An Interview with Paul Rotter – I was always the guy who traded a lot, sometimes up to a 100 trades a day

Paul Rotter is something of a legend among scalp traders with a penchant for the German government bond market. At the height of his scalping career he would sometimes trade as many as 1 million contracts a day with a more normal turnover of a still very significant 100,000-200,000 daily contracts.

Though he isn't a forex trader, apart from dabbling to hedge his positions in other markets, he has nonetheless caught the interest of forex traders, particularly the scalping fraternity. It's on that basis that MahiFX approached him for an interview.

However, he no longer does scalping reflecting the way the markets have evolved. His style is now more focused on longer-term trading strategies. He currently lives in Singapore and runs his own fund management company Rotter Invest.

----

Justin Pugsley from mahifx.com: Paul can you tell me a bit about how you got into trading and your trading style?

PR: I started trading about 20 years ago, when I was an apprentice to become a banker at a German bank in Munich. During that apprenticeship I had already spent one year in the trading room at HypoVereinsbank in Munich.

I was basically entering trades into the computer system for clients of the bank. They were trades that had been made over the Deutsche TerminBorse (DTB – a German futures exchange) as it was known back then.

I then moved to Frankfurt to work for Daiwa Securities as a junior trader and learned by doing it. I had never traded at this stage. So I started trading small contracts on the Dax (the main German stock market index) for around 6 months before I switched to the bond markets.

JP: And how did that go?

PR: Actually I was profitable right from the beginning, not every day, but I never had a losing month in the two years I was at Daiwa. It was a very easy market back then, you couldn't trade that easily now.

Electronic trading hadn't really started yet. In terms of volume the main activity was in London on the LIFFE (The London International Financial Futures and Options Exchange). On the DTB there were mainly the arbitrageurs and there weren't that many other traders there. So sometimes it was really like having a free lunch. You could take the Bobl (5 year German government bond) and it just lacked movement unlike the Bund (longer maturity German government bond). So the Bund moved and the Bobl didn't, so you just bought the Bobl and waited for some time for it to move.

Of course today it is a very different story with all the algorithmic systems, which arbitrage everything so there is no longer this kind of opportunity. It was a much easier trade than trading the news like Non-Farm Payrolls. These days automated algorithmic traders have their servers connected right next to Bloomberg's and next to the exchanges so they've already reacted very quickly, much faster than someone can manually.

At Daiwa I was trading small sizes, which were easy to get out of so I had flexibility. I was mainly doing directional trading.

JP: While you were at Daiwa did you have a mentor?

PR: Yeah, there was one, though he wasn't necessarily a mentor. I was doing my own thing like discovering technical analysis and he was the head of the trading desk and he was profitable almost every day. Actually, he didn't look at any kind of indicators as such, but followed his opinion.

He would explain to me on a chart about where all these people bought and where they would have to get out. So it was like looking at the psychology of the market and reading it. He didn't trade much. He would be shaking his head saying you can get old trading like that. But I learned a lot from him about market psychology.

JP: Can you give some insights into the tools and strategies you use?

PR: I have changed a lot over the years and I have stopped the really short term trading, where I was trading a couple of ticks and doing a kind of market making style. I stopped this a couple of years ago because of potential regulatory issues and also because of the evolution of all the algorithmic trading out there.

Now you have the FBI investigating algorithmic trading because what the algorithmic traders do is market manipulation, but somehow it is legal. If I put in orders and then cancelled them, I could be accused of market manipulation. But they do it in micro-seconds at the rate of 100,000’s of times a day, putting in and cancelling orders, and no one really stops them.

So for these reasons I am now doing more mid- to long-term trades in a variety of markets and I don't just concentrate on my core markets (bonds) which I was doing until I stopped short-term trading.

But I was always looking at technical analysis. I was never really a fundamentals follower, except for news releases. I was always following the technicals and trying to read market psychology.

The main technical analysis tool I use are point and figure charts. I

was already using them 20 years ago so this is the main one for me

really.

JP: So do you use indicators such as RSI, MACD and other tools such as trend lines and support and resistance?

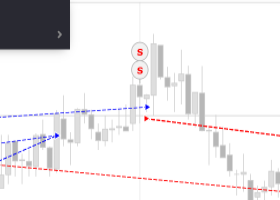

PR: Trend lines and support and resistance - yes. But I stopped using all the indicators like RSI, although I was using them about 20 years ago, but I never relied on them. But for very short term trading they don't really help much. What's more important is the market's behaviour around support and resistance levels.

Also, back in the old days I was gaining information from my trading, having bids and offers in many different markets and from my fills I could feel what the market wanted to do by how it reacted to my orders.

Sometimes I would sell at the low and someone would laugh at me for doing that, but I actually gained information, maybe by seeing there was big demand at that level. If they lifted a big offer of mine then I knew someone wants to buy and then I would try to go long. So it was very different thinking to what these guys thought I was doing.

JP: Just coming back to short-term trading, with all these algorithmic trading platforms in market, do you think it is now impossible for small traders to make money out of scalping forex?

PR: If I was to start trading today, I think I would even do foreign exchange because I think it is really easy to do the real scalping for a few pips here and there, especially after some number releases or someone’s speech. The (forex) markets can be really choppy.

Of course you must have some feeling for the market. You put in orders in a 5 to 10 tick range and you get filled on the bids and offers in this environment. Of course you must have some tight stop losses.

For retail traders they may not be able to tell where the market is going, but they can use the good short-term volatility for scalping.

JP: Have you ever traded forex?

PR: I don't really trade forex, but I am involved in it for money management purposes. Maybe I could trade it for short-term moves such as break-outs, but for longer-term trading and to predict direction it is really not that easy. Because some news or someone speaks and the market can just go completely the other way.

JP: What is your typical trading day like?

PR: Back in the old days (when trading intensively) I would try and take regular breaks. I would be at the trading desk at 8 AM (Central European Time) in the morning because I really liked the opening trades, which were always very interesting.

I would trade for two or three hours in the morning, then there would be the US market open at 2.20-2.30 PM (Central European Time). They opened and there would usually be some economic numbers released. At 5 PM it would usually be the end, because the cash market would be closed in Europe. Of course now they have extended the trading times of all these markets.

JP: So I guess these days you come into your office, read all the news, look at the up coming data releases etc... and maybe plan your trading campaign?

PR: No I never really plan a campaign. Of course I look at the charts and if I see a really big level right at the open then maybe I will plan something.

But usually if there aren't any special levels or something then I don't do anything.

I can trade from nothing, just give me a computer and some charts. For instance I can see that some big news release is due, because market liquidity has dried up. I can just trade - I don't need to study and prepare myself, but of course it is better to prepare.

So normally I have my charts and I have the news feed running and squawk boxes as well. In the old days this was very important to me to know what news was coming, what rumours were going around and so on. This was especially so because I liked to sit on my own away from other traders. I concentrate better on my own.

JP: What do you think separates moderately successful traders from very successful traders?

PR: I think everybody would say it is the discipline and money management, which is actually very hard. Many years ago when I was at Daiwa and even when I went off with some other partners we always had someone who looked at our P&L. If you were down a certain amount you would have to reduce your position size and if you were down even more then you have to turn off your computer.

When I was trading on my own I didn't have the benefit of that person enforcing discipline.

If you have someone to do that then it is fantastic because it is very important. Some days nothing works. And next day you come in and everything is fantastic.

I remember when I was at Daiwa and when I was having a bad day the chief trader would tell me “you have blood in your head” and tell me to go out and get “some fresh air.”

I used to get angry with myself when I made a mistake or something went wrong. But if you follow your strategy and lose then it is bad luck. Sometimes I traded at times when I shouldn't have traded because it was not my market , but I still traded anyway and lost money.

So in those situations, you must have strict money management, reduce your size or stop trading for a while.

So I think when you are losing it's good to stop and get some perspective.

(Talking about highly successful traders) Then you have some more talented people who can really feel the market. So when the charts say you should go long, but then it doesn't go up, these people will act against logic and go in the opposite direction because the market will go the other way.

So you need to be mentally flexible.

JP: Tell me a bit about your scalping?

PR: I can tell you one day I was losing and trading 1 million contracts – usually it was 100,000-200,000 contracts a day – that could be 100 trading decisions a day. I would have permanent fills on both sides, I was always feeling out the market, seeing how my orders were filled and sometimes I would trade break-outs.

I was a scalper sort of like a high frequency trader before the algorithmic systems came.

JP: What would you say are the main differences psychologically between scalpers and long-term traders as you have done both?

PR: I think it is even more stressful if you're a longer-term trader because you hold the positions that might be wrong and not going your way. Something can happen over-night, and I think you need stronger nerves.

JP: Interesting you say that because some people I've spoken with think scalping is more stressful because of the amount of trading you do:

PR: You must really like scalping to do it. It never affected my heart rate, but I did have some digestive problems after a while. To be good at it you need to be able to make decisions quickly. So for example I would sometimes buy and then look up the news to see what had happened to move the market.

Other people would read the news first to decide what to do, but that would be too late.

JP: How has moving from short-term to longer-term trading impacted your swings in profitability?

PR: That is a hard question. When I started out and I was telling you that I had no losing months … that changed when I increased the size of my positions. Sometimes I would get hit badly because I had a huge position.

Now I have much smaller positions in many more markets, so I maybe don't have so many swings in P&L.

JP: So your pursuing a diversification strategy?

PR: Yes, this prevents big P&L swings. With the big positions I used to take, it could sometimes be hard to exit them.

The worst day I had was in 2008 when Socgen (the French bank) was liquidating contracts accumulated by their trader Jerome Kerviel (he lost Socgen €4.9 billion). They were selling his positions in the DAX and some other Euro stocks and the market dropped something like 1,000-1,200 points in 2 days.

So I bought into the market a couple of times and got hit badly, because liquidity was down. I think there was a US public holiday as well.

JP: It must have taken you a while to recover from that?

PR: Yes, I lost badly those 2 days. I was on my own, I didn't really have risk management and I should have stopped and I just couldn't believe what was happening so I would buy again.

JP: Which traders do you most admire?

PR: When I started I admired Tom Baldwin (a bond trader often credited with being able to single handedly move the US Treasuries market) who traded on the Chicago Board of Trade, but I didn't know that many traders at the time. But I knew of these traders in the trading pits we were listening to on the ‘squawk boxes’ from Chicago and London.

At that time Baldwin was a big trader in treasury bonds, so when someone said Tom is on the bid then everyone would start buying. It was always important to know what he was doing.

JP: Which books about trading would rate as among some of the best you’ve ever read?

PR: Definitely Market Wizards and also some of the other books written by Jack Schwager. I also really liked Technical Analysis of the Financial Markets by John J. Murphy. I haven't read any books recently about trading, but 10-15 years ago I read a lot of books about trading.

There were a number of books I read about point and figure charts, which I really liked, but I can't remember their titles.

But the Market Wizard books were really good. It was great to find out about these different traders in different markets. It was very interesting to hear about the psychology and the different trading styles. I also read George Soros's books, such as the Alchemy of Finance, which was a fantastic book.

JP: What would you advise someone starting to trade today to do?

PR: It depends what they want to do. The scalpers are more likely to be people from the street, not necessarily the ones from the universities. For a very smart guy with a good idea of markets and valuations then I would advise him not to scalp. 20 years ago it was fantastic, when there was no algorithmic trading. They've taken the easy money off the table – they just front run and arbitrage everything.

I think it's (scalping) a much harder playing field for someone just starting out. Today I would recommend people go for longer-term trading or go for an investment style approach.

For scalping I think some of the less liquid Asian stock markets where the algorithmic traders aren't operating and the forex markets are a good choice.

JP: Any final thoughts about trading?

PR: Yes, I would say trading is not really for humans. When they're profitable they become cautious and when they lose money they start taking more risks and lose more, which is the exact opposite of good trading.

So a person must decide if they can take risk and if they can make decisions quickly.