Aleksei Kotlovanov / Profil

- Information

|

8+ Jahre

Erfahrung

|

0

Produkte

|

0

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

No bad trade happens. Sometimes a little cocaine *

Aleksei Kotlovanov

Bizgroup.info представляет вам Партнерскую программу. Наши партнеры получают более 40.000$ с комиссий ежемесячно Стань Партнером прямо сейчас...

Aleksei Kotlovanov

The incident happened in the very centre of London on March 22nd near British Parliament. The stranger in a car ran over the pedestrians on the Westminster bridge, ran out of the car, attacked a policeman with a knife and tried to enter the locations of British Parliament...

Aleksei Kotlovanov

Become our PARTNER. Only three simple steps: - Contact us and ask for a referal link to MAM account. - Give the link to your clients. - Gain 10% and more from your clients profit every month. mail to: info@bizgroup.info...

Aleksei Kotlovanov

Trump’s promises about tax cut and cancelling Obamacare caused optimism on the market and shares climbed. However due to history investors are prone to ignore the risks on specific markets, which may cause the system crash...

Aleksei Kotlovanov

According to Bloomberg, Great Britain will officially start exiting procedure from EU on March 29th. Theresa May informed that the Brexit will start in the end of March, but didn’t mention the day...

Aleksei Kotlovanov

BIZGROUP.INFO starts a partners program. Gain without investing.

22 März 2017, 19:14

Become our PARTNER. Only three simple steps: - Contact us and ask for a referal link to MAM account. - Give the link to your clients. - Gain 10% and more from your clients profit every month. mail to: info@bizgroup.info...

Aleksei Kotlovanov

Beitrag Great Britain will start Brexit on the March 29th. veröffentlicht

According to Bloomberg, Great Britain will officially start exiting procedure from EU on March 29th. Theresa May informed that the Brexit will start in the end of March, but didn’t mention the day...

Aleksei Kotlovanov

Beitrag 5 Triggers of the next financial crisis veröffentlicht

Trump’s promises about tax cut and cancelling Obamacare caused optimism on the market and shares climbed. However due to history investors are prone to ignore the risks on specific markets, which may cause the system crash...

Aleksei Kotlovanov

This week or later Theresa May will have to officially inform about the Brexit, but the real tough talks are about to start. Now neither of the parties want the agreement, and that means there will be none...

Aleksei Kotlovanov

The middle of March will be full of milestone events. CMC Markets are sure that 15th and 16th of March will bring incredible trading opportunities. The decision of FRS about monetary policy this Wednesday will attract heavy attention of the markets...

Aleksei Kotlovanov

Artem Slepushkin

5 Triggers of the next financial crisis

Trump’s promises about tax cut and cancelling Obamacare caused optimism on the market and shares climbed. However due to history investors are prone to ignore the risks on specific markets, which may cause the system crash.

Here are 5 problems which can become a trigger of the next financial crisis.

Real estate bubble

The big cities in USA with the best economic indicators had a fast growth of real estate prices because of low mortgage rate and credits for upper-middle class and money-bags. Now Fed funds rate growth can cause the growth of credit rates and monthly payment higher than approachable for potential house-owners. Also it will influence the rental prices in bi cities.

Students’ credits

The volume of students’ loans is higher than 1,4 trillion USD and more than 40% of the loaners caused or will cause the credit default. In the end there will be 2 options for Federal Government: to pay out hundreds of billions USD or let the banks and bondholders absorb great losses. This is one of the unpopular scenarios, or as we have seen on the Lehman Brothers’ example in 2008, one of the opportunities for the US Government to face the financial instability. Trump’s administration will face a poor choice.

European Banks

European banks are now facing slow economic growth and ultra-low interest rates which cause difficulties with bad loan write off. Around 17% of Italian bank loans have already exceeded time limits. Deutsche Bank (NYSE: Deutsche Bank [DB]) have recently been fined by US Department of Justice (USDOJ). The bank forced the bondholders to exchange bonds for shares in the DB and absorb huge losses. The recurrence of the story may cause panic in Europe. In Italy they already proposed to common bank depositors to buy bonds circuit-wise as Americans invested in certificates of deposit. The forces exchanges for shares in banks may cause big saving losses and economic recession with high consequences for other European and American Banks.

China

Chinese Government sponsored noneffective state ventures. The export companies used available credits and supported the growth of economics. Now the state deficit is 15% GDP, and total national and individual debt is 250% GDP. China was printing money what caused a scary growth of bonds, shares, materials and real estate. Investors are leaving China, what reduces the RMB cost in USD. If these bubbles burst and RMB falls down, Asian countries and other developing economics which depend on export to China will probably become unable to service their USD debts.

Trump’s promises and political discord

Trump’s Economic program may encourage the global growth and ease the regulation on the individual markets. However there are difficulties - he will need to unite the Republicans to force the law on public health and rearrange the corporate tax. His defeat at these lines may easily depress the shares prices and corporate investments, cause one more economic recession and panic among customers. Rough democrats and rightwing are going to force American president keep the ideological simplicity and prevail at the risk of global economical crisis.

Trump’s promises about tax cut and cancelling Obamacare caused optimism on the market and shares climbed. However due to history investors are prone to ignore the risks on specific markets, which may cause the system crash.

Here are 5 problems which can become a trigger of the next financial crisis.

Real estate bubble

The big cities in USA with the best economic indicators had a fast growth of real estate prices because of low mortgage rate and credits for upper-middle class and money-bags. Now Fed funds rate growth can cause the growth of credit rates and monthly payment higher than approachable for potential house-owners. Also it will influence the rental prices in bi cities.

Students’ credits

The volume of students’ loans is higher than 1,4 trillion USD and more than 40% of the loaners caused or will cause the credit default. In the end there will be 2 options for Federal Government: to pay out hundreds of billions USD or let the banks and bondholders absorb great losses. This is one of the unpopular scenarios, or as we have seen on the Lehman Brothers’ example in 2008, one of the opportunities for the US Government to face the financial instability. Trump’s administration will face a poor choice.

European Banks

European banks are now facing slow economic growth and ultra-low interest rates which cause difficulties with bad loan write off. Around 17% of Italian bank loans have already exceeded time limits. Deutsche Bank (NYSE: Deutsche Bank [DB]) have recently been fined by US Department of Justice (USDOJ). The bank forced the bondholders to exchange bonds for shares in the DB and absorb huge losses. The recurrence of the story may cause panic in Europe. In Italy they already proposed to common bank depositors to buy bonds circuit-wise as Americans invested in certificates of deposit. The forces exchanges for shares in banks may cause big saving losses and economic recession with high consequences for other European and American Banks.

China

Chinese Government sponsored noneffective state ventures. The export companies used available credits and supported the growth of economics. Now the state deficit is 15% GDP, and total national and individual debt is 250% GDP. China was printing money what caused a scary growth of bonds, shares, materials and real estate. Investors are leaving China, what reduces the RMB cost in USD. If these bubbles burst and RMB falls down, Asian countries and other developing economics which depend on export to China will probably become unable to service their USD debts.

Trump’s promises and political discord

Trump’s Economic program may encourage the global growth and ease the regulation on the individual markets. However there are difficulties - he will need to unite the Republicans to force the law on public health and rearrange the corporate tax. His defeat at these lines may easily depress the shares prices and corporate investments, cause one more economic recession and panic among customers. Rough democrats and rightwing are going to force American president keep the ideological simplicity and prevail at the risk of global economical crisis.

2

Aleksei Kotlovanov

Artem Slepushkin

Buy Dollar on Dips or Sell on Rallies – What’s the Better Trade? The U.S. dollar traded lower across the board this past week. The best performers were the Australian dollar and British pound but outside of the euro, nearly all of the major currencies appreciated more than 1% against the greenback.

Who would have thought that when the Federal Reserve raised interest rates by 25bp, the U.S. dollar would tank? But that was exactly what happened this past week as the greenback tumbled against all of the major currencies.

Who would have thought that when the Federal Reserve raised interest rates by 25bp, the U.S. dollar would tank? But that was exactly what happened this past week as the greenback tumbled against all of the major currencies.

2

Aleksei Kotlovanov

Artem Slepushkin

Ides of March for US Market

The middle of March will be full of milestone events. CMC Markets are sure that 15th and 16th of March will bring incredible trading opportunities. The decision of FRS about monetary policy this Wednesday will attract heavy attention of the markets. While almost 100% of investors are sure that after the hawkish February statement about the employment the interest rates will be increased. According to Boston Private Wealth FRS will choose to be “hawkish”. This may cause oversells on market. But Yellen will try to give positive statements to avoid depression. These statements may put an end to the liberal monetary policy and become the defining moment for US stock market.

The middle of March will be full of milestone events. CMC Markets are sure that 15th and 16th of March will bring incredible trading opportunities. The decision of FRS about monetary policy this Wednesday will attract heavy attention of the markets. While almost 100% of investors are sure that after the hawkish February statement about the employment the interest rates will be increased. According to Boston Private Wealth FRS will choose to be “hawkish”. This may cause oversells on market. But Yellen will try to give positive statements to avoid depression. These statements may put an end to the liberal monetary policy and become the defining moment for US stock market.

2

Aleksei Kotlovanov

Aleksei Kotlovanov

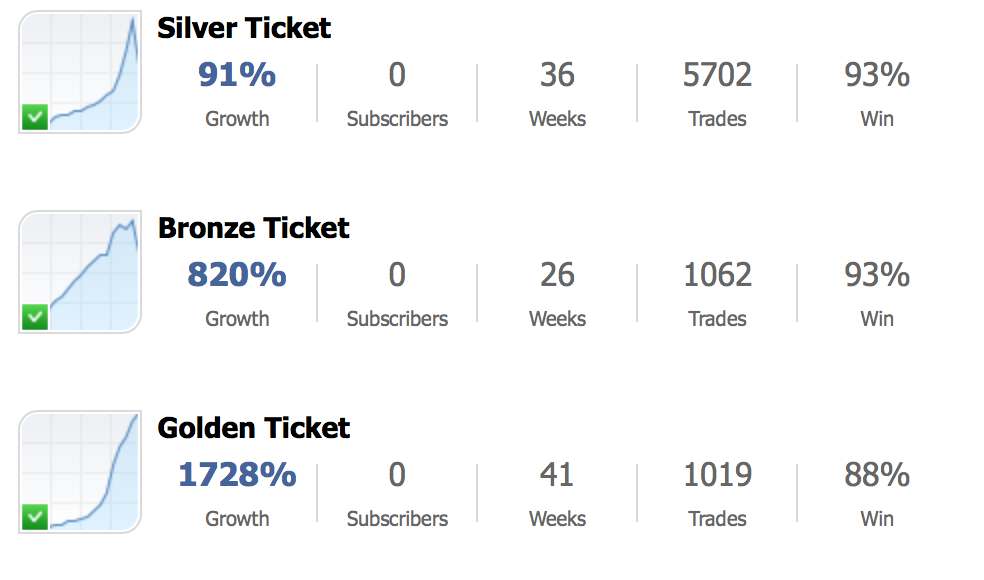

BIZGROUP.INFO starts a partners programю Gain without investing.

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to MAM account.

- Give the link to your clients.

- Gain 10% and more from your clients profit every month.

mail to: info@bizgroup.info

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to MAM account.

- Give the link to your clients.

- Gain 10% and more from your clients profit every month.

mail to: info@bizgroup.info

2

Aleksei Kotlovanov

BIZGROUP.INFO starts a partners programю Gain without investing.

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to MAM account.

- Give the link to your clients.

- Gain 10% and more from your clients profit every month.

mail to: info@bizgroup.info

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to MAM account.

- Give the link to your clients.

- Gain 10% and more from your clients profit every month.

mail to: info@bizgroup.info

Aleksei Kotlovanov

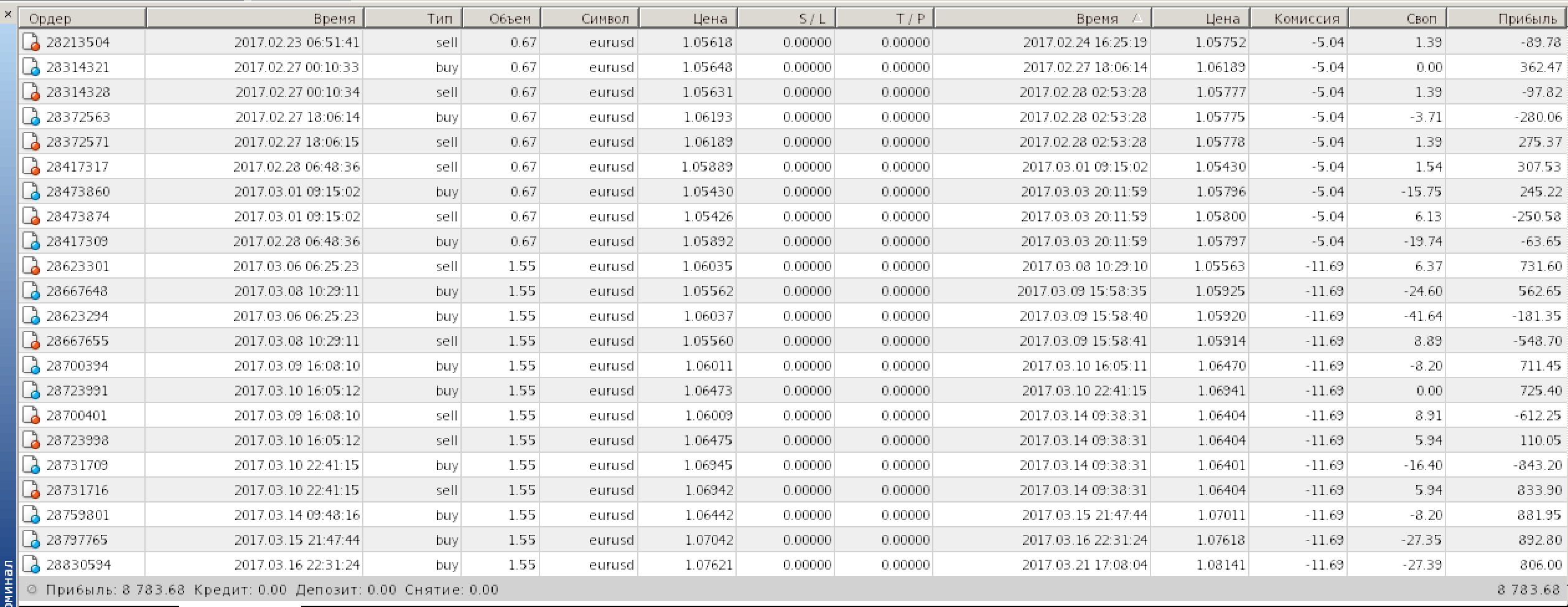

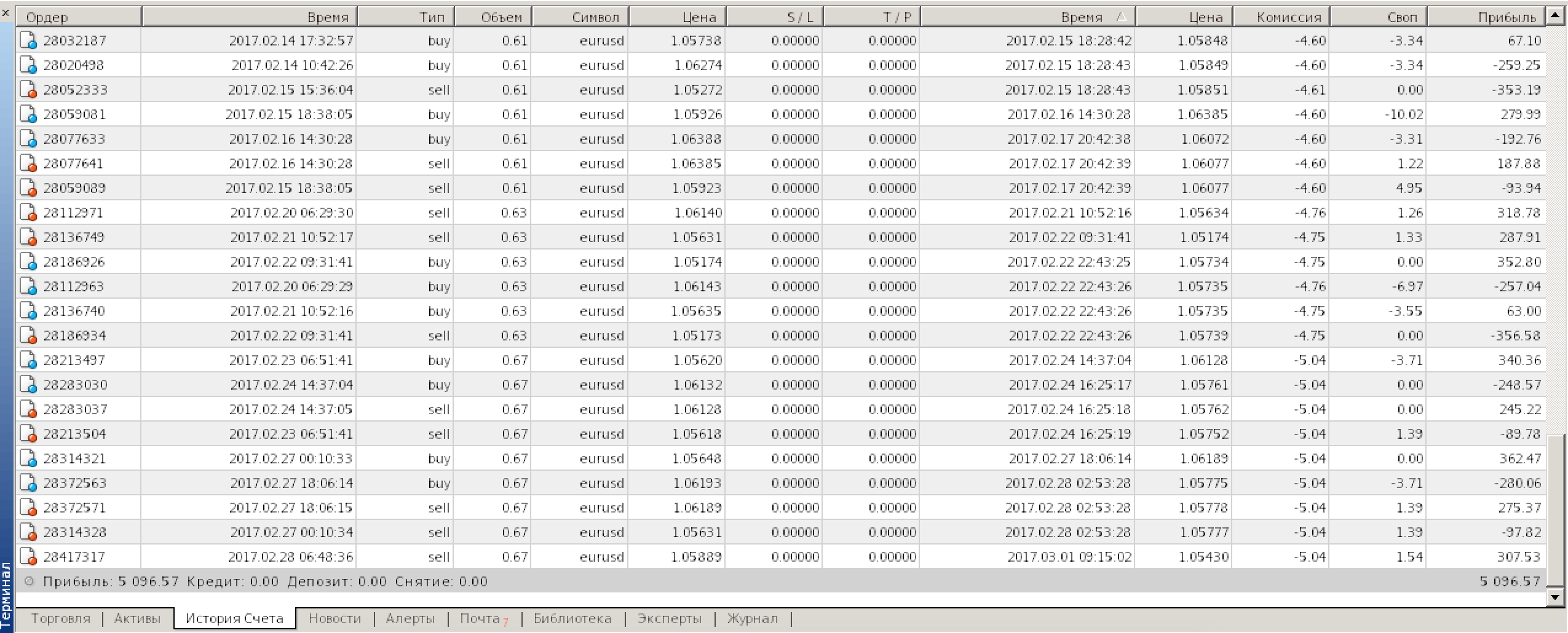

BIZGROUP.INFO can rescue your account

You have problems with your trading account and you start panic? We can help you! Our experienced team will rescue your account and find the exit point. We have a big portfolio of saved accounts from margin call. Please contact us for more information.

You have problems with your trading account and you start panic? We can help you! Our experienced team will rescue your account and find the exit point. We have a big portfolio of saved accounts from margin call. Please contact us for more information.

: