Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.26 18:19

Key Fundamental Releases this Week (7/28-8/1)

Last week the USD strengthened in anticipation of this week’s FOMC meeting. The market has replaced concerns that stemmed from poor Q1 GDP with USD-positive reactions to Q2 data, which have been in-line or better than expectations. The euro was a big loser last week as data continues to suggest the ECB might need further stimulus (QE). This week will be full of key US fundamentals. Let’s be prepared by taking a look at this week’s key fundamental releases for the majors.

Monday (7/28)

US Pending Home Sales for June, is forecast to have contracted at -0.2%. Pending home sales have been volatile and just came off a 6.1% gain in May. A slide in June is not the end of the world. We had 3 straight months of gains, which is something we have not seen since 2010. On the other hand, a positive reading could be USD-positive in the near-term, given it has not already rallied sharply before the housing data.

Tuesday (7/29)

US Conference Board Consumer Confidence for July is expected to edge up to 85.5 from 85.2. This reading would reflect the strongest reading since January 2008. It has risen sharply since the Jan. 2013 low of 58.6 and bodes well for the USD. A reading in line with forecast or better should keep the USD-buoyed. A reading below 85.0 might weigh slightly on the USD, but we should keep the implications in the intra-session time-frame.

Wednesday (7/30)

German Preliminary CPI for July is forecast to be 0.2% on the month, after a 0.3% reading in June. The annual reading in June was 1.0%. If the annual CPI reading for Germany falls below 1.0%, we might see some more pressure on the EUR. A ready above 1.0% on the year could help EUR consolidate, but should not be able to help EUR reverse its recent downtrend.

US ADP Non-Farm Employment Change for July is a precursor to Friday’s Non-Farm Payroll, which was hot last month. The ADP report was hot last month too, and came in at 281K, which was the strongest reading since December 2011, and was the 3rd strongest reading since the financial crisis. Economists are expecting July’s job market to have leveled off, and to have added 234K jobs, which is still a strong reading.

US Advanced GDP for Q2 will probably trump the jobs data in terms of importance. Q1 GDP was -2.9% at an annualized rate. This seems distant memory now. We can’t blame the weather anymore in the second quarter, and manufacturing, sales, and other economic data points for Q2 have not disappointed. Economists forecast a 3.1% advanced reading. Ability to show 3.0% and above should help the USD maintain its recent strength. A reading below 3.0% could be seen as disappointing, and might urge traders to pare USD’s recent gains.

The Federal Open Market Committee will conclude its monetary policy meeting and make a statement. It will have the GDP data to talk about. This is important because after Q1′s dismal growth data, the Fed showed concern about Q2 data. The market will be on top of the Fed’s reaction to the Q2 GDP and how it may affect the rate hike time-line, which is current projected to mid-2015.

Australian Building Approvals for June is forecast to have grown 0.2%, after a strong 9.9% reading in May.The AUD has regained some strength after seeing Australia’s annual CPI inflation grow from 2.9% to 3.0% in Q2. The housing data should have limited impact on the Aussie.

Thursday (7/31)

Eurozone CPI Flash Estimate for July is forecast to be 0.5% on the year. It has been stuck at 0.5% since May. ECB president Mario Draghi had predicted that inflation was at the bottom when it was 0.5% in February. So far, his prediction has neither materialized or been invalidated because the annual CPI inflation is still 0.5%. A drop below 0.5% will very likely weigh on the EUR because the ECB’s inaction is based on inflation not dropping further. a drop in inflation will be further impetus for the ECB to apply more monetary stimulus.

Eurozone’s unemployment rate is expected to stay at 11.6% for the month of July. There is more room for disappointment because the prevailing trend has been a steady improvement, and if the reading is 11.5% for example, it would not be such a big surprise. A reading of 11.7% however will buck the trend and provide the ECB with more reason to loosen monetary policy further.

Canadian GDP for the month of May is forecast to be 0.3%, which would be the strongest month since January when it was 0.5%. The monthly GDP was 0.1% for April and March. There has not been any negative readings so far this year. If we can keep that up, the CAD should maintain its recent strength (though it consolidated for a couple of weeks). A negative reading might be needed to hold CAD back and keep it in consolidation or bearish correction. A reading above 0.5% can definitely revive CAD-strength.

US Jobless claims was at a 10-year low this week, at 284K. Next week’s reading is expected to rise back to 306K which would still be at the lower range of 2014-data. A reading below 300K should be positive for the USD in the near-term. A reading above 320K might be needed to hold USD, but only in the intra-session time-frame. This assessment is assuming that the FOMC did not shake things up and put the USD in a medium term bearish outlook. We are assuming the USD continues to be bullish.

Chinese Manufacturing PMI for July provided by the government, is expected to improve to 51.4 from 51.0. This would reflect 5 straight months of steady improvement in manufacturing, and also reflects the quick recovery after we saw Chinese data slump in 2013. The final version of HSBC’s Chinese Manufacturing PMI is expected to be 52.0, which would also reflect the recovery in China’s economy.

Australia’s Producer Price Index is forecast to show inflation of 0.7% in Q2, down from 0.9% in Q1. Q1 PPI inflation compared to Q1 2013 was 2.5%. If this reading increases, we might see some AUD-strength, and if it declines we should see AUD consolidate. It is still too early to anticipate any economic data point to be able to put AUD into reversal, into a bearish market.

Friday (8/1)

UK Manufacturing PMI for July is forecast to be 57.2, slightly lower than the 57.5 reading in June. This is a second tier data point and shouldn’t have much impact on the GDP other than in the very near-term. The market is focused on whether the Bank of England can raise rates in 2014. Right now lack of wage growth is the concern, so even a strong improvement in manufacturing will not ease that concern, nor should a singular worse-than-expected reading add to that concern.

US Non-Farm Payroll report for July will be the key data point to wrap up the week. The 288K reading for June revived USD strength. Economists expect about a 230K reading, which is still decent. A reading above 200K is decent, and if it is above 250K, the Fed should have more reason to raise rates earlier than mid-2015 rather than after. A reading below 200K however might bring USD back into at least some short-term consolidation, especially if it has been gaining throughout the week.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.27 09:50

Forex Weekly Outlook Jul 28-Aug 1US Housing data, ADP Non-Farm Employment Change, GDP figures in the US and Canada, US rate decision and Non-Farm Payrolls are the main market movers this week. Here is an outlook on the major events coming our way.

Last week, the number of US jobless claims fell to 284K, the lowest level in nearly 8-1/2 years, indicating the labor market recovery is picking up. The 19,000 fall was contrary to analysts’ expectations of a rise to 308,000. The four-week average declined by 7,250 to 302,000, falling to the lowest level since May 2007. The US economy continues to improve suggesting the Fed may raise rates sooner than planned. Will we see a rate hike in 2014?

- US Pending Home Sales: Monday, 14:00. The number of contracts to purchase existing U.S. homes surged in May by 6.1%, the biggest climb since April 2010. The reading was far better than the 1.4% addition predicted by analysts, showing a strong rebound in the housing market. Stronger employment conditions as well as cheaper borrowing costs, enable the pick-up in the housing sector. Pending sales are expected to decline 0.2% this time.

- US CB Consumer Confidence: Tuesday, 14:00. U.S. consumer confidence edged up in June to 85.2 following a downwardly revised 82.2 in May, posting the highest reading since January 2008. Economists expected a smaller rise to 83.6. The expectations index increased to 85.2 in June from 83.5 in May, while the current situation index improved to 85.1 versus 80.3 in May. A further rise to 85.5 is expected now.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. Private sector employment increased by 281,000 workers in June from 179,000 in May, according to the ADP report. Economists’ expected a modest rise of 207,000 jobs. The strong reading reflects continued strengthening in the labor market with a pick-up in Job creation. Private sector employment is expected to expand by 234,000.

- US GDP data: Wednesday, 12:30. Advance GDP, the earliest GDP measure released in April showed an annual growth pace of 0.1% in the first quarter, falling behind expectations for a 1.2% climb. Weather conditions and sluggish exports, housing and business investment were the main contributors for the shabby growth rate. The Preliminary GDP reading is predicted to reach 3.1%.

- FOMC Statement: Wednesday, 18:00. The Fed decisions released in June were in line with market expectations. Rates remained unchanged at a range of zero to 0.25% and taper continued on schedule. The Fed expressed concerned about the elevated unemployment rate, however noted an improvement in economic activity. The Committee voted to maintain accommodative stance of monetary policy to support growth. The FOMC downgraded its GDP forecast due to adverse weather in the first quarter.

- Canadian GDP: Thursday, 12:30. Canadian GDP Growth stalled in April, inching 0.1% as in the previous month, while expected to rise 0.2%. Wholesale and retail activity edged up mildly, while mining and construction output weakened. On a year-over-year bases gross domestic product expanded 2.1%, the same rate marked in the previous month. Canadian economy is expected to grow by 0.3%.

- US Unemployment claims: Thursday, 12:30. The US Labor market registered a decline of 19,000 claims for jobless benefits in the previous week; reaching 283,000.Analysts expected a rise to 307,000 in the number of claims. This was the lowest reading since February 2006. The four-week moving average declined by 7,250 to 302,000, from the previous week. This is the lowest average level since May 19, 2007. This week’s reading reinforces views that the US economy is matching forward. The number of unemployment claims is expected to reach 306,000.

- Haruhiko Kuroda speaks: Friday, 3:30. BOJ Governor Haruhiko Kuroda will speak in Tokyo. He may speak about the slowdown in inflation and his plans for the coming months.

- US Non-Farm Employment Change and US Unemployment Rate: Friday, 12:30. The US labor market showed a remarkable job Addition of 288,000 in June, the strongest reading since January 2012, following a gain of 217,000 in May. Analysts expected a weaker increase of 214,000. This was another sign that the US job market is strengthening parallel to the economic recovery. The unemployment rate fell to 6.1% from 6.3% registered in May, the lowest level since Sep. 2008. Analysts expected rates to remain unchanged at 6.3%. The US labor market is expected to increase by 230,000 jobs, while the unemployment rate is forecasted to remain unchanged at 6.1%.

- US ISM Manufacturing PMI: Friday, 14:00. In June, the ISM manufacturing index declined mildly to 55.3, from 55.4% recorded in May. The figure was a little below market forecast of 55.6. However, the index still indicates expansion in the manufacturing sector. Declines in production and in supplier deliveries were the main reason for the lukewarm rise. US manufacturing sector is expected to expand to 56.1.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.27 09:54

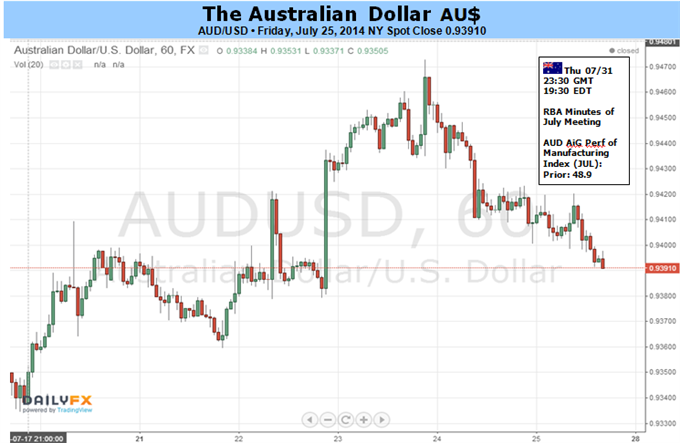

AUDUSD Fundamentals (based on dailyfx article)

Fundamental Forecast for Australian Dollar: Neutral- AUD Set For Another Flat Finish Despite Plenty Of Intraday Volatility

- Light Economic Docket May Do Little To Shift RBA Policy Bets

- Low Vol. Environment Could Continue To Support Carry Demand

The Australian Dollar is set for a relatively flat finish after a turbulent week that yielded plenty of intraday volatility. An upside surprise to the Australian second quarter core CPI reading, and rise in headline inflation to the top of the RBA’s 2 to 3 percent target band, sent the currency soaring above the 94 US cent handle. Additional strength for the Aussie was found on the back of a bumper China PMI print, as well as an absence of ‘jawboning’ in a speech from RBA Governor Glenn Stevens. Ultimately, most of the gains proved short-lived, which may have reflected some hesitation from traders to push the currency into a region of noteworthy technical resistance.

Looking to the week ahead; Building Approvals and the Performance of Manufacturing Index figures represent the only medium-tier domestic economic data on the calendar. However, the leading indicators for the health of the local economy may do little to materially shift the rate outlook, meaning any reaction from the AUD may fail to find follow-through. Similarly, the Chinese manufacturing figures (also on tap) could generate another round of knee-jerk volatility on a surprise reading, yet likely hold do not hold the requisite power to leave a lasting impact on the currency.

Indeed, Stevens’ recent address reinforced the prospect of a ‘period of stability’ for the cash rate over the near-term. At this stage it appears unlikely the RBA will change its stance while it attempts to foster a rebalancing of the domestic economy.

Implied volatility remains near multi-year lows, suggesting traders continue to price in a relatively small probability of a major economic crisis occurring in the near-term. Traders are seemingly looking past the latest flare-up in geopolitical tensions and have returned to the hunt for yield.

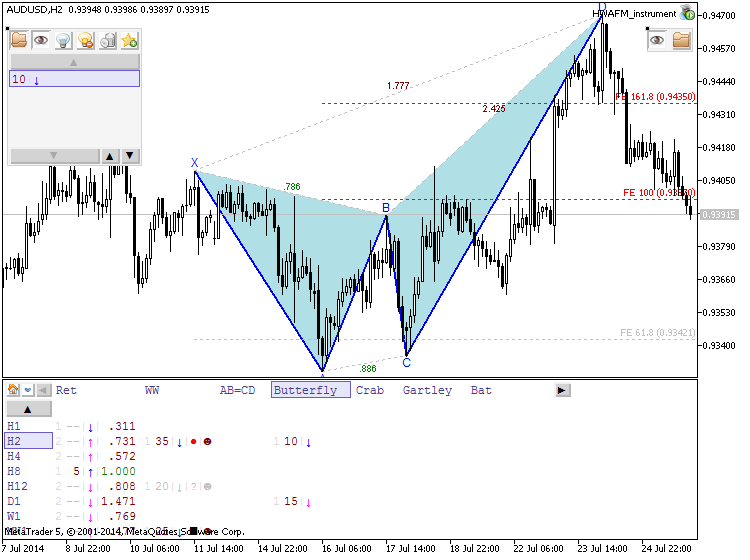

Formed bearish butterfly pattern for AUDUSD H2:

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.27 17:31

AUD/USD weekly outlook: July 28 - August 1The Australian dollar declined against its U.S. counterpart on Friday, as stronger than expected data on U.S. durable goods orders underlined the view that the Federal Reserve will hike interest rates sooner than expected.

AUD/USD hit a daily low of 0.9393 on Friday, before subsequently consolidating at 0.9395 by close of trade, down 0.24% for the day but 0.03% higher for the week.

The pair is likely to find support at 0.9379, the low from July 23 and resistance at 0.9469, the high from July 24.

The Commerce Department said that U.S. durable goods orders rose 0.7% in June, beating expectations for a 0.5% gain.

Core durable goods orders, which are stripped of transportation items, grew 0.8% in June, beating expectations for a 0.6% gain.

The upbeat data came a day after the U.S. Department of Labor said that the number of individuals filing for initial jobless benefits in the week ending July 19 declined by 19,000 to hit an eight-year low of 284,000.

Meanwhile, in Australia, official data released Wednesday showed that consumer price inflation rose 0.5% in the second quarter, after an increase of 0.6% in the three months to April. Analysts had expected CPI to rise 0.6% in the last quarter.

On a yearly basis, Australia CPI rose to 3.0% in the last quarter, from 2.9%, compared to expectations for an increase to 3.1%.

On Tuesday, Reserve Bank of Australia Governor Glenn Stevens said he is content with the current monetary policy setting and stands ready to do more if needed.

The Aussie had come under broad selling pressure earlier in the month, when Mr. Stevens warned investors that they were underestimating the risk of a significant fall in the currency.

Data from the Commodities Futures Trading Commission released Friday showed that speculators decreased their bullish bets on the Australian dollar in the week ending July 22.

Net longs totaled 38,793 contracts, down from net longs of 39,743 in the preceding week.

In the week ahead, investors will be focusing on Wednesday’s preliminary reading on U.S. second quarter growth, while Friday’s nonfarm payrolls report will also be in focus.

Wednesday’s Fed statement will also be closely watched for any indications that the central bank is moving closer to raising rates.

Monday, July 28

- The U.S. is to release data on pending home sales.

- The U.S. is to publish reports on house price inflation and consumer confidence.

- The U.S. is to release the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. The U.S. is also to publish revised data on second quarter growth.

- Later Wednesday, the Federal Reserve is to announce its federal funds rate and publish its rate statement.

- Australia is to release data on building approvals and import prices.

- The U.S. is to release the weekly report on initial jobless claims, as well as data on manufacturing activity in the Chicago area.

- Australia is to publish data on producer price inflation.

- The U.S. is to round up the week with what will be closely watched government data on nonfarm payrolls and the unemployment rate, while the Institute of Supply Management is to release data on manufacturing activity.

Forum on trading, automated trading systems and testing trading strategies

mazennafee, 2014.07.28 11:45

| AUD/USD Intraday: the downside prevails. |

| Pivot: 0.9425 Our preference: Short positions below 0.9425 with targets @ 0.938 & 0.9355 in extension. Alternative scenario: Above 0.9425 look for further upside with 0.9475 & 0.9505 as targets. Comment: A break below 0.938 would trigger a drop towards 0.9355. A bearish channel has formed. |

Autocharts

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.28 15:21

Technical Setups For AUD/USD - Credit Suisse (based on fxstreet article)

AUD/USD: Price support at .9380 ideally holds to keep the immediate risk higher.

AUDUSD has staged a reversal lower, but while still holding above .9380, the immediate risk can stay higher for a move back to the .9472 recent high. Above here can then see a challenge of the 2014 high at .9506 where we would expect to find a ceiling. However, a direct extension of strength can see a move towards the 38.2% retracement of the decline from 2011/2014 at .9584, with better sellers expected here.

Immediate support shows at .9380. A break below here is needed to ease the immediate upside bias, for weakness back to .9322/18.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

temp_file_screenshot_60371.png

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.28 16:09

AUDUSD – Stable Ahead of US Housing Data (based on marketpulse article)

The Australian dollar often takes its riders on roller coaster rides, but AUD/USD has been unusually subdued, with little movement since early June. Strong US numbers have not translated into gains for the US dollar, as the Aussie continues to trade at high levels and the occasional jab buy the RBA that the Aussie is overvalued has failed to push the currency to lower levels. This week's key events out of Australia are Building Approvals and PPI, and unexpected readings could shake up AUD/USD.

The US ended the week on a high note, courtesy of strong data from the manufacturing sector. Core Durable Goods Orders jumped 0.8%, beating the estimate of 0.6%, and rebounding nicely from a decline of 0.1% in May. Durable Goods Orders followed suit, posting a gain of 0.7%, compared to a weak reading of -1.0% last month. This easily surpassed the estimate of 0.4%. Unemployment Claims tumbled last week, as the key indicator fell to 284 thousand, its lowest level since February 2008. This surprised the markets, which had expected a reading of 310 thousand. The strong release continues a string of solid employment data, which has helped the dollar. As well, positive news on the employment front is bound to increase speculation about a rate increase by the Federal Reserve.

- AUD/USD dipped lower in the Asian session, but reversed directions in the European session, moving above the 0.94 line.

- 0.9361 is providing support.

- 0.9446 is an immediate resistance line. This is followed by strong resistance at 0.9617.

Further levels in both directions:

- Below: 0.9361, 0.9229, 0.9119 and 0.9000

- Above: 0.9446, 0.9617, 0.9757 and 0.9842

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on bullish ranging between 0.9470 resistance and 0.9335 support levels.

H4 price is on correction within primary bullish trying to be reversed to the ranging bearish by the following:

- Chinkou Span line of Ichimoku indicator is very near to the price for crossing it from above to below

- The price is crossing 0.9398 support level for the reversal from the bullish correction to the ranging bearish

If D1 price will break 0.9335 support level together with Chinkou Span line of Ichimoku indicator crossing the price from above to below so we may see the reversal to primary bearish on D1 timeframe.If not so we may see ranging market condition to be continuing.

UPCOMING EVENTS (high/medium impacted news events which may be affected on AUDUSD price movement for this coming week)

2014-07-28 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-07-29 14:00 GMT (or 16:00 MQ MT5 time) | [USD - CB Consumer Confidence]

2014-07-30 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2014-07-29 18:00 GMT (or 20:00 MQ MT5 time) | [USD - Federal Funds Rate]

2014-07-31 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Building Approvals]

2014-07-31 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Unemployment Claims]

2014-08-01 01:00 GMT (or 03:00 MQ MT5 time) | [CNY - Manufacturing PMI]

2014-08-01 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - PPI]

2014-08-01 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-08-01 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Non-Farm Employment Change]

2014-08-01 14:00 GMT (or 16:00 MQ MT5 time) | [USD - ISM Manufacturing PMI]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on AUDUSD price movementSUMMARY : bullish

TREND : ranging

Intraday Chart