Muhammad Syamil Bin Abdullah / Profil

- Information

|

10+ Jahre

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

I'm self-taught trader started trading since 2007. Trading in major currency pairs, gold and some US indices.

I am using RoboForex as main broker for all my trade.

I am using RoboForex as main broker for all my trade.

Muhammad Syamil Bin Abdullah

Market Roundup

• US w/e Initial Jobless Claims, 221k, 232k forecast, 230k previous.

• US w/e Jobless Claims 4-Wk Avg, 224.50k, 234.50k previous.

• US w/e Continued Jobless Claims, 1.923M, 1.945M forecast, 1.953M previous, 1.956 revised.

• U.S. Congress to vote on long-term budget deal, averting shutdown.

• Trump administration may target immigrants who use food aid, other benefits.

• Feds Dudley signals support for March hike if U.S. economy remains strong.

• Why cool the economy down now, Feds Kashkari asks.

• Fed likely to continue raising rates – Kaplan.

• Bank of England raises prospect of higher rates as global economy booms.

• Japan warns on Brexit: we cannot continue in UK without profit.

• CA Jan House Starts, Annualized, 216.2k, 210.0k forecast, 217.0k forecast, 216.3k revised

• CA Dec New Housing Price Index, 0.0%, 0.1% forecast, -0.10% forecast, 0.1% revised

• Bank of Canada: Technology will raise growth, policy can manage risks

Looking Ahead - Economic Data (GMT)

• 06:00 Australia Dec Housing Finance, -1.1% forecast, 2.1% previous

• 06:00 Australia Dec Invest Housing Finance, 1.5% previous

• 07:00 China Jan PPI YY, 4.4% forecast, 4.9% previous

• 07:00 China Jan CPI YY, 1.5% forecast 1.8% previous

• 07:00 China Jan CPI MM, 0.7% forecast, 0.3% previous

Looking Ahead - Events, Other Releases (GMT)

• 12:00 Riksbank general council meeting - Stockholm

• 16:45 BOE’s Deputy Governor for Financial Stability Jon Cunliffe to speak at

FIA SIFMA AMG Asset Management Derivatives Forum – California

Currency Summaries

EUR/USD is likely to find support at 1.2161 levels and currently trading at 1.2248 levels. The pair has made session high at 1.2296 and hit lows at 1.2228 levels. The euro declined against US dollar on Thursday as investors reduced bearish bets on the greenback, though many in the market saw the rally fast losing momentum. Analysts suggested this latest dollar strength was just a one-off bounce in the currencys overall bear market trend, driven in part by an improving near-term U.S. fundamental picture. A selloff across global stock markets since late Friday and bets that the United States could see at least three interest rate hikes in 2018 have driven the dollar up in recent days. The greenback has gained around 1.3 percent against its basket in the past week, on track to post its largest weekly gain since late October after rising in four of the last five sessions. On the data front, the number of Americans filing for unemployment benefits unexpectedly fell last week, dropping to its lowest level in nearly 45 years as the labor market tightened further, bolstering expectations of faster wage growth this year. Initial claims for state unemployment benefits decreased 9,000 to a seasonally adjusted 221,000 for the week ended Feb. 3, the Labor Department said. Claims fell to 216,000 in mid-January, which was the lowest level since January 1973.The euro was down 0.1 percent at $1.2249, after earlier falling to a two-week low. The single currency has declined 2.6 percent since hitting a three-year high of around $1.2536 just 10 days ago.

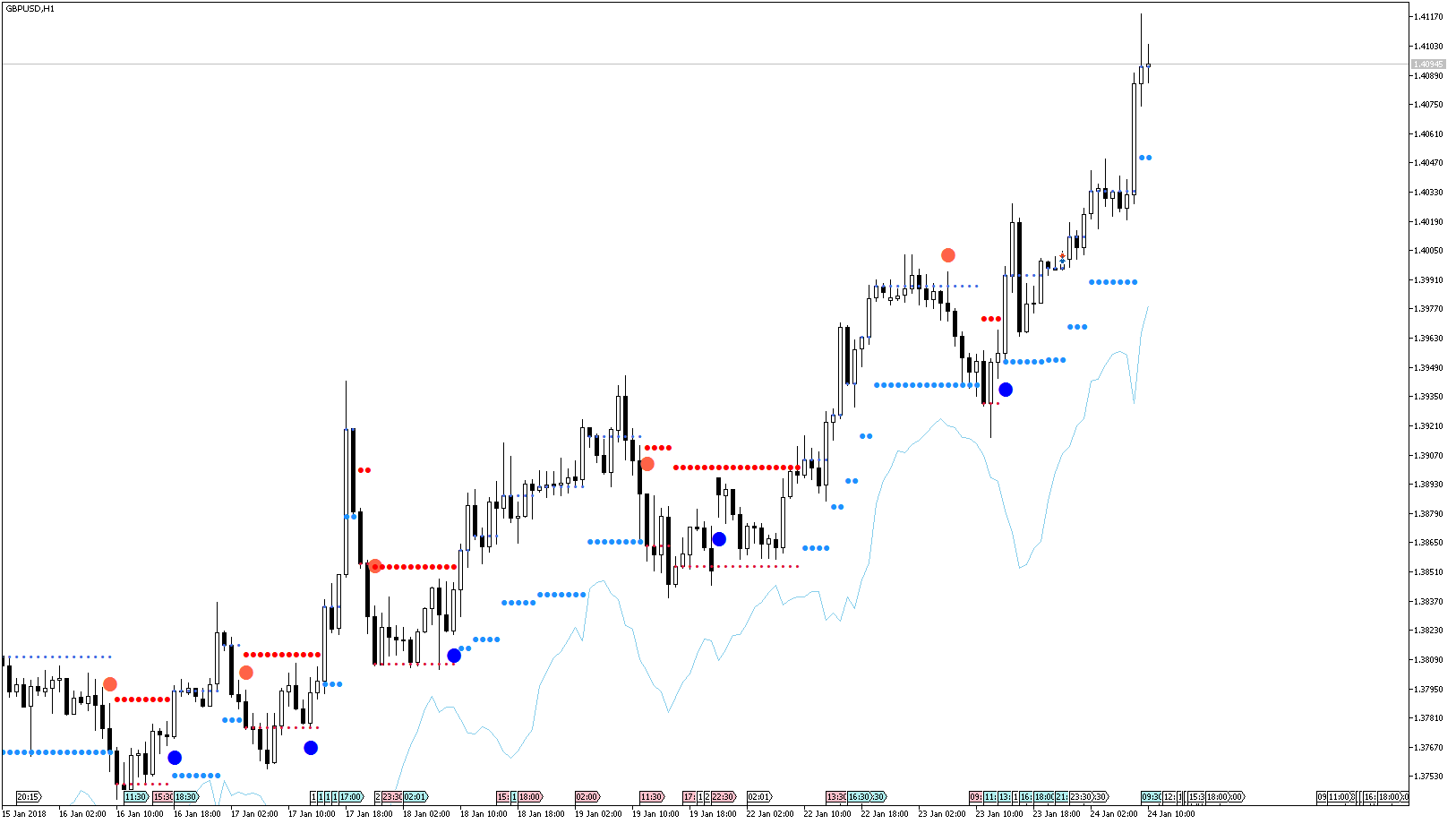

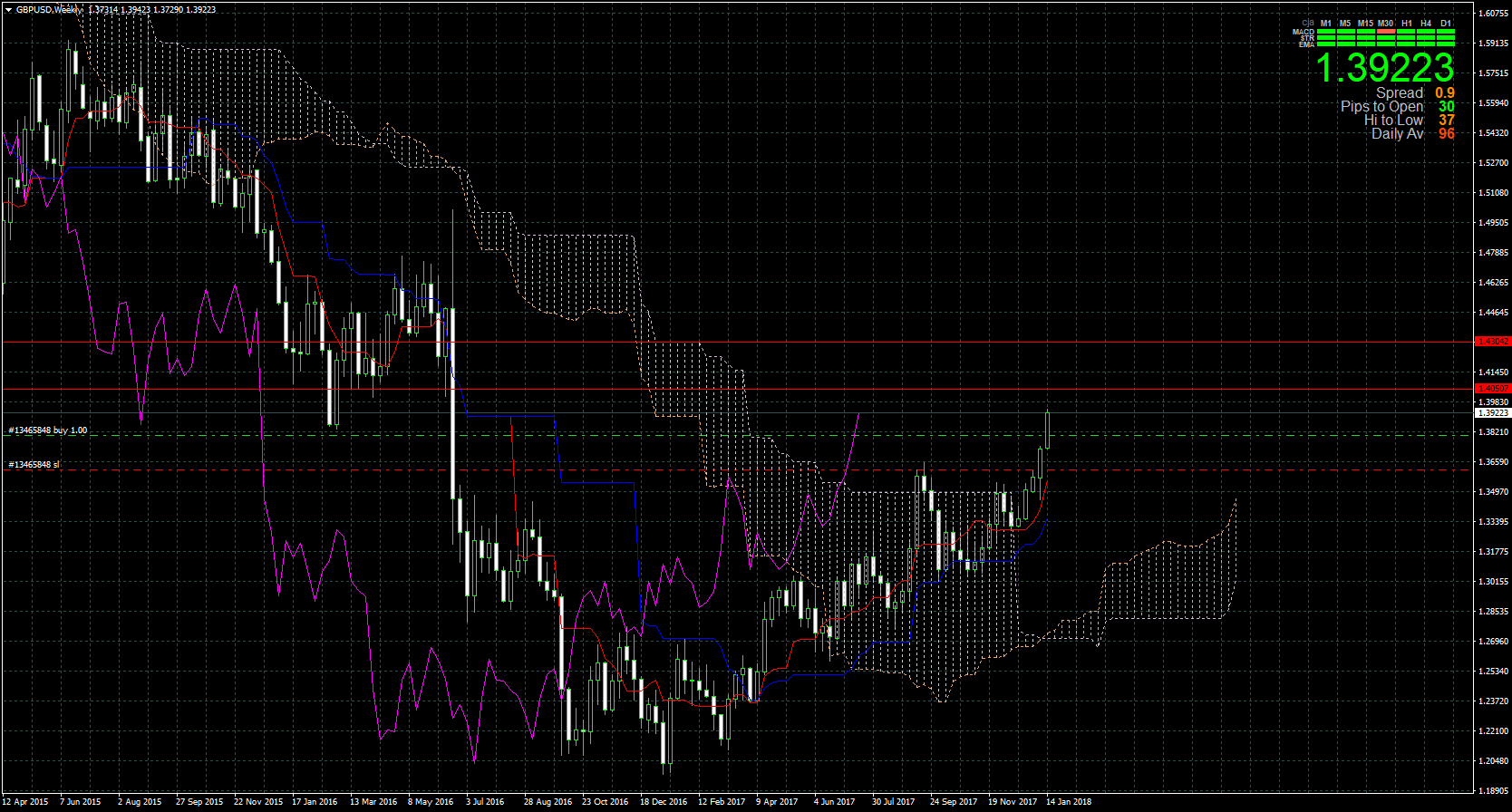

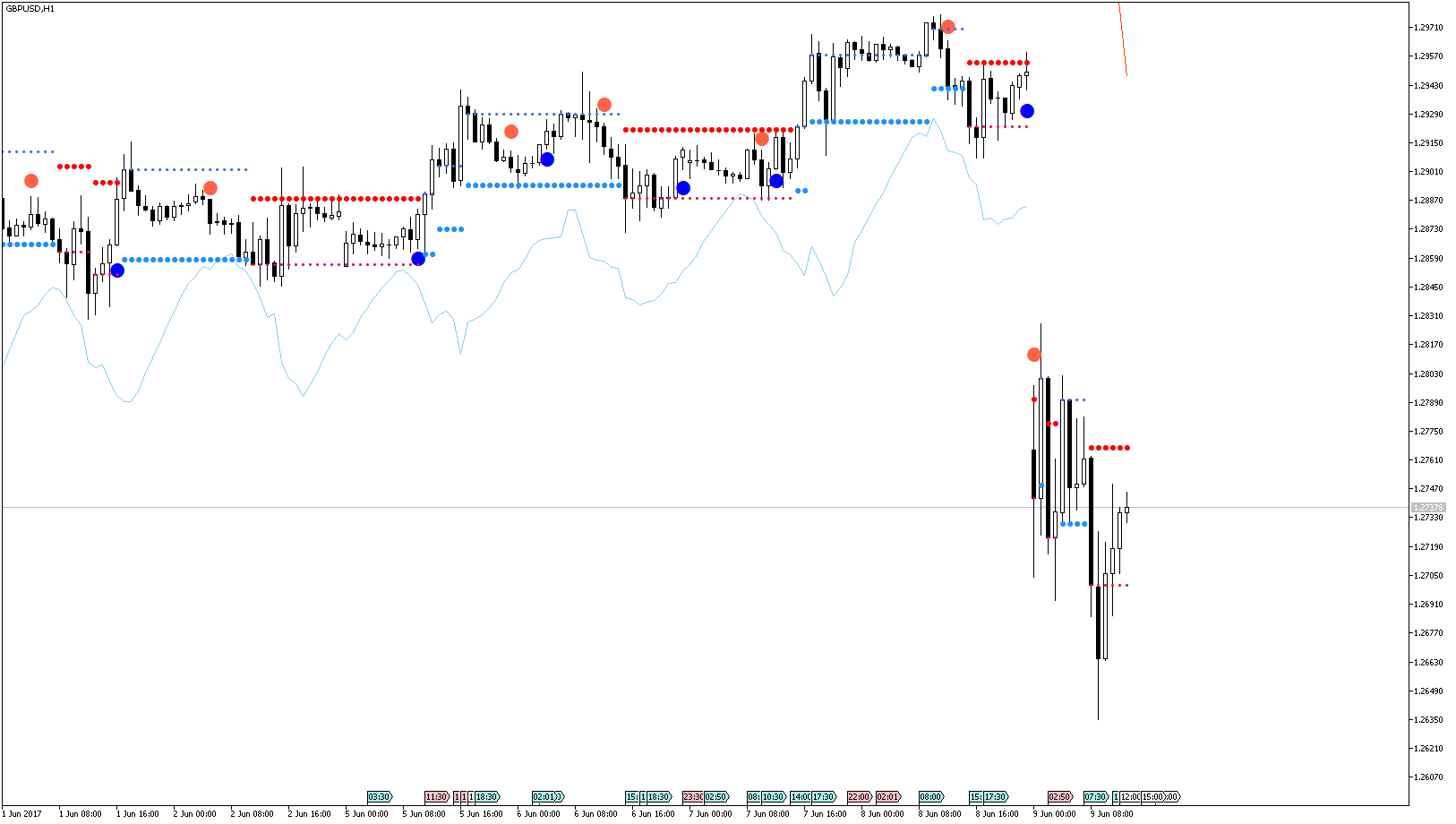

GBP/USD is supported in the range of 1.3798 levels and currently trading at 1.3907 levels. It reached session high at 1.4067 and dropped to session low at 1.3870 levels. Sterling jumped as much as 1.3 percent against the dollar on Thursday after the Bank of England said interest rates probably needed to rise sooner and by a bit more than it had previously thought because of the strength of the global economy. Interest rate futures now project a 60 percent chance of a BoE rate hike in June and fully price in an increase in August meeting. Before the BoE announcement, in which the bank also raised its UK economic forecasts, markets had priced in a 50 percent chance of a rate hike by May. The central banks Monetary Policy Committee raised interest rates for the first time in a decade in November. The BoE voted unanimously to keep rates on hold at 0.5 percent on Thursday but Governor Mark Carney and colleagues saw a growing need to move faster on raising rates to keep a grip on inflation. The pound rose to a days high of $1.4067 after trading flat before the BoE announcement. It later gave up much of those gains and was at $1.3942 as a broader sell-off in markets in late European trading hit sterling.

USD/CAD is supported at 1.2500 levels and is trading at 1.2600 levels. It has made session high at 1.2611 and lows at 1.2543 levels. The Canadian dollar weakened against its U.S. counterpart on Thursday as falling oil prices and strengthening U.S. dollar weighed on the Canadian dollar. The U.S. dollar turned higher, pulling back from an earlier session low against a basket of major currencies. Oil prices were down after data showed U.S. crude output had reached record highs and the North Seas largest crude pipeline reopened following an outage. U.S. stocks opened mixed, with investors assessing markets as volatility eased after hitting its highest level in more than two-and-a-half years earlier in the week. Commodity-linked currencies, such as the Canadian dollar tend to underperform when stocks fall. The loonie has retreated more than 2 percent since Wall Street began to head sharply lower on Friday. On the data front, Canadian new home prices were unchanged in December, breaking a streak of increases going back to April 2015, Statistics Canada said. The Canadian dollar was last trading at C$1.2583. The currencys strongest level of the session was C$1.2547, while it touched its weakest since Dec. 28 at C$1.2598.

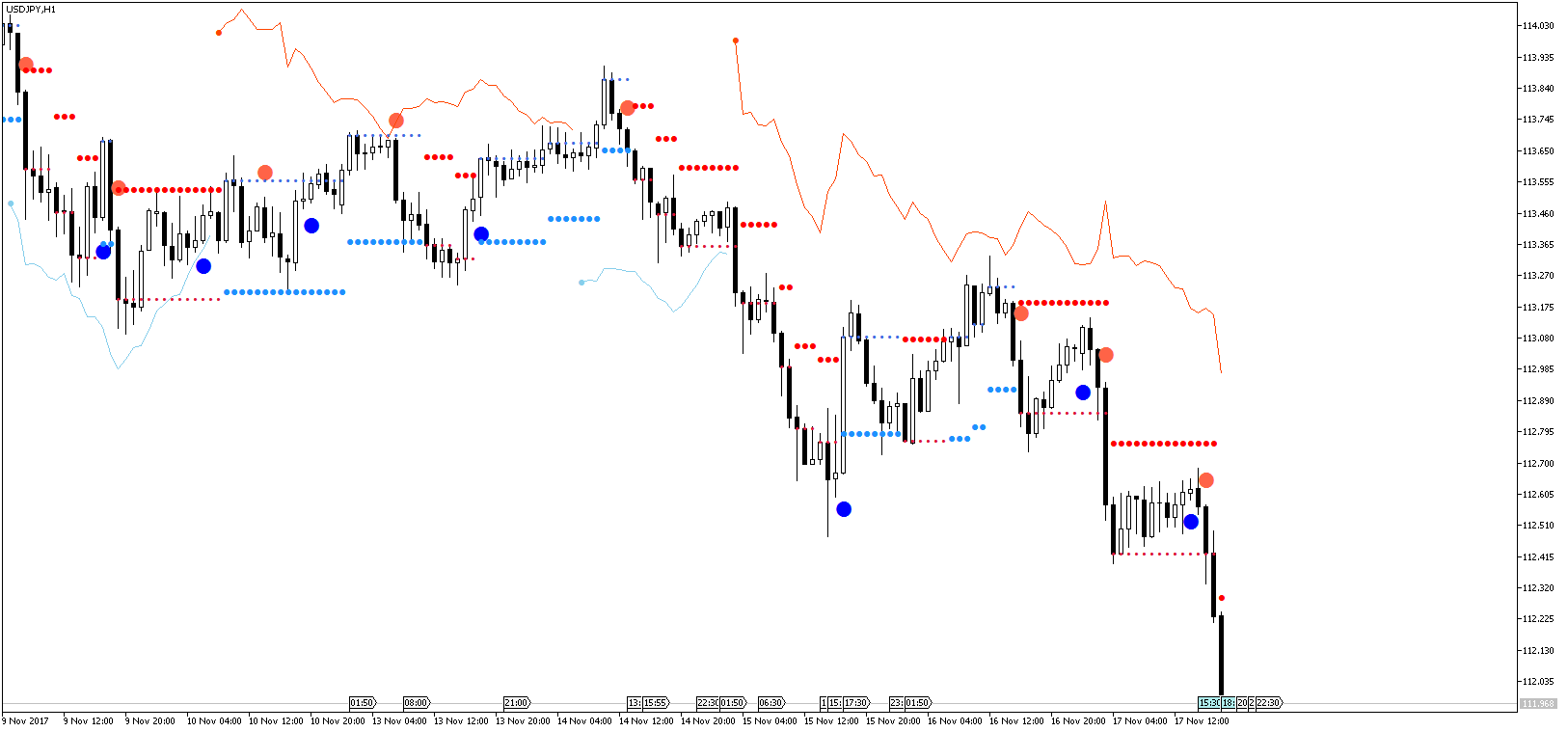

USD/JPY is supported around 113.00 levels and currently trading at 113.55 levels. It peaked to hit session high at 113.68 and made session lows at 113.21 levels. The U.S. dollar weakened against the yen on Thursday as demand increased for traditional safe haven assets as investors remained cautious on recent stock market volatility. U.S. stocks tumbled on Thursday in another trading session with big swings. Major indexes fell about 2 percent in US trading. The benchmark S&P 500 was set for a second day of declines, following sharp swings in recent sessions including its biggest drop in more than six years that pulled equities away from record highs. The retreat in equities had been long awaited by investors as the market climbed steadily to record high after record high with few bumps.The sharp selloff in recent days was kicked off by concerns over rising inflation and bond yields, sparked by Fridays January U.S. jobs report, with investors pointing to additional pressure from the violent unwind of trades linked to bets on volatility staying low. Investors are weighing whether the sharp swings this week are the start of a deeper correction or just a temporary bump in the nine-year bull market. The markets main gauge of volatility, the Cboe Volatility Index, rose 4.20 to 31.93 on Thursday, nearly three times the average level of the past year.

Equities Recap

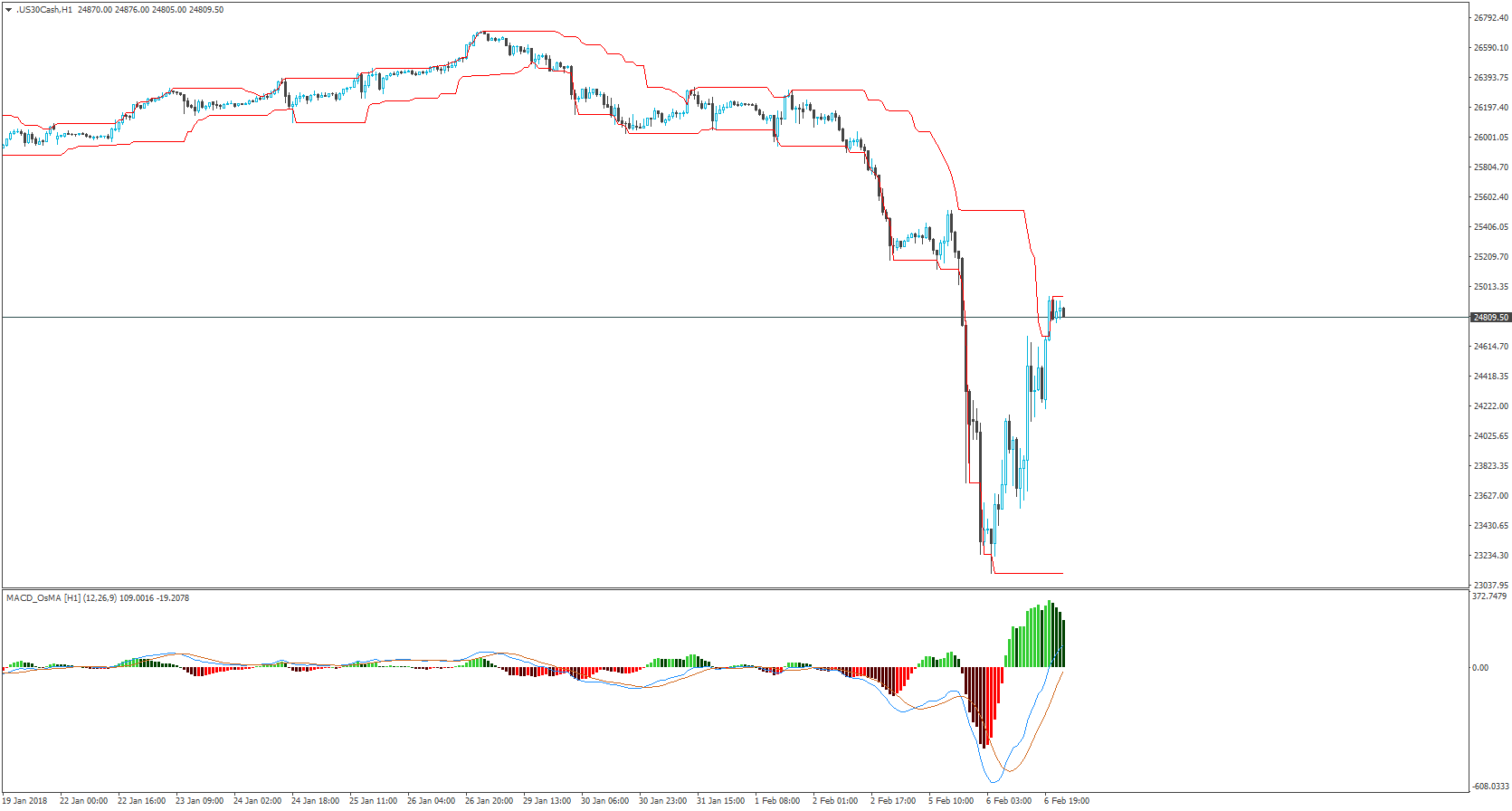

European shares closed in negative territory on Thursday as volatility made a brutal comeback and ended a short-lived rebound after the beginning of the weeks global sell-off.

UKs benchmark FTSE 100 closed down 1.6 percent, the pan-European FTSEurofirst 300 ended the day down by 1.89percent, Germanys Dax ended down by 3.1percent, France’s CAC finished the day down by 2.4 percent.

U.S. stocks tumbled anew on Thursday in another trading session with big swings, as investors remained on edge after several days of volatile trading

.

Dow Jones closed down by 4.16 percent, S&P 500 ended up by 3.75 percent, Nasdaq finished the day down by 3.90 percent.

Treasuries Recap

U.S. Treasury yields rose on Thursday in choppy trading as stocks pared some of their earlier weakness and after the Bank of England said interest rates probably need to rise sooner, adding to expectations of reduced central bank stimulus globally.

Benchmark 10-year note yields rose as high as 2.884 percent on Thursday, just below Monday’s four-year high of 2.885 percent. The notes were last down 6/32 in price to yield 2.853 percent.

Commodities Recap

Gold prices were flat on Thursday, slumping early on concern about rising U.S. bond yields and global interest rates, but buyers emerged to lift bullion when it hit a technical support level at about $1,312 an ounce.

Spot gold was unchanged at $1,318.12 per ounce by 1:53 p.m. EST (1853 GMT), up off the session low of $1,306.81, its lowest since Jan. 2.

U.S. gold futures for April delivery settled up $4.40, or 0.3 percent, at $1,319 per ounce.

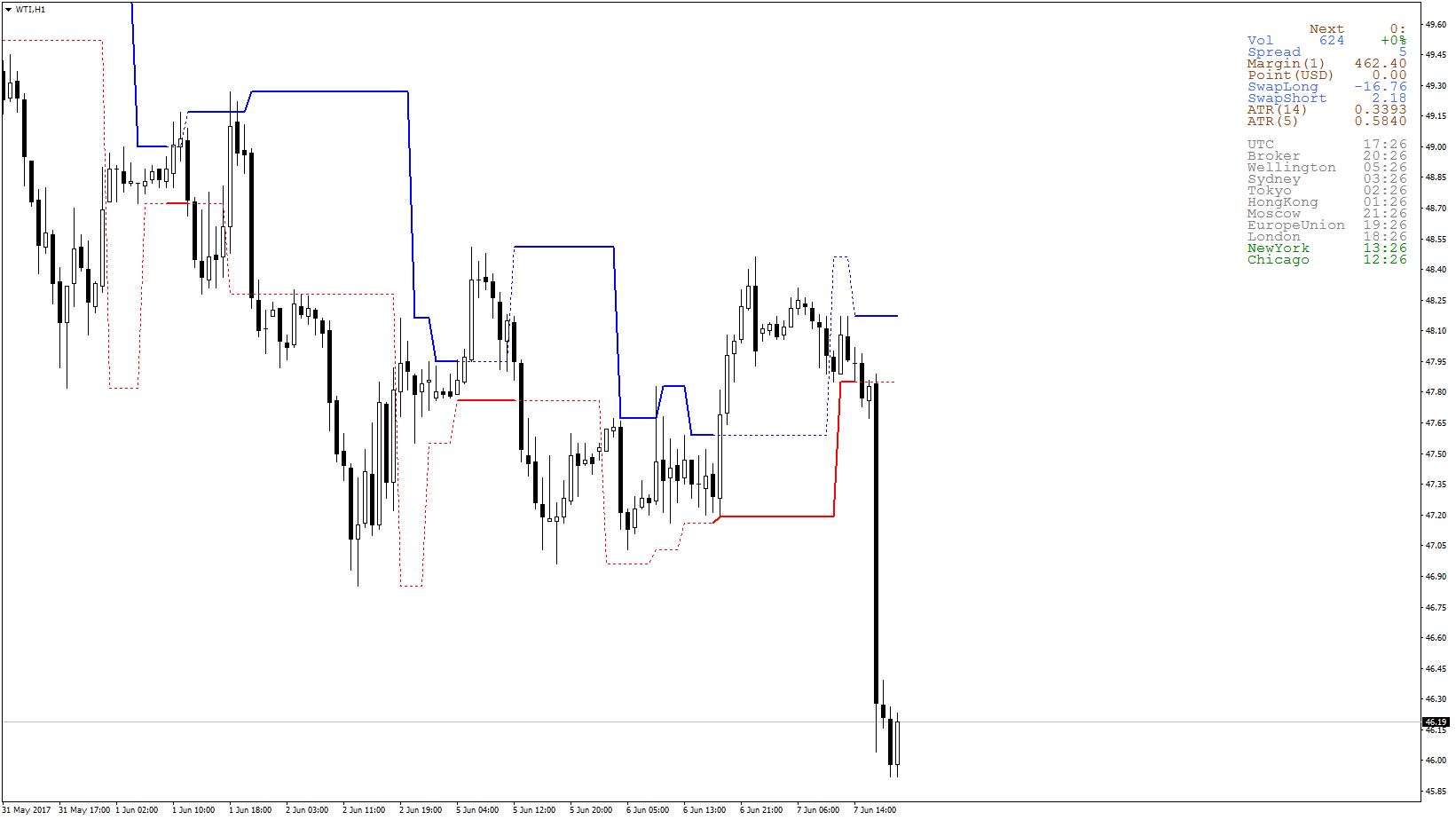

Oil prices fell to their lowest in six weeks on Thursday after data showed U.S. crude output had reached record highs and the North Seas largest crude pipeline reopened following an outage.

Brent futures were down 74 cents, or 1.1 percent, at $64.77 a barrel by 12:14 p.m. EST (1714 GMT), their lowest since Dec. 22.

U.S. West Texas Intermediate (WTI) crude, meanwhile, was down 86 cents, or 1.4 percent at $60.93, its lowest since Jan. 3.

• US w/e Initial Jobless Claims, 221k, 232k forecast, 230k previous.

• US w/e Jobless Claims 4-Wk Avg, 224.50k, 234.50k previous.

• US w/e Continued Jobless Claims, 1.923M, 1.945M forecast, 1.953M previous, 1.956 revised.

• U.S. Congress to vote on long-term budget deal, averting shutdown.

• Trump administration may target immigrants who use food aid, other benefits.

• Feds Dudley signals support for March hike if U.S. economy remains strong.

• Why cool the economy down now, Feds Kashkari asks.

• Fed likely to continue raising rates – Kaplan.

• Bank of England raises prospect of higher rates as global economy booms.

• Japan warns on Brexit: we cannot continue in UK without profit.

• CA Jan House Starts, Annualized, 216.2k, 210.0k forecast, 217.0k forecast, 216.3k revised

• CA Dec New Housing Price Index, 0.0%, 0.1% forecast, -0.10% forecast, 0.1% revised

• Bank of Canada: Technology will raise growth, policy can manage risks

Looking Ahead - Economic Data (GMT)

• 06:00 Australia Dec Housing Finance, -1.1% forecast, 2.1% previous

• 06:00 Australia Dec Invest Housing Finance, 1.5% previous

• 07:00 China Jan PPI YY, 4.4% forecast, 4.9% previous

• 07:00 China Jan CPI YY, 1.5% forecast 1.8% previous

• 07:00 China Jan CPI MM, 0.7% forecast, 0.3% previous

Looking Ahead - Events, Other Releases (GMT)

• 12:00 Riksbank general council meeting - Stockholm

• 16:45 BOE’s Deputy Governor for Financial Stability Jon Cunliffe to speak at

FIA SIFMA AMG Asset Management Derivatives Forum – California

Currency Summaries

EUR/USD is likely to find support at 1.2161 levels and currently trading at 1.2248 levels. The pair has made session high at 1.2296 and hit lows at 1.2228 levels. The euro declined against US dollar on Thursday as investors reduced bearish bets on the greenback, though many in the market saw the rally fast losing momentum. Analysts suggested this latest dollar strength was just a one-off bounce in the currencys overall bear market trend, driven in part by an improving near-term U.S. fundamental picture. A selloff across global stock markets since late Friday and bets that the United States could see at least three interest rate hikes in 2018 have driven the dollar up in recent days. The greenback has gained around 1.3 percent against its basket in the past week, on track to post its largest weekly gain since late October after rising in four of the last five sessions. On the data front, the number of Americans filing for unemployment benefits unexpectedly fell last week, dropping to its lowest level in nearly 45 years as the labor market tightened further, bolstering expectations of faster wage growth this year. Initial claims for state unemployment benefits decreased 9,000 to a seasonally adjusted 221,000 for the week ended Feb. 3, the Labor Department said. Claims fell to 216,000 in mid-January, which was the lowest level since January 1973.The euro was down 0.1 percent at $1.2249, after earlier falling to a two-week low. The single currency has declined 2.6 percent since hitting a three-year high of around $1.2536 just 10 days ago.

GBP/USD is supported in the range of 1.3798 levels and currently trading at 1.3907 levels. It reached session high at 1.4067 and dropped to session low at 1.3870 levels. Sterling jumped as much as 1.3 percent against the dollar on Thursday after the Bank of England said interest rates probably needed to rise sooner and by a bit more than it had previously thought because of the strength of the global economy. Interest rate futures now project a 60 percent chance of a BoE rate hike in June and fully price in an increase in August meeting. Before the BoE announcement, in which the bank also raised its UK economic forecasts, markets had priced in a 50 percent chance of a rate hike by May. The central banks Monetary Policy Committee raised interest rates for the first time in a decade in November. The BoE voted unanimously to keep rates on hold at 0.5 percent on Thursday but Governor Mark Carney and colleagues saw a growing need to move faster on raising rates to keep a grip on inflation. The pound rose to a days high of $1.4067 after trading flat before the BoE announcement. It later gave up much of those gains and was at $1.3942 as a broader sell-off in markets in late European trading hit sterling.

USD/CAD is supported at 1.2500 levels and is trading at 1.2600 levels. It has made session high at 1.2611 and lows at 1.2543 levels. The Canadian dollar weakened against its U.S. counterpart on Thursday as falling oil prices and strengthening U.S. dollar weighed on the Canadian dollar. The U.S. dollar turned higher, pulling back from an earlier session low against a basket of major currencies. Oil prices were down after data showed U.S. crude output had reached record highs and the North Seas largest crude pipeline reopened following an outage. U.S. stocks opened mixed, with investors assessing markets as volatility eased after hitting its highest level in more than two-and-a-half years earlier in the week. Commodity-linked currencies, such as the Canadian dollar tend to underperform when stocks fall. The loonie has retreated more than 2 percent since Wall Street began to head sharply lower on Friday. On the data front, Canadian new home prices were unchanged in December, breaking a streak of increases going back to April 2015, Statistics Canada said. The Canadian dollar was last trading at C$1.2583. The currencys strongest level of the session was C$1.2547, while it touched its weakest since Dec. 28 at C$1.2598.

USD/JPY is supported around 113.00 levels and currently trading at 113.55 levels. It peaked to hit session high at 113.68 and made session lows at 113.21 levels. The U.S. dollar weakened against the yen on Thursday as demand increased for traditional safe haven assets as investors remained cautious on recent stock market volatility. U.S. stocks tumbled on Thursday in another trading session with big swings. Major indexes fell about 2 percent in US trading. The benchmark S&P 500 was set for a second day of declines, following sharp swings in recent sessions including its biggest drop in more than six years that pulled equities away from record highs. The retreat in equities had been long awaited by investors as the market climbed steadily to record high after record high with few bumps.The sharp selloff in recent days was kicked off by concerns over rising inflation and bond yields, sparked by Fridays January U.S. jobs report, with investors pointing to additional pressure from the violent unwind of trades linked to bets on volatility staying low. Investors are weighing whether the sharp swings this week are the start of a deeper correction or just a temporary bump in the nine-year bull market. The markets main gauge of volatility, the Cboe Volatility Index, rose 4.20 to 31.93 on Thursday, nearly three times the average level of the past year.

Equities Recap

European shares closed in negative territory on Thursday as volatility made a brutal comeback and ended a short-lived rebound after the beginning of the weeks global sell-off.

UKs benchmark FTSE 100 closed down 1.6 percent, the pan-European FTSEurofirst 300 ended the day down by 1.89percent, Germanys Dax ended down by 3.1percent, France’s CAC finished the day down by 2.4 percent.

U.S. stocks tumbled anew on Thursday in another trading session with big swings, as investors remained on edge after several days of volatile trading

.

Dow Jones closed down by 4.16 percent, S&P 500 ended up by 3.75 percent, Nasdaq finished the day down by 3.90 percent.

Treasuries Recap

U.S. Treasury yields rose on Thursday in choppy trading as stocks pared some of their earlier weakness and after the Bank of England said interest rates probably need to rise sooner, adding to expectations of reduced central bank stimulus globally.

Benchmark 10-year note yields rose as high as 2.884 percent on Thursday, just below Monday’s four-year high of 2.885 percent. The notes were last down 6/32 in price to yield 2.853 percent.

Commodities Recap

Gold prices were flat on Thursday, slumping early on concern about rising U.S. bond yields and global interest rates, but buyers emerged to lift bullion when it hit a technical support level at about $1,312 an ounce.

Spot gold was unchanged at $1,318.12 per ounce by 1:53 p.m. EST (1853 GMT), up off the session low of $1,306.81, its lowest since Jan. 2.

U.S. gold futures for April delivery settled up $4.40, or 0.3 percent, at $1,319 per ounce.

Oil prices fell to their lowest in six weeks on Thursday after data showed U.S. crude output had reached record highs and the North Seas largest crude pipeline reopened following an outage.

Brent futures were down 74 cents, or 1.1 percent, at $64.77 a barrel by 12:14 p.m. EST (1714 GMT), their lowest since Dec. 22.

U.S. West Texas Intermediate (WTI) crude, meanwhile, was down 86 cents, or 1.4 percent at $60.93, its lowest since Jan. 3.

Muhammad Syamil Bin Abdullah

I haven't been use Linux Mint for quite some time, the last used was Linux Mint 12 with Cinnamon Desktop. A recent forum member posted problem installing MT5 on linux mint OS spike my interest again towards linux mint. I will try install Metatrader 5 on it and see if there are really any problem installation.

Muhammad Syamil Bin Abdullah

Hat den Code Daily Open Line veröffentlicht

Der einfache Indikator, der den Open-Preis des Tages darstellt.

In sozialen Netzwerken teilen · 1

1522

8380

: