LiteFinance / Profil

The online ECN broker LiteFinance (ex. LiteForex) has been providing its clients access to Tier 1 liquidity in the currency, commodity, and stock market since 2005. All major currency pairs and cross rates, oil, precious metals, stock indexes, blue chips, and the largest set of cryptocurrency pairs can be traded at LiteFinance (ex. LiteForex).

Freunde

381

Anfragen

Ausgehend

LiteFinance

Euro is to find a way out. Forecast as of 09.03.2021

The ECB's actions are different from the words, and the adoption of the $1.9-trillion stimulus from Joe Biden in the House of Representatives could suspend Treasuries' sales. Will it support the euro? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

If you have a will, you will find a way. The ECB, stating its willingness to interfere and suspend the euro-area bond yield rally that negatively affects the European economy, has been reducing the volume of asset purchases for the second consecutive week. In the week ended March 5, the net purchases amounted to €11.9 billion; a week earlier, the ECB bought €12 billion. The average purchase pace since the PEPP start has been €18.1 billion per week. The European central bank tries to explain the latter figures with massive redemption amounts. However, if there is a will, they will find a way, won’t they?

The discrepancy between words and facts suggests that the Governing Board meeting on March 11 will not be as dovish as the market expects. This circumstance may support the EURUSD, as the ECB's negative influence has been priced to a great extent. Moreover, the rise in the euro-area bond yields doesn’t worsen the financial conditions in the euro area much, and the recent drop in the euro exchange rate suggests the inflation rate should increase.

To the disappointment of the EURUSD bulls, the European Central Bank is not the only player in the city, and neither is it the most powerful one. Without a break in the US Treasury yields, the dollar buyers will hardly be discouraged. Investors need strong arguments to justify why an 8%-10% expansion in US GDP in the first quarter should not strengthen the greenback.

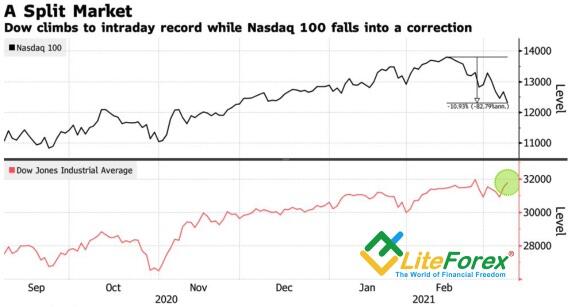

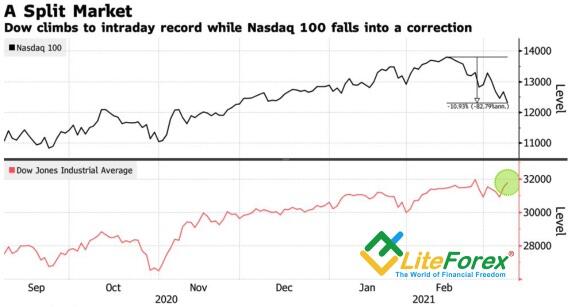

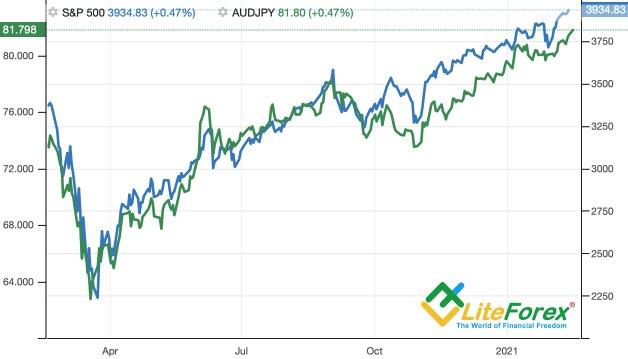

Expecting the US economic rebound, asset managers are selling treasuries and technology stocks and buying equity securities in banking and energy sectors, which are likely to experience explosive growth along with GDP. As a result, the Dow Jones breaks through intraday highs, and the Nasdaq Composite has tumbled into the bearish market, dropping 10% from its February 12 record highs. This kind of divergence in the stock indices’ trends has not occurred since 1993.

In terms of the debt market, investors still don't seem to understand how the Fed's average inflation targeting policy works. They are not willing to get rid of TIPS, which provide clearer Fed policy signals than their counterparts without inflation protection.

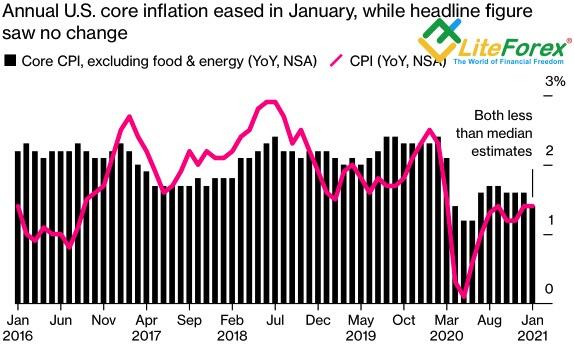

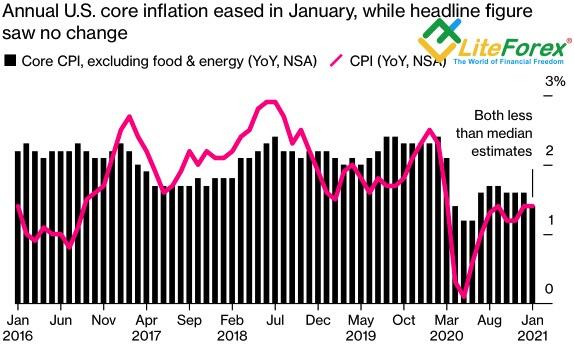

Jerome Powell and his fellow central-bankers believe that the consumer price spike will be temporary. Treasury Secretary Janet Yellen has the same opinion; she noted that the Fed has the tools to act if something goes wrong. The market continues to trade reflation, especially since the House of Representatives may approve the $1.9 fiscal stimulus plan on March 10.

Weekly EURUSD trading plan

I suppose the fiscal stimulus adoption could suspend the Treasury sales. Markets grow on the rumors and fall on the facts; the same applies to the US Treasuries. The EURUSD reached the target at 1.185 indicated earlier. The market could stop falling and find support in the zone of 1.18-1.185.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-is-to-find-a-way-out-forecast-as-of-09032021/?uid=285861726&cid=79634

Dynamics of Dow Jones and Nasdaq Composite

The ECB's actions are different from the words, and the adoption of the $1.9-trillion stimulus from Joe Biden in the House of Representatives could suspend Treasuries' sales. Will it support the euro? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

If you have a will, you will find a way. The ECB, stating its willingness to interfere and suspend the euro-area bond yield rally that negatively affects the European economy, has been reducing the volume of asset purchases for the second consecutive week. In the week ended March 5, the net purchases amounted to €11.9 billion; a week earlier, the ECB bought €12 billion. The average purchase pace since the PEPP start has been €18.1 billion per week. The European central bank tries to explain the latter figures with massive redemption amounts. However, if there is a will, they will find a way, won’t they?

The discrepancy between words and facts suggests that the Governing Board meeting on March 11 will not be as dovish as the market expects. This circumstance may support the EURUSD, as the ECB's negative influence has been priced to a great extent. Moreover, the rise in the euro-area bond yields doesn’t worsen the financial conditions in the euro area much, and the recent drop in the euro exchange rate suggests the inflation rate should increase.

To the disappointment of the EURUSD bulls, the European Central Bank is not the only player in the city, and neither is it the most powerful one. Without a break in the US Treasury yields, the dollar buyers will hardly be discouraged. Investors need strong arguments to justify why an 8%-10% expansion in US GDP in the first quarter should not strengthen the greenback.

Expecting the US economic rebound, asset managers are selling treasuries and technology stocks and buying equity securities in banking and energy sectors, which are likely to experience explosive growth along with GDP. As a result, the Dow Jones breaks through intraday highs, and the Nasdaq Composite has tumbled into the bearish market, dropping 10% from its February 12 record highs. This kind of divergence in the stock indices’ trends has not occurred since 1993.

In terms of the debt market, investors still don't seem to understand how the Fed's average inflation targeting policy works. They are not willing to get rid of TIPS, which provide clearer Fed policy signals than their counterparts without inflation protection.

Jerome Powell and his fellow central-bankers believe that the consumer price spike will be temporary. Treasury Secretary Janet Yellen has the same opinion; she noted that the Fed has the tools to act if something goes wrong. The market continues to trade reflation, especially since the House of Representatives may approve the $1.9 fiscal stimulus plan on March 10.

Weekly EURUSD trading plan

I suppose the fiscal stimulus adoption could suspend the Treasury sales. Markets grow on the rumors and fall on the facts; the same applies to the US Treasuries. The EURUSD reached the target at 1.185 indicated earlier. The market could stop falling and find support in the zone of 1.18-1.185.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-is-to-find-a-way-out-forecast-as-of-09032021/?uid=285861726&cid=79634

Dynamics of Dow Jones and Nasdaq Composite

LiteFinance

Dollar is a tough nut to crack. Forecast as of 08.03.2021

A strong reading of the US jobs report for February results in a new wave of sell-offs of the US treasuries and the EURUSD. Is the euro uptrend broken? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

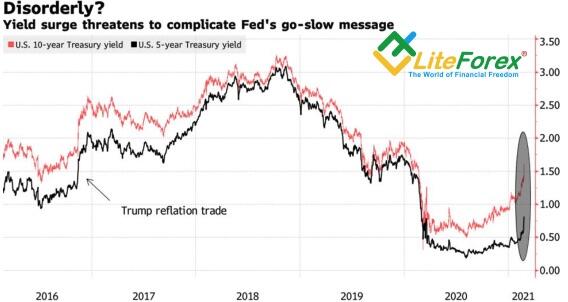

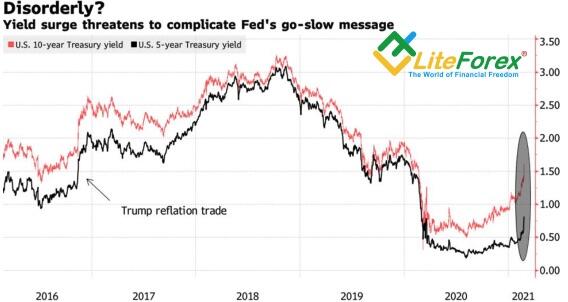

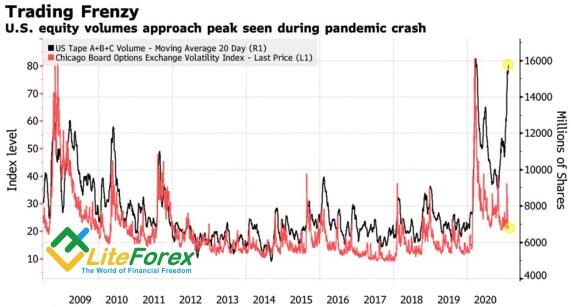

Jerome Powell is a tough nut to crack. The US bond market continues to test the Fed’s strength. A strong report on the US employment for February has sent the Treasury yield above 1.6%, the highest level since February 2020, strengthening the US dollar. The EURUSD rate went down in a momentum below 1.9. Only the S&P 500 price rise prevented the euro bears from driving the price lower.

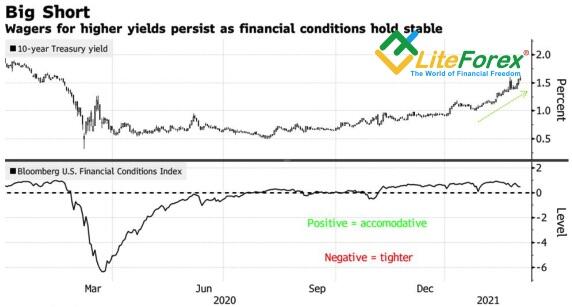

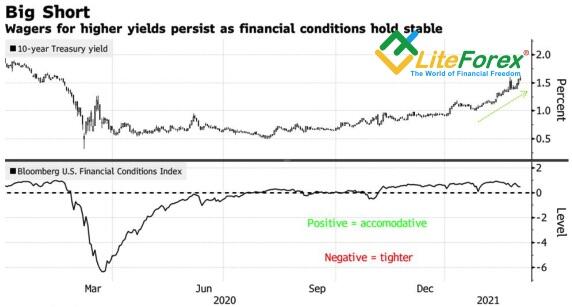

Investors wonder if the Treasury yields are high enough to encourage the Fed to take active steps. The US unemployment rate in February was down to 6.2%, nonfarm payrolls added 379,000 new jobs, and the January data have been revised up. Therefore, the Fed should start speaking about monetary normalization. On the other hand, there are 9.5 million fewer jobs in the United States than before the pandemic. The labor market has a long way to recover, and the Fed prioritizes financial conditions when making decisions. The financial conditions in the US suggest that the Fed could still remain passive for a long time.

The latest Commodity Futures Trading Commission data show that the US bond market faced the worst sell-off ever in the week ended March 2. Nonprofit traders were exiting long positions at a record pace. According to TD Securities, net longs fell by $ 45 billion. As 10-year Treasury yield increased by 45 bps, the US equity market capitalization decreased by $ 4 trillion from its high in mid-February.

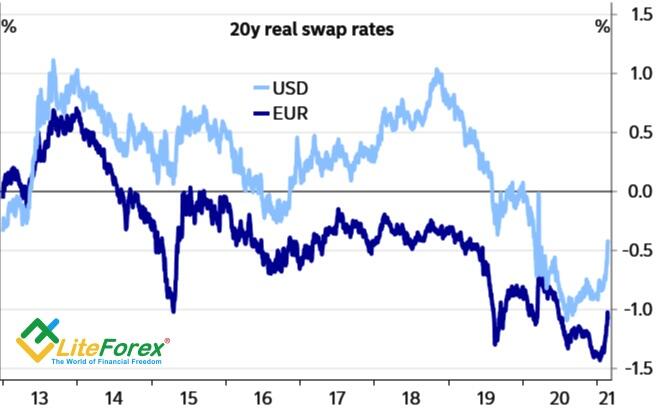

The increased popularity of the US assets and the growing demand for the greenback as a safe-haven encourage the EURUSD bears to go ahead. Based on the differences in the interest swap market, the euro is considerably overvalued against the US dollar.

It seems the euro uptrend has reversed down. However, I still believe the EURUSD bulls will regain the impulse because of the strength of the US and Chinese economies and the acceleration of vaccinations in the EU. Even if the euro resumes the uptrend later than previously expected, the second quarter may be radically different from the first. Indirectly, the change in the balance of power in the April-June quarter is indicated by the growth of US imports of goods and services by 1.2% MoM in January and the record expansion of Chinese exports in February. Furthermore, the US and the EU decided to suspend import tariffs in the Airbus-Boeing case.

Weekly EURUSD trading plan

After all, the US dollar is the Forex winner as of now. The greenback growth is especially strong against the non-commodity currencies. By and large, traders should enter short-term sell trades as the EURUSD bulls failed to consolidate the price above the resistance levels of 1.1935 and 1.1975.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-a-tough-nut-to-crack-forecast-as-of-08032021/?uid=285861726&cid=79634

Dynamics of financial conditions and 10-year Treasury yield

A strong reading of the US jobs report for February results in a new wave of sell-offs of the US treasuries and the EURUSD. Is the euro uptrend broken? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

Jerome Powell is a tough nut to crack. The US bond market continues to test the Fed’s strength. A strong report on the US employment for February has sent the Treasury yield above 1.6%, the highest level since February 2020, strengthening the US dollar. The EURUSD rate went down in a momentum below 1.9. Only the S&P 500 price rise prevented the euro bears from driving the price lower.

Investors wonder if the Treasury yields are high enough to encourage the Fed to take active steps. The US unemployment rate in February was down to 6.2%, nonfarm payrolls added 379,000 new jobs, and the January data have been revised up. Therefore, the Fed should start speaking about monetary normalization. On the other hand, there are 9.5 million fewer jobs in the United States than before the pandemic. The labor market has a long way to recover, and the Fed prioritizes financial conditions when making decisions. The financial conditions in the US suggest that the Fed could still remain passive for a long time.

The latest Commodity Futures Trading Commission data show that the US bond market faced the worst sell-off ever in the week ended March 2. Nonprofit traders were exiting long positions at a record pace. According to TD Securities, net longs fell by $ 45 billion. As 10-year Treasury yield increased by 45 bps, the US equity market capitalization decreased by $ 4 trillion from its high in mid-February.

The increased popularity of the US assets and the growing demand for the greenback as a safe-haven encourage the EURUSD bears to go ahead. Based on the differences in the interest swap market, the euro is considerably overvalued against the US dollar.

It seems the euro uptrend has reversed down. However, I still believe the EURUSD bulls will regain the impulse because of the strength of the US and Chinese economies and the acceleration of vaccinations in the EU. Even if the euro resumes the uptrend later than previously expected, the second quarter may be radically different from the first. Indirectly, the change in the balance of power in the April-June quarter is indicated by the growth of US imports of goods and services by 1.2% MoM in January and the record expansion of Chinese exports in February. Furthermore, the US and the EU decided to suspend import tariffs in the Airbus-Boeing case.

Weekly EURUSD trading plan

After all, the US dollar is the Forex winner as of now. The greenback growth is especially strong against the non-commodity currencies. By and large, traders should enter short-term sell trades as the EURUSD bulls failed to consolidate the price above the resistance levels of 1.1935 and 1.1975.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-a-tough-nut-to-crack-forecast-as-of-08032021/?uid=285861726&cid=79634

Dynamics of financial conditions and 10-year Treasury yield

LiteFinance

Dollar conquered the market. Forecast as of 05.03.2021

The increasing popularity of US assets and a rise in the safe-have demand during the S&P 500 correction allowed the EURUSD bears to drop the price below 1.2. What is next? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

If the current US President were Donald Trump, he would instantly call Jerome Powell an enemy of the United States. After the Fed Chair’s speech, the US stock indexes are rolling down. The Fed doesn’t seem to worry about a drop in the US stock index prices. Why should it? The US economic recovery is far from being complete, and the S&P 500 has risen too high. The US stock benchmark is overvalued, so why shouldn’t it go down into a correction? The drawdown in the US stock market usually supports the EURUSD bears.

The unstable market has been shaken even stronger after Powell reiterated his intention to keep easy-money policies in place, saying the US is still a long way from the Fed’s goals of maximum employment and inflation averaging 2% over time. The Fed focuses not on a single component of financial conditions but on overall economic performance aggregated data. The Fed chairman would be worried (that is, he is not worried at the moment) about the turmoil in the financial markets or the constant tightening of financial conditions, which would create obstacles to the achievement of the Fed goals. Powell seems to want to sound dovish, but when investors are worried, they can’t interpret his hints correctly.

Treasury yields rose sharply, stocks hit another wave of sell-offs, and the US dollar strengthened. Obviously, the EURUSD bears are supported by both the growing attractiveness of US assets and the increased demand for safe-haven currencies during the S&P 500 correction. Treasury yield spreads have grown over the past few weeks compared to their Japanese and European peers, which especially strongly affected the yen and the Swiss franc positions.

Investors believe that the 10-year Treasury yield could be up to 1.75% or even 2%, which encourages the USD bulls.

I believe the causes are more complex. Investors are frustrated that the global economic recovery is slow, varied, and uneven. The vaccination is relatively slow in the EU, where so far, only 8 doses have been given for every 100 people, compared with 24 in the US and 32 in Britain. Furthermore, the WHO has announced that in the euro-area, after six weeks of decline, the number of new COVID-19 cases has begun to rise again. That is why the markets doubt that the global economy will recover soon. The situation is fueled by the greenback strengthening, which tightens financial conditions in emerging markets, as they are heavily dependent on dollar funding.

The USA looks like an island of stability in the global ocean of turmoil. The US GDP could expand by 10% in the first quarter, and the Treasury yield growth signals the US economy’s strength.

Weekly EURUSD trading plan

The EURUSD won’t go up until there are any signs that the euro-area economic and epidemiological conditions are improving. As I expected, Jerome Powell’s speech sent the euro-dollar down below 1.2. If the price breaks out the supports at 1.195 and 1.1935, the euro could drop to $1.185-$1.188.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-conquered-the-market-forecast-as-of-05032021/?uid=285861726&cid=79634

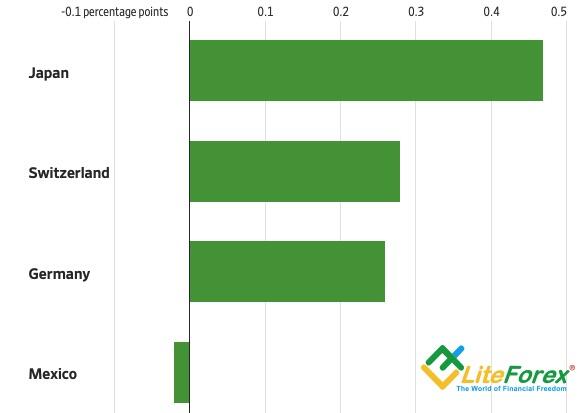

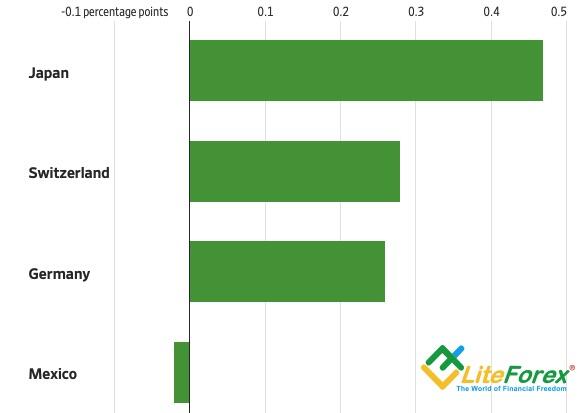

Changes in the bond yield spreads

The increasing popularity of US assets and a rise in the safe-have demand during the S&P 500 correction allowed the EURUSD bears to drop the price below 1.2. What is next? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

If the current US President were Donald Trump, he would instantly call Jerome Powell an enemy of the United States. After the Fed Chair’s speech, the US stock indexes are rolling down. The Fed doesn’t seem to worry about a drop in the US stock index prices. Why should it? The US economic recovery is far from being complete, and the S&P 500 has risen too high. The US stock benchmark is overvalued, so why shouldn’t it go down into a correction? The drawdown in the US stock market usually supports the EURUSD bears.

The unstable market has been shaken even stronger after Powell reiterated his intention to keep easy-money policies in place, saying the US is still a long way from the Fed’s goals of maximum employment and inflation averaging 2% over time. The Fed focuses not on a single component of financial conditions but on overall economic performance aggregated data. The Fed chairman would be worried (that is, he is not worried at the moment) about the turmoil in the financial markets or the constant tightening of financial conditions, which would create obstacles to the achievement of the Fed goals. Powell seems to want to sound dovish, but when investors are worried, they can’t interpret his hints correctly.

Treasury yields rose sharply, stocks hit another wave of sell-offs, and the US dollar strengthened. Obviously, the EURUSD bears are supported by both the growing attractiveness of US assets and the increased demand for safe-haven currencies during the S&P 500 correction. Treasury yield spreads have grown over the past few weeks compared to their Japanese and European peers, which especially strongly affected the yen and the Swiss franc positions.

Investors believe that the 10-year Treasury yield could be up to 1.75% or even 2%, which encourages the USD bulls.

I believe the causes are more complex. Investors are frustrated that the global economic recovery is slow, varied, and uneven. The vaccination is relatively slow in the EU, where so far, only 8 doses have been given for every 100 people, compared with 24 in the US and 32 in Britain. Furthermore, the WHO has announced that in the euro-area, after six weeks of decline, the number of new COVID-19 cases has begun to rise again. That is why the markets doubt that the global economy will recover soon. The situation is fueled by the greenback strengthening, which tightens financial conditions in emerging markets, as they are heavily dependent on dollar funding.

The USA looks like an island of stability in the global ocean of turmoil. The US GDP could expand by 10% in the first quarter, and the Treasury yield growth signals the US economy’s strength.

Weekly EURUSD trading plan

The EURUSD won’t go up until there are any signs that the euro-area economic and epidemiological conditions are improving. As I expected, Jerome Powell’s speech sent the euro-dollar down below 1.2. If the price breaks out the supports at 1.195 and 1.1935, the euro could drop to $1.185-$1.188.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-conquered-the-market-forecast-as-of-05032021/?uid=285861726&cid=79634

Changes in the bond yield spreads

LiteFinance

Dollar teases Fed. Forecast as of 04.03.2021

Weekly US dollar fundamental forecast

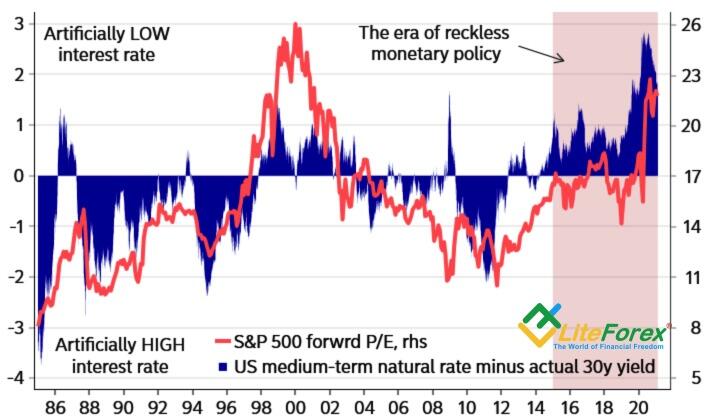

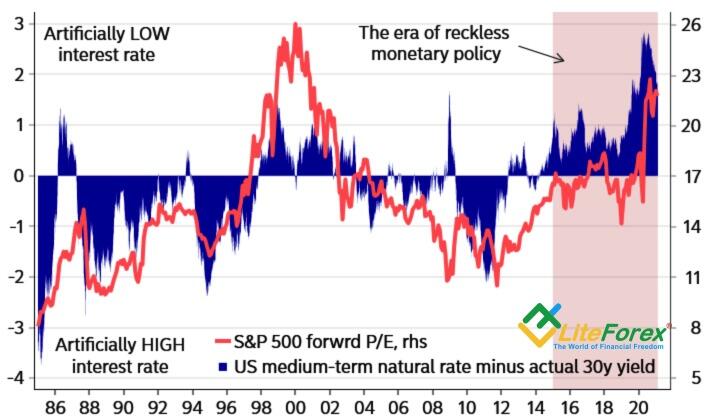

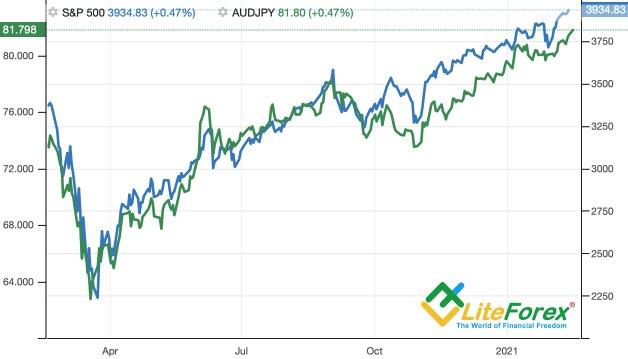

The turmoil in the stock market caused by the US Treasury yield growth is something that we will have to get used to. The problem is that the current generation of investors is simply not ready for shocks. They have never seen a real bear market in the S&P 500. That is why the Treasury yield rally shakes the stock indexes.

The US equity market, like the EURUSD, has been down. The US PMI has reached the highest level since 2016, according to Markit. The ISM services PMI has been growing for nine consecutive months. According to the Beige Book, most businesses in the USA remain optimistic regarding the next six to 12 months. Furthermore, the ADP private-sector employment has been increasing during the last nine months out of ten. The above-listed factors have pushed the Treasury yields up, sending down the US stock indexes and supporting the greenback. Yes, there was a slowdown in the ISM PMI, but the decline is temporary due to bad weather. This is proven by the rise in the ISM index of order backlogs to a six-month high, while the export demand was the strongest since June.

According to Bloomberg, the primary driver of the Treasury yield rally is the confidence in the US economic rebound, while the Fed's monetary policy and the increase in Treasury issuance are less significant factors.

Atlanta Fed’s leading indicator signals that the US GDP will expand by 10% in the first quarter, encouraging investors to sell the US bonds. The market seems to continue testing the Fed’s persistence. Yes, the principle 'don't fight against the Fed’ is still valid, but the markets have become stronger due to massive monetary stimulus. By the end of 2019, the assets of funds around the world were $ 89 trillion, which exceeds both the balance sheets of the leading central banks ($ 25 trillion) and the size of the global economy.

Therefore, traders need to get used to regular surges in Treasury yields that overvalue stocks (primarily tech stocks) and lead to pullbacks in stock indexes. According to FactSet, the S&P 500 P/E is 22, close to its highest value in 20 years. For comparison, in December 2009, 6 months after the recession, it was 14.

Weekly EURUSD trading plan

The FOMC officials seem to be unwilling to clamp down on the US bonds sales. Federal Reserve Bank of Chicago President Charles Evans joined with his colleagues, saying he was unworried about the Treasury yield rally. If Jerome Powell says the same, and the US jobs report for February is strong, the bond rates rally will continue. If so, the EURUSD could go down below 1.2. I hope the Fed’s Chair will express concerns about the negative impact of Treasury yield growth on the US financial conditions, which will allow the euro to go back above $1.2.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-teases-fed-forecast-as-of-04032021/?uid=285861726&cid=79634

Dynamics of drivers of Treasury yield change

Weekly US dollar fundamental forecast

The turmoil in the stock market caused by the US Treasury yield growth is something that we will have to get used to. The problem is that the current generation of investors is simply not ready for shocks. They have never seen a real bear market in the S&P 500. That is why the Treasury yield rally shakes the stock indexes.

The US equity market, like the EURUSD, has been down. The US PMI has reached the highest level since 2016, according to Markit. The ISM services PMI has been growing for nine consecutive months. According to the Beige Book, most businesses in the USA remain optimistic regarding the next six to 12 months. Furthermore, the ADP private-sector employment has been increasing during the last nine months out of ten. The above-listed factors have pushed the Treasury yields up, sending down the US stock indexes and supporting the greenback. Yes, there was a slowdown in the ISM PMI, but the decline is temporary due to bad weather. This is proven by the rise in the ISM index of order backlogs to a six-month high, while the export demand was the strongest since June.

According to Bloomberg, the primary driver of the Treasury yield rally is the confidence in the US economic rebound, while the Fed's monetary policy and the increase in Treasury issuance are less significant factors.

Atlanta Fed’s leading indicator signals that the US GDP will expand by 10% in the first quarter, encouraging investors to sell the US bonds. The market seems to continue testing the Fed’s persistence. Yes, the principle 'don't fight against the Fed’ is still valid, but the markets have become stronger due to massive monetary stimulus. By the end of 2019, the assets of funds around the world were $ 89 trillion, which exceeds both the balance sheets of the leading central banks ($ 25 trillion) and the size of the global economy.

Therefore, traders need to get used to regular surges in Treasury yields that overvalue stocks (primarily tech stocks) and lead to pullbacks in stock indexes. According to FactSet, the S&P 500 P/E is 22, close to its highest value in 20 years. For comparison, in December 2009, 6 months after the recession, it was 14.

Weekly EURUSD trading plan

The FOMC officials seem to be unwilling to clamp down on the US bonds sales. Federal Reserve Bank of Chicago President Charles Evans joined with his colleagues, saying he was unworried about the Treasury yield rally. If Jerome Powell says the same, and the US jobs report for February is strong, the bond rates rally will continue. If so, the EURUSD could go down below 1.2. I hope the Fed’s Chair will express concerns about the negative impact of Treasury yield growth on the US financial conditions, which will allow the euro to go back above $1.2.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-teases-fed-forecast-as-of-04032021/?uid=285861726&cid=79634

Dynamics of drivers of Treasury yield change

LiteFinance

Euro is trapped in the illusion. Forecast as of 03.03.2021

While the ECB uses verbal interventions, the change in the Fed’s tone stabilizes the global bond market. How will it influence the EURUSD? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

To solve the problem, one should know the causes. The ECB officials associate the drop in the euro-area bond yields with their announcements. However, they are wrong. The rally of the global bond market rates started in the USA amid the expectations of fiscal stimulus and rapid recovery of the US economy. It means the Fed, not the other world’s central bank, should solve the problem. A change in the FOMC officials' tone has stabilized the bond market, discouraging the EURUSD bears.

ECB Executive Board member Fabio Panetta said Tuesday that the jump in government-bond yields seen in recent weeks “is unwelcome and must be resisted.” The European Central Bank evaluates market conditions; it can intervene and change the scale of asset purchases. Vice President Luis de Guindos said the ECB has room for maneuver, and it has ammunition. The ECB has the flexibility to react to yield rise by changing the QE pace if necessary.

Verbal interventions seem to have become fashionable. The ECB officials may assume that their announcements discouraged the EURUSD bulls in January and clamped down on March's bond sales. Nonetheless, the euro failed to continue the rally amid a slow vaccination process in the euro area and the economic expansion divergence. The global bond market has also stabilized because of different reasons.

Taking into account the Fed’s significance in fighting the recession, it is natural that investors pay attention to the speeches of the Fed’s members. A couple of days ago, I noted that to stop the rally in Treasury yields, the Fed would only need to express concern about the negative impact of rising US debt market rates on financial conditions. As soon as Governor Lael Brainard expressed concerns about the Treasury yield rally, the bond sell-offs slowed down, and the EURUSD price went up.

It should be noted that the current levels of Treasury yields are attractive to foreign investors. Currency-hedged Treasury yields have hit the highest level since 2017. That is why foreign investors are willing to buy US bonds, which calms down the market.

Of course, the bond market has not been fully stabilized. Investors are concerned about two questions. Will the Treasury yield surge amid the US strong PMI and employment data, strengthening the US dollar? Will other FOMC members change the tone in their speeches in the first week of March?

Weekly EURUSD trading plan

Even if the Treasury yields continue rising, the euro bulls should not be discouraged; it is only essential that they should not grow as fast as they did in late February. The EURUSD has consolidated at the lower border of the consolidation range 1.2-1.22, so it could resume the uptrend. Continue focus on purchases, closely monitoring the tests of the resistances at 1.21 and 1.2125.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-is-trapped-in-the-illusion-forecast-as-of-03032021/?uid=285861726&cid=79634

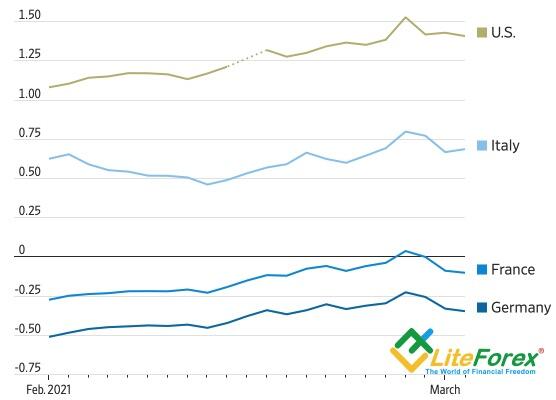

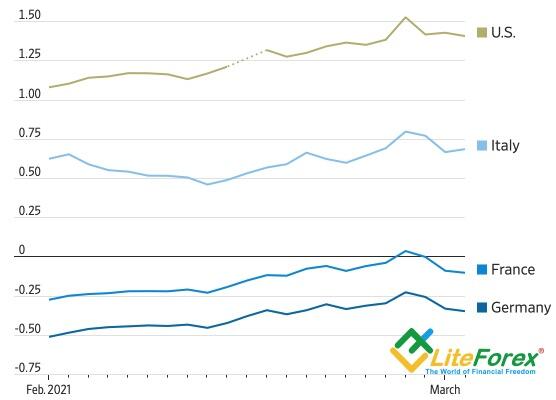

Dynamics of bond yields

While the ECB uses verbal interventions, the change in the Fed’s tone stabilizes the global bond market. How will it influence the EURUSD? Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

To solve the problem, one should know the causes. The ECB officials associate the drop in the euro-area bond yields with their announcements. However, they are wrong. The rally of the global bond market rates started in the USA amid the expectations of fiscal stimulus and rapid recovery of the US economy. It means the Fed, not the other world’s central bank, should solve the problem. A change in the FOMC officials' tone has stabilized the bond market, discouraging the EURUSD bears.

ECB Executive Board member Fabio Panetta said Tuesday that the jump in government-bond yields seen in recent weeks “is unwelcome and must be resisted.” The European Central Bank evaluates market conditions; it can intervene and change the scale of asset purchases. Vice President Luis de Guindos said the ECB has room for maneuver, and it has ammunition. The ECB has the flexibility to react to yield rise by changing the QE pace if necessary.

Verbal interventions seem to have become fashionable. The ECB officials may assume that their announcements discouraged the EURUSD bulls in January and clamped down on March's bond sales. Nonetheless, the euro failed to continue the rally amid a slow vaccination process in the euro area and the economic expansion divergence. The global bond market has also stabilized because of different reasons.

Taking into account the Fed’s significance in fighting the recession, it is natural that investors pay attention to the speeches of the Fed’s members. A couple of days ago, I noted that to stop the rally in Treasury yields, the Fed would only need to express concern about the negative impact of rising US debt market rates on financial conditions. As soon as Governor Lael Brainard expressed concerns about the Treasury yield rally, the bond sell-offs slowed down, and the EURUSD price went up.

It should be noted that the current levels of Treasury yields are attractive to foreign investors. Currency-hedged Treasury yields have hit the highest level since 2017. That is why foreign investors are willing to buy US bonds, which calms down the market.

Of course, the bond market has not been fully stabilized. Investors are concerned about two questions. Will the Treasury yield surge amid the US strong PMI and employment data, strengthening the US dollar? Will other FOMC members change the tone in their speeches in the first week of March?

Weekly EURUSD trading plan

Even if the Treasury yields continue rising, the euro bulls should not be discouraged; it is only essential that they should not grow as fast as they did in late February. The EURUSD has consolidated at the lower border of the consolidation range 1.2-1.22, so it could resume the uptrend. Continue focus on purchases, closely monitoring the tests of the resistances at 1.21 and 1.2125.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-is-trapped-in-the-illusion-forecast-as-of-03032021/?uid=285861726&cid=79634

Dynamics of bond yields

LiteFinance

Euro believes ECB's words. Forecast as of 02.03.2021

When the market doubts the Fed’s willingness to remain passive for a long time and believes the ECB should hold back the euro-area bond yield growth, the euro can’t but fall. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

Do not believe your eyes, believe your ears. Perhaps the European Central Bank chose not the best time to announce its intentions to counter the euro-area bond yield growth, but investors believed the words. Investors ignored a slowdown in the ECB assets purchases volume within the quantitative easing program and started to sell the EURUSD amid the strongest verbal intervention by the ECB officials.

Bank of France (BoF) Governor Francois Villeroy de Galhau said the European Central Bank “can and must react against” any unwarranted rise in bond yields that threaten to undermine the euro-area economy. The ECB’s concern is natural, as the euro-area yields are rising, unlike the trade-weighted euro, which was targeted by verbal interventions in January-February.

ECB says it is willing to accelerate asset purchases but reduces the purchase pace, in fact, which does not seem to be the right solution. In the last week of February, the ECB settled €12 billion ($14.5 billion) of net purchases under its emergency program, compared to €17.2 billion the week before. However, the total figures have been distorted by the enormous volumes of redemptions. The French government alone redeemed a 3-year bond last week, which had €31 billion outstanding.

When the market believes the ECB’s words and continues to test the Fed’s persistence, the EURUSD can’t but fall. Investors prefer to face facts. While the growth in Treasury bond yields due to the rapid recovery of the US economy and expectations of fiscal stimulus is logical, the increase in the euro-area debt market rates amid a double-dip recession is not a norm. And the ECB is willing to interfere in the bond market to overcome the situation.

According to Bloomberg estimates, if the US Congress adopts the $1.9 trillion aid package offered by Joe Biden, US GDP will return to pre-pandemic levels by mid-2021 and will expand by 7.4% by the end of this year. The euro area is lagging far behind. Divergence in economic growth continues to support the EURUSD bears. However, Forex likes wise and forward-looking traders.

Due to massive fiscal stimulus, the US has accumulated significant deferred demand, which a record savings level confirms. The US manufacturing sector will not grow fast enough to satisfy the demand in 2021. US domestic market will require imports, creating a strong tailwind for European exports. That is why I believe that the EURUSD uptrend should resume. However, the scenario, implying the US should support the euro-area growth, should take its time to work out. In the meanwhile, the euro could continue falling.

Weekly EURUSD trading plan

The euro bulls face a hard challenge, and they should not allow the price to break out the supports at 1.2 and 1.1985. If the buyers hold up the supports, the EURUSD will continue consolidation in the range of 1.2-1.22. If the price breaks out the support levels downside, the euro will continue sliding down towards $1.194 and 1.188. Take your trading decisions according to the closing prices of the bars during the support tests.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-believes-ecbs-words-forecast-as-of-02032021/?uid=285861726&cid=79634

Dynamics of swap rates and euro

When the market doubts the Fed’s willingness to remain passive for a long time and believes the ECB should hold back the euro-area bond yield growth, the euro can’t but fall. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

Do not believe your eyes, believe your ears. Perhaps the European Central Bank chose not the best time to announce its intentions to counter the euro-area bond yield growth, but investors believed the words. Investors ignored a slowdown in the ECB assets purchases volume within the quantitative easing program and started to sell the EURUSD amid the strongest verbal intervention by the ECB officials.

Bank of France (BoF) Governor Francois Villeroy de Galhau said the European Central Bank “can and must react against” any unwarranted rise in bond yields that threaten to undermine the euro-area economy. The ECB’s concern is natural, as the euro-area yields are rising, unlike the trade-weighted euro, which was targeted by verbal interventions in January-February.

ECB says it is willing to accelerate asset purchases but reduces the purchase pace, in fact, which does not seem to be the right solution. In the last week of February, the ECB settled €12 billion ($14.5 billion) of net purchases under its emergency program, compared to €17.2 billion the week before. However, the total figures have been distorted by the enormous volumes of redemptions. The French government alone redeemed a 3-year bond last week, which had €31 billion outstanding.

When the market believes the ECB’s words and continues to test the Fed’s persistence, the EURUSD can’t but fall. Investors prefer to face facts. While the growth in Treasury bond yields due to the rapid recovery of the US economy and expectations of fiscal stimulus is logical, the increase in the euro-area debt market rates amid a double-dip recession is not a norm. And the ECB is willing to interfere in the bond market to overcome the situation.

According to Bloomberg estimates, if the US Congress adopts the $1.9 trillion aid package offered by Joe Biden, US GDP will return to pre-pandemic levels by mid-2021 and will expand by 7.4% by the end of this year. The euro area is lagging far behind. Divergence in economic growth continues to support the EURUSD bears. However, Forex likes wise and forward-looking traders.

Due to massive fiscal stimulus, the US has accumulated significant deferred demand, which a record savings level confirms. The US manufacturing sector will not grow fast enough to satisfy the demand in 2021. US domestic market will require imports, creating a strong tailwind for European exports. That is why I believe that the EURUSD uptrend should resume. However, the scenario, implying the US should support the euro-area growth, should take its time to work out. In the meanwhile, the euro could continue falling.

Weekly EURUSD trading plan

The euro bulls face a hard challenge, and they should not allow the price to break out the supports at 1.2 and 1.1985. If the buyers hold up the supports, the EURUSD will continue consolidation in the range of 1.2-1.22. If the price breaks out the support levels downside, the euro will continue sliding down towards $1.194 and 1.188. Take your trading decisions according to the closing prices of the bars during the support tests.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-believes-ecbs-words-forecast-as-of-02032021/?uid=285861726&cid=79634

Dynamics of swap rates and euro

LiteFinance

Dollar gives little to pay the debts. Forecast as of 01.03.2021

Weekly US dollar fundamental forecast

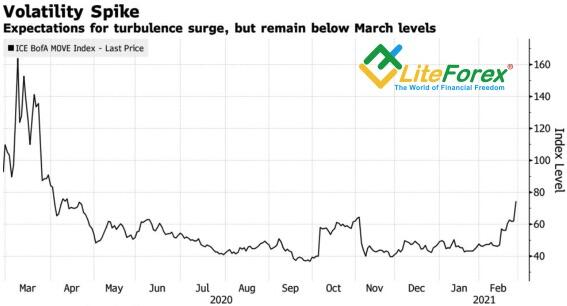

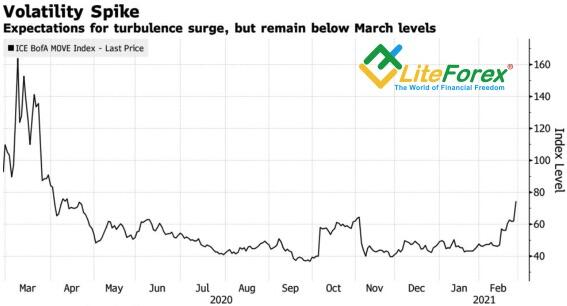

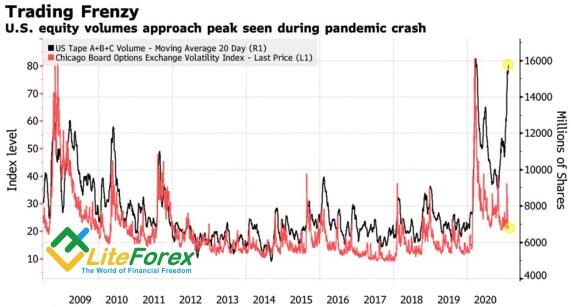

When the US dollar is following the yields on the US government bonds, it is strengthening against the basket of major currencies amid the sale of $21 trillion in the Treasury market, the most significant sell-off since November. According to Jefferies International, investors faced the largest debt deficit at the end of February since the taper tantrum in 2013. The need to balance portfolios at the end of the month stabilized the market. How long will the balance continue?

At the end of 2020, Bloomberg’s experts expected the US 10-year Treasury yield to grow from 1% to 1.5% amid the US economy's recovery, but few could have imagined that everything would happen so quickly. When debt rates rise, in theory, stockholders should not worry. Rapid GDP growth tends to lead to higher corporate profits, which should support the S&P 500. It seems that the rally in Treasury yields is not only due to the belief in a rapid recovery of the US economy, as the FOMC officials claim. And the surge in bond market volatility suggests that it is too early to give up on bond sales.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-gives-little-to-pay-the-debts-forecast-as-of-01032021/?uid=285861726&cid=79634

Dynamics of US bond market volatility

Weekly US dollar fundamental forecast

When the US dollar is following the yields on the US government bonds, it is strengthening against the basket of major currencies amid the sale of $21 trillion in the Treasury market, the most significant sell-off since November. According to Jefferies International, investors faced the largest debt deficit at the end of February since the taper tantrum in 2013. The need to balance portfolios at the end of the month stabilized the market. How long will the balance continue?

At the end of 2020, Bloomberg’s experts expected the US 10-year Treasury yield to grow from 1% to 1.5% amid the US economy's recovery, but few could have imagined that everything would happen so quickly. When debt rates rise, in theory, stockholders should not worry. Rapid GDP growth tends to lead to higher corporate profits, which should support the S&P 500. It seems that the rally in Treasury yields is not only due to the belief in a rapid recovery of the US economy, as the FOMC officials claim. And the surge in bond market volatility suggests that it is too early to give up on bond sales.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-gives-little-to-pay-the-debts-forecast-as-of-01032021/?uid=285861726&cid=79634

Dynamics of US bond market volatility

LiteFinance

Dollar tested Fed. Forecast as of 26.02.2021

Traders using fundamental analysis should have been satisfied. Strong euro-area domestic data resulted in the euro growth; strong US economic data supported the dollar. However, the market drivers are far more complex. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

A basic rule to trade in the financial markets suggests investors should not go against the Fed. But sometimes people want to play against the rules, especially since it can yield a significant profit. This is what George Soros did in the 1990s, betting against the Bank of England and making his billion dollars on it. History knows many other examples. Therefore, the best daily growth in Treasury yields is not surprising; the market is likely to test the Fed's strength.

The Fed presidents agreed with Jerome Powell’s patience in making any adjustments to monetary policy. Atlanta’s Fed president, Raphael Bostic, is not concerned about a rise in yields, suggesting the Fed should not respond to it. Some other Fed leaders, New York’s John Williams and Kansas City’s Esther George, believe that the Treasury yield surge likely reflects growing optimism in the strength of the recovery. The US bond yields accelerated after jobless claims slumped and durable goods orders rose at the fastest pace since summer.

The Treasuries sell-offs press down the US stock market. It's one thing to buy equity securities when rates are low and another thing when the rates are sharply increasing. The stocks (especially tech stocks) look overvalued according to the fundamental gauge, and investors look for alternatives. The tech-heavy Nasdaq Composite index dropped by 3%, which signals a decline in the global risk appetite. That is why the US dollar strengthened.

Thus, investors seem to be testing the Fed's persistance, carefully observing how Jerome Powell will behave under pressure. Usually, a rapid rally in Treasury yields indicates a rapid rise in inflation and forces the central bank to normalize monetary policy. I would suggest that the Fed will withstand the pressure. For the first time since 2008, there has appeared a signal in the bond market known as an inversion of the break-even curve. The difference between the yields on ordinary Treasuries and the yields on inflation-protected Treasuries (TIPS) is more significant for the short-term papers than for the long-term ones. It signals that the inflation rise will be temporary. That is the position the Fed sticks to.

Besides, there are more growth drivers for the euro, both global and domestic. The euro-area economic confidence index has been up to almost an annual high. Furthermore, the international trader is recovering faster than after the previous crisis. Therefore, I suggest it is still relevant to buy the EURUSD.

Weekly EURUSD trading plan

The EURUSD bulls failed to consolidate above the upper border of the consolidation range of 1.2-1.22, which signals their weakness and increases the chance of further correction down if the price breaks out the support at 1.214. Nonetheless, if you are going to enter short-term sell trades, be careful, set short targets, and be prepared to exit sales at any moment.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-tested-fed-forecast-as-of-26022021/?uid=285861726&cid=79634

Dynamics of US government bond yields

Traders using fundamental analysis should have been satisfied. Strong euro-area domestic data resulted in the euro growth; strong US economic data supported the dollar. However, the market drivers are far more complex. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

A basic rule to trade in the financial markets suggests investors should not go against the Fed. But sometimes people want to play against the rules, especially since it can yield a significant profit. This is what George Soros did in the 1990s, betting against the Bank of England and making his billion dollars on it. History knows many other examples. Therefore, the best daily growth in Treasury yields is not surprising; the market is likely to test the Fed's strength.

The Fed presidents agreed with Jerome Powell’s patience in making any adjustments to monetary policy. Atlanta’s Fed president, Raphael Bostic, is not concerned about a rise in yields, suggesting the Fed should not respond to it. Some other Fed leaders, New York’s John Williams and Kansas City’s Esther George, believe that the Treasury yield surge likely reflects growing optimism in the strength of the recovery. The US bond yields accelerated after jobless claims slumped and durable goods orders rose at the fastest pace since summer.

The Treasuries sell-offs press down the US stock market. It's one thing to buy equity securities when rates are low and another thing when the rates are sharply increasing. The stocks (especially tech stocks) look overvalued according to the fundamental gauge, and investors look for alternatives. The tech-heavy Nasdaq Composite index dropped by 3%, which signals a decline in the global risk appetite. That is why the US dollar strengthened.

Thus, investors seem to be testing the Fed's persistance, carefully observing how Jerome Powell will behave under pressure. Usually, a rapid rally in Treasury yields indicates a rapid rise in inflation and forces the central bank to normalize monetary policy. I would suggest that the Fed will withstand the pressure. For the first time since 2008, there has appeared a signal in the bond market known as an inversion of the break-even curve. The difference between the yields on ordinary Treasuries and the yields on inflation-protected Treasuries (TIPS) is more significant for the short-term papers than for the long-term ones. It signals that the inflation rise will be temporary. That is the position the Fed sticks to.

Besides, there are more growth drivers for the euro, both global and domestic. The euro-area economic confidence index has been up to almost an annual high. Furthermore, the international trader is recovering faster than after the previous crisis. Therefore, I suggest it is still relevant to buy the EURUSD.

Weekly EURUSD trading plan

The EURUSD bulls failed to consolidate above the upper border of the consolidation range of 1.2-1.22, which signals their weakness and increases the chance of further correction down if the price breaks out the support at 1.214. Nonetheless, if you are going to enter short-term sell trades, be careful, set short targets, and be prepared to exit sales at any moment.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-tested-fed-forecast-as-of-26022021/?uid=285861726&cid=79634

Dynamics of US government bond yields

LiteFinance

Dollar: blind, deaf and mute. Forecast as of 25.02.2021

The Fed’s unwillingness to respond to the Treasury yield growth and the US stock indexes’ rally eliminates the sense of risk. Where will the EURUSD go? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

The expectations of economic changes influence investors’ decisions today, thereby affecting the future. The expectations of inflation growth encourage consumers to buy, contributing to the GDP growth. These factors influence the US stock indexes, which have hit new all-time highs 32 times since early 2021, and the bond market. The US bond market featured the worst start since 2015, and the Treasury yield is rallying up. However, the Fed ignores the market signals.

Earlier, the Bank of Japan was considered the leading innovator in monetary policy, having introduced QE, negative rates, and a yield curve control. Currently, the Fed introduces the main innovations. The shift to average inflation targeting and ignoring financial markets’ signals confuse global central banks. Many of them are not ready to follow this path. The ECB emphasizes that it is closely monitoring European bond market rates. The RBNZ is willing to boost the monetary stimulus despite the economic recovery. The Bank of Korea warned it'd intervene in the market if bond yields continue rising. The RBA already interferes with record asset purchases since QE kicked off in March 2020.

The problem is that trying to go against the global trend alone is doomed to failure. The Reserve Bank of Australia's interventions did not stop Australia’s bond sellers. They bet on risk and reflation. Moreover, by its statement that it intends to make decisions on adjusting monetary policy based on actual, not expected data, the Fed only adds fuel to the fire. This statement by Jerome Powell on the second day of his speeches before Congress has pushed up the S&P 500 and EURUSD.

Market signals inflation should rise, but the US central bank doesn’t believe. In late 2019-early 2020, the Fed didn’t believe that the yield curve signals would result in a recession, but pandemic affected the economy. Jerome Powell pretends he does not understand how consumer prices can rise over a long time if they have not done so for the past 25 years. Powell says inflation is a long process that repeats year after year, not a single spike in prices. However, I do not think it is right to think that inflation cannot grow because it didn’t so before. There was no recession for a long time either, and it was considered unlikely at the beginning of last year.

Weekly EURUSD trading plan

Therefore, the market signals the US economy is overheating. Still, the Fed continues to ignore this, considering it is too early to take away the punch bowl just as the party gets going. This is a perfect environment to eliminate investors’ sense of risk and press down safe-havens, including the US dollar. The EURUSD bulls failed to break out the resistance at 1.218 at the first try, but the second try can well be successful. If so, the euro-dollar could reach the upside targets at 1.221 and 1.225.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-blind-deaf-and-mute-forecast-as-of-25022021/?uid=285861726&cid=79634

The Fed’s unwillingness to respond to the Treasury yield growth and the US stock indexes’ rally eliminates the sense of risk. Where will the EURUSD go? Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

The expectations of economic changes influence investors’ decisions today, thereby affecting the future. The expectations of inflation growth encourage consumers to buy, contributing to the GDP growth. These factors influence the US stock indexes, which have hit new all-time highs 32 times since early 2021, and the bond market. The US bond market featured the worst start since 2015, and the Treasury yield is rallying up. However, the Fed ignores the market signals.

Earlier, the Bank of Japan was considered the leading innovator in monetary policy, having introduced QE, negative rates, and a yield curve control. Currently, the Fed introduces the main innovations. The shift to average inflation targeting and ignoring financial markets’ signals confuse global central banks. Many of them are not ready to follow this path. The ECB emphasizes that it is closely monitoring European bond market rates. The RBNZ is willing to boost the monetary stimulus despite the economic recovery. The Bank of Korea warned it'd intervene in the market if bond yields continue rising. The RBA already interferes with record asset purchases since QE kicked off in March 2020.

The problem is that trying to go against the global trend alone is doomed to failure. The Reserve Bank of Australia's interventions did not stop Australia’s bond sellers. They bet on risk and reflation. Moreover, by its statement that it intends to make decisions on adjusting monetary policy based on actual, not expected data, the Fed only adds fuel to the fire. This statement by Jerome Powell on the second day of his speeches before Congress has pushed up the S&P 500 and EURUSD.

Market signals inflation should rise, but the US central bank doesn’t believe. In late 2019-early 2020, the Fed didn’t believe that the yield curve signals would result in a recession, but pandemic affected the economy. Jerome Powell pretends he does not understand how consumer prices can rise over a long time if they have not done so for the past 25 years. Powell says inflation is a long process that repeats year after year, not a single spike in prices. However, I do not think it is right to think that inflation cannot grow because it didn’t so before. There was no recession for a long time either, and it was considered unlikely at the beginning of last year.

Weekly EURUSD trading plan

Therefore, the market signals the US economy is overheating. Still, the Fed continues to ignore this, considering it is too early to take away the punch bowl just as the party gets going. This is a perfect environment to eliminate investors’ sense of risk and press down safe-havens, including the US dollar. The EURUSD bulls failed to break out the resistance at 1.218 at the first try, but the second try can well be successful. If so, the euro-dollar could reach the upside targets at 1.221 and 1.225.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-blind-deaf-and-mute-forecast-as-of-25022021/?uid=285861726&cid=79634

LiteFinance

Dollar has to unlearn. Forecast as of 24.02.2021

The Fed is willing to be patient and ignore a surge in the US inflation. If so, the EURUSD trend should not soon reverse. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

If anyone worried that the Fed would be frightened by the rise in inflation expectations and would signal to taper the QE, Jerome Powell's speech to Congress eliminated any worries. The US economy is far from the Fed’s targets for employment and inflation, and it will likely take some time to make significant progress in this direction. Therefore, the Federal Reserve won’t change the ultra-low federal funds rate or the asset purchases at a monthly pace of $120 billion. If so, the dollar should weaken.

In theory, the huge fiscal and monetary incentives should result in the growth of the money supply and inflation. According to Jerome Powell, economists need to unlearn what they studied at the universities a long time ago when M2 and monetary aggregates seemed to relate to economic growth and inflation. In recent decades, there has been a tendency for a significant slowdown in consumer price growth, and the Fed Chair does not understand how a surge in fiscal and monetary support that does not last for a long time can change this trend. Powell does not believe US inflation will reach alarming levels or will continue to rise.

Such a tone means the Fed is willing to be patient. The Central Bank is ready to allow the economy to overheat, just not to repeat the past mistakes when it ended QE and hiked the interest rates too early. If so, the US dollar will be under pressure, which gives hope for the EURUSD uptrend recovery. After all, the real rates in Europe are growing approximately as fast as in the United States, which makes the euro-area assets more promising, European stocks are undervalued compared to US peers, and the share of the euro in the central banks’ FX reserves must be increasing.

The greenback doesn’t strengthen although the vaccination campaign is progressing in the USA (65 million Americans were inoculated, which is 20% of the population), the reports on retail sales and PMI are positive. Investors understand that the US GDP rebound is good for the entire world economy, including the export-led euro area. When the EU countries start lifting lockdowns, the euro-area GDP should start growing rapidly, as it did last year, pushing the EURUSD up towards 1.25.

I do not think the euro bears can count on the S&P 500 correction, followed by a decline in the global risk appetite. Joe Biden's $1.9 billion is just the beginning. The new US administration intends to increase the fiscal stimulus to $3 trillion or $4 trillion, equivalent to 14-19% of GDP. Moreover, investments in infrastructure will be a priority in the second package.

Weekly EURUSD trading plan

Therefore, even if the EURUSD continues consolidation in the range of 1.2-1.22, as I suggested in one of the earlier articles, it will be more likely to break the trading channel upside than downside. It is still relevant to buy out the euro-dollar on the price fall.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-has-to-unlearn-forecast-as-of-24022021/?uid=285861726&cid=79634

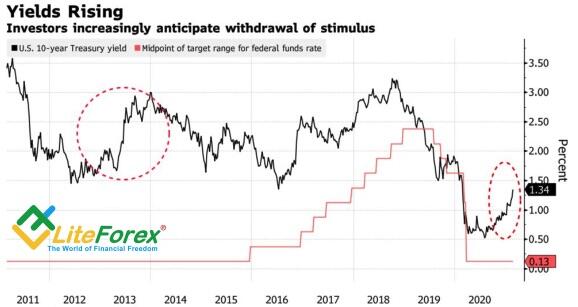

Dynamics of real swap rates

The Fed is willing to be patient and ignore a surge in the US inflation. If so, the EURUSD trend should not soon reverse. Let us discuss the Forex outlook and make up a trading plan.

Weekly US dollar fundamental forecast

If anyone worried that the Fed would be frightened by the rise in inflation expectations and would signal to taper the QE, Jerome Powell's speech to Congress eliminated any worries. The US economy is far from the Fed’s targets for employment and inflation, and it will likely take some time to make significant progress in this direction. Therefore, the Federal Reserve won’t change the ultra-low federal funds rate or the asset purchases at a monthly pace of $120 billion. If so, the dollar should weaken.

In theory, the huge fiscal and monetary incentives should result in the growth of the money supply and inflation. According to Jerome Powell, economists need to unlearn what they studied at the universities a long time ago when M2 and monetary aggregates seemed to relate to economic growth and inflation. In recent decades, there has been a tendency for a significant slowdown in consumer price growth, and the Fed Chair does not understand how a surge in fiscal and monetary support that does not last for a long time can change this trend. Powell does not believe US inflation will reach alarming levels or will continue to rise.

Such a tone means the Fed is willing to be patient. The Central Bank is ready to allow the economy to overheat, just not to repeat the past mistakes when it ended QE and hiked the interest rates too early. If so, the US dollar will be under pressure, which gives hope for the EURUSD uptrend recovery. After all, the real rates in Europe are growing approximately as fast as in the United States, which makes the euro-area assets more promising, European stocks are undervalued compared to US peers, and the share of the euro in the central banks’ FX reserves must be increasing.

The greenback doesn’t strengthen although the vaccination campaign is progressing in the USA (65 million Americans were inoculated, which is 20% of the population), the reports on retail sales and PMI are positive. Investors understand that the US GDP rebound is good for the entire world economy, including the export-led euro area. When the EU countries start lifting lockdowns, the euro-area GDP should start growing rapidly, as it did last year, pushing the EURUSD up towards 1.25.

I do not think the euro bears can count on the S&P 500 correction, followed by a decline in the global risk appetite. Joe Biden's $1.9 billion is just the beginning. The new US administration intends to increase the fiscal stimulus to $3 trillion or $4 trillion, equivalent to 14-19% of GDP. Moreover, investments in infrastructure will be a priority in the second package.

Weekly EURUSD trading plan

Therefore, even if the EURUSD continues consolidation in the range of 1.2-1.22, as I suggested in one of the earlier articles, it will be more likely to break the trading channel upside than downside. It is still relevant to buy out the euro-dollar on the price fall.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-has-to-unlearn-forecast-as-of-24022021/?uid=285861726&cid=79634

Dynamics of real swap rates

LiteFinance

Euro: forewarned is forearmed. Forecast as of 23.02.2021

If you can’t control the causes, you will hardly influence the situation. The ECB’s attempt to stop the growth of the global bond market yields is doomed to a failure. How will it affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The ECB’s warning shots do not encourage the EURUSD bears. The euro bulls prefer to spot the signals about the recovery of the euro-area economy. Strong Germany IFO business climate index is a stronger argument for the euro buyers than Christine Lagarde's statement that the European Central Bank is closely monitoring the euro-area bond yields. If European bond yields continue growing, the euro-area financing conditions could deteriorate, setting back the euro-area GDP recovery. However, the bond markets do not depend on only the ECB.

Lagarde noted that that the yield on sovereign bonds is essential, as banks use it as a benchmark when establishing the cost of loans to households and firms. Therefore, the central bank "is closely monitoring the evolution of longer-term nominal bond yields." However, I believe the reasons lie much deeper. An increase in debt market rates makes European assets more promising, which contributes to the capital flow from the US into the euro area, supporting the EURUSD growth. According to UniCredit, if the euro-area bond yields continue growing, it’ll leave the ECB no choice but to step up the QE. The European Central Bank has already increased the weekly pace of bond purchases to €17.2 billion under the pandemic purchase program, the most since the week ended January 15.

However, if the ECB can’t control the causes, it can’t radically affect the situation. The bond yields are growing elsewhere in the world amid the expectations of the US GDP rebound. Bloomberg raised its US growth forecast for 2021 from 3.5% to 4.6%, suggesting it could be revised up to 6%-7% if Congress approves Joe Biden's $ 1.9 trillion fiscal stimulus package. Besides, the Fed officials try to convince investors that they are not worried about Treasury yields rally since it reflects the US economy’s strength.

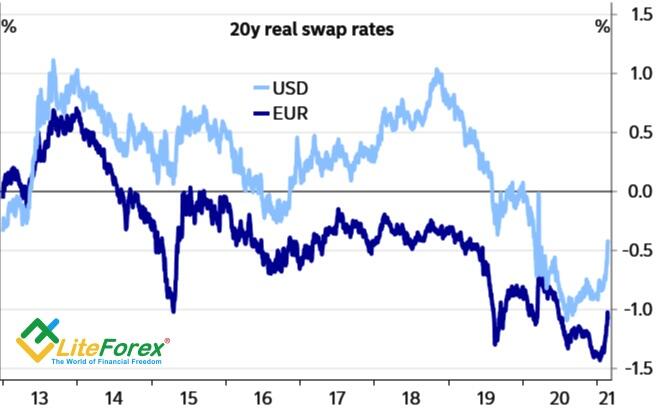

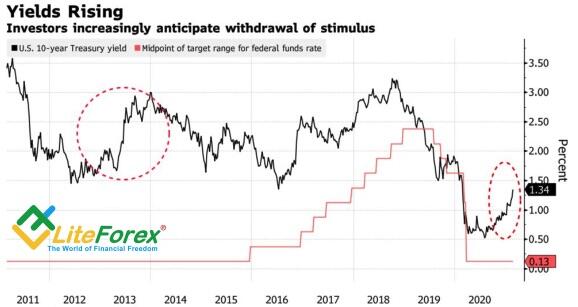

The current situation has a lot in common with the events of 2013 when the US bond rates were also growing, but there was still a long time before the federal funds rate hike. The FOMC now expects it will not change the interest rates until 2023, and the asset purchase program at a monthly pace of $ 120 billion will continue.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-forewarned-is-forearmed-forecast-as-of-23022021/?uid=285861726&cid=79634

Dynamics of federal funds rate and US 10-year Treasury yield

If you can’t control the causes, you will hardly influence the situation. The ECB’s attempt to stop the growth of the global bond market yields is doomed to a failure. How will it affect the EURUSD? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The ECB’s warning shots do not encourage the EURUSD bears. The euro bulls prefer to spot the signals about the recovery of the euro-area economy. Strong Germany IFO business climate index is a stronger argument for the euro buyers than Christine Lagarde's statement that the European Central Bank is closely monitoring the euro-area bond yields. If European bond yields continue growing, the euro-area financing conditions could deteriorate, setting back the euro-area GDP recovery. However, the bond markets do not depend on only the ECB.

Lagarde noted that that the yield on sovereign bonds is essential, as banks use it as a benchmark when establishing the cost of loans to households and firms. Therefore, the central bank "is closely monitoring the evolution of longer-term nominal bond yields." However, I believe the reasons lie much deeper. An increase in debt market rates makes European assets more promising, which contributes to the capital flow from the US into the euro area, supporting the EURUSD growth. According to UniCredit, if the euro-area bond yields continue growing, it’ll leave the ECB no choice but to step up the QE. The European Central Bank has already increased the weekly pace of bond purchases to €17.2 billion under the pandemic purchase program, the most since the week ended January 15.

However, if the ECB can’t control the causes, it can’t radically affect the situation. The bond yields are growing elsewhere in the world amid the expectations of the US GDP rebound. Bloomberg raised its US growth forecast for 2021 from 3.5% to 4.6%, suggesting it could be revised up to 6%-7% if Congress approves Joe Biden's $ 1.9 trillion fiscal stimulus package. Besides, the Fed officials try to convince investors that they are not worried about Treasury yields rally since it reflects the US economy’s strength.

The current situation has a lot in common with the events of 2013 when the US bond rates were also growing, but there was still a long time before the federal funds rate hike. The FOMC now expects it will not change the interest rates until 2023, and the asset purchase program at a monthly pace of $ 120 billion will continue.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-forewarned-is-forearmed-forecast-as-of-23022021/?uid=285861726&cid=79634

Dynamics of federal funds rate and US 10-year Treasury yield

LiteFinance

EURUSD: chained together. Forecast as of 22.02.2021

The Treasury yield rally and the divergence in the economic expansion of the USA and the euro-area do not send the EURUSD down yet. What is the reason? Where will the euro-dollar go next? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

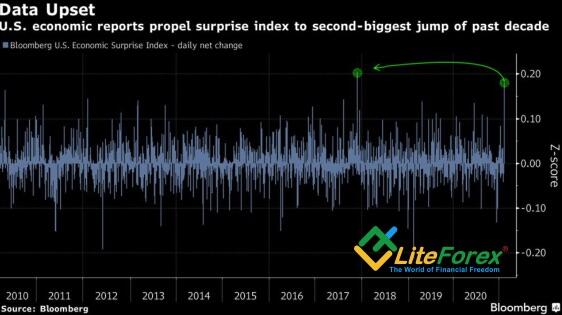

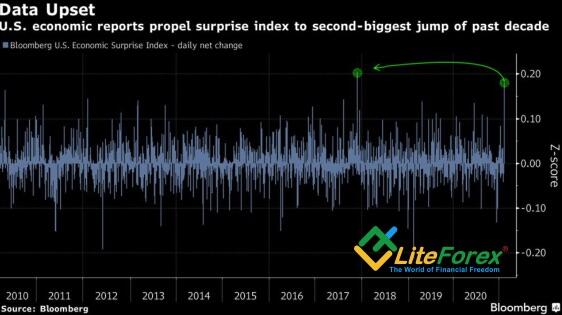

The USA manages the crisis successfully: the number of new COVID-19 is declining, vaccination is progressing, and the economic surprise index, which shows the difference between actual and projected data, featured the best rise since late 2017. As a result, the Treasury yield is rallying up, which, however, doesn’t strengthen the US dollar, as it did in January.

It would seem that an increase in the attractiveness of the US assets, along with the growth-gap between the US and the euro area, should have started the EURUSD correction. The problem is that the US, having a large amount of debts, needs to lure foreign investors to auctions. This is achieved in two ways: by increasing the yield or weakening the greenback. It looks like in February, both methods are applied due to the approaching $ 1.9-trillion fiscal stimulus. In addition, if bond rates are growing not only in the United States but also in Europe, and carry traders, as well as emerging markets’ currencies, are challenged in this situation, then why would the dollar grow against the euro?

The euro bears could have benefited more from the Treasury yield rally but for the Fed dovish stance. Ahead of Jerome Powell's speech to Congress, there was a message on the Fed website that monetary policy will continue to support the economy until the recovery is complete. New York Federal Reserve President John Williams said he is not worried about the sharp rise in Treasury yields, as it is most likely associated with the expectations of rapid growth in US GDP.

Different rates of economic expansion are an essential driver of forex pricing. And the fact that the European Commission expects a double-dip recession in the euro area, and JP Morgan raises the forecast for US GDP to 6.4% in 2021 and 2.8% in 2022 should support the greenback. However, the EURUSD is not falling, which suggests that this advantage of the euro bears is underestimated.

Investors understand that the world economies are chained together because of the pandemic. The faster is the US economic recovery, the more chances the euro-area economy has to rebound. Besides, traders remember the events of mid-2020, when the euro-area GDP rose sharply amid the lifting of the lockdown. Nobody wants to be caught off guard if it happens again.

Weekly EURUSD trading plan

Therefore, the EURUSD bulls have the advantages to outperform their opponents. The major currency pair is likely to continue consolidation until there are signals of the euro-area economic recovery. The matter is in the range of the trading channel. If the price breaks out the resistance at 1.215, it should grow towards 1.221 and 1.224 or even higher. Otherwise, if the price doesn’t consolidate above level 1.215, it could go down to 1.208 and 1.204.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-chained-together-forecast-as-of-22022021/?uid=285861726&cid=79634

Dynamics of US economic surprise index

The Treasury yield rally and the divergence in the economic expansion of the USA and the euro-area do not send the EURUSD down yet. What is the reason? Where will the euro-dollar go next? Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The USA manages the crisis successfully: the number of new COVID-19 is declining, vaccination is progressing, and the economic surprise index, which shows the difference between actual and projected data, featured the best rise since late 2017. As a result, the Treasury yield is rallying up, which, however, doesn’t strengthen the US dollar, as it did in January.

It would seem that an increase in the attractiveness of the US assets, along with the growth-gap between the US and the euro area, should have started the EURUSD correction. The problem is that the US, having a large amount of debts, needs to lure foreign investors to auctions. This is achieved in two ways: by increasing the yield or weakening the greenback. It looks like in February, both methods are applied due to the approaching $ 1.9-trillion fiscal stimulus. In addition, if bond rates are growing not only in the United States but also in Europe, and carry traders, as well as emerging markets’ currencies, are challenged in this situation, then why would the dollar grow against the euro?

The euro bears could have benefited more from the Treasury yield rally but for the Fed dovish stance. Ahead of Jerome Powell's speech to Congress, there was a message on the Fed website that monetary policy will continue to support the economy until the recovery is complete. New York Federal Reserve President John Williams said he is not worried about the sharp rise in Treasury yields, as it is most likely associated with the expectations of rapid growth in US GDP.

Different rates of economic expansion are an essential driver of forex pricing. And the fact that the European Commission expects a double-dip recession in the euro area, and JP Morgan raises the forecast for US GDP to 6.4% in 2021 and 2.8% in 2022 should support the greenback. However, the EURUSD is not falling, which suggests that this advantage of the euro bears is underestimated.

Investors understand that the world economies are chained together because of the pandemic. The faster is the US economic recovery, the more chances the euro-area economy has to rebound. Besides, traders remember the events of mid-2020, when the euro-area GDP rose sharply amid the lifting of the lockdown. Nobody wants to be caught off guard if it happens again.

Weekly EURUSD trading plan

Therefore, the EURUSD bulls have the advantages to outperform their opponents. The major currency pair is likely to continue consolidation until there are signals of the euro-area economic recovery. The matter is in the range of the trading channel. If the price breaks out the resistance at 1.215, it should grow towards 1.221 and 1.224 or even higher. Otherwise, if the price doesn’t consolidate above level 1.215, it could go down to 1.208 and 1.204.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/eurusd-chained-together-forecast-as-of-22022021/?uid=285861726&cid=79634

Dynamics of US economic surprise index

LiteFinance

Euro benefits from carry trades. Forecast as of 19.02.2021

The events of the beginning of the year look like the taper tantrum of 2013, but the Fed hasn’t yet commented on the situation. The US central bank is likely to let the US economy overheat, increasing the chance of the EURUSD uptrend recovery. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

The rising rates of the global debt market concern not only me but also institutional investors and central banks. The minutes of the January meetings of the Fed and the ECB show that the FOMC expresses much more concern about financial instability than Jerome Powell, who says the economic risks are moderate. The ECB board tried to calm the markets by stating that the evolution of real, not nominal, rates matters to monetary policy. In January, the issue was discussed, most likely initiated by Isabel Schnabel, who warned that higher yields could hit the stock market.

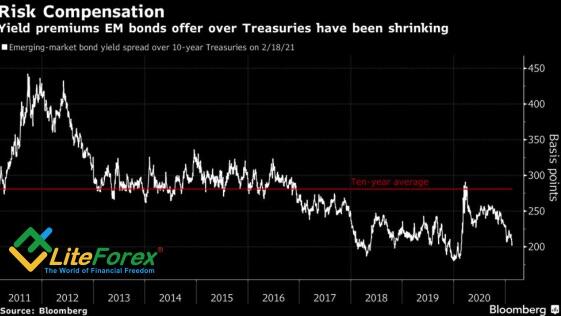

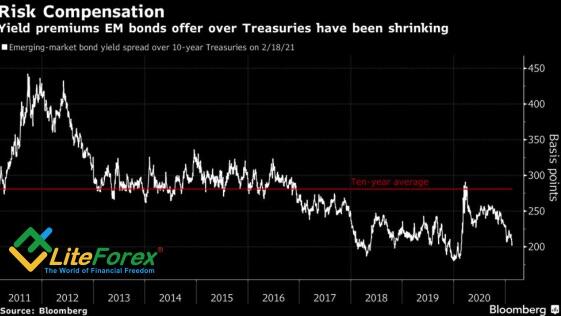

According to MUFG Bank, the fact that Treasury rates are significantly higher than a few days ago may force investors to reconsider their risk appetite. In the past few months, low bond yields encouraged investors to trade stocks. JP Morgan notes that if there is anything to worry about, it is the high share of emerging markets’ assets in investment portfolios.

The events of the beginning of 2020 look like the taper tantrum of 2013. However, the Treasury yields were rising because of the Fed’s announcement of future tapering of the QE. At present, the US yields are growing amid the hopes for a rapid recovery of the global growth and inflation rise. The surge in bond yields in the US and Europe presses down carry trades by narrowing spreads. Traders are worried and exit trades, which strengthens funding currencies, such as the euro and the greenback, and results in the EURUSD consolidation.

Euro strengthens amid the Governing Council members' comments, expressed in the minutes of the ECB January meeting. According to the ECB board members, the measures taken in December need more time to take full effect. Such speeches suggest that, even if European bond yields continue rising, the ECB will hardly react by the QE expansion.