First weak signal?

While the U.S. indices still record just below their highs, the DAX consolidated further ahead. When asked whether the DAX falls even to the bottom line of the former uptrend channel, thus breaking through the center line down, one would usually take the U.S. indices to help. However, there's a bit of a problem: The U.S. indices have in recent months developed completely differently than the DAX. While the DAX failed at the 10,000-point mark, the U.S. indices rose on and on. Only now, when the S & P500 the psychologically important 2.000er brand and the Nasdaq100 has reached the 4,000 mark, send the U.S. indices first signs of weakness.

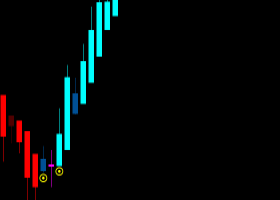

A sustained increase over the 4,000 mark would be worth still bullish. A first small (!) Bears signal arises now is when the 3,941 now as soon as possible by breaking down again. The target price - from the potential Iceland Gap - would then be 3,866 points.

And now it gets complicated. This raises a question as what happens to the DAX, when the Nasdaq100 should now fall. Normally, I would write:

If the Nasdaq100 below the 4,000 mark should pass in a consolidation (where it would even care if this is running sideways or down dynamically), it will also come in the DAX to continue falling prices.

BUT: Since the DAX significant less developed compared to the U.S. indices for half a year, could also be something else happened. It would be possible that the DAX in the case of a consolidation of the U.S. indices establishes a relative strength of the U.S. indices. And especially if the euro, which has now triggered the sell signal last week described, is falling against the dollar.

The simplistic reasoning: A falling euro will strengthen the European economy, while a strong dollar, the U.S. economy should be rather weaker. And that alone may lead even at this relative strength of the DAX to the U.S. indices.

So it remains very exciting: we must wait to see if the U.S. indices can overcome this psychologically important brands quickly or not. It is due to the different development of the U.S. indices DAX a very difficult time, especially since we are still in the critical summer months when piling up false signals. Because, unfortunately, there is nothing to change.

Written by Memselftrade