- Crude Oil Traders To Keep One Eye On Escalating Ukrainian Turmoil

- Gold In Tug-Of-War As Geopolitical Tensions Offset A Stronger Greenback

- Palladium Targeting 1,000 After Leaping Over The $900 an Ounce Hurdle

CRUDE OIL TECHNICAL ANALYSIS

Crude is at a critical juncture as the commodity threatens to clear the 23.6% Fib and descending trendline on the daily. A break through the nearby barrier would be required to mark a small base and threaten a more sustained recovery for the commodity.

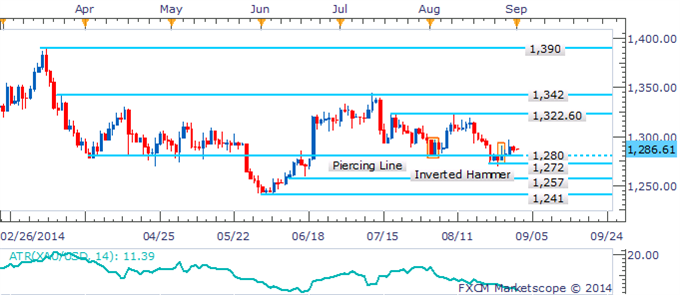

GOLD TECHNICAL ANALYSIS

Gold’s recovery appears to have lost momentum. Yet buying interest at the 1,280 floor and a low ATR reading suggests the potential for the commodity to remain elevated.

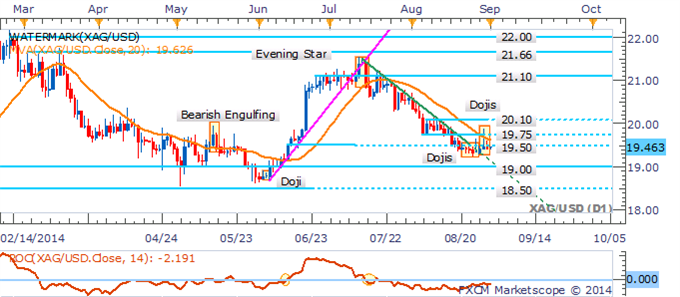

SILVER TECHNICAL ANALYSIS

The tug-of-war between the silver bulls and bears sub 19.50 continues. A parade of Doji formations suggests indecision from traders and does little to confirm a clear directional bias for the precious metal. A daily close above the nearby barrier would suggest a small base and open the potential for a greater recovery.

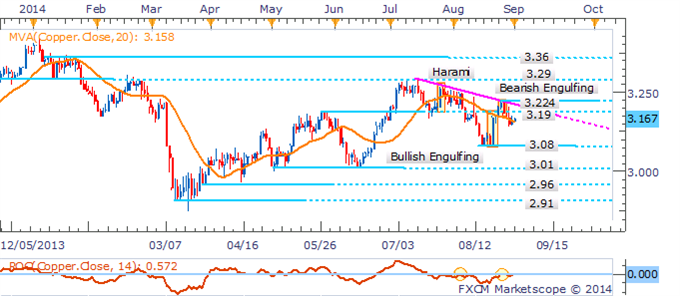

COPPER TECHNICAL ANALYSIS

A sharp correction for Copper has yielded a Bearish Engulfing

formation that may warn of further weakness. This could set the

commodity up for a retest of its recent lows near the 3.08 floor.

However, a clean run towards the target may prove difficult given the

commodity’s recent tendency to whipsaw in intraday trade.

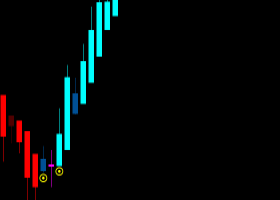

PALLADIUM TECHNICAL ANALYSIS

Palladium has cracked the 900 target offered in

recent commodities reports. With the core uptrend intact the upside

break opens the next psychologically-significant 1,000 handle. It is

also worth noting that a void of bearish candlestick signals casts some

doubt on the potential for a correction.

PLATINUM TECHNICAL ANALYSIS

Platinum’s recovery has faltered at the 1,424

ceiling, leaving a narrow trading band in play. Within the context of a

broader downtrend, selling into corrective rallies is preferred.