Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.13 19:41

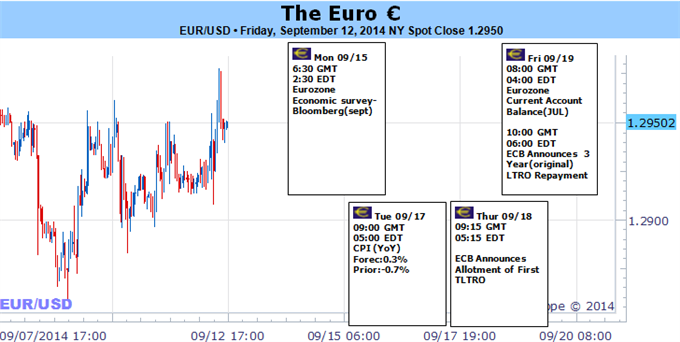

Forex Weekly Outlook September 15-19Inflation data in the UK and the US, German Economic Sentiment, US Federal Funds Rate and FOMC Press conference, GDP in New Zealand, US unemployment claims, Scottish Independence Vote are the major topics in Forex calendar. Check out these events on our weekly outlook.

Last week US jobless claims increased 11,000 last week, reaching 315K, exceeding the revised 304K posted in the week before. However, the 4 week moving average was little affected, rising 750 to 304K, 7% less than a year ago and still behind prerecession levels. Despite sluggish, hiring in August, the general trend is positive. The economy has generated an average of 215,000 jobs a month so far in 2014, up from 194,000 in 2013 and wage growth is expected to rise in the coming months alongside economic expansion. Will this trend continue?

- Haruhiko Kuroda speaks: Tuesday, 5:30. BOE Governor Haruhiko Kuroda will press conference in Osaka. Market volatility is expected.

- UK inflation data: Tuesday, 8:30. Annual inflation rate dropped more than expected in July, reaching 1.6% from 1.9% in June, lowering the chance of an interest rate rise in 2014. Economists expected a smaller decline to 1.8%. The main cause for the sharp fall was price reduction in summer clothing. Inflation was held below the BOE’s 2% target for the seventh consecutive month, indicating the UK economy is stabilizing. However, cost of living and income tax are still too high compared to wage growth. Annual inflation is expected to reach 1.5% in August.

- Eurozone German ZEW Economic Sentiment: Tuesday, 9:00. German economic sentiment plunged in August to 8.6 from 27.1 in July. The 18.5 fall brought sentiment to its lowest level since December 2012. Analysts expected a more modest decline to 18.2 points. The Current Conditions Index dropped to 44.3 from 61.8 in July, missing predictions for a decline to 55.5. The ongoing geopolitical tensions are the main reason for the sharp decline. Economic climate is expected to decline further to 5.2.

- US PPI: Tuesday, 12:30. U.S. producer prices inched marginally in July rising 0.1%, in line with market forecast, following a 0.4% gain in the previous month. The slow advance resulted from a decline in the cost of energy goods, lowering prices of finished goods. Despite the volatility in the PPI series, a trend of inflation is gathering pace, easing the Central Bank’s concerns. The government introduced three new indexes to the PPI series focusing on personal consumption. Personal consumption less food and energy rose 0.2% in July after a 0.3% gain in June. Excluding food, energy and trade services, the index increased 0.2% after a similar rise in June. Producer prices are predicted to gain 0.1% in August.

- UK employment data: Wednesday, 8:30. The number of people claiming unemployment benefits in the U.K. contracted more-than-expected in July, declining a seasonally adjusted 33,600, after a 39,500 fall in the previous month, lowering the Unemployment level to 6.4% in the three months to June. Economists expected a smaller decline of 29,700. Meanwhile, the average earnings index fell 0.2% in the three months to June after a 0.4% gain in the three months to May. The number of job seekers is expected to decline by 29,700 in August.

- US inflation data: Wednesday, 12:30. U.S. consumer prices inched 0.1% in July, in line with market forecast, following a 0.3% rise in June. On a yearly base, consumer prices gained 2.0%, compared to June’s increase of 2.1%. Excluding the volatile food and energy costs, July core consumer prices gained 0.1% after posting the same gain in June. On an annual basis, core CPI rose 1.9%, unchanged from June. Economists expect core CPI to rise above the 2% target next year, prompting the Fed to raise rates in March. U.S. consumer prices is expected to grow by 0.1% whiel Core CPI is predicted to gain 0.2%.

- FOMC Economic Projections, Rate statement and Press conference: Wednesday, 18:00. The Federal Reserve downgraded its outlook for the U.S. economy in its June meeting but continued with tapering as planned. Growth forecast was reduced to 2.1% from 2.3% due to the harsh winter in which the economy contracted 0.1%. However, Fed Chair Janet Yellen stated economic activity has rebounded in the second quarter. The Fed voted unanimously to continue the cut the monthly purchases down to $35 billion. The labor market continues to improve together with underlying strength in the broader economy. Economists believe inflation will rise once the Unemployment rate reaches 6%. Regarding interest rate increase, the Fed may stall its planned hike until reaching solid growth.

- New Zealand GDP: Wednesday, 22:45. New Zealand economy expanded 1.0% in the first quarter following a revised 1.0% in the last quarter of 2013. Construction sector was the main contributor to expansion, rising 12.5%, the largest since March 2000. Retail trade edged up 1.4% and 4.4% on a yearly base. Mining rose 6.3% in the first quarter. Household spending remained unchanged, despite the 7.3% gain in real gross national disposable income, the largest ever annual rise. Exports increased 3.1% for the quarter driven by an 18.6% rise in agriculture and fishing products.

- Switzerland rate decision: Thursday, 7:30. The Swiss National Bank (SNB) decided to maintain its Libor target at the historically-low range of 0% to 0.25%, in line with market forecast. The Central bank stated that economic growth picked up in the first quarter, after a softer fourth quarter last year. However, the Bank also noted that production capacities are still not fully utilized and expects a pickup in economic activity during the coming quarters. The downside risks remained unchanged including weaker-than-expected growth in major economies, geopolitical tensions, Eurozone financial difficulties. No change in rates is expected.

- US Building Permits: Thursday, 12:30. US building permits surged 15.7% in July, reaching a seasonally adjusted annual pace of 1.09-million units. The rise came after two consecutive declines. Economists expected starts to rise to a 969,000-unit rate. The housing market softened after the rise in interest rates. The government reported last month that the homeownership rate hit a 19-year low in the second quarter, while the rental vacancy rate was the lowest in more than 19 years. The number of Building permits is expected to reach 1.04 million units this time.

- US Unemployment Claims: Thursday, 12:30. The number of Americans seeking U.S. unemployment benefits increased by 11,000 last week to 315,000. However, the four-week average inched up only 750 to 304,000. The average remained 7.1% lower than last year. Unemployment benefits data can be volatile around holidays and could explain the 11,000 rise. Overall, the Us labor market continues to strengthen with a clear growth trend. Jobless claims are expected to grow by 312,000 this week.

- Janet Yellen speaks: Thursday, 12:45. Federal Reserve Chair Janet Yellen will speak in Washington DC. She may talk about the US labor market and the prospects of a rate hike following the taper period. Market volatility is expected.

- US Philly Fed Manufacturing Index: Thursday, 14:00. Business conditions in the Philadelphia area improved in August surging to 28 from 23.9 in July. This was the third consecutive rise and posting the highest reading since March 2011. Economists expected a more modest rise to 19.7 points. However despite the less encouraging new orders index, the general tone is positive. Business conditions in the Philadelphia area are expected to decline to 22.8.

- Scottish Independence Vote: Thursday. In September 18, Scottish voters will decide whether to split from the United Kingdom or stay as one country with England, Wales and Northern Ireland. A YouGov poll conducted for The Sunday Times and released on Sunday showed the “yes” vote at 51% and “no” at 49%. Scotland’s first minister and SNP leader Alex Salmond has been a vocal proponent of independence. British Prime Minister David Cameron wants Scotland to remain part of an undivided United Kingdom of Great Britain and Northern Ireland. Uncertainty over the outcome of the Scottish referendum weakened the pound.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.15 17:30

2014-09-15 13:15 GMT (or 15:15 MQ MT5 time) | [USD - Industrial Production]- past data is 0.2%

- forecast data is 0.3%

- actual data is -0.1% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - Industrial Production] = Change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. It's a leading indicator of economic health - production reacts quickly to ups and downs in the business cycle and is correlated with consumer conditions such as employment levels and earnings.

==========

U.S. Industrial Production Unexpectedly Edges Down 0.1% In August

With manufacturing output falling for the first time since January, the Federal Reserve released a report on Monday showing that U.S. industrial production unexpectedly decreased in the month of August.

The report said industrial production edged down by 0.1 percent in August after inching up by a downwardly revised 0.2 percent in July.

The modest drop came as a surprise to economists, who had expected production to climb by 0.3 percent compared to the 0.4 percent increase originally reported for the previous month.

The unexpected drop in industrial production came as manufacturing output fell by 0.4 percent in August after rising by 0.7 percent in July.

The Fed noted that the production of motor vehicles and parts tumbled by 7.6 percent in August after jumping by more than 9 percent in July.

Meanwhile, the report also said mining output rose by 0.5 percent in August after dipping by 0.3 percent in the previous month.

Utilities output also surged up by 1.0 percent in August after plunging by 2.7 percent and 2.0 percent in July and June, respectively.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 27 pips price movement by USD - Industrial Production news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.14 09:47

EURUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Euro: Neutral- Euro May Bounce on Strong Demand at First ECB TLTRO Operation

- FOMC Announcement, Scotland Referendum May Stoke Euro Volatility

Euro selling pressure appears to be waning at last after eight consecutive weeks of losses that brought the single currency to the lowest level in 14 months against the US Dollar.

The operative question going forward is whether this precedes a period

of consolidation before a reinvigorated push downward or a correction

upward. The answer will be found in the markets’ response to a hefty

dose of high-profile event risk on the domestic and the external fronts

in the week ahead.

Looking inward, thespotlight is on the first ECB TLTRO operation due to be held on September 18.

The effort represents one of many easing tools that Mario Draghi and

company have deployed in recent months in an attempt to check the slide

toward deflation and repair the seemingly broken monetary policy

transmission mechanism that has made the central bank’s prior attempts

at stimulus largely ineffective. The scheme envisions offering Eurozone

banks cheap capital tied up with conditions pushing them re-lend it

while passing on low borrowing costs to the real economy, stoking

activity and boosting prices. The key variable in play will be the

size of the liquidity provision that is ultimately taken up by banks

tapping the facility. In a somewhat counter-intuitive turn of events, a

large capital allocation seems likely to offer support to the Euro.

Externally, the first major item of note is the FOMC policy

announcement. September’s outing will be accompanied by the release of

an updated set of forecasts for key metrics of US economic activity as

well as press conference from Chair Janet Yellen. The Fed has long

warned about complacently buoyant risk appetite as the end of QE3 looms

ahead next month. If policymakers opt to shake things loose with

upbeat activity projections and/or a hawkish outing from Ms Yellen,

this may put the Euro’s increasingly unattractive yield profile in

stark relief and reinvigorate bearish momentum.

The second is the Scottish Independence referendum. Opinion polls ahead

of the ballot essentially point to a 50/50 chance that Scotland will

secede from the UK. This implies that – whatever the final result – a

surge of volatility is likely to follow the results as those on the

wrong side of the outcome are forced to readjust positions. A final

vote in favor of independence is likely weigh on Sterling, sending

capital fleeing to alternatives. The Euro looks like a natural

beneficiary in such a scenario. Needless to say, a victory for the “no”

campaign will probably yield the opposite result.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.16 12:52

2014-09-16 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]- past data is 8.6

- forecast data is 4.8

- actual data is 6.9 according to the latest press release

if actual > forecast (or actual data) = good for currency (for EUR in our case)

[EUR - German ZEW Economic Sentiment] = Level of a diffusion index based on surveyed German institutional investors and analysts. It's a leading indicator of economic health - investors and analysts are highly informed by virtue of their job, and changes in their sentiment can be an early signal of future economic activity

==========

German ZEW Investor Confidence Eases Less Than Expected

Germany's investor confidence weakened less-than-expected in September, reports said Tuesday citing data from the Centre for European Economic Research/ZEW.

The ZEW economic sentiment index fell to 6.9, which was above economists' forecast for a score of 5. In August, the index reading was 8.6.

The current conditions index of the survey, meanwhile, tumbled to 25.4, which was well below the consensus expectation of 40. In August, the reading was 44.3.

The Eurozone economic sentiment index of the survey eased to 14.2 in September. In August, the reading was 23.7.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 6 pips price movement by EUR - German ZEW Economic Sentiment news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.17 06:18

EURUSD Technical Analysis: Short at 1.3644 (based on dailyfx article)

- EURUSD Technical Strategy: Short at 1.3644

- Support: 1.2864, 1.2794, 1.2708

- Resistance:1.2981, 1.3057, 1.3104

A daily close above the 14.6% Fibonacci retracementat

1.2981 exposes the 23.6% level at 1.3057. Alternatively, a turn below

the 50% Fib expansion at 1.2864 opens the door for a test of the 61.8%

threshold at 1.2794.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.17 11:37

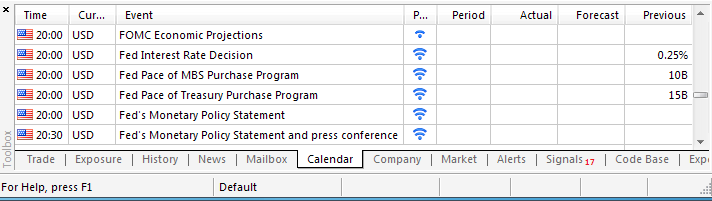

Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision (based on dailyfx article)

- Federal Open Market Committee (FOMC) Widely Expected to Deliver Another $10B Taper

- Will There Be a Larger Dissent as the Fed Looks to End QE in October?

The Federal Open Market Committee (FOMC) interest rate decision may spur

a bearish reaction in the dollar (bullish EUR/USD) if the central bank

remains reluctant to move away from the zero-interest rate policy

(ZIRP).

What’s Expected:

Why Is This Event Important:

Even though the Fed is widely expected to conclude its asset-purchase

program at the October 29 meeting, we would need a more hawkish twist to

the forward-guidance for monetary policy to favor further USD strength.

The dollar may come under pressure should we get more of the same from

the Fed, and the greenback may face a larger correction over the

remainder of the month should Chair Janet Yellen see greater scope to

retain the highly accommodative policy stance for an extended period of

time.

Nevertheless, sticky inflation paired with the uptick in wage growth may

spur a greater dissent within the committee and push the FOMC to lay

out a more detailed exit strategy as the central bank looks to move away

from its easing cycle.

How To Trade This Event Risk

Bearish USD Trade: FOMC Remains Reluctant to Normalize Monetary Policy

- Need green, five-minute candle following the policy statement to consider a long EUR/USD position

- If market reaction favors a bearish dollar trade, buy EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same strategy as the bearish dollar trade, just in the opposite direction

EUR/USD Daily

- Risks Larger Topside Correction as the Relative Strength Index (RSI) Threatens Bearish Momentum

- Interim Resistance: 1.2990 (23.6% retracement) to 1.3025 (23.6% expansion)

- Interim Support: 1.2858 (Monthly low) to 1.2870 (50.% expansion)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| JUL 2014 | 07/30/2014 18:00 GMT | 0.25% | 0.25% | +14 | +20 |

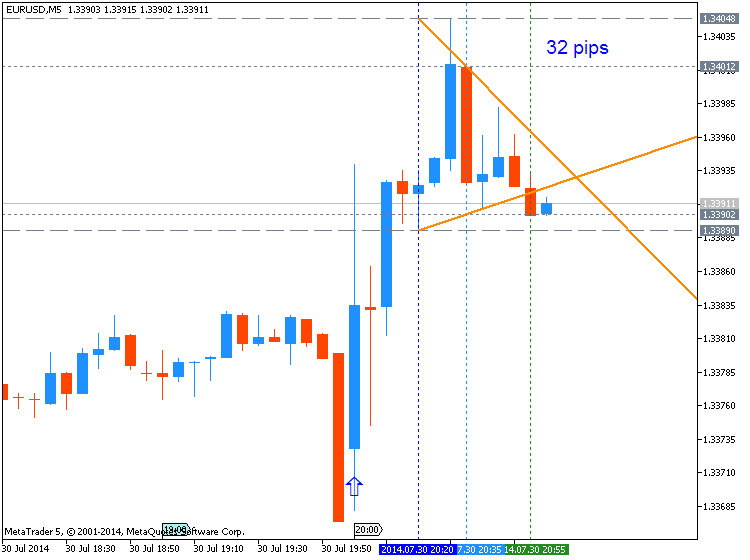

EURUSD M5 : 32 pips price movement by USD - Federal Funds Rate news event:

The Federal Open Market Committee (FOMC) voted to reduce its asset-purchase pace to $25B from $35B in July amid the sharp economic rebound in the second quarter. However, the Fed also highlighted the significant underutilization of labor resources and reiterated that it is appropriate to maintain the current fed fund rate for a considerable period of time even after the quantitative easing program ends. The Fed’s dovish tone dragged on the greenback, with EUR/USD climbing above 1.3400, but we saw limited follow-through behind the initial reaction as the pair ended the day at 1.3395.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 62 pips price movement by USD - Federal Funds Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.17 15:05

2014-09-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]- past data is 0.1%

- forecast data is 0.1%

- actual data is -0.2% according to the latest press release

if actual > forecast (or actual data) = good for currency (for USD in our case)

[USD - CPI] = Change in the price of goods and services purchased by consumers. Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

==========U.S. Consumer Prices Unexpectedly Show Modest Drop In August

With a substantial decrease in energy prices more than offsetting higher prices for food and shelter, the Labor Department released a report on Wednesday showing an unexpected drop in U.S. consumer prices in the month of August.

The Labor Department said its consumer price index dipped by 0.2 percent in August after inching up by 0.1 percent in July. The modest drop came as a surprise to economists, who had expected consumer prices to come in unchanged.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 24 pips price movement by USD - CPI news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.18 10:56

EUR/USD Vulnerable to Hawkish Fed- Outlook May Hinge on T-LTRO (based on dailyfx yotube channel)

The EUR/USD may look beyond the FOMC policy meeting to break out of the rate as the ECB implements the targeted long-term refinancing operation (T-LTRO).

=============

2014-09-18 09:15 GMT (or 11:15 MQ MT5 time) | [EUR - Targeted LTRO]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[EUR - Targeted LTRO] = Total value of money the ECB will create and use to loan to Eurozone banks. It provides liquidity to banks which usually leads to lower long-term interest rates and stimulates growth.

LTRO = Long Term Refinancing Option

==========Scottish Pride Pounds Sterling

The U.S. dollar remains king. It has risen against a broad basket of currencies for nine consecutive weeks and so far has completed its longest winning streak in 17 years. Will the Federal Reserve end its winning ratio or is it to be a temporary blip before pushing on to greater heights? Many expect the greenback to continue its rally, hitting €1.20 against the EUR by the end of 2015, driven mostly by the cyclical strength in the U.S. economy as opposed to Europe.

The single unit will have to battle various structural macro-disadvantages, and most importantly, the growing divergence in central bank monetary policy. A fear of the Fed taking a more hawkish stance at its two-day Federal Open Market Committee meeting that concludes tomorrow is keeping both European and U.S. bond yields elevated. U.S. policymakers are expected to shed some light on plans to raise interest rates. Despite policymakers having a habit of disappointing, the recent uptick in the dollar’s interest is a massive boost to both volume and volatility and hence opportunity for investors.

Celtic Pride Weighs on Sterling Despite central bank rhetoric dominating directional flows across the various asset classes, it’s nationalism that is pounding sterling. The looming Scottish referendum is dominating market price action. The pound remains under renewed pressure this morning (£1.6178), as the market suffers with last minute nerves with a too-close-to-call vote on sovereignty. There is a belief that the market is a tad too complacent in pricing the possibility of a “yes” vote – an outcome in favor of independence would probably weaken the GBP by a further -4 to -8%. Making it increasingly difficult for skittish investors is the Fed. If Chair Janet Yellen and company happen to be hawkish or less dovish tomorrow, it will certainly put the pound firmly on the back foot along with the remaining majors, as U.S. rate divergence trumps all.

Despite the ‘toing and froing’ in opinion polls, the U.K. bookies report that the “no” wagers outnumber “yes” bets by three to one — this would suggest that the danger to sterling remains to its left-hand side. So far this year, it has lost -2.5% in value to the dollar and even a close vote will bring its own repercussions. Just ask the Canadians about Quebec: it took years for the sovereignty question to go away while businesses fled la belle province, hurting the Canadian economy. Official results in the Scottish referendum will be made public on Friday.

RBA Finds New Pet Peeve Aussie policymakers rarely mince words, and on the release of the Reserve Bank of Australia’s (RBA) policy meeting minutes overnight, they renewed their concerns over the risks of rising housing prices. The RBA has warned of speculative demand in the country’s real estate sector, triggered by record low interest rates, signaling that further monetary policy easing is unlikely in the near term — on September 2 Governor Glenn Stevens kept interest rates at +2.5% for the thirteenth straight month. Like other prudent central banks, RBA officials are worried that Aussie macroeconomic stability would be in danger, and that speculative demand (instigated by Asian interest) increases the probability of a free-fall in prices. There is a flipside: many do not see a substantial risk in the sector and that Australia should produce more housing given the demand. Even economic growth, which is expected to recover next year thanks to encouraging trends in employment of late, would be expected to absorb most new development.

The AUD made a feeble attempt to rally today (AUD$0.9050), supported by the RBA’s growing concern about housing prices, and the uptick in iron-ore prices. Nevertheless, the rally is fleeting at best, as the Aussie is currently making an assault on the psychological AUD$0.9000 handle. Despite the diminished expectations of another rate cut, the AUD faces downside risks from a plethora of outside forces — the massive unwinding of the carry trade fueled by Fed rate divergence and soft Chinese data. Currently, the AUD is expected to make another assault on Monday’s six-month low (AUD$ 0.8984). Many investors will want to wait for the Fed tomorrow to support current convictions.

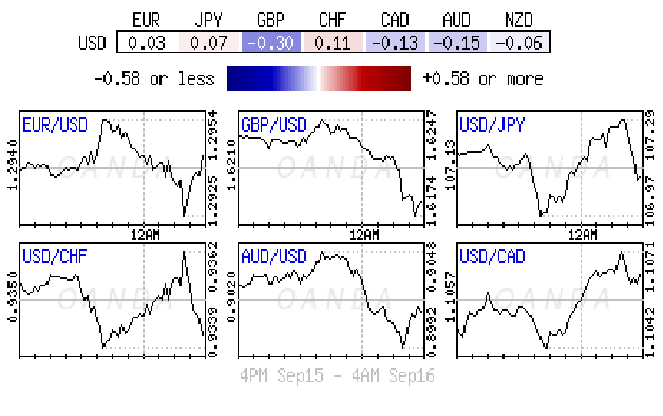

Euro Steady despite Improved ZEW The EUR has been contained, supported by carry trade unwinds, or EUR/GBP buying. Both of these trades had become crowed in recent months and currently the focus is not directly on the EUR but the Aussie dollar and sterling. Even this morning’s German ZEW has had little direct impact on the single unit despite it coming in slightly better than the 4.8 that was expected with a reading of 6.9 compared with 8.6 previously. It is the ninth consecutive month that the index is lower, but the rate of decline has slowed. The current condition index is much lower at 25.4 compared to 44.3 previously, obviously weighed down by geopolitical risk concerns and the fallout from sanctions imposed on Russia by the West. The market remains a comfortable seller of EUR on rallies with offers reported between €1.2965-75, and stop-losses just above the option reported €1.3000 level.

Many investors would be better served focusing on the CHF rather than the EUR outright this week as the single unit remains at the total mercy of other currencies. After the European Central Bank, the Swiss National Bank (SNB) could be the next up to introduce negative interest rates. Its officials meet on Thursday as the EUR/CHF cross has dropped below levels where the SNB has sought to hurt speculative positioning in the past. Swiss policymakers have the option of moving the €1.2000 floor, but why mess with something that seems to be working and replace it entirely with something that is unproven?

By

Vginz07

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.09.19 07:29

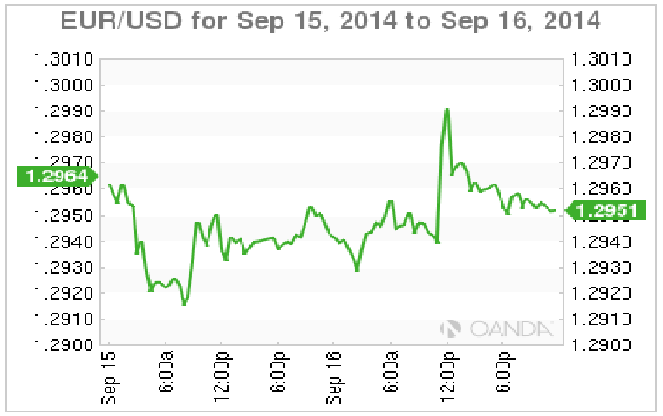

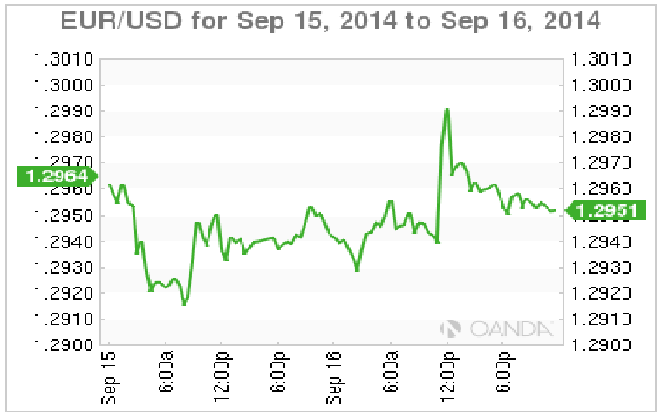

EURUSD Technical Analysis (based on dailyfx article)

- Support: 1.2858, 1.2796, 1.2673

-

Resistance:1.2951, 1.2994, 1.3074

The Euro may correct higher against the US Dollar

after forming a bullish Piercing Line candle pattern coupled with

positive RSI divergence. A daily close above trend line resistance at

1.2951 exposes the September 16 high at 1.2994. Alternatively, reversal

below above the 1.2858-71 area marked by the September 9 low and the

14.6% Fibonacci expansion opens the door for a test of the 23.6% level

at 1.2796.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on market rally with 1.2859 support and 1.3160 resistance levels.

H4 price is on market rally within primary bearish: Chinkou Span line crossed the price from below to Above on close bar, and price is trying to break 1.2979 resistance for possible reversal of the price movement from primary bearish to the primary bullish market condition.

W1 price is on primary bearish with 1.2920 as the nearest support line.

If D1 price will break 1.2988 resistance level on close bar so the rally will be continuing up to the next resistance: 1.3160.

If D1 price will break 1.2859 support level so the primary bearish will be continuing.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-09-15 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Trade Balance]

2014-09-16 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - German ZEW Economic Sentiment]

2014-09-16 12:30 GMT (or 14:30 MQ MT5 time) | [USD - PPI]

2014-09-17 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - CPI]

2014-09-17 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-09-17 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

2014-09-18 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Building Permits]

2014-09-18 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-09-18 12:45 GMT (or 14:45 MQ MT5 time) | [USD - Fed Chair Yellen Speech]

2014-09-18 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philly Fed Manufacturing Index]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : rally

Intraday Chart