Muhammad Syamil Bin Abdullah / Profil

- Information

|

10+ Jahre

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

I'm self-taught trader started trading since 2007. Trading in major currency pairs, gold and some US indices.

I am using RoboForex as main broker for all my trade.

I am using RoboForex as main broker for all my trade.

Muhammad Syamil Bin Abdullah

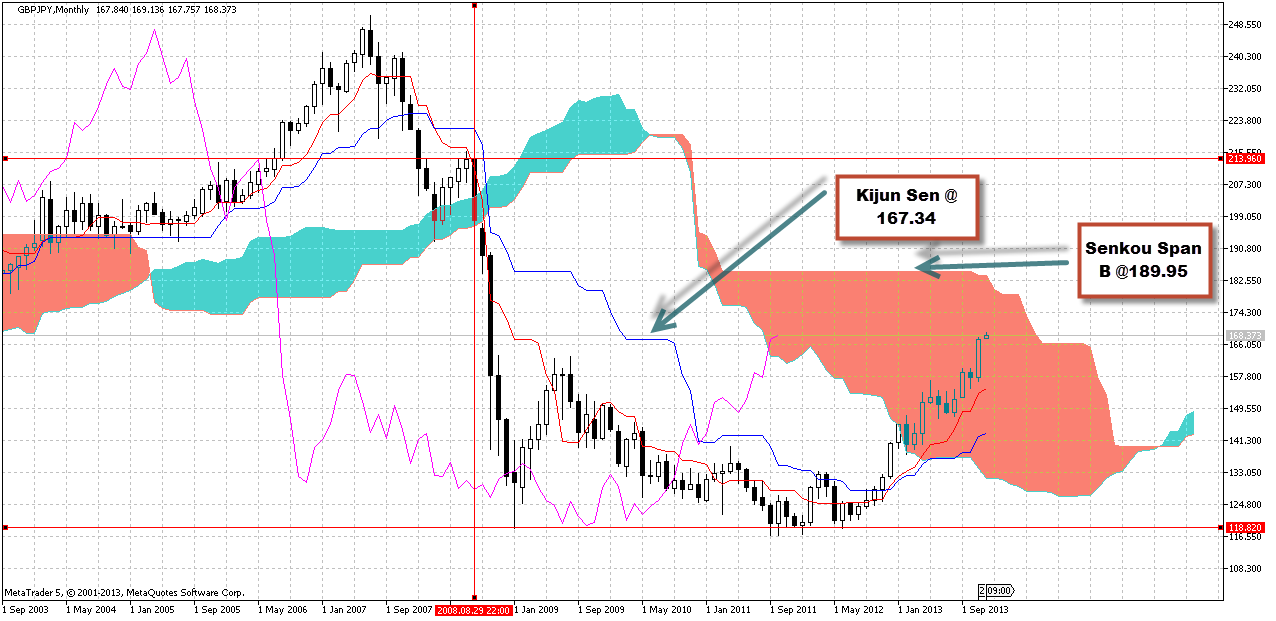

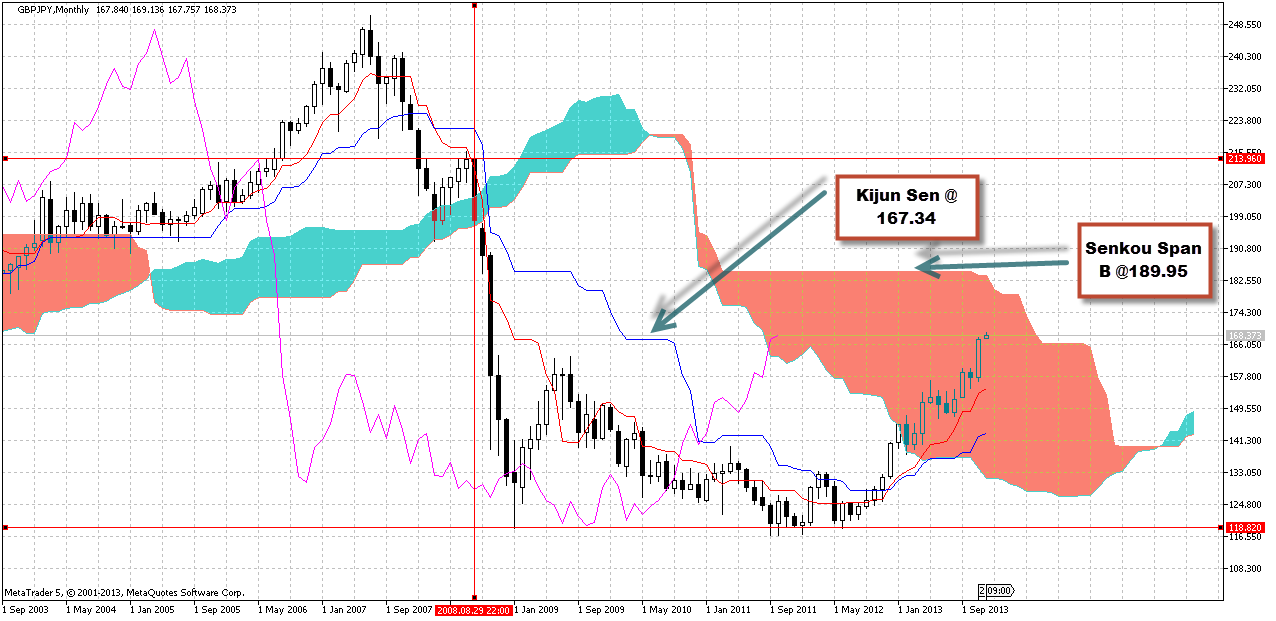

How high can GBPJPY go?

From monthly chart of GBPJPY we can see this pair are now recovering and moving in bullish trend. It fell more than 950 pips started of August 2008 till Jan 2009, as seen on the chart. Currently GBPJPY trade move above monthly kijun sen level @ 167.34, maybe it could move up to the kumo cloud border of senkou span B @189.95, a big flat area within this month. Only time can tell.

From monthly chart of GBPJPY we can see this pair are now recovering and moving in bullish trend. It fell more than 950 pips started of August 2008 till Jan 2009, as seen on the chart. Currently GBPJPY trade move above monthly kijun sen level @ 167.34, maybe it could move up to the kumo cloud border of senkou span B @189.95, a big flat area within this month. Only time can tell.

Muhammad Syamil Bin Abdullah

Quote of The Day : "Experienced traders control risk, inexperienced traders chase gains." -Alan Farley

Muhammad Syamil Bin Abdullah

Spread To Pip Potential : Which Pairs Are Worth Day Trading?

Spreads play a significant factor in profitable forex trading. When we compare to the average spread to the average daily movement many interesting issues arise. Namely, some pairs are more advantageous to trade than others. Secondly, retail spreads are much harder to overcome in short-term trading than some may anticipate. Third, a "larger" spread does not necessarily mean the pair is not as good for day trading when compared to some lower spread alternatives. Same goes for a "smaller" spread - it does not mean it is better to trade than a larger spread alternative.

Establishing a Base Line

To understand what we are dealing with, and which pairs are more suited to day trading, a base line is needed. For this the spread is converted to a percentage of the daily range. This allows us to compare spreads versus what the maximum pip potential is for a day trade in that particular pair. While the numbers below reflect the values in existence at a particular period of time, the test can be applied at any time to see which currency pair is offering the best value in terms of its spread to daily pip potential. The test can also be used to cover longer or shorter periods of time. These are the daily values and approximate spreads (will vary from broker to broker) as of April 7, 2010. As daily average movements change so will the percentage that the spread represents of the daily movement. A change in the spread will also affect the percentage. Please note that in the percentage calculation the spread has been deducted from the daily average range. This is to reflect that retail customers cannot buy at the lowest bid price of the day shown on their charts.

# EUR/USD

Daily Average Range (12):105

Spread: 3

Spread as a percentage of maximum pip potential: 3/102= 2.94%

# USD/JPY

Daily Average Range (12):80

Spread: 3

Spread as a percentage of maximum pip potential: 3/77= 3.90%

# GBP/USD

Daily Average Range (12):128

Spread: 4

Spread as a percentage of maximum pip potential: 4/124= 3.23%

# EUR/JPY

Daily Average Range (12):121

Spread: 4

Spread as a percentage of maximum pip potential: 4/117= 3.42%

# USD/CAD

Daily Average Range (12):66

Spread: 4

Spread as a percentage of maximum pip potential: 4/62= 6.45%

# USD/CHF

Daily Average Range (12):98

Spread: 4

Spread as a percentage of maximum pip potential: 4/94= 4.26%

# GBP/JPY

Daily Average Range (12):151

Spread: 6

Spread as a percentage of maximum pip potential: 6/145= 4.14%

Which Pairs to Trade

When the spread is placed into percentage terms of the daily average move, it can be seen that the spread can be quite significant and have a large impact on day-trading strategies. This is often overlooked by traders who feel they are trading for free since there is no commission.

If a trader is actively day trading and focusing on a certain pair, making trades each day, it is most likely they will trade pairs that have the lowest spread as a percentage of maximum pip potential. The EUR/USD and GBP/USD exhibit the best ratio from the pairs analyzed above. The EUR/JPY also ranks high among the pairs examined. It should be noted that even though the GBP/USD and EUR/JPY have a four-pip spread they out rank the USD/JPY which commonly has a three pip spread.

In the case of the USD/CAD, which also has a four-pip spread, it was one of the worst pairs to day trade with the spread accounting for a significant portion of the daily average range. Pairs such as these are better suited to longer term moves, where the spread becomes less significant the further the pair moves.

Adding Some Realism

The above calculations assumed that the daily range is capturable, and this is highly unlikely. Based simply on chance and based on the average daily range of the EUR/USD, there is far less than a 1% chance of picking the high and low. Despite what people may think of their trading abilities, even a seasoned day trader won't fair much better in being able to capture an entire day's range - and they don't have to.

Therefore, some realism needs to be added to our calculation, accounting for the fact that picking the exact high and low is extremely unlikely. Assuming that a trader is unlikely to exit/enter in the top 10% of the average daily range, and is unlikely to exit /enter in the bottom 10% of the average daily range, this means that trader has 80% of the available range available to them. Entering and exiting within this area is more realistic than being able to enter right in the area of a daily high or low.

Using 80% of the average daily range in the calculation provides the following values for the currency pairs. These numbers paint a portrait that the spread is very significant.

* EUR/USD

Spread as a percentage of possible (80%) pip potential: 3/81.6= 3.68%

* USD/JPY

Spread as a percentage of maximum pip potential: 3/61.6= 4.87%

* GBP/USD

Spread as a percentage of possible (80%) pip potential: 4/99.2= 4.03%

* EUR/JPY

Spread as a percentage of possible (80%) pip potential: 4/93.6= 4.27%

* USD/CAD

Spread as a percentage of possible (80%) pip potential: 4/49.6= 8.06%

* USD/CHF

Spread as a percentage of possible (80%) pip potential: 4/75.2= 5.32%

* GBP/JPY

Spread as a percentage of possible (80%) pip potential: 6/116= 5.17%

With the exception of the EUR/USD, which is just under, 4%+ of the daily range is eaten up by the spread. In some pairs the spread is a significant portion of the daily range when factoring for the likely possibly that the trader will not be able to accurately pick entries/exits within 10% of the high and low which establish the daily range. (To learn more, see Forex Currencies: The EUR/USD.)

Final Thoughts

Traders need to be aware that the spread represents a significant portion of the daily average range in many pairs. When factoring likely entry and exit prices the spread becomes even more significant. Traders, especially those trading on short time frames, can monitor daily average movements to verify if trading during low volatility times presents enough profit potential to realistically make active trading (with a spread) worthwhile. Based on the data the EUR/USD and the GBP/USD have the lowest spread-to-movement ratio, although traders must update the figures at regular intervals to see which pairs are worth trading relative to their spread and which ones are not. Statistics will change over time, and during times of great volatility the spread becomes less significant. It is important to track figures and understand when it is worth trading and when it isn't.

Spreads play a significant factor in profitable forex trading. When we compare to the average spread to the average daily movement many interesting issues arise. Namely, some pairs are more advantageous to trade than others. Secondly, retail spreads are much harder to overcome in short-term trading than some may anticipate. Third, a "larger" spread does not necessarily mean the pair is not as good for day trading when compared to some lower spread alternatives. Same goes for a "smaller" spread - it does not mean it is better to trade than a larger spread alternative.

Establishing a Base Line

To understand what we are dealing with, and which pairs are more suited to day trading, a base line is needed. For this the spread is converted to a percentage of the daily range. This allows us to compare spreads versus what the maximum pip potential is for a day trade in that particular pair. While the numbers below reflect the values in existence at a particular period of time, the test can be applied at any time to see which currency pair is offering the best value in terms of its spread to daily pip potential. The test can also be used to cover longer or shorter periods of time. These are the daily values and approximate spreads (will vary from broker to broker) as of April 7, 2010. As daily average movements change so will the percentage that the spread represents of the daily movement. A change in the spread will also affect the percentage. Please note that in the percentage calculation the spread has been deducted from the daily average range. This is to reflect that retail customers cannot buy at the lowest bid price of the day shown on their charts.

# EUR/USD

Daily Average Range (12):105

Spread: 3

Spread as a percentage of maximum pip potential: 3/102= 2.94%

# USD/JPY

Daily Average Range (12):80

Spread: 3

Spread as a percentage of maximum pip potential: 3/77= 3.90%

# GBP/USD

Daily Average Range (12):128

Spread: 4

Spread as a percentage of maximum pip potential: 4/124= 3.23%

# EUR/JPY

Daily Average Range (12):121

Spread: 4

Spread as a percentage of maximum pip potential: 4/117= 3.42%

# USD/CAD

Daily Average Range (12):66

Spread: 4

Spread as a percentage of maximum pip potential: 4/62= 6.45%

# USD/CHF

Daily Average Range (12):98

Spread: 4

Spread as a percentage of maximum pip potential: 4/94= 4.26%

# GBP/JPY

Daily Average Range (12):151

Spread: 6

Spread as a percentage of maximum pip potential: 6/145= 4.14%

Which Pairs to Trade

When the spread is placed into percentage terms of the daily average move, it can be seen that the spread can be quite significant and have a large impact on day-trading strategies. This is often overlooked by traders who feel they are trading for free since there is no commission.

If a trader is actively day trading and focusing on a certain pair, making trades each day, it is most likely they will trade pairs that have the lowest spread as a percentage of maximum pip potential. The EUR/USD and GBP/USD exhibit the best ratio from the pairs analyzed above. The EUR/JPY also ranks high among the pairs examined. It should be noted that even though the GBP/USD and EUR/JPY have a four-pip spread they out rank the USD/JPY which commonly has a three pip spread.

In the case of the USD/CAD, which also has a four-pip spread, it was one of the worst pairs to day trade with the spread accounting for a significant portion of the daily average range. Pairs such as these are better suited to longer term moves, where the spread becomes less significant the further the pair moves.

Adding Some Realism

The above calculations assumed that the daily range is capturable, and this is highly unlikely. Based simply on chance and based on the average daily range of the EUR/USD, there is far less than a 1% chance of picking the high and low. Despite what people may think of their trading abilities, even a seasoned day trader won't fair much better in being able to capture an entire day's range - and they don't have to.

Therefore, some realism needs to be added to our calculation, accounting for the fact that picking the exact high and low is extremely unlikely. Assuming that a trader is unlikely to exit/enter in the top 10% of the average daily range, and is unlikely to exit /enter in the bottom 10% of the average daily range, this means that trader has 80% of the available range available to them. Entering and exiting within this area is more realistic than being able to enter right in the area of a daily high or low.

Using 80% of the average daily range in the calculation provides the following values for the currency pairs. These numbers paint a portrait that the spread is very significant.

* EUR/USD

Spread as a percentage of possible (80%) pip potential: 3/81.6= 3.68%

* USD/JPY

Spread as a percentage of maximum pip potential: 3/61.6= 4.87%

* GBP/USD

Spread as a percentage of possible (80%) pip potential: 4/99.2= 4.03%

* EUR/JPY

Spread as a percentage of possible (80%) pip potential: 4/93.6= 4.27%

* USD/CAD

Spread as a percentage of possible (80%) pip potential: 4/49.6= 8.06%

* USD/CHF

Spread as a percentage of possible (80%) pip potential: 4/75.2= 5.32%

* GBP/JPY

Spread as a percentage of possible (80%) pip potential: 6/116= 5.17%

With the exception of the EUR/USD, which is just under, 4%+ of the daily range is eaten up by the spread. In some pairs the spread is a significant portion of the daily range when factoring for the likely possibly that the trader will not be able to accurately pick entries/exits within 10% of the high and low which establish the daily range. (To learn more, see Forex Currencies: The EUR/USD.)

Final Thoughts

Traders need to be aware that the spread represents a significant portion of the daily average range in many pairs. When factoring likely entry and exit prices the spread becomes even more significant. Traders, especially those trading on short time frames, can monitor daily average movements to verify if trading during low volatility times presents enough profit potential to realistically make active trading (with a spread) worthwhile. Based on the data the EUR/USD and the GBP/USD have the lowest spread-to-movement ratio, although traders must update the figures at regular intervals to see which pairs are worth trading relative to their spread and which ones are not. Statistics will change over time, and during times of great volatility the spread becomes less significant. It is important to track figures and understand when it is worth trading and when it isn't.

Muhammad Syamil Bin Abdullah

Quote of the Day: "Experience is one thing you can't get for nothing." Oscar Wilde

"Oscar Fingal O'Flahertie Wills Wilde was an Irish writer and poet. After writing in different forms throughout the 1880s, he became one of London's most popular playwrights in the early 1890s."

"Oscar Fingal O'Flahertie Wills Wilde was an Irish writer and poet. After writing in different forms throughout the 1880s, he became one of London's most popular playwrights in the early 1890s."

Muhammad Syamil Bin Abdullah

The Importance Of Creating A Forex Demo Account

Creating a demo trading account prior to setting up a live online forex trading account will almost certainly pave the way for your forex trading success. A demo trading account offers numerous advantages to the forex beginners, including learning the fundamentals of your selected trading platform, familiarizing yourself with the services provided by your selected forex broker, testing various manual trading system/strategies, testing various expert adviser for optimization result and establishing your trading strengths and weaknesses.

Although forex trading seems like an exciting and unique way to make a sizeable investment, it is also an easy way to lose money fast if approached with the wrong attitude and intentions. This is why setting up a demo trading account may be the most sensible step you can take, prior to getting started with the real thing.

Why Begin With a Demo Account?

Before depositing real funds with a forex broker, it is a wise idea to set up a demo trading account. This is because, although demo trading and live forex trading are two entirely different things, beginning with a demo account means that you can learn the ropes in a comfortable and safe setting, without any additional pressure or threat of losing funds.

Online forex trading is an exciting investment strategy, but it poses a number of risks to any trader. By first learning the ground rules of trading on a demo trading account, you will be in an excellent position to:

- Study the ins and outs of your chosen forex trading platform

- Establish some fail-safe trading strategies/EAs

- Learn what currency or commodity pairs suit your trading needs

- Take advantage of educational resources and other facilities provided by your selected forex brokers

The Importance of an Effective Risk Management Strategy

Although it is easy and convenient to copy someone else’s trading style, it is absolutely essential to ensure that your own trading style sustains your personal and financial needs. This is why the risk management strategies that you choose to follow must wholeheartedly suit your personal and financial needs.

Setting up a forex demo account gives you the opportunity to practice various risk management strategies, risk-free. This means that you can implement various forex trading strategies and understand what works best for you.

Finally, as with any investment strategy, patience is key. Trading forex through a demo account will give you the opportunity to repeatedly practice forex trading, and, although you may only be winning fake money, at least you will have the chance to learn what suits your needs, where your weaknesses lie and how you can best achieve online forex trading success.

Creating a demo trading account prior to setting up a live online forex trading account will almost certainly pave the way for your forex trading success. A demo trading account offers numerous advantages to the forex beginners, including learning the fundamentals of your selected trading platform, familiarizing yourself with the services provided by your selected forex broker, testing various manual trading system/strategies, testing various expert adviser for optimization result and establishing your trading strengths and weaknesses.

Although forex trading seems like an exciting and unique way to make a sizeable investment, it is also an easy way to lose money fast if approached with the wrong attitude and intentions. This is why setting up a demo trading account may be the most sensible step you can take, prior to getting started with the real thing.

Why Begin With a Demo Account?

Before depositing real funds with a forex broker, it is a wise idea to set up a demo trading account. This is because, although demo trading and live forex trading are two entirely different things, beginning with a demo account means that you can learn the ropes in a comfortable and safe setting, without any additional pressure or threat of losing funds.

Online forex trading is an exciting investment strategy, but it poses a number of risks to any trader. By first learning the ground rules of trading on a demo trading account, you will be in an excellent position to:

- Study the ins and outs of your chosen forex trading platform

- Establish some fail-safe trading strategies/EAs

- Learn what currency or commodity pairs suit your trading needs

- Take advantage of educational resources and other facilities provided by your selected forex brokers

The Importance of an Effective Risk Management Strategy

Although it is easy and convenient to copy someone else’s trading style, it is absolutely essential to ensure that your own trading style sustains your personal and financial needs. This is why the risk management strategies that you choose to follow must wholeheartedly suit your personal and financial needs.

Setting up a forex demo account gives you the opportunity to practice various risk management strategies, risk-free. This means that you can implement various forex trading strategies and understand what works best for you.

Finally, as with any investment strategy, patience is key. Trading forex through a demo account will give you the opportunity to repeatedly practice forex trading, and, although you may only be winning fake money, at least you will have the chance to learn what suits your needs, where your weaknesses lie and how you can best achieve online forex trading success.

Muhammad Syamil Bin Abdullah

http://www.amazon.com/dp/0470583541?tag=garttrad09-20&camp=14573&creative=327641&linkCode=as1&creativeASIN=0470583541&adid=0WCFE9RS4N3NG5P3DNM9&

A detailed look at the technical pattern simply referred to today as the Gartley Pattern

Gartley patterns are based on the work of H.M. Gartley, a prominent technical analyst best known for a particular retracement pattern that bears his name. In recent years, Gartley patterns-which reflect the underlying psychology of fear and greed in the markets-have received renewed interest.

This definitive guide skillfully explains how to utilize the proven methods of H.M. Gartley to capture consistent profits in the financial markets. Page by page, you'll become familiar with Gartley's original work, how his patterns can be adapted to today's fast moving markets, and what it takes to make them work for you.

- Examines how to identify and profit from the most powerful formation in the financial markets

- Discusses the similarities, differences and the superiority of the Gartley Pattern compared to classical chart patterns including Elliott Wave

- Shows how to apply filters to Gartley patterns to improve the probability of your trading opportunities, as well as specific rules where to enter and exit positions

Gartley's pattern is based on a unique market position where most traders refuse to participate due to fear. This book reveals how you can overcome this fear, and how to profit from the most consistent and reliable pattern in the financial markets.

A detailed look at the technical pattern simply referred to today as the Gartley Pattern

Gartley patterns are based on the work of H.M. Gartley, a prominent technical analyst best known for a particular retracement pattern that bears his name. In recent years, Gartley patterns-which reflect the underlying psychology of fear and greed in the markets-have received renewed interest.

This definitive guide skillfully explains how to utilize the proven methods of H.M. Gartley to capture consistent profits in the financial markets. Page by page, you'll become familiar with Gartley's original work, how his patterns can be adapted to today's fast moving markets, and what it takes to make them work for you.

- Examines how to identify and profit from the most powerful formation in the financial markets

- Discusses the similarities, differences and the superiority of the Gartley Pattern compared to classical chart patterns including Elliott Wave

- Shows how to apply filters to Gartley patterns to improve the probability of your trading opportunities, as well as specific rules where to enter and exit positions

Gartley's pattern is based on a unique market position where most traders refuse to participate due to fear. This book reveals how you can overcome this fear, and how to profit from the most consistent and reliable pattern in the financial markets.

Muhammad Syamil Bin Abdullah

Why wait? – Analyzing the Power of Patience

Have you ever found yourself making statements like,

“I’ve got to make some money today.”

“I’ve got to get in this trade.”

“I’ve got to make a move.”

“I need to find some action.”

Is any of this sounding familiar?

For a lot of traders the urge to ‘get in the game’ can be overwhelming. An even more powerful urge can be watching a trade you are in go sideways and wanting to DO something about it. For minutes, hours even days you must sit and wait for the market to either move in your favor, or worse, against you. During such times a traders internal dialoged can be going crazy as he or she struggles with what to do.

You see, we must DO something right? If we’re just sitting at our computer and nothing is happening we must be doing something wrong….right? If there is no action in our trade that means we’re missing the action somewhere else doesn’t it?

Many, many traders get involved in FOREX with dreams of quitting their job, working from home and possibly making more money than they ever thought possible. We can encapsulate all of these ambitions into one simple desire, freedom. Freedom from a job that require us to keep regular hours. Freedom from a boss who tells us what to do and how to do it. Freedom from the fear of losing that job and having nothing. And most of all, freedom from financial stress.

The idea of ‘calling your own shots’ and ‘making your own rules’ is enticing to most traders. We are free thinkers, tend to be fairly risk tolerant, and tend to view money as a tool rather than a commodity. That’s why it might be strange to learn that these same traits can be extremely detrimental to your account balance.

You see, trading (when done correctly) can be quite boring. Sure working in the pits on an exchange or on a high risk trading floor can be exhilarating, but there is nothing exciting about watching your trade move sideways for minutes, hours or days. It takes a great deal of discipline to trade your system day in and day out. Trading requires you to be unemotional. Nothing kills an account quicker than an ego.

But these traits fly in direct opposition to our stated goal….freedom. When we fix ourselves to a set of rules and conditions we MUST follow, we are no longer free. Discretion (read ego) must be set aside. How many of you have purchased a trading system or EA only to second guess it at every turn? The desire to add your own bit of ‘human element’ (read ego) undoubtedly led to loss after loss. Maybe the system was junk to begin with, but how could you really know?

Another heavy contributor to our desire to trade comes from this concept of “time for dollars”. For many of you, trading is not your first carrier. It certainly wasn’t mine. Some of you have spent 10, 15 even 20 years in a carrier before moving into trading. For a large chunk of your adult life you equated ‘hours worked’ to ‘dollars paid’. The overwhelming desire to trade often comes from that unreasonable expectation that we must DO something in order to EARN our paycheck. We MUST trade. Because if we simply sit in our chair and watch the market without trading we have not EARED any money.

Traders, we are not in the ‘got to make money’ business. Our compensation is not determined by how many trades we take, or how long we spend in front of the computer screen. We are PAID (if you must use that term) for our discipline and sound decision making. This means that some weeks we’ll make nothing. On occasion we will lose money. But over time we are profitable because we have a plan we know works and we have the discipline to follow it.

People who have run businesses have an easier time understanding this than those that have not. You see, when you run a business there are days, weeks, even months when you won’t make one penny. You may spend 18 hours a day trying to build that business into something great only to see those efforts lost in the result. If we stop thinking in terms of Hours Worked = Dollars Paid we can shift our focus and our expectations from one of, “I have to trade.” To something more profitable like, “I have got to stay disciplined.”

Ask yourself a simple question today. Do I have an urge to trade because of some unreasonable expectation I have been putting on myself? If the answer is yes there are some simple things you can do to refocus your goals and change your beliefs. You have already begun to ask yourself more empowering questions, so you are one step closer to discovering more empowering answers.

Have you ever found yourself making statements like,

“I’ve got to make some money today.”

“I’ve got to get in this trade.”

“I’ve got to make a move.”

“I need to find some action.”

Is any of this sounding familiar?

For a lot of traders the urge to ‘get in the game’ can be overwhelming. An even more powerful urge can be watching a trade you are in go sideways and wanting to DO something about it. For minutes, hours even days you must sit and wait for the market to either move in your favor, or worse, against you. During such times a traders internal dialoged can be going crazy as he or she struggles with what to do.

You see, we must DO something right? If we’re just sitting at our computer and nothing is happening we must be doing something wrong….right? If there is no action in our trade that means we’re missing the action somewhere else doesn’t it?

Many, many traders get involved in FOREX with dreams of quitting their job, working from home and possibly making more money than they ever thought possible. We can encapsulate all of these ambitions into one simple desire, freedom. Freedom from a job that require us to keep regular hours. Freedom from a boss who tells us what to do and how to do it. Freedom from the fear of losing that job and having nothing. And most of all, freedom from financial stress.

The idea of ‘calling your own shots’ and ‘making your own rules’ is enticing to most traders. We are free thinkers, tend to be fairly risk tolerant, and tend to view money as a tool rather than a commodity. That’s why it might be strange to learn that these same traits can be extremely detrimental to your account balance.

You see, trading (when done correctly) can be quite boring. Sure working in the pits on an exchange or on a high risk trading floor can be exhilarating, but there is nothing exciting about watching your trade move sideways for minutes, hours or days. It takes a great deal of discipline to trade your system day in and day out. Trading requires you to be unemotional. Nothing kills an account quicker than an ego.

But these traits fly in direct opposition to our stated goal….freedom. When we fix ourselves to a set of rules and conditions we MUST follow, we are no longer free. Discretion (read ego) must be set aside. How many of you have purchased a trading system or EA only to second guess it at every turn? The desire to add your own bit of ‘human element’ (read ego) undoubtedly led to loss after loss. Maybe the system was junk to begin with, but how could you really know?

Another heavy contributor to our desire to trade comes from this concept of “time for dollars”. For many of you, trading is not your first carrier. It certainly wasn’t mine. Some of you have spent 10, 15 even 20 years in a carrier before moving into trading. For a large chunk of your adult life you equated ‘hours worked’ to ‘dollars paid’. The overwhelming desire to trade often comes from that unreasonable expectation that we must DO something in order to EARN our paycheck. We MUST trade. Because if we simply sit in our chair and watch the market without trading we have not EARED any money.

Traders, we are not in the ‘got to make money’ business. Our compensation is not determined by how many trades we take, or how long we spend in front of the computer screen. We are PAID (if you must use that term) for our discipline and sound decision making. This means that some weeks we’ll make nothing. On occasion we will lose money. But over time we are profitable because we have a plan we know works and we have the discipline to follow it.

People who have run businesses have an easier time understanding this than those that have not. You see, when you run a business there are days, weeks, even months when you won’t make one penny. You may spend 18 hours a day trying to build that business into something great only to see those efforts lost in the result. If we stop thinking in terms of Hours Worked = Dollars Paid we can shift our focus and our expectations from one of, “I have to trade.” To something more profitable like, “I have got to stay disciplined.”

Ask yourself a simple question today. Do I have an urge to trade because of some unreasonable expectation I have been putting on myself? If the answer is yes there are some simple things you can do to refocus your goals and change your beliefs. You have already begun to ask yourself more empowering questions, so you are one step closer to discovering more empowering answers.

: