Bi-Directional Trading and Hedging of Positions in MetaTrader 5 Using the HedgeTerminal Panel, Part 1

Table of Contents

- INTRODUCTION

- CHAPTER 1. ORGANIZATION THEORY OF BI-DIRECTIONAL TRADING

- CHAPTER 2. INSTALLATION OF HEDGE TERMINAL, FIRST LAUNCH

- 2.1. Installation of HedgeTerminal

- 2.2. Three Step Installation. Installation Diagram and Solution to Possible Problems

- 2.3. Getting Started with HedgeTerminal, First Launch

- 2.4. Hedging and Calculation of Financial Operations

- 2.5. One Click Trading

- 2.6. Placing StopLoss and TakeProfit, Trailing Stop

- 2.7. Report Generation

- 2.8. Currency Swap Presentation

- 2.9. Bottom Row

- 2.10. Changing the Appearance of HedgeTerminal Tables

- 2.11. Planned Yet Unimplemented Features

- CHAPTER 3. UNDER THE BONNET OF HEDGE TERMINAL. SPECIFICATION AND PRINCIPLES OF OPERATIONS

- 3.1. Global and Local Contours. Context, Transfer and Storage of Information

- 3.2. Storing Global and Local Information

- 3.3. Stop Loss and Take Profit Levels. Order System Issues and OCO Orders

- 3.4. Can OCO Orders Resolve Issues with Protection of Bi-Directional Positions?

- 3.5. Storing Links to Initializing Orders

- 3.6. Limitations at Work with HedgeTerminal

- 3.7. Mechanism of Pairing Orders and Determinism of Actions

- 3.8. Splitting and Connecting Deals - the Basis of the Order Arithmetics

- 3.9. Order and Deal Virtualization

- 3.10. Mechanism of Hiding Orders

- 3.11. Adaptation Mechanisms

- 3.12. Performance and Memory Usage

- CONCLUSION

Introduction

Within the last 18 months MetaQuotes have conducted extensive work on consolidating the MetaTrader 4 and MetaTrader 5 platforms into a unified trading ecosystem. Now both platforms share a common market of program solutions - Market, offering different products from external developers. The compilers for both platforms were united as well. As a result both platforms have a common compiler based on MQL5 and one programming language - MQL with a different function set depending on the platform in use. All publicly available source codes located in the Code Base were also revised and some of them were adjusted to be compatible with the new compiler.

This major unification of the platforms left aside the unification of their trading parts. The trading models of MetaTrader 4 and MetaTrader 5 are still fundamentally incompatible despite the fact that the major part of the trading environment is shared. MetaTrader 4 facilitates individual management of trading positions through the system of orders - special program entities making the bi-directional trading in this terminal simple and easy. MetaTrader 5 is intended for the exchange trade where the main representation of a trader's obligations is their aggregate net position. Orders in MetaTrader 5 are simply instructions to buy or sell a financial instrument.

The difference between the trading performance of these two platforms caused a lot of heated discussions and debates. However, discussions remained discussions. Unfortunately, since the release of MetaTrader 5, not a single working solution was published that could enable presenting a trader's obligations as bi-directed positions like in MetaTrader 4. Although numerous published articles suggest various solutions, they are not flexible enough to be conveniently used on a large scale. In addition, none of those decisions are suitable for the exchange trading, which involves a lot of nuances that have to be taken into consideration.

This article should settle the controversies between the fans of the fourth and the fifth versions of the MetaTrader platform. This is going to provide a universal solution in the form of thorough program specification and the exact program solution implemented by this specification. This article discusses a visual panel and the virtualization library HedgeTerminal, which enable presenting a trader's obligation as bi-directional positions like in MetaTrader 4. At the same time, the model underlying HedgeTerminal takes into account the character of the trading orders execution. That means that it can be successfully implemented both at the over-the-counter market FOREX and centralized exchanges like, for example, trading derivative securities in the derivatives section of Moscow Exchange.

HedgeTerminal is a fully featured trading terminal inside the MetaTrader 5 terminal. Through the mechanism of virtualization it changes the representation of the current positions so a trader or a trading robot can manage their individual trading positions. Neither the number of positions, nor their direction have any importance. I would like to place emphasis on the fact that we are talking about virtualization - a specific mechanism transforming the presentation of a trader's obligations but not their qualitative characteristics.

This is not about distorting the results of the trader's financial activity but about transforming representation of this activity. HedgeTerminal is based on the MetaTrader 5 trading environment and the MQL5 programming language. It does not bring new trading information to the terminal, it simply makes the current trading environment seen from a different angle. That means that HedgeTerminal is essentially MetaTrader 5 and is its native application. Even though, we could put an identity sign between them, an inclusion sign is more appropriate as HedgeTerminal is just a small and one of many MetaTrader 5 applications.

The virtualization possibility and the HedgeTerminal existence are based on three paradigms:

- Conceptually, a complete and guaranteed convertibility of the position net representation into individual bi-directional trading transactions is possible. This statement proves the fact that in some external trading platforms including the ones designed for exchange trading, there is a means to manage bi-directional positions;

- The trading model of MetaTrader 5 at the user's level allows creating one way links of orders to each other. Calculations have shown that links designed in a certain way will be resistant to collisions. Moreover, even in the case of a corrupted history or any force majeure situations, bi-directional transactions could be retrospectively corrected and brought down to a financial result calculated at net representation;

- Advanced API in MQL5 allows to put the identity sign between MQL5 and the MetaTrader 5 terminal. In other words, nearly everything in MetaTrader 5 is accessible through the program interface and the MQL5 programming language. For instance, your own version of the terminal can be written inside the MetaTrader 5 terminal like HedgeTerminal.

This article discusses the underlying algorithms and how HedgeTerminal works. The specifications and algorithms ensuring consistent bi-directional trading are discussed in this article in detail. Irrespective of whether you decide to use HedgeTerminal or to create your own library to manage your own trading algorithms, you will find useful information in this article and its continuation.

This article is not targeting programmers specifically. If you do not have any experience in programming, you are still going to understand it. The MQL source code is not included in this article deliberately. All source code was replaced with more illustrative diagrams, tables and pictures schematically representing the operational principle and the data organization. I can tell from experience that even having a good grasp of programming principles, it is a lot easier to see a common pattern of the code than to analyze it.

In the second part of this article, we are going to talk about the integration of Expert Advisors with the HedgeTerminalAPI visualization library and then programming will be involved. However, even in that case, everything was done to simplify the perception of the code especially for novice programmers. For instance, object-oriented constructions like classes are not used though HedgeTerminal is an object oriented application.

How to Read this Article

This article is rather lengthy. On the one hand, this is good as the answer to virtually any question regarding this topic can be found here. On the other hand, many users would prefer to read only the most important information returning to the relevant section whenever necessity arises. This article covers in full a consistent presentation of the material. Similar to books, we are going to give a short summary of every chapter so you can see whether you need to read it or not.

- Part 1, Chapter 1. Theory of the bi-directional trading organization. This chapter contains the main ideas of HedgeTerminal. If you do not want in-depth information about organization of bi-directional trading, this chapter is sufficient to get an idea of the general principles of HedgeTerminal operation. This chapter is recommended for all readers.

- Part 1, Chapter 2. Installation of HedgeTerminal, first launch. This chapter describes the launch and setting up the visual panel of HedgeTerminal. If you are not going to use a visual panel of HedgeTerminal, then you can skip this chapter. If you, however, are going to use the HedgeTerminalAPI library, you will need to go through sections 2.1 and 2.2 of this chapter. They are dedicated to the HedgeTerminal installer. The installer is the common component for all the HedgeTerminal products.

- Part 1, Chapter 3. Under the bonnet of HedgeTerminal. Specification and principle of operations. This chapter highlights the internal arrangement of HedgeTerminal, its algorithm and internal data organization. Those who are interested in bi-directional trading may find this chapter informative. Professional algorithmic traders developing their own virtualization libraries and using a lot of robots simultaneously can find this chapter useful too.

- Part 2, Chapter 1. Communication of Expert Advisors with HedgeTerminal and its panel. This chapter will be appreciated by those who are just exploring this aspect and those who are in algorithmic trading professionally. It describes common principles of work with the HedgeTerminal library and the architecture of the trading robot.

- Part 2, Chapter 2. Documentation to the API HedgeTerminal. Contains documentation on using the functions of the HedgeTerminalAPI library. The chapter is written as a list of documentation that could be referred to from time to time. There are no unnecessary discussions and excessive text in it. This chapter contains only prototypes of function, structures and enumerations as well as brief examples of their usage.

- Part 2, Chapter 3. Basics of asynchronous trading operations. HedgeTerminal uses asynchronous operations in its work. This chapter comprises the experience of using them. This chapter was included in this article so any reader could find some useful information irrespective of their plans to use the HedgeTerminal in their work.

- Part 2, Chapter 4. Basics of multi-threaded programming in the MetaTrader environment. This chapter explains what multi-threading is, how to arrange it and what patterns of data organization can be used. Like Chapter 3 it shares the experience of multi-threaded application development with all MetaTrader users.

I hope that this article is interesting enough so you read it up to the end.

Chapter 1. Organization theory of bi-directional trading

1.1. MetaTrader 5 Opportunities in Organizing Bi-Directional Trading

The article "Principles of Exchange Pricing through the Example of Moscow Exchange's Derivatives Market" carefully describes the nuances of the exchange price formation and methods of financial result calculation of the market players. It outlines that pricing and calculation on the Moscow Exchange significantly differ from concepts and calculation methods accepted in the FOREX trading.

On the whole, formation of the exchange price is more complex and contains a lot of significant details hidden when trading Forex and in the MetaTrader 4 terminal.

For example, in MetaTrader 4 the deals that executed the trader's order are hidden whereas in MetaTrader 5 such information is available. On the other hand, detailed trade information in MetaTrader 5 is not always required. It may make work difficult for an inexperienced user or a novice programmer and cause misunderstanding. For example, in MetaTrader 4, to find out the price of the executed order, you simple need to look up the correspondent value in the "Price" column. In the MQL4 programming language it is enough to call the OrderOpenPrice() function. In MetaTrader 5 it is required to find all the deals that executed the order and then go over them and calculate their weighted average price. This very price is the price of the order execution.

There are other situations when extended representation of the trading environment in MetaTrader 5 requires additional efforts to analyze this information. That prompts logical questions:

Is there a way of making the trading process in MetaTrader 5 as simple and clear as in MetaTrader 4 and keep a convenient access to all required trade details? If there is a way to arrange bi-directional exchange trading using MetaTrader 5 the same simple way as MetaTrader 4? - The answer to those questions is: "Yes, there is"!

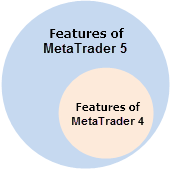

Let us refer to the diagram of capabilities of the MetaTrader 4 and MetaTrader 5 terminals to understand how this is possible:

Fig. 1 Capabilities of MetaTrader 4 and MetaTrader 5

As we can see, the "MetaTrader 5" set includes the "MetaTrader 4" subset. It means that everything possible in MetaTrader 4 can be done in MetaTrader 5 though the converse is false. New capabilities of MetaTrader 5 inevitably increase the amount and the complexity of the trade information presentation. This difficulty can be delegated to special assistant programs working in the MetaTrader 5 environment. These programs can process the complexity, leaving the terminal capabilities at the same level. One of such programs HedgeTerminal is the focus of this chapter.

HedgeTerminal is a full-fledged trading terminal inside the MetaTrader 5 terminal. It uses the MetaTrader 5 trading environment, transforms it with the MQL5 language and represents it as a convenient graphical interface - panel HedgeTerminalUltimate and special interface HedgeTerminalAPI for interaction with independent algorithms (Expert Advisors, scripts and indicators).

MetaTrader 4 features a possibility to use bi-directional positions or locking orders. In MetaTrader 5 there is such capability too but it is not explicit. This can be enabled using a specific add-on program, which HedgeTerminal essentially is. HedgeTerminal is built in MetaTrader 5 and uses its environment, gathering information by deals and orders into integrated positions looking very similar to orders in MetaTrader 4 and having all the capabilities of MetaTrader 5.

Such positions can be in a complete or partial locking order (when active long and short positions exist at the same time). The opportunity of maintaining such positions is not a goal in itself for HedgeTerminal. Its main objective is to unite trade information in unified groups (positions) that would be easy to analyze, manage and get access to. Bi-directional positions can exist in HedgeTerminal only because this is very convenient. In the case several traders are trading on one account, or more than one strategy is used, splitting trading actions must be arranged.

In addition, a number of nuances have to be taken into consideration at exchange trading such as partial order execution, position rollover, variation margin calculation, statistics and many others. HedgeTerminal was developed for meeting those challenges. It provides the user or an Expert Advisor a regular high level interface resembling MetaTrader 4 and at the same time working correctly in the exchange environment.

1.2. Pairing orders - Basis of Hedging and Statistics

To be able to manage trading techniques and algorithms consistently, it is required to know with certainty what trading action belongs to what algorithm. I highlighted the words "with certainty" because if there is even the smallest probability of failure, crash of position management is inevitable sooner or later. In its turn, it will result in damage of statistics and undermining the idea of managing different algorithms on one account.

A reliable separation of trade activities is based on two fundamental possibilities:

- The possibility of uniting or "pairing" two trading orders together so it can always be defined which of the two orders is opening the individual (virtual) position and which of them is closing this position;

- The algorithm, analyzing orders for their pairing must be completely deterministic and unified for all program modules.

The second requirement for the algorithm determinism will be considered in detail below. Now we are going to focus on the first one.

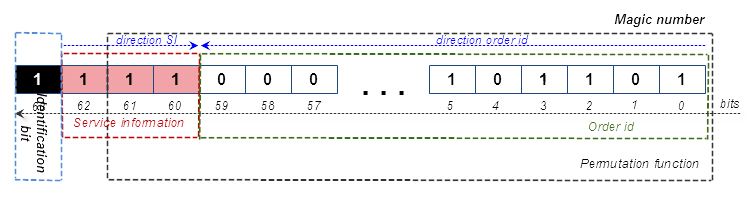

An order is an instruction to sell or buy. An order is a defined entity, which includes many more information "fields" in addition to the main information like magic number and order number, required price and opening conditions.

One of such fields in MetaTrader 5 is called "Order Magic". This is a specified field used for a trading robot or an Expert Advisor to be able to mark this order with its individual unique number also called the "magic number". This field is not used in manual trade though it is very important for trading algorithms because when a trading algorithm analyses the values of this field, it can always see if the order in question was placed by it or any other algorithm.

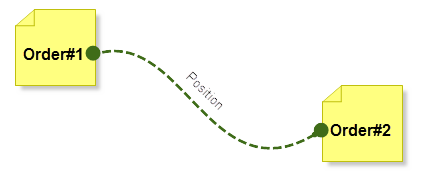

Let us take a look at an example. Let us assume that we need to open a classical long position and then, in some time, close it. For that we have to place two orders. The first order will open this position and the second order will close it:

Fig. 2. Orders forming a historical net position

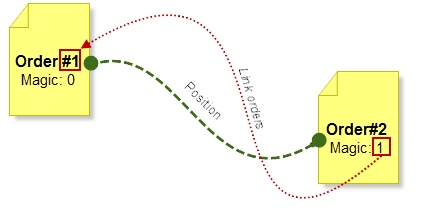

What if we write the magic number of the first order in the field "Order Magic" of the second order at the moment of sending it to the market?

Later, this order's field can be read and if the value is equal to the number of the first order, then we can definitely say that the second order is related to the first one and is opposite to it, i.e. a closing order.

On a diagram this pairing would look like:

Fig. 3. Pairing orders

Nominally such orders can be called paired as the second order contains a link to the first one. The first order opening a new position can be called an initiating or opening order. The second order can be called closing.

A pair of such orders can be called position. To avoid confusion with the concept of "position" in MetaTrader 5, we are going to call such paired positions bi-directional, hedging or the HedgeTerminal positions. Positions in MetaTrader 5 will be called net positions or the MetaTrader 5 classical positions.

Apparently, the number of HedgeTerminal positions and their directions, unlike the classical ones, can be any. What if there is an executed order that is not referred to by any other order? Such an order can be presented as an active bi-directional position. In fact, if an opposite order that contains a link to this order is placed, it will become an order that closes the first order. Such orders will become paired and make a closed bi-directional position as the volume of two orders is going to be equal and their direction is opposite.

So, let us define what is meant in HedgeTerminal by position:

If an executed order is not referred to by any other order, then HedgeTerminal treats such an order as an active bi-directional position.

If one executed order is referred to by another executed order, then two such orders make a pair and are treated by HedgeTerminal as one unified historical or closed bi-directional position.

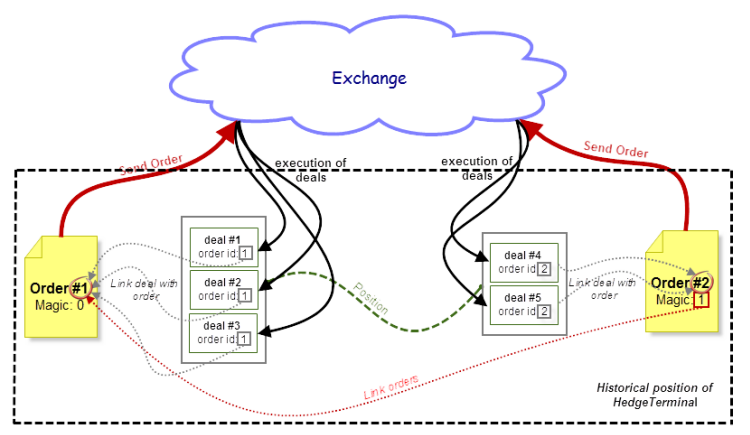

In reality, pairing orders in HedgeTerminal is more complicated, as every order generates a minimum one deal and in exchange trade there can be many such deals. In general, the trade process can be presented as follows: a trader places an order to open a new position through the MetaTrader 5 terminal. The exchange executes this order through one or several deals.

Deals, similar to orders, contain fields for additional information. One of such fields contains the order id, on the basis of which the deal was executed. This field contains information about the order a certain deal belongs to. The converse is false. The order itself does not know what deals belong to it. It happens because at the time of placing the order it is not clear what deals will execute the order and if the order is going to be executed at all.

This way, causality or determinism of actions is observed. Deals are referring to orders and orders are referring to each other. Such a structure can be presented as a singly linked list.

Executed deals of the opening order generate a classical position in MetaTrader 5 and deals that belong to a closing order, on the contrary, close this position. These pairs are presented in the figure below:

Fig. 4. Diagram of a relationship between orders, deals and exchange

We are going to get back to the detailed analysis of this diagram as the direction of the relationships is very important for building a strictly determined system of the trader's actions recording, which is HedgeTerminal.

1.3. Relationship of the MetaTrader 5 Net Positions and the HedgeTerminal Positions

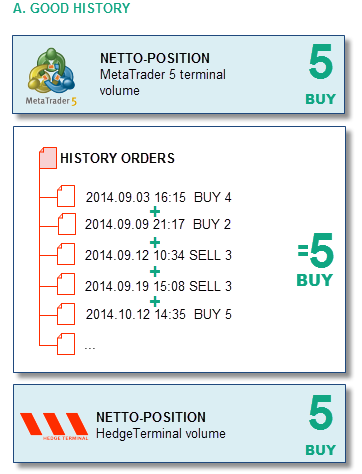

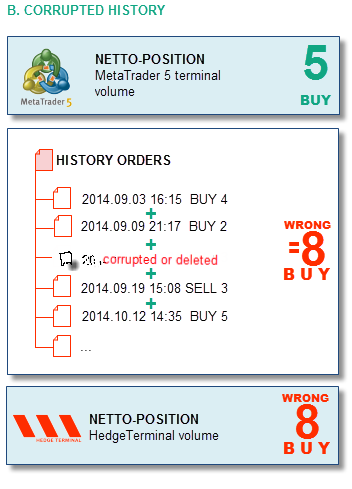

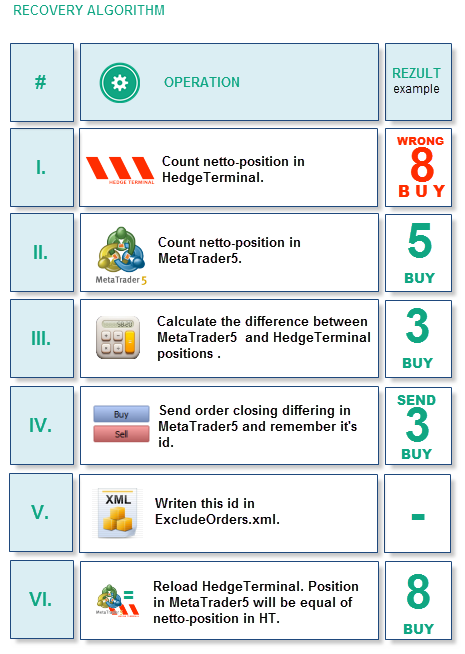

From the point of view of HedgeTerminal, two opposite orders with the same volumes can be two different positions. In this case their net position will be zero. That is why HedgeTerminal does not use information about the factual net positions opened in MetaTrader 5. Therefore, positions in HedgeTerminal are not connected with positions in MetaTrader 5. The only time when the current net positions get verified is the moment of the HedgeTerminal launch. The total volumes of the opposite active positions must be identical to the values of the factual net positions.

If this is not the case, then a warning exclamation mark in a frame will appear on the HedgeTerminal, ![]() indicating that positions in HedgeTerminal and positions in MetaTrader 5 are not equal. This asymmetry does not affect the efficiency of HedgeTerminal, though for further correct work it has to be eliminated.

indicating that positions in HedgeTerminal and positions in MetaTrader 5 are not equal. This asymmetry does not affect the efficiency of HedgeTerminal, though for further correct work it has to be eliminated.

In the majority of cases, it can appear when users make errors editing the files of excluded orders ExcludeOrders.xml, though corruption of the order and deal history on the server can also cause this sign to emerge. In any case, these discrepancies can be removed by the exclusion mechanism implemented through the ExcludeOrders.xml file.

1.4. Requirements of the Algorithms Implementing Bi-Directional Trading

Rather strict requirements are imposed on the algorithms implementing bi-directional trading. They must be met when developing HedgeTerminal. Otherwise, HedgeTerminal would quickly turn into a program working stochastically. The program would be "yet another solution that could operate or fail to do so with the same probability"

Below are some requirements specified for its development:

- The representation of traders' bi-directional positions must be reliable. Any idea implemented in HedgeTerminal must not lead to ambiguity or potential errors in the business logic. If some property or opportunity does not meet these requirements, then this idea won't be used in spite of its convenience and the demand for it;

- All algorithms must be based on the MetaTrader 5 trading environment as much as possible. Storing additional information in the files is permitted in the cases when this is strictly necessary. The virtualization algorithms must receive the major part of information from the trading environment. This property enhances the total level of reliability as the majority of changes are conveyed through the server and therefore are accessible from any point in the world;

- All actions on the trading environment transformation must be performed behind the scenes. Complex configuration and initialization of the API HedgeTerminal library should not be required. A user should be able to launch the application "out of the box" and receive the expected result;

- The HedgeTerminal visual panel must fit the general MetaTrader 5 interface as seamlessly as possible, giving simple and understandable visual tools for work with bi-directional positions familiar to all the users of MetaTrader 4 and 5. In other words, the visual panel must be intuitively clear and simple for all users;

- The visual panel of HedgeTerminal must be designed taking into consideration algorithmic traders' high requirements. For instance, the panel must be configurable, the user must be able to change its appearance and even add custom modules;

- It must provide the Intuitive and simple program interface (API) of interactions with external Experts. The program part of interactions between external Experts and the HedgeTerminal algorithms must fit seamlessly the existing standard of the program interaction of the custom Experts with the MetaTrader 4/5 system functions. Actually, the HedgeTerminal API appears to be a hybrid of the MetaTrader 4 and MetaTrader 5 APIs;

- HedgeTerminal must ensure reliable work in the exchange environment, taking into account all the nuances of the exchange orders execution. HedgeTerminal is written based on the canonical article Principles of Exchange Pricing through the Example of Moscow Exchange's Derivatives Market". Initially, this article was a part of a long article about HedgeTerminal, which later was divided into several independent articles because of the volume. One can say that HedgeTerminal is a program implementation of the ideas discussed in this article.

Many of these ideas are not quite connected with each other. For instance, the abundance of the exchange information that is to be reflected in the exchange trading is difficult to connect with the simplicity of this information representation.

Another difficulty was to create a panel that could be easy to use for novice traders and at the same time provide extensive opportunities for professional algorithmic traders. Nevertheless, assessing the result, it is clear that these mutually exclusive properties were successfully implemented in HedgeTerminal.

Chapter 2. Installation of HedgeTerminal, First Launch

2.1. Installation of HedgeTerminal

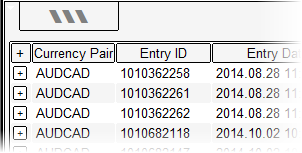

We know that all executed orders in HedgeTerminal are considered as positions. Positions can consist either of two paired orders, which make a closed historical position or an unbound order, which makes an open or active position.

If before HedgeTerminal was installed, there were some actions on the trading account and the trading history contains a lot of executed orders, then from the point of view of HedgeTerminal all these orders will be open positions as the links between them were not created. It does not matter if the account history contains 2-3 executed orders. If there are thousands of them, HedgeTerminal will generate thousands of open positions. What can one do with them? These orders can be "closed" by placing opposite orders containing links to the initiating orders through HedgeTerminal. There is a down side though. If by the time of installing HedgeTerminal there are too many of them, it can ruin the trader as the brokerage fee and slippage expenses are to be paid.

To avoid this, HedgeTerminal launches a dedicated installation wizard at the beginning of its installation, where different solutions of this problem are suggested. Let us launch HedgeTerminal, call this wizard and describe its work in detail. For that download and install HedgeTerminalDemo from the MetaTrader 5 Market.

Similar to HedgeTerminalUltimate, it has a form of an Expert Advisor and all it takes to launch it is dragging its icon available in the "Navigator" folder to a free chart.

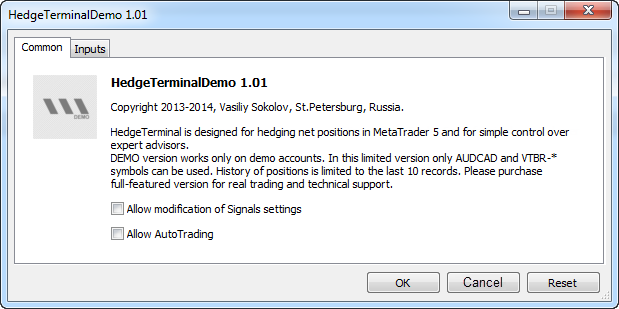

Dragging this icon will bring up a standard window suggesting to launch the Expert Advisor on the chart:

Fig. 5. The HedgeTerminal window before the launch

At this stage it is enough to set the flag "Allow AutoTrading", allowing the EA to perform trade actions. HedgeTerminal will follow your orders as it does not have its own trading logic but for executing trades it will still need your permission.

For any Expert Advisor to start trading, the general permission for trading through Expert Advisors must be enabled on the panel in addition to the personal permission to trade in MetaTrader 5.

![]()

Fig. 6. Enabling automated trading

HedgeTerminal was designed so the user could avoid long and complex configuration.

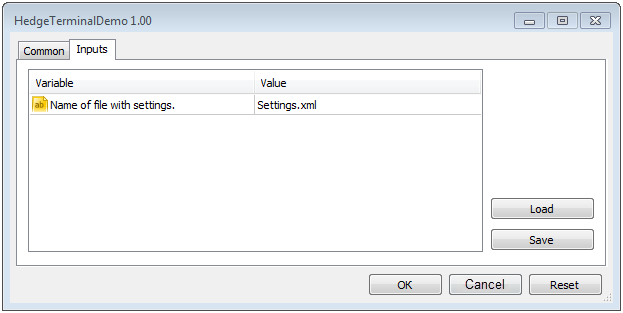

That is why all available settings are included in a special XML text file. The only explicit parameter for HedgeTerminal is the actual name of these settings file:

Fig. 7. Settings window of the HedgeTerminal panel

The nature of these settings and the way to change them will be discussed later.

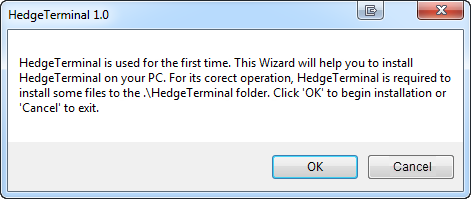

After pressing "OK", the HedgeTerminal installation wizard launches suggesting to start the installation process. The process of installation goes down to creating a few files in the shared directory for the terminals MetaTrader 4 and MetaTrader 5.

HedgeTerminal requests permission to install such files:

Fig. 8. Dialog of the installation start

If you do not want some files to be installed on your computer, press "Cancel". In this case HedgeTerminal will finish work. To continue installation press "OK".

The appearance of the following dialog will depend on the account you launch HedgeTerminal with. If no trades were executed on the trading account, then HedgeTerminal will complete its work.

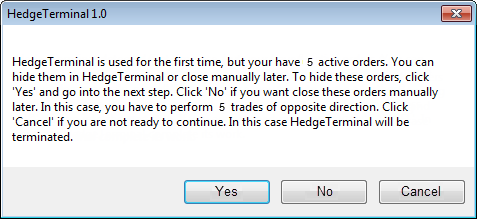

If some trades have already been executed, HedgeTerminal will display the following dialog:

Fig. 9. Dialog detecting the first launch of HedgeTerminal

On the figure above, HedgeTerminal identified 5 active orders. In your case their number will be different (it is likely to be big and equal to the total number of executed orders of the account lifetime). These orders do not make a pair with a closing order as from the point of view of HedgeTerminal, they are active positions.

HedgeTerminal suggests several options.

- Exclude these orders from HedgeTerminal: "You can hide them in HedgeTerminal... To hide these orders, click 'YES' and go into the next step". If you choose this option and press "YES", HedgeTerminal will put them into a specified list and from then will stop accounting their contribution to the aggregate net position as well as their financial result. These orders can be placed in the list only if there is no currently open net position. If you have an open position on one or several symbols, HedgeTerminal will call an additional dialog suggesting to close existing positions.

- Leave orders as they are and close them later if required: "You can… close manually later... Click 'No' if you want close these orders manually later. In this case, you have to perform 5 trades of opposite direction". In this case, if you press "No", HedgeTerminal will reflect after launch all these orders in the "Active" tab (i.e. as active positions). Later these orders can be closed with other orders through the HedgeTerminal panel. After that they will turn into closed positions and will be transferred to the "History" tab (historical positions). If these orders are great in number, then it is better to hide them than to close all executed orders again and pay brokerage fees.

- You can stop the installation: "If you are not ready continue press Cancel. In this case HedgeTerminal complete its work". If you choose this option and press "Cancel", HedgeTerminal will stop its work.

If there are no active positions by the time HedgeTerminal is installed, installation will be stopped at this stage.

If you have selected the second option and you currently have one or several opened positions, HedgeTerminal will call an additional dialog suggesting to close them:

Fig. 10. Dialog suggesting to close net positions automatically

HedgeTerminal requires closing all existing positions as all executed orders are to be put into the list of excluded orders. If there are no net positions, then any following order initializes a new net position. The direction and volume in this case are the same as in HedgeTerminal and that ensures avoiding unsynchronization of net positions with the total positions in HedgeTerminal.

HedgeTerminal can automatically close all net positions for you: "The HedgeTerminal can automatically close all active positions". If this is acceptable to you, press "OK". In this case it will try to close positions and if successful will finish work. If positions cannot be closed for some reason, it will move on to the dialog of manual position closing. If you select the manual position closing, "Click 'Cancel' if you want to close a position manually", press "Cancel".

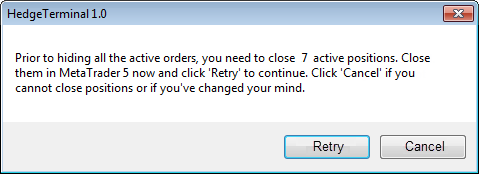

The dialog of manual position closing is called either when manual closure type was chosen in the previous dialog window or when automatic position closure is impossible.

Fig. 11. Dialog suggesting to close net positions manually

At this point all active positions have to be closed manually through MetaTrader 5 or installation should be cancelled by pressing "Cancel". After all positions are closed, press "Retry".

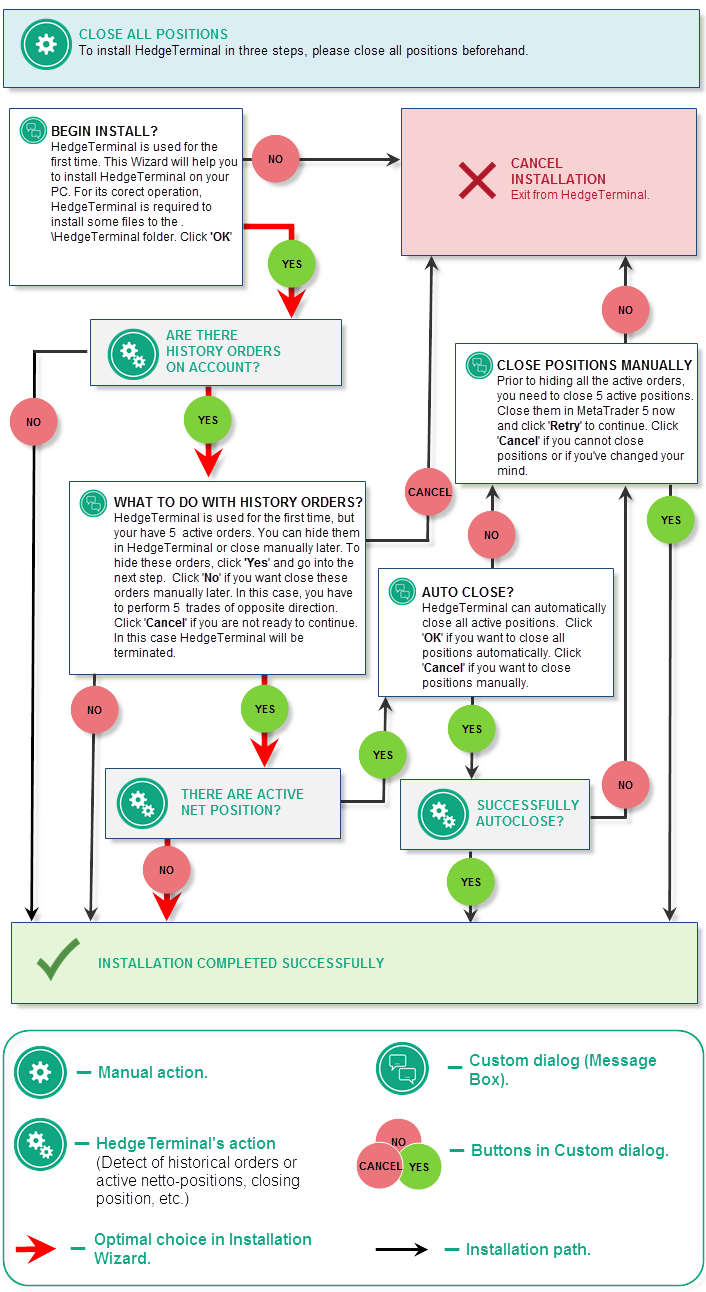

2.2. Three Step Installation. Installation Diagram and Solution to Possible Problems

If we simplify the installation process as much as possible, it can be narrowed down to three steps:

- Before installing HedgeTerminal, close all currently active net positions in the MetaTrader 5 terminal;

- Launch HedgeTerminal on the chart and press "Yes" in the appeared window of the installation wizard to start installation. HedgeTerminal in this case will install all the files required for its operation;

- In the next window if this appears, select the second option and press "Yes". In this case active positions won't appear when HedgeTerminal is launched and the information about previously executed orders will be transferred to the ExcludeOrders.xml file automatically as there are no active positions requiring closure.

The simplest way to describe it is as follows: close all positions before launching Hedge Terminal and then press "Yes" two times in the HedgeTerminal installation wizard.

Complete pattern of the installation wizard is represented on the diagram below. It will help to answer the questions and perform installation correctly:

Fig. 12. Installation wizard

What is the course of action if installation was not performed correctly or HedgeTerminal is required to be deleted from the computer? In the case installation was incorrect, simply delete all installed files. For that, go to the folder where programs for MetaTrader store shared information (as a rule this is located at: c:\Users\<your_user_name>\AppData\Roaming\MetaQuotes\Terminal\Common\Files\). If you want to delete information about the HedgeTerminal installation from all accounts, find the "HedgeTerminal" folder in this directory and delete it. If you want to delete information about the HedgeTerminal installation only for a certain account, go to the \HedgeTerminal\Brokers directory and select the folder, containing the name of your broker and the account number that looking like "Broker's name - account number". Delete this folder. Next time the installation wizard will launch again when HedgeTerminal is started on this account.

Installation on the terminal connected to the account already working with HedgeTerminal. It may happen that that HedgeTerminal is required to be installed on the terminal connected to the account where HedgeTerminal is already working. As you already know, the installation process consists of creating and configuring system files. If all these files are already created on another computer and properly configured, then there is no need to install HedgeTerminal. As a rule, these files are stored at c:\Users\<your_user_name>\AppData\Roaming\MetaQuotes\Terminal\Common\Files\HedgeTerminal. Simply carry over this folder to the same place on your computer. After copying the directory, launch HedgeTerminal again. The installation wizard will not get called as all files are present and configured. In this case active positions will be similar to the display on other terminals and computers.

Installation of HedgeTerminalAPI and using the library in test mode. HedgeTerminal is implemented both as a visual panel and a library of program functions - HedgeTerminalAPI. The library contains a similar installation wizard called at the first launch of HedgeTerminalAPI in real time. Installing files when using the library is similar. At the first call of any function, the Expert will bring up a relevant MessageBox suggesting to start installation. In that case the user has to do the same thing - close all positions before calling HedgeTerminalAPI and perform installation in three steps.

It is not required to install HedgeTerminal when launching the library in test mode. As in test mode the Expert starts every time working with a new virtual account, there is no need to hide previously executed order and install files. The settings stored in the file Settings.xml, in the library can be defined grammatically through calling relevant functions.

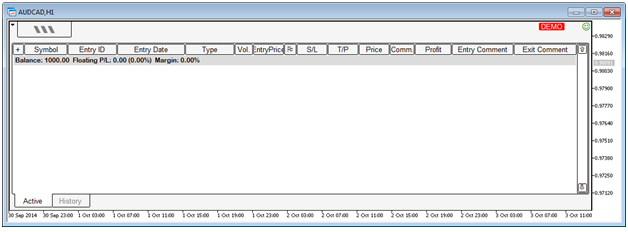

2.3. Getting Started with HedgeTerminal, First Launch

After HedgeTerminal has installed all the files required for its work, it will launch on the chart and display its panel:

Fig. 13. First launch of HedgeTerminal, appearance

As all existing orders are hidden, there are no displayed active positions. The upper panel contains a button of the HedgeTerminal menu on the left hand side and dedicated icons displaying the state of the panel. The buttons have the following functions:

- Indicates that the panel demo version has been launched. This does not support the trade on real accounts and displays positions only on the AUDCAD and VTBR* symbols. In this mode, the history of positions is also limited by the last 10 closed positions.

- Indicates that the panel demo version has been launched. This does not support the trade on real accounts and displays positions only on the AUDCAD and VTBR* symbols. In this mode, the history of positions is also limited by the last 10 closed positions. - Indicates that positions in HedgeTerminal are not equal to the total net position in MetaTrader 5. This is not a critical error but it is required to be eliminated. If the HedgeTerminal installation is correct, refer to the section of this article describing how to eliminate the mistake.

- Indicates that positions in HedgeTerminal are not equal to the total net position in MetaTrader 5. This is not a critical error but it is required to be eliminated. If the HedgeTerminal installation is correct, refer to the section of this article describing how to eliminate the mistake. - The icon signifies that trade is impossible. Hover the mouse over this icon and find out from the pop-up tip what the matter is. Possible reasons: no connection with the server; the Expert Advisor is prohibited to trade; trading with Expert Advisors is not allowed in MetaTrader 5.

- The icon signifies that trade is impossible. Hover the mouse over this icon and find out from the pop-up tip what the matter is. Possible reasons: no connection with the server; the Expert Advisor is prohibited to trade; trading with Expert Advisors is not allowed in MetaTrader 5. - An icon indicating that the trade is permitted; HedgeTerminal can perform any trade action.

- An icon indicating that the trade is permitted; HedgeTerminal can perform any trade action.

Now, when HedgeTerminal is launched and ready for work, carry out several trades and see how they are displayed. If HedgeTerminal is launched on Forex, trading actions are to be executed on the AUDCAD symbol. There should not be any open net positions as installation of HedgeTerminal could be successful only in that case. If this is not the case for some reason, close all active positions.

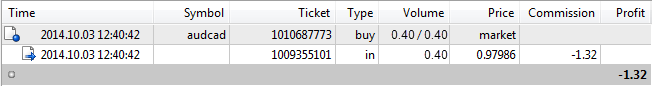

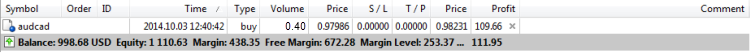

If HedgeTerminal is launched on an account connected to the Moscow Exchange, trading should be executed on one of the futures of the VTBR* group, for example VTBR-13.15 or VTBR-06.15. As an illustration, buy 0.4 lot of AUDCAD by the current price through the standard window "NewOrder". In a few moments, the order and the deal that executed it will appear in the order history of the terminal:

Fig. 14. Historical order and its deal in MetaTrader 5

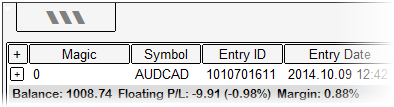

The active positions tab will contain a correspondent long position of 0.4 lot:

Fig. 15. Active net position in MetaTrader 5

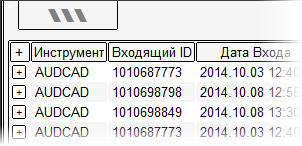

At the same time, HedgeTerminal will display the historical order as an active position:

Fig. 16. Active bi-directional position in HedgeTerminal and its deal

As we can see, the results are the same, as one position in HedgeTerminal is correspondent to 1 net position in MetaTrader 5.

Please pay attention that in addition to the order, the position in HedgeTerminal contains a deal that executed this position (to see it, maximize the position string by pressing ![]() )

)

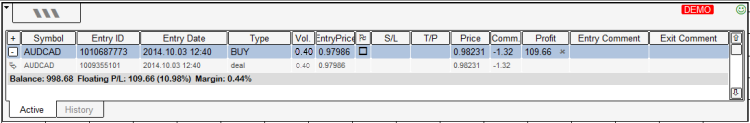

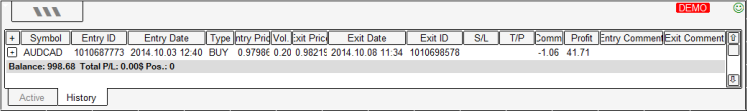

A part of an active position can be hidden. For that simply enter a new volume value in the field "Vol." (Volume). The new volume should be less than the current one. The difference between the current and the new volumes will be covered by the new order that forms a historical position and is displayed in the correspondent tab of historical positions. Enter the value of 0.2 in this field and then press Enter. In some time the volume of the active position is going to be 0.2 and the historical positions tab will feature the first historical transaction with the volume of 0.2 lot (0.4 - 0.2 = 0.2):

Fig. 17. Historical bi-directional position in HedgeTerminal

In other words, we closed half of our active position. Common financial result of the historical and active position will be identical to the result in the terminal.

Now we are going to close the rest of the active position. For that press the button of closing a position in ![]() HedgeTerminal:

HedgeTerminal:

Fig. 18. Close button of a bi-directional position in HedgeTerminal

After this button has been pressed, the remaining position must be closed by the opposite order and transferred to the historical position tab. This way active positions (both in MetaTrader 5 and in HedgeTerminal) will be closed.

2.4. Hedging and Calculation of Financial Operations

In this section we are going to describe methods of work with HedgeTerminal using several bi-directional positions as an example.

So currently we do not have any active positions. Open a new long position with the volume of 0.2 lot on AUDCAD. For that it is enough to open the "new order" dialog window and place a correspondent order. After the position has been opened, lock it by the opposite position - sell 0.2 lot through the MetaTrader 5 terminal.

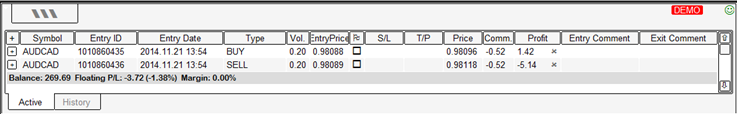

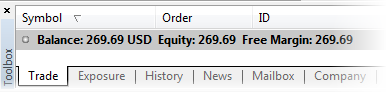

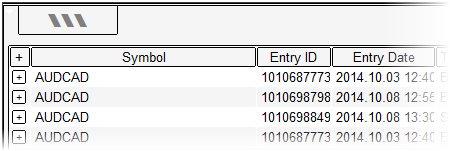

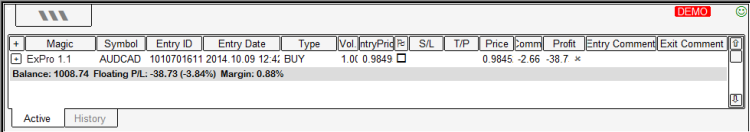

This time the trade result in HedgeTerminal and in the MetaTrader 5 terminal window are different. HedgeTerminal displays two positions:

Fig. 19. Opposite bi-directional positions in HedgeTerminal (lock)

In MetaTrader 5 they are not present at all:

Fig. 20. Absence of an active net position in MetaTrader 5

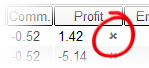

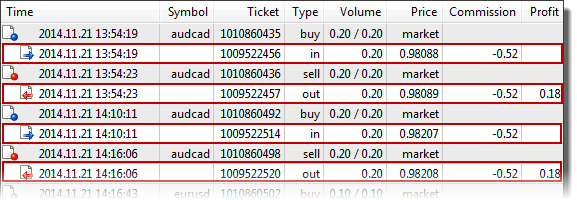

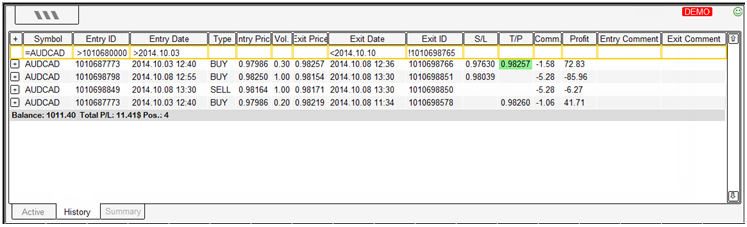

Let us assess the result. 4 deals have been executed. They are in the red frame on the screenshot below:

Fig. 21. Result of executed deals in MetaTrader 5

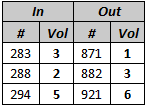

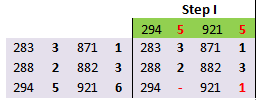

Put these deals in a table:

| Type | Direction | Price | Volume | Profit, pips |

|---|---|---|---|---|

| buy | in | 0,98088 | 0,2 | |

| sell | out | 0,98089 | 0,2 | 1 |

| buy | in | 0,98207 | 0,2 | |

| sell | out | 0,98208 | 0,2 | 1 |

Table 1. Displaying deals in the MetaTrader 5 terminal

It is obvious that 2 points were earned on 4 deals. The value of every point is roughly 0,887 dollar when trading 1 lot. So, the financial result is 0.18 dollar per position (0,887*0,2*1) or 34 cents for both positions. The "Profit" column shows that this result is correct. The net profit is 34 cents.

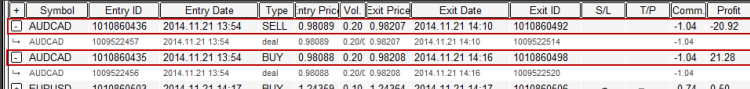

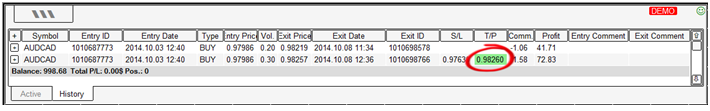

Now look at the result in HedgeTerminal:

Fig. 22. Result of historical bi-directional positions in HedgeTerminal

At first they seem to differ significantly. Let us calculate the result for our two bi-directional positions:

| Direction | Entry price | Exit price | Profit, pips | Profit, $ |

|---|---|---|---|---|

| buy | 0,98088 | 0,98208 | 0.00120 | 21,28 |

| sell | 0,98089 | 0,98207 | -0.00118 | -20,92 |

Table 2. Displaying positions in HedgeTerminal

The difference between them is 0.34$ (21,28$ - 20,92$), which is exactly the same as the result obtained in net trading.

2.5. One Click Trading

HedgeTerminal employs a peculiar management system. This is based on the direct entry of the required values to the active position field. There is no alternative management.

For instance, to place StopLoss for an active position, simply enter the required value in the StopLoss field and then press Enter:

Fig. 23. Entry of the StopLoss level directly to the table

Similarly, this way a trader can modify the volume, place TakeProfit or modify its level, change the initial comment.

In general, the position line in HedgeTerminal is similar to the position display in MetaTrader 4/5. The columns of the table with positions have identical names and values used in the MetaTrader terminals. There are differences too. So, a position in HedgeTerminal has two comments whereas in MetaTrader a position has only one comment. This means that a position in HedgeTerminal is formed by two orders and each of them has its own comment field. As HedgeTerminal does not use these comments for storing technical information, it is possible to create a position with an opening and closing comment.

HedgeTerminal features an opportunity to add columns that are not displayed by default. For example, a column reflecting the name of the Expert Advisor that opened the position. The section dedicated to configuring the Settings.xml file describes the way to do it.

2.6. Placing StopLoss and TakeProfit, Trailing Stop

HedgeTerminal allows to close positions by the StopLoss or TakeProfit levels.

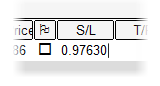

To see how it happens, introduce the StopLoss and TakeProfit levels in the active position and then wait till one of those levels triggers. In our case TakeProfit triggered. It closed the position and moved it to the list of historical transactions:

Fig. 24. Historical bi-directional position and its StopLoss and TakeProfit levels

The green mark in the TakeProfit level indicates that TakeProfit triggered and the position was closed by that level. In addition to TakeProfit, a position contains information about the StopLoss level which was also used when the position was active. Similarly, if the StopLoss level triggered, then the StopLoss cell would be highlighted pink and TakeProfit would not be colored.

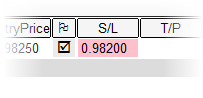

HedgeTerminal supports TrailingStop and future versions will allow to write a specific custom module containing the logic of carrying over the StopLoss. Currently the work with Trailing Stop in HedgeTerminal is different from the same Trailing Stop in the MetaTrader terminal. To enable it, it is required to enter the StopLoss level in the StopLoss cell of the correspondent position. When StopLoss is placed, following the price option can be flagged in the cell marked with a sign ![]() :

:

Fig. 25. Placing Trailing Stop in HedgeTerminal

After flagging, HedgeTerminal fixes the distance between the current price and the StopLoss level. If it increases, StopLoss will follow the price so the distance stays the same. Trailing Stop works only when HedgeTerminal is working and gets cleared upon the exit.

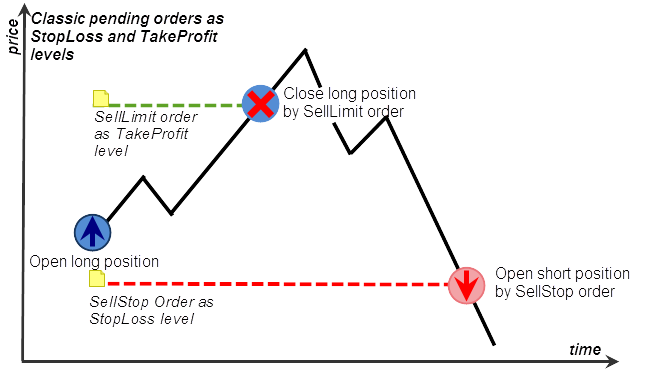

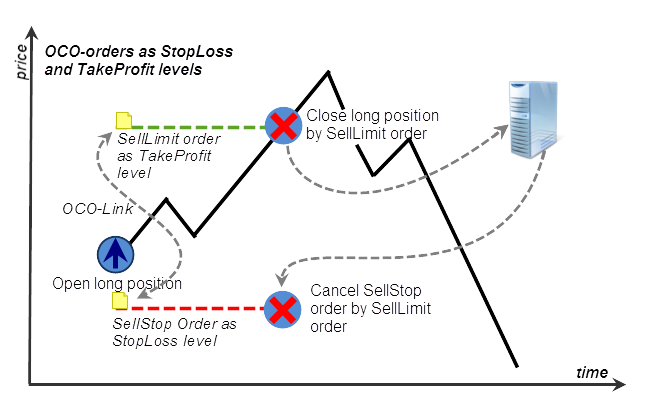

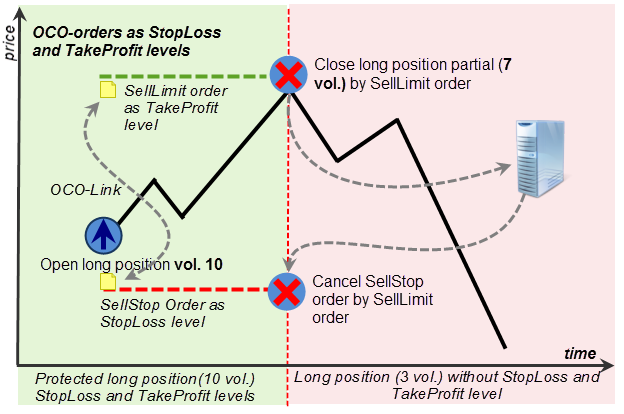

In HedgeTerminal, StopLoss is implemented with the BuyStop and SellStop orders. Every time a StopLoss is placed, a correspondent order with a magic number connected with the active position is placed too. If this pending order gets deleted in the MetaTrader terminal, then the StopLoss level in HedgeTerminal will disappear. Changing the price of the pending order will trigger the change of the StopLoss in HedgeTerminal.

TakeProfit works a little differently. This is virtual and it hides its trigger level from the broker. It means that HedgeTerminal closes a position by TakeProfit autonomously. Therefore, if you want your TakeProfit to trigger, you need to keep your HedgeTerminal in a working order.

2.7. Report Generation

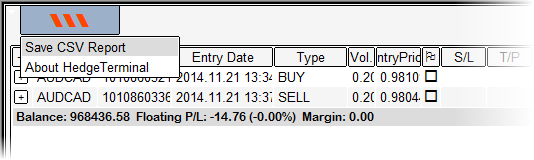

HedgeTerminal allows to save the information about its bi-directional positions to designated files, which can be loaded to third party statistical programs of analysis, for instance to Microsoft Excel.

Since HedgeTerminal currently does not have a system of analysis and statistics gathering, this feature is especially important. At the moment, only one format of report saving is supported - CSV (Comma-Separated Values). Let us see how this works. To save the bi-directional positions in the CSV file, select the "Save CSV Report" option in the menu after launching HedgeTerminal:

Fig. 26. Saving a report through the "Save CSV Report" menu

After selecting those points in the menu, HedgeTerminal will generate two files in the CSV format. One of them will comprise the information about active positions and another one about historical, completed ones. The reason why two different files are generated is because each of them has a different set of columns. Besides, the number of active positions can constantly vary, therefore it is more convenient to analyze them separately. The generated files are available by the relative path .\HedgeTerminal\Brokers\<Broker's name - account number> \. There must be two files at the end: History.csv and Active.csv. The first one contains information about historical positions and the second one about active positions.

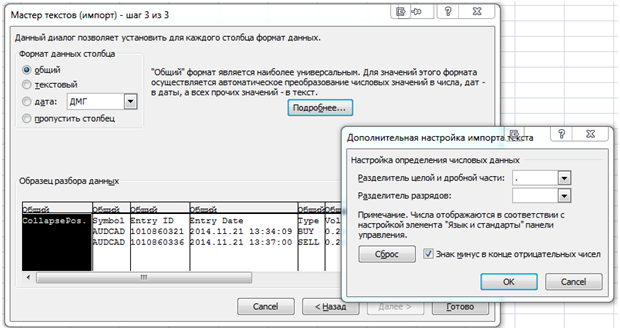

The files can be loaded into the statistical programs for analysis. Let us look at this procedure using Microsoft Excel as an example. Launch this program and select "Data" --> "From the text". In the appeared data export wizard select the mode with separators. In the following window, select semicolon as the separator. Press "Next". In the following window change the general format of floating point number representation. To do that press "Details". In the appeared window select the period character as a separator of the integer and fractional parts:

Fig. 27. Export the CSV report to Microsoft Excel

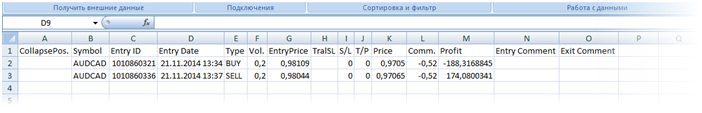

Press "ОК", and then "Finish". The appeared table will contain information about active positions:

Fig. 28. Information about active positions exported to Excel

Data on historical positions can be loaded in the next sheet the same way. The number of columns will be correspondent to the factual number of columns in HedgeTerminal. If one of the columns gets deleted from the HedgeTerminal panel, it will not be included into the report. This is a convenient way to form a report based only on the required data.

Later versions of the program will allow to save a report in the XML and HTML formats. Added to that, a report saved in HTML will be similar to a standard HTML report in MetaTrader 5, though it will consist of completed bi-directional positions.

2.8. Currency Swap Presentation

Currency swap is a combination of two bi-directional conversion deals for the same sum with different valuation dates.

In simple words, swap is a derivative operation on accruing the difference of the interest rates paid for holding two currencies forming a net position.

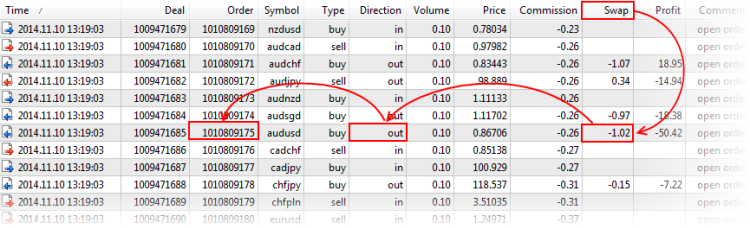

There is no history of net positions in MetaTrader 5. There are historical orders and deals that formed and closed historical net positions instead. As there are no historical positions, the swap is assigned to the order that closes a historical position:

Fig. 29. Currency swap as an independent transaction

It would be more accurate to present the swap as an independent derivative operation appearing as a result of a net position prolongation.

The current version of HedgeTerminal does not support swap representation though the later versions will feature such an option. There a swap will be shown as a separate historical position in the historical position tab. The swap identifier will be correspondent to the identifier of the net position that it was accrued on. The swap will include the name of the currency pair and its financial result.

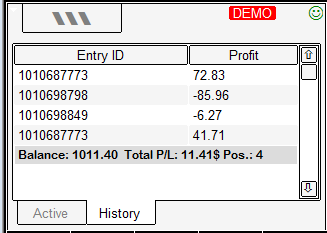

2.9. Bottom Row

Similar to MetaTrader, HedgeTerminal displays the final row with common characteristics for the whole account in the table of deals. For the table of active and historical positions these characteristics and their values are listed below:

- Balance – Total balance. Equal to the similar value "Profit" in the window of active positions in MetaTrader. This does not take into account the floating profit or loss from open positions.

Floating P/L – Floating profit/loss. This is equal to the sum of the profit of all currently active positions.

Margin – Contains a share of pledge funds from the account balance in percent. Can vary from 0% to 100%. Indicates a degree of the load on deposit.

Total P/L – Contains a sum of all profits and losses for closed positions.

Pos.:# - Displays the number of historical positions.

For correct display of the bottom row, it is required to add the "Arial Rounded MT Bold" font to the system.

2.10. Changing the Appearance of HedgeTerminal Tables

As mentioned before, HedgeTerminal has only one explicit parameter in the window of the Expert launch. This is the name if the settings file. This is so because the HedgeTerminal settings cannot be placed in the window of the Expert settings. There are many of them and they are too specific for such a window. That is why all settings are placed to the designated configuration file Settings.xml. For every launched version of HedgeTerminal, there can be its own settings file. That gives an opportunity to configure every launched version of HedgeTerminal individually.

HedgeTerminal currently does not allow editing this file through the visual windows of settings. Therefore, the only way to change the behavior of HedgeTerminal is to edit the file manually. The settings file is configured in the optimal way by default and therefore most of the time there is no need to edit the content. There may be situations when such editing may be required. Such editing is necessary for fine tuning and customizing the panel appearance. For instance, when a file has been edited, unnecessary columns can be deleted or, on the contrary, the columns not displayed by default can be added.

Let us see the content of this file and see how to customize it. To do that, find this file in the directory where HedgeTerminal has installed its files. This directory, as was mentioned before, can be located at the address c:\Users\<your user name>\AppData\Roaming\MetaQuotes\Terminal\Common\Files\HedgeTerminal. The Settings.xml file should be located inside. Open it with the help of any text editor:

<!--This settings valid for HedgeTerminal only. For settings HedgeTerminalAPI using API function and special parameters.--> <Hedge-Terminal-Settings> <!--This section defines what columns will be showed on the panel.--> <Show-Columns> <!--You can change the order of columns or comment not using columns.--> <!--You can change the value of 'Width' for a better scaling of visual table.--> <!--You can change the value of 'Name' to install your column name.--> <!--This columns for tab 'Active'--> <Active-Position> <Column ID="CollapsePosition" Name="CollapsePos." Width="20"/> <!-- Unset this comment if you want auto trading and want see name of your expert: <Column ID="Magic" Name="Magic" Width="100"/>--> <Column ID="Symbol" Name="Symbol" Width="70"/> <Column ID="EntryID" Name="Entry ID" Width="80"/> <Column ID="EntryDate" Name="Entry Date" Width="110"/> <Column ID="Type" Name="Type" Width="80"/> <Column ID="Volume" Name="Vol." Width="30"/> <Column ID="EntryPrice" Name="EntryPrice" Width="50"/> <Column ID="TralStopLoss" Name="TralSL" Width="20"/> <Column ID="StopLoss" Name="S/L" Width="50"/> <Column ID="TakeProfit" Name="T/P" Width="50"/> <Column ID="CurrentPrice" Name="Price" Width="50"/> <Column ID="Commission" Name="Comm." Width="40"/> <Column ID="Profit" Name="Profit" Width="60"/> <Column ID="EntryComment" Name="Entry Comment" Width="100"/> <Column ID="ExitComment" Name="Exit Comment" Width="100"/> </Active-Position> <!--This columns for tab 'History'--> <History-Position> <Column ID="CollapsePosition" Name="CollapsePos." Width="20"/> <!-- Unset this comment if you want auto trading and want see name of your expert: <Column ID="Magic" Name="Magic" Width="100"/>--> <Column ID="Symbol" Name="Symbol" Width="70"/> <Column ID="EntryID" Name="Entry ID" Width="80"/> <Column ID="EntryDate" Name="Entry Date" Width="110"/> <Column ID="Type" Name="Type" Width="40"/> <Column ID="EntryPrice" Name="Entry Price" Width="50"/> <Column ID="Volume" Name="Vol." Width="30"/> <Column ID="ExitPrice" Name="Exit Price" Width="50"/> <Column ID="ExitDate" Name="Exit Date" Width="110"/> <Column ID="ExitID" Name="Exit ID" Width="80"/> <Column ID="StopLoss" Name="S/L" Width="50"/> <Column ID="TakeProfit" Name="T/P" Width="50"/> <Column ID="Commission" Name="Comm." Width="40"/> <Column ID="Profit" Name="Profit" Width="50"/> <Column ID="EntryComment" Name="Entry Comment" Width="90"/> <Column ID="ExitComment" Name="Exit Comment" Width="90"/> </History-Position> </Show-Columns> <Other-Settings> <Deviation Value="30"/> <Timeout Seconds="180"/> <!-- If your computer is not fast enough - set a value 'Milliseconds' greater than 200, such as 500 or 1000. --> <RefreshRates Milliseconds="200"/> </Other-Settings> </Hedge-Terminal-Settings>

This file contains a special document written in the xml markup language, describing the behavior and the appearance of HedgeTerminal.

The main thing to do before the start of editing is to create a backup copy in case the file gets accidentally corrupted. The file has a hierarchical structure and consists of several sections enclosed into each other. The main section is called <Hedge-Terminal-Settings> and it contains two main subsections: <Show-Columns> and <Other-Settings>. As follows from their names, the first section adjusts the displayed columns and their conditional width and the second section has the settings for the panel itself and the HedgeTerminalAPI library.

Changing the size and the name of columns. Let us refer to the <Show-Columns> section and consider its structure. Essentially, this section contains two sets of columns: one for the table of active positions in the "Active" tab and the other one for the table of historical positions in the "History" tab. Every column in one of the sets looks like:

<Column ID="Symbol" Name="Symbol" Width="70"/>

The column must contain an identifier (ID="Symbol"), name of the column (Name="Symbol") and conditional width (Width="70").

The identifier contains a unique internal name of the column. It prompts HedgeTerminal how to display this column and what value to place in it. The identifier cannot be changed and it should be supported by HedgeTerminal.

The name of the column defines what name the column will be displayed with in the table. If the name is changed for another one, like: Name="Currency Pair", then at the next launch of HedgeTerminal, the name of the column displaying the symbol will change:

Fig. 30. Change of the column names in the HedgeTerminal panel

This very property allows creating a localized version of the panel where the name of every column will be displayed in preferred language, for example in Russian:

Fig. 31. The HedgeTerminal panel localization

The next tag contains the conditional width of the column. The thing is that a graphics engine automatically aligns the table size with the width of the window where the panel is launched. The wider the window is the wider each column. It is impossible to set up the width of the column precisely but the proportions can be specified by setting up the basic width of the column. The basic width is the width of the column in pixels when the width of the window is 1280 pixels.

If your display is wider, then the factual size of the column is greater. To see how uniform scaling works, set up the width of the Symbol column as 240 conditional pixels: Width="240". Then save the file and reset the panel:

Fig. 32. The width of the Symbol column is set up for 240 pixels.

The width of the column with symbols has increased significantly. However, it should be noted that its width was gained at the expense of the width of other columns ("Entry ID" and "Entry Date").

Other columns are now looking worse, last values do not fit in the allowed width. The size of the columns should be changed carefully, finding the best size for each of them. The standard settings have precise values for majority of displays and changing their size is normally not required.

Deleting columns. In addition to changing column sizes and their headers, the columns can be added or deleted too. For example, let us try and delete the "Symbol" column from the list. To do that, simply comment out the tag of the column in the Settings.xml file (highlighted in yellow):

<Column ID="CollapsePosition" Name="CollapsePos." Width="20"/> <!-- Unset this comment if you want auto trading and want see name of your expert: <Column ID="Magic" Name="Magic" Width="100"/>--> <!--<Column ID="Symbol" Name="Symbol" Width="70"/>--> <Column ID="EntryID" Name="Entry ID" Width="80"/>

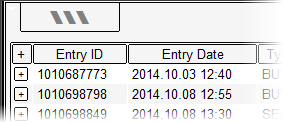

In xml a specified tag <!-- content of the comment --> has a role of the comment. The commented out column must be located in the tag. After changes in the file have been saved and HedgeTerminal was relaunched, its set of columns for historical positions will change. It won't contain a column displaying the symbol:

Fig. 33. Deleting the Symbol column from the table of active positions

Several columns can be deleted at once.

Let us comment out all columns except the symbol name and the profit size and then relaunch HedgeTerminal on the chart:

Fig. 34. Deleting main columns from the HedgeTerminal panel

As we can see, the HedgeTerminal table has significantly reduced. One should be careful with deleting columns as in some cases they contain elements of position management. In our case, the column that allows reversing positions and view their deals got deleted. Even the "Profit" column from the table of active positions can be deleted. This column, however, contains a button of closing position. In this case a position won't get closed as the close button is missing.

Adding columns and displaying the aliases of Experts. Columns can be deleted by editing and added, if HedgeTerminal was programmed to work with them. In the future, a user can create their own columns and calculate their own parameters. Such columns can be connected via the interface of the external indicator iCustom and the manifest of interaction with extension modules, written in xml.

Currently there is no such a functionality and only the columns supported by HedgeTerminal are available. The only column supported by the panel but not displayed in the settings by default is the column that contains the Expert's magic number.

Position can be open not only manually but also using a robot. In this case, the identifier of the robot, which opened a position can be displayed for every position. The commented out column tag including the Expert Advisor's number is already present in the settings file. Let us uncomment it:

<Column ID="Magic" Name="Magic" Width="100"/>

Save the changes and relaunch the panel:

Fig. 35. Adding the Magic column to the HedgeTerminal table

As we can see on the picture above, a column called "Magic" appeared. This is the identifier of the Expert Advisor that opened a position. The position was opened manually and therefore the identifier is equal to zero. A position opened by a robot as a rule contains an identifier different from zero. In that case a correspondent magic number of the Expert will be displayed in the column.

It is more convenient though to see the names of the Expert Advisors instead of their numbers. HedgeTerminal has this option. It takes the aliases (names) of the EAs taken from the ExpertAliases.xml file and displays them instead of the correspondent magic numbers.

For instance, if you have an Expert called "ExPro 1.1" and trading under the magic number 123847, it is enough to place the following tag in the ExpertsAliases.xml file in the <Expert-Aliases> section:

<Expert Magic="123847" Name="ExPro 1.1"></Expert>

From now on, when your robot opens a new position, it will have its name:

Fig. 36. Displaying the name of the Expert in the column Magic

The number of robots and their names is not limited. The only condition here is for their numbers to differ.

Other settings of HedgeTerminal. We have described all the settings of the visual panel the currently available. The next section <Other-Settings> contains the settings defining internal work of the terminal. Please note, that the program call library HedgeTerminalAPI uses these settings as default values. The Expert Advisor, however, can change the current values of these settings using the special Set... functions. To get the values of those settings, the Expert only needs to call special Get... functions. We are going to describe tags with settings in more detail.

<Deviation Value="30"/>

Contains the value of extreme deviation from the required price in units of minimal price change. So, for the pair EURUSD quoted to the fifth decimal place, it will be 0,0003 point. For the RTS index future this value will be 300 points as the minimum step of the price changing is 10 points. If the price deviation is greater, then the order to close or change the price will not be executed. This is in place for protection from unfavorable slippage.

<Timeout Seconds="180"/>

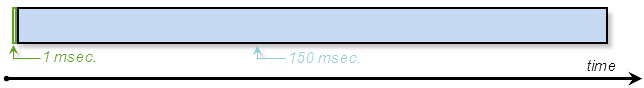

This tag contains the value of the maximum permissible response from the server. HedgeTerminal works in the asynchronous mode. That means that HedgeTerminal sends a trading signal to the server without waiting to receive a response from the latter. Instead, HedgeTerminal controls the sequence of events pointing at the fact that the order was placed successfully. The event may not take place at all. This is the reason why it is so important to set the wait timeout period, during which HedgeTerminal will be waiting for the server response. If there is no response during that time, the task will be cancelled, HedgeTerminal will unblock the position and carry on its work.

The wait timeout period can be shortened or extended. By default this is 180 seconds.

It is important to understand that in real trading, this limitation is never reached. Responses to trading signals come back quickly, the majority of them are executed within 150 – 200 milliseconds.

More details about the work of HedgeTerminal and about the peculiarities of work in the asynchronous mode can be found in the third section of this article: "Under the Bonnet of HedgeTerminal".

<RefreshRates Milliseconds="200"/>

This tag sets up the frequency of the panel updates. It contains the time in milliseconds between two consequent panel updates. The less this value is, the higher the panel update frequency is and the more CP resources are used. If your processor is not very powerful and it cannot cope with the update frequency of 200 milliseconds (default value), you can increase it up to 500 or even to 1000 milliseconds by editing the tag.

In this case the CP load will drop significantly. Values less than 100 milliseconds are not recommended. Increasing the update frequency, the CP load will increase nonlinearly. It is important to understand that the update frequency defines discreteness of the terminal. Some of its actions are defined by this timer and happen with a certain speed.

2.11. Planned Yet Unimplemented Features

HedgeTerminal has a flexible and nontrivial architecture due to which new nontrivial capabilities of this program become feasible. Today these capabilities have not been implemented, though they may appear in the future if there is demand. Below are the main ones:

Using color schemes and skins. HedgeTerminal uses its own graphics engine. This is based on the graphic primitives like a rectangular label or a usual text. Graphics based on pictures is not used at all. This gives an opportunity to change the color, size and font of all the elements displayed in HedgeTerminal. This way it is easy to create a description of fonts and the color scheme in the form of skin and load it at the launch of HedgeTerminal, changing its appearance.

Connecting custom Trailing Stop modules. Every Expert, and HedgeTerminal is essentially an Expert, can initiate a calculation of an arbitrary indicator through a specific program interface (function iCustom()). It allows to call the indicator calculation, which depends on the set of arbitrary parameters. Trailing Stop is an algorithm that places a new or keeps the old price level depending on the current price. This algorithm and its price levels can be implemented as an indicator. If the passed parameters are agreed on, HedgeTerminal can call such an indicator and calculate the required price level. HedgeTerminal can take care of the mechanics of transferring the Trailing Stop. This way, any HedgeTerminal user can write their own (even the most unusual one) module of managing Trailing Stop.

Adding new columns for the table of positions. That includes the custom columns. The HedgeTerminal tables are designed the way that they allow adding new columns. Support of new columns can be programmed inside HedgeTerminal and implemented in a familiar way through the iCustom() interface. Every cell in the line of a position represents a parameter (for example, opening price or Take Profit level). This parameter can be calculated by an indicator and that means that an unlimited number of indicators can be written so each of them calculates some parameter for a position. If passing parameters is coordinated for such indicators, it will become possible to add an unlimited number of custom columns to a table in HedgeTerminal.

Connecting extension modules. Other calculation algorithms can be calculated through the mechanism of the custom indicator call. For example, the report system includes a lot of calculation parameters such as expected payoff and Sharpe ratio. Many of those parameters can be received by moving their calculation block to the custom indicator.

Copying deals, receiving and transmission of deals from other accounts. HedgeTerminal is essentially a position manager. This can easily be a base for a deal copier as the main functionality have already been implemented. Such a copier will have nontrivial capabilities to copy bi-directional MetaTrader 4 positions to the MetaTrader 5 terminal. The copier will display those positions as bi-directional like in MetaTrader 4 with a possibility to manage every position individually.

Reports and statistics. The Equity chart and the “Summary" tab. The counting of bi-directional positions allows analyzing the contribution to the result of every strategy or trader. Alongside with statistics, a portfolio analysis can be carried out. This report can notably differ from the report in MetaTrader 5 and add to it. In the Summary tab report, in addition to the generally accepted parameters like expected payoff, maximum drawdown, profit factor, etc, other parameters will be included too. The names and the values of the latter can be obtained from the custom extension modules. Instead of the familiar balance chart on a picture, the Equity chart in the form of a custom candlestick exchange chart can be used.

Sorting columns. Usually, when pressing on the table header, the rows get sorted in the ascending or descending order (second pressing). Current version of HedgeTerminal does not support this option as sorting is connected with the deal filter and the custom set of columns, which are not available at the moment. Later versions will feature this option.

Sending a trade report via email, ftp. Push notifications. HedgeTerminal can use the system functions to send emails, ftp files and even push notifications. For instance it can form an html report once a day and send it to the list of users. Since HedgeTerminal is a manager of Expert Advisors and it knows all trading actions of other EAs, it can notify users about trading actions of other Expert Advisors. For instance, if one of the EAs opens a new position, HedgeTerminal can send a push notification informing users that a certain Expert entered a new position. HedgeTerminal will also specify the direction of the entry, its date, time and volume. The EA itself won't need to be configured, it will be enough to add its name into the alias file.

Filtering positions with the regular expressions console. This is the most powerful of the planned developments. It will bring up the work of HedgeTerminal to a completely new level. Regular expressions can be used for filtering historical and active positions so only those meeting the requirements of this filter are displayed. Regular expressions can be combined and entered in a dedicated console above the table of active and historical positions. This is how this console may look like in the future versions of HedgeTerminal:

Fig. 37. Request console in the future version of HedgeTerminal

Regular expressions can form very flexible conditions for filtering positions followed by statistic calculation on them. For example, to display historical positions only by the AUDCAD symbol, it is enough to enter the "AUDCAD" symbol in the cell "Symbol". Conditions can be combined. For example, positions by AUDCAD executed by a particular robot can be displayed for the period from 01.09.2014 till 01.10.2014. All you need to do for that is to enter conditions to the correspondent cells. After the filter displays the results, the report from the "Summary" tab will change in accordance with the new filter conditions.

Regular expressions will consist of a small number of simple operators. However, used together, they will allow to create very flexible filters.

The presence of the below operators is necessary and sufficient in console:

Operator = - Strict equality. If the word AUDСAD gets entered in the "Symbol" field, then all the symbols containing this substring, for example AUDCAD_m1 or AUDCAD_1, will be found. That means that an implicit insertion operator will be used. Strict equality "=" requires a complete match of the expression and therefore all symbols except AUDCAD will be excluded. AUDCAD_m1 or EURUSD will be excluded.

Operator > - Displays only the values greater than the specified one.

Operator < - Displays only the values less than the specified one.

Operator ! – Logical negation. Reflects only the values that are not equal to the specified one.

Operator | - Logical "OR". Allows specifying two or more conditions in one row at the same time. At the same time, to meet the criterion, it is enough to fulfill at least one stipulation. For instance, the expression "> 10106825|=10106833" entered in the cell "Entry Order" of the expression console will show all positions with the incoming order identifier greater than 10106825 or equal to 10106833.

Operator & - Logical "AND". Allows to specify two or more conditions in one row at the same time and each of them has to be fulfilled. The expression ">10106825&<10105939" entered in the cell "Entry Order" shows all positions with the incoming identifier greater than 10106825 or less than 10105939. Positions with identifiers between these two numbers, for example 10106320, will be filtered.

Correcting and managing positions using special commands. Additional symbols can be entered into the cells reflecting the volume or StopLoss and TakeProfit levels. This makes a more complex position management possible. For instance, to close a half of the current position volume, enter the value "50%" correspondent to the active position in the "Volume" field.

Instead of placing StopLoss and TakeProfit levels, a value, for example "1%", can be entered into those cells. HedgeTerminal will automatically calculate the StopLoss and TakeProfit level so they will be placed at a distance of 1% from the entry price. Numbers with the postfix "p" can be entered in these cells. For instance, "200p" will mean the order: "place the StopLoss and TakeProfit levels 200 points away from the position entry price". In the future, if a minus is put before the volume in the column "Volume", the volume will close by the value specified after that sign. For instance, if you have a position with the volume 1.0 and we want to close a part of the volume (for example 0.3), then it is enough to enter "-0.3" in the volume cell.

Chapter 3. Under the Bonnet of HedgeTerminal. Specification and Principle of Operations

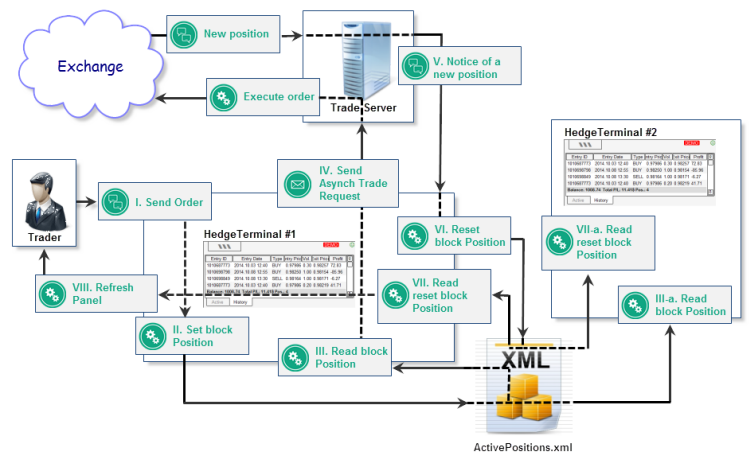

3.1. Global and Local Contours. Context, Transfer and Storage of Information

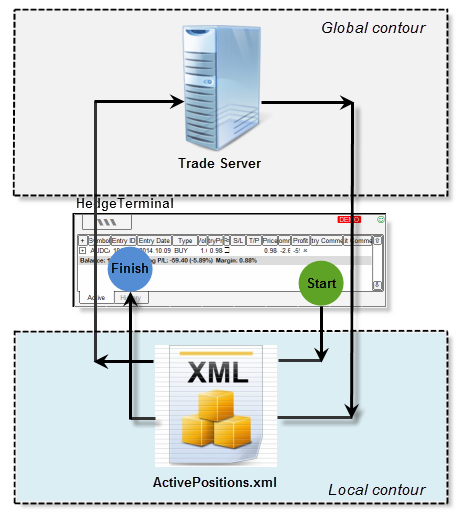

The appearance of HedgeTerminal and trading process resemble the familiar MetaTrader 4. This is possible due to the virtualization and the transformation of data display, when trading information available through MetaTrader 5 gets displayed by the panel in a more convenient way. This chapter describes the mechanisms that allow to create such virtualization and the mechanisms of group data processing.

As you know, HedgeTerminal is represented in several different products. The main of them are the visual panel and the library with program interface. The latter allows implementing management of bi-directional positions in any external Expert Advisor and it also integrates it into the HedgeTerminal visual panel. For example, an active position of an EA can be closed straight from the panel. The Expert Advisor will get the information and process it accordingly.

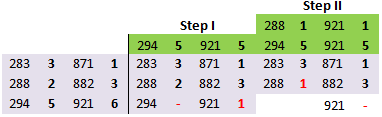

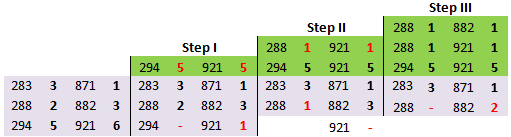

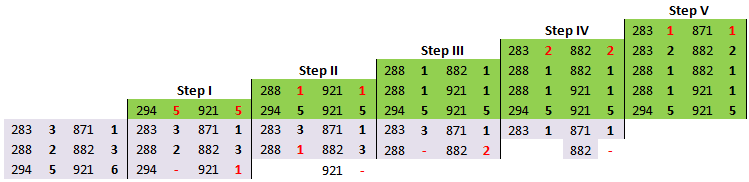

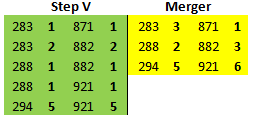

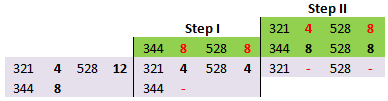

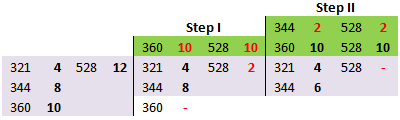

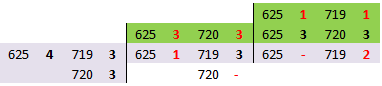

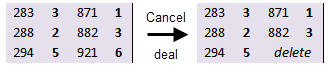

Apparently, such a structure requires a group interaction between the Expert Advisors. The panel, which is essentially an Expert Advisor, must know about all trading actions that take place. Conversely, every Expert Advisor using the HedgeTerminal library must know about trading actions executed manually (by third party programs or using the HedgeTerminal panel).