Object Approach in MQL

--- | 15 October, 2007

Introduction

This article will be interesting first of all for programmers both beginners and professionals working in MQL environment. Also it would be useful if this article were read by MQL environment developers and ideologists, because questions that are analyzed here may become projects for future implementation of MetaTrader and MQL. To some extent alike ideas may be found in articles Universal Expert Advisor Template and Sending Trading Signals in a Universal Expert Advisor

So,

One of the disadvantages of MQL, in my programmer opinion, is the absence of the object approach in constructing the model of the trading system. MQL developers offer us two ways out: using the calling of external functions or using the order parameter MAGIC for the identification of the order belonging.

Actually, if only one system operates on one account, we do not need identification. But when we have the program option of attaching to one account several automated trading systems, then we cannot do without MAGIC. Even when calling external functions, we need to determine them. Of course, we may build an array OrderTicket and identify the array belonging only to one trading system, but as we know in some brokerage companies the order ticket changes at swap (actually, one is closed, another one is opened). That is why we cannot do without using MAGIC.

So, while developers are busy improving MQL language making it more flexible, let us try to implement already now the object approach in building a trading model.

This is a trading system in accordance with my object model. Of course, it is not universal, but by now I do not see other approaches.

So, let us analyze this model.

A). Signal System (SS).

Object of this module process and interpret incoming quotes. Usually the "object" of the signal system is a set of indicators, for example, moving averages. As a result of processing quotes and indicator values, "the object" (or semaphore) produces signals to enter/exit, or order modification etc.

The semaphore forms its signal and sends it to another object from the module Entry/Exit (EE).

Setting the semaphore in MQL is rather easy.

1. Define a global identifier using #define.

It is better to set not consecutive numbers like 1, 2, 3, 4..., but in 5-10, so that in an Expert Advisor we could use one signal for several processes (see the second module).

//+------------------------------------------------------------------+ //| Signals.mqh | //| Copyright © 2007 Сергеев Алексей | //| los@we.kherson.ua | //+------------------------------------------------------------------+ #property copyright "Copyright © 2007, Сергеев Алексей " #property link "mailto: los@we.kherson.ua" #property library #define BLACKSYS 10 #define BORCHAN 20 #define ELDER 80 #define ENVELOP 90

2. Then in the global function of this module we should enable its processor.

int CheckSignal(bool bEntry, int SignalID) { switch (SignalID) { case BLACKSYS: return (BlackSys(bEntry)); break; case BORCHAN: return (BorChan(bEntry)); break; case ELDER: return (Elder(bEntry)); break; case ENVELOP: return (Envelop(bEntry)); break; default: return (-1); } }

3. And the last step is the description of functions.

Here is an example for processing signals of an object that inherits the features of the indicator Envelope.

int Envelope(bool bEntry) { int MA=21; double Deviation=0.6; int Mode=MODE_SMA;//0-sma, 1-ema, 2-smma, 3-lwma int Price=PRICE_CLOSE;//0-close, 1-open, 2-high, 3-low, 4-median, 5-typic, 6-wieight double envH0, envL0, m0; double envH1, envL1, m1; envH0=iEnvelopes(NULL, 0, MA, Mode, 0, Price, Deviation, MODE_UPPER, 0); envL0=iEnvelopes(NULL, 0, MA, Mode, 0, Price, Deviation, MODE_LOWER, 0); envH1=iEnvelopes(NULL, 0, MA, Mode, 0, Price, Deviation, MODE_UPPER, 1); envL1=iEnvelopes(NULL, 0, MA, Mode, 0, Price, Deviation, MODE_LOWER, 1); m0 = (Low[0]+High[0])/2; m1 = (Low[1]+High[1])/2; //----- condition for operation execution if (bEntry) //for opening { if (envH0<m0 && envH1<m1) return (OP_SELL); if (envL0>m0 && envL1>m1) return (OP_BUY); } else //for closing { if (envH0<m0 && envH1<m1) return (OP_BUY); if (envL0>m0 && envL1>m1) return (OP_SELL); } return (-1); //no signal }

Thus we get a module that will contain different objects-signals.

B). Objects of the block EE have minimal tasks:

First, its objects interact with objects-signals - observe them. The life cycle

and interaction is the following:

Checking semaphore -> if there are any positive signals, open/close/modify positions

-> Passing control to objects in the module PS.

All the objects in the module EE have a prefix Process…, which determine its behavior more specifically.

For example:

ProcessAvgLim // - the object processes signals with opening pending limit-orders and positions averaging ProcessTurn // - the object processes signals with position turning

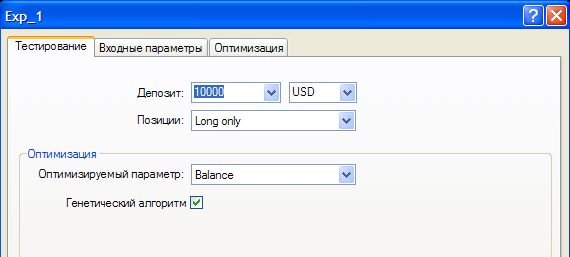

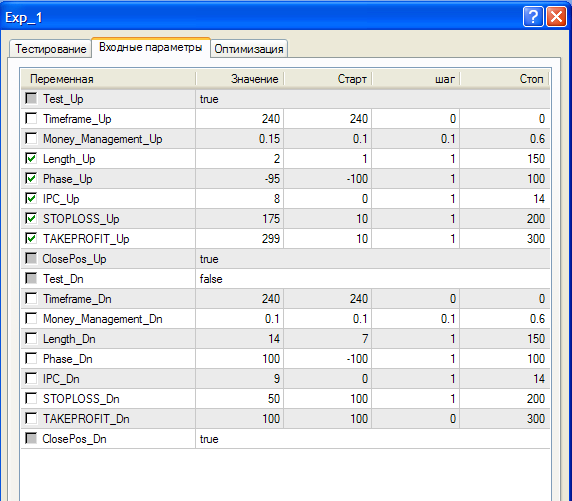

Each sample of a trading system class (we all understand this and use in our modules) must have its own individual characteristics, such as profit, stop-loss, its own Money Management, as well as other additional parameters, implemented in different trailing variants etc.

When implementing these features I tried several variants of approach and the most suiting in MQL, in my opinion, is creating a two-dimensional array. Here is its description:

double SysPar[nSignal][11]; #define _TP 0 // Profit #define _NullTP 1 // profit level, after which we set into losslessness #define _NullTP2 2 // profit level, after which we set into losslessness #define _TS 3 // distance of the trailing stop #define _NullSL 4 // level, after achieving which the expected profit is transfered into opening point #define _SL 5 // level, after achieving which the expected profit is transfered into opening point #define _dSL 6 // the initial step upon the opening level of the next order in the position support #define _dStep 7 // The step is increased in .. times upon the level of the next opening #define _dLot 8 // In how many times (as compared to the last one) we increase the lot on the next one #define _nLot 9 // In how many times (as compared to the initial one) we increase the lot on the next one string SysParName[nSignal];

where nSignal is the identifier of object-signals.

For example:

SysPar[ENVELOP][_TS] = 40.0; // distance of the trailing stop SysPar[ENVELOP][_NullSL] = 20.0;// level, after achieving which the expected profit is transfered into opening point SysPar[ENVELOP][_SL] = 70; // changing stop-loss

Upon your desire you may increase the number of set parameters of this array-structure.

So, after setting the parameters we call the function of semaphore processing. In other words we interact with the signal system. It is done in my favorite function start()

void start()

{

ProcessAvgLim(ENVELOP, ENVELOP, Green, Red);

… …

As it is seen in the scheme, in the trading system we have 4 registered semaphores and 3 observers. Each semaphore is based on its own variant of quote interpretation.

For example, Semaphore 1 sends signals analyzing the indicator MACD. Observer 1 in its turn after receiving these signals opens orders in a simple scheme ProcessSimple.

Observers 2 and 3 are more difficult. Each one controls signals of two semaphores. And, consequently, the approach to order opening is different.

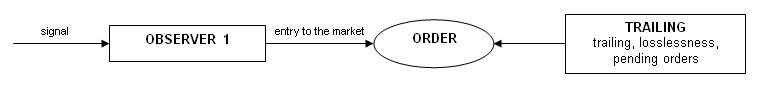

So, after we set parameters of the observer and attach a semaphore to it, we need to control and trail opening positions.

"Responsible" for the state of opened orders are objects of the module Position Support (PS).

C). Block PS is in my opinion the most interesting one, and not less important than semaphores.

Here different trailing variants are implemented, pending orders are opened, position support and locking, profit and loss controlling is implemented and so on. Such a PS should adequately react on EE signals about exiting the market in case of loss positions with minimal losses.

There is an interesting library of trailings on this site Library of Functions and Expert Advisors for trailing / Yury Dzyuban. All trailing types are easily attached to the system.

For an easier perception, all support objects start from the prefix Trailing…

It has the following scheme:

Calling, control transfer from an observer to trailing is done in the same function start()

void start()

{

ProcessSimple(MACD, MACD, Black, Plum); TrailingSimple(MACD, Black, Plum);

ProcessAvgLim(ENVELOPE, ENVELOPE, Green, Red); TrailingAvgLim(ENVELOPE, Green, Red);

}So this was an example variant of the object approach to system building. Those who want may use it.

And once again I would like to ask MQL developers to widen the options of the language. And as an example, here is a variant of implementing object classes written in the language C++.

struct SystemParam { double TP; // profit double NullTP; // profit level, after which we set into losslessness double NullTP2; // profit level, after which we set into losslessness a set of one-direction orders double TS; // distance of the trailing stop double NullSL; // loss level, at which we transfer the expected profit into losslessness double SL; // stop-loss double dSL; // a step upon the opening level of the next order for the position support double dStep; // In how many times we increase the step upon the opening level of the next order double dLot; // In how many times we increase the lot on the next order } class MTS { public: string m_NameTS; // system name (for making comments for the order) int m_SignalID; // identifier of trading signals (for semaphore inquiry) long int Tickets[1000]; // array of order tickets, selected upon m_SignalID (MAGIC) SystemParam SysPar; // Trading system parameters color ClrBuy; // color for indicating BUY order color ClrSell; // color for indicating SELL order // Initialization void MyMTS (); // standard function that sets initial values of the system void MyMTS (int aSignalID, int nProcessMode, int nTrailingMode); // standard function // that sets initial values of the system // Implementation int CheckSignal(); //function of checking state of market signals // Processing int m_nProcessMode; // identifier of observation mode int m_nTrailingMode; // identifier of trailing mode void Process(); // EE function - processing CheckSignal() void Trailing(); // PS function - order trailing // Special functions bool CreatTicketArray(int dir); // creating an array of tickets, selected upon m_SignalID (MAGIC) // and desired type dir: buy, sell, buylim, buystop, sellim, sellstop bool ArrangeOrderBy(int iSort); // arranging array Tickets upon the parameter (date, profit, price...) }; … MTS MyTS; // our trading system … int init() { … MyTS.m_SignalID = SIGNAL_MACD; // our system is based on MACD signals MyTS.m_NameTS = "MACD"; MyTS.SysPar.TP = 500; MyTS.SysPar.NullTP = 20; MyTS.SysPar.TS = 50; MyTS.SysPar.SL = 1000; MyTS.SetProcess (MODE_AVGLIM); MyTS.SetTrailing (MODE_AVGLIM); … } void start() { … MyTS.Process (); MyTS.Trailing (); … } … void MTS::Process() { … int Signal = CheckSignal(true, m_SignalID); //calling the global function of signal processing if (Signal == -1) return; // if no signal, do nothing //----- for buying if(Signal == OP_BUY) { } if(Signal == OP_SELL) { } … } … // global processor of semaphores int CheckSignal(bool bEntry, int SignalID) { switch (SignalID) { case ELDER: return (Elder(bEntry)); break; case ENVELOP: return (Envelop(bEntry)); break; case LAGUER: return (Laguer(bEntry)); break; case MACD: return (Macd(bEntry)); break; … } } // calling a certain semaphore int Macd(bool bEntry) { double MACDOpen=3; double MACDClose=2; double MA=26; int MODE_MA = MODE_EMA; // method of the calculation of averages int PRICE_MA = PRICE_CLOSE; // method of the calculation of averages int PERIOD = PERIOD_H1; // the period to work with //parameters of averages double MacdCur, MacdPre, SignalCur; double SignalPre, MaCur, MaPre; //---- get the value MacdCur=iMACD(NULL,0,8,17,9,PRICE_MA,MODE_MAIN,0); MacdPre=iMACD(NULL,0,8,17,9,PRICE_MA,MODE_MAIN,1); SignalCur=iMACD(NULL,0,8,17,9,PRICE_MA,MODE_SIGNAL,0); SignalPre=iMACD(NULL,0,8,17,9,PRICE_MA,MODE_SIGNAL,1); MaCur=iMA(NULL,0,MA,0,MODE_MA,PRICE_MA,0); MaPre=iMA(NULL,0,MA,0,MODE_MA,PRICE_MA,1); //----- condition for the operation execution if (bEntry) //for buying bEntry==true { if(MacdCur<0 && MacdCur>SignalCur && MacdPre<SignalPre && MathAbs(MacdCur)>(MACDOpen*Point) && MaCur>MaPre) return (OP_BUY); if(MacdCur>0 && MacdCur<SignalCur && MacdPre>SignalPre && MacdCur>(MACDOpen*Point) && MaCur<MaPre) return (OP_SELL); } else //for closing bEntry==false { if(MacdCur>0 && MacdCur<SignalCur && MacdPre>SignalPre && MacdCur>(MACDClose*Point)) return (OP_BUY); if(MacdCur>0 && MacdCur<SignalCur && MacdPre>SignalPre && MacdCur>(MACDOpen*Point) && MaCur<MaPre) return (OP_BUY); if(MacdCur<0 && MacdCur>SignalCur && MacdPre<SignalPre && MathAbs(MacdCur)>(MACDClose*Point)) return (OP_SELL); if(MacdCur<0 && MacdCur>SignalCur && MacdPre<SignalPre && MathAbs(MacdCur)>(MACDOpen*Point) && MaCur>MaPre) return (OP_SELL); } return (-1); //no signal }

The system logics in the MQL language will not be much different. All the functions become global. And for differentiating orders of one trading system from the orders of another one, we will need to add the parameter SignalID (i.e. MAGIC) into all functions that work with orders.