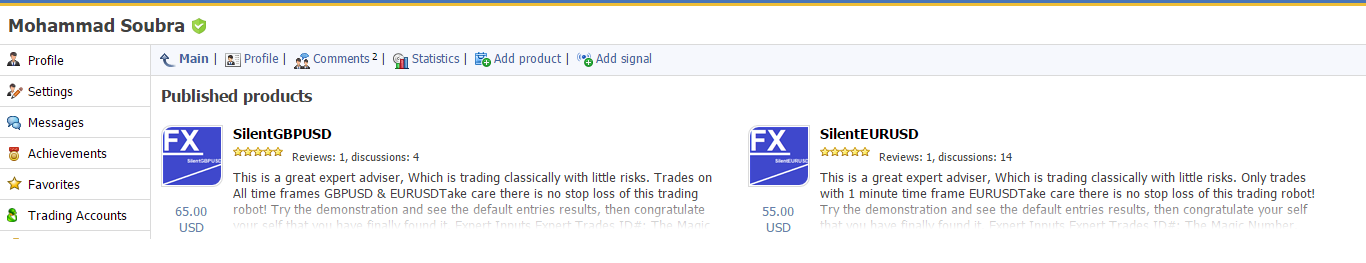

Mohammed Abdulwadud Soubra / Profil

- Information

|

8+ Jahre

Erfahrung

|

7

Produkte

|

1086

Demoversionen

|

|

134

Jobs

|

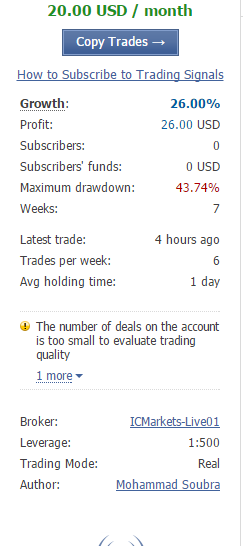

1

Signale

|

1

Abonnenten

|

Ich bin seit 2005 im Forex-Markt.

Schauen Sie sich dieses Produkt an:

https://www.mql5.com/en/users/soubra2003/seller

Verheißungsvolle Handelssignale für US30 und amerikanische Aktien:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Für sofortige Unterstützung treten Sie bitte dieser WhatsApp-Gruppe bei:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Schauen Sie sich dieses Produkt an:

https://www.mql5.com/en/users/soubra2003/seller

Verheißungsvolle Handelssignale für US30 und amerikanische Aktien:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Für sofortige Unterstützung treten Sie bitte dieser WhatsApp-Gruppe bei:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Freunde

8602

Anfragen

Ausgehend

Mohammed Abdulwadud Soubra

Good Bye

Evgeniy Tereshchenko

2016.05.20

Bye

Mohammed Abdulwadud Soubra

2016.05.21

C U next week ;-)

Mohammed Abdulwadud Soubra

Explosive levels of volatility rattled the financial markets during trading on Wednesday following the shockingly hawkish FOMC meeting minutes which renewed expectations over the Federal Reserve raising US rates in Q2. It was even more surprising when the minutes displayed that most participants in the committee deemed that if domestic data from the States was consistent with a revival in economic growth, then the prerequisites of a June/July hike could be fulfilled. Although data in the States has picked up, with the resurgence in retails sales and rise in inflation providing additional ammunition for the Dollar bulls to attack, concerns over April’s dismal NFP report continue to linger on. While the Fed could be commended on their ability to boost speculations of another US rate hike in Q2, the bitter fundamentals and ongoing fears over the unstable economic landscape should sabotage any efforts taken by the central bank to act.

The Dollar Index surged with ferocity

The Dollar Index surged with ferocity

Mohammed Abdulwadud Soubra

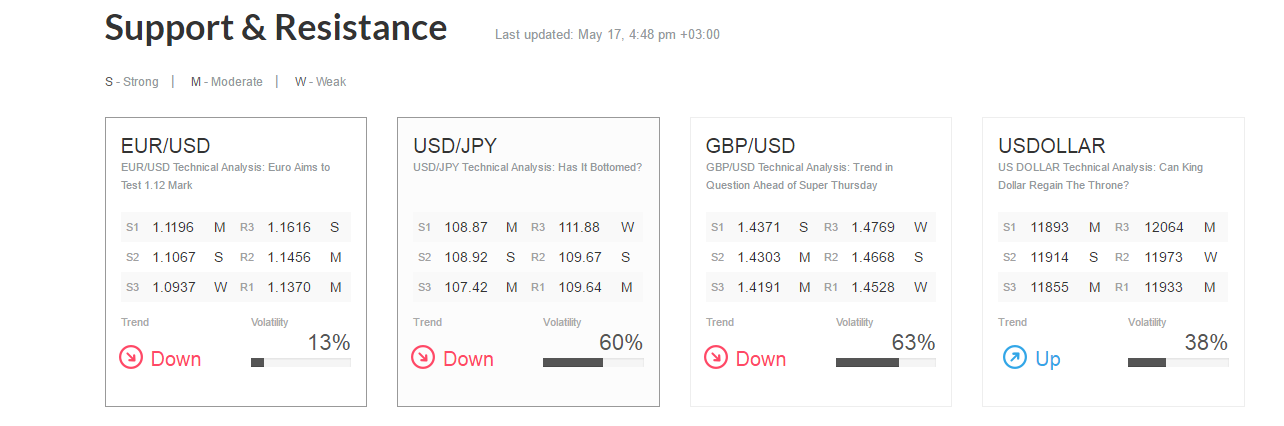

EUR/USD Intraday: the downside prevails.

Pivot: 1.1255

Most Likely Scenario: short positions below 1.1255 with targets @ 1.1175 & 1.1140 in extension.

Alternative scenario: above 1.1255 look for further upside with 1.1290 & 1.1325 as targets.

Comment: as long as the resistance at 1.1255 is not surpassed, the risk of the break below 1.1175 remains high.

Pivot: 1.1255

Most Likely Scenario: short positions below 1.1255 with targets @ 1.1175 & 1.1140 in extension.

Alternative scenario: above 1.1255 look for further upside with 1.1290 & 1.1325 as targets.

Comment: as long as the resistance at 1.1255 is not surpassed, the risk of the break below 1.1175 remains high.

Mohammed Abdulwadud Soubra

Pivot Points Daily Last Updated: May 20, 2:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.11026 1.11528 1.1177 1.1203 1.12272 1.12532 1.13034 USD/JPY 108.628 109.315 109.629 110.002 110.316 110.689 111.376 GBP/USD 1.44063 1.45084 1.45582 1.46105 1.46603 1.47126 1.48147 USD/CHF 0.97759 0...

Mohammed Abdulwadud Soubra

Pivot Points Hourly Last Updated: May 20, 2:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.11857 1.11928 1.1197 1.11999 1.12041 1.1207 1.12141 USD/JPY 109.758 109.845 109.884 109.932 109.971 110.019 110.106 GBP/USD 1.45876 1.45951 1.45995 1.46026 1.4607 1.46101 1.46176 USD/CHF 0.98976 0...

Mohammed Abdulwadud Soubra

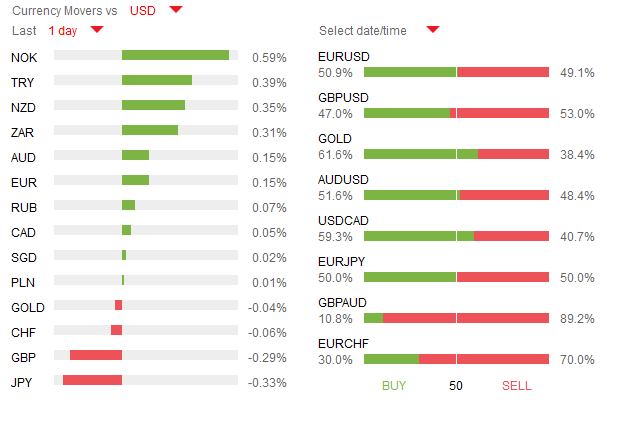

Latest News

The USD surged yesterday following the release of the FOMC meeting in which it explicitly stated that most FED members were leaning towards a June rate hike if economic data improves from Q1. EURUSD, AUDUSD & NZDUSD all dropped 0.8%, 1.2% and 0.8% respectively on the day while USDJPY rose 0.9%. The options markets is now pricing in a 34% probability for the FED to hike in June, from yesterday’s 15% and 4% from a week ago. The Pound meanwhile rose 1% vs. the USD, as recent “Brexit” polls have mostly been coming in favor of the stay camp. It is important to note that FED members did mention the possibility of the UK leaving the EU as one of the near-term risks and a reason to hold off on from raising interest rates.

Today we will get retail sales from the UK, expected to have risen from last month’s figure of -1.3% to 0.6%. The ECB will publish its monetary policy meeting minutes just before noon while the US is scheduled to publish unemployment claims and the Philly FED manufacturing index which is forecasted to improve to 3.2. More importantly perhaps will be the two FED speeches scheduled for later this evening, beginning with Stanley Fischer and followed by William Dudely. Expect strength in USD in case both of these FED members repeat the language published in the FOMC minutes.

The USD surged yesterday following the release of the FOMC meeting in which it explicitly stated that most FED members were leaning towards a June rate hike if economic data improves from Q1. EURUSD, AUDUSD & NZDUSD all dropped 0.8%, 1.2% and 0.8% respectively on the day while USDJPY rose 0.9%. The options markets is now pricing in a 34% probability for the FED to hike in June, from yesterday’s 15% and 4% from a week ago. The Pound meanwhile rose 1% vs. the USD, as recent “Brexit” polls have mostly been coming in favor of the stay camp. It is important to note that FED members did mention the possibility of the UK leaving the EU as one of the near-term risks and a reason to hold off on from raising interest rates.

Today we will get retail sales from the UK, expected to have risen from last month’s figure of -1.3% to 0.6%. The ECB will publish its monetary policy meeting minutes just before noon while the US is scheduled to publish unemployment claims and the Philly FED manufacturing index which is forecasted to improve to 3.2. More importantly perhaps will be the two FED speeches scheduled for later this evening, beginning with Stanley Fischer and followed by William Dudely. Expect strength in USD in case both of these FED members repeat the language published in the FOMC minutes.

Mohammed Abdulwadud Soubra

The dollar finds itself firmer during the Asia session, with gains most pronounced against the Aussie and Kiwi, those currencies still with positive interest rates and generally higher beta vs. the US dollar. This came about partly on the back of comments from regional Fed Presidents Lockhart and Williams, both of whom were pushing the prospect of two “possibly three” rate moves this year. But don’t forget that they have been consistently wrong over the past year in their predictions for the Fed Funds rate. The prospect of a June move remains weak in my opinion and although the dollar is firmer, it’s difficult to see such gains sustained unless the data starts to consistently push a change in the anticipated rate path. The firmer than expected data has only played a minority role in the recent recovery of the dollar from the lows. The Fed meeting minutes this evening will naturally be in focus later today.

Overnight, we’ve seen firmer than expected GDP data in Japan, but this was tempered by downward revisions to the previous quarter. So in summary, these numbers are not anything to get excited about and the price action on the yen reflected that, standing only modestly weaker after the initial volatility. After yesterday’s weaker CPI data was largely brushed aside in the UK, the focus today is with the labour market numbers today. The skew of expectations in sterling interest rate markets is towards a loosening of interest rates, but this only being a risk priced for later in the year (around 25% chance). As such, it’s hard to see sterling reacting strongly to the numbers given the limited chance of a change in policy this year. The pound continues to hold up well, despite the impending EU referendum next month.

Overnight, we’ve seen firmer than expected GDP data in Japan, but this was tempered by downward revisions to the previous quarter. So in summary, these numbers are not anything to get excited about and the price action on the yen reflected that, standing only modestly weaker after the initial volatility. After yesterday’s weaker CPI data was largely brushed aside in the UK, the focus today is with the labour market numbers today. The skew of expectations in sterling interest rate markets is towards a loosening of interest rates, but this only being a risk priced for later in the year (around 25% chance). As such, it’s hard to see sterling reacting strongly to the numbers given the limited chance of a change in policy this year. The pound continues to hold up well, despite the impending EU referendum next month.

Mohammed Abdulwadud Soubra

Latest News

Equity markets sold off yesterday following comments by San Francisco FED President John Williams and Atlanta FED President Dennis Lockhart both stating that the FOMC committee could still raise interest rates 2-3 times this year. GBPUSD appreciated marginally yesterday despite inflation in the UK dropping to 0.3% year-on-year versus estimates of 0.5%. Meanwhile, the USD ended the day relatively changed even though most macro-economic indicators including inflation, housing starts, industrial production & capacity utilization rate coming in positive. During the overnight session, Japan released quarterly GDP figures which beat estimates at 0.4% q/q versus forecasts of 0.1%. Despite the Yen initially appreciating, USDJPY has reversed and is currently slightly positive on the day.

The UK will be in today’s spotlight during the European session as they get set to publish employment data which includes average earnings and claimant count change. The UK’s unemployment rate is expected to remain unchanged at 5.1%. Europe is expected to show that deflation has returned on year-on-year basis when they publish inflation data this morning. Lastly, later this evening the FOMC will release its FED minutes from their April meeting - it is interesting to note that the markets are only pricing in a 23% chance for the FED to raise interest rates at either of their next two meetings (June & July).

Equity markets sold off yesterday following comments by San Francisco FED President John Williams and Atlanta FED President Dennis Lockhart both stating that the FOMC committee could still raise interest rates 2-3 times this year. GBPUSD appreciated marginally yesterday despite inflation in the UK dropping to 0.3% year-on-year versus estimates of 0.5%. Meanwhile, the USD ended the day relatively changed even though most macro-economic indicators including inflation, housing starts, industrial production & capacity utilization rate coming in positive. During the overnight session, Japan released quarterly GDP figures which beat estimates at 0.4% q/q versus forecasts of 0.1%. Despite the Yen initially appreciating, USDJPY has reversed and is currently slightly positive on the day.

The UK will be in today’s spotlight during the European session as they get set to publish employment data which includes average earnings and claimant count change. The UK’s unemployment rate is expected to remain unchanged at 5.1%. Europe is expected to show that deflation has returned on year-on-year basis when they publish inflation data this morning. Lastly, later this evening the FOMC will release its FED minutes from their April meeting - it is interesting to note that the markets are only pricing in a 23% chance for the FED to raise interest rates at either of their next two meetings (June & July).

Mohammed Abdulwadud Soubra

EUR/USD Technical Analysis: Euro Aims to Test 1.1200 Talking Points: EUR/USD Technical Strategy: Short at 1.1317 Euro vulnerable to deeper losses after largest 2-day drop in a month Short position entered, aiming for descent to challenge the 1.12 figure...

Mohammed Abdulwadud Soubra

GBP/USD: UK Employment Game Plan- Constructive Above 1.44 Talking Points GBPUSD 1.44-1.4530 key range in focus ahead of UK Jobs Report Updated targets & invalidation levels Check out FXCM’s Forex Trading Contest...

Mohammed Abdulwadud Soubra

Hat eine Bewertung über den Kunden hinsichtlich des Auftrags Modify EA abgegeben

Good Luck :)

: