solely from the deals of the first trading system, its volume will be minus three contract, or simply three short contract without cover. After some time, the second trading system makes the decision to buy 4 contracts of the same asset.

As a result, the net position will change, and will be consisting of 1 long contract. This time it will include the contributions of two trading systems. Further, the third trading system enters the scene and makes a short position with the same asset, with a volume of one standard contract. The net position will become neutral because -3 short+ 4 long - 1 short = 0.

Does the absence of the net position mean that all of the three trading systems are not on the market? Not at all. Two of them hold four contracts without cover, which means that the cover will be made over time. On the other hand, the third system holds 4 long contract, which are yet to be sold back. Only when the full repayment of the four short contracts is complete, and a covered sale of four long contracts is made, the neutral position will mean a real lack of positions in all three systems.

We can, of course, each time reconstruct the entire sequence of actions for each of the models, and thereby determine its specific contribution in the size of the current position, but a much simpler method exists. This method is simple - it is necessary to completely abandon the accounting of the aggregated position, which can be any size and which can depend on both external (eg, manual trading), as well as internal factors (the work of other models of the EA on one instrument). Since the current aggregated position can't be depended on, then how do we account the actions of a specific model instance?

The simplest and most effective way would be to equip each instance of a model with its own table of orders, which would consider all of the orders - both, pending, and those initiated by a deal or deleted. Extensive information on orders is stored on the trading server. Knowing the ticket of the order, we can get almost any information on an order, ranging from the time of its opening and to its volume.

The only thing we need to do is to link the ticket order with a specific instance of the model. Each model instance will have to contain its individual instance of a special class - the table of orders, which would contain a list of the current orders, set out by the model instance.

Projecting an abstract trading model

Now let's try to describe the common abstract class of the model, on which specific trading tactics will be based. Since the EA should use multiple models (or unlimited), it is obvious that this class should have a uniform interface through which an external power expert will give the signals.

For example, this interface may be the Processing() function. Simply put, each CModel class will have its Processing() function. This function will be called every tick or every minute, or upon the occurrence of a new event of Trade type.

Here is a simple example of solving this task:

class CModel { protected: string m_name; public: void CModel(){m_name="Model base";} bool virtual Processing(void){return(true);} }; class cmodel_macd : public CModel { public: void cmodel_macd(){m_name="MACD Model";} bool Processing(){Print("Model name is ", m_name);return(true);} }; class cmodel_moving : public CModel { public: void cmodel_moving(){m_name="Moving Average";} bool Processing(){Print("Model name is ", m_name);return(true);} }; cmodel_macd *macd; cmodel_moving *moving;

Let's figure out how this code works. The CModel base class contains one protected variable of string type called the m_name. The "protected" keyword allows the use of this variable by the class heirs, so its descendants will already contain this variable. Further, the base class defines the Processing() virtual function. In this case the 'virtual' word indicates that this is a wrapper or the interface between the Expert Advisor and the specific instance of the model.

Any class, inherited from the CModel, will be guaranteed to have the Processing() interface for interaction. The implementation of code of this function is delegated to its descendants. This delegation is obvious, since the inner workings of models may differ significantly from each other, and therefore there is no common generalizations that could be located on a general level CModel.

Further is the description of two classes cmodel_macd and cmodel_moving. Both are generated from the CModel class, therefore both have their own instances of the Processing() function and the m_name variable. Note that the internal implementation of the Processing() function of both models is different. In first model, it consists of the Print ("It is cmodel_macd. Model name is ", m_name), in the second of Print("It is cmodel_moving. Model name is ", m_name). Next, two pointers are created, each of them may point to a specific instance of the model, one to the class of cmodel_macd type, and the other to cmodel_moving type.

In the OnInit function these pointers inherit the dynamically created classes-models, after which within the OnEvent() function a Processing() function is called, which is contained in each class. Both pointers are announced at a global level, so even after exiting the OnInit() function, the classes created in it are not deleted, but continue to exist on a global level. Now, every five seconds, the OnTimer() function will sample both models in turn, calling in them the appropriate Processing() function.

This primitive system of sampling the models, which we have just created, lacks flexibility and scalability. What do we do if we want to work with several dozens of such models? Working with each one of them separately is inconvenient. It would be much easier to collect all of the models into a single community, for example an array, and then iterate over all of the elements of this array by calling the Processing() function, of each such element.

But the problem is that the organization of arrays requires that the data, stored in them, is of the same type. In our case, although the model cmodel_macd and cmodel_moving are very similar to each other, they are not identical, which automatically makes it impossible to use them in arrays.

Fortunately, the arrays are not the only way to summarize the data, there are other more flexible and scalable generalizations. One of them is the technique of linked lists. Its working scheme is simple. Each item that is included in the overall list should contain two pointers. One pointer points to the previous list item, the second - to the next one.

Also, knowing the index number of the item, you can always refer to it. When you want to add or delete an item, it is enough to rebuild its pointers, and the pointers of the neighboring items, so that they consistently refer to each other. Knowing the internal organization of such communities is not necessary, it is enough to understand their common device.

The standard installation of MetaTrader 5 includes a special auxiliary CList class, which provides the opportunity to work with linked lists. However, the element of this list can only be an object of CObject type, since only they have the special pointers for working with linked lists. On its own, the CObject class is rather primitive, being simply an interface for interacting with the CList class.

You can see this by taking a look at its implementation:

//+------------------------------------------------------------------+ //| Object.mqh | //| Copyright © 2010, MetaQuotes Software Corp. | //| https://www.metaquotes.net/ | //| Revision 2010.02.22 | //+------------------------------------------------------------------+ #include "StdLibErr.mqh" //+------------------------------------------------------------------+ //| Class CObject. | //| Purpose: Base class element storage. | //+------------------------------------------------------------------+ class CObject { protected: CObject *m_prev; // previous list item CObject *m_next; // next list item public: CObject(); //--- methods of access to protected data CObject *Prev() { return(m_prev); } void Prev(CObject *node) { m_prev=node; } CObject *Next() { return(m_next); } void Next(CObject *node) { m_next=node; } //--- methods for working with files virtual bool Save(int file_handle) { return(true); } virtual bool Load(int file_handle) { return(true); } //--- method of identifying the object virtual int Type() const { return(0); } protected: virtual int Compare(const CObject *node,int mode=0) const { return(0); } }; //+------------------------------------------------------------------+ //| Constructor CObject. | //| INPUT: no. | //| OUTPUT: no. | //| REMARK: no. | //+------------------------------------------------------------------+ void CObject::CObject() { //--- initialize protected data m_prev=NULL; m_next=NULL; } //+------------------------------------------------------------------+

As can be seen, the basis of this class are two pointers, which the typical features are implemented for.

Now the most important part. Owing to the mechanism of inheritance, it is possible to include this class into the trading model, which means that the class of the trading model can be included into a list of CList type! Let's try to do this.

And so, we will make our abstract CModel class as a descendant of the CObject class:

class CModel : public CObject

Since our classes cmodel_moving and cmodel_average are inherited from CModel class, they include the data and methods of CObject class, therefore, they can be included in the list of CList type. The source code, which creates the two conditional trading models, places them in the list, and sequentially samples each tick, is presented below:

//+------------------------------------------------------------------+ //| ch01_simple_model.mq5 | //| Copyright 2010, Vasily Sokolov (C-4). | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2010, Vasily Sokolov (C-4)." #property link "https://www.mql5.com" #property version "1.00" #include <Arrays\List.mqh> // Base model class CModel:CObject { protected: string m_name; public: void CModel(){m_name="Model base";} bool virtual Processing(void){return(true);} }; class cmodel_macd : public CModel { public: void cmodel_macd(){m_name="MACD Model";} bool Processing(){Print("Processing ", m_name, "...");return(true);} }; class cmodel_moving : public CModel { public: void cmodel_moving(){m_name="Moving Average";} bool Processing(){Print("Processing ", m_name, "...");return(true);} }; //Create list of models CList *list_models; void OnInit() { int rezult; // Great two pointer cmodel_macd *m_macd; cmodel_moving *m_moving; list_models = new CList(); m_macd = new cmodel_macd(); m_moving = new cmodel_moving(); //Check valid pointer if(CheckPointer(m_macd)==POINTER_DYNAMIC){ rezult=list_models.Add(m_macd); if(rezult!=-1)Print("Model MACD successfully created"); else Print("Creation of Model MACD has failed"); } //Check valid pointer if(CheckPointer(m_moving)==POINTER_DYNAMIC){ rezult=list_models.Add(m_moving); if(rezult!=-1)Print("Model MOVING AVERAGE successfully created"); else Print("Creation of Model MOVING AVERAGE has failed"); } } void OnTick() { CModel *current_model; for(int i=0;i<list_models.Total();i++){ current_model=list_models.GetNodeAtIndex(i); current_model.Processing(); } } void OnDeinit(const int reason) { delete list_models; }

Once this program is compiled and run, similar lines, indicating the normal operation of the EA, should appear in the journal "Experts".

2010.10.10 14:18:31 ch01_simple_model (EURUSD,D1) Prosessing Moving Average... 2010.10.10 14:18:31 ch01_simple_model (EURUSD,D1) Processing MACD Model... 2010.10.10 14:18:21 ch01_simple_model (EURUSD,D1) Model MOVING AVERAGE was created successfully 2010.10.10 14:18:21 ch01_simple_model (EURUSD,D1) Model MACD was created successfully

Let's analyze in detailhow this code works. So, as mentioned above, our basic trading model CModel is derived from the class CObject, which gives us the right to include the descendants of the basic model in the list of CList type:

rezult=list_models.Add(m_macd); rezult=list_models.Add(m_moving);

The organization of data requires working with pointers. Once the pointers of specific models are created at the local level of OnInit() function and are entered into the global list list_models, the need for them disappears, and they can be safely destructed, along with other variables of this function.

In general, a distinguishing feature of the proposed model is that the only global variable (in addition to the model classes themselves) is a dynamically linked list of these models. Thus, from the beginning, there is support of a high degree of encapsulation of the project.

If the creation of the model failed for some reason (for example, the values of the required parameters were listed incorrectly), then this model will not be added to the list. This will not affect the overall work of the EA, since it will handle only those models that were successfully added to the list.

The sampling of created models is made in the OnTick() function. It consists of a for loop. In this loop the number of elements is determined, after which there is a serial passage from the first element of the cycle (i = 0) to the last (i <list_models.Total();i++):

CModel *current_model; for(int i=0;i<list_models.Total();i++){ current_model=list_models.GetNodeAtIndex(i); current_model.Processing(); }

The pointer to the CModel base class is used as a universal adapter. This ensures that any function that is supported by this indicator will be available to the derivative models. In this case, we need the only Processing() function. Each model has its own version of Processing(), the internal implementation of which may differ from similar functions of other models. Overloading this function is not necessary, it can only exist in one form: not having any input parameters and returning the value of bool type.

Tasks that fall upon the "shoulders" of this function are extensive:

- The function should independently determine the current market situation based on its own trading models.

- After a decision is made to enter the market , the function should independently calculate the required amount of collateral, involved in the deal (the margin), the deal volume, the value of the maximum possible loss or the profit level.

- The behavior of the model should be correlated with its previous actions. For example, if there is a short position, initiated by the model, then building it further in the future may be impossible. All these verifications should be carried out within the Processing() function.

- Each of these functions should have access to the common parameters, such as the account status. Based on this data, this function should carry out its own money management, using the parameters embedded in its model. For example, if money management in one of the models is done through the means of the optimum formula f, then its value should be different for each of its models.

Obviously, the Processing() function, due to the magnitude of the tasks laid upon it, will rely on the developed apparatus of the auxiliary classes, those that are included in the MetaTrader 5, as well as those that are designed specifically for this solution.

As can be seen, most of the work is delegated to specific instances of the model. The external level of the EA gives the control in turn to each model, and its work is completed on this. What will be done by the specific model will depend on its internal logic.

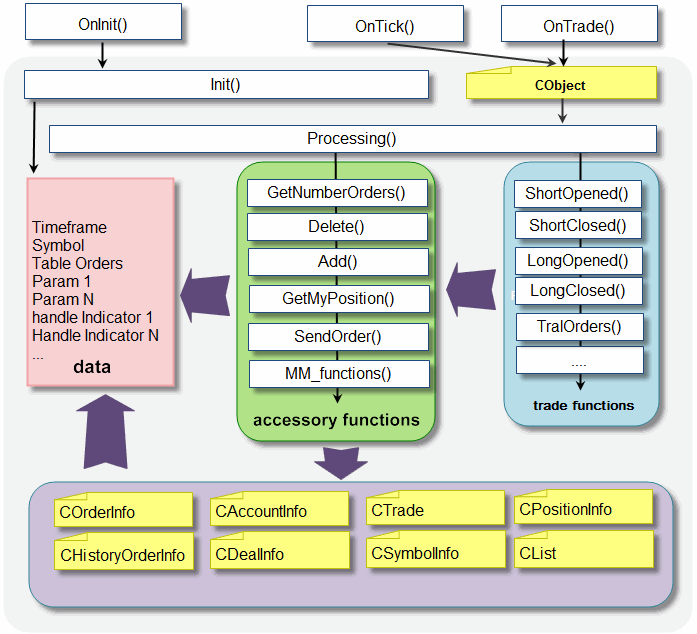

In general, the system of interaction, which we have built, can be described by the following scheme:

Note that although the sorting of models, as presented in the above code, occurs inside the OnTick() function, it does not necessary have to be so. The sorting cycle can be easily placed in any other desired function, such as the OnTrade() or OnTimer().

The table of virtual orders - the basis of the model

Once we have combined all of the trading models into a single list, it's time to describe the process of trade. Let's go back to the CModel class and try to supplement it with additional data and functions, which could be based upon in the trading process.

As mentioned above, the new net position paradigm defines the different rules for working with orders and deals. In MetaTrader 4, each deal is accompanied by its order, which existed on the tab "Trade" from the moment of its issue and until the termination of the order or the closing of the deal, initiated by it.

In MetaTrader 5 the pending orders only exist until the moment of the actual completion of the deal. After the deal, or the entrance of the market on it, is implemented, these orders pass to the history of orders, which is stored on the trading server. This situation creates uncertainty. Suppose the EA put out an order, which was executed. The aggregated position has changed. After some time, the EA needs to close its position.

Closing the specific order, as it could be done in MetaTrader 4, can not be done, as there is a lack of the very concept of closure of orders, we can close the position or a part of it. The question is, what part of the position should be closed. Alternatively, we can look through all of the historical orders, select the ones which have been put out by the EA, and then correlate these orders with the current market situation and, if necessary, block their counter orders. This method contains many difficulties.

For example, how can we determine that the orders were not already blocked in the past? We can take another way, assuming that the current position belongs exclusively to the current EA. This option can be used only if you intend to trade with one EA, trading on one strategy. All of these methods are not able to elegantly solve the challenges we face.

The most obvious and simplest solution would be to store all of the necessary information about the orders of the current model (ie, orders that are not blocked by opposite deals) within the model itself.

For example, if the model put out an order, its ticket is recorded in a special area of the memory of this model, for example, it can be organized with the help of an already familiar to us system of linked lists.

Knowing the ticket order, you can find almost any information about it, so all we need - is to link the ticket order with the model which put it out. Let the ticket order be stored in the CTableOrder special class. In addition to the ticket, it can accommodate the most essential information, for example, the volume of orders, the time of its installation, the magic number, etc.

Let's see how this class is structured:

#property copyright "Copyright 2010, MetaQuotes Software Corp." #property link "https://www.mql5.com" #include <Trade\_OrderInfo.mqh> #include <Trade\_HistoryOrderInfo.mqh> #include <Arrays\List.mqh> class CTableOrders : CObject { private: ulong m_magic; // Magic number of the EA that put out the order ulong m_ticket; // Ticket of the basic order ulong m_ticket_sl; // Ticket of the simulated-Stop-Loss order, assigned with the basic order ulong m_ticket_tp; // Ticket of the simulated-Take-Profit, assigned with the basic order ENUM_ORDER_TYPE m_type; // Order type datetime m_time_setup; // Order setup time double m_price; // Order price double m_sl; // Stop Loss price double m_tp; // Take Profit price double m_volume_initial; // Order Volume public: CTableOrders(); bool Add(COrderInfo &order_info, double stop_loss, double take_profit); bool Add(CHistoryOrderInfo &history_order_info, double stop_loss, double take_profit); double StopLoss(void){return(m_sl);} double TakeProfit(void){return(m_tp);} ulong Magic(){return(m_magic);} ulong Ticket(){return(m_ticket);} int Type() const; datetime TimeSetup(){return(m_time_setup);} double Price(){return(m_price);} double VolumeInitial(){return(m_volume_initial);} }; CTableOrders::CTableOrders(void) { m_magic=0; m_ticket=0; m_type=0; m_time_setup=0; m_price=0.0; m_volume_initial=0.0; } bool CTableOrders::Add(CHistoryOrderInfo &history_order_info, double stop_loss, double take_profit) { if(HistoryOrderSelect(history_order_info.Ticket())){ m_magic=history_order_info.Magic(); m_ticket=history_order_info.Ticket(); m_type=history_order_info.Type(); m_time_setup=history_order_info.TimeSetup(); m_volume_initial=history_order_info.VolumeInitial(); m_price=history_order_info.PriceOpen(); m_sl=stop_loss; m_tp=take_profit; return(true); } else return(false); } bool CTableOrders::Add(COrderInfo &order_info, double stop_loss, double take_profit) { if(OrderSelect(order_info.Ticket())){ m_magic=order_info.Magic(); m_ticket=order_info.Ticket(); m_type=order_info.Type(); m_time_setup=order_info.TimeSetup(); m_volume_initial=order_info.VolumeInitial(); m_price=order_info.PriceOpen(); m_sl=stop_loss; m_tp=take_profit; return(true); } else return(false); } int CTableOrders::Type() const { return((ENUM_ORDER_TYPE)m_type); }

Similar to CModel class, the CTableOrders class is inherited from CObject. Just like the classes of the models, we will place instances of CTableOrders into the ListTableOrders list of CList type.

In addition to its own ticket order (m_tiket), the class contains information about the magic number (ORDER_MAGIC) of the EA that put it out, its type, opening price, volume, and the level of the estimated overlap of orders: stoploss (m_sl) and takeprofit (m_tp). On the last two values, we need to speak separately. It is obvious that any deal should sooner or later be closed by an opposite deal. The opposite deal can be initiated on the basis of the current market situation or the partial close of the position at a predetermined price, at the time of its conclusion.

In MetaTrader4, such "unconditional exits from position" are special types of exits: StopLoss and TakeProfit. The distinguishing feature of MetaTrader 4 is the fact that these levels apply to a specific orders. For example, if a stop occurs in one of the active orders, it will not affect the other open orders on this instrument.

In MetaTrader 5, this is somewhat different. Although for each of the set orders, among other things, you can specify a price of the StopLoss and the TakeProfit, these levels will not act against a specific order, in which these prices were set, but in respect to the whole position on this instrument.

Suppose there is an open BUYposition for EURUSD of 1 standard lot without the levels of StopLoss and TakeProfit. Some time later, another order is put out for EURUSD to buy 0.1 lot, with the set levels of StopLoss and TakeProfit - each at a distance of 100 points from the current price. After some time, the price reaches the level of StopLossor the level of TakeProfit. When this occurs, the entire position with a size of 1.1 lot at EURUSDwill be closed.

In other words, the StopLoss and TakeProfit can be set only in relation to the aggregated position, and not against a particular order. On this basis, it becomes impossible to use these orders in multi-system EAs. This is obvious, because if one system will put out its own StopLoss and TakeProfit, then it will apply to all other systems, the interests of which is already included in the aggregated position of the instrument!

Consequently, each of the subsystems of the trading EA should only use their own, internal StopLoss and TakeProfit for each order individually. Also, this can concept can be derived from the fact that even within the same trading system, different orders may have different levels of StopLoss and TakeProfit, and as already mentioned above, in MetaTrader 5, these outputs can not be designated to individual orders.

If we place, within the virtual orders, synthetic levels of StopLoss and TakeProfit, the EA will be able to independently block the existing orders once the price reaches or exceeds these levels. After blocking these orders, they can be safely removed from the list of active orders. The way this is done is described below.

The class CTableOrders, aside from its own data, contains a highly important Add() function. This function receives the order ticket, which needs to be recorded into the table. In addition to the order ticket, this function receives the levels of the virtual StopLoss and TakeProfit. First, the Add() function tries to allocate the order among the historical orders, which are stored on the server. If it is able to do this, it inputs the information on the ticket into the instance of the class history_order_info, and then begins to enter the information through it into the new TableOrders element. Further, this element is added to the list of orders. If the selection of the order could not be completed, then, perhaps, we are dealing with a pending order, so we have to try to allocate this order from the current orders via the OrderSelect() function. In case of a successful selection of this order, the same actions are taken as for the historical order.

At the moment, before the introduction of the structure, which describes the event Trade, working with pending orders for multi-system EAs is difficult. Certainly, after the introduction of this structure, it will become possible to design EAs, based upon pending orders. Moreover, if an orders table is present, virtually any trading strategy with pending orders can be moved into performance on the market. For these reasons, all of the trading models presented in the article will have market execution (ORDER_TYPE_BUY or ORDER_TYPE_SELL).

CModel - the base class of the trading model

And so, when the table of orders is fully designed, comes the time to describe the full version of the basic model CModel:

class CModel : public CObject { protected: long m_magic; string m_symbol; ENUM_TIMEFRAMES m_timeframe; string m_model_name; double m_delta; CTableOrders *table; CList *ListTableOrders; CAccountInfo m_account_info; CTrade m_trade; CSymbolInfo m_symbol_info; COrderInfo m_order_info; CHistoryOrderInfo m_history_order_info; CPositionInfo m_position_info; CDealInfo m_deal_info; t_period m_timing; public: CModel() { Init(); } ~CModel() { Deinit(); } string Name(){return(m_model_name);} void Name(string name){m_model_name=name;} ENUM_TIMEFRAMES Timeframe(void){return(m_timeframe);} string Symbol(void){return(m_symbol);} void Symbol(string set_symbol){m_symbol=set_symbol;} bool virtual Init(); void virtual Deinit(){delete ListTableOrders;} bool virtual Processing(){return (true);} double GetMyPosition(); bool Delete(ENUM_TYPE_DELETED_ORDER); bool Delete(ulong Ticket); void CloseAllPosition(); //bool virtual Trade(); protected: bool Add(COrderInfo &order_info, double stop_loss, double take_profit); bool Add(CHistoryOrderInfo &history_order_info, double stop_loss, double take_profit); void GetNumberOrders(n_orders &orders); bool SendOrder(string symbol, ENUM_ORDER_TYPE op_type, ENUM_ORDER_MODE op_mode, ulong ticket, double lot, double price, double stop_loss, double take_profit, string comment); };

The data from this class contains the fundamental constants of any trading model.

This is the magic number (m_magic), the symbol on which the model will be launched, (m_symbol) the time-frame (m_timeframe), and the name of the most traded model (m_name).

In addition, the model includes the, already familiar to us, class of the orders table, (CTableOrders * table) and the list, in which the instances of this table will be kept, one copy for each order(CList*ListTableOrders). Since all of the data will be created dynamically, as the need arises, the work with this data will be carried out through pointers.

This is followed by the variable m_delta. This variable should hold a special coefficient for calculating the current lot in the formulas for money managing. For example, for the fixed-fractional formula of capitalization, this variable can store a share of the account, which can be risked, for instance,for the risk of 2% of the account, this variable must be equal to 0.02. For the more aggressive methods, for example, for the optimal method, fthis variable might be larger.

What is important in this variable is that it permits the individual selection of the risk for each model, which is part of a single EA. If the capitalization formula is not used, then filling it out is not required.By default it is equal to 0.0.

Next follows the inclusion of all auxiliary trading classes, which are designed to facilitate the receipt and processing of all of the required information, ranging from account information and to information about position. It is understood that the derivatives of specific trade models need to actively use these auxiliary classes, and not the regular features of type OrderSelect or OrderSend.

The variable m_timing needs to be described separately. During the process of the work of the EA, it is necessary to call certain events at certain time intervals. The OnTimer() function is not suitable for this, since the different models may exist in different time intervals.

For example, some events need to be called at each new bar. For the model, trading on an hourly graph, such events should be called each hour, for a model, trading on a daily graph - each new day bar. It is clear that these models have different time settings, and each must be stored, respectively, in its own model. The structure t_period, included in the CModel class, allows you to store these settings separately, each in its model.

Here is what the structure looks like:

struct t_period { datetime m1; datetime m2; datetime m3; datetime m4; datetime m5; datetime m6; datetime m10; datetime m12; datetime m15; datetime m20; datetime m30; datetime h1; datetime h2; datetime h3; datetime h4; datetime h6; datetime h8; datetime h12; datetime d1; datetime w1; datetime mn1; datetime current; };

As can be seen, it includes the usual listing of timeframes. To see whether a new bar has occurred, you need to compare the time of the last bar, with the time that was recorded in the structure t_period. If times do not match, then a new bar has occurred, and the time in the structure needs to be updated to the time of the current bar and return a positive result (true). If the time of the last bar and the structure are identical, this means that the new bar has not yet occurred, and a negative result needs to be returned (false).

Here is a function that works, based on the algorithm described:

bool timing(string symbol, ENUM_TIMEFRAMES tf, t_period &timeframes) { int rez; MqlRates raters[1]; rez=CopyRates(symbol, tf, 0, 1, raters); if(rez==0) { Print("Error timing"); return(false); } switch(tf){ case PERIOD_M1: if(raters[0].time==timeframes.m1)return(false); else{timeframes.m1=raters[0].time; return(true);} case PERIOD_M2: if(raters[0].time==timeframes.m2)return(false); else{timeframes.m2=raters[0].time; return(true);} case PERIOD_M3: if(raters[0].time==timeframes.m3)return(false); else{timeframes.m3=raters[0].time; return(true);} case PERIOD_M4: if(raters[0].time==timeframes.m4)return(false); else{timeframes.m4=raters[0].time; return(true);} case PERIOD_M5: if(raters[0].time==timeframes.m5)return(false); else{timeframes.m5=raters[0].time; return(true);} case PERIOD_M6: if(raters[0].time==timeframes.m6)return(false); else{timeframes.m6=raters[0].time; return(true);} case PERIOD_M10: if(raters[0].time==timeframes.m10)return(false); else{timeframes.m10=raters[0].time; return(true);} case PERIOD_M12: if(raters[0].time==timeframes.m12)return(false); else{timeframes.m12=raters[0].time; return(true);} case PERIOD_M15: if(raters[0].time==timeframes.m15)return(false); else{timeframes.m15=raters[0].time; return(true);} case PERIOD_M20: if(raters[0].time==timeframes.m20)return(false); else{timeframes.m20=raters[0].time; return(true);} case PERIOD_M30: if(raters[0].time==timeframes.m30)return(false); else{timeframes.m30=raters[0].time; return(true);} case PERIOD_H1: if(raters[0].time==timeframes.h1)return(false); else{timeframes.h1=raters[0].time; return(true);} case PERIOD_H2: if(raters[0].time==timeframes.h2)return(false); else{timeframes.h2=raters[0].time; return(true);} case PERIOD_H3: if(raters[0].time==timeframes.h3)return(false); else{timeframes.h3=raters[0].time; return(true);} case PERIOD_H4: if(raters[0].time==timeframes.h4)return(false); else{timeframes.h4=raters[0].time; return(true);} case PERIOD_H6: if(raters[0].time==timeframes.h6)return(false); else{timeframes.h6=raters[0].time; return(true);} case PERIOD_H8: if(raters[0].time==timeframes.h8)return(false); else{timeframes.h8=raters[0].time; return(true);} case PERIOD_H12: if(raters[0].time==timeframes.h12)return(false); else{timeframes.h12=raters[0].time; return(true);} case PERIOD_D1: if(raters[0].time==timeframes.d1)return(false); else{timeframes.d1=raters[0].time; return(true);} case PERIOD_W1: if(raters[0].time==timeframes.w1)return(false); else{timeframes.w1=raters[0].time; return(true);} case PERIOD_MN1: if(raters[0].time==timeframes.mn1)return(false); else{timeframes.mn1=raters[0].time; return(true);} case PERIOD_CURRENT: if(raters[0].time==timeframes.current)return(false); else{timeframes.current=raters[0].time; return(true);} default: return(false); } }

At the moment there is no possibility of a sequential sorting of the structures. Such sorting may be required when you need to create multiple instances in a cycle of the same trading model, trading on different time-frames. So I had to write a special function-sorters regarding the structure t_period.

Here is the source code of this function:

int GetPeriodEnumerator(uchar n_period) { switch(n_period) { case 0: return(PERIOD_CURRENT); case 1: return(PERIOD_M1); case 2: return(PERIOD_M2); case 3: return(PERIOD_M3); case 4: return(PERIOD_M4); case 5: return(PERIOD_M5); case 6: return(PERIOD_M6); case 7: return(PERIOD_M10); case 8: return(PERIOD_M12); case 9: return(PERIOD_M15); case 10: return(PERIOD_M20); case 11: return(PERIOD_M30); case 12: return(PERIOD_H1); case 13: return(PERIOD_H2); case 14: return(PERIOD_H3); case 15: return(PERIOD_H4); case 16: return(PERIOD_H6); case 17: return(PERIOD_H8); case 18: return(PERIOD_H12); case 19: return(PERIOD_D1); case 20: return(PERIOD_W1); case 21: return(PERIOD_MN1); default: Print("Enumerator period must be smallest 22"); return(-1); } }

All of these functions are conveniently combined into a single file in the folder \\Include. Let's name it Time.mqh.

This is what will be included in our base class CModel:

…

#incude <Time.mqh>

…

In addition to simple functions get/set of type Name(), Timeframe() and Symbol(), class CModel contain complex functions of type Init(), GetMyPosition(), Delete(), CloseAllPosition() и Processing(). The designation of the last function should already be familiar to you, we will discuss in greater detail its internal structure later, but for now let's start with a description of the main functions of the base class CModel.

The CModel::Add() function dynamically creates an instance of class CTableOrders, and then fills it using the appropriate CTabeOrders::Add() function. Its principle of operation has been described above. After being filled, this item gets included into the general list of all orders of the current model (ListTableOrders.Add (t)).

The CModel::Delete() function, on the other hand, deleted the element of CTableOrders type from the list of active orders. To do this you must specify the ticket of the orders, which must be deleted. The principles of its works is simple. The function sequentially sorts through the entire table of orders in search for the order with the right ticket. If it finds such an order, it deletes it.

The CModel::GetNumberOrders() function counts up the number of active orders. It fills the special structure n_orders:

struct n_orders { int all_orders; int long_orders; int short_orders; int buy_sell_orders; int delayed_orders; int buy_orders; int sell_orders; int buy_stop_orders; int sell_stop_orders; int buy_limit_orders; int sell_limit_orders; int buy_stop_limit_orders; int sell_stop_limit_orders; };

As can be seen, after it is called we can find out how many specific types of orders have been set. For example, to obtain the number of all short orders, you must read all of the values of short_ordersof the instance n_orders.

The CModel::SendOrder() function is the basic and only function for the factual sending of orders to the trading server. Instead of each particular model having its own algorithm for sending orders to the server, the SendOrder() function defines the general procedure for these submission. Regardless of the model, the process of putting out orders is associated with the same checks, which are efficiently carried out in a centralized location.

Let's get ourselves familiarized with the source code of this function:

bool CModel::SendOrder(string symbol, ENUM_ORDER_TYPE op_type, ENUM_ORDER_MODE op_mode, ulong ticket, double lot, double price, double stop_loss, double take_profit, string comment) { ulong code_return=0; CSymbolInfo symbol_info; CTrade trade; symbol_info.Name(symbol); symbol_info.RefreshRates(); mm send_order_mm; double lot_current; double lot_send=lot; double lot_max=m_symbol_info.LotsMax(); //double lot_max=5.0; bool rez=false; int floor_lot=(int)MathFloor(lot/lot_max); if(MathMod(lot,lot_max)==0)floor_lot=floor_lot-1; int itteration=(int)MathCeil(lot/lot_max); if(itteration>1) Print("The order volume exceeds the maximum allowed volume. It will be divided into ", itteration, " deals"); for(int i=1;i<=itteration;i++) { if(i==itteration)lot_send=lot-(floor_lot*lot_max); else lot_send=lot_max; for(int i=0;i<3;i++) { //Print("Send Order: TRADE_RETCODE_DONE"); symbol_info.RefreshRates(); if(op_type==ORDER_TYPE_BUY)price=symbol_info.Ask(); if(op_type==ORDER_TYPE_SELL)price=symbol_info.Bid(); m_trade.SetDeviationInPoints(ulong(0.0003/(double)symbol_info.Point())); m_trade.SetExpertMagicNumber(m_magic); rez=m_trade.PositionOpen(m_symbol, op_type, lot_send, price, 0.0, 0.0, comment); // Sleeping is not to be deleted or moved! Otherwise the order will not have time to get recorded in m_history_order_info!!! Sleep(3000); if(m_trade.ResultRetcode()==TRADE_RETCODE_PLACED|| m_trade.ResultRetcode()==TRADE_RETCODE_DONE_PARTIAL|| m_trade.ResultRetcode()==TRADE_RETCODE_DONE) { //Print(m_trade.ResultComment()); //rez=m_history_order_info.Ticket(m_trade.ResultOrder()); if(op_mode==ORDER_ADD){ rez=Add(m_trade.ResultOrder(), stop_loss, take_profit); } if(op_mode==ORDER_DELETE){ rez=Delete(ticket); } code_return=m_trade.ResultRetcode(); break; } else { Print(m_trade.ResultComment()); } if(m_trade.ResultRetcode()==TRADE_RETCODE_TRADE_DISABLED|| m_trade.ResultRetcode()==TRADE_RETCODE_MARKET_CLOSED|| m_trade.ResultRetcode()==TRADE_RETCODE_NO_MONEY|| m_trade.ResultRetcode()==TRADE_RETCODE_TOO_MANY_REQUESTS|| m_trade.ResultRetcode()==TRADE_RETCODE_SERVER_DISABLES_AT|| m_trade.ResultRetcode()==TRADE_RETCODE_CLIENT_DISABLES_AT|| m_trade.ResultRetcode()==TRADE_RETCODE_LIMIT_ORDERS|| m_trade.ResultRetcode()==TRADE_RETCODE_LIMIT_VOLUME) { break; } } } return(rez); }

The first thing that this function does is it verifies the possibility of executing the stated volume of the trading server. This it does by using the CheckLot() function. There may be some trading restrictions on the size of the position. They need to be taken into account.

Consider the following case: there is a limit on the size of a trading positions of 15 standard lots in both directions. The current position is long and equals to 3 lots. The trading model, based of its system of money management, wants to open a long position with a volume of 18.6 lots.The CheckLot() function will return the corrected volume of the deal. In this case, it will be equal to 12 lots (since 3 lots out of 15 are already occupied by other deals). If the current open position was short, rather than long, then the function would returns 15 lots instead of 18.6. This is the maximum possible volume of positions.

After putting out 15 lots buy, the net position, in this case, will be 12 lots (3 - sell, 15 - buy). When another model overrides its initial short position of 3 lots, buy the aggregated position will become the maximum possible - 15 lots. Other signals to buy will not be processed until the model overrides some or all of its 15 lots buy. A possible volume for the requested deal has been exceed, the function returns a constant EMPTY_VALUE, such signal must be passed.

If the check for the possibility of the set volume has been successful, then calculations are made on the value of the required margin. The may not be enough funds in the account for the stated volume. For these purposes, there is a CheckMargin() function. If the margin is not enough, it will try to correct the order volume so that the current free margin allowed it to open. If the margin is not enough even to open the minimum amount, we are in a state of Margin-Call.

If there are currently no positions, and the margin is not used, it means only one thing - technical margin-call - a state where it is impossible to open a deal. Without adding money to the account, we are unable to continue. If some margin is still in use, then we are left with nothing else but to wait until the transaction, which uses this margin, is closed. In any case, the lack of margin will return a constant EMPTY_VALUE.

A distinguishing feature of this function is the ability to divide of the current order into several independent deals. If the trading models use a system of capitalization of the account, then the required amount can easily exceed all conceivable limits (for example, the system of capitalization may require the opening of a deal with a volume of several hundred, and sometimes thousand, standard lots). Clearly is is impossible to ensure such an amount for a single deal. Typically, the trading conditions determine the size of a maximum deal of one hundred lots, but some trading servers have other restrictions, for example, on the MetaQuotes Championship 2010 server this limitation was 5 lots. It is clear that such restrictions must be taken into account, and based on this, correctly calculate the actual volume of the deal.

First the number of orders, needed to implement the set volume, is counted. If the set amount does not exceed the maximum amount of the transaction, it requires only one pass for putting out this order. If the desired volume of the transactions exceeds the maximum possible volume, then this volume is divided into several parts. For example, you want to buy a 11.3 lots of EURUSD. The maximum size of the transaction on this instrument is 5.0 lots. Then the OrderSend function breaks up this volume into three orders: one order - of 5.0 lots, second order - 5.0 lots, third order - 1.3 lots.

Thus, instead of one order, there will be as many as three. Each of them will be listed in the table of orders, and will have their own independent settings, such as the virtual values of Stop Loss and Take Profit, the magic number, and other parameters. In the processing of such orders there should not be any difficulties, since the trading models are designed in such a way that they can handle any number of orders in their lists.

Indeed, all of the orders will have the same values TakeProfitand StopLoss. Each of them will be sequentially sorted by the LongClose and ShortClose functions. Once the right conditions for their closure occur, or they reach their thresholds SL and TP, they will all be closed.

Every order is sent to the server using the OrderSend function of the CTrade class. The most interesting detail of the work is hidden below.

The fact is that the assignment of an order may be twofold. The order to buy or sell can be sent upon the occurrence of the signal, or it may be an order for blocking the previously existing one. The OrderSend function must know the type of the sent order, since this is the function that actually places all of the orders in the table of orders, or removes them from the table upon the occurrence of certain events.

If the order type you want to add is ADD_ORDER. I.e. is an independent order, which needs to be placed in the table of orders, then the function adds information about this order into the table of orders. If the order is put out to override previously placed order (for example, in the occurrence of a virtual stop-loss), then it must have a type DELETE_ORDER. After it has been put up, the function OrderSend manually removes the information about the order, with which it is linked from the list of orders. For this the function, in addition to the order type, inherits an order ticket, with which it is linked. If this is ADD_ORDER, then the ticket can be filled with a simple zero.

The first trading model, based on the crossover of moving averages

We discussed all of the major elements of the CModel base class. It is time to consider a specific trading class.

For these purposes, we will first create a simple trading model, based on a simple indicator MACD.

This model always will have the long position or a short one. As soon as the fast line crosses the slow line downwards, we will open a short position, while a long position, if there is one, will be closed. In the case of the upward crossover, we will open a long position, while a short position, if there is one, will be closed. In this model, we do not use protective stops and profit levels.

#include <Models\Model.mqh> #include <mm.mqh> //+----------------------------------------------------------------------+ //| This model uses MACD indicator. | //| Buy when it crosses the zero line downward | //| Sell when it crosses the zero line upward | //+----------------------------------------------------------------------+ struct cmodel_macd_param { string symbol; ENUM_TIMEFRAMES timeframe; int fast_ema; int slow_ema; int signal_ema; }; class cmodel_macd : public CModel { private: int m_slow_ema; int m_fast_ema; int m_signal_ema; int m_handle_macd; double m_macd_buff_main[]; double m_macd_current; double m_macd_previous; public: cmodel_macd(); bool Init(); bool Init(cmodel_macd_param &m_param); bool Init(string symbol, ENUM_TIMEFRAMES timeframes, int slow_ma, int fast_ma, int smothed_ma); bool Processing(); protected: bool InitIndicators(); bool CheckParam(cmodel_macd_param &m_param); bool LongOpened(); bool ShortOpened(); bool LongClosed(); bool ShortClosed(); }; cmodel_macd::cmodel_macd() { m_handle_macd=INVALID_HANDLE; ArraySetAsSeries(m_macd_buff_main,true); m_macd_current=0.0; m_macd_previous=0.0; } //this default loader bool cmodel_macd::Init() { m_magic = 148394; m_model_name = "MACD MODEL"; m_symbol = _Symbol; m_timeframe = _Period; m_slow_ema = 26; m_fast_ema = 12; m_signal_ema = 9; m_delta = 50; if(!InitIndicators())return(false); return(true); } bool cmodel_macd::Init(cmodel_macd_param &m_param) { m_magic = 148394; m_model_name = "MACD MODEL"; m_symbol = m_param.symbol; m_timeframe = (ENUM_TIMEFRAMES)m_param.timeframe; m_fast_ema = m_param.fast_ema; m_slow_ema = m_param.slow_ema; m_signal_ema = m_param.signal_ema; if(!CheckParam(m_param))return(false); if(!InitIndicators())return(false); return(true); } bool cmodel_macd::CheckParam(cmodel_macd_param &m_param) { if(!SymbolInfoInteger(m_symbol, SYMBOL_SELECT)) { Print("Symbol ", m_symbol, " selection has failed. Check symbol name"); return(false); } if(m_fast_ema == 0) { Print("Fast EMA must be greater than 0"); return(false); } if(m_slow_ema == 0) { Print("Slow EMA must be greater than 0"); return(false); } if(m_signal_ema == 0) { Print("Signal EMA must be greater than 0"); return(false); } return(true); } bool cmodel_macd::InitIndicators() { if(m_handle_macd==INVALID_HANDLE) { Print("Load indicators..."); if((m_handle_macd=iMACD(m_symbol,m_timeframe,m_fast_ema,m_slow_ema,m_signal_ema,PRICE_CLOSE))==INVALID_HANDLE) { printf("Error creating MACD indicator"); return(false); } } return(true); } bool cmodel_macd::Processing() { //if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_DISABLED)return(false); //if(m_account_info.TradeAllowed()==false)return(false); //if(m_account_info.TradeExpert()==false)return(false); m_symbol_info.Name(m_symbol); m_symbol_info.RefreshRates(); CopyBuffer(this.m_handle_macd,0,1,2,m_macd_buff_main); m_macd_current=m_macd_buff_main[0]; m_macd_previous=m_macd_buff_main[1]; GetNumberOrders(m_orders); if(m_orders.buy_orders>0) LongClosed(); else LongOpened(); if(m_orders.sell_orders!=0) ShortClosed(); else ShortOpened(); return(true); } bool cmodel_macd::LongOpened(void) { if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_DISABLED)return(false); if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_SHORTONLY)return(false); if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_CLOSEONLY)return(false); bool rezult, ticket_bool; double lot=0.1; mm open_mm; m_symbol_info.Name(m_symbol); m_symbol_info.RefreshRates(); CopyBuffer(this.m_handle_macd,0,1,2,m_macd_buff_main); m_macd_current=m_macd_buff_main[0]; m_macd_previous=m_macd_buff_main[1]; GetNumberOrders(m_orders); //Print("LongOpened"); if(m_macd_current>0&&m_macd_previous<=0&&m_orders.buy_orders==0) { //lot=open_mm.optimal_f(m_symbol, ORDER_TYPE_BUY, m_symbol_info.Ask(), 0.0, m_delta); lot=open_mm.jons_fp(m_symbol, ORDER_TYPE_BUY, m_symbol_info.Ask(), 0.1, 10000, m_delta); rezult=SendOrder(m_symbol, ORDER_TYPE_BUY, ORDER_ADD, 0, lot, m_symbol_info.Ask(), 0, 0, "MACD Buy"); return(rezult); } return(false); } bool cmodel_macd::ShortOpened(void) { if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_DISABLED)return(false); if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_LONGONLY)return(false); if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_CLOSEONLY)return(false); bool rezult, ticket_bool; double lot=0.1; mm open_mm; m_symbol_info.Name(m_symbol); m_symbol_info.RefreshRates(); CopyBuffer(this.m_handle_macd,0,1,2,m_macd_buff_main); m_macd_current=m_macd_buff_main[0]; m_macd_previous=m_macd_buff_main[1]; GetNumberOrders(m_orders); if(m_macd_current<=0&&m_macd_previous>=0&&m_orders.sell_orders==0) { //lot=open_mm.optimal_f(m_symbol, ORDER_TYPE_SELL, m_symbol_info.Bid(), 0.0, m_delta); lot=open_mm.jons_fp(m_symbol, ORDER_TYPE_SELL, m_symbol_info.Bid(), 0.1, 10000, m_delta); rezult=SendOrder(m_symbol, ORDER_TYPE_SELL, ORDER_ADD, 0, lot, m_symbol_info.Bid(), 0, 0, "MACD Sell"); return(rezult); } return(false); } bool cmodel_macd::LongClosed(void) { if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_DISABLED)return(false); CTableOrders *t; int total_elements; int rez=false; total_elements=ListTableOrders.Total(); if(total_elements==0)return(false); for(int i=total_elements-1;i>=0;i--) { if(CheckPointer(ListTableOrders)==POINTER_INVALID)continue; t=ListTableOrders.GetNodeAtIndex(i); if(CheckPointer(t)==POINTER_INVALID)continue; if(t.Type()!=ORDER_TYPE_BUY)continue; m_symbol_info.Refresh(); m_symbol_info.RefreshRates(); CopyBuffer(this.m_handle_macd,0,1,2,m_macd_buff_main); if(m_symbol_info.Bid()<=t.StopLoss()&&t.StopLoss()!=0.0) { rez=SendOrder(m_symbol, ORDER_TYPE_SELL, ORDER_DELETE, t.Ticket(), t.VolumeInitial(), m_symbol_info.Bid(), 0.0, 0.0, "MACD: buy close buy stop-loss"); } if(m_macd_current<0&&m_macd_previous>=0) { //Print("Long position closed by Order Send"); rez=SendOrder(m_symbol, ORDER_TYPE_SELL, ORDER_DELETE, t.Ticket(), t.VolumeInitial(), m_symbol_info.Bid(), 0.0, 0.0, "MACD: buy close by signal"); } } return(rez); } bool cmodel_macd::ShortClosed(void) { if(m_symbol_info.TradeMode()==SYMBOL_TRADE_MODE_DISABLED)return(false); CTableOrders *t; int total_elements; int rez=false; total_elements=ListTableOrders.Total(); if(total_elements==0)return(false); for(int i=total_elements-1;i>=0;i--) { if(CheckPointer(ListTableOrders)==POINTER_INVALID)continue; t=ListTableOrders.GetNodeAtIndex(i); if(CheckPointer(t)==POINTER_INVALID)continue; if(t.Type()!=ORDER_TYPE_SELL)continue; m_symbol_info.Refresh(); m_symbol_info.RefreshRates(); CopyBuffer(this.m_handle_macd,0,1,2,m_macd_buff_main); if(m_symbol_info.Ask()>=t.StopLoss()&&t.StopLoss()!=0.0) { rez=SendOrder(m_symbol, ORDER_TYPE_BUY, ORDER_DELETE, t.Ticket(), t.VolumeInitial(), m_symbol_info.Ask(), 0.0, 0.0, "MACD: sell close buy stop-loss"); } if(m_macd_current>0&&m_macd_previous<=0) { rez=SendOrder(m_symbol, ORDER_TYPE_BUY, ORDER_DELETE, t.Ticket(), t.VolumeInitial(), m_symbol_info.Ask(), 0.0, 0.0, "MACD: sell close by signal"); } } return(rez); }

The CModel base class does not impose any restrictions on the internal content of its descendants. The only thing that it makes mandatory, is the use of the Processing() interface function. All of the problems of the internal organization of this function are delegated to a specific class of models. There is no any universal algorithm that could be placed inside a function Processing(), therefore, there are no reason to impose on the descendants its method of how a particular model should be arranged. However, the internal structure of virtually any model can be standardized. Such standardization will greatly facilitate the understanding of an externaland even your code, and will make the model more "formulaic."

Each model must have its own initializer. The initializer of the model is responsible for loading the correct parameters, which are necessary for its operation, for example, in order for our model to work, we need to select the MACD indicator values, obtain a handle of the corresponding buffer, and in addition, of course,determine the trading instrument and time-frame for the model. All of this must be done by the initializer.

The initializers of models - are simple overloaded methods of their classes. These methods have a common name Init. The fact is that MQL5 does not support the overloaded constructors, so there is no way to create the initializer of the model in its constructor, because the overload will be needed for input parameters. Although no one restricts us from indicating in the model's constructor the its basic parameters.

Every model should have three initializers. First - the default initializer. It must configure and load the model by default, without requesting the parameters. This can be very convenient for testing in the "as is" mode. For example, for our model, the default initializer as an instrument tooland time-frame of the model, will select the current graph and the current time-frame.

The settings of the MACD indicator will also be standard: fast EMA = 12, slow EMA = 26, signal MA = 9; If the model is required to be configured in a certain way, such initializer will no longer be suitable. We will need initializers with parameters. It is desirable (but not necessarily) to make two types. The first will receive its parameters as a classical function: Init (type param1, type param2, ..., type paramN). The second will find out the parameters of the model using a special structure, which saves these parameters. This option is sometimes more preferable because sometimes the number of parameters can be large, in which case it would be convenient to pass them through the structures.

Each model has the structure of its parameters. This structure can have any name, but it is preferable to call it by the pattern modelname_param. Configuring the model - is a very important step in using the opportunities of multi-time-frame/multi-system/multi-currency trading. It is at this stage that it is determined, how and on what instrument this model will be trading on.

Our trading model has only four trading functions. The function for opening a long position: LongOpen, the function for opening a short position: ShortOpen, the function for closing a long position: LongClosed, and the function for closing a short position: ShortClosed. The work of the functions LongOpen и ShortOpen is trivial. Both receive the indicator value of the MACD previous bar, which is compared with the value of two bars before that. To avoid the "redrawing", the current (zero) bar will not be used.

If there is a downward crossover, then the ShortOpencalculates function using the functions, included in the header file mm.mqh, after which the necessary lot sends its command to the OrderSend function. The LongClose at this moment, on the contrary, closes all of the long positions in the model. This occurs because the function sequentially sorts all of the current open orders in the orders table of the model. If there is a long order found, then the function closes it with a counter-order. The same exact thing, although in the opposite direction, is done by the ShortClose() function. The work of these functions can be found in the listing provided above.

Let us analyze in more detail how the current lot is calculated in the trading model.

As mentioned above, for these purposes we use special functions for the capitalization of the account. In addition to the formulas of capitalizations, these functions include the verification of the calculation of the lot, based on the level of the used margin and by the restriction of the size of the trading positions.There may be some trading restrictions on the size of the position. They need to be taken into account.

Consider the following case: there is a limit on the size of a trading positions of 15 standard lots in both directions. The current position is long and equals to 3 lots. The trading model, based on its system of capital management, wants to open a long position with a volume of 18.6 lots. The function CheckLot() will return the corrected amount of the order volume. In this case, it will be equal to 12 lots (since 3 lots out of 15 are already occupied by other deals). If the current open position was short, and not long, then the function would have returned 15 lots instead of 18.6. This is the maximum possible volume of the positions.

After putting up 15 lots to buy, the net position, in this case, will be 12 lots (3 - sell, 15 - buy). When another model overrides its initial short position of 3 lots, buy the aggregated position will become the maximum possible - 15 lots. Other signals to buy will not be processed until themodel overrides some or all of its 15 lots buy. If the available volume for the requested transactionis exhausted, then the function will return a EMPTY_VALUE constant. This signal must be passed.

If the check for the possibility of the set volume has been successful, then calculations are made on the value of the required margin. Account funds may be insufficient for the set volume. For these purposes, there is a function CheckMargin(). If the margin is not enough, it will try to correct the stated amount of the transaction so that the current free margin allowed it to open. If the margin is not enough even to open the minimum volume, then we are in a state of Margin-Call.

If there are currently no positions, and the margin is not used, it means only one thing - technical margin-call - a state where it is impossible to open a deal. Without adding money to the account, we are unable to continue. If some margin is still used, then we have no choice but to wait until the closure of the position that uses this margin. In any case, the lack of margin will return a constant EMPTY_VALUE.

The functions for controlling the lot size and the margins are usually not used directly. They are called by special functions for managing capital. These functions implement the formulas for the capitalization of accounts. The file mm.mqh includes only two basic functions of capital management, one is calculated on the basis of a fixed fraction of the account, and the other, based on the method proposed by Ryan Jones, known as the method of fixed proportions.

The purpose of the first method is to define a fixed part of the account, which can be risked. For example, if the allowed risk is 2% of the account, and the account is equal to 10,000 dollars, then the maximum risk amount is $ 200. In order to calculate what lot should be used for a 200 dollar stop, you need to know exactly what the maximumdistance can be reached by the price against the opened position. Therefore, to calculate the lot through this formula, we need to accurately determine the Stop Loss and the price level, at which the deal will be made.

The method proposed by Ryan Jones is different from the previous one. Its essence is that capitalization is done by the function, defined by a particular case of a quadratic equation.

Here is its solution:

x=((1.0+MathSqrt(1+4.0*d))/2)*Step;

where: x - the lower boundary of the transition to the next level d = (Profit / delta) * 2.0 Step- a step of the delta, such as 0.1 lots.

The lower the size of the delta, the more aggressively the function tries to increase the number of positions.For more details on how this function is constructed, you can refer to the book by Ryan Jones: The Trading Game: Playing by the Numbers to Make Millions.

If the functions of capital management are not planned to be used, it is necessary to directly call the functions of controlling the lot and margin.

So we have reviewed all of the elements of our basic EA. It is time to reap the fruits of our work.

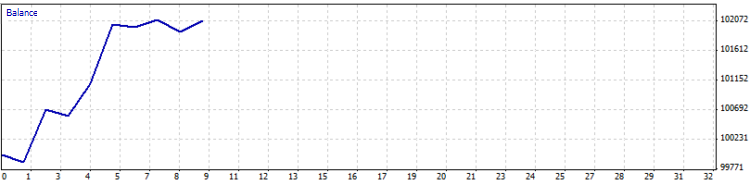

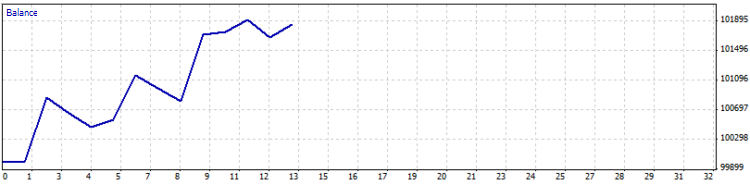

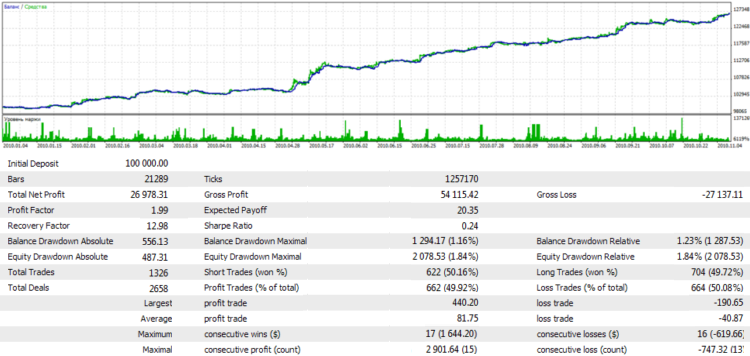

To begin with, let's create four models. Let one model trade by EURUSD default parameters, the second one will also trade on EURUSD, but on a 15-minute time-frame. The third model will be launched on the graph GBPUSDwith default parameters. The fourth - on USDCHF on a two-hour graph, with the following parameters: SlowEMA= 6 FastEMA = 12 SignalEMA = 9. The period for testing - H1, the testing mode - all of the ticks, the time from 01.01.2010 to 01.09.2010.

But before we run this model in four different modes, first we'll try to test it for each instrument and time-frame separately.

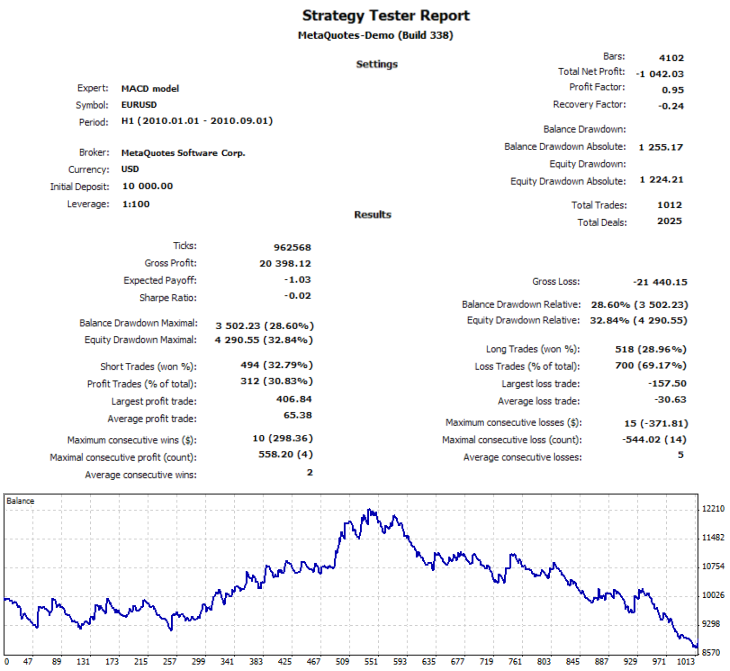

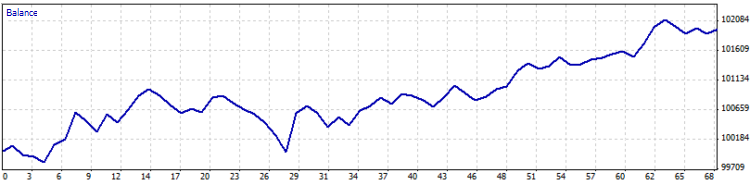

Here is the table on which the main indicators of testing is made:

| System | Number of Deals | Profit, $ |

|---|---|---|

| MACD(9,12,26)H1 EURUSD | 123 | 1092 |

| MACD (9,12,26) EURUSD M15 | 598 | -696 |

| MACD(9,6,12) USDCHF H2 | 153 | -1150 |

| MACD(9,12,26) GBPUSD H1 | 139 | -282 |

| All systems | 1013 | -1032 |

The table shows that the total number of deals for all models should be 1013, and the total profit should be $ -1032.

Consequently, these are the same values that we should obtain if we test these systems at the same time. The results should not differ, although some minor deviations still occur.

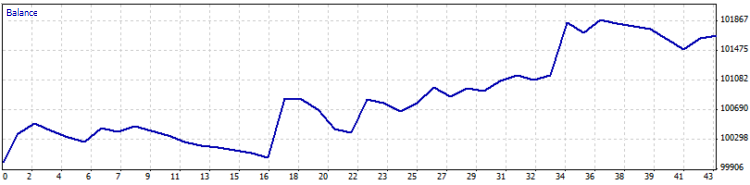

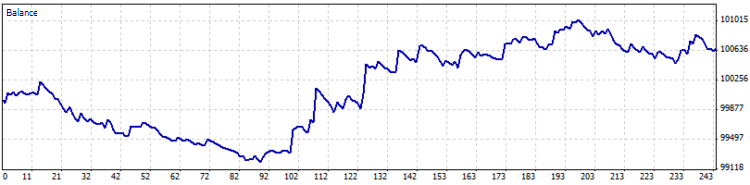

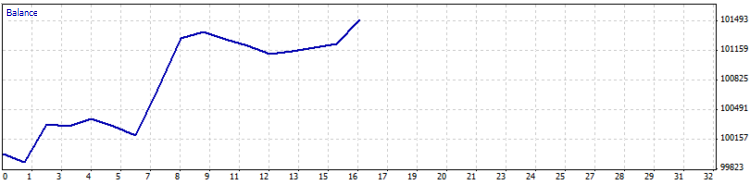

So here's the final test:

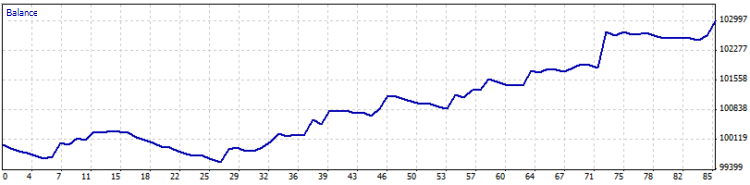

As can be seen, there is only one less deals, and the profits differs only by $ 10, which corresponds to only 10 points of difference with a lot of 0.1. It should be noted that the results of combined testing, in the case of using the system of money management will be radically different from theamount of test results of each model individually. This is because the dynamics of the balance influence each of the systems, so the calculated values of the lots will vary.

Despite the fact that on its own, the results do not present an interest, we have created a complicated, but very flexible and manageable structure of the EA. Let us briefly again consider its structure.

For this we will turn to the scheme shown below:

The scheme shows the basic structure of the model's instance.

Once a class instance of the trading model is created, we call the overloaded Init() function. It initializes the necessary parameters, prepares the data, loads the handles of Indicators, if they are being used. All this happens during the initialization of the EA, ie inside the OnInit() function. Note that the data includes instances of the base classes, designed to facilitate trade. It is assumed that the trading models need to actively use these classes instead of the standard functions of MQL5. After the model class is created successfully and initialized, it falls into the list of models CList. Further communication with it is carried out through a universal adapter CObject.

After the occurrence of the OnTrade() or OnTick() events, there is a sequential sorting of all instances of the models in the list. Communication with them is carried out by calling the Processing() function. Further, it calls the trading functions of its own model (the blue functions group). Their list and names are not strictly defined, but it is convenient to use the standard names such as LongOpened(), ShortClosed(), etc. These functions, based on their embedded logic, chose the time to complete the deal, and then send a specially formed request for the opening or closing of the deal of the SendOrder() function.

The latter makes the necessary checks, and then outputs the orders to the market. The trading functions rely on the auxiliary functions of the model (green group), which, in turn, actively use the basic auxiliary classes (purple group). All of the auxiliary classes are represented as instances of classes in the data section (pink group). The interaction between the groups is shown by dark-blue arrows.

The trading model, based on the indicator of Bollinger Bands

Now that the general structure of data and methods becomes clear, we will create another trading model, based on the trend indicators of the Bollinger Bands. As the basis for this trading model, we used a simple EA An Expert Advisor, based on Bollinger Bands by Andrei Kornishkin. Bollinger Bands - are levels, equal to a certain size of standard deviations from the simple moving average. More details on how this indicator is constructed can be found in the Help section for technical analysis, attached to the MetaTrader 5 terminal.

The essence of the trading idea is simple: the price has the property of returning, ie if the price reached a certain level, then most likely, it will turn to the opposite direction. This thesis is proven by a test on a normal distribution of any real trading instrument: the normal distribution curve will be slightly elongated. The Bollinger bands determine the most probable culminations of price levels. Once they are reached (upper or lower Bollinger bands), the price is likely to turn in the opposite direction.

We slightly simplify the trading tactic, and will not use the auxiliary indicator - the double exponential moving average (Double Exponential Moving Average, or DEMA). But we will use strict protective stops - virtual Stop Loss. They will make the trading process more stable, and at the same time help us understand an example, in which each trading model uses its own independent level of protective stops.

For the level of protective stops, we use the current price plus or minus the indicator value volatility ATR. For example, if the current value of ATR is equal to 68 points and there is a signal to sell at a price of 1.25720, then the virtual Stop Loss for this deal will be equal to 1.25720 + 0.0068 = 1.26400. Similarly, but in the opposite direction, it is done for buying: 1.25720 - 0.0068 = 1.25040.

The source code of this model is provided below: