Forum on trading, automated trading systems and testing trading strategies

Something Interesting in Financial Video October 2014

newdigital, 2014.10.17 20:03

Difference between ECN, market makers and STP brokers

In a perfect world the cost of buying and selling currencies would be

the same, no matter which Forex broker you use. Unlike the stock market

where we get heavy regulation and where stock prices are derived from a

single exchange, prices vary from different Forex broker platforms.

The

reason why is because currency prices are derived from the Interbank

market which is a conglomerate of banks and hedge funds that provide

prices to various Forex brokers around the world. The better the

relationship between the Interbank market participants and the broker

means that the prices are cheaper.

We expand on this in the video

tutorial whilst also describing the main difference between ECN, market

makers and STP Forex brokers.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.02 08:19

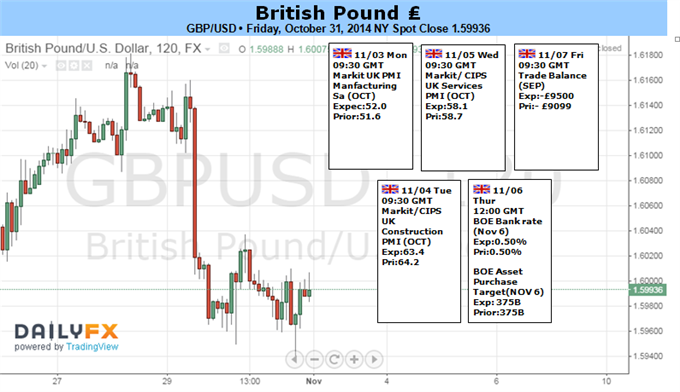

GBPUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Pound: Neutral- Sterling finishes sharply lower versus US Dollar and targets fresh lows

- Bank of England Rate Decision threatens volatility on surprises, but watch US Dollar on NFPs

The British pound finished the week notably lower versus the resurgent

US Dollar, but a busy week of economic event risk ahead suggests the GBP/USD may see big moves and could very well stage a reversal.

Watch for any surprises out of an upcoming Bank of England Rate Decision

and/or the highly-anticipated US Nonfarm Payrolls report to drive the

lion’s share of Sterling/Dollar moves in the week ahead. Traders are

clearly preparing for big volatility across the major FX pairs as 1-week

volatility prices have hit their highest since the Scottish Referendum

vote in September.

We do not expect the Sterling will see the same level of turmoil on a

simple BoE rate announcement. Yet we need only look to the past week’s

Bank of Japan interest rate decision to see the effects of a truly

surprising central bank meeting. Analysts widely expect that the

Monetary Policy Committee will leave interest rates unchanged and

therefore produce no post-decision statement. To that end we’ll watch

earlier-week PMI figures to gauge sentiment ahead of next week’s Bank of

England Quarterly Inflation Report.

Beyond UK event risk it remains important to watch how the US Dollar and

British Pound start the new month. Through September it seemed as

though the US Currency was unstoppable as it hit fresh peaks against

almost all major counterparts. Yet the month of October brought

considerable consolidation. Late volatility suggests that November could

produce a material change in market conditions. And indeed historical

seasonality studies have shown that major currencies are more likely to

see important reversals at the beginning and end of a given calendar

period. Let’s watch and see how the Sterling starts to gauge whether a

more significant breakdown is likely.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.02 08:21

EUR/USD forecast for the week of November 3, 2014, Technical AnalysisThe EUR/USD pair initially tried to rally during the course of the week, but found enough trouble at the 1.28 level in order to turn things back around and fall very harshly. We tested the 1.25 level, but found it to be somewhat supportive towards the end of the session on Friday. Ultimately, if we break down below the lows of the week, we could go much lower at that point in time. We believe that the market should continue to go lower given enough time, and that the 1.25 level will eventually break down.

Ultimately, we believe that the market could very well head back down to the 1.2050 level, as it would then be a “round-trip” of the entire uptrend that we have obviously broken down below now. The fact that the 1.28 level, which of course was the 61.8% Fibonacci retracement level of the longer move, was broken down significantly, it appears that the market should make that round-trip previously mentioned.

Ultimately, we believe that anytime that this market will continue to be sold off every time it rallies, as the sellers are most certainly in control at this point time. And we think about it, it makes him presents as the European Central Bank almost certainly has to keep a very loose monetary policy in order to bring down the value of the Euro in order to try to stimulate the economy.

Given enough time, we believe that the real way to make profits over the longer term will be to continue to hang onto trades, perhaps adding to a position in order to increase its size every time we rally. The 1.20 level below should be rather supportive though, so we don’t know whether or not the market will actually go below there. At that point in time, it is possible that the trend will turned back to the upside, but assuredly at this point in time it appears of the market is ready to break down significantly. We have no interest in buying this market until we break above the 1.30 handle, something that does not look very likely.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.05 05:04

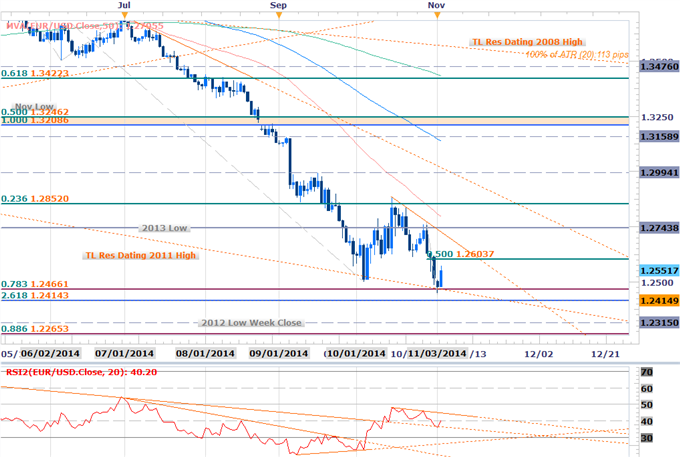

EURUSD Scalps Target 1.26 Ahead of ECB / NFPs (based on dailyfx article)

- EURUSD responds to long-dated trendline- immediate focus is higher

- Scalps target topside correction / short entries higher up

- EURUSD responds to 2011 trendline- Recovery shifts immediate focus is higher

- Broader downtrend remains intact sub-October trendline resistance

- Resistance (possible short entries) at 1.26, 1.2640 & 1.27

- Support objectives at 1.2466, 1.2414 & 1.2315

- Daily RSI divergence / former resistance-trigger now support- constructive

- Numerous resistance/support triggers pending

- Event Risk Ahead: Eurozone Retail Sales and US ADP Employment & ISM on Wednesday, ECB on Thursday, NFP on Friday

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.06 09:58

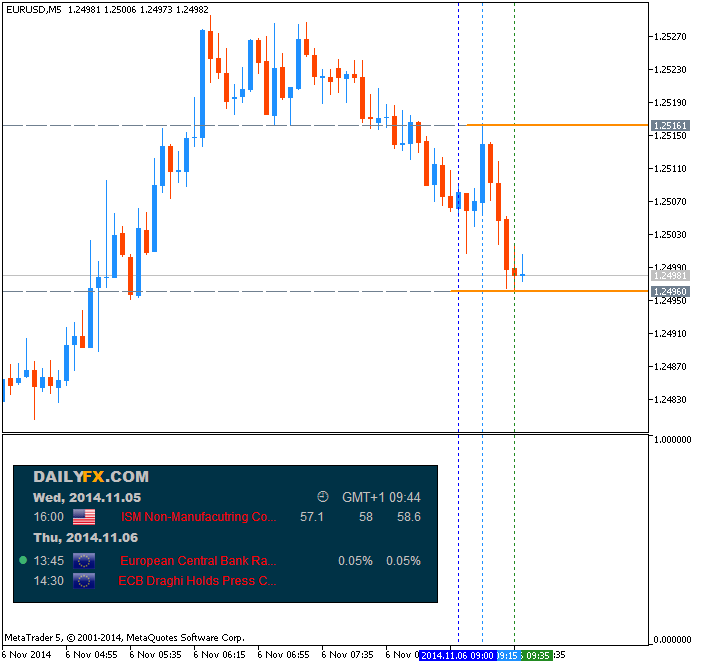

Trading the News: European Central Bank (ECB) Interest Rate Decision (adapted from dailyfx article)

- European Central Bank (ECB) to Retain Current Policy Ahead of Next T-LTRO in December.

- Will ECB Expand the Scope & Attractiveness of Non-Standard Measures?

The EUR/USD may face another selloff in the days ahead should the

European Central Bank (ECB) adopt a more dovish tone and offer

additional monetary support to prop up the ailing economy.

What’s Expected:

Why Is This Event Important:

The ECB may take a more aggressive approach in expanding its balance-sheet amid the growing threat for deflation, but we may see a relief rally in the EUR/USD should the Governing Council merely make an attempt to buy more time.

Nevertheless, ECB President Mario Draghi may promote a wait-and-see

approach as the central bank continues to assess the impact of the

non-standard measures, and the Euro may face a more meaningful rebound

in the days ahead if we see more of the same from the Governing

Council’s October 2 meeting.

How To Trade This Event Risk

Bearish EUR Trade: Governing Council Shows Greater Willingness to Implement More Easing

- Need red, five-minute candle following the updated forward-guidance to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

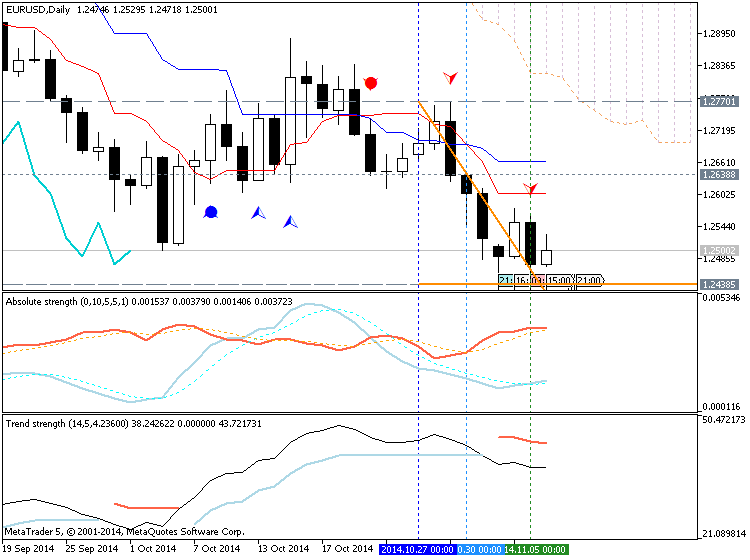

EUR/USD Daily Chart

- Despite the range-bound price action in EUR/USD, the long-term outlook remains bearish as the RSI retains the downward momentum carried over from the previous year.

- Interim Resistance: 1.2580 (78.6% retracement) to 1.2620 (50.0% expansion)

- Interim Support: 1.2450 (78.6% retracement) to 1.2470 (78.6% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| OCT 2014 | 10/02/2014 11:45 GMT | 0.05% | 0.05% | +5 | +20 |

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.08 09:35

Trading Video: Next EURUSD, USDJPY and SPX Moves Require Greater Conviction (based on dailyfx article)

- The divergence in monetary policy presents the greatest potential for EURUSD, GBPUSD and USDJPY trends

- GBPUSD and the Pound face the most concentrated event risk next week on the BoE's Quarterly report

- Risk trends may not be active now, but be wary of their influence over the FX and capital markets

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.09 08:22

USD/CAD forecast for the week of November 10, 2014, Technical AnalysisThe USD/CAD pair broke higher during the course of the week, testing the 1.15 level. We failed there and turned back around and form a shooting star, and that of course is a very sign. However, the candle ready for was a hammer at the 1.12 level, so it appears of the market will probably bounce around in this general vicinity. With that being said, the market should eventually go higher, and perhaps go as high as 1.20 the course of the next several months. We are bullish of this market, and have no interest whatsoever in selling.

50 minute dicumentary video

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.12 05:24

Video: Yen Crosses Surge and GBPUSD Ready for Volatility

- Volatility and risk trends leveled out this past session to be replaced by region-specific event risk

- Yen crosses were once again top movers as market speculation of an election and tax hike delay circulated

- Ahead, Pound traders are preparing for a clear update on the BoE's rate forecasts

Market-wide sentiment swings have settled, but that hasn't curbed FX

volatility. In the absence of a unified catalyst, we are finding

localized fundamental developments that are generating heavy trading

conditions. This past session, the Yen crosses were the most active

amongst the majors. A troubled economic outlook and doubt over the

effectiveness of stimulus measures has led to speculation/fear that an

election could be around the corner and/or a delay in the second sales

tax hike. This theme certainly isn't played out. Meanwhile, the most

potential-packed liquid currency moving forward is the Pound. A key

event release will tap a Sterling nerve with volatility and trend

high-probability outcomes. We look at what is driving the FX market in

today's Trading Video.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.13 05:44

Price & Time: USD Waiting On A Catalyst (based on dailyfx article)- USD/JPY tests trendline resistance

- GBP/USD threatening new yearly lows

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Please upload forex video you consider as interesting one. No direct advertising and no offtopic please.

The comments without video will be deleted.