Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.20 11:42

Forex Weekly Outlook July 21-25Glenn Stevens’ speech, US housing data, inflation and industrial data, NZ rate decision, British GDP data are the main events on FX calendar this week. Here is an outlook on the main market-movers ahead.

Last week the Philly Fed Index jumped to 23.9 points in July marking the highest reading since March 2011. Current activity rose to 23.9 from 17.8 in June, orders index jumped to 34.2 from 16.8. Economists expected the index to fall to 15.6. This release suggests manufacturing has accelerated across the board in the Philadelphia region heading towards a successful second half –year. More positive news came from the US employment market with a lower than expected release of 302,000 clams, down 3,000 from the prior week, beating expectations for a rise to 310,000. Will the US economy continue its upturn trend?

- Glenn Stevens speaks: Tuesday, 3:00. Governor Glenn Stevens, head of the Reserve Bank of Australia will speak in Sydney. He may talk about the increasing value of the Australian dollar. In a former speech Stevens noted that the zero interest rate policies of major central banks are partly to blame for the inflation of the Australian dollar, and also warned market participants that this was no reason to remain complacent on the value of the currency. He continued to say that the RBA still has room to cut interest rates when required.

- US inflation data: Tuesday, 12:30. U.S consumer prices edged up 0.4% in May, amid sharp rise in food prices. Economists expected a smaller increase of 0.2 %, getting close to the Fed’s target of 2.0%. Meanwhile, core prices also climbed more than expected, rising 0.3% from a 2.0% gain posted in April. In a yearly base, the core CPI increased 2.0 %, up from 1.8 % in April and the biggest gain since February of last year. The increase in prices, suggest the Fed may raise interest rates sooner than expected. U.S consumer prices are expected to gain 0.3% while core prices are predicted to increase by 0.2%.

- US Existing Home Sales: Tuesday, 14:00. The number of pre-owned home sales edged up in May to a nearly three year high, reaching an annualized rate of 4.89 million from 4.66 million posted in the previous month. Analysts expected a lower rise to 4.74 million units. The housing recovery continues amid higher income and lower housing prices, which increase affordability. A further rise to 4.98 million is expected this time.

- NZ rate decision: Wednesday, 21:00. New Zealand’s central bank announced a rate hike of 25 basis points in its June meeting, reaching 3.25%. This was the highest level since January 2009 and the third consecutive rise. The central bank said rates need to be higher as long as economic growth fuels inflation. Annual inflation slowed mildly to 1.5 % in the first quarter, while the RBNZ wants rates to be around 2 %, the mid-point of its 1-3 % target band. New Zealand’s central bank is expected to raise rates again to 3.50%.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits declined 3,000 last week reaching 302,000, indicating the US labor market recovery is picking up. Analysts expected claims to reach 310,000 last week. The four-weak average fell 3,000 to 309,000, the lowest level since June 2007. Yellen warned that the Fed may kike rates sooner than planned in case the labor market continues to strengthen. The numer of claims is expected to rise to 310,000.

- US New Home Sales: Thursday, 14:00. Sales of new U.S. single-family homes climbed to a six-year high in May, reaching a seasonally adjusted annual rate of 504,000 units, 18.6% more than in the previous month, beating predictions for 442,000 units. The high mortgage rates seen in the second half of 2013 are beginning to settle increasing affordability. The median price of a new home increased 6.9% from May since inventory remained unchanged, but prices are beginning to settle and should help to stimulate demand for houses. Sales of new homes is predicted to reach 485,000.

- Eurozone German Ifo Business Climate: Friday, 8:00. German business climate index declined to 109.7 in June from 110.4 in May, posting its second consecutive monthly fall. Economists expected a minor drop to 110.3. German manufacturers fear the potential consequences of the crises in Ukraine and Iraq. More than 6,000 German companies are related to Russia and business and trade bodies have warned that further escalation in tensions over Ukraine may result in catastrophic losses for firms. Business sentiment is expected to edge down to109.6.

- UK Prelim GDP: Friday, 8:30. In Q1 2014 the UK economy expanded by 0.8% in the first quarter and by 3.1% when compared with 2013 Q1. This was the fifth consecutive rise, the longest growth period since the economic downturn reaching 0.6% below its pre-downturn peak in Q1 2008. The main contributor to growth was the services industry, which grew by 0.9% on the quarter. The labor market also performs well. UK economy is predicted to expand 0.8% in the second quarter.

- US Core Durable Goods Orders: Friday, 12:30. Orders for U.S. durable goods fell 1 % in May amid a sharp decline in demand for military equipment. The reading was worse than the 0.1% drop predicted by analysts and lower than the previous release of 0.6%. However, excluding defense-related goods, orders actually rose, and orders in a key category that signals business investment also increased. Meanwhile core orders excluding transportation, declined by 0.1%, while expected to rise 0.3%. Durable goods orders are expected to rise 0.4%, while core orders are predicted to gain 0.6%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.20 11:45

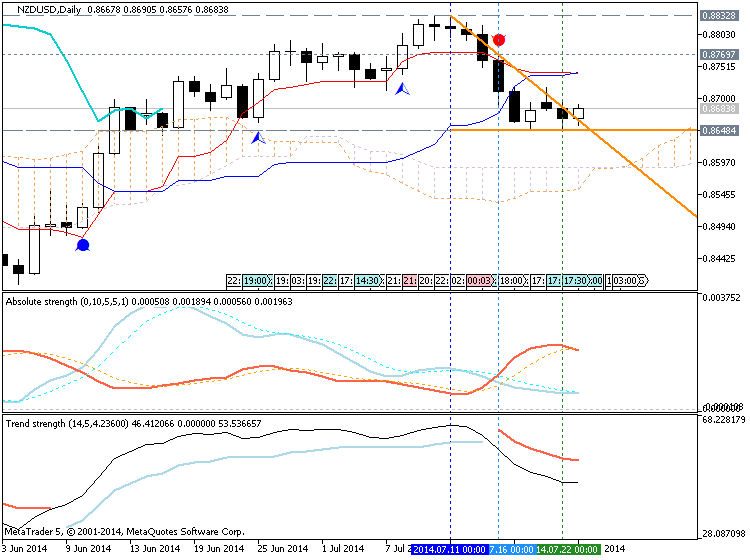

NZD/USD forecast for the week of July 21, 2014, Technical AnalysisThe NZD/USD pair fell hard during the course of the week, breaking below the 0.87 handle. There is a significant amount of support below though, so we are not necessarily excited about shorting at this point. In fact, we think that the massive amount of support below should come into play, and we would be buyers of a supportive candle, as we see the 0.85 level as the beginning of massive support. On the other hand, if we get above the 0.88 level, we believe that this market that goes to the 0.90 handle.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.22 10:44

Trading the News: U.S. Consumer Price Index (CPI) (based on dailyfx article)

- U.S. Consumer Price Index to Hold at 2.1% for Second Month.

- Core Inflation to Retain Fastest Pace of Growth Since October 2012.

The U.S. Consumer Price Index (CPI) may spur a bullish reaction in the

U.S. dollar (bearish EUR/USD) should the report undermine the Fed’s

dovish outlook for monetary policy.

What’s Expected:

Why Is This Event Important:

Sticky price growth in the world’s largest economy may heighten the appeal of the greenback as it puts increased pressure on the Federal Reserve to move away from its easing cycle, and the next policy meeting on July 30 may generate an improved outlook for the reserve currency should a growing number of central bank officials show a greater willingness to normalize monetary policy sooner rather than later.

Higher input costs along with the pickup in wage growth may generate another stronger-than-expected inflation print, and an unexpected uptick in the CPI may fuel a near-term rally in the USD as it boosts interest rate expectations.

However, the persist slack in the real economy paired with the slowdown

in private sector consumption may drag on price growth, and a weak

inflation print may heighten the bearish sentiment surrounding the

greenback as it gives the Fed greater scope to retain its highly

accommodative policy stance for an extended period of time.

How To Trade This Event Risk

Bullish USD Trade: Headline Reading for Inflation Climbs 2.1% or Greater

- Need to see red, five-minute candle following the release to consider a short trade on EURUSD

- If market reaction favors a long dollar trade, sell EURUSD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need green, five-minute candle to favor a long EURUSD trade

- Implement same setup as the bullish dollar trade, just in the opposite direction

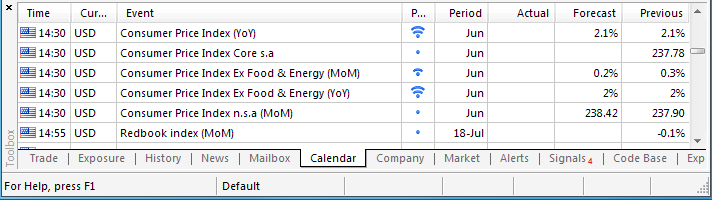

EUR/USD Daily

- Remains at Risk for a Lower-Low as Downward Trending Channel Takes Shape

- Interim Resistance: 1.3650 (78.6% expansion) to 1.3670 (61.8% retracement)

- Interim Support: 1.3490 (50.0% retracement) to 1.3500 Pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| MAY 2014 |

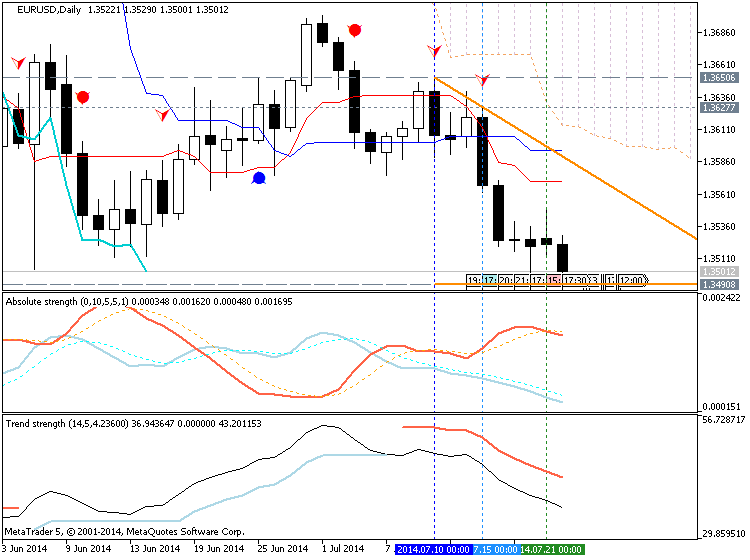

06/17/2014 12:30 GMT | 2.0% | 2.1% | -23 | -23 |

May 2014 U.S. Consumer Price Index (CPI)

EURUSD M5 : 33 pips price movement by USD - CPI news event

The headline reading for U.S. inflation unexpectedly climbed to an

annualized 2.1% in May to mark the fastest pace of growth since October

2011, while the core Consumer Price Index (CPI) advance to 2.0% amid

forecasts for 1.9% print. The stronger-than-expected print sparked a

bullish reaction in the reserve currency, with the EUR/USD slipping

below the 1.3550 region, and the greenback retained the gains throughout

the North American session as the pair ended the day at 1.3545.

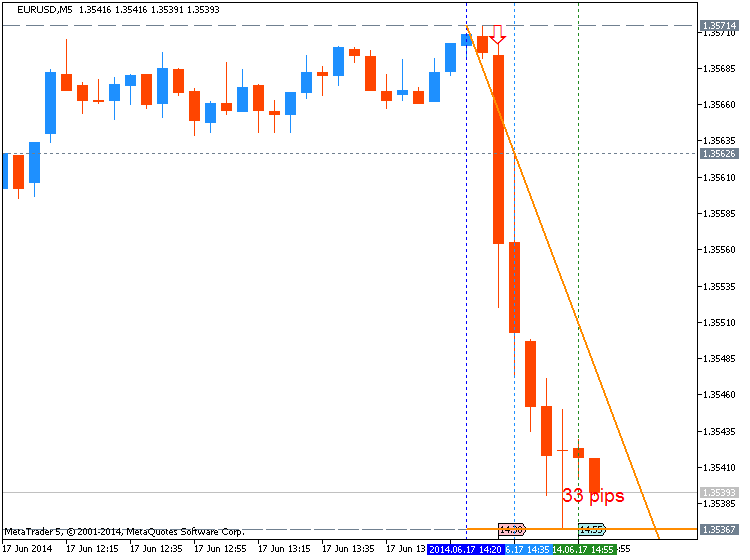

NZDUSD M5 : 44 pips price movement by USD - CPI news event :

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.20 18:54

NZD/USD weekly outlook: July 21 - 25The New Zealand dollar ended Friday’s session close to a four-week low against its U.S. counterpart, amid speculation that the Federal Reserve could hike U.S. interest rates sooner than expected.

NZD/USD hit 0.8648 on Thursday, the pair’s lowest since June 17, before subsequently consolidating at 0.8688 by close of trade on Friday, up 0.24% for the day but 1.45% lower for the week.

The pair is likely to find support at 0.8648, the low from July 17 and resistance at 0.8717, the high from July 17.

Demand for the U.S. dollar continued to be underpinned after Federal Reserve Chair Janet Yellen indicated earlier in the week that interest rates may rise sooner if the economy continues to improve.

Meanwhile, investors reassessed the geopolitical situation in Eastern Europe and in the Middle East.

A Malaysian Airlines passenger jet crashed in eastern Ukraine on Thursday. All 298 people on board were killed, with the U.S. blaming pro-Russian separatists for the act.

Moscow has denied involvement in the crash, which came a day after the U.S. announced a fresh round of sanctions against Russia for supporting separatists in east Ukraine.

Markets were also unsettled as Israel expanded its ground offensive in Gaza against Hamas militants who fired hundreds of rockets into Israel.

Data from the Commodities Futures Trading Commission released Friday showed that speculators increased their bullish bets on the New Zealand dollar in the week ending July 15.

Net longs totaled 15,453 contracts, compared to net longs of 14,416 in the preceding week.

In the week ahead, the U.S. is to release what will be closely watched data on consumer prices, home sales and manufacturing orders, while a rate statement by New Zealand’s central bank will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets. The guide skips Monday and Wednesday as there are no relevant events on these days.

Tuesday, July 22

- The U.S. is to release reports on consumer price inflation and existing home sales.

- The Reserve Bank of New Zealand is to announce its benchmark interest rate and publish its rate statement, which outlines economic conditions and the factors affecting the monetary policy decision. The central bank is also to hold a press conference to discuss the monetary policy decision.

- New Zealand is also due to release a report on its trade balance.

- The U.S. is to produce data on unemployment claims, manufacturing activity and new home sales.

- New Zealand is to release private sector data on business confidence.

- The U.S. is to round up the week with data on durable goods orders.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.23 20:49

Trading the News: Reserve Bank of New Zealand (RBNZ) Rate Decision (based on dailyfx article)

- RBNZ Expected to Raise the Cash Rate for the Fourth Consecutive Meeting.

- Benchmark Interest Rate of 3.50% Would Mark the Highest Level Since 2009.

Despite expectations of seeing another 25bp rate hike from the Reserve

Bank of New Zealand (RBNZ), the forward-guidancefor monetary policy will

be the key focus as market participants see the central bank taking a

pause from its normalization cycle.

What’s Expected:

Why Is This Event Important:

Indeed, the weaker-than-expected 2Q Consumer Price Index (CPI) has dragged on interest rate expectations as the resilience in the New Zealand dollar dampens the outlook for price growth, and the NZD/USD may face a larger correction over the near-term should the central bank soften its hawkish tone for monetary policy.

The pickup in household confidence along with the ongoing improvement in employment may encourage the RBNZ to retain a very hawkish tone for monetary policy, and the NZD/USD may recoup the losses from earlier this month should Governor Graeme Wheeler show a greater willingness to deliver another rate hike later this year.

Nevertheless, the RBNZ may strike a more balanced tone for the region

amid the slowdown in private sector consumption along with the limited

pickup in price growth, and the New Zealand dollar continue to press

fresh monthly lows should the fresh batch of central bank rhetoric drag

on interest rate expectations.

How To Trade This Event Risk

Bullish NZD Trade: RBNZ Hikes to 3.50% & Retains Hawkish Forward-Guidance

- Need green, five-minute candle following the statement to consider a long New Zealand dollar trade

- If market reaction favors buying kiwi, go long NZD/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

- Need red, five-minute candle to favor a short NZD/USD trade

- Implement same setup as the bullish New Zealand dollar trade, just in the opposite direction

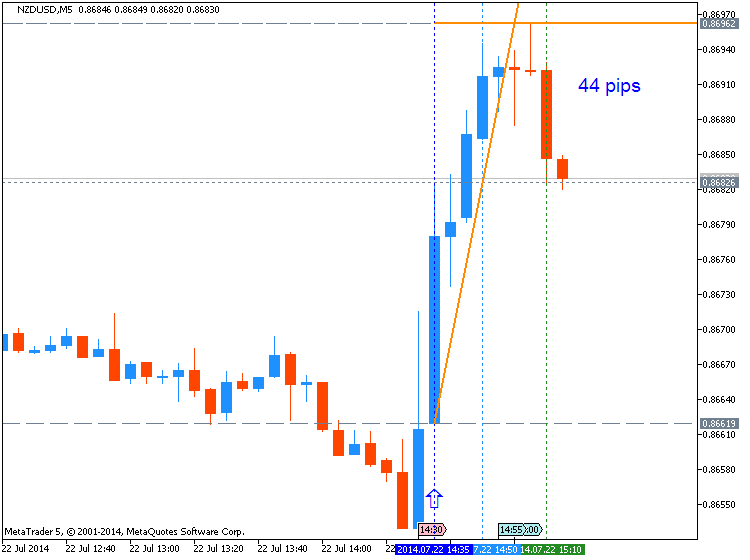

NZD/USD Daily

- Will look for fresh highs should the NZD/USD carve a higher-low in July

- Interim Resistance: 0.8841 (2011 High) to 0.8850 (61.8% expansion)

- Interim Support: 0.8600 (23.6% retracement) to 0.8620 (50.0% retracement)

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| JUN 2014 | 06/11/2014 21:00 GMT | 3.25% | 3.25% | +75 | +153 |

The headline reading for New Zealand inflation unexpectedly slowed during the first three-months of 2014, with the CPI figure slipping to an annualized 1.5% from 1.6% in the fourth quarter. The New Zealand dollar struggled to hold its ground following the dismal print, with the NZD/USD moving back below the 0.8600 handle, but the higher-yielding currency pared the losses during the North American trade to close at 0.8622.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 77 pips price movement by NZD - Official Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.07.25 14:42

2014-07-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

- past data is -0.9%

- forecast data is 0.5%

- actual data is 0.7% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

[USD - Durable Goods Orders] = Change in the total value of new purchase orders placed with manufacturers for durable goods. It's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders

==========

U.S. durable goods orders rebound, core capital goods rise

Orders for long-lasting U.S. manufactured goods rose more than expected in June, pointing to momentum in the economy at the end of the second quarter.

The Commerce Department said on Friday durable goods orders increased 0.7 percent as demand increased from transportation to machinery and computers and electronic products.

Orders for durable goods, items ranging from toasters to aircraft that are meant to last three years or more, were revised to show a slightly bigger 1.0 percent fall in May.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

NZDUSD M5 : 12 pips price movement by USD - Durable Goods Orders news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

D1 price is on primary bullish with secondary correction for beaking 0.8661 support level for the correction to be continuing.

H4 price is ranging between 0.8708 resistance and 0.8648 support levels since the beginning of the last week.

If D1 price will break 0.8661 support level so the correction will be continuing.If not so we may see ranging market condition within primary bullish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on NZDUSD price movement for this coming week)

2014-07-20 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Visitor Arrivals]

2014-07-22 12:30 GMT (or 14:30 MQ MT5 time) | [USD - CPI]

2014-07-22 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Existing Home Sales]

2014-07-23 21:00 GMT (or 23:00 MQ MT5 time) | [NZD - Official Cash Rate]

2014-07-23 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Trade Balance]

2014-07-24 01:45 GMT (or 03:45 MQ MT5 time) | [CNY - HSBC Manufacturing PMI]

2014-07-24 14:00 GMT (or 16:00 MQ MT5 time) | [USD - New Home Sales]

2014-07-25 01:00 GMT (or 03:00 MQ MT5 time) | [NZD - ANZ Business Confidence]

2014-07-25 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on NZDUSD price movement

SUMMARY : bullish

TREND : correction

Intraday Chart