The Fall of the Carry Trade, or The Carry Trade Works Best When Market Volatility is Low

One of the most popular currency trading strategies in recent

history, the carry trade has been successfully used by traders for

years. With recent market conditions, this very popular strategy is

beginning to look like a losing proposition. Traders find themselves

wondering is this strategy ever going to be back en vogue or will it

remain taboo for generations to come? The answer is murky at best and

highly dependent on the global economy and the foreign exchange market.

What is the Carry Trade and How does it work?

Before one can understand why the carry trade isn't working, one must first understand what the carry trade is. The short answer is that the carry trade is a trade where a currency trader or speculator is attempting to not only gain from the rise or decline of the currency pair, but also the interest rate differential between the two currencies. When carry trading, the trader buys the currency with the higher interest yield while selling the currency with the lower interest. The speculator is attempting to capture the interest rate differential as well as any appreciation in the currency. The carry trader is often more interested in the positive interest earned on the currency pair rather than the profits from the trade itself.

Sample carry trade:

- Trader Buys New Zealand Dollars (Earns 7%)

- At the same time, Trader Sells Japanese Yen (Pays 0.25%)

- If the currency pairs stays at the same rate for the entire year trader makes 6.75% (Interest Rate Difference)

If this is a 100k position, the trader has earned 6.75% interest on 100,000. With 10:1 leverage, the trader put up 10k and earned $6,750NZD.

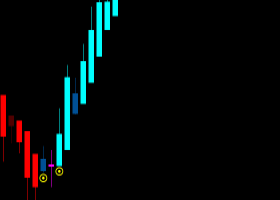

In the recent past, the NZDJPY has often been a great example of the carry trade strategy. Forex traders bought this currency pair not for economic growth in the New Zealand economy, but for its carry trade opportunity. Currency traders jumped at the chance to earn the high 8 percent interest rate that the Reserve Bank of New Zealand was offering at the time while simultaneously, paying a cost of 0.5 percent for the Japanese Yen. This 7.5% rate on margined funds lead to huge potential gain which helped money managers garner a high return coupled with the rise in the currency as the New Zealand dollar appreciated against the Yen.

The fall of the carry trade

Like great empires, all good things must come to an end, and this includes the carry trade. Three major concepts have recently taken down this seemingly infallible strategy. With that said, conditions may again become favorable once the market downturn runs its course.

Increase in Risk Aversion

An increase in currency market volatility, which is often signified by the large increase in average daily ranges, causes investors became more risk averse. In turn, these investors decide to close these high risk positions. As short term benefits for the carry trade and many stocks decrease, traders close out of their carry trade positions in the FX market. The carry trade, which was once the stable position, is no longer viable as carry trades work best in less volatile environments. Carry traders are now keeping their distance.

Interest Rates Cuts

With a great deal of global economies in jeopardy and desperate to free markets, they have decided to begin cutting interest rates. This has caused traders and money managers alike to reconsider their already long term carry trade positions. The eight percent return they were previously getting is now a smaller five to six percent return. Although the Japanese yen, a favorite funding currency for the carry trade has also slightly lowered their interest rate from .5% to .3% their interest rate differential is still less. This shrinking differential became too small to compensate against increasing losses as the New Zealand dollar began to weaken. This led to a mass asset reallocation so traders could cut losses and try to build funds elsewhere.

Government Intervention

Although rare, government forex intervention can occur, most often as a tool when a countries currency either rises or declines faster than central bank expectations. It has rarely been used or mentioned as carry traders exited en masse. The absence of intervention helped to fuel a new generation of sellers as favorite carry candidates took a beating. The list included popular carry trade currencies like the Australian and New Zealand dollars, Euro and British Pound. Had central bank policy makers hinted at some potential action. Unfortunately, this was not the case and there was nothing to curb the downfall.

Where Can We Go From Here?

Risk aversion risk won't last forever, nor will these volatile markets. Forex, like the equity markets typically recover along when investors appetites for higher returns increase. There have been similar situations that appeared in the last ten years, and carry trades will likely repeat once volatile markets have calmed. This opportunity will take some time to resurface, but it will be worth the wait.

When conditions are ideal again, here is what to look for in a carry trade.

1. Low Market Volatility

The carry trade works best when market volatility is low

2. Healthy Economy of the Higher Interest Rate Currency

Healthy economies are vital for the carry trade to work and are a large part why it is currently failing. Be sure to watch out for strengthening global economies after volatility calms.

3. Large interest rate differentials:

An example of a good pair to look at would be the British Pound if it has a 4.50% interest rate and the Japanese Yen if it has a 0.50% interest rate.