The Use of the MQL5 Standard Trade Class libraries in writing an Expert Advisor

Introduction

The new MQL5 program comes with

a lot of built-in Standard class libraries which are meant to make development

of MQL5 Expert Advisors, Indicators and Scripts as easy as possible for traders

and developers.

These class libraries are available in the \Include\ folder

located within the MQL5 folder in the MetaTrader 5 client terminal folder. The class libraries

are divided into various categories – Arrays, ChartObjects, Charts, Files,

Indicators, Strings and Trade classes.

In this article, we will describe in detail how we can use the built-in Trade classes to write an Expert Advisor. The Expert Advisor will be based on a strategy that will include closing and modifying of opened positions when a stipulated condition is met.

If you already have an idea of

what classes are and how they can be used, then you are welcome to another

world of opportunity which the new MQL5 language has to offer.

If, on the other hand, you are completely new to MQL5; then I suggest you read these two articles for a start Step-By-Step Guide to writing an Expert Advisor in MQL5 for Beginners, Writing an Expert Advisor Using the MQL5 Object-Oriented Programming Approach or any other article that will give you an introduction to the new MQL5 language. There are a lot of articles that have been written that will give you the required knowledge.

1. The Trade Classes

The trade classes folder

consists of different classes which are meant to make life easier for traders

who which to develop an EA for personal use or for programmers who will not

have to re-invent the wheel when developing their Expert Advisors (EA).

In using a class, you do not have to know the

internal workings of the class (that is, how it accomplishes what the developer

says it does), all you need to concentrate on is how the class can be used to

solve your problem. This is why using a built in class library makes things

pretty easy for anyone who wants to use them. In this article we will be

looking at the major classes that will be needed in the course of developing an

Expert Advisor.

In discussing the classes, we will not bother ourselves with the internal details of the classes, but we will discuss in details what the class can do and how we can use it to accomplish our mission in developing a very profitable EA. Let us discuss them one after the other.

1.1 The СAccountInfo Class

The CAccountInfo is a

class that makes it easy for the user to have access to all the account

properties or information for the current opened trade account in the client terminal.

To understand better, we will look at the major member functions of this class that we may likely use in our EA. Before we can use a class, we must first of all create an object of that class, so to use the CAccountInfo class, we must create an object of the class.

Let’s call it myaccount:

//--- The AccountInfo Class Object

CAccountInfo myaccount;

Remember that to create an

object of a class, you will use the class name followed by the name you wish to

give the object.

We can now use our myaccount object to access the public

member functions of the CAccountInfo class.

| Method | Description | Example of use |

|---|---|---|

| myaccount.Login() | This function is used when you want to get the account number for the current opened trade in the terminal. | // returns account number, example 7770 long accountno = myaccount.Login() |

| myaccount.TradeModeDescription() | This function is used to get the description of the trade mode for the currently active account on the terminal. | // returns Demo trading account, // or Real trading account or Contest trading account string acc_trading_mode = myaccount.TradeModeDescription(); |

| myaccount.Leverage() | This function is used to get the description of the trade mode for the currently active account on the terminal. | // returns leverage given to the active account long acc_leverage = myaccount.Leverage(); |

| myaccount.TradeAllowed() | This function is used to check if trade is allowed on the active account on the terminal. If trade is not allowed, the account cannot trade. | if (myaccount.TradeAllowed()) { // trade is allowed } else { // trade is not allowed } |

| myaccount.TradeExpert() | This function is used to check if Expert Advisors are allowed to trade for the currently active account in the terminal. | if (myaccount.TradeExpert()) { // Expert Advisor trade is allowed } else { // Expert Advisor trade is not allowed } |

| myaccount.Balance() | This function gives the account balance for the active account on the terminal. | // returns account balance in the deposit currency double acс_balance = myaccount.Balance(); |

| myaccount.Profit() | This function is used to obtain the current profit of the active account on the terminal. | // returns account profit in deposit currency double acс_profit = myaccount.Profit(); |

| myaccount.FreeMargin() | This function is used to get the free margin of the active account on the terminal. | // returns free margin for active account double acс_free_margin = myaccount.FreeMargin(); |

| myaccount.Currency() | This function is used to get the deposit currency for the active account on the terminal. | string acс_currency = myaccount.Currency(); |

| myaccount.OrderProfitCheck(const string symbol, ENUM_ORDER_TYPE trade_operation, double volume, double price_open, double price_close) | This function gets the evaluated profit, based on the parameters passed. The input parameters are: symbol, trade operation type, volume and open/close prices. |

double op_profit=myaccount.OrderProfitCheck(_Symbol,ORDER_TYPE_BUY, 1.0,1.2950,1.3235); Print("The amount of Profit for deal buy EURUSD", "at 1.2950 and sell at 1.3235 is: ",op_profit); |

| myaccount.MarginCheck(const string symbol,ENUM_ORDER_TYPE trade_operation,double volume,double price) | This function is used to get the margin required to open an order. This function has four input parameters which are : the symbol (currency-pair), order type, the lots (or volume) to trade and the order price. This function is very important when placing a trade. | // depending on the type of position to open - in our case buy double price=SymbolInfoDouble(_Symbol,SYMBOL_ASK); double margin_req=myaccount.MarginCheck(_Symbol,ORDER_TYPE_BUY,LOT,price); |

| myaccount.FreeMarginCheck(const string symbol,ENUM_ORDER_TYPE trade_operation,double volume,double price) | This function is used to obtain the amount of free margin left in that active account when an order is placed. It has four input parameters which are : the symbol (currency-pair), order type, lots (or volume) to trade and the order price. | double acс_fm=myaccount.FreeMarginCheck(_Symbol,ORDER_TYPE_BUY,LOT,price); |

| myaccount.MaxLotCheck(const string symbol,ENUM_ORDER_TYPE trade_operation,double price) | This function is used to get the maximum lot possible to placing an order for the active account on the terminal. It has three input parameters which are : the symbol, the order type and the order open price. | double max_lot=myaccount.MaxLotCheck(_Symbol,ORDER_TYPE_BUY,price); |

1.2 The СSymbolInfo Class

The CSymbolInfo

class makes it very easy for the user to quickly have access to all the properties of

the current symbol.

To use the class, we must create an object of the class, in this case we will call it mysymbol.

// the CSymbolInfo Class object CSymbolInfo mysymbol;

Let us have a look at most of the functions of this class that may be used in the process of writing our Expert Advisor:

| Method | Description | Example of use |

|---|---|---|

| mysymbol.Name(string name) | This function is used to set the symbol for the class object. It takes the symbol name as input parameter. | // set the symbol name for our CSymbolInfo class Object mysymbol.Name(_Symbol); |

| mysymbol.Refresh() | This function is used to refresh all the symbol data. It is also called automatically when you set a new symbol name for the class. | mysymbol.Refresh(); |

| mysmbol.RefreshRates() | This function is used to check the latest quotes data. It returns true on success and false on failure. This is a useful function you cannot do without. | //--- Get the last price quote using the CSymbolInfo // class object function if (!mysymbol.RefreshRates()) { // error getting latest price quotes } |

| mysymbol.IsSynchronized() | This function is used to check if the current data of the set symbol on the terminal is synchronized with the data on the server. It returns true if data are synchronized and false if not. | // check if symbol data are synchronized with server if (!mysymbol.IsSynchronized()) { // error! Symbol data aren't synchronized with server } |

| mysymbol.VolumeHigh() | This function is used to get the maximum volume of the day for the set symbol. | long max_vol = mysymbol.VolumeHigh(); |

| mysymbol.VolumeLow() | This function is used to get the minimum volume of the day for the set symbol. | long min_vol = mysymbol.VolumeLow(); |

| mysymbol.Time() | This function is used to get the time of the last price quote for the set symbol. | datetime qtime = mysymbol.Time(); |

| mysymbol.Spread() | This function is used to get the current spread value (in points) for the set symbol. | int spread = mysymbol.Spread(); |

| mysymbol.StopsLevel() | This function is used to get the minimal level (in points) to the current close price for which stop loss can be placed for the set symbol. A very useful function for use if you are considering using Trailing Stop or order /position modification. | int stp_level = mysymbol.StopsLevel(); |

| mysymbol.FreezeLevel() | This function is used to get the distance (in points) of freezing trade operation for the set symbol | int frz_level = mysymbol.FreezeLevel(); |

| mysymbol.Bid() | This function is used to get the current BID price for the set symbol. | double bid = mysymbol.Bid(); |

| mysymbol.BidHigh() | This function is used to get the maximum/highest BID price for the day. | double max_bid = mysymbol.BidHigh(); |

| mysymbol.BidLow() | This function is used to get the minimum/lowest BID price for the day for the set symbol. | double min_bid = mysymbol.BidLow(); |

| msymbol.Ask() | This function is used to get the current ASK price for the set symbol. | double ask = mysymbol.Ask(); |

| mysymbol.AskHigh() | This function is used to get the maximum/highest ASK price for the day for the set symbol. | double max_ask = mysymbol.AskHigh(); |

| mysymbol.AskLow() | This function is used to get the minimum/lowest ASK price for the day. | double min_ask = mysymbol.AskLow(); |

| mysymbol.CurrencyBase() | This function is used to get the base currency for the set symbol. | // returns "USD" for USDJPY or USDCAD string base_currency = mysymbol.CurrencyBase(); |

| mysymbol.ContractSize() | This function is used to get the amount for the contract size for trading the set symbol. | double cont_size = mysymbol.ContractSize(); |

| mysymbol.Digits() | This function is used to get the number of digits after the decimal point for the set symbol. | int s_digits = mysymbol.Digits(); |

| mysymbol.Point() | This function is used to get the value of one point for the set symbol. | double s_point = mysymbol.Point(); |

| mysymbol.LotsMin() | This function is used to obtain the minimum volume required to close a deal for the symbol. | double min_lot = mysymbol.LotsMin(); |

| mysymbol.LotsMax() | This function is used to obtain the maximum volume required to close a deal for the symbol. | double max_lot = mysymbol.LotsMax(); |

| mysymbol.LotsStep() | This function is used to obtain the minimum step of volume change to close a deal for the symbol. | double lot_step = mysymbol.LotsStep(); |

| mysymbol.NormalizePrice(double price) | This function is used to get a normalized price to the correct digits of the set symbol. | // A normalized current Ask price double n_price = mysymbol.NormalizePrice(mysymbol.Ask()); |

| mysymbol.Select() | This

function is used to determine if a symbol has been selected in the market watch

window. It returns true if symbol has been selected otherwise it returns false. | if (mysymbol.Select()) { //Symbol successfully selected } else { // Symbol could not be selected } |

| mysymbol.Select(bool select) | This function is used to select a symbol in the Market watch window or to remove a symbol in the market watch window. It should be noted that removing a symbol from the market watch window when the chart is opened of when it already has a position opened will return false. | if (!mysymbol.Select()) { //Symbol not selected, Select the symbol mysymbol.Select(true); } else { // Symbol already selected, // remove Symbol from market watch window mysymbol.Select(false); } |

| mysymbol.MarginInitial() | This function is used to get the amount required for opening a position with volume of one lot in the margin currency. | double init_margin = mysymbol.MarginInitial() ; |

| mysymbol.TradeMode() | This function is used to obtain the order execution type allowed for the symbol. | if (mysymbol.TradeMode() == SYMBOL_TRADE_MODE_FULL) { // Full trade allowed for this symbol, // no trade restrictions } |

| mysymbol.TradeModeDescription() | This function is used to obtain the description of the order execution type allowed for the symbol. | Print("The trade mode for this symbol is", mysymbol.TradeModeDescription()); |

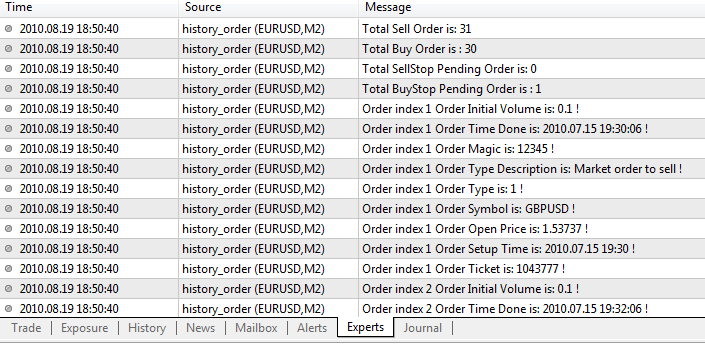

1.3 The СHistoryOrderInfo Class

The CHistoryOrderInfo is another

class that makes it very easy to handle order history properties.

Once we create an object of this class we can then use the object to access the important public member functions that we need to solve an immediate problem.

Let us name the object of the class myhistory.

// The CHistoryOrderInfo Class object

CHistoryOrderInfo myhistory;Let us look at some of the major functions of this class.

In using this class to get the details of orders in history, we need to first of all get the total orders in history and then pass the order ticket to our class object, myhistory.

//Select all history orders within a time period if (HistorySelect(0,TimeCurrent())) // get all history orders { // Get total orders in history int tot_hist_orders = HistoryOrdersTotal();

We will now iterate through the total history orders available and get the details of each history orders with our class object.

ulong h_ticket; // Order ticket for (int j=0; j<tot_hist_orders; j++) { h_ticket = HistoryOrderGetTicket(j)); if (h_ticket>0) { // First thing is to now set the order Ticket to work with by our class object

| Method | Description | Example of use |

|---|---|---|

| myhistory.Ticket(ulong ticket) | This function is used to select the order ticket for which we want to obtain its properties or details. | myhistory.Ticket(h_ticket); |

| myhistory.Ticket() | This function is used to obtain the order ticket for an order. | ulong o_ticket = myhistory.Ticket(); |

| myhistory.TimeSetup() | This function is used to obtain the Time the order was carried out or setup. | datetime os_time = myhistory.TimeSetup(); |

| myhistory.OrderType() | This function is used to obtain the order type (ORDER_TYPE_BUY, etc). | if (myhistory.OrderType() == ORDER_TYPE_BUY) { // This is a buy order } |

| myhistory.State() | This

function is used to obtain the current state of the order. If the order has been cancelled, accepted, rejected or placed, etc. | if(myhistory.State() == ORDER_STATE_REJECTED) { // order was rejected, not placed. } |

| myhistory.TimeDone() | This function is used to obtain the time the order was placed, cancelled or rejected. | datetime ot_done = myhistory.TimeDone(); |

| myhistory.Magic() | This function is used to get the Expert Advisor id that initiated the order. | long o_magic = myhistory.Magic(); |

| myhistory.PositionId() | This function is used to get the id of position to which the order was included when placed. | long o_posid = myhistory.PositionId(); |

| myhistory.PriceOpen() | This function is used to get the Order open price. | double o_price = myhistory.PriceOpen(); |

| myhistory.Symbol() | This function is used to get the symbol property (currency pair) of the order. | string o_symbol = myhistory.Symbol();

|

Don’t forget that we used these

functions within a loop of total orders in history.

1.4 The СOrderInfo Class

This COrderInfo is a

class that provides easy access to all the pending order properties. Once an

object of this class has been created, it can be used to public member

functions of this class.

The usage of this class is somewhat similar to the CHistoryOrderInfo class discussed above.

Let us create an object of the class, we will call it myorder.

// The OrderInfo Class object

COrderInfo myorder;To be able to use this class to obtain the details of a pending order, we need to first of all get the total available orders and then select them by the order ticket.

// Select all history orders within a time period if (HistorySelect(0,TimeCurrent())) // get all history orders { // get total orders int o_total = OrdersTotal();

We will loop through the total orders and obtain their corresponding properties using the object we have created.

for (int j=0; j<o_total; j++) { // we must confirm if the order is available for us to get its details using the Select function of the COrderInfo Class

| Method | Description | Example of use |

|---|---|---|

| myorder.Select(ulong ticket) | This fucntion is used to select an order by ticket number so that the order can easily be manipulated. | if (myorder.Select(OrderGetTicket(j)) { // order has been selected and can now be manipulated. } |

| myorder.Ticket() | This function is used to get the order ticket for the selected order. | ulong o_ticket = myorder.Ticket(); |

| myorder.TimeSetup() | This function is used to get the time this order was setup. | datetime o_setup = myorder.TimeSetup(); |

| myorder.Type() | This function is used to get the order type like ORDER_TYPE_BUY_STOP, etc. | if (myorder.Type() == ORDER_TYPE_BUY_LIMIT) { // This is a Buy Limit order, etc } |

| myorder.State() | This

function is used to get the state of the order. If the order has been cancelled, accepted, rejected or placed, etc. | if (myorder.State() ==ORDER_STATE_STARTED) { // order has been checked // and may soon be treated by the broker } |

| myorder.TimeDone() | This function is used to get the time the order was placed, rejected or cancelled. | datetime ot_done = myorder.TimeDone(); |

| myorder.Magic() | This function is used to get the id of the Expert Advisor that initiated the order. | long o_magic = myorder.Magic(); |

| myorder.PositionId() | This function is used to obtain the id of the position to which the order is included when placed. | long o_posid = myorder.PositionId(); |

| myorder.PriceOpen() | This function is used to get the open price for the order. | double o_price = myorder.PriceOpen(); |

| myorder.StopLoss() | This function is used to obtain the Stop loss of the order. | double s_loss = myorder.StopLoss(); |

| myorder.TakeProfit() | This function is used to obtain the Take Profit of the order. | double t_profit = myorder.TakeProfit(); |

| myorder.PriceCurrent() | This function is used to get the current price of the symbol in which the order was placed. | double cur_price = myorder.PriceCurrent(); |

| myorder.Symbol() | This function is used to get the name of the symbol in which the order was placed. | string o_symbol = myorder.Symbol(); |

| myorder.StoreState() | This function is used to save or store the current detail of the order so that we will able to compare if anything has changed later. | myorder.StoreState(); |

| myorder.CheckState() | This function is used to check if the detail of the order that was saved or stored has changed. | if (myorder.CheckState() == true) { // Our order status or details have changed } |

1.5 The CDealInfo Class

The CDealInfo class provide access to

all the history of deal properties or information. Once we have created an

object of this class, we will then use it to get every information about deals

in history, in a similar way to the CHistoryOrderInfo class.

So, the first thing we want to do is to create an object of this class and name it mydeal.

// The DealInfo Class object

CDealInfo myinfo;

We will start by getting the total deals in history

if (HistorySelect(0,TimeCurrent())) { // Get total deals in history int tot_deals = HistoryDealsTotal();

We will now iterate through the total history orders available and get the details of each history orders with our class object.

ulong d_ticket; // deal ticket for (int j=0; j<tot_deals; j++) { d_ticket = HistoryDealGetTicket(j); if (d_ticket>0) { // First thing is to now set the deal Ticket to work with by our class object

| Method | Description | Example of use |

|---|---|---|

| mydeal.Ticket(ulong ticket) | This function is used to set the deal ticket for further use by the object we have created | mydeal.Ticket(d_ticket); |

| mydeal.Ticket() | This function is used to get the deal ticket | ulong deal_ticket = mydeal.Ticket(); |

| mydeal.Order() | This function is used to get the order ticket for the order in which the deal was executed | long deal_order_no = mydeal.Order(); |

| mydeal.Time() | This function is used to get the time the deal was executed | datetime d_time = mydeal.Time(); |

| mydeal.Type() | This function is used to obtain the deal type, whether it was a DEAL_TYPE_SELL, etc | if (mydeal.Type() == DEAL_TYPE_BUY) { // This deal was executed as a buy deal type } |

| mydeal.Entry() | This function is used to obtain the direction of the deal, whether it is DEAL_ENTRY_IN or DEAL_ENTRY_OUT, etc. | if (mydeal.Entry() == DEAL_ENTRY_IN) { // This was an IN entry deal } |

| mydeal.Magic() | This function is used to obtain the id of the Expert Advisor that executed the deal. | long d_magic = mydeal.Magic(); |

| mydeal.PositionId() | This function is used to get the unique position identifier for the position in which the deal was part of. | long d_post_id = mydeal.PositionId(); |

| mydeal.Price() | This function is used to get the price at which the deal was executed | double d_price = mydeal.Price(); |

| mydeal.Volume() | This function is used to get the volume (lot) of the deal | double d_vol = mydeal.Volume(); |

| mydeal.Symbol() | This function is used to obtain the symbol (currency-pair) for which the deal was executed | string d_symbol = mydeal.Symbol(); |

1.6 The CPositionInfo Class

The CPositionInfo class provides easy access to the current position properties. We must create an object of this class to be able to use it to get the position properties.

Let us create an object of this class and call it myposition.

// The object of the CPositionInfo class

CPositionInfo myposition;We will now use this object to get open positions details. We will start by getting the total open positions available:

int pos_total = PositionsTotal();

It is now time to go through all open positions to get their details.

for (int j=0; j<pos_total; j++) {

| Method | Description | Example of use |

|---|---|---|

| myposition.Select(const string symbol) | This function is used to select the symbol corresponding to the current open position so that it can be worked on. | if (myposition.Select(PositionGetSymbol(j))) { // symbol successfully selected, we can now work // on the current open position for this symbol } OR // when dealing with the current symbol/chart only if (myposition.Select(_Symbol)) { // symbol successfully selected, we can now work // on the current open position for this symbol } |

| myposition.Time() | This function is used to get the time the position was opened. | datetime pos_time = myposition.Time(); |

| myposition.Type() | This function is used to get the type of position opened. | if (myposition.Type() == POSITION_TYPE_BUY) { // This is a buy position } |

| myposition.Magic() | This function is used to obtain the id of the Expert Advisor that opened the position. | long pos_magic = myposition.Magic(); |

| myposition.Volume() | This function is used to get the volume (lots) of the open position. | double pos_vol = myposition.Volume(); // Lots |

| myposition.PriceOpen() | This function is used to get the price at which the position was opened – the position open price. | double pos_op_price = myposition.PriceOpen(); |

| myposition.StopLoss() | This function is used to get the Stop Loss price for the open position. | double pos_stoploss = myposition.StopLoss(); |

| myposition.TakeProfit() | This function is used to get the Take Profit price for the open position. | double pos_takeprofit = myposition.TakeProfit(); |

| myposition.StoreState() | This function is used to store the current state of the position. | // stores the current state of the position

myposition.StoreState(); |

| myposition.CheckState() | This function is used to check if the state of the open position has changed. | if (!myposition.CheckState()) { // position status has not changed yet } |

| myposition.Symbol() | This function is used to get the name of the symbol in which the position was opened. | string pos_symbol = myposition.Symbol(); |

1.7 The СTrade Class

The CTrade class provides easy access to the trade operations in MQL5. To use this class, we have to create an object of the class and then use it to perform the necessary trade operations.

We will create an object of this class and name it mytrade:

//An object of the CTrade class

CTrade mytrade;The first step is to set most of the parameters that the object will use in making trade operation.

| Method | Description | Example of use |

|---|---|---|

| mytrade.SetExpertMagicNumber(ulong magic) | This function is used to set the expert id (magic number) the class will use for trade operations. | ulong Magic_No=12345; mytrade.SetExpertMagicNumber(Magic_No); |

| mytrade.SetDeviationInPoints(ulong deviation) | This function is also used to set the value of deviation (in points) to be used when placing a trade. | ulong Deviation=20; mytrade.SetDeviationInPoints(Deviation); |

| mytrade.OrderOpen(const

string symbol, ENUM_ORDER_TYPE order_type,double volume, double limit_price,double price,double sl, double tp,ENUM_ORDER_TYPE_TIME type_time, datetime expiration,const string comment="") | This function is used to place a pending order. To use this function, the parameters must first of all be prepared and then passed to this function. | // define the input parameters double Lots = 0.1; double SL = 0; double TP = 0; // latest Bid price using CSymbolInfo class object double Oprice = mysymbol.Bid()-_Point*550; // place (BuyStop) pending order mytrade.OrderOpen(_Symbol,ORDER_TYPE_SELLSTOP,Lots,0.0,Oprice, SL,TP,ORDER_TIME_GTC,0); |

| mytrade.OrderModify(ulong

ticket,double price, double sl,double tp,ENUM_ORDER_TYPE_TIME type_time,datetime expiration) | This function is used to modify an existing pending order. | // Select total orders in history and get total pending orders // (as shown within the COrderInfo class section). // Use the CSymbolInfo class object to get the current ASK/BID price int Stoploss = 400; int Takeprofit = 550; for(int j=0; j<OrdersTotal(); j++) { ulong o_ticket = OrderGetTicket(j); if(o_ticket != 0) { // Stoploss must have been defined double SL = mysymbol.Bid() + Stoploss*_Point; // Takeprofit must have been defined double TP = mysymbol.Bid() - Takeprofit*_Point; // lastest ask price using CSymbolInfo class object double Oprice = mysymbol.Bid(); // modify pending BuyStop order mytrade.OrderModify(o_ticket,Oprice,SL,TP,ORDER_TIME_GTC,0); } } |

| mytrade.OrderDelete(ulong ticket) | This function is used to delete a pending order. | // Select total orders in history and get total pending orders // (as shown within the COrderInfo class section). int o_total=OrdersTotal(); for(int j=o_total-1; j>=0; j--) { ulong o_ticket = OrderGetTicket(j); if(o_ticket != 0) { // delete the pending Sell Stop order mytrade.OrderDelete(o_ticket); } } |

| mytrade.PositionOpen(const string symbol,ENUM_ORDER_TYPE order_type,double volume,double price,double sl,double tp,const string comment="") | This function is used to open a BUY or a SELL position. To use this function, all the required parameters must first of all be prepared and then passed to this function. | // define the input parameters and use the CSymbolInfo class // object to get the current ASK/BID price double Lots = 0.1; // Stoploss must have been defined double SL = mysymbol.Ask() – Stoploss*_Point; //Takeprofit must have been defined double TP = mysymbol.Ask() + Takeprofit*_Point; // latest ask price using CSymbolInfo class object double Oprice = mysymbol.Ask(); // open a buy trade mytrade.PositionOpen(_Symbol,ORDER_TYPE_BUY,Lots, Oprice,SL,TP,"Test Buy"); |

| mytrade.PositionModify(const

string symbol, double sl,double tp) | This function is used to modify the StopLoss and/or TakeProfit for an existing open position. To use this function, we must first of all select the position to be modified using the CPositionInfo Class object, use the CSymbolInfo class object to get current BID/ASK price. | if (myposition.Select(_Symbol)) { int newStoploss = 250; int newTakeprofit = 500; double SL = mysymbol.Ask() – newStoploss*_Point; double TP = mysymbol.Ask() + newTakeprofit*_Point; //modify the open position for this symbol mytrade.PositionModify(_Symbol,SL,TP); } |

| mytrade.PositionClose(const

string symbol, ulong deviation=ULONG_MAX) | This function is used to close an existing open position. | if (myposition.Select(_Symbol)) { //close the open position for this symbol mytrade.PositionClose(_Symbol); } |

| mytrade.Buy(double volume,const string symbol=NULL,double price=0.0,double sl=0.0,double tp=0.0,const string comment="") | This function is used to open a buy trade. It is recommended that you set the volume (or lots ) to trade when using this function. While the tp (take profit) and sl (stop loss) can be set later by modify the opened position, it uses the current Ask price to open the trade. |

double Lots = 0.1; // Stoploss must have been defined double SL = mysymbol.Ask() – Stoploss*_Point; //Takeprofit must have been defined double TP = mysymbol.Ask() +Takeprofit*_Point; // latest ask price using CSymbolInfo class object double Oprice = mysymbol.Ask(); // open a buy trade mytrade.Buy(Lots,NULL,Oprice,SL,TP,“Buy Trade”); //OR mytrade.Buy(Lots,NULL,0.0,0.0,0.0,“Buy Trade”); // modify position later |

| mytrade.Sell(double volume,const string symbol=NULL,double price=0.0,double sl=0.0,double tp=0.0,const string comment="") | This function is used to open a Sell trade. It is recommended that you set the volume (or lots ) to trade when using this function. While the tp (take profit) and sl (stop loss) can be set later by modify the opened position, it uses the current Bid price to open the trade. | double Lots = 0.1; // Stoploss must have been defined double SL = mysymbol.Bid() + Stoploss*_Point; //Takeprofit must have been defined double TP = mysymbol.Bid() - Takeprofit*_Point; // latest bid price using CSymbolInfo class object double Oprice = mysymbol.Bid(); // open a Sell trade mytrade.Sell(Lots,NULL,Oprice,SL,TP,“Sell Trade”); //OR mytrade.Sell(Lots,NULL,0.0,0.0,0.0,“Sell Trade”); //(modify position later) |

| mytrade.BuyStop(double volume,double price,const string symbol=NULL,double sl=0.0,double tp=0.0, ENUM_ORDER_TYPE_TIME type_time=ORDER_TIME_GTC,datetime expiration=0,const string comment="") | This function is used to place a BuyStop pending order. The default Order type time is ORDER_TIME_GTC, and expiration is 0. There is no need to specify these two variables if you have the same order type time in mind. | double Lot = 0.1; //Buy price = bar 1 High + 2 pip + spread int sprd=mysymbol.Spread(); double bprice =mrate[1].high + 2*_Point + sprd*_Point; //--- Buy price double mprice=NormalizeDouble(bprice,_Digits); //--- Stop Loss double stloss = NormalizeDouble(bprice - STP*_Point,_Digits); //--- Take Profit double tprofit = NormalizeDouble(bprice+ TKP*_Point,_Digits); //--- open BuyStop order mytrade.BuyStop(Lot,mprice,_Symbol,stloss,tprofit); |

| mytrade.SellStop(double volume,double price,const string symbol=NULL,double sl=0.0,double tp=0.0, ENUM_ORDER_TYPE_TIME type_time=ORDER_TIME_GTC,datetime expiration=0,const string comment="") | This function is used to place a SellStop Pending order with the set parameters. The default Order type time is ORDER_TIME_GTC, and expiration is 0. There is no need to specify these two variables if you have the same order type time in mind. | double Lot = 0.1; //--- Sell price = bar 1 Low - 2 pip //--- MqlRates mrate already declared double sprice=mrate[1].low-2*_Point; //--- SellStop price double slprice=NormalizeDouble(sprice,_Digits); //--- Stop Loss double ssloss=NormalizeDouble(sprice+STP*_Point,_Digits); //--- Take Profit double stprofit=NormalizeDouble(sprice-TKP*_Point,_Digits); //--- Open SellStop Order mytrade.SellStop(Lot,slprice,_Symbol,ssloss,stprofit); |

| mytrade.BuyLimit(double volume,double price,const string symbol=NULL,double sl=0.0,double tp=0.0, ENUM_ORDER_TYPE_TIME type_time=ORDER_TIME_GTC,datetime expiration=0,const string comment="") | This function is used to place a BuyLimit order with the set parameters. | Usage: //--- Buy price = bar 1 Open - 5 pip + spread double Lot = 0.1; int sprd=mysymbol.Spread(); //--- symbol spread double bprice = mrate[1].open - 5*_Point + sprd*_Point; //--- MqlRates mrate already declared double mprice=NormalizeDouble(bprice,_Digits); //--- BuyLimit price //--- place buyLimit order, modify stoploss and takeprofit later mytrade.BuyLimit(Lot,mprice,_Symbol); |

| mytrade.SellLimit (double volume,double price,const string symbol=NULL,double sl=0.0,double tp=0.0, ENUM_ORDER_TYPE_TIME type_time=ORDER_TIME_GTC,datetime expiration=0,const string comment="") | This function is used to place a Sell Limit order with the set parameters. | //--- Sell Limit price = bar 1 Open + 5 pip double Lot = 0.1; //--- MqlRates mrate already declared double sprice = mrate[1].open + 5*_Point; //--- SellLimit double slprice=NormalizeDouble(sprice,_Digits); //place SellLimit order, modify stoploss and takeprofit later mytrade.SellLimit(Lot,slprice,_Symbol); |

TRADE RESULT FUNCTIONS | ||

| mytrade.ResultRetcode() | This function is used to get the result code for a trade operation. | // a trade operation has just been carried out int return_code = mytrade.ResultRetcode(); |

| mytrade.ResultRetcodeDescription() | This function is used to get the full description or interpretation of the returned code of a trade operation. | string ret_message = ResultRetcodeDescription(); // display it Alert("Error code - " , mytrade.ResultRetcode() , "Error message - ", ret_message); |

| mytrade.ResultDeal() | This function is used to get the deal ticket for the open position. | long dl_ticket = mytrade.ResultDeal(); |

| mytrade.ResultOrder() | This function is used to get the order ticket for the opened position. | long o_ticket = mytrade.ResultOrder(); |

| mytrade.ResultVolume() | This function is used to get the volume (Lots) of order for the opened position. | double o_volume = mytrade.ResultVolume(); |

| mytrade.ResultPrice() | This function is used to get the deal price for the opened position. | double r_price = mytrade.ResultPrice(); |

| mytrade.ResultBid() | This function is used to get the current market BID price (re-quote price). | double rq_bid = mytrade.ResultBid; |

| mytrade.ResultAsk() | This function is used to get the current market ASK price (re-quote price). | double rq_ask = mytrade.ResultAsk; |

| mytrade.PrintRequest() / mytrade.PrintResult() | These two functions can be used to print, to the Journal Tab, the trade request parameters and the result parameters respectively. | // after a trade operation // prints the trade request parameters mytrade.PrintRequest(); //prints the trade results mytrade.PrintResult(); |

TRADE REQUEST FUNCTIONS | ||

| mytrade.RequestAction() | This function is used to obtain the Trade Operation type for the last Trade request that has just been sent. | //determine the Trade operation type for the last Trade request if (mytrade.RequestAction() == TRADE_ACTION_DEAL) { // this is a market order for an immediate execution } else if (mytrade.RequestAction() == TRADE_ACTION_PENDING) { // this is a pending order. } |

| mytrade.RequestMagic() | This

function is used to obtain the Expert Magic number that was used in the last

request. | ulong mag_no = mytrade. RequestMagic(); |

| mytrade.RequestOrder() | This function is used to obtain the order ticket that was used in the last request. This relates mainly to modification of pending orders. | ulong po_ticket = mytrade.RequestOrder(); |

| mytrade.RequestSymbol() | This function is used to obtain the symbol or currency pair that was used in the last request. | string symb = mytrade.RequestSymbol(); |

| mytrade.RequestVolume() | This function is used to obtain the volume of trade (in lots) placed in the last request. | double Lot = mytrade.RequestVolume(); |

| mytrade.RequestPrice() | This function is used to obtain the order price used in the last request. | double oprice = mytrade.RequestPrice(); |

| mytrade.RequestStopLimit() | This function is used to obtain the Stop Loss price used in the last request. | double limitprice = mytrade.RequestStopLimit(); |

| mytrade.RequestSL() | This function is used to obtain the Stop Loss price used in the last request. | double sloss = mytrade.RequestSL(); |

| mytrade.RequestTP() | This function is used to obtain the Take Profit price used in the last request. | double tprofit = mytrade.RequestTP(); |

| mytrade.RequestDeviation() | This function is used to obtain the Deviation used in the last request. | ulong dev = mytrade.RequestDeviation(); |

| mytrade.RequestType() | This function is used to obtain the type of order that was placed in the last request. | if (mytrade.RequestType() == ORDER_TYPE_BUY) { // market order Buy was placed in the last request. } |

| mytrade.RequestTypeDescription() | This function is used to get the description of the type of order placed in the last request. | Print("The type of order placed in the last request is :", mytrade.RequestTypeDescription()); |

| mytrade.RequestActionDescription() | This function is used to get the description of the request action used in the last request. | Print("The request action used in the last request is :", mytrade.RequestTypeDescription()); |

| mytrade.RequestTypeFillingDescription() | This function is used to get the type of order filling policy used in the last request. | Print("The type of order filling policy used", " in the last request is :", RequestTypeFillingDescription()); |

The Trade Class Request functions are very useful when identifying errors associated with placing of orders. There are times when we get some error messages when placing an order and it becomes a bit confusing when we can not immediately identify what went wrong. By using the Trade Class request functions, we can be able to identify what we did wrong by printing our some of the request parameters that was sent to the trade server. An example of such usage will be similar as the code below:

//--- open Buy position and check the result if(mytrade.Buy(Lot,_Symbol,mprice,stloss,tprofit)) //if(mytrade.PositionOpen(_Symbol,ORDER_TYPE_BUY,Lot,mprice,stloss,tprofit)) { //--- Request is completed or order placed Alert("A Buy order at price:", mytrade.ResultPrice() , ", vol:",mytrade.ResultVolume(), " has been successfully placed with deal Ticket#:",mytrade.ResultDeal(),"!!"); mytrade.PrintResult(); } else { Alert("The Buy order request at vol:",mytrade.RequestVolume(), ", sl:", mytrade.RequestSL(), ", tp:",mytrade.RequestTP(), ", price:", mytrade.RequestPrice(), " could not be completed -error:",mytrade.ResultRetcodeDescription()); mytrade.PrintRequest(); return; }

In the above code, we have tried to be able to identify some of the the parameters sent in our request in case there was an error. For example, if we did not specify the correct Stop Loss price, we may get Invalid Stops error and by printing out the value of the Stop Loss using the mytrade.RequestSL(), we will be able to know what the problem is with our specified Stop Loss price.

Having taken time to show how

each of the classes can be used, it is now time to

put into practice some of the functionalities we have described.

Please note that all the functionalities we are going to use in the Expert Advisor has already been described above, it will be a good idea to always refer to the descriptions once you see any of the functions in the codes we are going to write.

2. Using

the Trade Classes' functionalities

In order to demonstrate how to use these trade classes' functionalities, we are going to write an Expert Advisor that will perform the following tasks.

- It will check for a Buy or Sell condition, and if the condition is met, it will place a Buy or Sell order depending on the condition that was met.

- If a position has been opened and the trade continues to go in our direction, we will modify the take profit or stop loss of the position. However, if the trade is going against us and our profit target has not been hit, we will close the position.

- Our EA will be used to trade on the daily chart on any of the following currencies – GBPUSD, AUDUSD, EURUSD, etc.

2.1 Writing the Expert Advisor

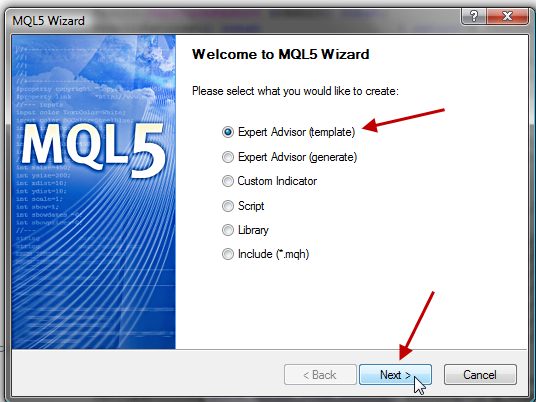

To begin, start a new MQL5 document and select Expert Advisor (template) and click the Next button:

Figure 1. Starting a new MQL5 document

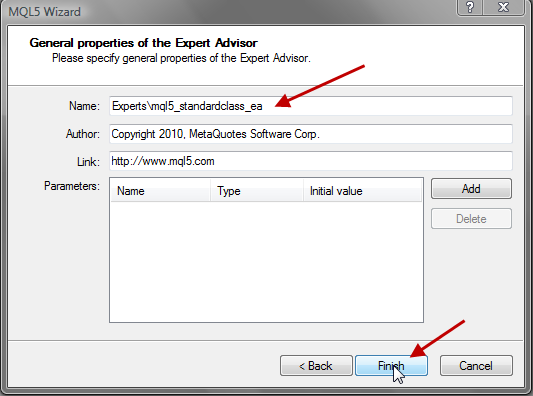

Type the name for the Expert Advisor and click the Finish button. We will define the input parameters manually later.

Figure 2. Naming the Expert Advisor

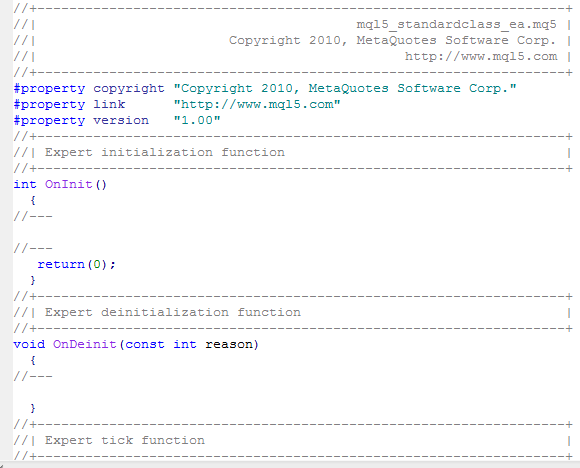

The created new document should look similar like below.

Just immediately after the #property version line, we will include all the Trade classes we are going to use.

//+------------------------------------------------------------------+ //| Include ALL classes that will be used | //+------------------------------------------------------------------+ //--- The Trade Class #include <Trade\Trade.mqh> //--- The PositionInfo Class #include <Trade\PositionInfo.mqh> //--- The AccountInfo Class #include <Trade\AccountInfo.mqh> //--- The SymbolInfo Class #include <Trade\SymbolInfo.mqh>

Next we will define our input parameters:

//+------------------------------------------------------------------+ //| INPUT PARAMETERS | //+------------------------------------------------------------------+ input int StopLoss=100; // Stop Loss input int TakeProfit=240; // Take Profit input int ADX_Period=15; // ADX Period input int MA_Period=15; // Moving Average Period input ulong EA_Magic=99977; // EA Magic Number input double Adx_Min=24.0; // Minimum ADX Value input double Lot=0.1; // Lots to Trade input ulong dev=100; // Deviation input long Trail_point=32; // Points to increase TP/SL input int Min_Bars = 20; // Minimum bars required for Expert Advisor to trade input double TradePct = 25; // Percentage of Account Free Margin to trade

We will also specify other parameters that will be used in this Expert Advisor code:

//+------------------------------------------------------------------+ //| OTHER USEFUL PARAMETERS | //+------------------------------------------------------------------+ int adxHandle; // handle for our ADX indicator int maHandle; // handle for our Moving Average indicator double plsDI[],minDI[],adxVal[]; // Dynamic arrays to hold the values of +DI, -DI and ADX values for each bars double maVal[]; // Dynamic array to hold the values of Moving Average for each bars double p_close; // Variable to store the close value of a bar int STP, TKP; // To be used for Stop Loss, Take Profit double TPC; // To be used for Trade percent

Let us now create an object of each of the classes we have included:

//+------------------------------------------------------------------+ //| CREATE CLASS OBJECTS | //+------------------------------------------------------------------+ //--- The Trade Class Object CTrade mytrade; //--- The PositionInfo Class Object CPositionInfo myposition; //--- The AccountInfo Class Object CAccountInfo myaccount; //--- The SymbolInfo Class Object CSymbolInfo mysymbol;

The next thing we want to do

now, is to define some functions we are going to use to make our work very

easy.

Once we have defined these functions, we will just be calling them within necessary sections in the OnInit() and OnTick() functions.

2.1.1 The checkTrading function

This function is going to be used to perform all initial checks to see if our Expert Advisor can trade or not. If this function returns true, our EA will proceed, otherwise the EA will not perform any trade.

//+------------------------------------------------------------------+ //| Checks if our Expert Advisor can go ahead and perform trading | //+------------------------------------------------------------------+ bool checkTrading() { bool can_trade = false; // check if terminal is syncronized with server, etc if (myaccount.TradeAllowed() && myaccount.TradeExpert() && mysymbol.IsSynchronized()) { // do we have enough bars? int mbars = Bars(_Symbol,_Period); if(mbars >Min_Bars) { can_trade = true; } } return(can_trade); }

We declared a bool data type

can_trade and make it false. We used the

object of the CAccountInfo class to check if trade is allowed and also if

Expert Advisors are allowed to trade on this account. We also use an object of the

CSymbolInfo class to check if the terminal is synchronized with the trade

server.

Once these three conditions are satisfied, we then check if the total

number of current bars is greater than the minimum required bars for our EA to

trade. If this function returns true, then our EA will perform trade

activities, otherwise, our EA will not engage in any trade activity until the

conditions in this function is satisfied.

As you have seen, we have decided to include all the necessary trade check activities in this function, using the necessary objects of the standard trade class libraries.

2.1.2 The ConfirmMargin function

//+------------------------------------------------------------------+ //| Confirms if margin is enough to open an order //+------------------------------------------------------------------+ bool ConfirmMargin(ENUM_ORDER_TYPE otype,double price) { bool confirm = false; double lot_price = myaccount.MarginCheck(_Symbol,otype,Lot,price); // Lot price/ Margin double act_f_mag = myaccount.FreeMargin(); // Account free margin // Check if margin required is okay based on setting if(MathFloor(act_f_mag*TPC)>MathFloor(lot_price)) { confirm =true; } return(confirm); }

We use the object of the

CAccountInfo class to confirm if there is enough margin to place a trade based

on the setting that we will only use a certain percentage of our account free

margin to place an order.

If the required percentage of the account free margin is greater that the margin required for the order, then this function returns true, otherwise, it returns false. By this, we only want to place an order if the function returns true. This function takes the order type as input parameter.

2.1.3 The checkBuy function

//+------------------------------------------------------------------+ //| Checks for a Buy trade Condition | //+------------------------------------------------------------------+ bool checkBuy() { bool dobuy = false; if ((maVal[0]>maVal[1]) && (maVal[1]>maVal[2]) &&(p_close > maVal[1])) { // MA increases upwards and previous price closed above MA if ((adxVal[1]>Adx_Min)&& (plsDI[1]>minDI[1])) { // ADX is greater than minimum and +DI is greater tha -DI for ADX dobuy = true; } } return(dobuy); }

We have decided to wrap up the

conditions for opening a buy trade in this function. We did not use any of the

Class object functionalities here. We are checking for condition where the

values of the Moving Average indicator is increasing upwards and the close price

of the previous bar is higher than the value of Moving average at that point.

We also want a situation where the value of ADX indicator is greater than the required minimum set in the input parameters and the value of positive DI of ADX indicator is greater than the negative DI value. Once these conditions are met, then we will want our EA to open a BUY order.

2.1.4 The checkSell function

//+------------------------------------------------------------------+ //| Checks for a Sell trade Condition | //+------------------------------------------------------------------+ bool checkSell() { bool dosell = false; if ((maVal[0]<maVal[1]) && (maVal[1]<maVal[2]) &&(p_close < maVal[1])) { // MA decreases downwards and previuos price closed below MA if ((adxVal[1]>Adx_Min)&& (minDI[1]>plsDI[1])) { // ADX is greater than minimum and -DI is greater tha +DI for ADX dosell = true; } } return(dosell); }

This function checks exactly

the opposite of the CheckBuy function. Also we did not use any of the class

objects in this function. This function checks for a condition where the values

of the Moving Average indicator is decreasing downwards and the close price of

the previous bar is lower than the value of Moving average at that point.

We also want a situation where the value of ADX indicator is greater than the required minimum set in the input parameters and the value of negative DI of ADX indicator is greater than the positive DI value. Once these conditions are met, then we will want our EA to open a SELL order.

2.1.5 The checkClosePos function//+------------------------------------------------------------------+ //| Checks if an Open position can be closed | //+------------------------------------------------------------------+ bool checkClosePos(string ptype, double Closeprice) { bool mark = false; if (ptype=="BUY") { // Can we close this position if (Closeprice < maVal[1]) // Previous price close below MA { mark = true; } } if (ptype=="SELL") { // Can we close this position if (Closeprice > maVal[1]) // Previous price close above MA { mark = true; } } return(mark); }

This function is used to check

if the present open position can be closed. This function is used to monitor

the if the close price of the previous bar is higher or lower than the value of

the Moving Average indicator at that point (depending on the direction of the

trade).

If any of the condition is met, this function returns true and then we will expect our EA to close the position. This function has two input parameters, the type of order (this time the name – BUY or SELL) and the close price of the previous bar.

2.1.6 The ClosePosition function

//+------------------------------------------------------------------+ //| Checks and closes an open position | //+------------------------------------------------------------------+ bool ClosePosition(string ptype,double clp) { bool marker=false; if(myposition.Select(_Symbol)==true) { if(myposition.Magic()==EA_Magic && myposition.Symbol()==_Symbol) { //--- Check if we can close this position if(checkClosePos(ptype,clp)==true) { //--- close this position and check if we close position successfully? if(mytrade.PositionClose(_Symbol)) //--- Request successfully completed { Alert("An opened position has been successfully closed!!"); marker=true; } else { Alert("The position close request could not be completed - error: ", mytrade.ResultRetcodeDescription()); } } } } return(marker); }

This is the function that

actually uses the above function (checkclosepos). It makes use of the objects

of the CPositionInfo and the CTrade classes. This function uses the object of

the CPositionInfo class to check the available open positions for the position

that was opened by our EA and for the current symbol. If any position is found,

it checks if it can be closed using the checkclosepos function.

If the

checkclosepos function returns true, this function uses the object of the

CTrade class to close the position and displays the results for the position

close operation. If the position was closed successfully, this function returns true, otherwise, it returns false.

The function takes two input parameters (the position name , BUY or SELL and the previous bar close price). These parameters were actually passed to the checkclosepos function which uses them.

2.1.7 The CheckModify function

//+------------------------------------------------------------------+ //| Checks if we can modify an open position | //+------------------------------------------------------------------+ bool CheckModify(string otype,double cprc) { bool check=false; if (otype=="BUY") { if ((maVal[2]<maVal[1]) && (maVal[1]<maVal[0]) && (cprc>maVal[1]) && (adxVal[1]>Adx_Min)) { check=true; } } else if (otype=="SELL") { if ((maVal[2]>maVal[1]) && (maVal[1]>maVal[0]) && (cprc<maVal[1]) && (adxVal[1]>Adx_Min)) { check=true; } } return(check); }

This function is used to check

for a condition that confirms if an opened position can be modified or not. It

uses the order type name and the previous bar close price as input parameters.

What this function does is to check if the Moving average is still increasing

upwards and the previous bar close price is still higher than the Moving

average value at that point and the value of ADX is also greater that the

required minimum (for a BUY position) while it checks if the Moving average is

still decreasing downwards and the close price of the previous bar is lower

that the value of moving average at that point (for a SELL position). Depending

on the type of position we have, if any of the condition is met, the EA will

consider modifying the position.

The function takes tow input parameters (the position name, BUY or SELL, and the previous bar close price).

2.1.8 The Modify function

//+------------------------------------------------------------------+ //| Modifies an open position | //+------------------------------------------------------------------+ void Modify(string ptype,double stpl,double tkpf) { //--- New Stop Loss, new Take profit, Bid price, Ask Price double ntp,nsl,pbid,pask; long tsp=Trail_point; //--- adjust for 5 & 3 digit prices if(_Digits==5 || _Digits==3) tsp=tsp*10; //--- Stops Level long stplevel= mysymbol.StopsLevel(); //--- Trail point must not be less than stops level if(tsp<stplevel) tsp=stplevel; if(ptype=="BUY") { //--- current bid price pbid=mysymbol.Bid(); if(tkpf-pbid<=stplevel*_Point) { //--- distance to takeprofit less or equal to Stops level? increase takeprofit ntp = pbid + tsp*_Point; nsl = pbid - tsp*_Point; } else { //--- distance to takeprofit higher than Stops level? dont touch takeprofit ntp = tkpf; nsl = pbid - tsp*_Point; } } else //--- this is SELL { //--- current ask price pask=mysymbol.Ask(); if(pask-tkpf<=stplevel*_Point) { ntp = pask - tsp*_Point; nsl = pask + tsp*_Point; } else { ntp = tkpf; nsl = pask + tsp*_Point; } } //--- modify and check result if(mytrade.PositionModify(_Symbol,nsl,ntp)) { //--- Request successfully completed Alert("An opened position has been successfully modified!!"); return; } else { Alert("The position modify request could not be completed - error: ", mytrade.ResultRetcodeDescription()); return; } }

This function makes use of the above function (checkmodify) to do its job. It uses the objects of the CSymbolInfo and CTrade classes. First of all, we declared four double data types to hold the new take profit, stop loss, bid price and ask price. Then we declared a new long data type tsp to hold the Trail_point value set at the input parameters section.

The trail point value (tsp) was then adjusted for 5 and 3 digit prices. We then used the CSymbolInfo object to get the stops level and make sure that the trail point we want to add is not less than the required stop level. If it is less than stops level, then we will use the stops level value.

Depending on the position type, we use the CSymbolInfo class object to get the current BID or ASK price as the case may be. If the difference between the current BID or ASK price and the initial take profit price is less or equal to the stops level, we decide to adjust both the stop loss and take profit prices otherwise, we only adjust the stop loss value.

We then use the CTrade class object to modify the Stop loss and the take profit for the position. Based on the trade result return code, a success or failure message is also displayed.

We have finished defining some user defined functions that will make our job easier. Let us now go ahead to the EA codes section.

2.1.9 The OnInit Section

//--- set the symbol name for our SymbolInfo Object mysymbol.Name(_Symbol); // Set Expert Advisor Magic No using our Trade Class Object mytrade.SetExpertMagicNumber(EA_Magic); // Set Maximum Deviation using our Trade class object mytrade.SetDeviationInPoints(dev); //--- Get handle for ADX indicator adxHandle=iADX(NULL,0,ADX_Period); //--- Get the handle for Moving Average indicator maHandle=iMA(_Symbol,Period(),MA_Period,0,MODE_EMA,PRICE_CLOSE); //--- What if handle returns Invalid Handle if(adxHandle<0 || maHandle<0) { Alert("Error Creating Handles for MA, ADX indicators - error: ",GetLastError(),"!!"); return(1); } STP = StopLoss; TKP = TakeProfit; //--- Let us handle brokers that offers 5 or 3 digit prices instead of 4 if(_Digits==5 || _Digits==3) { STP = STP*10; TKP = TKP*10; } //--- Set trade percent TPC = TradePct; TPC = TPC/100; //---

We decide to set the current symbol for the CSymbolInfo class object. We also set the Expert Advisor magic number and the deviation (in points) using the CTrade class object. After this we decide to get the handles for our indicators and display an error if getting of handles failed.

Next, we decide to adjust the

stop loss and take profit for 3 and 5 digit prices and we also convert the

percentage free account margin to use for trade into percentage.

2.1.10 The OnDeinit Section

//--- Release our indicator handles IndicatorRelease(adxHandle); IndicatorRelease(maHandle);

Here we decide to release all the indicator handles.

2.1.11. The OnTick Section

//--- check if EA can trade if (checkTrading() == false) { Alert("EA cannot trade because certain trade requirements are not meant"); return; } //--- Define the MQL5 MqlRates Structure we will use for our trade MqlRates mrate[]; // To be used to store the prices, volumes and spread of each bar /* Let's make sure our arrays values for the Rates, ADX Values and MA values is store serially similar to the timeseries array */ // the rates arrays ArraySetAsSeries(mrate,true); // the ADX values arrays ArraySetAsSeries(adxVal,true); // the MA values arrays ArraySetAsSeries(maVal,true); // the minDI values array ArraySetAsSeries(minDI,true); // the plsDI values array ArraySetAsSeries(plsDI,true);

The first thing we do here is to check and be sure if our EA should trade or not. If the checktrade function returns false, EA will wait for the next tick and make the check again.

After this we declared a MQL5 MqlRates Structure to get the prices of each bar and then we use the ArraySetAsSeries function to set all the required arrays.

//--- Get the last price quote using the SymbolInfo class object function if (!mysymbol.RefreshRates()) { Alert("Error getting the latest price quote - error:",GetLastError(),"!!"); return; } //--- Get the details of the latest 3 bars if(CopyRates(_Symbol,_Period,0,3,mrate)<0) { Alert("Error copying rates/history data - error:",GetLastError(),"!!"); return; } //--- EA should only check for new trade if we have a new bar // lets declare a static datetime variable static datetime Prev_time; // lest get the start time for the current bar (Bar 0) datetime Bar_time[1]; //copy the current bar time Bar_time[0] = mrate[0].time; // We don't have a new bar when both times are the same if(Prev_time==Bar_time[0]) { return; } //Save time into static varaiable, Prev_time = Bar_time[0];

We use the CSymbolInfo class object to get the current price quotes and then copy the current bar prices to the mrates array. Immediately after this we decide to check for the presence of a new bar.

If we have a new bar, then our EA will proceed to check if a BUY or SELL condition has been met, otherwise it will wait until we have a new bar.

//--- Copy the new values of our indicators to buffers (arrays) using the handle if(CopyBuffer(adxHandle,0,0,3,adxVal)<3 || CopyBuffer(adxHandle,1,0,3,plsDI)<3 || CopyBuffer(adxHandle,2,0,3,minDI)<3) { Alert("Error copying ADX indicator Buffers - error:",GetLastError(),"!!"); return; } if(CopyBuffer(maHandle,0,0,3,maVal)<3) { Alert("Error copying Moving Average indicator buffer - error:",GetLastError()); return; } //--- we have no errors, so continue // Copy the bar close price for the previous bar prior to the current bar, that is Bar 1 p_close=mrate[1].close; // bar 1 close price

Here, we used the CopyBuffer functions to get the buffers of our indicators into arrays and if error occurs in the process, it will be displayed. The previous bar close price was copied.

//--- Do we have positions opened already? bool Buy_opened = false, Sell_opened=false; if (myposition.Select(_Symbol) ==true) // we have an opened position { if (myposition.Type()== POSITION_TYPE_BUY) { Buy_opened = true; //It is a Buy // Get Position StopLoss and Take Profit double buysl = myposition.StopLoss(); // Buy position Stop Loss double buytp = myposition.TakeProfit(); // Buy position Take Profit // Check if we can close/modify position if (ClosePosition("BUY",p_close)==true) { Buy_opened = false; // position has been closed return; // wait for new bar } else { if (CheckModify("BUY",p_close)==true) // We can modify position { Modify("BUY",buysl,buytp); return; // wait for new bar } } } else if(myposition.Type() == POSITION_TYPE_SELL) { Sell_opened = true; // It is a Sell // Get Position StopLoss and Take Profit double sellsl = myposition.StopLoss(); // Sell position Stop Loss double selltp = myposition.TakeProfit(); // Sell position Take Profit if (ClosePosition("SELL",p_close)==true) { Sell_opened = false; // position has been closed return; // wait for new bar } else { if (CheckModify("SELL",p_close)==true) // We can modify position { Modify("SELL",sellsl,selltp); return; //wait for new bar } } } }

We use the CPositionInfo class object to select and check if we have an open position for the current symbol. If a position exists, and it is a BUY, we set Buy_opened to be true and then use the CPositionInfo class object to get the stop loss and take profit of the position. Using a function we had defined earlier, ClosePosition, we checked if the position can be close. If the function returns true, then the position has been closed, so we set Buy_opened to false we the initial BUY position has just been closed. The EA will now wait for a new tick.

However, if the function returns false, then the position has not been closed. It is now time to check if we can modify the position. This we achieved by using the function CheckModify which we had earlier defined. If the function returns true, then it means the position can be modified, so we use the Modify function to modify the position.

If, on the other hand, a position exists and it is a SELL, we set Sell_opened to be true and use the CPositionInfo class object to get the stop loss and take profit of the position. We repeated the same step as we did for the BUY position in order to see if the position can be closed or modified.

if(checkBuy()==true) { //--- any opened Buy position? if(Buy_opened) { Alert("We already have a Buy position!!!"); return; //--- Don't open a new Sell Position } double mprice=NormalizeDouble(mysymbol.Ask(),_Digits); //--- latest ask price double stloss = NormalizeDouble(mysymbol.Ask() - STP*_Point,_Digits); //--- Stop Loss double tprofit = NormalizeDouble(mysymbol.Ask()+ TKP*_Point,_Digits); //--- Take Profit //--- check margin if(ConfirmMargin(ORDER_TYPE_BUY,mprice)==false) { Alert("You do not have enough money to place this trade based on your setting"); return; } //--- open Buy position and check the result if(mytrade.Buy(Lot,_Symbol,mprice,stloss,tprofit)) //if(mytrade.PositionOpen(_Symbol,ORDER_TYPE_BUY,Lot,mprice,stloss,tprofit)) { //--- Request is completed or order placed Alert("A Buy order has been successfully placed with deal Ticket#:", mytrade.ResultDeal(),"!!"); } else { Alert("The Buy order request at vol:",mytrade.RequestVolume(), ", sl:", mytrade.RequestSL(),", tp:",mytrade.RequestTP(), ", price:", mytrade.RequestPrice(), " could not be completed -error:",mytrade.ResultRetcodeDescription()); return; } }

Or we can use the PositionOpen function

if(checkBuy()==true) { //--- any opened Buy position? if(Buy_opened) { Alert("We already have a Buy position!!!"); return; //--- Don't open a new Sell Position } double mprice=NormalizeDouble(mysymbol.Ask(),_Digits); //--- latest Ask price double stloss = NormalizeDouble(mysymbol.Ask() - STP*_Point,_Digits); //--- Stop Loss double tprofit = NormalizeDouble(mysymbol.Ask()+ TKP*_Point,_Digits); //--- Take Profit //--- check margin if(ConfirmMargin(ORDER_TYPE_BUY,mprice)==false) { Alert("You do not have enough money to place this trade based on your setting"); return; } //--- open Buy position and check the result //if(mytrade.Buy(Lot,_Symbol,mprice,stloss,tprofit)) if(mytrade.PositionOpen(_Symbol,ORDER_TYPE_BUY,Lot,mprice,stloss,tprofit)) { //--- Request is completed or order placed Alert("A Buy order has been successfully placed with deal Ticket#:", mytrade.ResultDeal(),"!!"); } else { Alert("The Buy order request at vol:",mytrade.RequestVolume(), ", sl:", mytrade.RequestSL(),", tp:",mytrade.RequestTP(), ", price:", mytrade.RequestPrice(), " could not be completed -error:",mytrade.ResultRetcodeDescription()); return; } }

Here, we use the function

checkbuy to check for a buy setup and if

it returns true, then our BUY trade conditions have been met. If we already

have a BUY position, we don't want to place a new order. We then used the CSymbolInfo class object to get the current ASK price and

calculated the Stop loss and Take profit as required.

We also use the ConfirmMargin function to check if the the percentage of the account allowed for placing an order is greater than the required margin for placing this order. If the function returns true, then we go ahead and place the trade otherwise, we will not place the trade.

Using the CTrade class object, we placed our order and used the same calls object to get the trade operation return code. Based on the result of the trade, a message is displayed.

if(checkSell()==true) { //--- any opened Sell position? if(Sell_opened) { Alert("We already have a Sell position!!!"); return; //--- Wait for a new bar } double sprice=NormalizeDouble(mysymbol.Bid(),_Digits); //--- latest Bid price double ssloss=NormalizeDouble(mysymbol.Bid()+STP*_Point,_Digits); //--- Stop Loss double stprofit=NormalizeDouble(mysymbol.Bid()-TKP*_Point,_Digits); //--- Take Profit //--- check margin if(ConfirmMargin(ORDER_TYPE_SELL,sprice)==false) { Alert("You do not have enough money to place this trade based on your setting"); return; } //--- Open Sell position and check the result if(mytrade.Sell(Lot,_Symbol,sprice,ssloss,stprofit)) //if(mytrade.PositionOpen(_Symbol,ORDER_TYPE_SELL,Lot,sprice,ssloss,stprofit)) { //---Request is completed or order placed Alert("A Sell order has been successfully placed with deal Ticket#:",mytrade.ResultDeal(),"!!"); } else { Alert("The Sell order request at Vol:",mytrade.RequestVolume(), ", sl:", mytrade.RequestSL(),", tp:",mytrade.RequestTP(), ", price:", mytrade.RequestPrice(), " could not be completed -error:",mytrade.ResultRetcodeDescription()); return; } }

Or we can also used the PositionOpen fucntion:

if(checkSell()==true) { //--- any opened Sell position? if(Sell_opened) { Alert("We already have a Sell position!!!"); return; //--- Wait for a new bar } double sprice=NormalizeDouble(mysymbol.Bid(),_Digits); //--- latest Bid price double ssloss=NormalizeDouble(mysymbol.Bid()+STP*_Point,_Digits); //--- Stop Loss double stprofit=NormalizeDouble(mysymbol.Bid()-TKP*_Point,_Digits); //--- Take Profit //--- check margin if(ConfirmMargin(ORDER_TYPE_SELL,sprice)==false) { Alert("You do not have enough money to place this trade based on your setting"); return; } //--- Open Sell position and check the result //if(mytrade.Sell(Lot,_Symbol,sprice,ssloss,stprofit)) if(mytrade.PositionOpen(_Symbol,ORDER_TYPE_SELL,Lot,sprice,ssloss,stprofit)) { //---Request is completed or order placed Alert("A Sell order has been successfully placed with deal Ticket#:",mytrade.ResultDeal(),"!!"); } else { Alert("The Sell order request at Vol:",mytrade.RequestVolume(), ", sl:", mytrade.RequestSL(),", tp:",mytrade.RequestTP(), ", price:", mytrade.RequestPrice(), " could not be completed -error:",mytrade.ResultRetcodeDescription()); return; } }

Just as we did for the BUY, we used the Checksell function to check for a sell setup. If it returns true and we do not have an already open sell position, we used the ConfirmMargin function to check if we have enough money to open the order. If ConfirmMargin returns true, the CTrade class object is used to place the order and based on the response from the trade server, the result of the trade is displayed using the CTrade class object functions.

So far we have looked at how we

can use the Trade class libraries in writing an Expert Advisor. The next thing

is to test our Expert Advisor with the strategy tester and see its performance.

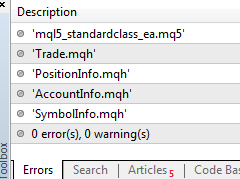

Compile the EA code and then load it in the Strategy Tester.

Figure 3. Expert Advisor compile report

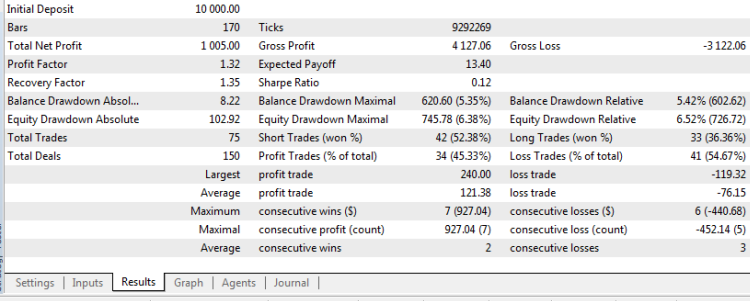

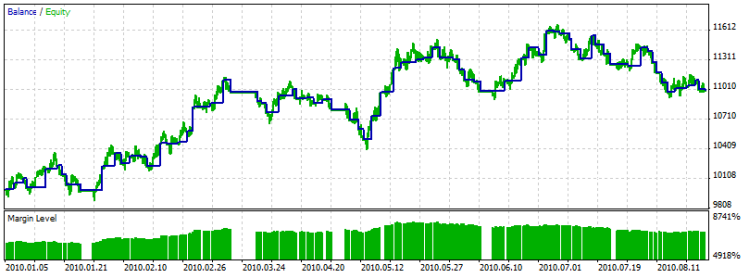

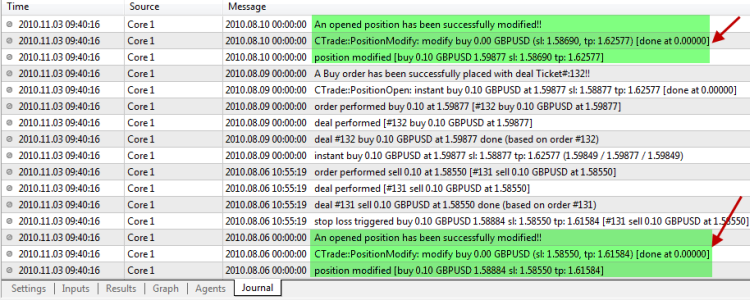

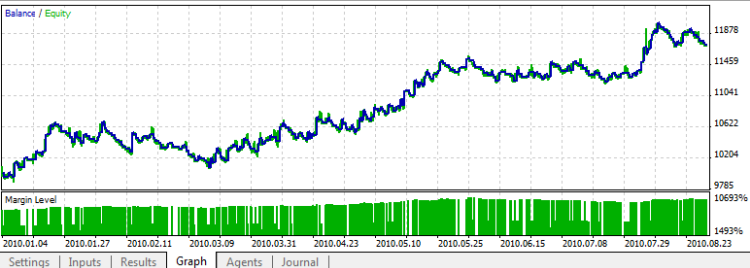

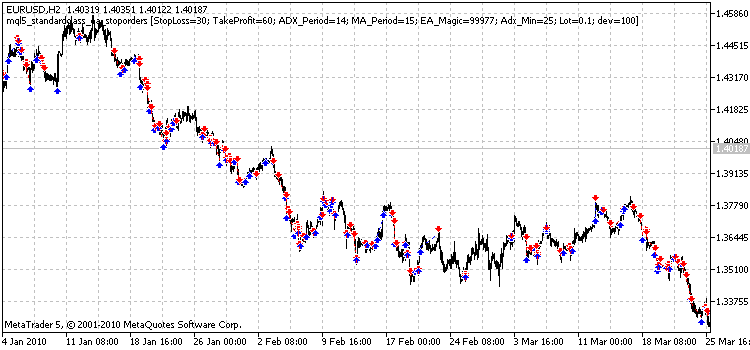

On the GBPUSD Daily chart using the default settings: Take Profit - 270, Stop Loss - 100 and Trails Point (TP/SL) - 32, we have the following results:

Figure 4. Expert Advisor test report - GBPUSD daily chart

Figure 5. Expert Advisor test graph result - GBPUSD daily chart

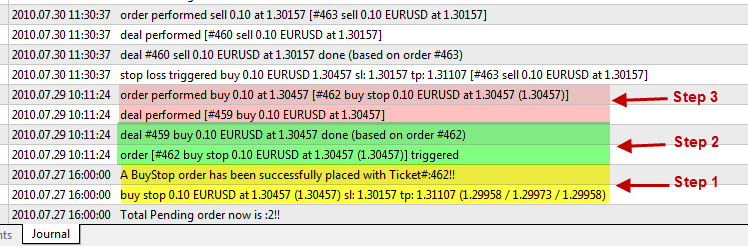

Figure 6. Expert Advisor test report shows modification of open positions - GBPUSD daily chart

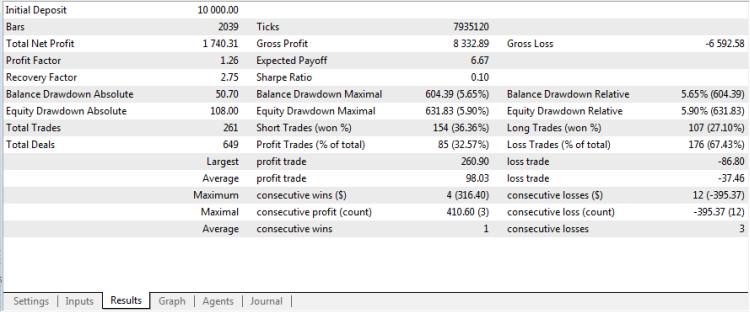

Figure 7. Expert Advisor test chart report for GBPUSD daily chart

You are free to test the EA on

any other symbol daily chart with different settings of the Take profit, Stop

loss and the Trail point setting and see what you get.

However, you should understand that this Expert Advisor has been written for test purposes only...

Let us now see how we can use the other classes (COrderInfo, CHistoryOrderInfo, and CDealInfo) to get order/deal details.

2.2 Opening/Deleting a Pending Order

In this example, we will write a simple Expert Advisor which will place a pending order (BuyStop or SellStop) when we have a buy or Sell setup conditions met respectively.

2.2.1 Include The Required Classes

//+------------------------------------------------------------------+ //| Include ALL classes that will be used | //+------------------------------------------------------------------+ //--- The Trade Class #include <Trade\Trade.mqh> //--- The PositionInfo Class #include <Trade\PositionInfo.mqh> //--- The SymbolInfo Class #include <Trade\SymbolInfo.mqh> //--- The OrderInfo Class #include <Trade\OrderInfo.mqh>

We have included the four classes we will be using in this simple Expert Advisor. They have been explained in the examples above.

I will not explain every section of this Expert Advisor as it is similar to the one explained above, however, I will go through the essential part of the Expert Advisor that explains what we want to discuss in this section.

The only thing that is different is that we have decided to declare MqlRates mrate[] on a global scope.

//--- Define the MQL5 MqlRates Structure we will use for our trade MqlRates mrate[]; // To be used to store the prices, volumes and spread of each bar

Once we have included the classes, we must also remember to create objects of each class:

//+------------------------------------------------------------------+ //| CREATE CLASS OBJECTS | //+------------------------------------------------------------------+ //--- The CTrade Class Object CTrade mytrade; //--- The CPositionInfo Class Object CPositionInfo myposition; //--- The CSymbolInfo Class Object CSymbolInfo mysymbol; //--- The COrderInfo Class Object COrderInfo myorder;

The CheckBuy() and CheckSell() functions is the same as in the Expert Advisor explained before.

What we want to do here is to place a BUYSTOP order when we have a buy setup and a SELLSTOP order when we have a sell setup.

Let us now go through some of the funсtions we have created to make things easy for us.

2.2.2 The CountOrders function

//+------------------------------------------------------------------+ //| Count Total Orders for this expert/symbol | //+------------------------------------------------------------------+ int CountOrders() { int mark=0; for(int i=OrdersTotal()-1; i>=0; i--) { if(myorder.Select(OrderGetTicket(i))) { if(myorder.Magic()==EA_Magic && myorder.Symbol()==_Symbol) mark++; } } return(mark); }

This function is used to get the total pending orders available at a point in time.

We used the object of our class COrderInfo to check the details of order if it is successfully selected with the myorder.Select() function.

If the Magic return by our class object and the symbol returned is what we are looking for, then the order was placed by our Expert Advisor, so it is counted and stored in the variable mark.

2.2.3 The DeletePending function

//+------------------------------------------------------------------+ //| Checks and Deletes a pending order | //+------------------------------------------------------------------+ bool DeletePending() { bool marker=false; //--- check all pending orders for(int i=OrdersTotal()-1; i>=0; i--) { if(myorder.Select(OrderGetTicket(i))) { if(myorder.Magic()==EA_Magic && myorder.Symbol()==_Symbol) { //--- check if order has stayed more than two bars time if(myorder.TimeSetup()<mrate[2].time) { //--- delete this pending order and check if we deleted this order successfully? if(mytrade.OrderDelete(myorder.Ticket())) //Request successfully completed { Alert("A pending order with ticket #", myorder.Ticket(), " has been successfully deleted!!"); marker=true; } else { Alert("The pending order # ",myorder.Ticket(), " delete request could not be completed - error: ",mytrade.ResultRetcodeDescription()); } } } } } return(marker); }

Just like the countorder

function, this function also makes use of the COrderInfo class functions to get

the order properties. The function checks for any pending order that has was

setup three bars before (the pending order setup time is less than

mrate[2].time) and has not yet been triggered.

If any order falls into that category, the CTrade class function OrderDelete is used to delete the order. This function returns true on success and false if otherwise.

The above two functions are used immediately after a new bar is formed, before checking for a new trade setup. We want to be sure we don't have more than three pending orders placed at every point in time. To do this we use the following code:

// do we have more than 3 already placed pending orders if (CountOrders()>3) { DeletePending(); return; }

2.2.4 Placing a Pending Order

if(checkBuy()==true) { Alert("Total Pending Orders now is :",CountOrders(),"!!"); //--- any opened Buy position? if(Buy_opened) { Alert("We already have a Buy position!!!"); return; //--- Don't open a new Sell Position } //Buy price = bar 1 High + 2 pip + spread int sprd=mysymbol.Spread(); double bprice =mrate[1].high + 10*_Point + sprd*_Point; double mprice=NormalizeDouble(bprice,_Digits); //--- Buy price double stloss = NormalizeDouble(bprice - STP*_Point,_Digits); //--- Stop Loss double tprofit = NormalizeDouble(bprice+ TKP*_Point,_Digits); //--- Take Profit //--- open BuyStop order if(mytrade.BuyStop(Lot,mprice,_Symbol,stloss,tprofit)) //if(mytrade.OrderOpen(_Symbol,ORDER_TYPE_BUY_STOP,Lot,0.0,bprice,stloss,tprofit,ORDER_TIME_GTC,0)) { //--- Request is completed or order placed Alert("A BuyStop order has been successfully placed with Ticket#:",mytrade.ResultOrder(),"!!"); return; } else { Alert("The BuyStop order request at vol:",mytrade.RequestVolume(), ", sl:", mytrade.RequestSL(),", tp:",mytrade.RequestTP(), ", price:", mytrade.RequestPrice(), " could not be completed -error:",mytrade.ResultRetcodeDescription()); return; } }

Or we can also use the OrderOpen function to place the BUYSTOP order

if(checkBuy()==true) { Alert("Total Pending Orders now is :",CountOrders(),"!!"); //--- any opened Buy position? if(Buy_opened) { Alert("We already have a Buy position!!!"); return; //--- Don't open a new Sell Position } //Buy price = bar 1 High + 2 pip + spread int sprd=mysymbol.Spread(); double bprice =mrate[1].high + 10*_Point + sprd*_Point; double mprice=NormalizeDouble(bprice,_Digits); //--- Buy price double stloss = NormalizeDouble(bprice - STP*_Point,_Digits); //--- Stop Loss double tprofit = NormalizeDouble(bprice+ TKP*_Point,_Digits); //--- Take Profit //--- open BuyStop order //if(mytrade.BuyStop(Lot,mprice,_Symbol,stloss,tprofit)) if(mytrade.OrderOpen(_Symbol,ORDER_TYPE_BUY_STOP,Lot,0.0,bprice,stloss,tprofit,ORDER_TIME_GTC,0)) { //--- Request is completed or order placed Alert("A BuyStop order has been successfully placed with Ticket#:",mytrade.ResultOrder(),"!!"); return; } else { Alert("The BuyStop order request at vol:",mytrade.RequestVolume(), ", sl:", mytrade.RequestSL(),", tp:",mytrade.RequestTP(), ", price:", mytrade.RequestPrice(), " could not be completed -error:",mytrade.ResultRetcodeDescription()); return; } }

In placing our BUYSTOP order, the open price is the Bar 1 High + 2pip + spread.