Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal API, Part 2

Vasiliy Sokolov | 9 April, 2015

Table Of Contents

- INTRODUCTION

- CHAPTER 1. INTERACTION OF EXPERT ADVISORS WITH HEDGE TERMINAL API AND ITS PANEL

- CHAPTER 2. HEDGE TERMINAL API MANUAL

- CHAPTER 3. THE FUNDAMENTALS OF ASYNCHRONOUS TRADING

- CHAPTER 4. THE FUNDAMENTALS OF MULTI-THREADED PROGRAMMING IN THE METATRADER 5 IDE

- ATTACHMENT DESCRIPTION

- CONCLUSION

Introduction

This article is a continuation of the first part "Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1". In the second part, we will discuss integration of Expert Advisors and other MQL5 programs with the HedgeTerminalAPI library. Read this article to learn how to work with the library. It will help you create bi-directional trading Expert Advisors while still working in a comfortable and simple trading environment.

In addition to the library description, the article touches on the fundamentals of asynchronous trading and multi-threaded programming. These descriptions are given in the third and fourth sections of this article. Therefore, this material will be useful for the traders who are not interested in bi-directional trading, but who would like to find out something new about asynchronous and multi-threaded programming.

The material presented below is intended for experienced algorithmic traders who know the MQL5 programming language. If you don't know MQL5, please read the first part of the article, which contains simple diagrams and drawings explaining the general principle of the library and the HedgeTerminal panel.

Chapter 1. Interaction of Expert Advisors with HedgeTerminal and its panel

1.1. Installation of HedgeTermianlAPI. The First Start of the Library

The process of HedgeTerminalAPI installation differs from the installation of the HT visual panel, since the library can't run alone in MetaTrader 5. Instead, you will need to develop a special Expert Advisor to call the HedgeTerminalInstall() function from the library. This function will set a special header file Prototypes.mqh describing the functions available in HedgeTerminalAPI.

A library is installed on a computer in three steps:

Step 1. Download the HedgeTerminalAPI library on your computer. Library location relative to your terminal: \MQL5\Experts\Market\HedgeTerminalApi.ex5.

Step 2. Create a new Expert Advisor in the MQL5 Wizard using a standard template. The MQL5 Wizard generates the following source code:

//+------------------------------------------------------------------+ //| InstallHedgeTerminalExpert.mq5 | //| Copyright 2015, MetaQuotes Software Corp. | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2015, MetaQuotes Software Corp." #property link "https://www.mql5.com" #property version "1.00" //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- //--- return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { //--- } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- }

Step 3. You will need only one function of the resulting Expert Advisor - OnInit(), and the export directive describing the special installer function HedgeTerminalInstall() exported by the HedgeTerminalApi library. Run this function right in the OnInit() function. The source code marked in yellow performs these operations:

//+------------------------------------------------------------------+ //| InstallHedgeTerminalExpert.mq5 | //| Copyright 2015, MetaQuotes Software Corp. | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2015, MetaQuotes Software Corp." #property link "https://www.mql5.com" #property version "1.00" #import "HedgeTerminalAPI.ex5" void HedgeTerminalInstall(void); #import //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- HedgeTerminalInstall(); ExpertRemove(); //--- return(INIT_SUCCEEDED); }

Step 4. Your further actions depend on whether you have purchased the library. If you have bought it, you can run the Expert Advisor in real-time directly on the chart. This will start the standard installer of the whole product line of HedgeTerminal. You can easily complete this step by following the instructions described in sections 2.1 and 2.2 of the article "Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1". The installation wizard installs all the required files including the header file and the test Expert Advisor on your computer.

If you have not purchased the library and only wish to test it, then EA operation in real time will not be available to you, but you can test API by running the EA in the strategy tester. The installer will not run in this case. In the test mode, HedgeTermianalAPI works in a single-user mode, so it does not need the files installed in the normal mode. It means you do not need to configure anything else.

As soon as EA testing is done, folder \HedgeTerminal is created in the common folder of the terminal. The normal path to the common directory of the MetaTrader terminals is c:\Users\<Username>\AppData\Roaming\MetaQuotes\Terminal\Common\Files\HedgeTerminal\, where <Username> is the name of your current computer account. The \HedgeTerminal folder already contains files \MQL5\Include\Prototypes.mqh and \MQL5\Experts\Chaos2.mq5. Copy these files into the same directories of your terminal: file Prototypes.mqh to \MetaTrader5\MQL5\Include, and file Chaos2.mq5 to \MetaTrader5\MQL5\Experts.

File Prototypes.mqh is a header file containing description of the functions exported from the HedgeTerminalAPI library. Their purpose and descriptions are contained in comments to them.

File Chaos2.mq5 contains a sample EA described in section "The SendTradeRequest Function and the HedgeTradeRequest Structure through the Example of Chaos II EA". This way you can visually understand how HedgeTerminalAPI works and how to develop an Expert Advisor utilizing the virtualization technology of HedgeTerminal.

The copied files are available for your EAs. So you only need to include the header file in the Expert Advisor source code to start using the library. Here is an example:

#include <Prototypes.mqh> //+------------------------------------------------------------------+ //| Script program start function | //+------------------------------------------------------------------+ void OnStart() { //--- int transTotal = TransactionsTotal(); printf((string)transTotal); }

For example, the above code gets the total number of active positions and displays the number in the "Experts" tab of the MetaTrader 5 terminal.

It is important to understand that HedgeTerminal is actually initialized at the first call of one of its functions. This initialization is called lazy. Therefore, the first call of one of its functions can take a long time. If you want a fast response during the first run, you must initialize HT in advance, for example, you can call the TransactionTotal() function in the block of OnInit().

With lazy initialization you can omit the explicit initialization of the Expert Advisor. This greatly simplifies working with HedgeTerminal and makes it unnecessary to pre-configure it.

1.2. Integration of Expert Advisors with the HedgeTerminal Panel

If you have the HedgeTerminal visual panel and the full-featured version of the library, which can be run in real time, you can integrate your Expert Advisors with the panel so that all trade operations performed by them will also appear in the panel. In general, the integration is not visible. If you use HedgeTermianalAPI functions, actions performed by the robots are automatically displayed on the panel. However, you can expand the visuality by indicating the EA name in each committed transaction. You can do it by uncommenting the below line in the file Settings.xml:

<Column ID="Magic" Name="Magic" Width="100"/>

This tag is in sections <Active-Position> and <History-Position>.

Now, comments are removed, and the tags are included into processing. After panel restart, new column of "Magic" will appear in the tables of active and history positions. The column contains the magic number of the Expert Advisor, to which the position belongs.

If you want to show the EA name instead of its magic number, add the name to the alias file ExpertAliases.xml. For example, an EA's magic number is 123847, and you want to displays its name, like "ExPro 1.1", add the following tag to the file:

<Expert Magic="123847" Name="ExPro 1.1"></Expert>

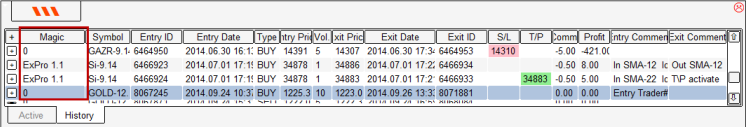

If it's done correctly, the EA name will be displayed instead of its magic in the appropriate column:

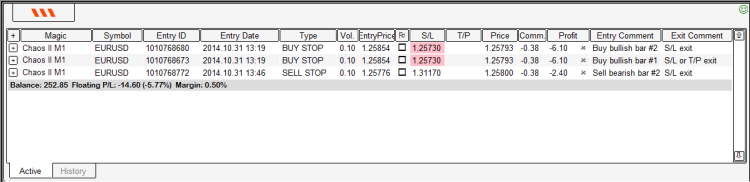

Fig. 1. Displaying EA name instead of Magic

Note that the panel and Expert Advisors communicate in real time. This means that if you close an EA's position directly on the panel, the EA will know about this with the next call of the TransactionsTotal() function. And vice versa: after the Expert Advisor closes its position, it immediately disappears from the active positions tab.

1.3. General Principles of HedgeTerminalAPI Operation

In addition to bi-directional positions, HedgeTerminal works also with other trading types, such as pending orders, deals and broker's operations. HedgeTerminal treats all these types as a single group of transactions. A deal, a pending order, a be-directional position - all of them are transactions. However, a transaction cannot exist alone. In terms of object-oriented programming, a transaction can be introduced as an abstract base class, from which all possible trading entities, such as deals and be-directional positions are inherited. In this regard all functions of HedgeTerminalAPI can be divided into several groups:

- Transaction search and selection functions. The common signature of the functions and the way they work almost completely coincide with the functions OrderSend() and OrderSelect() in MetaTrader 4;

- Functions for getting properties of a selected transaction. Every transaction has a specific set of properties and specific functions for property selection. The common signature of the functions and the way they work resemble MetaTrader 5 system functions in how they access positions, deals and orders (such as OrderGetDouble() or HistoryDealGetInteger());

- HedgeTerminalAPI uses only one trading function: SendTradeRequest(). This function allows closing a bi-directional position or part of it. The same function is used for modifying stop loss, take profit or the outgoing comment. Working with the function is similar to OrderSend() in MetaTrader 5;

- The function for getting common errors GetHedgeError(), functions for detailed analysis of HedgeTerminal trading actions: TotalActionsTask() and GetActionResult(). Also used for error detection. There are no analogues in MetaTrader 4 or MetaTrader 5.

Working with almost all the functions is similar to using MetaTrader 4 and MetaTrader 5 system functions. As a rule, the function input is some identifier (enumeration value), and the function returns a value that corresponds to it.

Specific enumerations are available for each function. The common call signature is the following:

<value> = Function(<identifier>);

Let's consider an example of getting a unique position identifier. This is how it looks line in MetaTrader 5:

ulong id = PositionGetInteger(POSITION_IDENTIFIER);

In HedgeTerminal, receiving a unique identifier of a bi-directional position is as follows:

ulong id = HedgePositionGetInteger(HEDGE_POSITION_ENTRY_ORDER_ID)

The general principles of the functions are the same. Only types of enumerations differ.

1.4. Selecting Transactions

Selecting a transaction is going through the list of transactions, which is similar to search for orders in MetaTrader 4. However, in MetaTrader 4 only orders are searched for, while in HedgeTerminal anything can be found as a transaction - such as a pending order or a hedging position. Therefore, each transaction should first be selected using the TransactionSelect() function, and then its type should be identified through TransactionType().

Two lists of transactions are available to date: active and history transactions. The list to be applied is defined based on the ENUM_MODE_TRADES modifier. It is similar to the MODE_TRADES modifier in MetaTrader 4.

Transaction search and selection algorithm is as follows:

1: for(int i=TransactionsTotal(MODE_TRADES)-1; i>=0; i--) 2: { 3: if(!TransactionSelect(i,SELECT_BY_POS,MODE_TRADES))continue; 4: if(TransactionType()!=TRANS_HEDGE_POSITION)continue; 5: if(HedgePositionGetInteger(HEDGE_POSITION_MAGIC) != Magic)continue; 6: if(HedgePositionGetString(HEDGE_POSITION_SYMBOL) != Symbol())continue; 7: if(HedgePositionGetInteger(HEDGE_POSITION_STATE) == POSITION_STATE_FROZEN)continue; 8: ulong id = HedgePositionGetInteger(HEDGE_POSITION_ENTRY_ORDER_ID) 9: }

The code loops through the list of active transactions in the cycle for (line 1). Before you proceed with the transaction, select it using TransactionSelect() (line 3). Only bi-directional positions are selected from these transactions (line 4). If the magic number of the position and its symbol do not match the magic number of the current EA and the symbol it is running on, HT moves on to the next position (lines 5 and 6). Then it defines the unique position identifier (line 8).

Special attention should be paid to line 7. The selected positions should be checked in terms of modification possibility. If the position is already in the process of modification, it cannot be changed in the current thread, although you can get one of its properties. If the position is locked, better wait until it's released to access its properties or retry to modify it. Property HEDGE_POSITION_STATE is used to find out whether position modification is possible.

The POSITION_STATE_FROZEN modifier denotes that the position is "frozen" and cannot be changed. The POSITION_STATE_ACTIVE modifier shows that a position is active and can be changed. These modifiers are listed in the ENUM_HEDGE_POSITION_STATE enumeration, which is documented in the appropriate section.

If a search through historical transactions is needed, the MODE_TRADES modifier in functions TransactionTotal() and TransactionSelect() must be replaced by MODE_HISTORY.

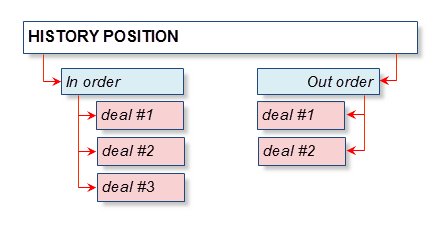

One transaction in HedgeTerminal can be nested into another. This is very much different from the concept of MetaTrader 5 where there is no nesting. For example, the historical bi-directional position in HedgeTerminal consists of two orders, each of which includes an arbitrary set of deals. Nesting can be represented as follows:

Fig. 2. Nested transactions

Nesting of transactions is clearly seen in the HedgeTerminal visual panel.

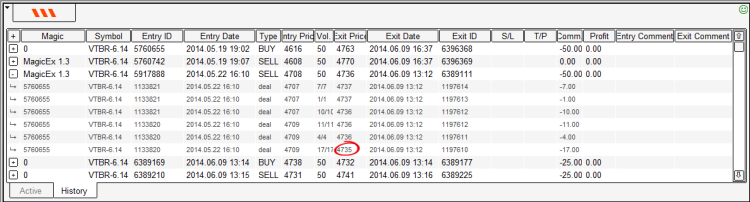

The below screenshot shows the details of a position of MagicEx 1.3:

Fig. 3. Nested transactions in the HedgeTerminal panel

You can access the properties of a particular order or a deal in the bi-directional position.

To do this:

- Select a historical transaction and make sure that it is a bi-directional position;

- Select one of the orders of this position using HedgeOrderSelect();

- Get one of the properties of the selected order: the number of deals that it contains;

- Select one of the deals belonging to the order by searching through all deals;

- Get the required deal property.

Note that after the transaction has been selected, its specific properties become available to it. For example, if the transaction is an order, then after selection through HedgeOrderSelect(), you can find the number of deals for it (HedgeOrderGetInter(HEDGE_ORDER_DEALS_TOTAL)) or the weighted average entry price (HedgeDealGetDouble(HEDGE_DEAL_PRICE_EXECUTED)).

Let's find out the price of deal #1197610, which is marked red on the screenshot. This deal is part of the bi-directional position of the MagicEx 1.3 EA.

Through the below code, the EA can access its position and this deal:

#include <Prototypes.mqh> ulong Magic=5760655; // MagicEx 1.3. //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { for(int i=TransactionsTotal(MODE_HISTORY)-1; i>=0; i--) { if(!TransactionSelect(i,SELECT_BY_POS,MODE_HISTORY))continue; // Select transaction #i; if(TransactionType()!=TRANS_HEDGE_POSITION)continue; // If transaction is not position - continue; if(HedgePositionGetInteger(HEDGE_POSITION_MAGIC) != Magic)continue; // If position is not main - continue; ulong id = HedgePositionGetInteger(HEDGE_POSITION_ENTRY_ORDER_ID); // Get id for closed order; if(id!=5917888)continue; // If id of position != 5917888 - continue; printf("1: -> Select position #"+(string)id); // Print position id; if(!HedgeOrderSelect(ORDER_SELECTED_CLOSED))continue; // Select closed order or continue; ulong order_id = HedgeOrderGetInteger(HEDGE_ORDER_ID); // Get id closed order; printf("2: ----> Select order #" + (string)order_id); // Print id closed order; int deals_total = (int)HedgeOrderGetInteger(HEDGE_ORDER_DEALS_TOTAL);// Get deals total in selected order; for(int deal_index = deals_total-1; deal_index >= 0; deal_index--) // Search deal #1197610... { if(!HedgeDealSelect(deal_index))continue; // Select deal by index or continue; ulong deal_id = HedgeDealGetInteger(HEDGE_DEAL_ID); // Get id for current deal; if(deal_id != 1197610)continue; // Select deal #1197610; double price = HedgeDealGetDouble(HEDGE_DEAL_PRICE_EXECUTED); // Get price executed; printf("3: --------> Select deal #"+(string)deal_id+ // Print price excecuted; ". Executed price = "+DoubleToString(price,0)); } } }

After code execution, the following entry will be created in the Experts tab of the MetaTrader 5 terminal:

2014.10.21 14:46:37.545 MagicEx1.3 (VTBR-12.14,D1) 3: --------> Select deal #1197610. Executed price = 4735 2014.10.21 14:46:37.545 MagicEx1.3 (VTBR-12.14,D1) 2: ----> Select order #6389111 2014.10.21 14:46:37.545 MagicEx1.3 (VTBR-12.14,D1) 1: -> Select position #5917888

The EA first selects position #5917888, and then selects order #6389111 inside the position. Once the order is selected, the EA starts searching for the deal number 1197610. When the deal is found, the EA gets its execution price and adds the price in the journal.

1.5. How to Get Error Codes Using GetHedgeError()

Errors and unforeseen situations may occur while working with the HedgeTerminal environment. Error getting and analyzing functions are used in these cases.

The simplest case when you get an error is when you forget to select a transaction using the TransactionSelect() function. The TransactionType() function will return modifier TRANS_NOT_DEFINED in this case.

To understand where the problem lies, we need to get the modifier of the last error. The modifier will tell us that now transaction has been selected. The following code does this:

for(int i=TransactionsTotal(MODE_HISTORY)-1; i>=0; i--) { //if(!TransactionSelect(i,SELECT_BY_POS,MODE_HISTORY))continue; // forgot to select; ENUM_TRANS_TYPE type = TransactionType(); if(type == TRANS_NOT_DEFINED) { ENUM_HEDGE_ERR error = GetHedgeError(); printf("Error, transaction type not defined. Reason: " + EnumToString(error)); } }

This is the resulting message:

Error, transaction type not defined. Reason: HEDGE_ERR_TRANS_NOTSELECTED

The error ID suggests that we have forgotten to select a transaction before trying to get its type.

All possible errors are listed in the ENUM_HEDGE_ERR structure.

1.6. Detailed Analysis of Trading and Identification of Errors Using TotalActionsTask() and GetActionResult()

In addition to the errors occurring in the process of working with the HedgeTerminal environment, trade errors may occur as a result of SendTradeRequest() call. These types of errors are more difficult to deal with. One task performed by SendTradeRequest() can contain multiple trading activities (subtasks). For example, to change the outgoing comment in an active position protected by a stop loss level, you must make two trading actions:

- Cancel the pending stop order representing the stop level;

- Place a new pending stop order with a new comment in the place of the previous order.

If the new stop order triggers, then its comment will be displayed as a comment closing the position, which is a correct way.

However, the task can be executed in part. Suppose, the pending order is successfully canceled, but placing new order fails for whatever reason. In this case, the position will be left without the stop loss level. In order to be able to handle this error, the EA will need to call a special task log and search in it to find the subtask that failed.

This is done using two functions: TotalActionsTask() returns the total number of trading actions (subtasks) within this task; and GetActionResult() accepts the subtasks index and returns its type and its execution result. Since all trading operations are performed using standard MetaTrader 5 tools, the result of their performance corresponds to the return code of the trade server.

In general, the algorithm of search for the failure reason is as follows:

- Getting the total number of sub-tasks in the task using TotalActionsTask();

- Searching through all subtasks in the for loop. Determining the type of each subtask and its result.

Suppose, the stop order with a new comment could not be placed because the order execution price was too close to the current price level.

The below example code shows how the EA could find the reason for this failure:

#include <Prototypes.mqh> ulong Magic=5760655; // MagicEx 1.3. //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //detect active position for(int i=TransactionsTotal(MODE_HISTORY)-1; i>=0; i--) { if(!TransactionSelect(i,SELECT_BY_POS,MODE_HISTORY))continue; ENUM_TRANS_TYPE type=TransactionType(); if(type==TRANS_NOT_DEFINED) { ENUM_HEDGE_ERR error=GetHedgeError(); printf("Error, transaction not defined. Reason: "+EnumToString(error)); } if(TransactionType()!=TRANS_HEDGE_POSITION)continue; if(HedgePositionGetInteger(HEDGE_POSITION_MAGIC) != Magic)continue; if(HedgePositionGetString(HEDGE_POSITION_SYMBOL) != Symbol())continue; HedgeTradeRequest request; request.action=REQUEST_MODIFY_COMMENT; request.exit_comment="My new comment"; if(!SendTradeRequest(request)) // Is error? { for(uint action=0; action < TotalActionsTask(); action++) { ENUM_TARGET_TYPE typeAction; int retcode=0; GetActionResult(action, typeAction, retcode); printf("Action#" + (string)action + ": " + EnumToString(type) +(string)retcode); } } } }

The following message will appear after the code execution:

Action #0 TARGET_DELETE_PENDING_ORDER 10009 (TRADE_RETCODE_PLACED) Action #1 TARGET_SET_PENDING_ORDER 10015 (TRADE_RETCODE_INVALID_PRICE)

By comparing the numbers with standard modifiers of trade server return codes, we find out that the pending order was successfully removed, but placing of a new order failed. The trade server returned an error 10015 (incorrect price), which may mean that the current price is too close to the stop level.

Knowing this, the EA can take control over the stop levels. To do so, the EA will only have to close this position using the same SendTradeRequest() function.

1.7. Tracking the Status of Trade Task Execution

Every trading task can consist of any number of subtasks that should be performed sequentially.

In the asynchronous mode, one task can be performed in several passes of the code. There may also be cases when the task can "freeze". Therefore EA's control over task execution is required. When calling the HedgePositionGetInteger() function with the HEDGE_POSITION_TASK_STATUS modifier, it returns the ENUM_TASK_STATUS type enumeration containing the status of the current position task.

For example, if something goes wrong after sending an order to close a position, due to which the position is not closed, then you need to get the status of the task.

The following example shows the code that an asynchronous Expert Advisor can execute to analyze the status of the task for the position:

ENUM_TASK_STATUS status=HedgePositionGetInteger(HEDGE_POSITION_TASK_STATUS); switch(status) { case TASK_STATUS_COMPLETE: printf("Task complete!"); break; case TASK_STATUS_EXECUTING: printf("Task executing. Waiting..."); Sleep(200); break; case TASK_STATUS_FAILED: printf("Filed executing task. Print logs..."); for(int i=0; i<TotalActionsTask(); i++) { ENUM_TARGET_TYPE type; uint retcode; GetActionResult(i,type,retcode); printf("#"+i+" "+EnumToString(type)+" "+retcode); } break; case TASK_STATUS_WAITING: printf("task will soon start."); break; }

Note that execution of some complex tasks requires multiple iterations.

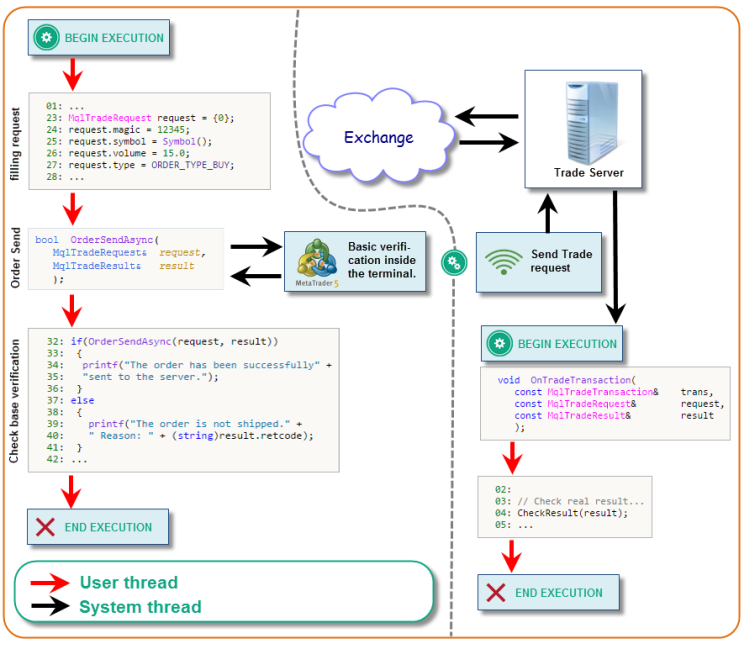

In the asynchronous mode, coming events that signal changes in trading environment start a new iteration. Thus, all the iterations are performed without delay, one after another, following responses received from the trading server. The task execution differs in the synchronous mode.

The synchronous method uses the synchronous operation emulator, due to which users can perform even composite tasks in a single pass. The emulator uses time lags. For example, after execution of a subtask starts, the emulator does not return the execution thread to the EA. Instead, it waits for some time expecting the trading environment to change. After that, it rereads the trading environment again. If it understands that the subtask has been successfully completed, starts the next subtasks.

This process somewhat reduces the overall performance, as it takes some time to wait. But it turns execution of even complex tasks into quite a simple sequential operation performed in a single function call. Therefore, you almost never need to analyze the task execution log in the synchronous method.

1.8. How to Modify and Close Bi-Directional Positions

Bi-directional positions are modified and closed using the SendTradeRequest() function. Only three options can be applied to an active position:

- A position can be fully or partially closed;

- Position stop loss and take profit can be modified;

- The outgoing comment of a position can be changed.

Historical position cannot be change. Similar to the OrderSend() function in MetaTrader 5, SendTradeRequest() uses a pre-compiled query in the form of a trading structure HedgeTraderRequest. Read the documentation for further details on the SendTradeRequest() function and the HedgeTraderRequest structure. The example showing position modification and closure is available in the section on Chaos II EA.

1.9. How to Set HedgeTerminal Properties from an Expert Advisor

HedgeTerminal possesses a set of properties, such as refresh frequency, the number of seconds to wait for a response from the server and others.

All of these properties are defined in Settings.xml. When an EA is running in real time, the library reads properties from the file and sets appropriate internal parameters. When the EA is tested on a chart, file Settings.xml is not used. However, in some situations you may need to individually modify the EA properties regardless of whether it is running on a chart or in the strategy tester.

This is done through the special set of functions HedgePropertySet…The current version features only one prototype from this set:

enum ENUM_HEDGE_PROP_INTEGER { HEDGE_PROP_TIMEOUT, }; bool HedgePropertySetInteger(ENUM_HEDGE_PROP_INTEGER property, int value)

For example, to set the timeout for the library to wait for a server response, write the following:

bool res = HedgePropertySetInteger(HEDGE_PROP_TIMEOUT, 30);

If the server response is not received within 30 seconds after you send an asynchronous request, the locked position will be released.

1.10. Synchronous and Asynchronous Modes of Operation

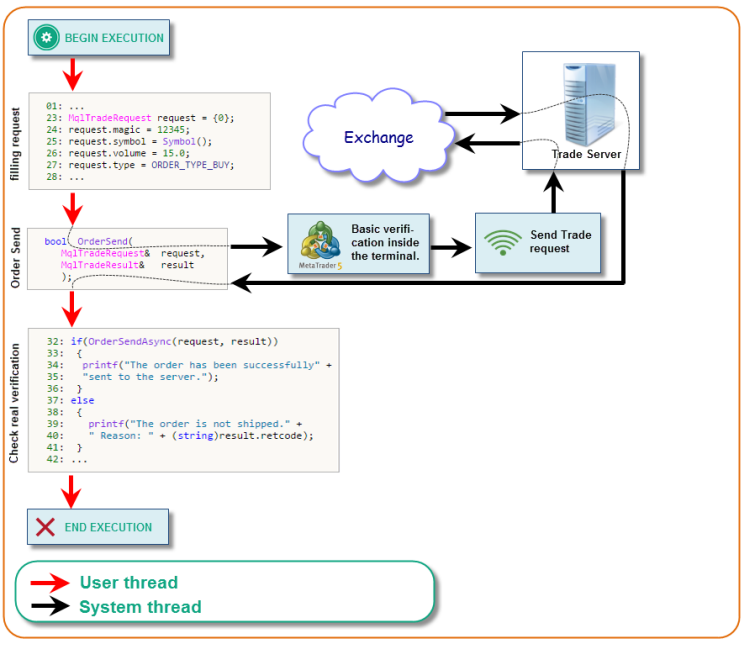

HedgeTerminal and its API perform trading activities completely asynchronously.

However, this mode requires more complex logic of EAs. To hide this complexity, HedgeTerminalAPI includes a special emulator of synchronous operation, allowing EAs developed in a conventional synchronous method to communicate with asynchronous algorithms of HedgeTerminalAPI. This interaction is revealed at the time of bi-directional position modification and closure through SendTradeRequest(). This function allows executing a trade task either in synchronous or asynchronous mode. By default, all trading actions are executed synchronously through the synchronous operation emulator. However, if a trade request (HedgeTradeRequest structure) contains an explicitly specified flag asynch_mode = true, the trade task will be performed in an asynchronous mode.

In the asynchronous mode, tasks are performed independently of the main thread. Implementation of interaction between an asynchronous EA and asynchronous algorithms of HedgeTerminal is not complete yet.

The synchronous emulator is very simple. It starts the subtasks sequentially, and then waits for some time until the trade environment in MetaTrader 5 changes. The emulator analyzes these changes and determines the status of the current task. If the task execution is successful, the emulator moves on to the next one.

Synchronous emulator causes minor delays in the execution of trading orders. This is due to the fact that the trading environment in the MetaTrader 5 takes some time to reflect executed trading activities. The necessity to access to the environment is primarily connected with the fact that HedgeTermianlAPI cannot access events coming to the OnTradeTransaction() handler in the synchronous thread emulation mode.

The problems of interaction between asynchronous threads, as well as between the asynchronous and synchronous threads through emulation are too complicated and have no obvious solutions.

1.11. Management of Bi-Directional Position Properties through the Example of a Script

In the script below, the TransactionSelect() function searches through all available transactions in the list of active transactions.

Each transaction is selected from the list. If the transaction is a position, some of its properties are accessed and then printed. In addition to the properties of the positions, properties of orders and deals inside the position are also printed. An order and a deal are first selected using HedgeOrderSelect() and HedgeDealSelect() respectively.

All properties of the position, its orders and deals are combined and printed as a single line using the system function printf.

//+------------------------------------------------------------------+ //| sample_using_htapi.mq5 | //| Copyright 2014, Vasiliy Sokolov, Russia, St.-Petersburg. | //| https://login.mql5.com/ru/users/c-4 | //+------------------------------------------------------------------+ #property copyright "Copyright 2014, Vasiliy Sokolov." #property link "https://login.mql5.com/ru/users/c-4" #property version "1.00" // Include prototypes function of HedgeTerminalAPI library. #include <Prototypes.mqh> //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnStart() { // Search all transaction in list transaction... for(int i=TransactionsTotal(); i>=0; i--) { if(!TransactionSelect(i,SELECT_BY_POS,MODE_TRADES)) // Selecting from active transactions { ENUM_HEDGE_ERR error=GetHedgeError(); // Get reason if selecting has failed printf("Error selecting transaction # "+(string)i+". Reason: "+ // Print reason EnumToString(error)); ResetHedgeError(); // Reset error continue; // Go to next transaction } // Only for hedge positions if(TransactionType()==TRANS_HEDGE_POSITION) { // --- Position captions --- // ENUM_TRANS_DIRECTION direction=(ENUM_TRANS_DIRECTION) // Get direction caption HedgePositionGetInteger(HEDGE_POSITION_DIRECTION); double price_entry = HedgeOrderGetDouble(HEDGE_ORDER_PRICE_EXECUTED); // Get volume of positions string symbol = HedgePositionGetString(HEDGE_POSITION_SYMBOL); // Get symbol of position // --- Order captions --- // if(!HedgeOrderSelect(ORDER_SELECTED_INIT))continue; // Selecting init order in position double slippage = HedgeOrderGetDouble(HEDGE_ORDER_SLIPPAGE); // Get some slippage was uint deals_total = (uint)HedgeOrderGetInteger(HEDGE_ORDER_DEALS_TOTAL); // Get deals total // --- Deals captions --- // double commissions=0.0; ulong deal_id=0; //Search all deals in list deals... for(uint d_index=0; d_index<deals_total; d_index++) { if(!HedgeDealSelect(d_index))continue; // Selecting deal by its index deal_id = HedgeDealGetInteger(HEDGE_DEAL_ID); // Get deal id commissions += HedgeDealGetDouble(HEDGE_DEAL_COMMISSION); // Count commissions } int digits = (int)SymbolInfoInteger(symbol, SYMBOL_DIGITS); printf("Position #" + (string)i + ": DIR " + EnumToString(direction) + // Print result line "; PRICE ENTRY " + DoubleToString(price_entry, digits) + "; INIT SLIPPAGE " + DoubleToString(slippage, 2) + "; LAST DEAL ID " + (string)deal_id + "; COMMISSIONS SUM " + DoubleToString(commissions, 2)); } } }

1.12. The SendTradeRequest() Function and the HedgeTradeRequest Structure through the Example of Chaos II EA

As an example, let's develop a trading robot based on the trading tactics proposed by Bill Williams in his book Trading Chaos. Second Edition.

We will not follow all his recommendations, but simplify the scheme by omitting the Alligator indicator and some other conditions. The choice of this strategy stems from several considerations. The main one is that this strategy includes composite position maintenance tactics. Sometimes you need to close a part of a position and move the stop loss to breakeven.

When moved to breakeven, the stop level should be trailed following the price. The second consideration is that this tactic is known enough and indicators developed for it are included in the standard MetaTrader 5 delivery pack. Let's slightly modify and simplify the rules, to prevent the complex logic of the Expert Advisor from hindering its primary objectives: to show an example of EA interaction with the HedgeTerminalAPI library. The EA's logic uses most of trading functions of HedgeTerminalAPI. This is a good test for the library.

Let's start on the reversal bar. A bullish reversal bar is a bar with the close price in its upper third, whose Low is the lowest one for the last N bars. A bearish reversal bar is a bar with the close price in its lower third, whose High is the highest one for the last N bars. N is a randomly chosen parameter, it can be set during start of the Expert Advisor. This differs from the classic strategy "Chaos 2".

After the reversal bar is defined, two pending orders are placed. For a bullish bar, the orders are placed above its high, a bearish bar - just below its low. If these two orders do not trigger during the OldPending bars, the signal is considered obsolete, and orders are canceled. The values of OldPending and N are set by the user before launching the EA on the chart.

The orders trigger and turn into two bi-directional positions. The EA distinguishes between them by numbers in the comments, "# 1" and "# 2", respectively. This is not a very elegant solution, but it's fine for demonstration purposes. Once the orders trigger, a stop loss is placed at the high (for a bearish bar) or the low (if the bar bullish) of the reversal bar.

The first position has tight targets. Its take profit is set so that in case of triggering, the position profit would be equal to the absolute loss of a triggered stop loss. For example, if a long position is opened at a price of 1.0000, and its stop loss is at the level of 0.9000, the level of take profit would be 1.0000 + (1.0000 - 0.9000) = 1.1000. The EA exits the position at stop loss or take profit.

The second position is a long term one. Its stop loss is trailed following the price. The stop moves after the newly formed Bill Williams' fractal. For a long position, the stop is moved according to the lower fractals, and upper fractals are used for a short position. The EA exits the position only at stop loss.

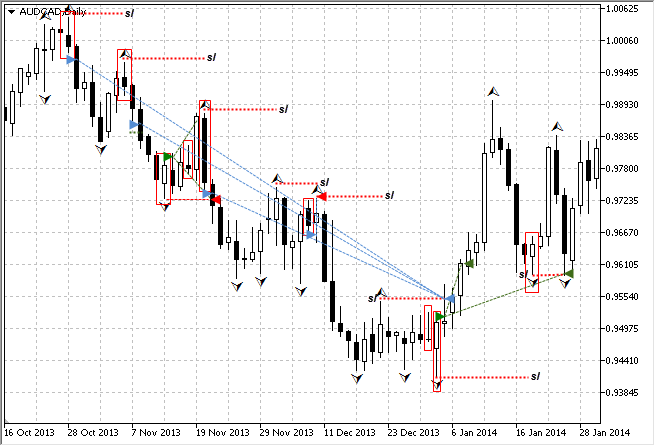

The following chart illustrates this strategy:

Fig. 4. The representation of bi-directional positions of the Chaos 2 EA on the price chart

Reversal bars are marked with a red frame. The N period on this chart is equal to 2. The most opportune moment is chosen for this strategy. Short positions are shown as a blue dotted line, long positions are represented by green. As can be seen, long and short positions can exist simultaneously even in a relatively simple strategy. Pay attention to the period from 5 to 8 January, 2014.

This is a turning point for the AUDCAD downtrend. January 4 a signal was received from the bullish reversal bar, and January 5 two long positions were opened. At the same time, there were still three short positions whose stops were trailed following the trend (dashed red line). Then, on January 7, stop triggered for the short positions, so only long positions were left in the market.

Changes would be hard to monitor on a net position, since the net volume would not take into account the number of positions actually maintained by the EA. HedgeTerminal allows the EAs to monitor their individual positions regardless of the current net position, making it possible to get these charts and develop similar strategies.

Below is the code implementing this strategy.

I intentionally did not use object oriented programming, adapting the code for beginners:

//+------------------------------------------------------------------+ //| Chaos2.mq5 | //| Copyright 2014, Vasiliy Sokolov specially for HedgeTerminal. | //| St.-Petersburg, Russia. | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2014, Vasiliy Sokolov." #property link "https://login.mql5.com/ru/users/c-4" #property version "1.00" //+------------------------------------------------------------------+ //| Include files | //+------------------------------------------------------------------+ #include <Prototypes.mqh> // Include prototypes function of HedgeTerminalAPI library //+------------------------------------------------------------------+ //| Input parameters. | //+------------------------------------------------------------------+ input uint N=2; // Period of extermum/minimum input uint OldPending=3; // Old pending //+------------------------------------------------------------------+ //| Private variables of expert advisor. | //+------------------------------------------------------------------+ ulong Magic = 2314; // Magic number of expert datetime lastTime = 0; // Remembered last time for function DetectNewBar int hFractals = INVALID_HANDLE; // Handle of indicator 'Fractals'. See: 'https://www.mql5.com/en/docs/indicators/ifractals' //+------------------------------------------------------------------+ //| Type of bar by Bill Wiallams strategy. | //+------------------------------------------------------------------+ enum ENUM_BAR_TYPE { BAR_TYPE_ORDINARY, // Ordinary bar. BAR_TYPE_BEARISH, // This bar close in the upper third and it's minimum is lowest at N period BAR_TYPE_BULLISH, // This bar close in the lower third and it's maximum is highest at N period }; //+------------------------------------------------------------------+ //| Type of Extremum. | //+------------------------------------------------------------------+ enum ENUM_TYPE_EXTREMUM { TYPE_EXTREMUM_HIGHEST, // Extremum from highest prices TYPE_EXTREMUM_LOWEST // Extremum from lowest prices }; //+------------------------------------------------------------------+ //| Type of position. | //+------------------------------------------------------------------+ enum ENUM_ENTRY_TYPE { ENTRY_BUY1, // Buy position with short target ENTRY_BUY2, // Buy position with long target ENTRY_SELL1, // Sell position with short target ENTRY_SELL2, // Sell position with long target ENTRY_BAD_COMMENT // My position, but wrong comment }; //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- Create indicator 'Fractals' ---// hFractals=iFractals(Symbol(),NULL); if(hFractals==INVALID_HANDLE) printf("Warning! Indicator 'Fractals' not does not create. Reason: "+ (string)GetLastError()); //--- Corection magic by timeframe ---// int minPeriod=PeriodSeconds()/60; string strMagic=(string)Magic+(string)minPeriod; Magic=StringToInteger(strMagic); //--- return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { //--- Delete indicator 'Fractals' ---// if(hFractals!=INVALID_HANDLE) IndicatorRelease(hFractals); //--- } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { //--- Run logic only open new bar. ---// int totals=SupportPositions(); if(NewBarDetect()==true) { MqlRates rates[]; CopyRates(Symbol(),NULL,1,1,rates); MqlRates prevBar=rates[0]; //--- Set new pendings order ---// double closeRate=GetCloseRate(prevBar); if(closeRate<=30 && BarIsExtremum(1,N,TYPE_EXTREMUM_HIGHEST)) { DeleteOldPendingOrders(0); SetNewPendingOrder(1,BAR_TYPE_BEARISH); } else if(closeRate>=70 && BarIsExtremum(1,N,TYPE_EXTREMUM_LOWEST)) { DeleteOldPendingOrders(0); SetNewPendingOrder(1,BAR_TYPE_BULLISH); } DeleteOldPendingOrders(OldPending); } //--- } //+------------------------------------------------------------------+ //| Analyze open positions and modify it if needed. | //+------------------------------------------------------------------+ int SupportPositions() { //--- int count=0; //--- Analize active positions... ---// for(int i=0; i<TransactionsTotal(); i++) // Get total positions. { //--- Select main active positions ---// if(!TransactionSelect(i, SELECT_BY_POS, MODE_TRADES))continue; // Select active transactions if(TransactionType() != TRANS_HEDGE_POSITION)continue; // Select hedge positions only if(HedgePositionGetInteger(HEDGE_POSITION_MAGIC) != Magic) // Select main positions by magic if(HedgePositionGetInteger(HEDGE_POSITION_STATE) == POSITION_STATE_FROZEN) // If position is frozen - continue continue; // Let's try to get access to positions later count++; //--- What position do we choose?... ---// ENUM_ENTRY_TYPE type=IdentifySelectPosition(); bool modify=false; double sl = 0.0; double tp = 0.0; switch(type) { case ENTRY_BUY1: case ENTRY_SELL1: { //--- Check sl, tp levels and modify it if need. ---// double currentStop=HedgePositionGetDouble(HEDGE_POSITION_SL); sl=GetStopLossLevel(); if(!DoubleEquals(sl,currentStop)) modify=true; tp=GetTakeProfitLevel(); double ask = SymbolInfoDouble(Symbol(), SYMBOL_ASK); double bid = SymbolInfoDouble(Symbol(), SYMBOL_BID); //--- Close by take-profit if price more tp level bool isBuyTp=tp<bid && !DoubleEquals(tp,0.0) && type==ENTRY_BUY1; bool isSellTp=tp>ask && type==ENTRY_SELL1; if(isBuyTp || isSellTp) { HedgeTradeRequest request; request.action=REQUEST_CLOSE_POSITION; request.exit_comment="Close by TP from expert"; request.close_type=CLOSE_AS_TAKE_PROFIT; if(!SendTradeRequest(request)) { ENUM_HEDGE_ERR error=GetHedgeError(); string logs=error==HEDGE_ERR_TASK_FAILED ? ". Print logs..." : ""; printf("Close position by tp failed. Reason: "+EnumToString(error)+" "+logs); if(error==HEDGE_ERR_TASK_FAILED) PrintTaskLog(); ResetHedgeError(); } else break; } double currentTakeProfit=HedgePositionGetDouble(HEDGE_POSITION_TP); if(!DoubleEquals(tp,currentTakeProfit)) modify=true; break; } case ENTRY_BUY2: { //--- Check sl level and set modify flag. ---// sl=GetStopLossLevel(); double currentStop=HedgePositionGetDouble(HEDGE_POSITION_SL); if(sl>currentStop) modify=true; break; } case ENTRY_SELL2: { //--- Check sl level and set modify flag. ---// sl=GetStopLossLevel(); double currentStop=HedgePositionGetDouble(HEDGE_POSITION_SL); bool usingSL=HedgePositionGetInteger(HEDGE_POSITION_USING_SL); if(sl<currentStop || !usingSL) modify=true; break; } } //--- if need modify sl, tp levels - modify it. ---// if(modify) { HedgeTradeRequest request; request.action=REQUEST_MODIFY_SLTP; request.sl = sl; request.tp = tp; if(type==ENTRY_BUY1 || type==ENTRY_SELL1) request.exit_comment="Exit by T/P level"; else request.exit_comment="Exit by trailing S/L"; if(!SendTradeRequest(request)) { ENUM_HEDGE_ERR error=GetHedgeError(); string logs=error==HEDGE_ERR_TASK_FAILED ? ". Print logs..." : ""; printf("Modify stop-loss or take-profit failed. Reason: "+EnumToString(error)+" "+logs); if(error==HEDGE_ERR_TASK_FAILED) PrintTaskLog(); ResetHedgeError(); } else break; } } return count; //--- } //+------------------------------------------------------------------+ //| Return stop-loss level for selected position. | //| RESULT | //| Stop-loss level | //+------------------------------------------------------------------+ double GetStopLossLevel() { //--- double point=SymbolInfoDouble(Symbol(),SYMBOL_TRADE_TICK_SIZE)*3; double fractals[]; double sl=0.0; MqlRates ReversalBar; if(!LoadReversalBar(ReversalBar)) { printf("Reversal bar load failed."); return sl; } //--- What position do we choose?... ---// switch(IdentifySelectPosition()) { case ENTRY_SELL2: { if(HedgePositionGetInteger(HEDGE_POSITION_USING_SL)) { sl=NormalizeDouble(HedgePositionGetDouble(HEDGE_POSITION_SL),Digits()); CopyBuffer(hFractals,UPPER_LINE,ReversalBar.time,TimeCurrent(),fractals); for(int i=ArraySize(fractals)-4; i>=0; i--) { if(DoubleEquals(fractals[i],DBL_MAX))continue; if(DoubleEquals(fractals[i],sl))continue; if(fractals[i]<sl) { double price= SymbolInfoDouble(Symbol(),SYMBOL_ASK); int ifreeze =(int)SymbolInfoInteger(Symbol(),SYMBOL_TRADE_FREEZE_LEVEL); double freeze=SymbolInfoDouble(Symbol(),SYMBOL_TRADE_TICK_SIZE)*ifreeze; if(fractals[i]>price+freeze) sl=NormalizeDouble(fractals[i]+point,Digits()); } } break; } } case ENTRY_SELL1: sl=ReversalBar.high+point; break; case ENTRY_BUY2: if(HedgePositionGetInteger(HEDGE_POSITION_USING_SL)) { sl=NormalizeDouble(HedgePositionGetDouble(HEDGE_POSITION_SL),Digits()); CopyBuffer(hFractals,LOWER_LINE,ReversalBar.time,TimeCurrent(),fractals); for(int i=ArraySize(fractals)-4; i>=0; i--) { if(DoubleEquals(fractals[i],DBL_MAX))continue; if(DoubleEquals(fractals[i],sl))continue; if(fractals[i]>sl) { double price= SymbolInfoDouble(Symbol(),SYMBOL_BID); int ifreeze =(int)SymbolInfoInteger(Symbol(),SYMBOL_TRADE_FREEZE_LEVEL); double freeze=SymbolInfoDouble(Symbol(),SYMBOL_TRADE_TICK_SIZE)*ifreeze; if(fractals[i]<price-freeze) sl=NormalizeDouble(fractals[i]-point,Digits()); } } break; } case ENTRY_BUY1: sl=ReversalBar.low-point; } sl=NormalizeDouble(sl,Digits()); return sl; //--- } //+------------------------------------------------------------------+ //| Return Take-Profit level for selected position. | //| RESULT | //| Take-profit level | //+------------------------------------------------------------------+ double GetTakeProfitLevel() { //--- double point=SymbolInfoDouble(Symbol(),SYMBOL_TRADE_TICK_SIZE)*3; ENUM_ENTRY_TYPE type=IdentifySelectPosition(); double tp=0.0; if(type==ENTRY_BUY1 || type==ENTRY_SELL1) { if(!HedgePositionGetInteger(HEDGE_POSITION_USING_SL)) return tp; double sl=HedgePositionGetDouble(HEDGE_POSITION_SL); double openPrice=HedgePositionGetDouble(HEDGE_POSITION_PRICE_OPEN); double deltaStopLoss=MathAbs(NormalizeDouble(openPrice-sl,Digits())); if(type==ENTRY_BUY1) tp=openPrice+deltaStopLoss; if(type==ENTRY_SELL1) tp=openPrice-deltaStopLoss; return tp; } else return 0.0; //--- } //+------------------------------------------------------------------+ //| Identify what position type is select. | //| RESULT | //| Return type position. See ENUM_ENTRY_TYPE | //+------------------------------------------------------------------+ ENUM_ENTRY_TYPE IdentifySelectPosition() { //--- string comment=HedgePositionGetString(HEDGE_POSITION_ENTRY_COMMENT); int pos=StringLen(comment)-2; string subStr=StringSubstr(comment,pos); ENUM_TRANS_DIRECTION posDir=(ENUM_TRANS_DIRECTION)HedgePositionGetInteger(HEDGE_POSITION_DIRECTION); if(subStr=="#0") { if(posDir==TRANS_LONG) return ENTRY_BUY1; if(posDir==TRANS_SHORT) return ENTRY_SELL1; } else if(subStr=="#1") { if(posDir==TRANS_LONG) return ENTRY_BUY2; if(posDir==TRANS_SHORT) return ENTRY_SELL2; } return ENTRY_BAD_COMMENT; //--- } //+------------------------------------------------------------------+ //| Set pending orders under or over bar by index_bar. | //| INPUT PARAMETERS | //| index_bar - index of bar. | //| barType - type of bar. See enum ENUM_BAR_TYPE. | //| RESULT | //| True if new order successfully set, othewise false. | //+------------------------------------------------------------------+ bool SetNewPendingOrder(int index_bar,ENUM_BAR_TYPE barType) { //--- MqlRates rates[1]; CopyRates(Symbol(),NULL,index_bar,1,rates); MqlTradeRequest request={0}; request.volume=SymbolInfoDouble(Symbol(),SYMBOL_VOLUME_MIN); double vol=request.volume; request.symbol = Symbol(); request.action = TRADE_ACTION_PENDING; request.type_filling=ORDER_FILLING_FOK; request.type_time=ORDER_TIME_GTC; request.magic=Magic; double point=SymbolInfoDouble(Symbol(),SYMBOL_TRADE_TICK_SIZE)*3; string comment=""; if(barType==BAR_TYPE_BEARISH) { request.price=rates[0].low-point; comment="Entry sell by bearish bar"; request.type=ORDER_TYPE_SELL_STOP; } else if(barType==BAR_TYPE_BULLISH) { request.price=rates[0].high+point; comment="Entry buy by bullish bar"; request.type=ORDER_TYPE_BUY_STOP; } MqlTradeResult result={0}; //--- Send pending order twice... for(int i=0; i<2; i++) { request.comment=comment+" #"+(string)i; // Detect order by comment; if(!OrderSend(request,result)) { printf("Trade error #"+(string)result.retcode+" "+ result.comment); return false; } } return true; //--- } //+------------------------------------------------------------------+ //| Delete old pending orders. If pending order set older that | //| n_bars ago pending orders will be removed. | //| INPUT PARAMETERS | //| period - count bar. | //+------------------------------------------------------------------+ void DeleteOldPendingOrders(int n_bars) { //--- for(int i=0; i<OrdersTotal(); i++) { ulong ticket = OrderGetTicket(i); // Get ticket of order by index. if(!OrderSelect(ticket)) // Continue if not selected. continue; if(Magic!=OrderGetInteger(ORDER_MAGIC)) // Continue if magic is not main. continue; if(OrderGetString(ORDER_SYMBOL)!=Symbol()) // Continue if symbol is not main. continue; //--- Count time elipsed ---// datetime timeSetup=(datetime)OrderGetInteger(ORDER_TIME_SETUP); int secElapsed=(int)(TimeCurrent()-timeSetup); //--- delete old pending order ---// if(secElapsed>=PeriodSeconds() *n_bars) { MqlTradeRequest request={0}; MqlTradeResult result={0}; request.action= TRADE_ACTION_REMOVE; request.order = ticket; if(!OrderSend(request,result)) printf("Delete pending order failed. Reason #"+(string)result.retcode+" "+result.comment); } } //--- } //+------------------------------------------------------------------+ //| Detect new bar. | //+------------------------------------------------------------------+ bool NewBarDetect(void) { //--- datetime timeArray[1]; CopyTime(Symbol(),NULL,0,1,timeArray); if(lastTime!=timeArray[0]) { lastTime=timeArray[0]; return true; } return false; //--- } //+------------------------------------------------------------------+ //| Get close rate. Type bar defined in trade chaos strategy | //| and equal enum 'ENUM_TYPE_BAR'. | //| INPUT PARAMETERS | //| index - index of bars series. for example: | //| '0' - is current bar. 1 - previous bar. | //| RESULT | //| Type of ENUM_TYPE_BAR. | //+------------------------------------------------------------------+ double GetCloseRate(const MqlRates &bar) { //--- double highLowDelta = bar.high-bar.low; // Calculate diaposon bar. double lowCloseDelta = bar.close - bar.low; // Calculate Close - Low delta. double percentClose=0.0; if(!DoubleEquals(lowCloseDelta, 0.0)) // Division by zero protected. percentClose = lowCloseDelta/highLowDelta*100.0; // Calculate percent 'lowCloseDelta' of 'highLowDelta'. return percentClose; //--- } //+------------------------------------------------------------------+ //| If bar by index is extremum - return true, otherwise | //| return false. | //| INPUT PARAMETERS | //| index - index of bar. | //| period - Number of bars prior to the extremum. | //| type - Type of extremum. See ENUM_TYPE_EXTREMUM TYPE enum. | //| RESULT | //| True - if bar is extremum, otherwise false. | //+------------------------------------------------------------------+ bool BarIsExtremum(const int index,const int period,ENUM_TYPE_EXTREMUM type) { //--- Copy rates --- // MqlRates rates[]; ArraySetAsSeries(rates,true); CopyRates(Symbol(),NULL,index,N+1,rates); //--- Search extremum --- // for(int i=1; i<ArraySize(rates); i++) { //--- Reset comment if you want include volume analize. ---// //if(rates[0].tick_volume<rates[i].tick_volume) // return false; if(type==TYPE_EXTREMUM_HIGHEST && rates[0].high<rates[i].high) return false; if(type==TYPE_EXTREMUM_LOWEST && rates[0].low>rates[i].low) return false; } return true; //--- } //+------------------------------------------------------------------+ //| Print current error and reset it. | //+------------------------------------------------------------------+ void PrintTaskLog() { //--- uint totals=(uint)HedgePositionGetInteger(HEDGE_POSITION_ACTIONS_TOTAL); for(uint i = 0; i<totals; i++) { uint retcode=0; ENUM_TARGET_TYPE type; GetActionResult(i,type,retcode); printf("---> Action #"+(string)i+"; "+EnumToString(type)+"; RETCODE: "+(string)retcode); } //--- } //+------------------------------------------------------------------+ //| Load reversal bar. The current position must be selected. | //| OUTPUT PARAMETERS | //| bar - MqlRates bar. //+------------------------------------------------------------------+ bool LoadReversalBar(MqlRates &bar) { //--- datetime time=(datetime)(HedgePositionGetInteger(HEDGE_POSITION_ENTRY_TIME_SETUP_MSC)/1000+1); MqlRates rates[]; ArraySetAsSeries(rates,true); CopyRates(Symbol(),NULL,time,2,rates); int size=ArraySize(rates); if(size==0)return false; bar=rates[size-1]; return true; //--- } //+------------------------------------------------------------------+ //| Compares two double numbers. | //| RESULT | //| True if two double numbers equal, otherwise false. | //+------------------------------------------------------------------+ bool DoubleEquals(const double a,const double b) { //--- return(fabs(a-b)<=16*DBL_EPSILON*fmax(fabs(a),fabs(b))); //--- }

Below is a brief description of how this code works. The EA is called on every tick. It analyzes the previous bar using the BarIsExtremum() function: if it is bearish or bullish, it places two pending orders (function SetNewPendingOrder()). Once activated, pending orders are converted into positions. The EA sets stop loss and take profit for the positions then.

Unfortunately, these levels cannot be placed together with pending orders, because there is no real position yet. The levels are set through the SupportPositions() function. To operate properly, we need to know the position for which take profit should be placed, and the position that should be trailed following fractals. This definition of positions is done by the IdentifySelectPosition() function. It analyzes the initiating position comment, and if it contains the string "#1", a tight target is set for it; if it contains "# 2", trailing stop is applied.

To modify an open bi-directional position, or to close it, a special trade request is created, which is then sent to the SendTradeRequest() function for execution:

... if(modify) { HedgeTradeRequest request; request.action=REQUEST_MODIFY_SLTP; request.sl = sl; request.tp = tp; if(type==ENTRY_BUY1 || type==ENTRY_SELL1) request.exit_comment="Exit by T/P level"; else request.exit_comment="Exit by trailing S/L"; if(!SendTradeRequest(request)) { ENUM_HEDGE_ERR error=GetHedgeError(); string logs=error==HEDGE_ERR_TASK_FAILED ? ". Print logs..." : ""; printf("Modify stop-loss or take-profit failed. Reason: "+EnumToString(error)+" "+logs); if(error==HEDGE_ERR_TASK_FAILED) PrintTaskLog(); ResetHedgeError(); } else break; } ...

Pay attention to error handling.

If sending fails and the function returns false, we need to get the last error code using the GetHedgeError() function. In some cases the execution of a trading order will not even start. If position has not been pre-selected, then the query is made incorrectly, and its execution is impossible.

If an order is not executed, it is pointless to analyze the log of its implementation, getting an error code is enough.

However, if the query is correct, but the order has not been executed for some reason, error HEDGE_ERR_TASK_FAILED will be returned. In this case, it is necessary to analyze the order execution log by searching through the log. This is done through the special function PrintTaskLog():

//+------------------------------------------------------------------+ //| Print current error and reset it. | //+------------------------------------------------------------------+ void PrintTaskLog() { //--- uint totals=(uint)HedgePositionGetInteger(HEDGE_POSITION_ACTIONS_TOTAL); for(uint i = 0; i<totals; i++) { uint retcode=0; ENUM_TARGET_TYPE type; GetActionResult(i,type,retcode); printf("---> Action #"+(string)i+"; "+EnumToString(type)+"; RETCODE: "+(string)retcode); } //--- }

These messages allow to identify the reason for the failure and fix it.

Let us now illustrate the display of the Chaos2 EA and its positions in HedgeTerminal in real time. The EA is running on the M1 chart:

Fig. 5. The representation of bi-directional positions of the Chaos 2 EA in the HedgeTerminal panel

As can be seen, even bi-directional positions of one EA can perfectly coexist.

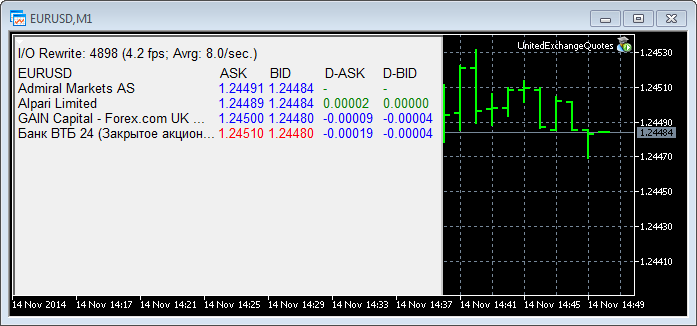

1.13. On "Duplicate Symbols" and Virtualization by Broker

When MetaTrader 5 was released, some brokers started to provide the so-called duplicate symbols. Their quotes are equal to the original instruments, but they have a postfix as a rule, like "_m" or "_1". They were introduced to allow traders to have bi-directional positions on virtually the same symbol.

However, such symbols are almost useless for algorithmic traders using robots. And here's why. Suppose we would need to write the "Chaos II" EA without the HedgeTerminalAPI library. Instead, we would have some duplicate symbols. How would we do that? Assume all sell operations were opened on a single instrument, such as EURUSD, and all buy operations on the other one, for example EURUSD_m1.

But what would happen if, at the moment of position opening one of the symbols were already traded by another robot or by the trader? Even if such symbols were always free, the problem would not be solved for this robot, which could simultaneously have multiple positions in the same direction.

The screenshot above shows three sell positions, and there can be even more of them. The positions have different protective stop levels, that is why they cannot be combined into a single net position. The solution is to open a new position for a new duplicate symbol. But there can be not enough such symbols, because one robot needs six duplicate instruments (three in each trade direction). If two robots run on different timeframes, 12 symbols are required.

None of the brokers provide so many duplicate symbols. But even if there were an unlimited amount of such symbols, and they were always free, a complex decomposition of the algorithm would be required. The robot would have to go through all the available symbols searching for duplicates and its own positions. This would create more problems than it could solve.

There are even more difficulties with the duplicate symbols. Here is a brief list of additional problems arising from their use:

- You pay for each duplicate symbol in the form of negative swaps, because swaps for locking or partial locking are always negative, and this is the case when you keep two bi-directional positions on two different instruments.

- Not all brokers provide duplicate symbols. A strategy developed for a broker who provides duplicate symbols will not work with a broker providing only one instrument. The difference in the symbol names is another potential source of problems.

- Creating a duplicate symbol is not always possible. On transparent markets subject to strict regulations, any transaction is a financial document. The net position is the de facto standard in such markets and therefore creation of individual symbols is far from possible there. For example, no broker providing duplicate symbols can ever appear on Moscow Exchange MOEX. In less strict regulated markets brokers can create any symbols for their clients.

- Duplicate instruments are ineffective when trading using robots. The reasons for their ineffectiveness have been disclosed in the above example of the Chaos 2 EA.

A duplicate symbol is essentially a virtualization on the broker side. HedgeTerminal uses virtualization on the client side.

In both cases we use virtualization as such. It changes the actual representation of trader's obligations. With virtualization, one position can turn into two positions. There is no problem when it occurs on the client side, because clients can represent whatever they want. But if virtualization is done by the broker, regulatory and licensing organizations may have questions about how the information provided relates to the actual information. The second difficulty is that this requires having two APIs in one: a set of functions and modifiers for use in the net mode, and another one for the bi-directional mode.

Many algorithmic traders have found their own way to bind trades into a single position. Many of these methods work well, and there are articles describing these methods. However, virtualization of positions is a more complicated procedure than it might seem. In HedgeTerminal, the algorithms associated with virtualization of positions take about 20,000 lines of the source code. Moreover, HedgeTerminal implements only basic functions. Creating a similar amount of code in your EA only to accompany bi-directional positions would be too much resource consuming.

Chapter 2. HedgeTerminal API Manual

2.1. Transaction Selection Functions

Function TransactionsTotal()

The function returns the total number of transactions in the list of transactions. This is the basic function for searching though available transactions (see the example in section 1.4 and 1.11 of this article).

int TransactionsTotal(ENUM_MODE_TRADES pool = MODE_TRADES);

Parameters

- [in] pool=MODE_TRADES – Specifies the identifier of the data source for selection. It can be one of the values of the ENUM_MODE_TRADES enumeration.

Return Value

The function returns the total number of transactions in the list of transactions.

Function TransactionType()

The function returns the type of a selected transaction.

ENUM_TRANS_TYPE TransactionType(void);

Return Value

Return type. The value can be one of the ENUM_TRANS_TYPE values.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function TransactionSelect()

This function selects a transaction for further manipulations. The function selects a transaction by its index or unique identifier in the list of transactions.

bool TransactionSelect(int index, ENUM_MODE_SELECT select = SELECT_BY_POS, ENUM_MODE_TRADES pool=MODE_TRADES );

Parameters

- [in] index – The index of the order in the list of orders or a unique identifier of the transaction depending on the 'select' parameter.

- [in] select=SELECT_BY_POS – Identifier of the 'index' type of the parameter. The value can be one of the ENUM_MODE_SELECT values.

- [in] pool=MODE_TRADES – Specifies the identifier of the data source for selection. It can be one of the values of the ENUM_MODE_TRADES enumeration.

Return Value

Returns true if a transaction has been successfully selected or false otherwise. To get error details, call GetHedgeError().

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Note

If a transaction is selected based on its index, the complexity of the operation corresponds to O(1). If a transaction is selected based on its unique identifier, the complexity of the operation asymptotically tends to O(log2(n)).

Function HedgeOrderSelect()

The function selects one of the orders included in the bi-directional position. The bi-directional position, which includes the required order, must be pre-selected using TransactionSelect ().

bool HedgeOrderSelect(ENUM_HEDGE_ORDER_SELECTED_TYPE type);

Parameters

- [in] type – the identifier of the order to be selected. The value can be one of the ENUM_HEDGE_ORDER_SELECTED_TYPE enumeration values.

Return Value

Returns true if an order has been successfully selected or false otherwise. To get error details, call GetHedgeError().

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function HedgeDealSelect()

The function selects one of the deals that have executed the order. The order the part of which is the selected deal must be pre-selected using the HedgeOrderSelect() function.

bool HedgeDealSelect(int index);

Parameters

- [in] index – The index of the deal to be selected from the list of deals that executed the order. To find out the total number of deals inside one order, call the appropriate order property using the HedgeOrderGetInteger() function. For the parameter, use the ENUM_HEDGE_ORDER_PROP_INTEGER modifier equal to the HEDGE_ORDER_DEALS_TOTAL value.

Return Value

Returns true if a deal has been successfully selected or false otherwise. To get error details, call GetHedgeError().

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

2.2. Functions for Getting Properties of a Selected Transaction

Function HedgePositionGetInteger()

The function returns the property of a selected bi-directional position. The property can be of type int, long, datetime or bool depending on the type of the requested property. The bi-directional position must be pre-selected using the TransactionSelect() function.

ulong HedgePositionGetInteger(ENUM_HEDGE_POSITION_PROP_INTEGER property);

Parameters

- [in] property – Identifier of the property of the bi-directional position. The value can be one of the ENUM_HEDGE_DEAL_PROP_INTEGER enumeration values.

Return Value

Value of the ulong type. For further use of the value, its type should be explicitly cast to the type of the requested property.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function HedgePositionGetDouble()

The function returns the property of a selected bi-directional position. The type of the return property is double. Property type is specified through the ENUM_HEDGE_POSITION_PROP_DOUBLE enumeration. The bi-directional position must be pre-selected using the TransactionSelect().

ulong HedgePositionGetDouble(ENUM_HEDGE_POSITION_PROP_DOUBLE property);

Parameters

- [in] property – Identifier of the property of the bi-directional position. The value can be one of the ENUM_HEDGE_DEAL_PROP_DOUBLE enumeration values.

Return Value

A value of type double.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function HedgePositionGetString()

The function returns the property of a selected bi-directional position. The property is of the string type. Property type is specified through the ENUM_HEDGE_POSITION_PROP_STRING enumeration. The bi-directional position must be pre-selected using the TransactionSelect().

ulong HedgePositionGetString(ENUM_HEDGE_POSITION_PROP_STRING property);

Parameters

- [in] property – Identifier of the property of the bi-directional position. The value can be one of the ENUM_HEDGE_POSITION_PROP_STRING enumeration values.

Return Value

A value of the string type.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function HedgeOrderGetInteger()

The function returns the property of the selected order, which is part of the bi-directional position. The property can be of type int, long, datetime or bool. Property type is specified through the ENUM_HEDGE_ORDER_PROP_INTEGER enumeration. The order must be pre-selected using the HedgeOrderSelect() function.

ulong HedgeOrderGetInteger(ENUM_HEDGE_ORDER_PROP_INTEGER property);

Parameters

- [in] property – Identifier of the property of the order, which is part of the bi-directional position. The value can be one of the ENUM_HEDGE_ORDER_PROP_INTEGER enumeration values.

Return Value

Value of the ulong type. For further use of the value, its type must be explicitly cast to the type of the requested property.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function HedgeOrderGetDouble()

The function returns the property of the selected order, which is part of the bi-directional position. The requested property is of the double type. Property type is specified through the ENUM_HEDGE_ORDER_PROP_DOUBLE enumeration. The order must be pre-selected using the HedgeOrderSelect() function.

double HedgeOrderGetDouble(ENUM_HEDGE_ORDER_PROP_DOUBLE property);

Parameters

- [in] property – Identifier of the property of the order, which is part of the bi-directional position. The value can be any of the ENUM_HEDGE_ORDER_PROP_DOUBLE enumeration values.

Return Value

A value of type double.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function HedgeDealGetInteger()

The function returns the property of the selected deal, which is part of the executed order. The property can be of type int, long, datetime or bool. Property type is specified through the ENUM_HEDGE_DEAL_PROP_INTEGER enumeration. The deal must be pre-selected using the HedgeDealSelect() function.

ulong HedgeOrderGetInteger(ENUM_HEDGE_DEAL_PROP_INTEGER property);

Parameters

- [in] property – Identifier of the property of the selected deal included in the executed order. The value can be one of the ENUM_HEDGE_DEAL_PROP_INTEGER enumeration values.

Return Value

Value of the ulong type. For further use of the value, its type should be explicitly cast to the type of the requested property.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function HedgeDealGetDouble()

The function returns the property of the selected deal, which is part of the executed order. The property can be of type double. Property type is specified through the ENUM_HEDGE_DEAL_PROP_DOUBLE enumeration. The deal must be pre-selected using the HedgeDealSelect() function.

ulong HedgeOrderGetDouble(ENUM_HEDGE_DEAL_PROP_DOUBLE property);

Parameters

- [in] property – Identifier of the property of the selected deal included in the executed order. The value can be one of the ENUM_HEDGE_DEAL_PROP_DOUBLE enumeration values.

Return Value

A value of type double.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

2.3. Functions for Setting and Getting HedgeTerminal Properties from Expert Advisors

Function HedgePropertySetInteger()

The function sets one of the HedgeTerminal properties. The property can be of type int, long, datetime or bool. Property type is specified through the ENUM_HEDGE_PROP_INTEGER enumeration.

bool HedgePropertySetInteger(ENUM_HEDGE_PROP_INTEGER property, long value);

Parameters

- [in] property – Identifier of the property that should be set for HedgeTerminal. The value can be one of the ENUM_HEDGE_PROP_INTEGER enumeration values.

Return Value

A value of type bool. If the property has been successfully set, the function returns true, otherwise it returns false.

Example of Use

In the example, the function is used to set the position locking time while sending an asynchronous request. If the server response is not received within 30 seconds after you send an asynchronous request, the blocked position will be unblocked.

void SetTimeOut() { bool res=HedgePropertySetInteger(HEDGE_PROP_TIMEOUT,30); if(res) printf("The property is set successfully"); else printf("Property is not set"); }

Function HedgePropertyGetInteger()

The function gets one of the HedgeTerminal properties. The property can be of type int, long, datetime or bool. Property type is specified through the ENUM_HEDGE_PROP_INTEGER enumeration.

long HedgePropertyGetInteger(ENUM_HEDGE_PROP_INTEGER property);

Parameters

- [in] property – Identifier of the property that should be received from HedgeTerminal. The value can be one of the ENUM_HEDGE_PROP_INTEGER enumeration values.

Return Value

A value of type long.

Example of Use

The function receives the position blocking time while sending an asynchronous request and shows it in the terminal.

void GetTimeOut() { int seconds=HedgePropertyGetInteger(HEDGE_PROP_TIMEOUT); printf("Timeout is "+(string) seconds); }

2.4. Functions for Getting and Handling Error Codes

Function GetHedgeError()

The function returns the identifier of the error, which was obtained from the last action. The error identifier corresponds to the ENUM_HEDGE_ERR enumeration.

ENUM_HEDGE_ERR GetHedgeError(void);

Return Value

Position ID. The value can be any of the ENUM_HEDGE_ERR enumeration type.

Note

After the call, the GetHedgeError() function does not reset the error ID. To reset the error ID use the ResetHedgeError() function.

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function ResetHedgeError()

The function resets the identifier of the last received error. After its call, the ENUM_HEDGE_ERR identifier returned by GetHedgeError() will be equal to HEDGE_ERR_NOT_ERROR.

void ResetHedgeError(void);

Example of Use

See the example of function use in section 1.11 of this article: "Management of Bi-Directional Position Properties through the Example of a Script".

Function TotalActionsTask()

Once the position is selected using the HedgePositionSelect() function, it can be modified using the SendTradeRequest() function. For example, it can be closed, or its outgoing comment can be changed. This modification is performed by a special trading task. Each task can consist of several trading activities (subtasks). A task may fail. In this case you may need to analyze the result of all the subtasks included in the task to see what kind of the subtasks failed.

The TotalActionTask() function returns the number of subtasks contained in the last trading task being executed for the selected position. Knowing the total number of subtasks, you can search though all the subtasks by their index, and analyze their execution results using the GetActionResult() function and thereby find out the circumstances of the failure.

uint TotalActionsTask(void);

Return Value

Returns the total number of subtasks within the task.

Example of Use

See the example of use in section 1.6 of this article: "Detailed Analysis of Trading and Identification of Errors Using TotalActionsTask() and GetActionResult()".

Function GetActionResult()

The function takes the index of the subtask within the task (see TotalActionTask()). Returns the type of the subtask and its execution results through reference parameters. The type of the subtask is defined by the ENUM_TARGET_TYPE enumeration. The subtask execution result corresponds to the MetaTrader 5 trade server return codes.

void GetActionResult(uint index, ENUM_TARGET_TYPE& target_type, uint& retcode);

Parameters

- [in] index – The index of the subtask in the list of subtasks.

- [out] target_type – Type of the subtask. The value can be one of the ENUM_TARGET_TYPE enumeration values.

- [out] retcode – Trade server return code received upon the subtask execution.

Example of Use

See the example of use in section 1.6 of this article: "Detailed Analysis of Trading and Identification of Errors Using TotalActionsTask() and GetActionResult()".

2.5. Trading

Function SendTradeRequest()

The function sends a request to change the selected bi-directional position in HedgeTerminalAPI. The function execution result is one of the three actions:

- Closing a position or a part of its volume;

- Modification of stop loss and take profit levels;