NEW YORK (MarketWatch) — The U.S. dollar turned sharply lower against the yen Wednesday afternoon as a weaker-than-expected U.S. ISM reading led investors to sell U.S. stocks and buy Treasurys, pulling down yields.

The dollar-yen pair is especially sensitive to fluctuations in interest-rate differentials, with the dollar often declining alongside U.S. Treasury yields, according to Omer Esiner, chief currency market analyst at Commonwealth Foreign Exchange.

The 10-year Treasury note yield 10_YEAR, -0.08% which moves in the opposite direction as prices, skidded 10 basis points on the day to 2.3880%, its lowest level since the beginning of September.

The Institute for Supply Management’s manufacturing index dropped to 56.6% in September, from a three-month high of 59% in August. Economists were expecting a reading of 58.5%.

The ISM data was the second significant U.S. data release Wednesday, following Automatic Data Processing Inc.’s jobs data. The ADP data showed the U.S. added 213,000 private-sector jobs, in line with analysts’ expectations.

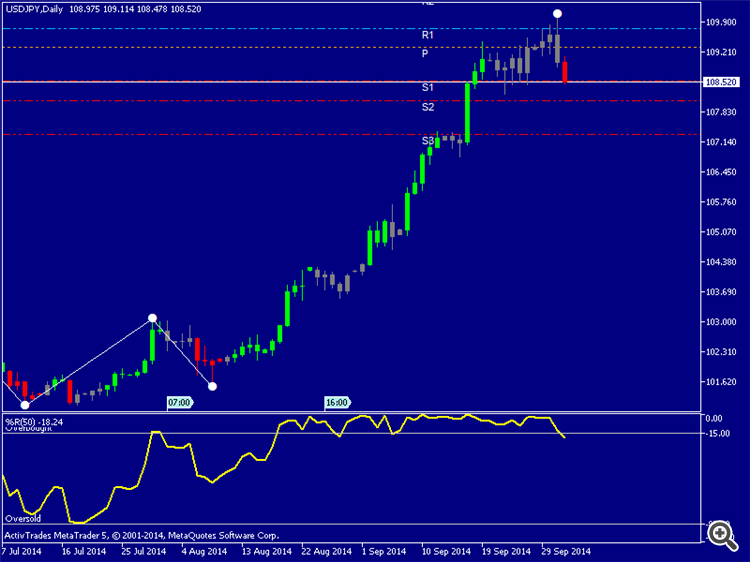

After briefly topping 110 yen for the first time in more than six years during the Asia trading day, the dollar fell to ¥108.92 USDJPY, +0.03% Wednesday, its lowest level since August. 26. It traded at ¥109.66 Tuesday.

The euro and the pound fell against the greenback after a series of dour European data highlighted the increasing divergence in economic growth between the U.S. and its G-10 rivals.

PMI data for Germany and the U.K. showed a steeper-than-expected decline in manufacturing in both countries in September, with Germany joining France in contraction. The U.K. number fell to 51.6, below the 52.7 expected by economists.

The euro EURUSD, -0.02% traded at $1.2618 late Wednesday, compared to $1.2629 Tuesday evening. The pound GBPUSD, -0.02% traded at $1.6182, compared to $1.6217 Tuesday evening.

Australian retail sales increased by 0.1% in August, missing expectations of a gain of 0.4%. The lackluster data pushed the Australian dollar lower against the U.S. dollar. The aussie AUDUSD, -0.10% traded at 86.62 cents in the Asia trading day, its lowest level against the dollar since January.

But buyers stepped in, halting the decline just before the currency reached a fresh four-year low below 86.60 cents. It then pared losses, trading at 87.34 cents late Wednesday, compared to 87.43 cents Tuesday evening.