Social Trading with the MetaTrader 4 and MetaTrader 5 Trading Platforms

What is social trading? It is a mutually beneficial cooperation

of traders and investors whereby successful traders allow monitoring of

their trading and potential investors take the opportunity to monitor

their performance and copy trades of those who look more promising.

You monitor real-time trading of a number of traders, connect to the most successful ones and copy their trades in automatic mode - that's what social trading is about. For novice and inexperienced traders who have just turned to financial markets for additional income, it is probably the best opportunity to actually start trading.

You do not need to be a professional trader with a great bundle of

knowledge and skills in order to trade professionally. Nor do you need

to follow and analyze the news from financial markets, work out and

implement trading strategies and be prepared to change the ones that

fail to keep monitoring their performance in the new market conditions.

Thanks to social trading it all becomes unnecessary since you can simply

copy trades of all those who follow the news, analyze markets and

create profitable strategies.

Is it difficult to start mirror trading and how much does it take? While hedge fund investing was not available to many due to high entry threshold (hundreds of thousands and millions of dollars), social trading is a highly affordable system available to absolutely any trader with any income level. It opens up access to a large market with vast opportunities that you, too, can use.

Social trading advantages are obvious:

- Additional income for both traders and investors

- Investment diversification

- Opportunity to connect to the most successful traders and automatically mirror their trades

- Low entry threshold: you can start with a minimum budget

- Practice opportunities: you can trade on demo accounts in a training mode

- Time saving

- High operability and user-friendly interface

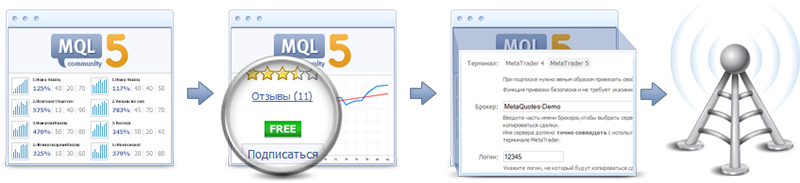

Ready to take the opportunities offered by social trading but don't know where to start? MetaTrader 4 and MetaTrader 5 are the most famous and popular platforms for social and mirror trading, with Trading Signals service being a very convenient, advanced social trading feature offered in these platforms. Social trading with the MetaTrader platforms is very straightforward: the user chooses the signal directly in the terminal, subscribes to it and from that moment on all trades are copied in his account.

Social trading with MetaTrader will allow you to monitor trading activity and profitability of successful traders, and most importantly, copy their trades. If you see a positive trend in performance of one of the traders whose signal is available for subscription, go ahead with it and start copying his trades. The trading terminal will automatically mirror all trades of the signals provider in your account, without any manual intervention necessary.

So, after subscribing the trader can earn money using the Signals service, without effort, skills or trading experience.

After all, social trading should be simple and straightforward to be easily understood by traders with any background. We cannot but admit it. In this light, MetaTrader trading signals appear to be perfectly adequate. They are available to any user, regardless of their trading experience. Here, you are not required to sign an agreement with a provider of the selected signal or a broker, nor is there any paperwork or manual control necessary. Everything is done automatically.

All you need is to specify your broker and enter the number of your account on the broker's server. Nothing more than that. Subscription process will take very little time. The description of a step-by-step subscription procedure is available in the article entitled "How to Subscribe to Trading Signals". After reading it, you will subscribe to the signal of your choice quickly and easily.

Despite being seemingly complicated, choosing a provider of the suitable signal has been made as simple as possible - the Trading Signals section features a regularly updated list of providers. By default, signals on the list are sorted by quality ensuring that top positions are taken by signals with higher credibility and better financial performance. However, for your convenience trading signals can also be sorted by monthly growth, number of subscribers, price and other parameters.

Social trading with the MetaTrader trading platforms is easy, straightforward and available to everyone. Out of thousands of available signals providers, you just need to choose the one that suits you more and measures up to your parameters!

Some articles dedicated to signals which can be useful to you:

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/701

Graphical Control of External Parameters of Indicators

Graphical Control of External Parameters of Indicators

MQL5 Market Results for Q2 2013

MQL5 Market Results for Q2 2013

Testing Expert Advisors on Non-Standard Time Frames

Testing Expert Advisors on Non-Standard Time Frames

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

When you say anyone can join social trading with little bits of capital that can be misleading because if the signal provider has a large or size able starting capital then it will be difficult for someone with less to take on proportionate risk especially if the signal provider is mostly risk averse.

New article Social Trading with the MetaTrader 4 and MetaTrader 5 Trading Platforms is published:

Author: MetaQuotes

I have a problem with the lot size or risk. Your balance is 1856 usd and my balance is 715 usd, your lot size is 0.01 and my lot size is 0.01. But You get profit 7 usd and I get profit 0.70 usd. I try to increase the risk by "use no more than 95% of deposit" setting at option signal but nothing change. Could you tell me how to fix this so I get at least 3.5 usd profit?

What are you talking about ? Who is your interlocutor ?

Can you please post your question about Signals in Frequently Asked Questions about the Signals service, thanks.

Forum on trading, automated trading systems and testing trading strategies

Press review

newdigital, 2014.06.06 09:25

3 Steps to Trade Major News Events (based on dailyfx article)

Talking Points:

- News releases can be stressful on traders

- Develop a plan before the event arrives

Major news releases can be stressful on traders. That stress can show up for a variety of trading styles.Perhaps you are already in a good position with a good entry and you are afraid the news release may take a bite out of your good entry.

Perhaps you want to enter into a new position as prices are near a technically sound entry point, but you are uncertain if the technical picture will hold up through the volatile release. Therefore, you agonize over the decision of whether to enter now or after the news event.

Maybe, you like to be in the action and initiating new positions during the release. The fast paced volatility during the news release still gets makes your palms sweat as you place trades.

As you can see, news events stress traders in a variety of ways.

Today, we are going to cover three steps to trade news events.

Step 1 - Have a Strategy

It sounds simple, yet the emotion of the release can easily draw us off course. We see prices moving quickly in a straight line and are afraid to miss out or afraid to lose the gains we have been sitting on. Therefore, we make an emotional decision and act.

Having a strategy doesn’t have to be complicated. Remember, staying out of the market during news and doing nothing is a strategy.

A strategy for the trader with a floating profit entering the news event could be as simple as “I am going to close off half my position and move my stop loss to better than break even.”

For the trader wanting to initiate a new position that is technically based, they may decide to wait until at least 15 minutes after the release, then decide if the set-up is still valid.

The active news trader may realize they need a plan of buy and sell rules because they trade based on what ‘feels good.’

Step 2 - Use Conservative Leverage

If you are in the market when the news is released, make sure you are implementing conservative amounts of leverage. We don’t know where the prices may go and during releases, prices tend to move fast. Therefore, de-emphasize the influence of each trade on your account equity by using low amounts of leverage.

Our Traits of Successful Traders research found that traders who implement less than ten times effective leverage tend to be more profitable on average.

3 - Don’t Deviate from the Strategy

If you have taken the time to think about a strategy from step number one and if you have realized the importance of being conservatively levered, then you are 90% of the way there! However, this last 10% can arguably be the most difficult. Whatever your plan is, stick to it!

If I put together a plan to lose 20 pounds of body weight that includes eating healthier and exercising, but I continue to eat high fat and sugar foods with limited exercise, then I am only setting myself up for frustration.

You don’t have to be stressed or frustrated through fundamental news releases.