Hey,

this looks good - the only thing I don't understand: Why you green so blue? ; )

Can anyone discribe (in 5 little words), what these zones are for? High possibility of bullish or bearish trends? Sorry for my dumbness.

TuRRiCAN

thank you so much this works very good and on the one hour tf

Hey,

this looks good - the only thing I don't understand: Why you green so blue? ; )

Can anyone discribe (in 5 little words), what these zones are for? High possibility of bullish or bearish trends? Sorry for my dumbness.

TuRRiCAN

I think the author means that the royal blue was described the green zone...sorry if i wrong.

Bliue Zone + Red HA = Blue??

Shouldn't that be Gray??

Look at first red bar from the left in the HA chart.

Sorry people how do you set up this indcator on meta trader 4? i seem to have problems on it.basaically it comes up but its the same as the usual candle sticks the grey candles dnt show up.i know the trade zone trade iam just not sure how to set this up on mt4.

need your help

Could anybody please help me with compiling Heiken Ashi ZoneTrade indicator.I keep getting this error.

" variable 'limit' not used HeikenAshiZoneTrade1.mq4 120 11"

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2013.11.13 14:09

Heiken Ashi Smoothed (based on asiapacfinance.com article)

In this video, we conduct a simple review of how we would trade the Heiken Ashi Smoothed MT4 indicator

In the Video above, the silver moving line is the price. The blue and red indicators are the Heiken Ashi bars. Blue indicates bullish momentum, while red indicates bearish momentum.

This indicator will probably work well in combination with another indicator. It reduces “fake-outs” and fake reversals while keeping you in trends with momentum indicated by the color of the bars.

Heikin Ashi is a type of trading chart that originated in Japan (heikin ashi translates as average bar). Heikin Ashi charts are similar to candlestick and bar charts in that they show similar information (the open, high, low, and close of the time frame), but Heikin Ashi charts calculate the information differently.

Heikin Ashi charts are used in trading in the same manner as standard candlestick or bar charts (i.e. chart patterns are used to indicate price movements). However, Heikin Ashi charts have an additional aspect in that the direction of the bar (i.e. its color for candlesticks) is supposed to indicate the overall direction of the market, while ignoring the intermediate direction (e.g. false changes of direction).

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.01.15 20:40

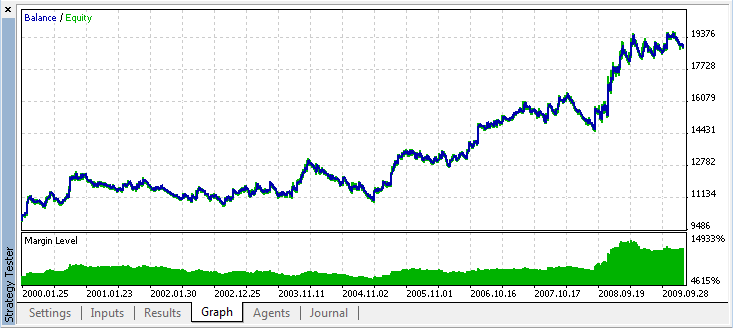

An Example of a Trading System Based on a Heiken-Ashi Indicator

With the appearance of candlestick chart in the U.S., more than two decades ago, there was a revolution in the understanding of how the forces of bulls and bears work on the Western markets. Candlesticks became a popular trading instrument, and traders began working with them in order to ease the reading of the charts. But the interpretation of candlesticks differ from one another.

One of these methods, which changes the traditional candlestick chart, and facilitates its perception, is called the Heikin Ashi technology.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Heiken Ashi ZoneTrade:

Author: Zenoni