Mohammed Abdulwadud Soubra / Profil

- Information

|

8+ Jahre

Erfahrung

|

7

Produkte

|

1086

Demoversionen

|

|

134

Jobs

|

1

Signale

|

1

Abonnenten

|

Ich bin seit 2005 im Forex-Markt.

Schauen Sie sich dieses Produkt an:

https://www.mql5.com/en/users/soubra2003/seller

Verheißungsvolle Handelssignale für US30 und amerikanische Aktien:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Für sofortige Unterstützung treten Sie bitte dieser WhatsApp-Gruppe bei:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Schauen Sie sich dieses Produkt an:

https://www.mql5.com/en/users/soubra2003/seller

Verheißungsvolle Handelssignale für US30 und amerikanische Aktien:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Für sofortige Unterstützung treten Sie bitte dieser WhatsApp-Gruppe bei:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Freunde

8602

Anfragen

Ausgehend

Mohammed Abdulwadud Soubra

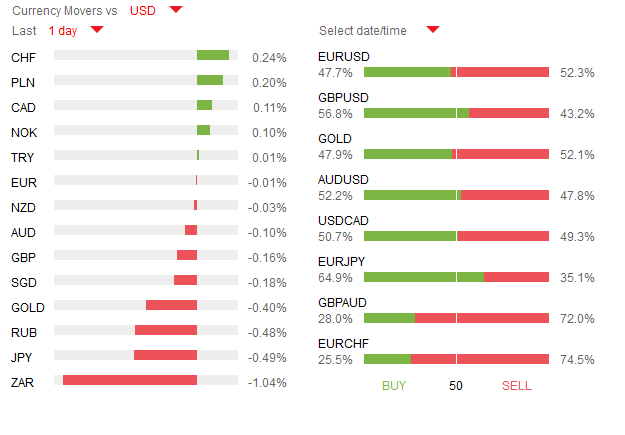

EUR/USD Intraday: under pressure.

Pivot: 1.1420

Most Likely Scenario: short positions below 1.1420 with targets @ 1.1365 & 1.1340 in extension.

Alternative scenario: above 1.1420 look for further upside with 1.1445 & 1.1480 as targets.

Comment: the RSI lacks upward momentum.

Pivot: 1.1420

Most Likely Scenario: short positions below 1.1420 with targets @ 1.1365 & 1.1340 in extension.

Alternative scenario: above 1.1420 look for further upside with 1.1445 & 1.1480 as targets.

Comment: the RSI lacks upward momentum.

Mohammed Abdulwadud Soubra

https://www.mql5.com/en/market/product/15575

https://www.mql5.com/en/market/product/16143

the above are my products

if you got one I will give you the 2nd for free

https://www.mql5.com/en/market/product/16143

the above are my products

if you got one I will give you the 2nd for free

Mohammed Abdulwadud Soubra

Surprisingly, we saw a significant increase in volatility today despite the lack of economic figures across the globe.

From Germany, both the factory orders MoM and YoY jumped to 1.9% and 1.7% in March up from -0.8% and 0.7% respectively, while in the U.K, Halifax house prices index retreated by -0.8% in April while it was anticipated at -0.3%.

Regarding the U.S numbers, the labor market conditions index worsened for third month to confirm that the gain in March payrolls was temporary.

Now, let’s have a look at the technical picture.

DXY (Dollar index)

The U.S Dollar continue to register further gains as bulls succeeded to preserve the lower side of the weekly range located around 92.00/92.50 support zone.

The dollar index overtook 94.00 handle, which keeps the outlook positive in the short-term. However, we expect strong sellers to appear this week around 94.50/80 zone.

Support: 91.90-91.

From Germany, both the factory orders MoM and YoY jumped to 1.9% and 1.7% in March up from -0.8% and 0.7% respectively, while in the U.K, Halifax house prices index retreated by -0.8% in April while it was anticipated at -0.3%.

Regarding the U.S numbers, the labor market conditions index worsened for third month to confirm that the gain in March payrolls was temporary.

Now, let’s have a look at the technical picture.

DXY (Dollar index)

The U.S Dollar continue to register further gains as bulls succeeded to preserve the lower side of the weekly range located around 92.00/92.50 support zone.

The dollar index overtook 94.00 handle, which keeps the outlook positive in the short-term. However, we expect strong sellers to appear this week around 94.50/80 zone.

Support: 91.90-91.

Mohammed Abdulwadud Soubra

Hopes for a June rate hike by the Federal Reserve were totally diminished after the disappointing NFP report on Friday showed the U.S. economy added only 160,000 jobs in the month of April. This marked the fewest number of jobs added in seven months and well below the one-year median of 232,000. The labor force participation rate which dropped by 0.2%, after increasing moderately for the past six months provided another worrying sign as Fed officials take this number seriously when planning for the next move. On the bright side, average hourly earnings increased by 0.3% in April, taking the year-on-year change to 2.5%. Wage growth and comments from permanent Fed voter William Dudley who reiterated on Friday that it’s reasonable to expect the U.S. central bank would raise rates twice this year, supported the dollar from collapsing. From the other side traders seemed prepared for a weak release as CFTC report indicated U.S. dollar short positions climbed for a third consecutive

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Monday, May 09, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: under pressure. Pivot: 1.1445 Most Likely Scenario: short positions below 1...

Mohammed Abdulwadud Soubra

Beitrag Pivot Points Hourly veröffentlicht

Pivot Points Hourly Last Updated: May 9, 5:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.13527 1.13743 1.13879 1.13959 1.14095 1.14175 1.14391 USD/JPY 106.719 107.03 107.149 107.341 107.46 107.652 107.963 GBP/USD 1.43996 1.44104 1.44174 1.44212 1.44282 1.4432 1.44428 USD/CHF 0.96919 0.97065 0...

Mohammed Abdulwadud Soubra

Beitrag Pivot Points Hourly veröffentlicht

Pivot Points Hourly Last Updated: May 9, 4:04 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.1361 1.13725 1.13774 1.1384 1.13889 1.13955 1.1407 USD/JPY 106.788 107.122 107.291 107.456 107.625 107.79 108.124 GBP/USD 1.43748 1.43949 1.4405 1.4415 1.44251 1.44351 1.44552 USD/CHF 0.97064 0.97179 0...

Mohammed Abdulwadud Soubra

Pivot Points Daily Last Updated: May 9, 3:30 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.12379 1.13289 1.13633 1.14199 1.14543 1.15109 1.16019 USD/JPY 105.001 105.988 106.539 106.975 107.526 107.962 108.949 GBP/USD 1.42034 1.43314 1.4377 1.44594 1.4505 1.45874 1.47154 USD/CHF 0.95331 0.96156 0...

Mohammed Abdulwadud Soubra

Pivot Points Weekly Last Updated: May 9, 3:30 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.10049 1.12354 1.13166 1.14659 1.15471 1.16964 1.19269 USD/JPY 102.804 104.755 105.923 106.706 107.874 108.657 110.608 GBP/USD 1.38254 1.41802 1.43014 1.4535 1.46562 1.48898 1.52446 USD/CHF 0.90608 0...

Mohammed Abdulwadud Soubra

Weekly Trading Forecast: Dollar Struggles with Recovery, Euro Faces Greece, Pound Awaits BoE A notable slip in risk trend and rebound from the Dollar this past week has spurred speculation of reversals...

Mohammed Abdulwadud Soubra

A notable slip in risk trend and rebound from the Dollar this past week has spurred speculation of reversals. However, is there enough fundamental leverage to change the market's tack and develop serious moves?

US Dollar Forecast – Dollar’s Next Move Falls to Speculators Rather Than Data

The Dollar started off this past week at an 11-month low and ended it with the best run since the early November climb that drove the Dow Jones FXCM Dollar Index (ticker = USDollar) to 12-year highs.

Euro Lacking Direction as Data Momentum Improves, Brexit Concerns Ebb

Q1’16 growth figures due at the end of the week should garner some attention, but the Euro remains without a sincerely meaningful domestic driver in the short-term.

Japanese Yen Forecast - Japanese Yen Could Trade Higher If and When this Occurs

The Japanese Yen gave back some of its recent gains versus the US Dollar in a choppy week for financial markets.

British Pound Forecast -Super Thursday: Brexit Possibility to Complicate Inflation Projections

It was just seven months ago that we were going into the Bank of England’s Super Thursday announcements with the potential of hearing about a rate hike in the not-too-distant future.

Chinese Yuan (CNH) Forecast - Yuan Volatility to Continue on PBOC Activity, CPI and Equity Volatility

The offshore Yuan (CNH) rate closed at a five-week low against theUS Dollaron Friday following the biggest downward move in Yuan fixing by the PBOC since the Yuan’s de-pegging.

New Zealand Dollar Forecast - New Zealand Dollar Looks To Wheeler Speech At Financial Stability Report on Tuesday

The US Dollar surprised a lot of G10 currencies this week, but few more than the New Zealand Dollar and other commodity currencies.

Australian Dollar Forecast - Aussie Dollar Still Vulnerable After Largest Drop in Three Weeks

The Australian Dollar is vulnerable to deeper losses as risk aversion continues to batter the financial markets, putting pressure on the sentiment-sensitive currency.

Gold Forecast - Gold Dips as USD Rips- NFP Extinguishes June Rate Hike Hopes

Gold pricesare softer this week with the precious metal off 0.21% to trade at 1290 ahead of the New York close on Friday.

US Dollar Forecast – Dollar’s Next Move Falls to Speculators Rather Than Data

The Dollar started off this past week at an 11-month low and ended it with the best run since the early November climb that drove the Dow Jones FXCM Dollar Index (ticker = USDollar) to 12-year highs.

Euro Lacking Direction as Data Momentum Improves, Brexit Concerns Ebb

Q1’16 growth figures due at the end of the week should garner some attention, but the Euro remains without a sincerely meaningful domestic driver in the short-term.

Japanese Yen Forecast - Japanese Yen Could Trade Higher If and When this Occurs

The Japanese Yen gave back some of its recent gains versus the US Dollar in a choppy week for financial markets.

British Pound Forecast -Super Thursday: Brexit Possibility to Complicate Inflation Projections

It was just seven months ago that we were going into the Bank of England’s Super Thursday announcements with the potential of hearing about a rate hike in the not-too-distant future.

Chinese Yuan (CNH) Forecast - Yuan Volatility to Continue on PBOC Activity, CPI and Equity Volatility

The offshore Yuan (CNH) rate closed at a five-week low against theUS Dollaron Friday following the biggest downward move in Yuan fixing by the PBOC since the Yuan’s de-pegging.

New Zealand Dollar Forecast - New Zealand Dollar Looks To Wheeler Speech At Financial Stability Report on Tuesday

The US Dollar surprised a lot of G10 currencies this week, but few more than the New Zealand Dollar and other commodity currencies.

Australian Dollar Forecast - Aussie Dollar Still Vulnerable After Largest Drop in Three Weeks

The Australian Dollar is vulnerable to deeper losses as risk aversion continues to batter the financial markets, putting pressure on the sentiment-sensitive currency.

Gold Forecast - Gold Dips as USD Rips- NFP Extinguishes June Rate Hike Hopes

Gold pricesare softer this week with the precious metal off 0.21% to trade at 1290 ahead of the New York close on Friday.

Mohammed Abdulwadud Soubra

Crude Oil (WTI) (M6) Intraday: key resistance at 44.90.

Pivot: 44.90

Most Likely Scenario: short positions below 44.90 with targets @ 44.00 & 43.30 in extension.

Alternative scenario: above 44.90 look for further upside with 45.35 & 46.00 as targets.

Comment: as long as 44.90 is resistance, expect a return to 44.00.

Pivot: 44.90

Most Likely Scenario: short positions below 44.90 with targets @ 44.00 & 43.30 in extension.

Alternative scenario: above 44.90 look for further upside with 45.35 & 46.00 as targets.

Comment: as long as 44.90 is resistance, expect a return to 44.00.

Mohammed Abdulwadud Soubra

Gold spot Intraday: under pressure.

Pivot: 1289.70

Most Likely Scenario: short positions below 1289.70 with targets @ 1271.50 & 1264.00 in extension.

Alternative scenario: above 1289.70 look for further upside with 1301.50 & 1314.00 as targets.

Comment: the RSI lacks upward momentum.

Pivot: 1289.70

Most Likely Scenario: short positions below 1289.70 with targets @ 1271.50 & 1264.00 in extension.

Alternative scenario: above 1289.70 look for further upside with 1301.50 & 1314.00 as targets.

Comment: the RSI lacks upward momentum.

Mohammed Abdulwadud Soubra

AUD/USD Intraday: under pressure.

Pivot: 0.7520

Most Likely Scenario: short positions below 0.7520 with targets @ 0.7440 & 0.7410 in extension.

Alternative scenario: above 0.7520 look for further upside with 0.7550 & 0.7590 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Pivot: 0.7520

Most Likely Scenario: short positions below 0.7520 with targets @ 0.7440 & 0.7410 in extension.

Alternative scenario: above 0.7520 look for further upside with 0.7550 & 0.7590 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Mohammed Abdulwadud Soubra

USD/JPY Intraday: the upside prevails.

Pivot: 106.10

Most Likely Scenario: long positions above 106.10 with targets @ 107.45 & 107.85 in extension.

Alternative scenario: below 106.10 look for further downside with 105.50 & 105.00 as targets.

Comment: the RSI is mixed to bullish.

Pivot: 106.10

Most Likely Scenario: long positions above 106.10 with targets @ 107.45 & 107.85 in extension.

Alternative scenario: below 106.10 look for further downside with 105.50 & 105.00 as targets.

Comment: the RSI is mixed to bullish.

Mohammed Abdulwadud Soubra

GBP/USD Intraday: under pressure.

Pivot: 1.4575

Most Likely Scenario: short positions below 1.4575 with targets @ 1.4465 & 1.4400 in extension.

Alternative scenario: above 1.4575 look for further upside with 1.4620 & 1.4660 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Pivot: 1.4575

Most Likely Scenario: short positions below 1.4575 with targets @ 1.4465 & 1.4400 in extension.

Alternative scenario: above 1.4575 look for further upside with 1.4620 & 1.4660 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Mohammed Abdulwadud Soubra

EUR/USD Intraday: under pressure.

Pivot: 1.1540

Most Likely Scenario: short positions below 1.1540 with targets @ 1.1450 & 1.1415 in extension.

Alternative scenario: above 1.1540 look for further upside with 1.1600 & 1.1660 as targets.

Comment: the RSI is mixed to bearish.

Pivot: 1.1540

Most Likely Scenario: short positions below 1.1540 with targets @ 1.1450 & 1.1415 in extension.

Alternative scenario: above 1.1540 look for further upside with 1.1600 & 1.1660 as targets.

Comment: the RSI is mixed to bearish.

: