Tkhis is very precise Indicator. Thank You!

Tkhis is very precise Indicator. Thank You!

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.12 08:59

What Does a Spread Tell Traders?

- Spreads are based off the Buy and Sell price of a currency pair.

- Costs are based off of spreads and lot size.

- Spreads are variable and should be referenced from your trading software.

Spreads and Forex

Every market has a spread and so does Forex. A spread is simply defined as the price difference between where a trader may purchase or sell an underlying asset. Traders that are familiar with equities will synonymously call this the Bid: Ask spread.

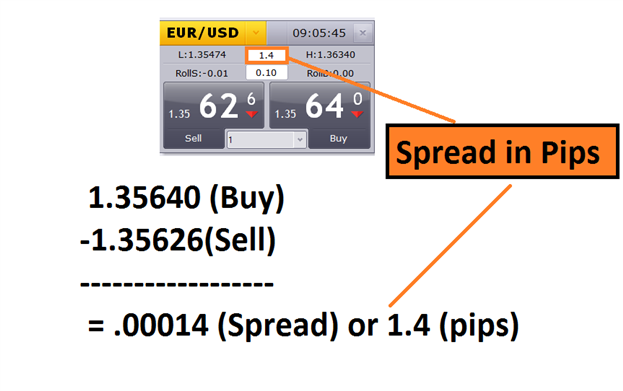

Below we can see an example of the spread being calculated for the EURUSD. First we will find the buy price at 1.35640 and then subtract the sell price of 1.32626. What we are left with after this process is a reading of .00014. Traders should remember that the pip value is then identified on the EURUSD as the 4th digit after the decimal, making the final spread calculated as 1.4 pips.

Now we know how to calculate the spread in pips, let’s look at the actual cost incurred by traders.

Spreads Costs and Calculations

Since the spread is just a number, we now need to know how to relate the spread into Dollars and Cents. The good news is if you can find the spread, finding this figure is very mathematically straight forward once you have identified pip cost and the number of lots you are trading.

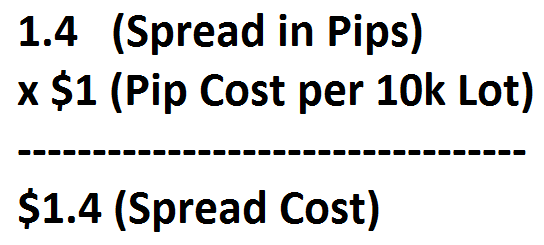

Using the quotes above, we know we can currently buy the EURUSD at 1.3564 and close the transaction at a sell price of 1.35474.That means as soon as our trade is open, a trader would incur 1.4 pips of spread. To find the total cost, we will now need to multiply this value by pip cost while considering the total amount of lots traded. When trading a 10k EURUSD lot with a $1 pip cost, you would incur a total cost of $1.40 on this transaction.

Remember, pip cost is

exponential. This means you will need to multiply this value based off

of the number of lots you are trading. As the size of your positions

increase, so will the cost incurred from the spread.

Changes in the Spread

It is important to remember that spreads are variable meaning they will not always remain the same and will change sporadically. These changes are based off of liquidity, which may differ based off of market conditions and upcoming economic data. To reference current spread rates, always reference your trading platform.Dear Sir, I would like to get a spread indicator that floats near the current candle.

1. When the price drops, I want the spread color in green

2. and when the price goes up, I want the spread to turn to red color.

3. I want the inputs panel to have color coding where I can easily adjust the color I want. And also the font and its size.

4. I also want it to draw a horizontal line when such spread is detected with following condition :

-If price drops, and spread is detected to be (the prefixed spread in input panel), the drawn line should be green color.

-If price goes up, and spread is detected to (the prefixed s[read in input panel), the drawn line should be red color.

-The lines should be drawn again and again if the above phenomena happens.

Can you make this simple indicator Sir?

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Spread Indicator:

Author: Daniel F