Claws and Horns / Profil

Claws and Horns

Claws and Horns

News of the day. 1.03.2016

Switzerland

Data on Real Retail Sales for February is due in Switzerland at 10:15 am (GMT+2). The data measures changes in the volume of retail sales and is followed as an indicator of consumer confidence. A growth in retail sales represents a growth in consumption and has a positive impact on the economy. A fall in the index is seen as a negative factor for the economy. A high reading strengthens the Franc, while a low reading weakens the Franc.

Germany

Markit Manufacturing PMI is due in Germany at 10:55 am (GMT+2). The index is expected to remain unchanged at 50.2 points in February. The index, being one of the key indicators of the economy, evaluates economic conditions in the manufacturing sector and its prospects. A result above 50 points is perceived positive and strengthens the Euro. A result below 50 points, on the contrary, is seen as a negative signal and weakens the Euro.

Data on Unemployment Rate is due in Germany at 10:55 am (GMT+2). The indicator is expected to remain unchanged at 6.2% in February. The unemployment rate measures the percentage of the total labour force that is unemployed. A growth in the index represents a slowdown of economic growth and pressures the Euro. A fall in the index has a positive impact on economic growth and strengthens the Euro.

EU

Markit Manufacturing PMI is due in the EU at 11:00 am (GMT+2). The index is expected to remain unchanged at 51 points in February. The index, being one of the key indicators of the economy, evaluates economic conditions in the manufacturing sector and its prospects. A result above 50 points is perceived positive and strengthens the Euro. A result below 50 points, on the contrary, is seen as a negative signal and weakens the Euro.

Data on unemployment rate is due in the EU at 12:00 pm (GMT+2). The indicator is expected to remain unchanged at 10.4% in January. The unemployment rate measures the percentage of the total labour force that is unemployed. A growth in the index represents a slowdown of economic growth. A high result pressures the Euro, while a low one, on the contrary, strengthens the Euro.

UK

Markit Manufacturing PMI is due in the UK at 11:30 am (GMT+2). The index, being one of the key indicators of the economy, evaluates economic conditions in the manufacturing sector and its prospects. A result above 50 points is perceived positive and strengthens the Pound. A result below 50 points, on the contrary, is seen as a negative signal and weakens the Pound.

Canada

Data on Canada’s GDP in the fourth quarter is due at 3:30 pm (GMT+2). The indicator measures the value of all goods and services produced by the country during a certain period. A growth in the indicator supports the Canadian Dollar. A fall in the indicator weakens the Canadian Dollar.

RBC Manufacturing PMI is due in Canada at 4:30 pm (GMT+2). The index is based on survey responses from executives of 400 large companies regarding their opinion on current economic conditions in the sector and its prospects. A result above 50 represents a positive mood and strengthens the Canadian Dollar. A result below 50 represents pessimism and weakens the Canadian Dollar.

USA

Data on Construction Spending is due in the US at 5:00 pm (GMT+2). On a monthly basis, the indicator is expected to grow to 0.5% from 0.1%. The data represents expenditures by construction companies on all types of construction activities. A growth in the index indicates economic growth. A high reading strengthens the US Dollar.

Data on ISM Prices Paid is due in the US at 5:00 pm (GMT+2). The indicator is expected to grow to 35.0 from 33.5 points. The index is based on surveys of executives of manufacturing companies and evaluates current economic conditions in the manufacturing sector.

ISM Manufacturing PMI for February is due in the US at 5:00 pm (GMT+2). The indicator is expected to be up to 48.8 from 48.2 points. The index is the indicator of the general state of the US economy. Values above 50 represent economic growth and strengthen the US Dollar. Values below 50 indicate a slowdown of the economy and weaken the US Dollar.

The American Petroleum Institute releases data on crude oil inventories at 11:30 pm (GMT+2). An increase in crude oil inventories pressures oil prices. A decrease, on the contrary, supports oil prices.

Switzerland

Data on Real Retail Sales for February is due in Switzerland at 10:15 am (GMT+2). The data measures changes in the volume of retail sales and is followed as an indicator of consumer confidence. A growth in retail sales represents a growth in consumption and has a positive impact on the economy. A fall in the index is seen as a negative factor for the economy. A high reading strengthens the Franc, while a low reading weakens the Franc.

Germany

Markit Manufacturing PMI is due in Germany at 10:55 am (GMT+2). The index is expected to remain unchanged at 50.2 points in February. The index, being one of the key indicators of the economy, evaluates economic conditions in the manufacturing sector and its prospects. A result above 50 points is perceived positive and strengthens the Euro. A result below 50 points, on the contrary, is seen as a negative signal and weakens the Euro.

Data on Unemployment Rate is due in Germany at 10:55 am (GMT+2). The indicator is expected to remain unchanged at 6.2% in February. The unemployment rate measures the percentage of the total labour force that is unemployed. A growth in the index represents a slowdown of economic growth and pressures the Euro. A fall in the index has a positive impact on economic growth and strengthens the Euro.

EU

Markit Manufacturing PMI is due in the EU at 11:00 am (GMT+2). The index is expected to remain unchanged at 51 points in February. The index, being one of the key indicators of the economy, evaluates economic conditions in the manufacturing sector and its prospects. A result above 50 points is perceived positive and strengthens the Euro. A result below 50 points, on the contrary, is seen as a negative signal and weakens the Euro.

Data on unemployment rate is due in the EU at 12:00 pm (GMT+2). The indicator is expected to remain unchanged at 10.4% in January. The unemployment rate measures the percentage of the total labour force that is unemployed. A growth in the index represents a slowdown of economic growth. A high result pressures the Euro, while a low one, on the contrary, strengthens the Euro.

UK

Markit Manufacturing PMI is due in the UK at 11:30 am (GMT+2). The index, being one of the key indicators of the economy, evaluates economic conditions in the manufacturing sector and its prospects. A result above 50 points is perceived positive and strengthens the Pound. A result below 50 points, on the contrary, is seen as a negative signal and weakens the Pound.

Canada

Data on Canada’s GDP in the fourth quarter is due at 3:30 pm (GMT+2). The indicator measures the value of all goods and services produced by the country during a certain period. A growth in the indicator supports the Canadian Dollar. A fall in the indicator weakens the Canadian Dollar.

RBC Manufacturing PMI is due in Canada at 4:30 pm (GMT+2). The index is based on survey responses from executives of 400 large companies regarding their opinion on current economic conditions in the sector and its prospects. A result above 50 represents a positive mood and strengthens the Canadian Dollar. A result below 50 represents pessimism and weakens the Canadian Dollar.

USA

Data on Construction Spending is due in the US at 5:00 pm (GMT+2). On a monthly basis, the indicator is expected to grow to 0.5% from 0.1%. The data represents expenditures by construction companies on all types of construction activities. A growth in the index indicates economic growth. A high reading strengthens the US Dollar.

Data on ISM Prices Paid is due in the US at 5:00 pm (GMT+2). The indicator is expected to grow to 35.0 from 33.5 points. The index is based on surveys of executives of manufacturing companies and evaluates current economic conditions in the manufacturing sector.

ISM Manufacturing PMI for February is due in the US at 5:00 pm (GMT+2). The indicator is expected to be up to 48.8 from 48.2 points. The index is the indicator of the general state of the US economy. Values above 50 represent economic growth and strengthen the US Dollar. Values below 50 indicate a slowdown of the economy and weaken the US Dollar.

The American Petroleum Institute releases data on crude oil inventories at 11:30 pm (GMT+2). An increase in crude oil inventories pressures oil prices. A decrease, on the contrary, supports oil prices.

Claws and Horns

News of the day. 29.02.2016

Switzerland

KOF Leading Indicator for February is due in Switzerland at 10:00 am (GMT+2). The data is based on 12 main economic indicators and represents economic conditions in the country. A high reading is the positive factor for the economy and strengthens the Franc. A low reading, on the contrary, weakens the Franc.

UK

Data on Mortgage Approvals is due in the UK at 11:30 am (GMT+2). The data represents the number of new approved mortgages. A growth in the index supports the Pound. A fall in the index pressures the Pound.

Data on Consumer Credit is due in the UK at 11:30 am (GMT+2). The indicator represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money that indicates consumers feel confident about the economy. A high reading strengthens the Pound. A low reading weakens the Pound. Fact: a too high reading could indicate credit overconsumption, when consumers take more credits than they actually need.

EU

The core Consumer Price Index is due in the eurozone at 12:00 pm (GMT+2). On a year-over-year basis, the index is expected to be down to 0.9% from 1.0%. The core CPI is the key indicator of inflation in the region. The data represents a price change for the fixed basket of goods and services. A growth in the index can strengthen the Euro, while a decline, on the contrary, has a negative effect on the Euro.

Canada

Data on Current Account for the fourth quarter is due in Canada at 3:30 pm (GMT+2). The indicator represents balance of Canada’s savings and investment. A current account surplus indicates that the county is a net lender to the rest of the world. A current account deficit indicates that the country is a net debtor to the rest of the world. A high result strengthens the Canadian Dollar. A negative result weakens the Canadian Dollar.

USA

Chicago Purchasing Managers' Index for February is due in the US at 4:45 pm (GMT+2). The index is expected to be down to 54.0 from 55.6 points.

Data on Pending Home Sales is due in the US at 5:00 pm (GMT+2). The data is one of the main indicators of the property market and represents the general state of the economy. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Switzerland

KOF Leading Indicator for February is due in Switzerland at 10:00 am (GMT+2). The data is based on 12 main economic indicators and represents economic conditions in the country. A high reading is the positive factor for the economy and strengthens the Franc. A low reading, on the contrary, weakens the Franc.

UK

Data on Mortgage Approvals is due in the UK at 11:30 am (GMT+2). The data represents the number of new approved mortgages. A growth in the index supports the Pound. A fall in the index pressures the Pound.

Data on Consumer Credit is due in the UK at 11:30 am (GMT+2). The indicator represents the change in the volume of consumer credits. Generally, an index increase shows readiness of consumers to spend money that indicates consumers feel confident about the economy. A high reading strengthens the Pound. A low reading weakens the Pound. Fact: a too high reading could indicate credit overconsumption, when consumers take more credits than they actually need.

EU

The core Consumer Price Index is due in the eurozone at 12:00 pm (GMT+2). On a year-over-year basis, the index is expected to be down to 0.9% from 1.0%. The core CPI is the key indicator of inflation in the region. The data represents a price change for the fixed basket of goods and services. A growth in the index can strengthen the Euro, while a decline, on the contrary, has a negative effect on the Euro.

Canada

Data on Current Account for the fourth quarter is due in Canada at 3:30 pm (GMT+2). The indicator represents balance of Canada’s savings and investment. A current account surplus indicates that the county is a net lender to the rest of the world. A current account deficit indicates that the country is a net debtor to the rest of the world. A high result strengthens the Canadian Dollar. A negative result weakens the Canadian Dollar.

USA

Chicago Purchasing Managers' Index for February is due in the US at 4:45 pm (GMT+2). The index is expected to be down to 54.0 from 55.6 points.

Data on Pending Home Sales is due in the US at 5:00 pm (GMT+2). The data is one of the main indicators of the property market and represents the general state of the economy. A high reading strengthens the US Dollar. A low reading weakens the US Dollar.

Claws and Horns

News of the day. 26.02.2016

Germany

Data on the Consumer Price Index for February is due at 03:00 pm (GMT+2) in Germany. According to forecasts, on a year-to-year basis the index will fall from 0.5% to 0.2%.

USA

Data on the Goods Trade Balance is due at 03:30 pm (GMT+2) in the US. According to forecasts, in January the figure amounted to -61.1 billion, against -61.5 billion USD for the previous month. The Goods Trade Balance represents the difference between imports and exports of goods for a certain period and is published few days before the Trade Balance is out. A positive reading indicates a balance surplus and strengthens the USD. A negative reading represents a balance deficit and weakens the USD.

Data on the Gross Domestic Product Price Index for the 4 quarter of 2015 is due at 03:30 pm (GMT+2) in the US. The index represents the price change for goods and services. Is an inflation indicator. A high reading strengthens the USD. A low reading weakens the USD.

Data on the GDP for the fourth quarter of 2015 is due at 03:30 pm (GMT+2) in the US. The index is expected to fall from 0.7% to 0.4%. The index represents the total value of all goods and services created in the country during the year. Indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Data on the Personal Income for January is due at 05:00 pm (GMT+2) in the US. The index is forecasted to grow from 0.3% to 0.4%. The index represents an income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the index indicates consumer readiness to spend money in current economic conditions.

Data on the Core Personal Consumption Expenditure – Price Index for January is due at 05:00 pm (GMT+2) in the US. On a year-to-year basis, the index is expected to fall from 1.4% to 1.2%. The index represents the average amount of money consumers spend a month for goods and services. Prices for food and energy are excluded from the index. A high reading strengthens the USD. A low reading weakens the USD.

Germany

Data on the Consumer Price Index for February is due at 03:00 pm (GMT+2) in Germany. According to forecasts, on a year-to-year basis the index will fall from 0.5% to 0.2%.

USA

Data on the Goods Trade Balance is due at 03:30 pm (GMT+2) in the US. According to forecasts, in January the figure amounted to -61.1 billion, against -61.5 billion USD for the previous month. The Goods Trade Balance represents the difference between imports and exports of goods for a certain period and is published few days before the Trade Balance is out. A positive reading indicates a balance surplus and strengthens the USD. A negative reading represents a balance deficit and weakens the USD.

Data on the Gross Domestic Product Price Index for the 4 quarter of 2015 is due at 03:30 pm (GMT+2) in the US. The index represents the price change for goods and services. Is an inflation indicator. A high reading strengthens the USD. A low reading weakens the USD.

Data on the GDP for the fourth quarter of 2015 is due at 03:30 pm (GMT+2) in the US. The index is expected to fall from 0.7% to 0.4%. The index represents the total value of all goods and services created in the country during the year. Indicates the pace of a growth/decline of the economy. A high reading strengthens the USD. A low reading weakens the USD.

Data on the Personal Income for January is due at 05:00 pm (GMT+2) in the US. The index is forecasted to grow from 0.3% to 0.4%. The index represents an income of individuals from different sources. A high reading strengthens the USD. A low reading weakens the USD. A growth in the index indicates consumer readiness to spend money in current economic conditions.

Data on the Core Personal Consumption Expenditure – Price Index for January is due at 05:00 pm (GMT+2) in the US. On a year-to-year basis, the index is expected to fall from 1.4% to 1.2%. The index represents the average amount of money consumers spend a month for goods and services. Prices for food and energy are excluded from the index. A high reading strengthens the USD. A low reading weakens the USD.

Claws and Horns

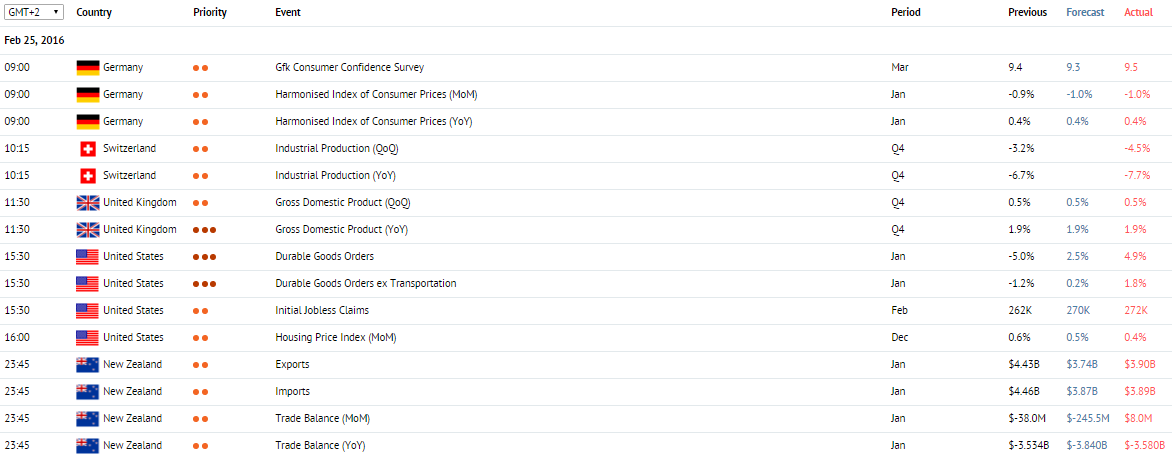

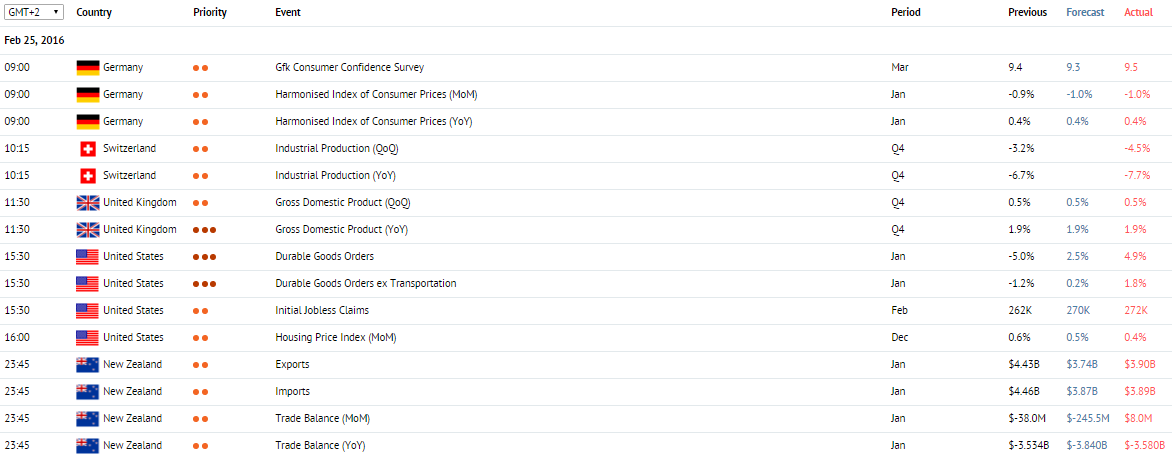

News of the day. 25.02.2016

Germany

Harmonised Index of Consumer Prices for January is due in Germany at 9:00 am (GMT+2). On a monthly basis, the index is expected to be down to -1.0% from -0.9%.

Gfk Consumer Confidence Survey for March is due in Germany at 9:00 am (GMT+2). The indicator is expected to be down to 9.3 from 9.4 points. The index is based on survey responses from consumers regarding how confident they fell about the German economy. A result above 0 represents optimism and strengthens the EUR.

Consumer Price Index for January is due in Germany at 12:00 pm (GMT+2). On a year-over-year basis, the indicator is expected to remain unchanged at 0.4%.

Switzerland

Data on Industrial Production for the fourth quarter is due in Switzerland at 10:15 am (GMT+2). The indicator represents industrial output in Switzerland. A growth in the index is the positive factor for the economy and strengthens the Franc.

UK

Data on GDP for the fourth quarter is due in the UK at 11:30 am (GMT+2). On a year-over-year basis, UK GDP is expected to remain unchanged at 1.9%. The indicator reflects the value of all goods and services produced by the UK. The data is followed as a measure of economic growth or slowdown. A high result strengthens the Pound, while a low result, on the contrary, weakens the national currency.

USA

Data on Durable Goods Orders for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 2.5% from -5.0%. Durable Goods Orders excluding the transport sector are expected to grow to 0.2% from -1.2%.

Data on Initial Jobless Claims for the week ended 19 February is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 270K from 262K. The data in published weekly on Thursdays and represents the number of new unemployment claims. The indicator allows approximating what Nonfarm Payrolls will be. A growth in the index weakens the US Dollar.

Housing Price Index is due in the US at 4:00 pm (GMT+2). The indicator represents changes in property prices. A high reading strengthens the US Dollar.

New Zealand

Data on Exports and Imports for January is due in New Zealand at 11:45 pm (GMT+2). Imports are expected to be down to 3.87 billion from 4.48 billion. Exports are expected to be down to 3.74 billion from 4.43 billion. Imports indicator measures the value of all goods and services received by the country from the rest of the world. A growth in imports represents a growth in consumption. Exports indicator represents the value of all goods and services provided by the country to the rest of the world. A growth in exports has a positive impact on the country’s economy.

Data on Trade Balance for January is due in New Zealand at 11:45 pm (GMT+2). A trade deficit is expected to grow to 3.840 billion from 3.549 billion on an annual basis and to 245.5 million from 53.0 million on a monthly basis.

Germany

Harmonised Index of Consumer Prices for January is due in Germany at 9:00 am (GMT+2). On a monthly basis, the index is expected to be down to -1.0% from -0.9%.

Gfk Consumer Confidence Survey for March is due in Germany at 9:00 am (GMT+2). The indicator is expected to be down to 9.3 from 9.4 points. The index is based on survey responses from consumers regarding how confident they fell about the German economy. A result above 0 represents optimism and strengthens the EUR.

Consumer Price Index for January is due in Germany at 12:00 pm (GMT+2). On a year-over-year basis, the indicator is expected to remain unchanged at 0.4%.

Switzerland

Data on Industrial Production for the fourth quarter is due in Switzerland at 10:15 am (GMT+2). The indicator represents industrial output in Switzerland. A growth in the index is the positive factor for the economy and strengthens the Franc.

UK

Data on GDP for the fourth quarter is due in the UK at 11:30 am (GMT+2). On a year-over-year basis, UK GDP is expected to remain unchanged at 1.9%. The indicator reflects the value of all goods and services produced by the UK. The data is followed as a measure of economic growth or slowdown. A high result strengthens the Pound, while a low result, on the contrary, weakens the national currency.

USA

Data on Durable Goods Orders for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 2.5% from -5.0%. Durable Goods Orders excluding the transport sector are expected to grow to 0.2% from -1.2%.

Data on Initial Jobless Claims for the week ended 19 February is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 270K from 262K. The data in published weekly on Thursdays and represents the number of new unemployment claims. The indicator allows approximating what Nonfarm Payrolls will be. A growth in the index weakens the US Dollar.

Housing Price Index is due in the US at 4:00 pm (GMT+2). The indicator represents changes in property prices. A high reading strengthens the US Dollar.

New Zealand

Data on Exports and Imports for January is due in New Zealand at 11:45 pm (GMT+2). Imports are expected to be down to 3.87 billion from 4.48 billion. Exports are expected to be down to 3.74 billion from 4.43 billion. Imports indicator measures the value of all goods and services received by the country from the rest of the world. A growth in imports represents a growth in consumption. Exports indicator represents the value of all goods and services provided by the country to the rest of the world. A growth in exports has a positive impact on the country’s economy.

Data on Trade Balance for January is due in New Zealand at 11:45 pm (GMT+2). A trade deficit is expected to grow to 3.840 billion from 3.549 billion on an annual basis and to 245.5 million from 53.0 million on a monthly basis.

Claws and Horns

News of the day. 24.02.2016

Japan

Data on Coincident Index for December is due in Japan at 7:00 am (GMT+2). The index is based on 11 indicators and tracks the current economic situation in the country. Values above 50 indicate economic growth and strengthen the Yen. Values below 50 represent economic slowdown and weaken the Yen.

Switzerland

UBS Consumption Indicator for January is due in Switzerland at 9:00 am (GMT+2). The index is based on 5 economic indicators: car sales, consumer sentiment, retail sales, the number of domestic hotel overnights, credit cards transactions. A high reading strengthens the Franc, while a low reading weakens the Franc.

USA

Data on Markit Services PMI for February is due in the US at 4:45 pm (GMT+2). The indicator is expected to grow to 53.5 from 53.2 points. The index is based on surveys of executives of US companies operating in the services sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the US Dollar.

Data on New Home Sales for January is due in the US at 5:00 pm (GMT+2). The indicator is expected to be down to -4.4% from 10.8%. It is an important indicator of the US property market. A low reading weakens the US Dollar.

Japan

Data on Coincident Index for December is due in Japan at 7:00 am (GMT+2). The index is based on 11 indicators and tracks the current economic situation in the country. Values above 50 indicate economic growth and strengthen the Yen. Values below 50 represent economic slowdown and weaken the Yen.

Switzerland

UBS Consumption Indicator for January is due in Switzerland at 9:00 am (GMT+2). The index is based on 5 economic indicators: car sales, consumer sentiment, retail sales, the number of domestic hotel overnights, credit cards transactions. A high reading strengthens the Franc, while a low reading weakens the Franc.

USA

Data on Markit Services PMI for February is due in the US at 4:45 pm (GMT+2). The indicator is expected to grow to 53.5 from 53.2 points. The index is based on surveys of executives of US companies operating in the services sector regarding their opinion on current economic conditions in the sector and its future prospects. A reading above 50 is perceived positive and strengthens the US Dollar.

Data on New Home Sales for January is due in the US at 5:00 pm (GMT+2). The indicator is expected to be down to -4.4% from 10.8%. It is an important indicator of the US property market. A low reading weakens the US Dollar.

Claws and Horns

News of the day. 23.02.2016

Germany

Data on the GDP for the fourth quarter of 2015 is due at 09:00 am (GMT+2) in Germany. On a quarter-to-quarter basis, the index is expected to remain unchanged at 0.3%. The index represents the total value of all goods and services created in Germany for the year. Values above expectations can strengthen the Euro, and below – weaken.

Data on the IFO – Business Climate for February is due at 11:00 am (GMT+2) in Germany. The index is expected to fall from 107.3 to 106.8 points. It is based on surveys of more than 700 executives regarding their opinion on current economic conditions in the country. A growth in the index can strengthen the Euro.

Switzerland

The speech by Swiss NB Chairman Tomas Jordan is due at 01:15 pm (GMT+2). He will give commentaries on current economic conditions and monetary policy. His comments can increase volatility in the Franc.

USA

Data on the S&P/CaseShiller Home Price Indices for December is due at 04:00 pm (GMT+2) in the US. The index is expected to remain unchanged at 5.8% on a year-to-year basis.

Data on the Consumer Confidence for December is due at 05:00 pm (GMT+2) in the US. The index is expected to fall from 98.1 to 97.4 points. It represents consumer confidence in current economic conditions in the country. Values above expectations can strengthen the US Dollar.

Data on the API Weekly Crude Oil Stock for the week is due at 11:30 pm (GMT+2) in the US. A growth in the index can pressure oil prices.

Germany

Data on the GDP for the fourth quarter of 2015 is due at 09:00 am (GMT+2) in Germany. On a quarter-to-quarter basis, the index is expected to remain unchanged at 0.3%. The index represents the total value of all goods and services created in Germany for the year. Values above expectations can strengthen the Euro, and below – weaken.

Data on the IFO – Business Climate for February is due at 11:00 am (GMT+2) in Germany. The index is expected to fall from 107.3 to 106.8 points. It is based on surveys of more than 700 executives regarding their opinion on current economic conditions in the country. A growth in the index can strengthen the Euro.

Switzerland

The speech by Swiss NB Chairman Tomas Jordan is due at 01:15 pm (GMT+2). He will give commentaries on current economic conditions and monetary policy. His comments can increase volatility in the Franc.

USA

Data on the S&P/CaseShiller Home Price Indices for December is due at 04:00 pm (GMT+2) in the US. The index is expected to remain unchanged at 5.8% on a year-to-year basis.

Data on the Consumer Confidence for December is due at 05:00 pm (GMT+2) in the US. The index is expected to fall from 98.1 to 97.4 points. It represents consumer confidence in current economic conditions in the country. Values above expectations can strengthen the US Dollar.

Data on the API Weekly Crude Oil Stock for the week is due at 11:30 pm (GMT+2) in the US. A growth in the index can pressure oil prices.

Claws and Horns

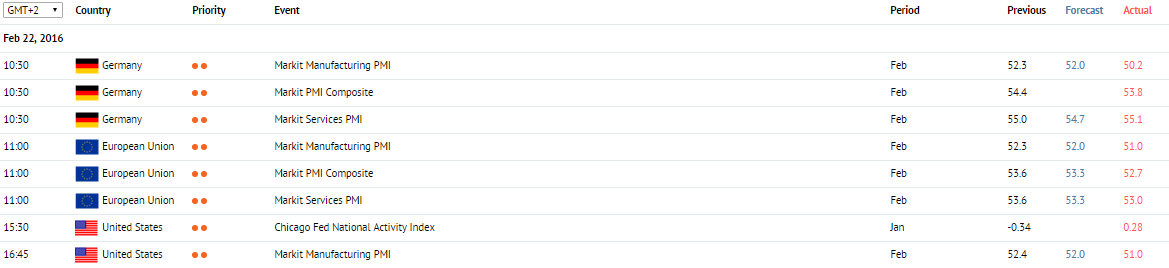

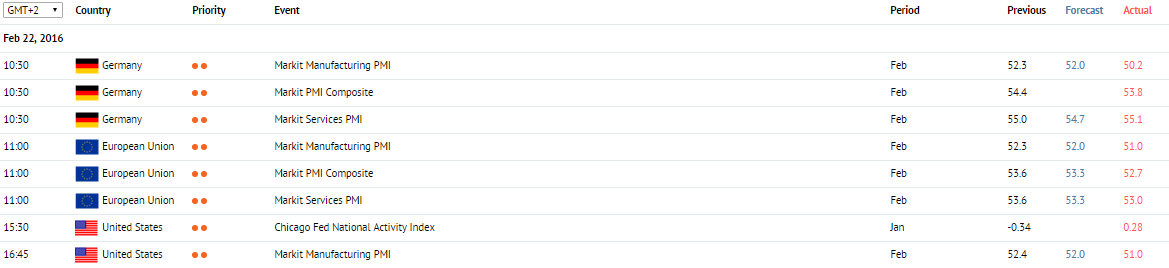

News of the day. 22.02.2016

Germany

Data on Markit Manufacturing PMI for February is due in Germany at 10:30 am (GMT+2). The index reflects economic conditions in the German manufacturing sector. A result above 50 is a favorable signal and might strengthen the Euro.

Data on Markit Services PMI for February is due in Germany at 10:30 am (GMT+2). The index reflects economic situation in the German service sector. The indicator is based on a survey of executives of German companies in the service sector regarding their assessment of the current economic situation. A result above 50 is a favorable signal and might strengthen the Euro.

EU

Data on Markit Services PMI for February is due in the eurozone at 11:00 am (GMT+2). The indicator is expected to be down to 53.5 from 53.6 points. The index reflects economic situation in the service sector and its prospects. A result above 50 is a favorable signal and might strengthen the Euro.

Data on Markit Manufacturing PMI for February is due in the eurozone at 11:00 am (GMT+2). The indicator is expected to be down to 52.2 from 52.3 points. The index is based on a survey of executives of manufacturing companies regarding their assessment of the current economic situation. A result above 50 is a favorable signal and might strengthen the Euro.

USA

Data on Chicago Fed National Activity Index for January is due in the US at 3:30 pm (GMT+2). The index reflects economic situation in the region. A result above 0 is a favorable signal and might strengthen the US Dollar. A result below 0, on the contrary, might affect the USD.

Data on Markit Manufacturing PMI for February is due in the US at 4:45 pm (GMT+2). The index reflects economic situation in the manufacturing sector and its prospects. A result above 50 is a favorable signal and might strengthen the US Dollar.

Germany

Data on Markit Manufacturing PMI for February is due in Germany at 10:30 am (GMT+2). The index reflects economic conditions in the German manufacturing sector. A result above 50 is a favorable signal and might strengthen the Euro.

Data on Markit Services PMI for February is due in Germany at 10:30 am (GMT+2). The index reflects economic situation in the German service sector. The indicator is based on a survey of executives of German companies in the service sector regarding their assessment of the current economic situation. A result above 50 is a favorable signal and might strengthen the Euro.

EU

Data on Markit Services PMI for February is due in the eurozone at 11:00 am (GMT+2). The indicator is expected to be down to 53.5 from 53.6 points. The index reflects economic situation in the service sector and its prospects. A result above 50 is a favorable signal and might strengthen the Euro.

Data on Markit Manufacturing PMI for February is due in the eurozone at 11:00 am (GMT+2). The indicator is expected to be down to 52.2 from 52.3 points. The index is based on a survey of executives of manufacturing companies regarding their assessment of the current economic situation. A result above 50 is a favorable signal and might strengthen the Euro.

USA

Data on Chicago Fed National Activity Index for January is due in the US at 3:30 pm (GMT+2). The index reflects economic situation in the region. A result above 0 is a favorable signal and might strengthen the US Dollar. A result below 0, on the contrary, might affect the USD.

Data on Markit Manufacturing PMI for February is due in the US at 4:45 pm (GMT+2). The index reflects economic situation in the manufacturing sector and its prospects. A result above 50 is a favorable signal and might strengthen the US Dollar.

Claws and Horns

News of the day. 19.02.2016

Germany

Data on Producer Price Index for January is due in Germany at 10:00 am (GMT+2). The indicator is expected to grow to -0.3% from -0.5%. The index tracks dynamics of wholesale prices in the primary market. Generally, a growth in the indicator might strengthen the Euro.

UK

Data on Public Sector Net Borrowing for December is due in the UK at 11:30 am (GMT+2). The indicator is expected to come in at -13.950 billion against 6.817 billion in the previous month. A negative number indicates the UK is facing a fiscal surplus and, therefore, strengthens the Pound.

Canada

Data on Consumer Price Index for January is due in Canada at 3:30 pm (GMT+2). The indicator is expected to grow to 1.7% from 1.6% in annual terms and to -0.1% from -0.5% in monthly terms.

Data on Retail Sales for December is due in Canada at 3:30 pm (GMT+2). On a year-over-year basis, the indicator is expected to be down to -0.6% from 1.7%. The data represents changes in the volume of goods sold by retailers. A fall in the indicator might affect the Canadian Dollar.

USA

Data on Consumer Price Index for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 1.3% from 0.7% in annual terms and to remain unchanged at -0.1% in monthly terms. The data represents a price change for the fixed basket of goods and services and is followed as the key indicator of inflation. A growth in the index can strengthen the US Dollar.

Germany

Data on Producer Price Index for January is due in Germany at 10:00 am (GMT+2). The indicator is expected to grow to -0.3% from -0.5%. The index tracks dynamics of wholesale prices in the primary market. Generally, a growth in the indicator might strengthen the Euro.

UK

Data on Public Sector Net Borrowing for December is due in the UK at 11:30 am (GMT+2). The indicator is expected to come in at -13.950 billion against 6.817 billion in the previous month. A negative number indicates the UK is facing a fiscal surplus and, therefore, strengthens the Pound.

Canada

Data on Consumer Price Index for January is due in Canada at 3:30 pm (GMT+2). The indicator is expected to grow to 1.7% from 1.6% in annual terms and to -0.1% from -0.5% in monthly terms.

Data on Retail Sales for December is due in Canada at 3:30 pm (GMT+2). On a year-over-year basis, the indicator is expected to be down to -0.6% from 1.7%. The data represents changes in the volume of goods sold by retailers. A fall in the indicator might affect the Canadian Dollar.

USA

Data on Consumer Price Index for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 1.3% from 0.7% in annual terms and to remain unchanged at -0.1% in monthly terms. The data represents a price change for the fixed basket of goods and services and is followed as the key indicator of inflation. A growth in the index can strengthen the US Dollar.

Claws and Horns

News of the day. 18.02.2016

Australia

Data on the Participation Rate for January is due at 02:30 am (GMT+2) in Australia. According to forecasts, the index will grow from 65.1% to 65.2%. The index shows the percentage of participants from the total labour force, and considers already employed and those in search of work.

Data on the Unemployment Rate for January is due at 02:30 am (GMT+2) in Australia. The index is expected to remain unchanged at 5.8%. The index shows the percentage of unemployed from the total number of able to work. A growth in the figure is a negative factor for the economy and leads to the weakening in the Australian Dollar.

EU

The ECB Monetary Policy Meeting Accounts are due at 02:30 pm (GMT+2). Accounts contain a review of current economic conditions, commentaries regarding monetary policy decisions and macroeconomic forecasts.

USA

Data on the Philadelphia Fed Manufacturing Survey is due at 03:30 pm (GMT+2). According to forecasts, the index will grow from -3.5 to -2.8 points. The index is compiled from a monthly survey of a hundred of the leading manufacturers in Philadelphia regarding their opinion of current economic conditions and economic perspectives for the next 6 months.

Data on the CB Leading Indicator for January is due in the US at 05:00 pm (GMT+2). On a month-to-month basis, the index is forecasted to remain unchanged at -0.2%.

Australia

Data on the Participation Rate for January is due at 02:30 am (GMT+2) in Australia. According to forecasts, the index will grow from 65.1% to 65.2%. The index shows the percentage of participants from the total labour force, and considers already employed and those in search of work.

Data on the Unemployment Rate for January is due at 02:30 am (GMT+2) in Australia. The index is expected to remain unchanged at 5.8%. The index shows the percentage of unemployed from the total number of able to work. A growth in the figure is a negative factor for the economy and leads to the weakening in the Australian Dollar.

EU

The ECB Monetary Policy Meeting Accounts are due at 02:30 pm (GMT+2). Accounts contain a review of current economic conditions, commentaries regarding monetary policy decisions and macroeconomic forecasts.

USA

Data on the Philadelphia Fed Manufacturing Survey is due at 03:30 pm (GMT+2). According to forecasts, the index will grow from -3.5 to -2.8 points. The index is compiled from a monthly survey of a hundred of the leading manufacturers in Philadelphia regarding their opinion of current economic conditions and economic perspectives for the next 6 months.

Data on the CB Leading Indicator for January is due in the US at 05:00 pm (GMT+2). On a month-to-month basis, the index is forecasted to remain unchanged at -0.2%.

Claws and Horns

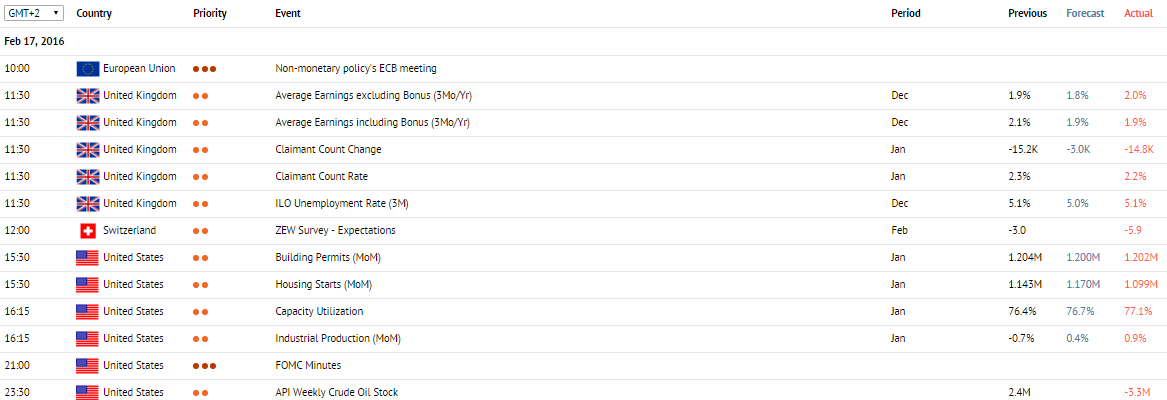

News of the day. 17.02.2016

EU

Non-monetary policy's ECB meeting is due at 10:00 am (GMT+2). At this time, the volatility of the European currency might increase. Monetary policy meetings changed to a six-week cycle while non-monetary policy meetings are held once a month.

UK

Data on ILO Unemployment Rate is due in the UK at 11:30 am (GMT+2). The indicator is expected to decline to 5.0% from 5.1%. The data measures the percentage of unemployed people in the total labour force. A decline in the indicator is seen as a favorable factor and might strengthen the Pound.

Data on Average earning is due in the UK at 11:30 am (GMT+2). Both Average Earnings indicators, excluding and including bonus, are expected to be down to 1.8% from 1.9% and to 1.9% from 2.0%, respectively. The data is seen as an indicator of labour costs. A growth in the indicators presents an increase in labour costs and strengthens the Pound. A decline, on the contrary, might affect the national currency.

Data on Claimant Count Change for January is due in the UK at 11:30 am (GMT+2). The indicator is expected to shrink to -3K from -4.3K. The data reflects the number of unemployed people in the UK. A high result might affect the Pound. A low result, on the contrary, strengthens the national currency.

Switzerland

The Centre for European Economic Research releases data on economic expectations in Switzerland at 12:00 pm (GMT+2). The assessment of the current economic situation is based on such criteria as business conditions, employment conditions and others. A high result provides support for the Franc while a low result, on the contrary, might affect the national currency.

USA

Data on Housing Starts for January is due in the US at 3:30 pm (GMT+2). The data measures the number of new homes under construction. A high result might strengthen the US Dollar.

Data on Building Permits for January is due in the US at 3:30 pm (GMT+2). The data measures the number of permits for construction of new homes. Construction volumes are closely related to the level of income. Thus, a growth in the indicator is seen as a sign of favorable economic conditions and might strengthen the US Dollar.

Data on Capacity Utilization for January is due in the US at 4:15 pm (GMT+2). The data measures the percentage of production capacity that is actually used and is followed as an indicator of economic growth and the level of demand in the country. A result close to 85% is seen as preferable and presents a favorable balance between economic growth and inflation. A result above 85% activates inflationary processes in the country. In general, a growth in the indicator supports the US Dollar.

Data on Industrial Production for January is due in the US at 4:15 pm (GMT+2). The data reflects the volume of industrial production in the country and is followed as one of key indicators of the economy. A growth in industrial production might strengthen the US Dollar.

FOMC Minutes are released at 9:00 pm (GMT+2). The Federal Open Market Committee gives assessment to the current economic and financial situation in the country and outlines future monetary policy. The publication has a strong effect on the market.

EU

Non-monetary policy's ECB meeting is due at 10:00 am (GMT+2). At this time, the volatility of the European currency might increase. Monetary policy meetings changed to a six-week cycle while non-monetary policy meetings are held once a month.

UK

Data on ILO Unemployment Rate is due in the UK at 11:30 am (GMT+2). The indicator is expected to decline to 5.0% from 5.1%. The data measures the percentage of unemployed people in the total labour force. A decline in the indicator is seen as a favorable factor and might strengthen the Pound.

Data on Average earning is due in the UK at 11:30 am (GMT+2). Both Average Earnings indicators, excluding and including bonus, are expected to be down to 1.8% from 1.9% and to 1.9% from 2.0%, respectively. The data is seen as an indicator of labour costs. A growth in the indicators presents an increase in labour costs and strengthens the Pound. A decline, on the contrary, might affect the national currency.

Data on Claimant Count Change for January is due in the UK at 11:30 am (GMT+2). The indicator is expected to shrink to -3K from -4.3K. The data reflects the number of unemployed people in the UK. A high result might affect the Pound. A low result, on the contrary, strengthens the national currency.

Switzerland

The Centre for European Economic Research releases data on economic expectations in Switzerland at 12:00 pm (GMT+2). The assessment of the current economic situation is based on such criteria as business conditions, employment conditions and others. A high result provides support for the Franc while a low result, on the contrary, might affect the national currency.

USA

Data on Housing Starts for January is due in the US at 3:30 pm (GMT+2). The data measures the number of new homes under construction. A high result might strengthen the US Dollar.

Data on Building Permits for January is due in the US at 3:30 pm (GMT+2). The data measures the number of permits for construction of new homes. Construction volumes are closely related to the level of income. Thus, a growth in the indicator is seen as a sign of favorable economic conditions and might strengthen the US Dollar.

Data on Capacity Utilization for January is due in the US at 4:15 pm (GMT+2). The data measures the percentage of production capacity that is actually used and is followed as an indicator of economic growth and the level of demand in the country. A result close to 85% is seen as preferable and presents a favorable balance between economic growth and inflation. A result above 85% activates inflationary processes in the country. In general, a growth in the indicator supports the US Dollar.

Data on Industrial Production for January is due in the US at 4:15 pm (GMT+2). The data reflects the volume of industrial production in the country and is followed as one of key indicators of the economy. A growth in industrial production might strengthen the US Dollar.

FOMC Minutes are released at 9:00 pm (GMT+2). The Federal Open Market Committee gives assessment to the current economic and financial situation in the country and outlines future monetary policy. The publication has a strong effect on the market.

Claws and Horns

News of the day. 16.02.2016

Australia

The minutes of the Reserve Bank of Australia are due at 2:30 am (GMT+2). The minutes are released two weeks after the interest rate decision and contain commentaries regarding this decision. They also give full account of the voting process of the Reserve Bank Board.

UK

Data on Consumer Price Index for January is due in the UK at 11:30 am (GMT+2). Consumer Price Index is one of key indicators to measure inflation in the country. A high result might strengthen the Pound.

Data on Producer Price Index Input for January is due in the UK at 11:30 am (GMT+2). The data reflects changes in prices of goods are services purchased by UK manufacturers. A growth in the indicator might strengthen the Pound.

Data on Producer Price Index Output for January is due in the UK at 11:30 am (GMT+2). The data reflects changes in prices of goods produced by UK manufacturers. A growth in the indicator might strengthen the Pound.

USA

The National Association of Home Builders releases Housing Market Index for January at 5:00 pm (GMT+2). The index is based on a survey of homeowners regarding their assessment of current property prices and price dynamics for the next six months. A result above 50 indicates that current property prices are seen as acceptable.

The American Petroleum Institute releases data on US crude oil stock at 11:30 pm (GMT+2). A decline in crude inventories might support the price of oil. An increase, on the contrary, might affect the price.

Australia

The minutes of the Reserve Bank of Australia are due at 2:30 am (GMT+2). The minutes are released two weeks after the interest rate decision and contain commentaries regarding this decision. They also give full account of the voting process of the Reserve Bank Board.

UK

Data on Consumer Price Index for January is due in the UK at 11:30 am (GMT+2). Consumer Price Index is one of key indicators to measure inflation in the country. A high result might strengthen the Pound.

Data on Producer Price Index Input for January is due in the UK at 11:30 am (GMT+2). The data reflects changes in prices of goods are services purchased by UK manufacturers. A growth in the indicator might strengthen the Pound.

Data on Producer Price Index Output for January is due in the UK at 11:30 am (GMT+2). The data reflects changes in prices of goods produced by UK manufacturers. A growth in the indicator might strengthen the Pound.

USA

The National Association of Home Builders releases Housing Market Index for January at 5:00 pm (GMT+2). The index is based on a survey of homeowners regarding their assessment of current property prices and price dynamics for the next six months. A result above 50 indicates that current property prices are seen as acceptable.

The American Petroleum Institute releases data on US crude oil stock at 11:30 pm (GMT+2). A decline in crude inventories might support the price of oil. An increase, on the contrary, might affect the price.

Claws and Horns

News of the day. 15.02.2016

Japan

Data on Industrial Production for December is due in Japan at 6:30 am (GMT+2). The data measures changes in the volume of industrial production and is followed as one of key indicators of the country’s economy. A growth in the indicator might strengthen the Yen.

Tertiary Industry Index for December is due in Japan at 6:30 am (GMT+2). The index reflects the current situation in the service sector. A growth in the indicator is seen as a favorable sign and might strengthen the Yen.

EU

Data on Trade Balance for December is due in the eurozone at 12:00 pm (GMT+2). The indicator measures the difference between the value of exports and imports of goods and services. A positive result represents a trade surplus and might strengthen the Euro.

ECB President Mario Draghi gives a press-conference at 4:00 pm (GMT+2). He will answer questions regarding the current economic situation in the eurozone. His commentaries might influence dynamics of the Euro.

New Zealand

Data on Retail Sales and Retail Sales ex Autos for the fourth quarter are due in New Zealand at 11:45 pm (GMT+2). The data measures the total volume of sales in retail stores and is followed as an indicator of consumer spending. A growth in retail sales is seen as a favorable factor for economic development. A high result might strengthen the NZ Dollar.

Japan

Data on Industrial Production for December is due in Japan at 6:30 am (GMT+2). The data measures changes in the volume of industrial production and is followed as one of key indicators of the country’s economy. A growth in the indicator might strengthen the Yen.

Tertiary Industry Index for December is due in Japan at 6:30 am (GMT+2). The index reflects the current situation in the service sector. A growth in the indicator is seen as a favorable sign and might strengthen the Yen.

EU

Data on Trade Balance for December is due in the eurozone at 12:00 pm (GMT+2). The indicator measures the difference between the value of exports and imports of goods and services. A positive result represents a trade surplus and might strengthen the Euro.

ECB President Mario Draghi gives a press-conference at 4:00 pm (GMT+2). He will answer questions regarding the current economic situation in the eurozone. His commentaries might influence dynamics of the Euro.

New Zealand

Data on Retail Sales and Retail Sales ex Autos for the fourth quarter are due in New Zealand at 11:45 pm (GMT+2). The data measures the total volume of sales in retail stores and is followed as an indicator of consumer spending. A growth in retail sales is seen as a favorable factor for economic development. A high result might strengthen the NZ Dollar.

Claws and Horns

News of the day. 12.02.2016

Australia

Data on Investment Lending for Homes for December is due in Australia at 2:30 am (GMT+2). The data measures the number of long-term construction loans. A growth in the indicator might strengthen the Australian Dollar.

Data on Home Loans for December is due in Australia at 2:30 am (GMT+2). The indicator is expected to grow to 3.0% from 1.8%. The data measures the number of new home loans and is followed as one of key indicators of the property market. A growth in the indicator might strengthen the Australian Dollar.

Germany

Data on Germany’s GDP for the fourth quarter is due at 9:00 am (GMT+2). Analysts expect the indicator to remain unchanged at 0.3% on a quarterly basis and to grow to 2.3% from 1.7% on an annual basis.

Consumer Price Index for January is due in Germany at 9:00 am (GMT+2). The indicator is expected to remain unchanged, both in annual and monthly terms, at 0.5% and -0.8%, respectively. The index, reflecting price change for goods and services purchased by households, is seen as the key indicator of inflation. A high result might strengthen the Euro.

EU

Data on the eurozone’s GDP for the fourth quarter is due at 11:00 am (GMT+2). Both in quarterly and annual terms, a fall is expected, to 0.0% from 0.3% and to 1.5% from 1.6%, respectively.

Data on Industrial Production for December is due in the eurozone at 12:00 pm (GMT+2). In monthly terms, the indicator is expected to grow to 0.3% from -0.7%. In annual terms, on the contrary, analysts forecast a decline to 0.9% from 1.1%. The data reflects changes in the volume of production and is followed as one of key indicators of economic conditions. A high result might strengthen the Euro.

USA

Data on Retail Sales ex Autos for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to recover to 0.0% from -0.1%. The data reflects changes in the volume of goods sold by retailers and is followed as an indicator of consumer spending. A growth in the indicator is seen as a positive factor for the country’s economy and might strengthen the US Dollar.

Data on Retail Sales for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 0.1% from -0.1%. The data reflects changes in the volume of goods sold by retailers and is followed as an indicator of consumer spending. A growth in Retail Sales is seen as a positive factor for the country’s economy and might strengthen the US Dollar.

Australia

Data on Investment Lending for Homes for December is due in Australia at 2:30 am (GMT+2). The data measures the number of long-term construction loans. A growth in the indicator might strengthen the Australian Dollar.

Data on Home Loans for December is due in Australia at 2:30 am (GMT+2). The indicator is expected to grow to 3.0% from 1.8%. The data measures the number of new home loans and is followed as one of key indicators of the property market. A growth in the indicator might strengthen the Australian Dollar.

Germany

Data on Germany’s GDP for the fourth quarter is due at 9:00 am (GMT+2). Analysts expect the indicator to remain unchanged at 0.3% on a quarterly basis and to grow to 2.3% from 1.7% on an annual basis.

Consumer Price Index for January is due in Germany at 9:00 am (GMT+2). The indicator is expected to remain unchanged, both in annual and monthly terms, at 0.5% and -0.8%, respectively. The index, reflecting price change for goods and services purchased by households, is seen as the key indicator of inflation. A high result might strengthen the Euro.

EU

Data on the eurozone’s GDP for the fourth quarter is due at 11:00 am (GMT+2). Both in quarterly and annual terms, a fall is expected, to 0.0% from 0.3% and to 1.5% from 1.6%, respectively.

Data on Industrial Production for December is due in the eurozone at 12:00 pm (GMT+2). In monthly terms, the indicator is expected to grow to 0.3% from -0.7%. In annual terms, on the contrary, analysts forecast a decline to 0.9% from 1.1%. The data reflects changes in the volume of production and is followed as one of key indicators of economic conditions. A high result might strengthen the Euro.

USA

Data on Retail Sales ex Autos for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to recover to 0.0% from -0.1%. The data reflects changes in the volume of goods sold by retailers and is followed as an indicator of consumer spending. A growth in the indicator is seen as a positive factor for the country’s economy and might strengthen the US Dollar.

Data on Retail Sales for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 0.1% from -0.1%. The data reflects changes in the volume of goods sold by retailers and is followed as an indicator of consumer spending. A growth in Retail Sales is seen as a positive factor for the country’s economy and might strengthen the US Dollar.

Claws and Horns

News of the day. 10.02.2016

Australia

The Housing Industry Association releases data on New Home Sales in Australia at 2:00 am (GMT+2). The data measures changes in the number of new home sales. A growth in the indicator is seen a sign of general improvement in the country’s economy and might strengthen the Australian Dollar

UK

The National Institute of Economic and Social Research releases its UK GDP Estimate at 5:00 pm (GMT+2). The indicator tracks dynamics of the country’s economic growth over the last three months. The report might influence monetary policy in the UK. A high result strengthens the Pound.

USA

Fed’s Chair Janet Yellen testifies before the Congress about the current economic situation and, later on, answers congressmen’s questions. Her comments might lead to an increase in market volatility.

The Energy Information Administration releases its weekly Crude Oil Stock Change report at 5:30 pm (GMT+2). A growth in crude oil inventories might affect the price of oil.

Monthly Budget Statement is due in the US at 9:00 pm (GMT+2). The US is expected to record a budget surplus of $45 billion after a $14 billion deficit in the previous month. The indicator measures a ratio between the government’s revenues and expenditures. A budget surplus occurs when revenues exceed expenditures. In this situation, the US Dollar might strengthen.

New Zealand

Data on Business PMI for January is due in New Zealand at 11:30 pm (GMT+2). The index is based on a survey of purchasing managers regarding their assessment of the current economic situation and its prospects. A result above 50 reflects a generally favorable assessment and might strengthen the NZ Dollar.

Australia

The Housing Industry Association releases data on New Home Sales in Australia at 2:00 am (GMT+2). The data measures changes in the number of new home sales. A growth in the indicator is seen a sign of general improvement in the country’s economy and might strengthen the Australian Dollar

UK

The National Institute of Economic and Social Research releases its UK GDP Estimate at 5:00 pm (GMT+2). The indicator tracks dynamics of the country’s economic growth over the last three months. The report might influence monetary policy in the UK. A high result strengthens the Pound.

USA

Fed’s Chair Janet Yellen testifies before the Congress about the current economic situation and, later on, answers congressmen’s questions. Her comments might lead to an increase in market volatility.

The Energy Information Administration releases its weekly Crude Oil Stock Change report at 5:30 pm (GMT+2). A growth in crude oil inventories might affect the price of oil.

Monthly Budget Statement is due in the US at 9:00 pm (GMT+2). The US is expected to record a budget surplus of $45 billion after a $14 billion deficit in the previous month. The indicator measures a ratio between the government’s revenues and expenditures. A budget surplus occurs when revenues exceed expenditures. In this situation, the US Dollar might strengthen.

New Zealand

Data on Business PMI for January is due in New Zealand at 11:30 pm (GMT+2). The index is based on a survey of purchasing managers regarding their assessment of the current economic situation and its prospects. A result above 50 reflects a generally favorable assessment and might strengthen the NZ Dollar.

Claws and Horns

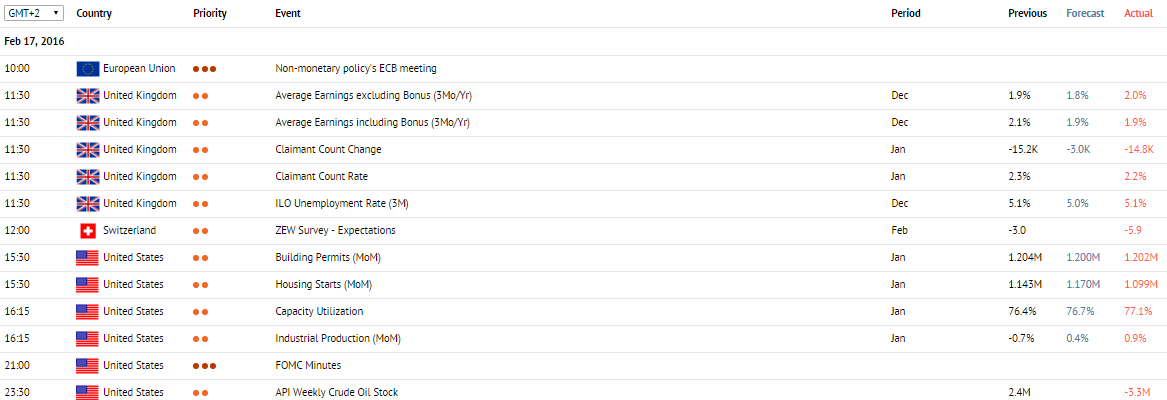

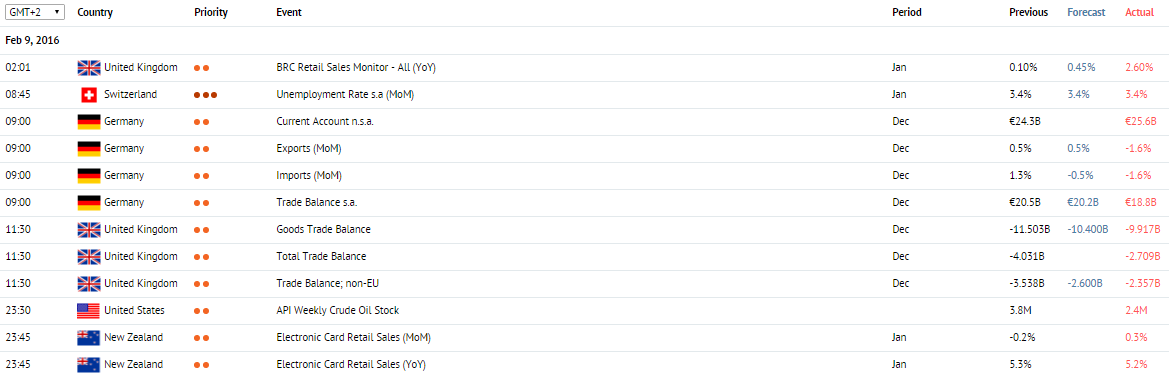

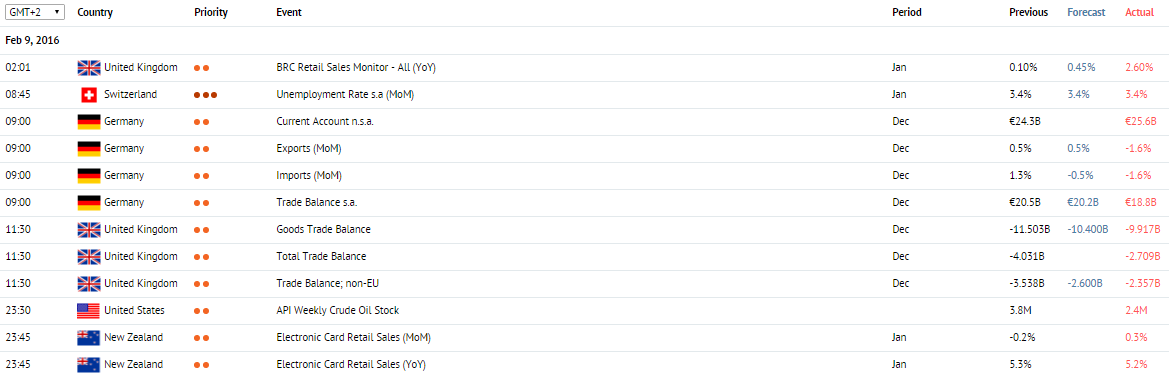

News of the day. 9.02.2016

UK

The British Retail Consortium (BRC) Retail Sales Monitor for January is due at 2:01 am (GMT+2). The indicator is expected to grow to 0.4% from 0.1%. The data reflects changes in the actual value of retail sales from companies participating in BRC. A high result might strengthen the Pound.

Data on Goods Trade Balance with non-EU countries for December is due in the UK at 11:30 am (GMT+2). The country’s trade deficit is expected to increase to 2.55 billion from 2.45 billion pounds. The indicator measures difference between the value of goods and services exported out of and imported into the country. A negative value shows a trade deficit and might affect the Pound.

Data on Goods Trade Balance for December is due in the UK at 11:30 am (GMT+2). The country’s trade deficit is expected to decrease to 10.35 billion from 10.64 billion pounds. The indicator measures difference between the value of goods and services exported out of and imported into the country. A negative value shows a trade deficit and might affect the Pound.

Switzerland

Data on Unemployment Rate for January is due in Switzerland at 8:45 am (GMT+2). On a monthly basis, the indicator is expected to remain unchanged at 3.4%.

Germany

Data on Imports and Exports for December are due at 9:00 am (GMT+2). The indicators are released by Statistiches Bundesamt Deutschland. Imports are expected to be down to -0.5% from 1.6%, while Exports – to be up to 0.5% from 0.4%. Imports present changes in the total amount of goods and services imported into the country (purchases, grant, gifts). Exports present changes in the total amount of goods and services exported out of the country (sales, grant, gifts).

Data on Trade Balance for December is due in Germany at 9:00 am (GMT+2). A trade surplus is expected to increase to 20.2 billion from 19.7 billion euros. The data presents difference between the value of goods and services exported out of and imported into the country. A positive value shows a trade surplus, an excess of exports over imports. A growth in exports has a positive effect on the country’s economy and might strengthen the Euro.

USA

The American Petroleum Institute releases its Weekly Crude Oil Stock report at 11:30 pm (GMT+2). A growth in crude oil inventories might affect the price of oil.

New Zealand

Data on Electronic Card Retail Sales for January is due in New Zealand at 11:45 pm (GMT+2). The data measures the number of purchases made using debit and credit cards and reflects situation in the retail sector. A high result might strengthen the NZ Dollar.

UK

The British Retail Consortium (BRC) Retail Sales Monitor for January is due at 2:01 am (GMT+2). The indicator is expected to grow to 0.4% from 0.1%. The data reflects changes in the actual value of retail sales from companies participating in BRC. A high result might strengthen the Pound.

Data on Goods Trade Balance with non-EU countries for December is due in the UK at 11:30 am (GMT+2). The country’s trade deficit is expected to increase to 2.55 billion from 2.45 billion pounds. The indicator measures difference between the value of goods and services exported out of and imported into the country. A negative value shows a trade deficit and might affect the Pound.

Data on Goods Trade Balance for December is due in the UK at 11:30 am (GMT+2). The country’s trade deficit is expected to decrease to 10.35 billion from 10.64 billion pounds. The indicator measures difference between the value of goods and services exported out of and imported into the country. A negative value shows a trade deficit and might affect the Pound.

Switzerland

Data on Unemployment Rate for January is due in Switzerland at 8:45 am (GMT+2). On a monthly basis, the indicator is expected to remain unchanged at 3.4%.

Germany

Data on Imports and Exports for December are due at 9:00 am (GMT+2). The indicators are released by Statistiches Bundesamt Deutschland. Imports are expected to be down to -0.5% from 1.6%, while Exports – to be up to 0.5% from 0.4%. Imports present changes in the total amount of goods and services imported into the country (purchases, grant, gifts). Exports present changes in the total amount of goods and services exported out of the country (sales, grant, gifts).

Data on Trade Balance for December is due in Germany at 9:00 am (GMT+2). A trade surplus is expected to increase to 20.2 billion from 19.7 billion euros. The data presents difference between the value of goods and services exported out of and imported into the country. A positive value shows a trade surplus, an excess of exports over imports. A growth in exports has a positive effect on the country’s economy and might strengthen the Euro.

USA

The American Petroleum Institute releases its Weekly Crude Oil Stock report at 11:30 pm (GMT+2). A growth in crude oil inventories might affect the price of oil.

New Zealand

Data on Electronic Card Retail Sales for January is due in New Zealand at 11:45 pm (GMT+2). The data measures the number of purchases made using debit and credit cards and reflects situation in the retail sector. A high result might strengthen the NZ Dollar.

Claws and Horns

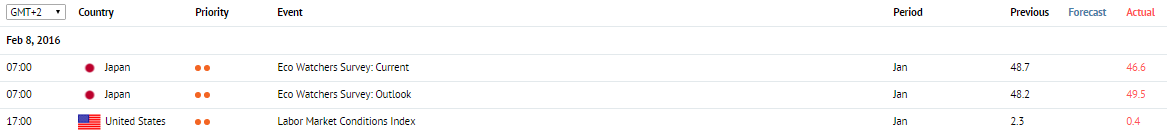

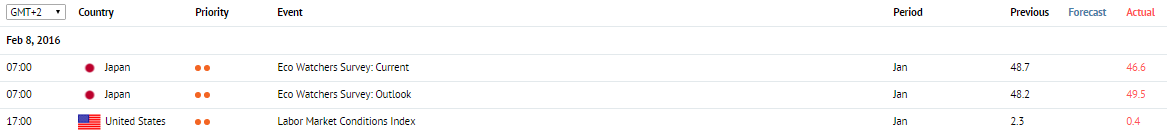

News of the day. 8.02.2016

Japan

The Eco Watchers Survey for January is due in Japan at 8 am (GMT+2). The survey reflects how employees of the largest companies assess current and future economic conditions. A result above 50 represents a generally positive assessment and might strengthen the Yen.

The Eco Watchers Survey for January is due in Japan at 8 am (GMT+2). The survey reflects how employees of the largest companies assess current and future economic conditions. A result above 50 represents a generally positive assessment and might strengthen the Yen.

USA

Labor Market Conditions Index for January is due in the US at 5:00 pm (GMT+2). The index, developed by Federal Reserve economists, consists of 19 indicators. The data is seen as key to assess the state of the country’s economy. A high result might strengthen the US Dollar.

Japan

The Eco Watchers Survey for January is due in Japan at 8 am (GMT+2). The survey reflects how employees of the largest companies assess current and future economic conditions. A result above 50 represents a generally positive assessment and might strengthen the Yen.

The Eco Watchers Survey for January is due in Japan at 8 am (GMT+2). The survey reflects how employees of the largest companies assess current and future economic conditions. A result above 50 represents a generally positive assessment and might strengthen the Yen.

USA

Labor Market Conditions Index for January is due in the US at 5:00 pm (GMT+2). The index, developed by Federal Reserve economists, consists of 19 indicators. The data is seen as key to assess the state of the country’s economy. A high result might strengthen the US Dollar.

Claws and Horns

News of the day. 5.02.2016

Australia

The Reserve Bank of New Zealand releases its Monetary Policy Statement at 2:30 am (GMT+2). This publication gives an overview of the current economic situation and factors that determine the stance of monetary policy. The Monetary Policy Statement gives information on how the Regulator assesses economic conditions both in the country and the world.

Data on Retail Sales for December is due in Australia at 2:30 am (GMT+2). The indicator is expected to grow to 0.5% from 0.4%. This data measures the amount of goods sold by retailers and is seen as an indicator of consumer spending and economic growth. A growth in Retail Sales might strengthen the Australian Dollar.

Japan

Coincident Index for December is due in Japan at 7:00 am (GMT+2). The index is based on 11 indicators and assesses economic conditions in the country. A result above 50 indicates a growth in the country’s economy and might strengthen the Yen.

Canada

Data on Unemployment Rate for January is due in Canada at 3:30 pm (GMT+2). The indicator is expected to remain unchanged at 7.1%. The data, released by the Statistics Canada, measures the percentage of unemployed people in the total labor force. A growth in the indicator is seen as a sign of a slowdown in economic growth and might affect the Canadian Dollar.

Ivey Purchasing Managers Index for January is due in Canada at 5:00 pm (GMT+2). The indicator is expected to grow to 50.0 points from 49.9 points. The index, released by the Richard Ivey School of Business, assesses business conditions and the overall state of the country’s economy. A result above 50 is seen as a favorable one and might strengthen the Canadian Dollar.

USA

Data on Trade Balance for December is due in the US at 3:30 pm (GMT+2). Trade deficit is expected to grow to -43 billion from 42.4 billion. The indicator measures the difference between the value of goods and services exported out of the country and the value of goods and services imported into the country. A result below 0 represents a negative balance of trade and might affect the US Dollar.

Data on Average Hourly Earnings for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 0.3% from 0.0%. The data serves as an indicator of labor cost inflation. A high result might strengthen the US Dollar.

Data on Nonfarm Payrolls for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to decline to 190K from 292K. The data measures the number of new jobs created in non-agricultural sector and is seen as one of the key indicators of employment that has a strong influence on the market. A high result might support the US Dollar.

Data on Consumer Credit Change for December is due in the US at 10:00 pm (GMT+2). The indicator is expected to grow to 16.00 billion from 13.95 billion. The data measures changes in the amount of outstanding consumer credits. A high result might strengthen the US Dollar. However, a very high result might indicate “overconsumption”, the situation when consumers borrow more than theу are able to pay back.

Australia

The Reserve Bank of New Zealand releases its Monetary Policy Statement at 2:30 am (GMT+2). This publication gives an overview of the current economic situation and factors that determine the stance of monetary policy. The Monetary Policy Statement gives information on how the Regulator assesses economic conditions both in the country and the world.

Data on Retail Sales for December is due in Australia at 2:30 am (GMT+2). The indicator is expected to grow to 0.5% from 0.4%. This data measures the amount of goods sold by retailers and is seen as an indicator of consumer spending and economic growth. A growth in Retail Sales might strengthen the Australian Dollar.

Japan

Coincident Index for December is due in Japan at 7:00 am (GMT+2). The index is based on 11 indicators and assesses economic conditions in the country. A result above 50 indicates a growth in the country’s economy and might strengthen the Yen.

Canada

Data on Unemployment Rate for January is due in Canada at 3:30 pm (GMT+2). The indicator is expected to remain unchanged at 7.1%. The data, released by the Statistics Canada, measures the percentage of unemployed people in the total labor force. A growth in the indicator is seen as a sign of a slowdown in economic growth and might affect the Canadian Dollar.

Ivey Purchasing Managers Index for January is due in Canada at 5:00 pm (GMT+2). The indicator is expected to grow to 50.0 points from 49.9 points. The index, released by the Richard Ivey School of Business, assesses business conditions and the overall state of the country’s economy. A result above 50 is seen as a favorable one and might strengthen the Canadian Dollar.

USA

Data on Trade Balance for December is due in the US at 3:30 pm (GMT+2). Trade deficit is expected to grow to -43 billion from 42.4 billion. The indicator measures the difference between the value of goods and services exported out of the country and the value of goods and services imported into the country. A result below 0 represents a negative balance of trade and might affect the US Dollar.

Data on Average Hourly Earnings for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 0.3% from 0.0%. The data serves as an indicator of labor cost inflation. A high result might strengthen the US Dollar.

Data on Nonfarm Payrolls for January is due in the US at 3:30 pm (GMT+2). The indicator is expected to decline to 190K from 292K. The data measures the number of new jobs created in non-agricultural sector and is seen as one of the key indicators of employment that has a strong influence on the market. A high result might support the US Dollar.

Data on Consumer Credit Change for December is due in the US at 10:00 pm (GMT+2). The indicator is expected to grow to 16.00 billion from 13.95 billion. The data measures changes in the amount of outstanding consumer credits. A high result might strengthen the US Dollar. However, a very high result might indicate “overconsumption”, the situation when consumers borrow more than theу are able to pay back.

Claws and Horns

News of the day. 4.02.2016

Australia

Data on National Australia Bank's Business Confidence for the fourth quarter is due at 2:30 am (GMT+2). The index is based on a survey of present business conditions in Australia and reflects the performance of the country’s economy in the short term. A growth in the indicator might strengthen the Australian Dollar.

Switzerland

Data on SECO Consumer Climate for the first quarter is due in Switzerland at 8:45 am (GMT+2). Though, in general, negative dynamics will continue, the indicator is expected to come in at -15 points, up from -18 points. The index, released by the State Secretariat for Economic Affairs, measures consumer attitudes towards the current economic situation. A result above 0 indicates a generally favorable attitude and might strengthen the Franc.

EU

At 10:00 am (GMT+2), ECB President Mario Draghi will answer questions regarding the current economic situation in the eurozone. An increase in volatility might be expected.

ECB releases its Economic Bulletin at 11:00 am (GMT+2). The Bulletin is released two weeks after each Governing Council meeting and contains data on macroeconomic indicators as well as commentary on the current economic situation and monetary policy.

UK

The Bank of England releases its Quarterly Inflation Report at 2:00 pm (GMT+2). The report provides a detailed analysis of the current economic situation and inflation projections for the following two years. Favorable data might strengthen the Pound.

Data on BoE Asset Purchase Facility is due at 2:00 pm (GMT+2). The indicator measures the value of money the Bank of England plants to inject into the economy through open market bond purchases. This monetary policy tool is also called Quantitative Easing.

The Monetary Policy Summary is released alongside an interest rate decision at 2:00 pm (GMT+2). The Summary contains commentary on the decision as well as information on the voting processes.

The Bank of England releases its interest rate decision at 2:00 pm (GMT+2). Interest rates are expected to remain unchanged at 0.5%. When making a decision, the Regulator considers the current economic situation and inflation. A rate increase might strengthen the Pound whereas a rate cut or the decision to keep interest rates unchanged might affect the national currency.

At 2:45 pm (GMT+2), BOE's Governor Mark Carney will comment on the current economic situation in the country.

USA

Data on Initial Jobless Claims for the week ended 29 January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 280K from 278K. The data is released every Thursday and represents the number of the first-time claims for state unemployment insurance. A decline in the indicator might strengthen the US Dollar.

Data on Factory Orders for December is due in the US at 5:00 pm (GMT+2). The indicator is expected to fall to -2.8% from -0.2%. The data reflects changes in the amount of factory orders and is followed as in indicator of a growth in the manufacturing sector. An increase in the amount of factory orders might strengthen the US Dollar.

Australia

Data on National Australia Bank's Business Confidence for the fourth quarter is due at 2:30 am (GMT+2). The index is based on a survey of present business conditions in Australia and reflects the performance of the country’s economy in the short term. A growth in the indicator might strengthen the Australian Dollar.

Switzerland

Data on SECO Consumer Climate for the first quarter is due in Switzerland at 8:45 am (GMT+2). Though, in general, negative dynamics will continue, the indicator is expected to come in at -15 points, up from -18 points. The index, released by the State Secretariat for Economic Affairs, measures consumer attitudes towards the current economic situation. A result above 0 indicates a generally favorable attitude and might strengthen the Franc.

EU

At 10:00 am (GMT+2), ECB President Mario Draghi will answer questions regarding the current economic situation in the eurozone. An increase in volatility might be expected.

ECB releases its Economic Bulletin at 11:00 am (GMT+2). The Bulletin is released two weeks after each Governing Council meeting and contains data on macroeconomic indicators as well as commentary on the current economic situation and monetary policy.

UK

The Bank of England releases its Quarterly Inflation Report at 2:00 pm (GMT+2). The report provides a detailed analysis of the current economic situation and inflation projections for the following two years. Favorable data might strengthen the Pound.

Data on BoE Asset Purchase Facility is due at 2:00 pm (GMT+2). The indicator measures the value of money the Bank of England plants to inject into the economy through open market bond purchases. This monetary policy tool is also called Quantitative Easing.

The Monetary Policy Summary is released alongside an interest rate decision at 2:00 pm (GMT+2). The Summary contains commentary on the decision as well as information on the voting processes.

The Bank of England releases its interest rate decision at 2:00 pm (GMT+2). Interest rates are expected to remain unchanged at 0.5%. When making a decision, the Regulator considers the current economic situation and inflation. A rate increase might strengthen the Pound whereas a rate cut or the decision to keep interest rates unchanged might affect the national currency.

At 2:45 pm (GMT+2), BOE's Governor Mark Carney will comment on the current economic situation in the country.

USA

Data on Initial Jobless Claims for the week ended 29 January is due in the US at 3:30 pm (GMT+2). The indicator is expected to grow to 280K from 278K. The data is released every Thursday and represents the number of the first-time claims for state unemployment insurance. A decline in the indicator might strengthen the US Dollar.

Data on Factory Orders for December is due in the US at 5:00 pm (GMT+2). The indicator is expected to fall to -2.8% from -0.2%. The data reflects changes in the amount of factory orders and is followed as in indicator of a growth in the manufacturing sector. An increase in the amount of factory orders might strengthen the US Dollar.

Claws and Horns

News of the day. 3.02.2016

New Zealand